How to get a business license in the Bahamas? This seemingly straightforward question opens a door to a world of regulations, procedures, and paperwork. Successfully navigating the Bahamian business licensing landscape requires understanding the various license types available, the specific requirements for each, and the meticulous steps involved in the application process. From choosing the right business structure to meeting stringent legal and regulatory compliance, this guide unravels the complexities and empowers you to confidently establish your business in the Bahamas.

This comprehensive guide walks you through every stage, from selecting the appropriate business license type based on your industry and structure to understanding the associated fees and payment methods. We’ll clarify the necessary documentation, highlight potential pitfalls, and provide valuable resources to ensure a smooth and efficient licensing process. We’ll even cover post-licensing requirements and offer tips for navigating any challenges you might encounter.

Types of Business Licenses in the Bahamas

Obtaining the correct business license is crucial for legal operation in the Bahamas. The type of license required depends on several factors, including the nature of your business, its size, and location. Failure to secure the appropriate license can result in significant penalties. This section details the various license types available, their requirements, and associated fees.

Business License Categories

The Bahamian government categorizes business licenses based on the nature of the business activity. These categories aren’t rigidly defined and may overlap in some instances, necessitating careful review of the specific requirements for your business. Seeking clarification from the relevant authorities is always recommended.

Specific Business License Types and Requirements

The Bahamas offers a range of business licenses, tailored to different industries and business structures. Below are some examples, though this list may not be exhaustive. Always check with the Registrar General’s Department for the most up-to-date information.

- Sole Proprietorship: This license is for businesses owned and operated by a single individual. Requirements typically include providing personal identification, business address, and a description of business activities.

- Partnership: This license covers businesses owned and operated by two or more individuals. Similar to sole proprietorships, it requires identification of all partners, business address, and a detailed description of operations.

- Limited Liability Company (LLC): LLCs offer limited liability protection to owners. Licensing requirements include registering the LLC with the Registrar General’s Department, providing articles of organization, and specifying business activities.

- Company (Corporation): Corporations are separate legal entities. Licensing involves registering the company, submitting the Certificate of Incorporation, and providing details of directors and shareholders. Specific requirements depend on whether it’s a domestic or foreign corporation.

- Retail Business License: This license is necessary for businesses selling goods directly to consumers. Requirements often include details about the premises, inventory, and sales projections.

- Wholesale Business License: This applies to businesses selling goods to other businesses, rather than directly to consumers. Similar to retail licenses, it necessitates providing information about the business location, suppliers, and target clientele.

- Service Business License: This covers businesses providing services, such as consulting, accounting, or legal services. Requirements usually focus on qualifications, experience, and service descriptions.

- Restaurant/Food Service License: This license is required for restaurants, cafes, and other food service establishments. Stricter regulations often apply, including health and safety standards, and inspections may be required.

Business License Comparison Table

| License Type | Application Fee (Estimate) | Renewal Process | Required Documentation |

|---|---|---|---|

| Sole Proprietorship | $100 – $200 (Approximate) | Annual renewal, typically online or in person. | ID, business address proof, business description. |

| Partnership | $200 – $400 (Approximate) | Annual renewal, similar to sole proprietorships. | IDs of all partners, business address proof, business description. |

| LLC | $500 – $1000 (Approximate) | Annual renewal, may involve filing updated information. | Articles of Organization, registered agent information, business description. |

| Corporation | $1000+ (Approximate, varies significantly) | Annual renewal, often more complex than other license types. | Certificate of Incorporation, details of directors and shareholders, business description. |

Application Process Overview

Securing a business license in the Bahamas involves a multi-step process that requires careful preparation and adherence to specific guidelines. Understanding these steps is crucial for a smooth and efficient application. Failure to meet requirements can lead to delays or rejection.

The application procedure for a business license in the Bahamas is managed primarily by the Department of Inland Revenue. The specific requirements may vary slightly depending on the type of business license sought, as Artikeld in the previous section. However, the overall process remains consistent.

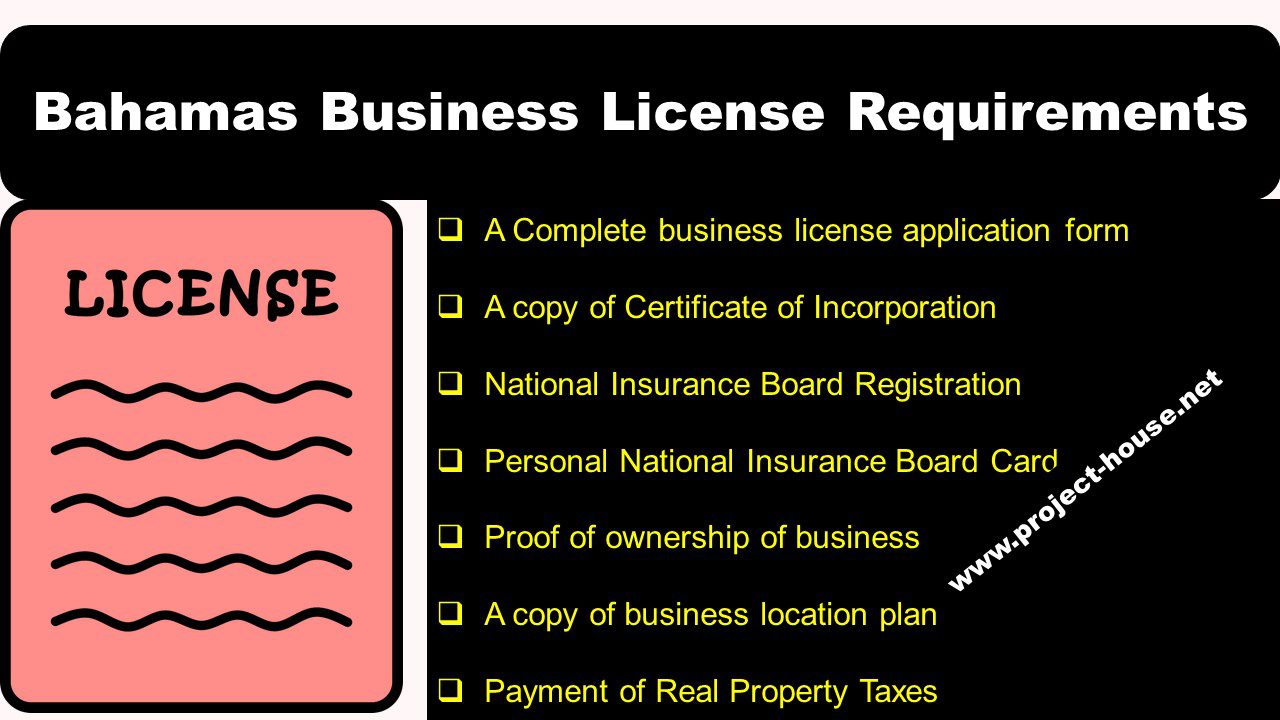

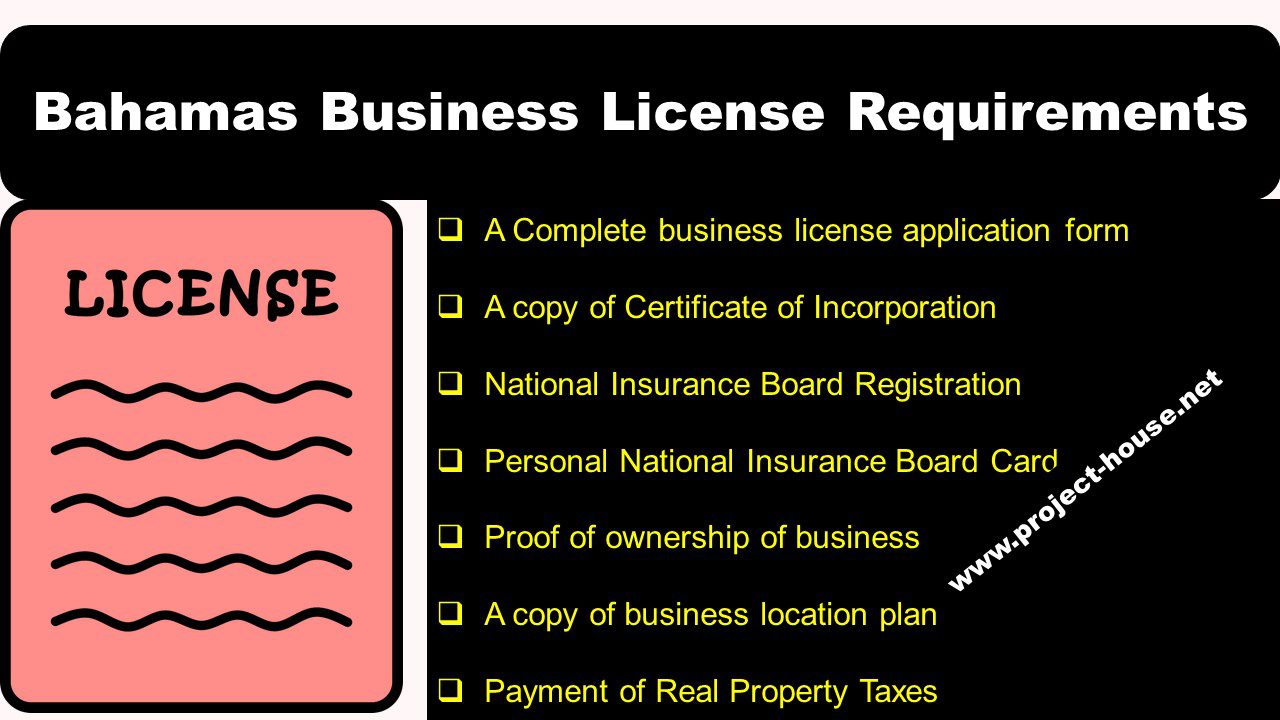

Required Documents and Information

A complete application necessitates a comprehensive collection of documents and information. Omitting even one item can significantly delay the process. It’s recommended to meticulously check the list before submitting your application.

- Completed application form: This form, available from the Department of Inland Revenue, requires detailed information about your business.

- Business plan: A well-structured business plan outlining your business objectives, strategies, and financial projections is essential.

- Proof of identity: This typically includes a valid passport or national identification card for all business owners and directors.

- Proof of address: Utility bills or bank statements demonstrating the business’s physical address are usually required.

- Certified copies of incorporation documents (if applicable): For companies, certified copies of the Certificate of Incorporation and Memorandum and Articles of Association are necessary.

- Police certificate of character (for all directors and shareholders): This is a crucial document demonstrating good standing.

- Taxpayer Registration Number (TRN): Obtain this number from the Department of Inland Revenue before applying for the business license.

- Details of business premises (lease agreement or ownership documents): Documentation proving your right to operate from the specified location.

- Payment of the prescribed fees: The relevant fees must be paid according to the stipulated schedule.

Step-by-Step Application Procedure

The application process unfolds in a series of sequential steps. Each step is critical and should be completed accurately and efficiently. Delays can occur at any stage if documentation is incomplete or inaccurate.

- Obtain the necessary application forms: Downloadable forms are usually available on the Department of Inland Revenue’s website.

- Complete the application forms accurately: Ensure all information is correct and consistent across all forms.

- Gather and prepare all required documents: Compile all necessary documentation, ensuring they are certified where required.

- Submit the application: Submit the completed forms and supporting documents to the designated office of the Department of Inland Revenue.

- Awaiting processing: The Department of Inland Revenue will process the application. The processing time varies, but applicants should expect some delay.

- License issuance (or notification of deficiencies): Upon successful review, the business license will be issued. If deficiencies are found, the applicant will be notified to rectify them.

Application Process Flowchart

Imagine a flowchart beginning with “Application Initiation,” branching to “Document Gathering and Preparation.” This then leads to “Application Submission,” followed by “Departmental Review and Processing.” The process then splits into two branches: “License Issued” and “Application Rejected/Deficiencies Noted.” The “Application Rejected/Deficiencies Noted” branch loops back to “Document Gathering and Preparation” requiring correction of issues. Potential delays are represented at each stage with a small cloud icon, indicating possible delays due to incomplete documentation or administrative backlog. The entire process is visualized linearly, showing the clear sequence of events and potential points of delay.

Required Documentation and Forms

Securing a business license in the Bahamas requires submitting a comprehensive set of documents to the relevant authorities. The completeness and accuracy of these documents are crucial for a smooth and efficient application process. Failure to provide the necessary documentation may result in delays or rejection of your application.

The specific documents required may vary slightly depending on the type of business and its activities. However, the following list covers the most common requirements. It’s always advisable to check the official website of the Registrar General’s Department for the most up-to-date and precise information.

Proof of Identity

Proof of identity is essential to verify the applicant’s legitimacy and prevent fraudulent activities. Acceptable forms of identification include a valid Bahamian passport, driver’s license, or national identification card. For foreign applicants, a valid passport with a current visa (if required) is usually accepted. Copies of these documents should be clear and legible. The document must clearly display the applicant’s full name, photograph, and date of birth.

Proof of Address

Verifying the applicant’s residential address is important for communication purposes and to ensure the business operates from a legitimate location. Acceptable proof of address includes a recent utility bill (electricity, water, or telephone), a bank statement, or a lease agreement. The document must show the applicant’s name and current address and be dated within the last three months. A copy of the address proof should be provided with the application.

Business Plan

A well-structured business plan is crucial for demonstrating the viability and potential success of the proposed business. This document Artikels the business’s objectives, target market, marketing strategies, financial projections, and management team. The business plan should be comprehensive and realistic, showcasing a clear understanding of the market and the business’s competitive advantage. A well-written business plan significantly increases the likelihood of application approval. The business plan should be presented in a professional format, ideally typed and bound.

Articles of Incorporation or Partnership Agreement

Depending on the business structure, either Articles of Incorporation (for companies) or a Partnership Agreement (for partnerships) are required. These legal documents Artikel the structure, ownership, and operational details of the business. They should be properly prepared and legally sound, reflecting the accurate details of the business. These documents should be originals or certified copies, bearing the necessary signatures and seals.

Application Form

The application form is the official document used to formally request a business license. It requires detailed information about the business, its owners, and its operations. The form is typically available for download from the Registrar General’s Department website or can be obtained in person at their offices. The form must be completed accurately and completely, following all instructions carefully. Any incomplete or inaccurate information can lead to delays or rejection.

Fees and Payment Methods

Obtaining and maintaining a business license in The Bahamas involves several fees, payable through designated methods. Understanding these costs is crucial for accurate budgeting and successful business operation. This section details the fee structure and accepted payment options.

The specific fees associated with a business license in The Bahamas vary depending on several factors, including the type of business, its location, and the size of the operation. It’s important to consult the official website of the relevant licensing authority for the most up-to-date information. While precise figures cannot be provided here due to their dynamic nature, a general overview of potential costs is presented below.

Application Fees

Application fees cover the initial processing of your business license application. These fees are typically a fixed amount, though they may vary depending on the business type. For instance, a small retail business might have a lower application fee than a large-scale import-export company. This fee covers administrative costs incurred by the licensing authority in reviewing the application and issuing the license. Expect this fee to be in the range of several hundred Bahamian dollars.

Renewal Fees

Annual renewal fees are required to maintain the validity of your business license. These fees are usually based on factors such as the type of business and its revenue. Businesses with higher annual turnovers generally face higher renewal fees. These fees are designed to cover the ongoing administrative costs of the licensing authority in ensuring compliance and maintaining business records. The renewal fee is typically due each year on or before the license’s expiration date. Failure to renew on time may result in penalties.

Other Applicable Charges

Beyond application and renewal fees, additional charges may apply depending on specific circumstances. These might include late payment penalties, fees for amendments to the license, or costs associated with expedited processing of the application. It is advisable to inquire about any potential additional charges during the application process to avoid unexpected costs.

Payment Methods

The Bahamas’ licensing authorities typically accept several payment methods for business license fees. Common options include direct deposit into a designated government account, payment via online banking platforms, and payment through authorized agents or financial institutions. Some authorities may also accept cash or check payments, but it’s advisable to confirm the accepted methods with the specific licensing authority handling your application to avoid delays. Providing payment through the preferred method will ensure a smoother application process.

Calculating Total Cost

Calculating the total cost involves adding the application fee, annual renewal fees (projected over several years), and any potential additional charges. For example: If the application fee is $500, the annual renewal fee is $250, and the business plans to operate for five years, the total estimated cost would be $500 (application) + ($250 x 5 years) = $1750. This is a simplified example, and actual costs will vary depending on the specific business and circumstances. It’s essential to obtain the most current fee schedule from the relevant licensing authority before making any financial commitments.

Business Structure Considerations

Choosing the right business structure in the Bahamas is crucial, impacting not only your licensing process but also your liability, taxation, and overall business operations. The structure you select will directly influence the specific requirements and procedures you must follow to obtain your business license. Understanding these implications beforehand is essential for a smooth and efficient licensing process.

The selection of a business structure significantly impacts the complexity and requirements of obtaining a Bahamian business license. Each structure has its own set of advantages and disadvantages concerning administrative burden, liability exposure, and tax implications. This section details the implications of various business structures on the licensing process.

Sole Proprietorship

A sole proprietorship is the simplest business structure, where the business and the owner are legally indistinguishable. This structure is straightforward to establish, requiring minimal paperwork. However, the owner bears unlimited personal liability for business debts and obligations.

- Licensing Implications: The licensing process is generally less complex compared to other structures. The requirements usually involve registering the business name and obtaining the necessary trade licenses.

- Advantages: Easy setup, simple administration, direct control.

- Disadvantages: Unlimited personal liability, limited access to capital, business ends upon owner’s death or incapacity.

Partnership, How to get a business license in the bahamas

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Partnerships can be general or limited, with differing liability implications for the partners.

- Licensing Implications: The licensing process typically involves registering the partnership agreement and obtaining the necessary trade licenses. Specific requirements may vary based on the type of partnership (general or limited).

- Advantages: Relatively easy to establish, pooled resources and expertise.

- Disadvantages: Partners share liability (in general partnerships), potential for disagreements among partners.

Limited Liability Company (LLC)

An LLC offers the benefits of limited liability, separating the personal assets of the owners from the business’s liabilities. This structure is becoming increasingly popular due to its flexibility and protection.

- Licensing Implications: Establishing an LLC involves registering the company with the relevant authorities and obtaining the necessary business licenses. This usually involves more paperwork than a sole proprietorship or partnership.

- Advantages: Limited liability for owners, flexible management structure, pass-through taxation.

- Disadvantages: More complex setup than a sole proprietorship or partnership, potentially higher administrative costs.

Company (Corporation)

A company, often referred to as a corporation, is a separate legal entity from its owners (shareholders). This structure offers the strongest protection from personal liability but involves more complex regulatory requirements.

- Licensing Implications: Incorporating a company in the Bahamas requires registration with the Registrar General’s Department and compliance with various corporate laws. The licensing process is more rigorous and involves more extensive documentation.

- Advantages: Strongest protection from personal liability, easier access to capital, potential for perpetual existence.

- Disadvantages: Complex setup and ongoing administrative requirements, higher costs, more stringent regulatory compliance.

Legal and Regulatory Compliance

Operating a business in The Bahamas requires adherence to a comprehensive framework of laws and regulations. Understanding these legal obligations is crucial for avoiding penalties and ensuring the smooth operation of your business. Non-compliance can lead to significant consequences, impacting your business’s reputation and financial stability. This section Artikels key legal aspects of business licensing in The Bahamas.

Relevant Bahamian Laws and Regulations

The legal framework governing business licensing in The Bahamas is multifaceted, encompassing various acts and regulations depending on the nature of the business. Key legislation includes, but is not limited to, the Companies Act, the Business Licenses Act, and specific regulations pertaining to particular industries (e.g., financial services, tourism). These laws dictate licensing requirements, operational standards, and reporting obligations. For instance, the Business Licenses Act Artikels the process for obtaining licenses, specifies the types of businesses requiring licenses, and details the information needed for applications. Specific industry regulations might include additional requirements, such as adherence to environmental protection laws or specific safety standards. It is advisable to consult with legal professionals specializing in Bahamian business law to ensure full compliance.

Penalties for Non-Compliance

Failure to obtain the necessary business licenses or to comply with ongoing regulatory requirements can result in a range of penalties. These penalties can include significant fines, business closure orders, and even criminal prosecution in certain cases. The severity of the penalty depends on the nature of the violation and the history of the business. For example, operating a business without a license might result in daily fines until the license is obtained, along with a potential fine for the period of unlicensed operation. Repeated violations or serious breaches can lead to more substantial penalties, including the revocation of the business license and potential legal action.

Common Mistakes to Avoid During the Application Process

Several common mistakes can delay or even jeopardize the business licensing process. One frequent error is submitting incomplete or inaccurate application forms. Ensuring all required information is provided accurately and completely is paramount. Another common mistake is failing to understand the specific requirements for the type of business being registered. Different business types have different licensing requirements, and overlooking these specifics can lead to delays or rejection of the application. Furthermore, neglecting to pay the required fees on time can also lead to delays or penalties. Finally, failing to maintain accurate records and comply with ongoing reporting requirements can result in non-compliance issues later. Careful planning and thorough review of the application before submission are crucial to avoid these common pitfalls.

Post-Licensing Requirements

Securing a business license in the Bahamas is just the first step. Maintaining compliance involves ongoing responsibilities that ensure your business operates legally and ethically within the country’s regulatory framework. Failure to meet these post-licensing requirements can result in penalties, including fines, license suspension, or even revocation.

Obtaining a business license doesn’t grant permanent permission to operate; it’s a privilege contingent upon consistent adherence to Bahamas’ business regulations. This section details the ongoing obligations and potential consequences of non-compliance.

Annual License Renewals

The Bahamas requires annual renewal of most business licenses. The specific renewal dates vary depending on the type of license and the issuing authority. Businesses must submit renewal applications within the designated timeframe, typically accompanied by the relevant fees. Late renewal applications may incur late fees or penalties. For example, a restaurant license might need renewal by December 31st each year, while a retail license might have a different deadline. Failing to renew on time can lead to operational disruption and potential legal repercussions.

Financial Reporting and Tax Compliance

Businesses operating in the Bahamas are subject to various tax obligations, including annual filing of tax returns. These requirements vary based on the business structure (sole proprietorship, partnership, company, etc.) and the nature of the business activities. Accurate and timely submission of financial reports and tax returns is crucial for maintaining compliance. Failure to comply with these obligations can result in significant penalties, including interest charges and potential legal action. For instance, a failure to file Value Added Tax (VAT) returns by the deadline can incur substantial penalties.

Compliance Reporting

Depending on the specific business activity and license type, ongoing compliance reporting might be necessary. This could involve reporting on employee numbers, sales figures, or other relevant metrics. These reports help the government monitor economic activity and ensure compliance with regulations. Failure to submit required reports, or submitting inaccurate information, can lead to penalties and investigations. For example, businesses in the tourism sector might be required to report visitor statistics periodically.

Timeline of Key Post-Licensing Deadlines and Actions

The following timeline illustrates typical post-licensing obligations. Specific deadlines should be verified with the relevant licensing authority.

| Month | Action | Consequence of Non-Compliance |

|---|---|---|

| Month 6 | Review license conditions and ensure ongoing compliance | Potential for non-compliance if issues are not addressed promptly. |

| Month 11 | Begin preparing for annual license renewal | Potential late fees and operational disruption if renewal is delayed. |

| Month 12 | Submit annual license renewal application and fees | License suspension or revocation; potential legal action. |

| Month 12 | File annual tax returns | Penalties, interest charges, and potential legal action. |

Resources and Support

Securing a business license in the Bahamas involves navigating various government agencies and regulations. Fortunately, several resources and support services are available to assist entrepreneurs throughout this process. Understanding these resources can significantly streamline the licensing procedure and minimize potential delays.

The Bahamian government provides a range of support for businesses, aiming to foster a thriving entrepreneurial environment. This includes online resources, dedicated contact points, and assistance programs designed to guide businesses through the complexities of licensing and beyond. Effective utilization of these resources is key to a smooth and efficient licensing experience.

Government Websites and Contact Information

Several government websites offer crucial information regarding business licensing in the Bahamas. These websites provide access to application forms, relevant legislation, fee schedules, and contact details for various departments. Regularly checking these sites for updates is advisable, as regulations and procedures can change.

| Department | Website | Phone Number | Email Address |

|---|---|---|---|

| Registrar General’s Department | (Insert Website Address Here – This should be the official government website) | (Insert Phone Number Here) | (Insert Email Address Here) |

| Ministry of Finance | (Insert Website Address Here – This should be the official government website) | (Insert Phone Number Here) | (Insert Email Address Here) |

| Department of Inland Revenue | (Insert Website Address Here – This should be the official government website) | (Insert Phone Number Here) | (Insert Email Address Here) |

| Relevant Licensing Authority (Specific to business type) | (Insert Website Address Here – This will vary depending on the business type) | (Insert Phone Number Here – This will vary depending on the business type) | (Insert Email Address Here – This will vary depending on the business type) |

Available Support Services

Beyond readily available online resources, the Bahamian government and private sector offer various support services to assist businesses with the licensing process. These services can range from providing guidance on completing applications to offering legal and financial advice.

For example, some organizations offer workshops and seminars specifically designed to help entrepreneurs understand the licensing requirements and navigate the application process. Business incubators and accelerators often provide mentorship and support, helping entrepreneurs overcome challenges and access necessary resources. Additionally, private consultants specializing in business setup and legal compliance can offer tailored assistance.

Illustrative Example: Obtaining a Restaurant License in the Bahamas: How To Get A Business License In The Bahamas

This example details the process of obtaining a restaurant license in the Bahamas, highlighting the necessary steps, documentation, and potential challenges. The specific requirements may vary slightly depending on the location and type of restaurant, so it’s crucial to verify information with the relevant authorities.

Application Process for a Restaurant License

The application process begins with submitting a completed application form to the relevant licensing authority, typically the Ministry of Tourism or a local government office depending on the island. This involves providing accurate information about the business, its location, and the applicant. The process then involves inspections, fee payments, and final approval. Failure to meet specific requirements at any stage can delay or prevent license issuance.

Required Documents and Forms for Restaurant License Application

The application requires several key documents to ensure compliance with Bahamian regulations. These include the completed application form itself, which will request details about the business’s name, address, owners, menu, and intended operating hours. Additionally, a detailed floor plan showing the layout of the restaurant, including kitchen facilities, seating areas, and restrooms, is usually required. A copy of the lease agreement or proof of property ownership demonstrating the applicant’s legal right to operate at the specified location is essential. Furthermore, health permits and fire safety certificates from relevant inspectors are necessary to prove compliance with health and safety standards. Finally, evidence of liability insurance, demonstrating financial responsibility in case of accidents or incidents, must be provided. The format of these documents should generally be clear, concise, and easy to read, usually in English.

Potential Challenges and Solutions in Obtaining a Restaurant License

Securing a restaurant license can present challenges. One common hurdle is meeting the stringent health and safety regulations. Thorough preparation, including investing in appropriate equipment and training staff on hygiene practices, is crucial to pass inspections. Another potential issue involves delays in processing applications. Submitting a complete and accurate application, along with all required documentation, can help minimize delays. Furthermore, understanding and complying with local zoning regulations and building codes are essential. Consulting with a legal professional familiar with Bahamian business regulations can provide valuable guidance and assist in navigating potential complexities. Finally, ensuring adequate capital to cover the license fees, initial setup costs, and potential unforeseen expenses is vital for successful business launch.