How to get seller financing for business? Securing seller financing can be a game-changer for acquiring a business, offering unique advantages over traditional bank loans. This strategic approach allows buyers to leverage the seller’s equity and often negotiate more favorable terms. We’ll explore the intricacies of this financing method, guiding you through each step, from identifying suitable sellers and negotiating terms to navigating the legal and financial aspects and securing additional funding if needed.

This comprehensive guide will equip you with the knowledge and strategies to successfully secure seller financing, transforming your business acquisition journey from a daunting challenge into a manageable and potentially highly rewarding endeavor. We’ll cover everything from understanding the mechanics of seller financing and identifying suitable sellers to negotiating favorable terms and managing the post-acquisition phase. Real-world examples will illustrate the practical application of these strategies.

Understanding Seller Financing

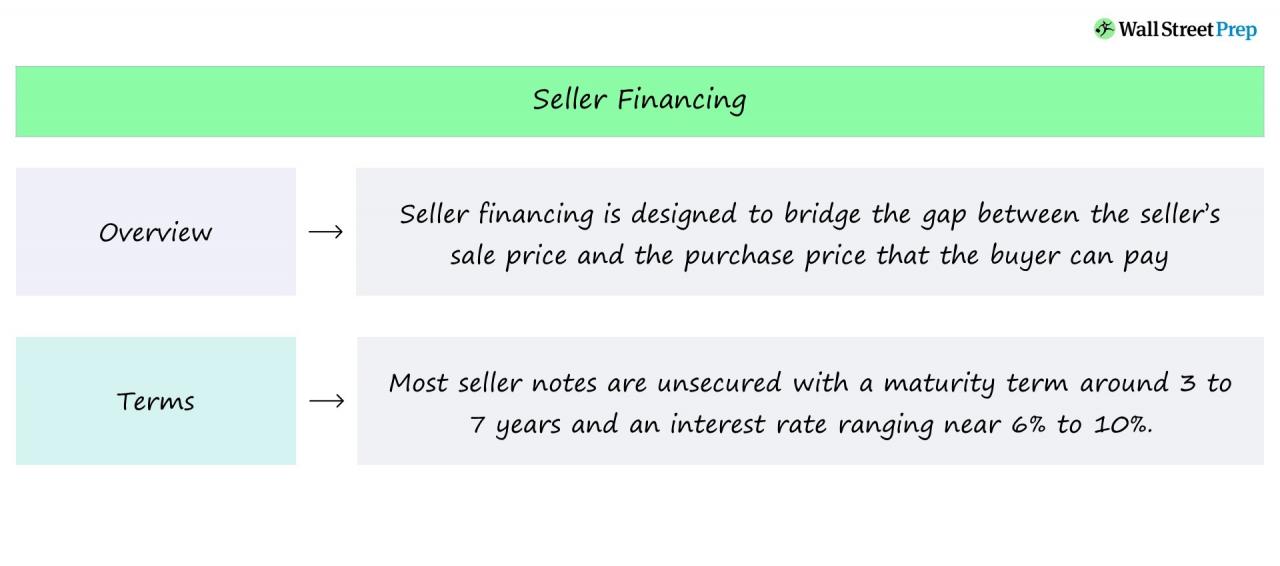

Seller financing, in the context of business acquisitions, is a powerful alternative to traditional bank loans. It involves the seller of a business providing financing to the buyer, often structured as a series of payments over time, instead of a lump-sum cash payment at closing. This arrangement can be highly beneficial for both parties involved, offering flexibility and unique advantages not always available through conventional lending channels.

Seller financing fundamentally alters the dynamics of a business acquisition. Instead of the buyer securing a loan from a third-party lender (like a bank), the seller themselves becomes the lender, essentially extending credit to the buyer. This credit is typically secured by the assets of the acquired business itself, providing the seller with a degree of security. The terms of the agreement are negotiated between buyer and seller, allowing for customized repayment schedules, interest rates, and other stipulations. This flexibility is a key differentiator compared to standardized bank loan products.

Benefits of Seller Financing for Buyers and Sellers, How to get seller financing for business

Seller financing offers distinct advantages for both buyers and sellers. For buyers, it often means securing financing even when traditional lenders deem them too risky or require substantial collateral. It can also lead to lower initial capital outlay, preserving cash for working capital and operational expenses. For sellers, seller financing allows them to receive payment for their business over an extended period, potentially mitigating capital gains taxes. Furthermore, it can facilitate a smoother transition and ensure the ongoing success of the business under new ownership, as the seller often maintains a vested interest in its performance. The seller might also be able to achieve a higher sale price compared to a cash sale, as the buyer is willing to pay more given the more favorable financing terms.

Comparison of Seller Financing and Traditional Bank Loans

Seller financing and traditional bank loans differ significantly in several key aspects. Bank loans typically require extensive due diligence, credit checks, and collateral, often leading to a lengthy and complex approval process. Interest rates are usually fixed and determined by market conditions. In contrast, seller financing is negotiated directly between buyer and seller, offering greater flexibility in terms and conditions. The approval process is often quicker and less stringent, although the seller will naturally conduct their own due diligence on the buyer’s capabilities. Interest rates in seller financing can be more favorable to the buyer in some situations, but the terms are largely dependent on the seller’s risk assessment and financial goals. The absence of a third-party lender also simplifies the transaction process, reducing bureaucratic hurdles.

Examples of Seller Financing Structures

Several structures can be employed for seller financing. One common method is a promissory note, a legally binding document outlining the repayment terms, interest rate, and other conditions. This note serves as the primary agreement between the buyer and seller. Another structure is an installment sale, where the purchase price is paid in installments over a predetermined period. This structure often involves transferring ownership of the business to the buyer immediately, with the seller receiving payments over time. Other structures might involve a combination of cash upfront and seller financing for the remaining balance, or even the use of a secured loan with the business assets as collateral. The specific structure chosen depends on the circumstances of the transaction and the preferences of both the buyer and the seller. For instance, a seller might prefer a larger upfront payment to reduce risk, while a buyer might prefer a longer repayment period to ease the financial burden. The ideal structure will balance the needs and risk tolerance of both parties.

Identifying Suitable Sellers

Securing seller financing hinges on identifying the right business and owner. This involves a strategic search, careful evaluation, and thorough due diligence. The process requires a blend of proactive searching and discerning assessment to minimize risk and maximize the chances of a successful transaction.

Finding businesses open to seller financing isn’t always straightforward. Many sellers prefer traditional financing methods, but a proactive approach can uncover opportunities.

Strategies for Finding Businesses Offering Seller Financing

Targeting businesses actively seeking an exit strategy is key. This often involves businesses owned by aging entrepreneurs nearing retirement or those looking to diversify their investments. Networking within industry circles, attending business events, and utilizing online business brokerage platforms can yield promising leads. Furthermore, reviewing online business listings and actively contacting businesses that might be a good fit, even if they haven’t explicitly advertised seller financing, can prove fruitful. Direct outreach, emphasizing the benefits of seller financing for both parties, can sometimes persuade sellers initially hesitant to consider this option. Finally, consulting with business brokers specializing in seller financing transactions can provide access to a curated network of potential sellers.

Criteria for Evaluating Potential Sellers and Their Businesses

Evaluating potential sellers requires a multifaceted approach. Beyond the financial aspects of the business, the seller’s character and business acumen are crucial. Assessing the seller’s willingness to negotiate, their understanding of the financing terms, and their commitment to a smooth transition are all critical factors. The business itself needs thorough scrutiny, examining its financial performance, market position, and operational efficiency. A strong track record, a sustainable business model, and a capable management team are all positive indicators.

The Importance of Due Diligence in Seller Financing Deals

Due diligence is paramount in seller financing deals. It’s a process of investigation to verify the accuracy of information provided by the seller, mitigating potential risks. This goes beyond simply reviewing financial statements; it involves independent verification of revenue streams, expenses, and assets. A comprehensive due diligence process can uncover hidden liabilities or inconsistencies that could jeopardize the transaction. Legal and tax implications must also be carefully examined to ensure compliance and protect the buyer’s interests. Neglecting due diligence can lead to significant financial losses and legal complications.

Checklist for Assessing the Financial Health of a Seller’s Business

A robust due diligence process requires a systematic approach. A checklist helps ensure all critical aspects are addressed. This checklist should include:

- Review of Financial Statements: Thoroughly examine at least three years of audited financial statements, including income statements, balance sheets, and cash flow statements. Look for consistent profitability, positive cash flow, and manageable debt levels.

- Verification of Revenue Streams: Independently verify revenue figures by contacting key clients and reviewing contracts. Assess the stability and diversification of revenue streams.

- Analysis of Expenses: Scrutinize expenses to identify any unusual or excessive costs. Compare expense ratios to industry benchmarks.

- Assessment of Assets and Liabilities: Verify the value of assets and liabilities, including inventory, equipment, and accounts receivable and payable. Assess the potential for hidden liabilities.

- Debt Analysis: Evaluate the seller’s debt levels, including the terms and conditions of any existing loans. Assess the business’s ability to service its debt.

- Tax Compliance Review: Review tax returns for compliance and identify any potential tax liabilities.

Failure to conduct thorough due diligence can lead to unforeseen complications and financial losses. A comprehensive approach, incorporating the above elements, is crucial for a successful seller financing transaction.

Negotiating the Financing Terms

Securing favorable seller financing requires a strategic approach to negotiation. This involves understanding your leverage, presenting a compelling offer, and skillfully navigating the key terms to reach an agreement that benefits both buyer and seller. A well-structured negotiation can significantly impact the overall cost and feasibility of the acquisition.

Negotiating seller financing differs from traditional bank loans. Sellers are often motivated by factors beyond just maximizing profit, such as a desire for a smooth transition, minimizing tax liabilities, or maintaining a relationship with the business. Understanding these motivations is crucial to crafting a successful negotiation strategy.

Sample Negotiation Strategy

A successful negotiation hinges on preparation and a clear understanding of your objectives. Begin by thoroughly researching comparable transactions and assessing the seller’s financial situation and motivations. Develop a range of acceptable terms, acknowledging potential compromises. Present your offer confidently, highlighting the benefits to the seller, such as a quicker sale, reduced risk, and a potential ongoing relationship. Be prepared to counter-offer strategically, focusing on areas where you have leverage. Maintain open communication and a professional demeanor throughout the process. Finally, document all agreed-upon terms meticulously to avoid future disputes.

Key Terms to Negotiate

Several key terms significantly impact the buyer’s financial obligations and overall return on investment. These include the interest rate, down payment, loan term, prepayment penalties, and balloon payments.

- Interest Rate: Negotiate a rate that reflects prevailing market conditions and the risk involved. Consider the seller’s desired return and your borrowing capacity. A lower interest rate reduces the overall cost of financing.

- Down Payment: A larger down payment might secure a lower interest rate or more favorable terms. However, it reduces available capital for business operations. Balance the need for a manageable down payment with the desire for better financing terms.

- Repayment Schedule: A longer repayment period lowers monthly payments but increases the total interest paid. A shorter term reduces the total interest but necessitates higher monthly payments. Choose a schedule that aligns with your cash flow projections.

- Prepayment Penalties: Negotiate to minimize or eliminate prepayment penalties, allowing for flexibility should refinancing opportunities arise.

- Balloon Payments: If a balloon payment is unavoidable, ensure it aligns with your projected future cash flow and ability to refinance or make a substantial payment.

Comparison of Financing Terms

The following table illustrates how different financing terms impact the buyer. Note that these are illustrative examples and actual costs will vary based on numerous factors.

| Term | Scenario A | Scenario B | Scenario C |

|---|---|---|---|

| Loan Amount | $500,000 | $500,000 | $500,000 |

| Interest Rate | 6% | 8% | 10% |

| Loan Term (Years) | 10 | 10 | 5 |

| Down Payment | 20% | 10% | 30% |

| Monthly Payment (approx.) | $4,200 | $4,600 | $9,600 |

| Total Interest Paid (approx.) | $104,000 | $144,000 | $104,000 |

Calculating Total Cost of Seller Financing

The total cost of seller financing includes the principal amount borrowed plus the total interest paid over the loan term. A simple formula to calculate the total cost is:

Total Cost = Principal + Total Interest Paid

For example, in Scenario A above, the total cost would be $500,000 (principal) + $104,000 (total interest) = $604,000. Always factor in all associated fees and costs when calculating the total expense. Remember to account for any potential prepayment penalties or balloon payments in your calculations.

Legal and Financial Aspects

Securing seller financing involves significant legal and financial complexities. A thorough understanding of these aspects is crucial to protect both the buyer and the seller, ensuring a smooth and mutually beneficial transaction. Ignoring these considerations can lead to costly disputes and financial setbacks. This section details the critical roles of legal and financial professionals and Artikels the essential steps for documenting the agreement.

The Importance of Legal Counsel

Engaging legal counsel is paramount throughout the negotiation and closing process of a seller financing agreement. A skilled attorney can review the terms of the agreement, identify potential risks, and ensure the contract protects your interests. They will draft or review the agreement, ensuring it complies with all applicable laws and regulations, preventing future disputes. Their expertise is vital in negotiating favorable terms, particularly regarding payment schedules, interest rates, default provisions, and dispute resolution mechanisms. Failing to seek legal advice could result in unforeseen liabilities or an unenforceable contract. For instance, an attorney can help navigate complex issues such as the transfer of property ownership, ensuring all necessary paperwork is correctly filed and all legal requirements are met.

The Role of Financial Advisors

Financial advisors play a crucial role in evaluating the financial viability of seller financing deals. They assess the financial health of both the buyer and the seller, analyzing the buyer’s capacity to make timely payments and the seller’s ability to manage the financing arrangement. This involves reviewing financial statements, cash flow projections, and conducting due diligence. A financial advisor helps determine the appropriate interest rate, loan term, and repayment schedule, ensuring the deal is structured to minimize risk for both parties. Their expertise in risk assessment can help identify potential red flags and suggest appropriate mitigation strategies. For example, a financial advisor can help determine if the business valuation is accurate and if the proposed terms align with prevailing market rates and industry benchmarks.

Potential Risks and Mitigation Strategies

Seller financing, while offering advantages, carries inherent risks. For the buyer, the primary risk is the potential for financial strain if the business underperforms. For the seller, the risk lies in the buyer’s inability to repay the loan. Other risks include disputes over contract terms, changes in market conditions impacting the business’s profitability, and unforeseen circumstances affecting the buyer’s financial capacity. Mitigation strategies include thorough due diligence on the buyer and the business, obtaining comprehensive financial projections, negotiating strong default provisions in the contract (including clauses for collateralization), and maintaining open communication between the buyer and the seller throughout the loan term. Regular monitoring of the buyer’s financial performance is also crucial. For example, a detailed business plan, backed by strong financial projections and realistic sales forecasts, can significantly reduce the risk for both parties.

Documenting the Seller Financing Agreement

A well-documented seller financing agreement is crucial for a successful transaction. The agreement should clearly Artikel all terms and conditions, leaving no room for ambiguity. A step-by-step guide for documenting the agreement includes:

- Define the parties involved: Clearly identify the buyer and seller, including their legal names and addresses.

- Specify the purchase price: State the total purchase price of the business or asset.

- Detail the financing terms: Artikel the loan amount, interest rate, repayment schedule (amortization), and any balloon payments.

- Describe the collateral: If applicable, specify the assets used as collateral to secure the loan.

- Artikel default provisions: Clearly define the consequences of default, including late payment penalties and potential foreclosure.

- Include dispute resolution mechanisms: Specify how disputes will be resolved, such as mediation or arbitration.

- Specify governing law: State the jurisdiction whose laws govern the agreement.

- Obtain signatures: Both the buyer and seller must sign the agreement.

The agreement should be reviewed by legal counsel for both parties to ensure its completeness and legal soundness. A poorly drafted agreement can lead to significant legal disputes and financial losses for both parties. The level of detail should be sufficient to prevent any misunderstanding and protect the interests of both the buyer and the seller. For example, the repayment schedule should specify the exact dates and amounts of payments, avoiding any ambiguity that could lead to disputes.

Securing Additional Funding (if needed)

Seller financing, while advantageous, often doesn’t cover the entire acquisition cost. Businesses frequently require supplemental funding to bridge the gap, cover renovation costs, manage working capital, or fund operational expenses post-acquisition. Strategic planning for securing this additional capital is crucial for a smooth and successful transition. This section Artikels various funding options and the application process.

Supplementing seller financing with other funding sources is a common practice in business acquisitions. This approach mitigates risk by diversifying funding sources and can lead to more favorable terms than relying solely on seller financing. The choice of supplementary funding depends heavily on the specifics of the acquisition, the buyer’s financial standing, and the nature of the business being acquired.

SBA Loans and Private Equity: A Comparison

Small Business Administration (SBA) loans and private equity represent two distinct avenues for securing supplemental funding. SBA loans, backed by the U.S. government, offer lower interest rates and longer repayment terms than conventional loans. They’re often accessible to businesses that might struggle to qualify for traditional financing. However, the application process can be lengthy and involves rigorous documentation. Private equity, on the other hand, involves investment from private firms in exchange for equity in the business. While this can provide significant capital infusions, it comes at the cost of relinquishing some ownership control. Private equity investments are typically reserved for businesses with high growth potential and a strong management team. The selection of the appropriate funding source hinges on the buyer’s risk tolerance, long-term goals, and the financial health of the target business. For example, a stable, established business might find an SBA loan more suitable, whereas a high-growth startup might benefit from the larger capital injection and expertise offered by private equity.

The Application Process for Additional Funding

The process of applying for supplemental funding involves several key steps. First, buyers need to prepare a comprehensive business plan detailing the acquisition strategy, financial projections, and management team. This plan should clearly articulate the need for additional funding and how it will be used. Second, they should compile all necessary financial documentation, including tax returns, bank statements, and credit reports. Third, they need to identify and approach potential lenders or investors. This may involve contacting banks, credit unions, SBA lenders, or private equity firms. Finally, the buyer will need to negotiate terms, secure approvals, and complete the closing process. This process can be complex and time-consuming, often requiring assistance from financial advisors and legal counsel. For instance, securing an SBA loan often involves working with an SBA-approved lender and navigating the specific requirements of the SBA loan program.

Resources for Finding Additional Financing

Finding suitable funding sources requires diligent research and networking. A strategic approach increases the chances of securing favorable terms.

- SBA Website: The official SBA website provides comprehensive information on SBA loan programs and eligibility requirements.

- Local Banks and Credit Unions: These institutions often offer business loans tailored to local market needs.

- Online Lending Platforms: Several online platforms connect businesses with various lenders, offering a broader range of options.

- Private Equity Firms: Researching and contacting private equity firms specializing in the target industry can open doors to significant investment opportunities.

- Business Brokers: Experienced business brokers often have established relationships with lenders and investors and can facilitate the funding process.

- Financial Advisors: Seeking guidance from a financial advisor can prove invaluable in navigating the complexities of securing additional funding.

Post-Acquisition Management: How To Get Seller Financing For Business

Successfully securing seller financing is only half the battle; the post-acquisition phase is crucial for ensuring a smooth transition and maintaining a positive relationship with the seller. Effective management during this period safeguards your investment and fosters continued collaboration, ultimately contributing to the long-term success of your business. Neglecting this aspect can lead to strained relationships, payment defaults, and even legal disputes.

Maintaining a strong financial relationship with the seller is paramount. This involves consistent and transparent communication, meticulous record-keeping, and a demonstrable commitment to the repayment schedule Artikeld in the financing agreement. The seller has a vested interest in your success, as their financial return depends on your ability to meet your obligations. Building trust and demonstrating financial responsibility are key to a mutually beneficial partnership.

Managing the Repayment Schedule

Adhering to the agreed-upon repayment schedule is non-negotiable. This includes making timely payments, accurately documenting each transaction, and promptly addressing any discrepancies or unforeseen circumstances. Regularly reviewing the repayment schedule with the seller ensures both parties are on the same page and allows for proactive problem-solving. Consider setting up automated payment systems to minimize the risk of missed payments. Proactive communication regarding any potential delays, coupled with a clear plan for remediation, can prevent misunderstandings and maintain a positive relationship.

Addressing Potential Post-Acquisition Challenges

Several challenges can arise after acquisition. For example, unexpected economic downturns can impact your cash flow, making it difficult to meet payment obligations. In such cases, open communication with the seller is vital. Proposing a revised repayment plan, supported by realistic financial projections, can help mitigate the situation. Another potential challenge is unforeseen operational issues. These could range from equipment malfunctions to unexpected staffing shortages. Transparent communication about these issues and how they are being addressed can help maintain the seller’s confidence in your ability to manage the business. Finally, disagreements over the interpretation of the financing agreement can also arise. Having a well-defined agreement, reviewed by legal counsel, minimizes the risk of such disputes. If disagreements do occur, mediation or arbitration can provide a constructive path to resolution.

Sample Communication Plan

A structured communication plan is essential for maintaining open communication with the seller. This plan should include regular check-ins, preferably monthly, to review financial performance and address any concerns. These check-ins could be formal meetings or informal phone calls, depending on the relationship dynamics. A clear reporting mechanism, such as monthly financial statements or progress reports, should be established. This ensures the seller remains informed about the business’s health and progress. The plan should also detail the communication channels to be used (email, phone, etc.) and the response times expected. In addition, the plan should Artikel procedures for handling unexpected events or urgent issues, ensuring prompt and effective communication. For instance, a defined escalation protocol for addressing significant financial setbacks can help maintain trust and prevent misunderstandings. Finally, documenting all communication, including dates, times, and key discussion points, creates a clear record for future reference.

Illustrative Examples of Successful Seller Financing Deals

Seller financing, while carrying inherent risks, can be a powerful tool for both buyers and sellers. Successful implementations often hinge on careful planning, transparent communication, and a well-structured agreement. The following case studies illustrate the diverse applications and potential outcomes of this financing strategy.

Case Study 1: The Acquisition of a Local Bakery

This case involves the acquisition of a small, established bakery in a suburban town. The bakery, “Sweet Surrender,” had been operating successfully for 15 years but the owner, nearing retirement, sought a smooth transition. The buyer, a young entrepreneur with experience in food service management but limited capital, proposed a seller financing arrangement. The deal structured a down payment of 25% of the agreed-upon purchase price of $200,000, with the remaining $150,000 financed by the seller over five years at a 6% interest rate. The seller also agreed to a consulting role for the first year, providing valuable expertise and ensuring a smooth transition of operations. The deal proved mutually beneficial. The buyer successfully managed the bakery, increasing profits by 10% within two years, and consistently met the payment schedule. The seller received a steady income stream and ensured the continued success of their life’s work. The consulting role added value beyond the financial aspect, creating a smoother transition and reduced the risk for both parties.

Case Study 2: Expansion of a Regional Manufacturing Company

This example focuses on a larger transaction: a regional manufacturing company, “Precision Parts,” acquired a smaller competitor, “Quality Components,” to expand its market share. “Quality Components” had a strong customer base but lacked the capital for further growth. The acquisition involved a complex seller financing arrangement. The purchase price was $1 million, with a 30% down payment from “Precision Parts.” The remaining $700,000 was financed by the seller over seven years, with interest payments tied to “Precision Parts’” annual profits. This profit-sharing element incentivized “Precision Parts” to increase profitability, directly benefiting the seller. The agreement included detailed performance metrics and milestones, providing transparency and accountability. This arrangement allowed “Precision Parts” to avoid taking on substantial debt and to benefit from the existing customer relationships of “Quality Components.” The seller received a substantial return on their investment and minimized tax implications compared to an outright sale.

Case Study 3: The Sale of a Software Development Firm

This case involves the sale of a software development firm, “CodeCraft,” to a larger technology company. “CodeCraft” had developed a unique software platform with high growth potential, but the owner, the sole developer, was seeking an exit strategy. The buyer, a larger technology firm, agreed to a seller financing arrangement. The purchase price was $500,000, with a significant portion financed by the seller. The structure included a deferred payment schedule with a portion of the payment tied to the future revenue generated by the software platform. This incentivized the buyer to successfully integrate and market the software. The seller also retained a consulting role for a specified period, ensuring a smooth technology transfer and contributing to the platform’s success. This arrangement allowed the buyer to acquire a valuable asset without tying up significant capital immediately, while providing the seller with continued financial benefits tied to the platform’s future success. The deferred payment, linked to revenue, mitigated risk for the buyer and provided a substantial return for the seller based on the platform’s performance.