How to record loan in quickbooks desktop – How to record a loan in QuickBooks Desktop is a crucial skill for any small business owner. Mastering this process ensures accurate financial reporting and a clear understanding of your company’s financial health. This guide walks you through the entire process, from setting up the necessary accounts to recording payments and generating insightful reports. We’ll cover different loan types, address common issues, and provide practical examples to solidify your understanding.

Understanding how to accurately record loans is essential for maintaining accurate financial records. This involves not only recording the initial loan disbursement but also tracking subsequent payments, including both principal and interest. Properly categorizing these transactions is vital for generating reliable financial reports, helping you make informed business decisions.

Understanding Loan Types in QuickBooks Desktop

QuickBooks Desktop allows for the recording of various loan types, each impacting your financial statements differently. Accurate recording is crucial for maintaining precise financial records and generating reliable reports. Understanding the nuances of each loan type ensures you categorize transactions correctly and gain valuable insights into your financial health.

Loan Types and Their Recording Methods

QuickBooks Desktop primarily handles three main loan types: business loans, personal loans (if integrated with personal finance tracking), and lines of credit. The key difference lies in how the loan is structured and how the interest and principal are tracked. Business loans typically involve fixed principal payments over a set period, while lines of credit allow for variable borrowing and repayment. Personal loans, when tracked within QuickBooks, function similarly to business loans but are typically categorized separately for better financial segregation.

Comparing Loan Types in QuickBooks Desktop

The following table summarizes the key characteristics of each loan type and their impact on your financial statements. Note that the specific account used might vary based on your QuickBooks chart of accounts setup.

| Loan Type | Interest Rate Treatment | Principal Payment Method | Account Used |

|---|---|---|---|

| Business Loan | Accrued and expensed over the loan term. Amortization schedule is often used. | Fixed payments, typically amortized over the loan term. | Loan Payable (Liability Account) and Interest Expense (Expense Account) |

| Personal Loan (if tracked) | Similar to business loans, accrued and expensed over the loan term. | Fixed payments, typically amortized over the loan term. | Loan Payable (Liability Account, potentially a separate account for personal loans) and Interest Expense (Expense Account) |

| Line of Credit | Interest is typically accrued and expensed only on the outstanding balance. | Variable payments, based on the outstanding balance and credit usage. | Line of Credit (Liability Account) and Interest Expense (Expense Account) |

Setting Up Accounts for Loan Recording

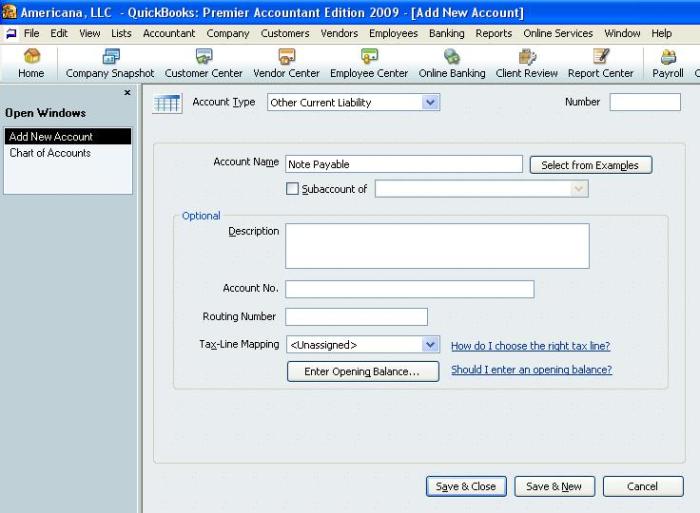

Accurate loan tracking in QuickBooks Desktop hinges on a properly configured chart of accounts. This ensures that all loan-related transactions are categorized correctly, facilitating accurate financial reporting and analysis. The chart of accounts acts as the backbone of your financial record-keeping, providing a structured framework for classifying all your financial data. Without a well-defined chart of accounts, tracking loan details becomes significantly more challenging, potentially leading to errors and inconsistencies in your financial statements.

Liability Accounts for Loans Payable

Creating liability accounts for loans payable is crucial for accurately reflecting your company’s debt obligations. Each loan should have its own separate liability account to maintain clear distinction and facilitate individual loan tracking. This allows for precise monitoring of loan balances, interest payments, and principal repayments. For instance, you might create accounts such as “Loan Payable – Bank of America” and “Loan Payable – Small Business Loan,” clearly identifying the source and nature of each loan. Within QuickBooks, navigate to the Chart of Accounts, select “New,” and choose the “Liability” account type. Provide a descriptive account name and number. Remember to maintain consistency in naming conventions for easy identification and reporting.

Asset Accounts for Loan Proceeds

When you receive loan proceeds, these funds represent an increase in your company’s assets. You need to create asset accounts to record where these funds are allocated. This is crucial for tracking how the loan money is utilized within the business. Depending on the intended use of the loan, you may create different asset accounts. For example, if the loan is used to purchase equipment, you would create an asset account such as “Equipment – Loan Funded.” If the loan is for working capital, you could create an account like “Cash – Loan Proceeds.” Similar to liability accounts, these asset accounts are created within QuickBooks’ Chart of Accounts, selecting “New” and choosing the “Asset” account type. Ensure account names clearly reflect the source and purpose of the funds.

Expense Accounts for Loan Interest Payments

Interest payments on loans are considered expenses for your business. To accurately track these costs, you need to create a specific expense account for loan interest. This account allows you to segregate interest expenses from other operational expenses, providing a clearer picture of your financing costs. A common practice is to create an account like “Interest Expense – Loans.” This account is also created within the Chart of Accounts, selecting “New” and choosing the “Expense” account type. Categorizing interest expenses separately aids in financial analysis, allowing you to assess the impact of borrowing costs on your profitability. The account name should be clear and unambiguous to ensure accurate reporting.

Recording the Initial Loan Transaction

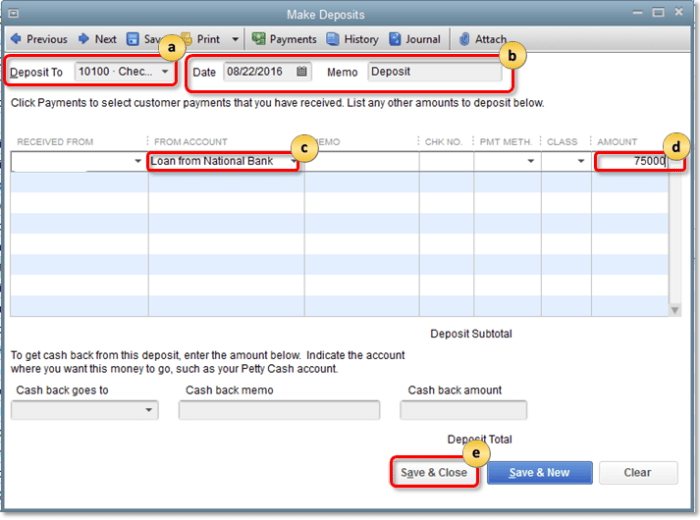

Recording the initial loan disbursement in QuickBooks Desktop involves accurately reflecting the increase in your company’s assets (cash) and the corresponding increase in its liabilities (the loan payable). This process ensures your financial statements accurately represent your financial position. Accurate recording is crucial for maintaining reliable financial records and making informed business decisions.

The process of recording the initial loan disbursement involves a simple journal entry. This entry debits the asset account representing the received cash and credits the liability account representing the loan payable. The debit increases the asset account, while the credit increases the liability account, maintaining the fundamental accounting equation (Assets = Liabilities + Equity).

Journal Entry for Loan Disbursement

A journal entry is the foundational record of any financial transaction. For a loan disbursement, the journal entry clearly demonstrates the increase in cash (an asset) and the simultaneous increase in the loan payable (a liability). Let’s illustrate this with an example. Assume your company received a $10,000 loan from a bank.

The journal entry would appear as follows:

| Date | Account | Debit | Credit |

|---|---|---|---|

| October 26, 2024 | Cash | $10,000 | |

| Loan Payable | $10,000 |

In this entry:

* Cash (Debit): The debit of $10,000 increases the cash account, reflecting the influx of funds from the loan. This account is typically found under the “Assets” section of your QuickBooks chart of accounts.

* Loan Payable (Credit): The credit of $10,000 increases the loan payable account, representing the company’s obligation to repay the borrowed funds. This account is found under the “Liabilities” section of your QuickBooks chart of accounts.

This simple yet crucial journal entry accurately reflects the financial impact of the loan disbursement, ensuring that your QuickBooks financial records are up-to-date and reliable. Remember to always ensure that the debits and credits are equal in every transaction to maintain the fundamental accounting equation.

Recording Loan Payments

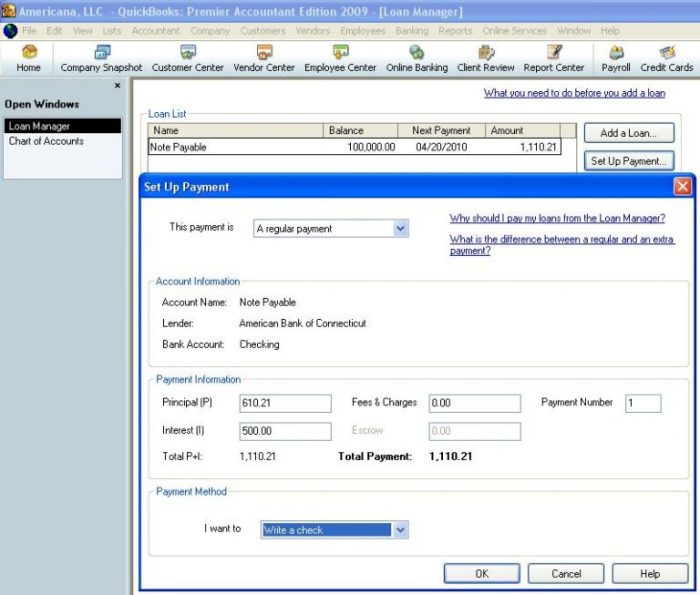

Accurately recording loan payments in QuickBooks Desktop is crucial for maintaining accurate financial records. This process involves separating principal and interest payments and correctly posting them to the relevant accounts. Failure to do so can lead to inaccurate financial statements and potentially tax complications.

Recording loan principal payments reduces the outstanding loan balance. Recording interest payments reflects the cost of borrowing. Both are essential components of a complete and accurate accounting of your loan activity.

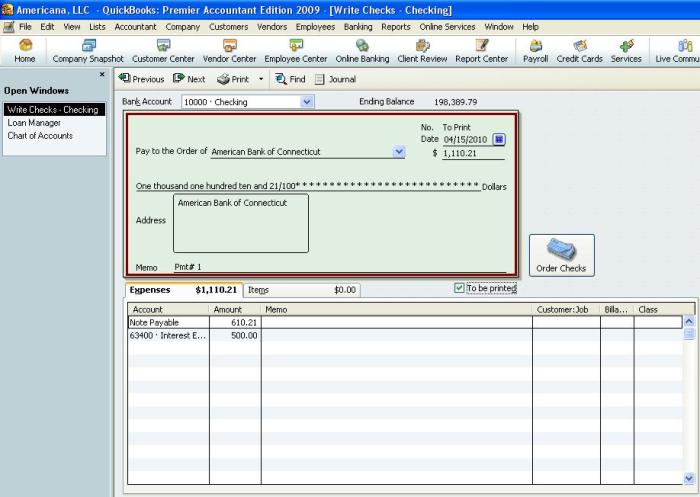

Recording Loan Principal Payments

To record a loan principal payment, you’ll use a journal entry debiting the loan payable account and crediting the bank account used for the payment. The debit reduces the liability (the loan), while the credit reflects the decrease in your bank balance. The amount debited will correspond to the principal portion of the loan payment. QuickBooks Desktop will automatically update the loan’s outstanding balance. For example, a $500 principal payment would be recorded with a $500 debit to the “Loan Payable” account and a $500 credit to the appropriate bank account.

Recording Loan Interest Payments

Interest payments are recorded separately from principal payments. A journal entry debiting the interest expense account and crediting the bank account is used. The debit increases the expense, reflecting the cost of borrowing, and the credit reduces the bank balance. The amount debited will be the interest portion of the loan payment. For instance, a $50 interest payment would involve a $50 debit to “Interest Expense” and a $50 credit to the relevant bank account.

Recording a Loan Payment (Principal and Interest)

This process combines the steps for recording principal and interest payments. Let’s assume a loan payment of $550, consisting of $500 principal and $50 interest.

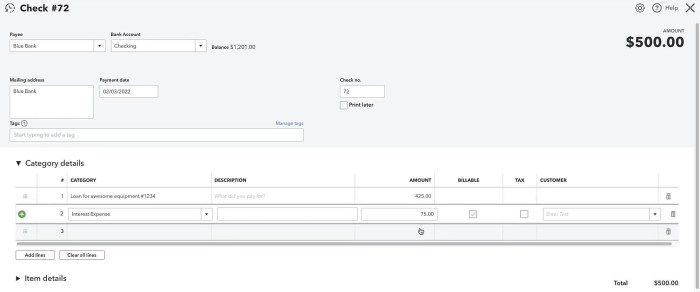

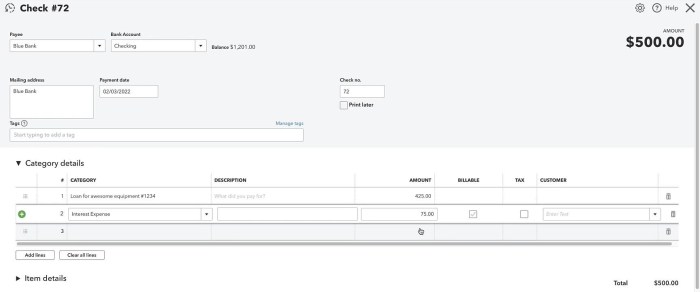

- Open QuickBooks Desktop and navigate to the “Write Checks” or “Enter Bills” section (depending on your payment method).

- Select the appropriate bank account from which the payment will be made.

- In the “Pay to” field, enter the lender’s name.

- In the “Amount” field, enter the total payment amount ($550).

- In the “Memo” field, include details like the loan number and payment date for easy identification.

- Navigate to the “Add Line” section.

- Add a line item with a debit to “Loan Payable” for $500 (principal).

- Add another line item with a debit to “Interest Expense” for $50 (interest).

- A credit of $550 will automatically be applied to your selected bank account to balance the entry.

- Review the journal entry for accuracy before saving.

Journal Entry Examples

The following examples illustrate journal entries for various loan payment scenarios.

| Scenario | Debit Account | Debit Amount | Credit Account | Credit Amount |

|---|---|---|---|---|

| Full Payment ($1000 principal, $100 interest) | Loan Payable | $1000 | Bank Account | $1100 |

| Interest Expense | $100 | |||

| Partial Payment ($200 principal, $20 interest) | Loan Payable | $200 | Bank Account | $220 |

| Interest Expense | $20 |

Managing Loan Amortization

Loan amortization is the process of gradually paying off a loan over time through a series of scheduled payments. Understanding and tracking loan amortization is crucial for accurate financial record-keeping, particularly when managing loans within accounting software like QuickBooks Desktop. Proper amortization tracking allows for accurate interest expense calculations, facilitates better financial planning, and ensures compliance with loan agreements.

QuickBooks Desktop doesn’t have a built-in loan amortization schedule feature that automatically calculates and displays a detailed schedule. However, you can effectively track amortization by manually recording each payment and its allocation to principal and interest. This requires careful attention to detail and accurate calculations. While not automated, the system provides the tools to maintain a complete record of the loan’s repayment progress.

Loan Amortization Schedule Details, How to record loan in quickbooks desktop

A loan amortization schedule details each payment’s breakdown into principal and interest components. It typically includes the payment number, payment date, beginning balance, payment amount, interest paid, principal paid, and ending balance. The interest portion is calculated based on the outstanding principal balance and the interest rate. The principal portion is the remaining amount after subtracting the interest from the total payment. This process repeats for each payment until the loan is fully repaid.

Example Loan Amortization Schedule and QuickBooks Desktop Representation

Let’s consider a $10,000 loan with a 5% annual interest rate and a 3-year term (36 monthly payments). The monthly payment amount, calculated using a standard loan amortization formula, is approximately $299.70.

| Payment # | Payment Date | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|---|

| 1 | 2024-01-31 | $10,000.00 | $299.70 | $41.67 | $258.03 | $9,741.97 |

| 2 | 2024-02-29 | $9,741.97 | $299.70 | $40.60 | $259.10 | $9,482.87 |

| 3 | 2024-03-31 | $9,482.87 | $299.70 | $39.51 | $260.19 | $9,222.68 |

| … | … | … | … | … | … | … |

| 36 | 2026-12-31 | $299.70 | $299.70 | $1.25 | $298.45 | $0.00 |

In QuickBooks Desktop, you would record each monthly payment as a separate transaction. You’d need to create separate accounts for the loan liability, interest expense, and loan principal. Each payment entry would credit the loan liability account (reducing the principal), debit the interest expense account, and debit the cash account. The amounts debited and credited would correspond to the values shown in the amortization schedule. This manual process allows for complete tracking of the loan’s amortization, though it requires diligent record-keeping. While QuickBooks doesn’t automate this, its flexible account structure allows for this level of detailed tracking.

Reporting and Analysis of Loan Data: How To Record Loan In Quickbooks Desktop

Tracking and analyzing loan data in QuickBooks Desktop is crucial for maintaining accurate financial records and making informed business decisions. Effective reporting allows you to monitor loan balances, payment progress, and interest expenses, providing valuable insights into your financial health. This section will Artikel the reporting tools available within QuickBooks Desktop and demonstrate how to interpret the key metrics for effective loan management.

QuickBooks Desktop offers several reports to analyze loan activity, providing a comprehensive view of your loan portfolio. These reports allow for detailed tracking of loan balances, payment history, and interest expenses, crucial for both financial reporting and strategic planning. Understanding how to generate and interpret these reports is essential for effective financial management.

Available Reports for Loan Analysis

QuickBooks Desktop provides various reports suitable for analyzing loan data. The specific reports available may vary slightly depending on your QuickBooks version and the specific setup of your loan accounts. However, key reports commonly used include the Balance Sheet, the Income Statement, and customized reports focusing specifically on loan transactions. The Balance Sheet shows the current outstanding loan balance as a liability, while the Income Statement displays the interest expense incurred during a specific period. Custom reports, created through QuickBooks’ report customization features, allow for highly specific views of loan data, focusing on individual loans or groups of loans. For example, a custom report could be created to show the payment history for a specific loan, or to compare the performance of multiple loans over time.

Generating Reports Showing Loan Balances, Payment History, and Interest Expense

Generating reports in QuickBooks Desktop is straightforward. Navigate to the “Reports” menu. Select the report type needed. For example, to view a loan balance, the Balance Sheet report would be appropriate. To view payment history, a customized report focusing on specific loan accounts might be necessary. This involves selecting the “Custom Report” option and defining the criteria for the report to include specific loan accounts and the desired data fields, such as payment date, amount, and remaining balance. Similarly, the Income Statement report will display the interest expense for a selected period. You can further customize these reports by specifying date ranges, filtering by loan account, and selecting the specific data fields you want to include in the report. The process involves selecting the report, defining the date range, and choosing the level of detail needed. The resulting report will display the relevant information in a clear and concise format, facilitating easy analysis.

Interpreting Key Metrics Related to Loan Performance

Key metrics derived from QuickBooks Desktop reports provide crucial insights into loan performance. These metrics offer a quantifiable assessment of the loan’s health and repayment progress. For example, the outstanding loan balance shows the amount still owed, indicating the remaining debt. The payment history, often visualized as a graph or table, displays the regularity and consistency of loan payments, highlighting any missed or late payments. Interest expense provides insight into the cost of borrowing. Analyzing these metrics together gives a holistic picture of loan performance. For instance, a consistently decreasing outstanding balance coupled with a consistent payment history indicates positive loan performance. Conversely, a stagnant or increasing outstanding balance combined with missed payments suggests potential issues that require attention. The effective interest rate, though not directly reported, can be calculated by dividing the total interest paid by the average outstanding loan balance during the period. This metric offers a more accurate representation of the true cost of borrowing compared to the nominal interest rate.

Troubleshooting Common Issues

Recording loans in QuickBooks Desktop, while straightforward, can sometimes lead to errors. Understanding common problems and their solutions is crucial for maintaining accurate financial records. This section addresses typical issues encountered during loan recording, offering practical solutions to resolve discrepancies and ensure the integrity of your financial data.

Incorrect Loan Balance

Discrepancies in loan balances often stem from inaccurate initial loan entry or inconsistent payment recording. For example, entering an incorrect loan amount or failing to record interest payments correctly will lead to a balance that doesn’t reflect the true loan status. To resolve this, meticulously review the initial loan transaction entry, ensuring the principal amount, interest rate, and loan term are accurately recorded. Verify all subsequent payment entries, checking for correct amounts and dates. If necessary, use QuickBooks’ reporting tools to compare the recorded payments against the loan amortization schedule. Correct any identified discrepancies by creating adjusting journal entries. Always back up your QuickBooks data before making any corrections.

Reporting Inconsistencies

Inconsistent reporting can arise from improper account setup or incorrect categorization of loan transactions. For instance, if loan payments are recorded in the wrong expense account, your reports will show inaccurate figures for both loan liability and expense accounts. To address this, carefully review your chart of accounts to ensure that loan-related accounts (e.g., loan payable, interest expense) are correctly set up. Verify that all loan transactions are categorized accurately within these accounts. Utilize QuickBooks’ report customization options to generate specific loan reports (e.g., loan register, balance sheet) to identify any inconsistencies. If problems persist, consider consulting the QuickBooks help documentation or seeking assistance from a qualified accountant.

Missing or Duplicate Transactions

Missing or duplicate loan transactions can significantly distort financial reports and lead to inaccurate loan balances. A missing payment entry will result in an inflated loan balance, while a duplicate entry will artificially reduce the balance. To identify missing transactions, reconcile your loan account with your bank statements. This process involves comparing the transactions recorded in QuickBooks with those listed on your bank statements. Any discrepancies should be investigated and corrected. To find duplicate transactions, use QuickBooks’ search function to look for identical transactions based on date and amount. If a duplicate is found, void the incorrect entry and ensure only one accurate transaction remains.

Troubleshooting Flowchart

A flowchart can streamline the troubleshooting process. Imagine a flowchart starting with a “Problem with Loan Recording?” Yes/No decision point. If yes, it branches to three options: Incorrect Loan Balance, Reporting Inconsistencies, and Missing/Duplicate Transactions. Each of these options then leads to a series of steps: Review initial entry, check payment entries, use reports for comparison, and make corrections. For Reporting Inconsistencies, the steps could be: Review chart of accounts, verify transaction categorization, customize reports, and consult documentation. For Missing/Duplicate Transactions, the steps would be: Reconcile bank statements, use search function, void incorrect entries. Each path ultimately converges on a “Problem Resolved?” Yes/No decision point. If no, it loops back to the initial problem identification, suggesting further investigation or seeking professional help.

Illustrative Examples with Visuals

This section provides a practical example of recording a small business loan in QuickBooks Desktop, illustrating the process step-by-step and highlighting the impact on financial statements. We will follow the journey of “Cozy Candles,” a small candle-making business securing a loan to expand its operations.

Let’s assume Cozy Candles obtains a $10,000 loan from a local bank with a 5% annual interest rate, payable over 24 months. The loan proceeds will be used to purchase new candle-making equipment. We will track the loan’s impact on Cozy Candles’ financial statements, specifically the balance sheet and income statement.

A Small Business Loan Scenario: Cozy Candles

The following details the transactions involved in recording Cozy Candles’ loan in QuickBooks Desktop. Each transaction includes a description and the corresponding journal entry. Note that the specific accounts used might vary slightly depending on your QuickBooks setup, but the principles remain the same.

- Transaction 1: Receiving the Loan Proceeds

Description: Cozy Candles receives $10,000 from the bank.

Journal Entry: Debit: Cash ($10,000); Credit: Loan Payable ($10,000) - Transaction 2: First Monthly Payment

Description: Cozy Candles makes its first monthly payment of principal and interest. Assuming a standard amortization schedule, this payment might be approximately $438.71 (principal + interest). The exact amount will depend on the loan’s amortization schedule.

Journal Entry: Debit: Loan Payable (Portion of payment applied to principal, e.g., $380); Debit: Interest Expense (Portion of payment applied to interest, e.g., $58.71); Credit: Cash ($438.71) - Transaction 3: Subsequent Monthly Payments

Description: Cozy Candles makes subsequent monthly payments following the same format as Transaction 2. The portion of the payment applied to principal will increase each month, while the interest portion will decrease.

Journal Entry: Similar to Transaction 2, adjusting the principal and interest portions according to the amortization schedule. - Transaction 4: Purchase of Equipment

Description: Cozy Candles uses the loan proceeds to purchase new candle-making equipment.

Journal Entry: Debit: Equipment ($10,000); Credit: Cash ($10,000)

Impact on Financial Statements

Recording these loan transactions significantly impacts Cozy Candles’ balance sheet and income statement. Let’s examine these effects.

Balance Sheet Impact: The initial receipt of the loan increases both assets (Cash) and liabilities (Loan Payable) by $10,000. As Cozy Candles makes loan payments, the Cash account decreases, and the Loan Payable account decreases correspondingly. The purchase of equipment increases the company’s fixed assets.

Income Statement Impact: The interest expense incurred on the loan is recorded on the income statement, reducing net income. Each month, the interest expense is recorded as a debit (an expense), reducing net income. The principal payments themselves are not directly reflected on the income statement.

Conclusive Thoughts

Successfully recording loans in QuickBooks Desktop provides a solid foundation for accurate financial management. By following the steps Artikeld in this guide, you’ll gain confidence in managing your loan accounts and generating reliable financial statements. Remember, consistent and accurate record-keeping is key to understanding your business’s financial performance and making informed decisions about future growth.

Question & Answer Hub

Can I record a personal loan in QuickBooks Desktop?

While primarily designed for business accounting, you can record personal loans, but it’s crucial to maintain clear separation from business transactions for accurate reporting.

What if I make an early loan payment?

Record the early payment similarly to a regular payment, specifying the extra principal amount paid. QuickBooks will adjust the remaining balance accordingly.

How do I handle loan forgiveness?

Loan forgiveness is treated as income, and the forgiven amount should be recorded as income and the corresponding liability reduced. Consult a tax professional for specific guidance.

How often should I reconcile my loan accounts?

Reconcile your loan accounts regularly, ideally monthly, to identify and correct any discrepancies promptly, ensuring accuracy in your financial statements.