How to keep track of sales small business – How to keep track of sales for a small business is crucial for growth and profitability. Ignoring this aspect can lead to inaccurate financial reporting, missed opportunities, and ultimately, business failure. This comprehensive guide navigates you through the essential steps, from selecting the right sales tracking system to leveraging data for future planning. We’ll explore various methods, from simple spreadsheets to sophisticated CRM software, ensuring you find the perfect solution for your unique needs and budget.

We’ll delve into effective data entry techniques, highlighting the importance of accuracy and consistency. Learn how to track key sales metrics, analyze trends, and ultimately use this valuable data to improve your business performance. Discover how forecasting becomes possible using historical sales data, enabling you to make informed decisions about pricing, marketing, and overall business strategy. Finally, we’ll examine the benefits of integrating your sales tracking system with other business systems for a streamlined and efficient workflow.

Choosing the Right Sales Tracking System for Small Businesses

Effective sales tracking is crucial for small businesses to monitor performance, identify growth opportunities, and make informed decisions. The right system will streamline processes, improve accuracy, and ultimately boost profitability. Selecting the appropriate sales tracking method depends on factors like business size, budget, technical expertise, and the complexity of sales processes.

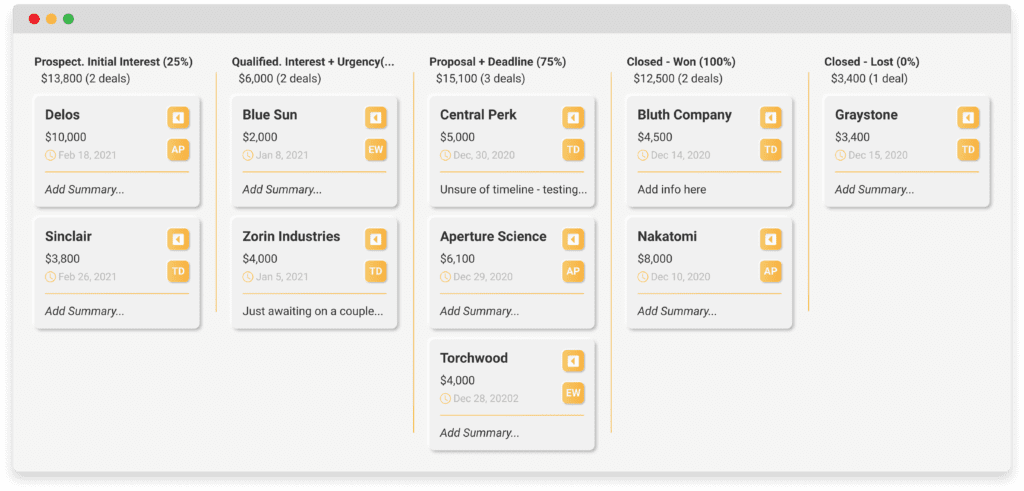

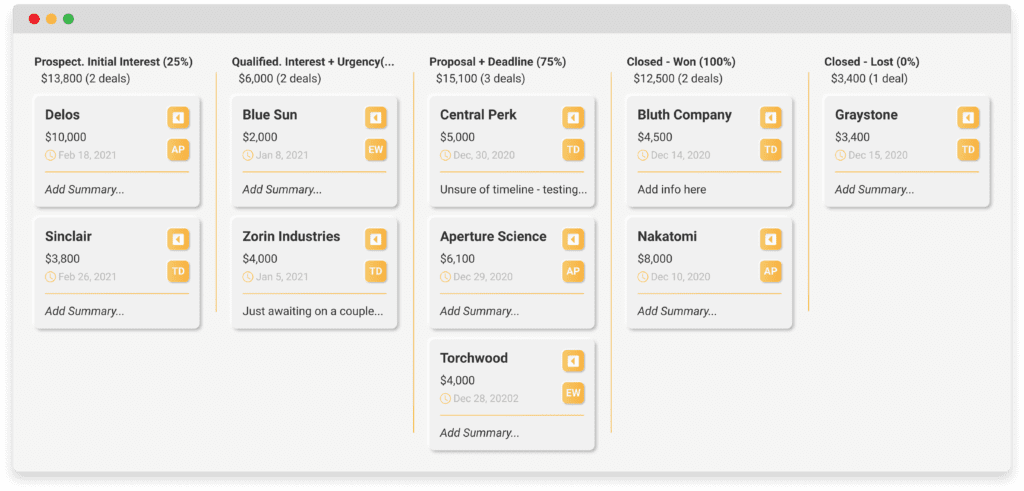

Sales Tracking Software Options Compared

Choosing the right sales tracking system involves weighing the benefits of different software options against the needs of your business. The following table compares several popular choices.

| Software Name | Cost | Features | Pros/Cons |

|---|---|---|---|

| Spreadsheet Software (e.g., Google Sheets, Microsoft Excel) | Free (basic versions); Subscription for advanced features | Basic sales data entry, formula calculations, charting, limited reporting | Pros: Cost-effective, readily accessible. Cons: Limited automation, prone to errors with large datasets, difficult to collaborate on, lacks advanced analytics. |

| Dedicated CRM Software (e.g., HubSpot CRM, Zoho CRM) | Free (basic plans); Subscription for advanced features | Contact management, sales pipeline tracking, lead management, reporting, automation features (email marketing, task assignments) | Pros: Comprehensive features, automation capabilities, improved sales process management. Cons: Can be expensive, requires learning curve, may be overkill for very small businesses. |

| Accounting Software with Sales Tracking (e.g., Xero, QuickBooks) | Subscription-based | Sales tracking integrated with accounting, invoicing, expense management, financial reporting | Pros: Streamlined financial management, accurate financial data, integrated reporting. Cons: May lack advanced CRM features, can be complex to learn. |

Manual vs. Automated Sales Tracking Systems

The decision between manual and automated systems hinges on your business’s scale and resources. Manual systems, typically using spreadsheets or notebooks, are simple to implement but become inefficient as sales volume grows. Automated systems, like CRM software, offer scalability and efficiency but require an initial investment and training.

Manual systems, while inexpensive, are highly susceptible to human error and lack the analytical capabilities of automated solutions. They also consume significant time and effort in data entry and reporting. Automated systems, on the other hand, offer real-time data, improved accuracy, and valuable insights through advanced reporting and analytics. They automate repetitive tasks, freeing up time for more strategic activities.

Selecting a Sales Tracking System: A Flowchart

The selection process should consider budget and business needs. The following flowchart illustrates a systematic approach.

(Imagine a flowchart here. The flowchart would begin with a decision box: “Is your budget limited?” A “Yes” branch would lead to a box suggesting spreadsheets or basic CRM plans. A “No” branch would lead to a box: “Do you need advanced CRM features?” A “Yes” branch would lead to a box recommending dedicated CRM software. A “No” branch would lead to a box recommending accounting software with sales tracking features. All branches would ultimately converge at a final box: “Implement chosen system and monitor performance.”)

Effective Data Entry and Organization

Accurate and consistent sales data entry is the bedrock of effective sales tracking for any small business. Without it, your reports become unreliable, hindering informed decision-making and potentially impacting your bottom line. Clean, organized data allows for accurate sales analysis, revealing trends, identifying top-performing products, and pinpointing areas needing improvement. This ultimately leads to better strategic planning and increased profitability.

The process of inputting sales data might seem straightforward, but consistent application of best practices is key to ensuring data integrity and facilitating efficient analysis. Inaccurate data leads to flawed insights and potentially costly mistakes.

Sales Data Input Procedures

Entering sales data accurately and consistently is crucial for generating reliable sales reports. A well-defined process minimizes errors and ensures data integrity. This involves a step-by-step approach, starting with the initial sale and encompassing any subsequent adjustments.

Here’s a suggested process: Immediately after a sale, record the transaction details. This includes the date, customer information (if applicable), product details (including SKU if used), quantity sold, price per unit, any applicable discounts or taxes, and the total revenue generated. Use a standardized format for consistency. For example, a simple spreadsheet with clearly labeled columns can be very effective. For online sales, many platforms automatically record this data, simplifying the process. However, even then, regular review and verification are crucial.

When handling returns and refunds, create a separate entry clearly indicating the nature of the transaction. Use negative values to reflect the reduction in revenue. Include the original transaction date and reference number for easy reconciliation. For instance, if a customer returns a product, record the return date, the original sale date, the product details, the refund amount, and a brief reason for the return. This ensures a complete and accurate picture of your sales performance.

Best Practices for Organizing Sales Data

Organizing your sales data effectively is as crucial as accurate data entry. A well-organized system makes data retrieval and analysis significantly easier, saving time and improving the accuracy of your insights. Consider these best practices:

Implementing these best practices will significantly improve the efficiency and accuracy of your sales tracking system. The benefits extend beyond simple data management, ultimately contributing to better business decisions and enhanced profitability.

- Use a standardized format: Maintain consistency in data entry across all transactions. Use the same format for dates, product codes, and other relevant information. This makes data analysis much simpler.

- Regularly back up your data: Protect your valuable sales data from loss by regularly backing it up to a secure location, either locally or in the cloud.

- Implement a system of checks and balances: Regularly review your data for inconsistencies or errors. Consider using automated checks to identify potential problems.

- Use clear and descriptive labels: Use consistent and unambiguous labels for your data fields to avoid confusion and ensure accurate interpretation.

- Categorize your data: Organize your data by relevant categories such as product type, sales channel, or customer segment to facilitate targeted analysis.

- Consider using a database or spreadsheet software: These tools offer advanced features for data organization, filtering, and analysis, streamlining your workflow.

Tracking Key Sales Metrics

Understanding and monitoring key sales metrics is crucial for the growth and profitability of any small business. These metrics provide valuable insights into sales performance, allowing businesses to identify areas for improvement and make data-driven decisions. By consistently tracking and analyzing these figures, small business owners can gain a clear picture of their sales trajectory and proactively address potential challenges.

Analyzing sales data shouldn’t be an overwhelming task. Focusing on a few key metrics provides a clear and actionable overview of your business’s performance. The metrics below offer a balanced perspective, encompassing revenue, efficiency, and customer behavior.

Five Crucial Sales Metrics for Small Businesses

The following five metrics offer a comprehensive view of your sales performance. Tracking these regularly enables informed decision-making and strategic adjustments to optimize your sales process.

- Average Revenue Per User (ARPU): This metric measures the average revenue generated per customer. A high ARPU indicates strong customer value and effective upselling/cross-selling strategies.

- Customer Acquisition Cost (CAC): This metric represents the total cost of acquiring a new customer. A low CAC indicates efficient marketing and sales efforts.

- Conversion Rate: This metric shows the percentage of website visitors or leads who complete a desired action, such as making a purchase or signing up for a newsletter. A high conversion rate signifies effective marketing and a user-friendly sales process.

- Customer Lifetime Value (CLTV): This metric predicts the total revenue a business expects to generate from a single customer throughout their relationship. A high CLTV indicates strong customer loyalty and retention.

- Sales Cycle Length: This metric measures the time it takes to close a sale, from initial contact to final purchase. A shorter sales cycle indicates efficiency and effectiveness in the sales process.

Calculating Key Sales Metrics, How to keep track of sales small business

Accurately calculating these metrics is vital for their effective use. The following formulas provide a clear method for determining each metric’s value.

- Average Revenue Per User (ARPU):

Total Revenue / Total Number of Customers

- Customer Acquisition Cost (CAC):

Total Marketing & Sales Costs / Number of New Customers Acquired

- Conversion Rate:

(Number of Conversions / Number of Total Opportunities) x 100%

- Customer Lifetime Value (CLTV):

Average Purchase Value x Average Purchase Frequency x Average Customer Lifespan

Note: Estimating the average customer lifespan often requires analyzing historical data and considering factors like customer churn rate.

- Sales Cycle Length:

Total Time Spent in Sales Process / Number of Sales Closed

This can be tracked from the initial contact to the final sale.

Visualizing Sales Metrics with Charts and Graphs

Data visualization makes understanding trends and patterns in sales metrics significantly easier. The following chart types are particularly useful for representing these metrics.

- Line graphs: Ideal for showing trends over time for metrics like ARPU, CAC, and Sales Cycle Length. A line graph clearly illustrates increases or decreases in these metrics over a specific period (e.g., monthly, quarterly, or annually).

- Bar charts: Effective for comparing different metrics across various time periods or customer segments. For example, a bar chart could compare the conversion rates across different marketing campaigns or the ARPU across different customer demographics.

- Pie charts: Useful for illustrating the proportion of different factors contributing to a metric. For instance, a pie chart could show the breakdown of marketing costs contributing to the overall CAC.

- Funnel charts: Excellent for visualizing the stages of the sales process and identifying bottlenecks. This would clearly show the number of leads at each stage (e.g., initial contact, proposal, negotiation, close) and highlight any stages with significant drop-off rates.

Analyzing Sales Data for Improved Performance

Analyzing sales data isn’t just about crunching numbers; it’s about uncovering hidden opportunities to boost your small business’s bottom line. By understanding trends and patterns in your sales data, you can make informed decisions that lead to increased revenue and improved efficiency. This involves monitoring key metrics, identifying weaknesses, and strategically adjusting your business practices.

Effective analysis reveals actionable insights. It allows you to pinpoint precisely where your business excels and where it needs improvement, leading to targeted strategies for growth. This proactive approach helps avoid costly mistakes and maximizes your return on investment in marketing and sales efforts.

Common Sales Trends to Monitor

Regularly tracking specific sales trends provides a clear picture of your business’s performance and identifies areas needing attention. These trends offer valuable insights into customer behavior, seasonal fluctuations, and the overall effectiveness of your sales strategies.

- Seasonal Sales Fluctuations: Many businesses experience predictable peaks and valleys throughout the year. For example, a swimwear retailer might see significantly higher sales during summer months compared to winter. Understanding these seasonal patterns allows for proactive inventory management and targeted marketing campaigns during peak seasons.

- Average Order Value (AOV): Tracking AOV reveals the average amount customers spend per transaction. A declining AOV might indicate a need to review your product offerings, upselling techniques, or overall customer experience. Conversely, a rising AOV suggests successful strategies.

- Customer Acquisition Cost (CAC): This metric measures the cost of acquiring a new customer. A high CAC relative to customer lifetime value (CLTV) indicates inefficient marketing or sales processes that need optimization.

- Sales Conversion Rates: This tracks the percentage of website visitors or leads who ultimately make a purchase. Low conversion rates suggest potential problems with your website design, marketing messaging, or sales process.

- Customer Churn Rate: This metric shows the percentage of customers who stop doing business with you over a specific period. A high churn rate requires investigating customer satisfaction, product quality, or competition.

Identifying Areas for Improvement

Analyzing sales data allows for pinpointing specific areas needing improvement. This involves comparing performance against benchmarks, identifying trends, and using this information to develop targeted solutions.

For example, a consistent drop in sales during a particular month might suggest the need for a targeted marketing campaign or a special promotion during that period. Similarly, low conversion rates from a specific marketing channel might indicate a need to adjust the messaging or targeting of that channel.

Using Sales Data to Adjust Business Strategies

Sales data provides the foundation for informed decisions regarding pricing, marketing, and sales strategies. Analyzing this data helps in optimizing these elements for improved performance and profitability.

Pricing Adjustments: If sales data reveals that a particular product is consistently underperforming despite marketing efforts, a price reduction might stimulate demand. Conversely, if a product is consistently selling out, a price increase might be warranted, assuming market conditions allow.

Marketing Strategy Adjustments: If sales data shows a particular marketing channel is underperforming, resources should be reallocated to more effective channels. For example, if social media marketing isn’t generating leads, shifting budget to search engine optimization () might yield better results.

Sales Strategy Adjustments: If sales data indicates that a particular sales technique is ineffective, changes need to be implemented. For example, if phone sales are underperforming, investing in email marketing or online chat support might be a more effective approach.

Using Sales Data for Forecasting and Planning

Predicting future sales is crucial for any small business. Accurate forecasting allows for better resource allocation, inventory management, and strategic decision-making. By leveraging historical sales data, businesses can identify trends and patterns to create more realistic and effective sales projections. This process involves analyzing past performance, accounting for seasonal variations, and incorporating any anticipated changes in the market or business operations.

Historical sales data provides the foundation for sales forecasting. Analyzing this data reveals trends, seasonality, and growth patterns. For example, a consistent upward trend might indicate market expansion or successful marketing campaigns, while seasonal fluctuations might reflect increased demand during specific periods (e.g., holiday shopping). By identifying these patterns, businesses can develop more accurate predictions for future periods. Furthermore, external factors, such as economic conditions or competitor actions, should also be considered when making sales forecasts.

Sales Forecasting Methodology

A common method for forecasting sales involves analyzing past sales figures to identify trends and patterns. This can be done using various statistical techniques, including moving averages or regression analysis. However, for small businesses with limited resources, a simpler approach might suffice. For instance, examining sales data from the past few years, identifying seasonal peaks and troughs, and extrapolating these patterns into the future can provide a reasonable forecast. It’s important to remember that these forecasts are estimates, and unexpected events can significantly impact actual sales.

Hypothetical Sales Forecast

Let’s consider a hypothetical scenario for “Cozy Candles,” a small business selling handmade candles. Their sales data for the past year is as follows: October: $5,000; November: $7,000; December: $10,000; January: $4,000; February: $3,000; March: $4,000; April: $5,000; May: $6,000; June: $7,000; July: $6,000; August: $5,000; September: $4,500.

Based on this data, we can observe a clear seasonal pattern, with higher sales during the holiday season (November-December) and lower sales during the winter months (January-February). To forecast sales for the next quarter (October, November, December), we can use a simple extrapolation method, adjusting for the expected seasonal increase.

| Month | Forecasted Sales ($) |

|---|---|

| October | 5,500 |

| November | 7,500 |

| December | 11,000 |

This forecast assumes a 10% increase in sales compared to the previous year’s figures for October and November, and a 10% increase in December’s sales, reflecting anticipated holiday demand. This is a simplified example; a more sophisticated approach might involve more complex statistical models.

Integrating Sales Forecasts into Business Planning

Accurate sales forecasts are vital for effective business planning. They inform crucial decisions across various departments. For instance, the marketing department can use the forecast to allocate budget effectively, focusing on promotional activities during periods of anticipated high demand. The production or purchasing department can use the forecast to manage inventory levels, ensuring sufficient stock to meet anticipated demand while minimizing storage costs. The finance department can use the forecast to prepare cash flow projections and secure necessary funding. In short, a well-defined sales forecast acts as a cornerstone for sound business strategy and resource allocation.

Integrating Sales Tracking with Other Business Systems: How To Keep Track Of Sales Small Business

Seamlessly integrating your sales tracking system with other crucial business platforms like accounting and inventory management is paramount for a streamlined and efficient operation. This interconnectedness eliminates data silos, reduces manual data entry, and provides a holistic view of your business performance, ultimately leading to better decision-making and improved profitability. Effective integration unlocks the true potential of your sales data, transforming it from isolated figures into actionable insights.

Integrating your sales tracking system with other business software offers significant advantages. Connecting your sales data with your accounting software, for instance, automates invoice generation and expense tracking, reducing the risk of errors and freeing up valuable time. Similarly, linking it with your inventory management system provides real-time visibility into stock levels, enabling proactive replenishment and preventing stockouts – a crucial aspect for maintaining customer satisfaction and avoiding lost sales. This interconnected approach fosters a dynamic and responsive business environment.

Benefits of System Integration

The benefits extend beyond simple automation. Real-time data synchronization between systems provides a unified view of financial performance, inventory levels, and sales trends. This holistic perspective allows for more accurate forecasting, improved resource allocation, and better inventory control. For example, a small bakery integrating its sales data with inventory management could automatically reorder flour when sales of bread exceed a certain threshold, preventing production delays. This proactive approach minimizes operational disruptions and enhances overall efficiency. The improved data accuracy also contributes to more reliable financial reporting, simplifying tax preparation and streamlining audits.

Methods of Data Integration

Several methods facilitate the integration of sales data with other business systems. Application Programming Interfaces (APIs) offer a robust and automated solution. APIs allow different software systems to communicate and exchange data directly, eliminating the need for manual data entry and minimizing errors. Many modern sales tracking, accounting, and inventory management systems offer API integrations, simplifying the connection process. Alternatively, manual data transfer can be employed, although this method is considerably less efficient and prone to human error. This typically involves exporting data from one system and importing it into another, a process that requires careful attention to detail and is often time-consuming.

Challenges of System Integration and Solutions

While system integration offers substantial benefits, potential challenges exist. Data format inconsistencies between different systems can hinder seamless integration. Different systems may use varying data formats or structures, requiring data transformation before integration. This can be addressed by employing data transformation tools or working with a system integrator experienced in data mapping and transformation. Another challenge is ensuring data security and privacy. Integrated systems need to comply with relevant data protection regulations. This requires careful selection of integrated systems and implementation of appropriate security measures. Finally, the initial setup and ongoing maintenance of integrated systems can be complex and require technical expertise. Outsourcing this process to a specialized IT consultant or leveraging the support of the software vendors can significantly ease the burden.