How to repair business credit? It’s a question many entrepreneurs grapple with. A damaged business credit score can severely limit access to funding, hindering growth and potentially jeopardizing the entire enterprise. This guide delves into the intricacies of repairing your business credit, offering actionable strategies to rebuild your financial reputation and unlock new opportunities. We’ll explore common credit report errors, effective dispute resolution methods, and proven strategies for improving your score, ultimately paving the way for securing loans and expanding your business.

From understanding the factors that influence your business credit score to navigating the complexities of different credit bureaus and loan options, we provide a comprehensive roadmap to financial recovery. We’ll also equip you with the knowledge to avoid common pitfalls and identify fraudulent credit repair services, ensuring you take control of your financial future.

Understanding Business Credit Scores

Building and maintaining a strong business credit profile is crucial for securing loans, attracting investors, and negotiating favorable terms with vendors. Understanding how business credit scores are calculated and what factors influence them is the first step towards achieving financial success. This section will delve into the intricacies of business credit scoring, highlighting key differences from personal credit and providing insights into the major players in the industry.

Factors Contributing to Business Credit Scores

Several factors contribute to a business’s creditworthiness, and these are weighted differently by various credit bureaus. Key elements include payment history (the most significant factor), credit utilization (the amount of credit used relative to the total available), length of credit history (how long your business has had credit accounts open), types of credit used (mix of credit cards, loans, etc.), and new credit (frequency of applying for new credit). Consistent on-time payments are paramount, as late or missed payments severely damage your score. Similarly, maintaining low credit utilization demonstrates responsible credit management. A longer credit history generally indicates financial stability and reliability.

Differences Between Personal and Business Credit Scores

Personal and business credit scores are distinct entities. Your personal credit score reflects your individual financial history, while your business credit score assesses the financial health and reliability of your company. Lenders use business credit scores to evaluate the risk associated with extending credit to your business. Importantly, they are not directly linked; a strong personal credit score does not automatically translate to a strong business credit score, and vice versa. Maintaining both is essential for a holistic financial profile.

Major Business Credit Bureaus and Their Scoring Models

The three primary business credit bureaus – Experian, Equifax, and Dun & Bradstreet (D&B) – each employ proprietary scoring models. While the specific algorithms are confidential, they generally consider the factors Artikeld above. D&B’s PAYDEX score is a widely recognized indicator, often used by lenders. Experian and Equifax also offer business credit reports and scores, providing a comprehensive view of your creditworthiness from multiple perspectives. Each bureau may weight certain factors differently, leading to variations in scores across platforms.

Common Mistakes That Lower Business Credit Scores

Several common errors can negatively impact your business credit score. These include late payments, exceeding credit limits, frequently applying for new credit, and failing to address negative information on your credit reports. Furthermore, neglecting to establish business credit separately from personal credit can hinder the development of a strong business credit profile. Ignoring outstanding debts or failing to respond to inquiries from credit bureaus can also have detrimental consequences. Proactive credit monitoring and timely dispute resolution are crucial for maintaining a healthy business credit score.

Comparison of Major Business Credit Bureaus

| Feature | Experian | Equifax | Dun & Bradstreet (D&B) |

|---|---|---|---|

| Primary Score | Intelliscore Plus | Business Credit Score | PAYDEX |

| Report Content | Credit history, payment patterns, public records | Similar to Experian, with potential variations | Financial strength indicators, payment behavior, business information |

| User Base | Wide range of businesses and lenders | Similar to Experian | Often preferred by larger lenders and financial institutions |

| Cost | Varies depending on services | Varies depending on services | Varies depending on services and subscription levels |

Identifying and Addressing Credit Report Errors

Maintaining a clean and accurate business credit report is crucial for securing favorable financing terms and establishing a strong financial reputation. Inaccuracies on your report can significantly hinder your ability to access credit and negatively impact your business’s overall financial health. Understanding how to identify and dispute these errors is a critical skill for any business owner.

Common Business Credit Report Errors

Errors on business credit reports are surprisingly common. These inaccuracies can range from minor discrepancies to significant misrepresentations of your business’s financial standing. Common errors include incorrect business names or addresses, outdated or inaccurate payment information (late payments reported as on-time, or vice versa), accounts that don’t belong to your business, and incorrect tax liens or judgments. Furthermore, errors in the reporting of your business’s incorporation date or the number of employees can also negatively affect your credit score. The consequences of these errors can range from difficulty securing loans to higher interest rates.

Disputing Inaccurate Information

The process of disputing inaccurate information on your business credit reports involves formally contacting the reporting agencies (such as Dun & Bradstreet, Experian, and Equifax) and providing compelling evidence to support your claim. Each agency has its own dispute process, typically involving submitting a formal dispute letter or using an online portal. It’s crucial to be thorough and organized in your approach, ensuring you clearly identify the specific errors and provide sufficient documentation. Ignoring errors can have long-term negative consequences for your business credit.

Documentation Needed to Support a Dispute

To successfully dispute inaccurate information, you’ll need to provide strong evidence to support your claims. This may include:

- Copies of your business’s incorporation documents, showing the correct business name and address.

- Proof of payment for disputed accounts, such as canceled checks, bank statements, or payment confirmations.

- Legal documentation, such as court records, to refute incorrect judgments or liens.

- Correspondence with creditors to clarify any discrepancies in payment history.

- A detailed explanation of the error and how it impacts your business credit score.

The more comprehensive your documentation, the higher the likelihood of a successful dispute. Remember to keep copies of all documentation submitted for your records.

Best Practices for Maintaining Accurate Business Credit Information

Proactive measures are essential to prevent errors from appearing on your business credit report in the first place. These include:

- Regularly monitoring your business credit reports from all three major agencies.

- Promptly paying all business debts and obligations.

- Maintaining accurate and up-to-date business information with all creditors and reporting agencies.

- Reviewing all invoices and statements carefully for accuracy.

- Establishing a robust system for tracking payments and financial transactions.

Consistent vigilance and diligent record-keeping are key to protecting your business’s creditworthiness.

Step-by-Step Guide for Disputing Errors

Disputing errors effectively requires a systematic approach. Follow these steps:

- Gather Documentation: Compile all necessary documents to support your claim, as Artikeld previously.

- Identify the Reporting Agency: Determine which credit reporting agency contains the inaccurate information.

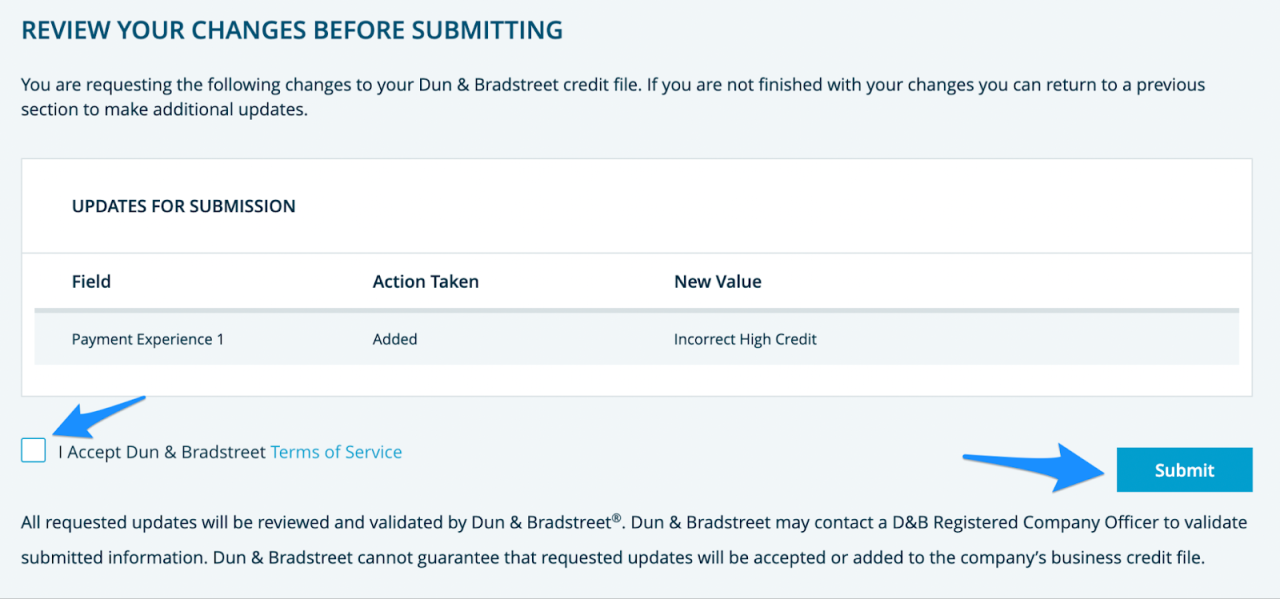

- Submit a Formal Dispute: Use the agency’s designated dispute process, whether it’s an online portal or a formal letter. Clearly state the specific errors and provide supporting evidence.

- Follow Up: After submitting your dispute, follow up with the agency to track its progress. Keep records of all communication.

- Review the Results: Once the agency completes its investigation, review the updated credit report to ensure the errors have been corrected.

This systematic approach will maximize your chances of successfully resolving inaccuracies on your business credit report. Remember that persistence and meticulous record-keeping are crucial throughout the process.

Strategies for Improving Business Credit

Building and maintaining strong business credit is crucial for accessing favorable financing options, securing business contracts, and fostering overall financial health. This section Artikels effective strategies for both establishing business credit from scratch and enhancing existing scores. Understanding the nuances of different credit accounts and their impact is key to a successful approach.

Establishing Business Credit from Scratch

Building business credit from nothing requires a strategic and patient approach. The initial steps focus on establishing a strong credit profile by opening and responsibly managing various business credit accounts. This process differs significantly from personal credit building, as lenders assess business creditworthiness based on factors distinct from personal financial history. Ignoring this distinction can lead to missed opportunities or even financial setbacks.

Improving Existing Business Credit Scores

Improving an existing business credit score involves actively managing existing accounts and strategically adding new ones. Consistent on-time payments are paramount, as payment history significantly impacts credit scores. Furthermore, maintaining low credit utilization across all accounts demonstrates responsible financial management, leading to improved scores over time. Regularly monitoring credit reports for errors and promptly addressing any inaccuracies is also vital.

Types of Business Credit Accounts and Their Impact

Several types of business credit accounts contribute to a comprehensive credit profile. Trade credit accounts, obtained from suppliers, reflect responsible payment practices with vendors. Business credit cards, used judiciously, provide opportunities to demonstrate consistent payment behavior. Bank loans, particularly term loans, showcase a company’s ability to manage larger debts effectively. Each account type contributes differently to the overall score, with a diverse portfolio often viewed more favorably than reliance on a single account type. For example, consistently paying off a business credit card balance in full each month demonstrates responsible credit management and can positively influence credit scores. Conversely, consistently carrying a high balance on multiple accounts will negatively impact scores.

Comparison of Credit-Building Strategies

Different strategies for building business credit offer varying benefits and drawbacks. Using only trade credit accounts offers a low-risk approach, but it may build credit slowly. Establishing multiple business credit cards can accelerate credit building but carries the risk of high debt if not managed properly. Securing a business loan demonstrates financial strength but requires meeting stringent lending criteria. The optimal strategy depends on the business’s specific financial situation, risk tolerance, and long-term goals. A small business might start with trade credit lines to establish a payment history, then graduate to a business credit card to demonstrate broader credit management capabilities, eventually working towards a small business loan for more significant capital.

Resources for Accessing Business Credit Reports and Scores

Several reputable agencies provide business credit reports and scores. Dun & Bradstreet (D&B), Experian, and Equifax are prominent examples. Each agency uses different scoring models and data sources, so it’s beneficial to monitor reports from multiple agencies. Accessing these reports often involves a fee, but understanding your credit profile is essential for informed decision-making. Many lenders and financing platforms also offer access to credit reports as part of their application processes. Directly contacting these agencies is the most reliable method for obtaining accurate and up-to-date information.

Utilizing Business Credit for Funding

Building a strong business credit profile is crucial for accessing favorable financing options. A robust credit history demonstrates financial responsibility and reduces lender risk, ultimately impacting the terms and availability of loans and other funding sources. This section details how a positive business credit score unlocks better financing opportunities and the advantages of separating business and personal finances.

Impact of Business Credit Score on Loan Approval and Terms

A high business credit score significantly increases the likelihood of loan approval and secures more favorable terms. Lenders view a strong score as an indicator of low risk, leading to higher approval rates and potentially lower interest rates. Conversely, a poor credit score may result in loan rejection or the offer of loans with significantly higher interest rates and stricter terms, increasing the overall cost of borrowing. For instance, a business with a high score might qualify for a loan with a 5% interest rate, while a business with a low score might face a rate of 15% or more, making the difference substantial over the loan’s lifespan. This difference can be the deciding factor in a business’s financial success or failure.

Financing Options Available with Good Business Credit

Businesses with excellent credit scores have access to a wider range of financing options and more competitive rates. These options include:

* Term Loans: These loans offer a fixed amount of money over a set repayment period, often used for equipment purchases or expansion. Businesses with strong credit often qualify for lower interest rates and longer repayment terms.

* Lines of Credit: Similar to a credit card for businesses, lines of credit provide access to funds as needed up to a pre-approved limit. Good credit significantly increases the available credit limit and improves the interest rate offered.

* Equipment Financing: Specialized loans for purchasing equipment, often with the equipment itself serving as collateral. Businesses with good credit can secure better terms and lower interest rates.

* Invoice Financing: This allows businesses to receive immediate payment for outstanding invoices, improving cash flow. Creditworthiness plays a significant role in determining the percentage of invoice value that can be financed and the associated fees.

* Merchant Cash Advances: These advances provide a lump sum of cash in exchange for a percentage of future credit card sales. While generally more expensive than other options, businesses with good credit might still secure better terms.

Situations Where Business Credit is Essential for Securing Funding, How to repair business credit

There are numerous situations where establishing and utilizing separate business credit is critical for securing funding:

* Starting a New Business: New businesses often lack the personal credit history to qualify for loans. Building business credit from the start is essential for obtaining necessary capital.

* Expanding Operations: Securing funding for expansion projects often requires strong business credit to demonstrate financial stability and repayment capacity.

* Managing Cash Flow: Lines of credit and other short-term financing options are crucial for managing cash flow fluctuations. Access to these is directly linked to business credit score.

* Purchasing Equipment: Equipment financing requires a strong credit profile to secure favorable terms and interest rates.

* Responding to Unexpected Expenses: Business credit provides a safety net for unforeseen expenses or emergencies, avoiding the need to rely solely on personal funds.

Benefits of Using Business Credit over Personal Credit for Financing

Separating business and personal finances through the use of business credit offers significant advantages:

* Protection of Personal Assets: Using business credit protects personal assets from business liabilities. If the business fails, personal assets are generally not at risk.

* Improved Credit Scores: Building strong business credit improves the business’s creditworthiness without impacting personal credit scores.

* Access to Better Financing Options: Businesses with good credit qualify for more favorable loan terms and interest rates.

* Enhanced Business Reputation: A strong business credit score enhances the business’s reputation and credibility with suppliers and customers.

* Easier Access to Funding in the Future: A positive credit history makes securing future funding significantly easier.

Comparison of Business Loan Types

| Loan Type | Credit Score Requirement | Typical Interest Rate Range | Typical Loan Amount |

|---|---|---|---|

| Term Loan | 680+ (often higher for larger loans) | 5% – 15% | $5,000 – $1,000,000+ |

| Line of Credit | 650+ | 8% – 20% | $1,000 – $100,000+ |

| Equipment Financing | 600+ (often depends on collateral value) | 7% – 18% | Varies based on equipment cost |

| SBA Loan | Varies, often lower requirements than conventional loans | Lower than conventional loans | Varies, can be significant |

Maintaining Good Business Credit: How To Repair Business Credit

Maintaining a strong business credit score is crucial for long-term financial health and success. A high score unlocks access to better financing options, more favorable terms with vendors, and improved relationships with lenders, ultimately contributing to increased profitability and business growth. Neglecting business credit management, however, can lead to significant financial constraints and hinder future expansion opportunities.

Long-Term Benefits of a High Business Credit Score

A high business credit score translates to numerous tangible advantages. Access to lower interest rates on loans and lines of credit significantly reduces borrowing costs, freeing up capital for investment in growth initiatives. Favorable credit terms from suppliers and vendors, such as extended payment periods or higher credit limits, improve cash flow management. Furthermore, a strong credit history builds trust and credibility with lenders and business partners, opening doors to more lucrative opportunities and strategic alliances. This positive feedback loop fosters sustainable growth and enhances the overall financial resilience of the business. For example, a business with a high credit score might secure a loan at 5% interest, while a business with a poor score might face interest rates exceeding 15%, significantly impacting profitability.

Key Steps in Consistently Managing Business Credit

Effective business credit management requires a proactive and disciplined approach. Regularly reviewing credit reports from all three major business credit bureaus (Experian, Equifax, and Dun & Bradstreet) is paramount to identify and rectify any inaccuracies promptly. Establishing and maintaining a robust accounting system ensures accurate and timely reporting of financial information to credit bureaus. Furthermore, developing and adhering to a strict payment schedule prevents late payments, a major factor in negatively impacting credit scores. Finally, utilizing credit responsibly, avoiding excessive credit utilization, and strategically managing debt contribute to a healthy credit profile.

Importance of Timely Payments and Responsible Credit Usage

Timely payments are the cornerstone of a good business credit score. Late payments significantly damage creditworthiness and can lead to higher interest rates and reduced credit limits. Responsible credit usage involves understanding and managing credit utilization ratios. Keeping credit utilization below 30% is generally recommended to avoid negatively impacting credit scores. Over-reliance on credit can create a cycle of debt, hindering the business’s financial stability. For instance, consistently paying bills on time demonstrates financial responsibility, while consistently exceeding credit limits signals poor financial management.

Preventing Negative Impacts on Business Credit

Several proactive measures can mitigate the risk of negative impacts on business credit. Regularly reviewing and verifying information reported to credit bureaus helps identify and correct any inaccuracies or errors. Maintaining open communication with creditors and promptly addressing any payment discrepancies demonstrates responsibility and builds positive relationships. Furthermore, understanding and complying with all credit agreements and avoiding fraudulent activities are crucial for protecting business credit. For example, disputing incorrect information on credit reports can improve scores, while promptly addressing late payments can minimize their negative impact.

Best Practices for Ongoing Business Credit Monitoring and Maintenance

Proactive monitoring and maintenance are essential for preserving good business credit. Establishing a system for regular credit report reviews (at least quarterly) ensures timely identification of potential issues. Utilizing credit monitoring services can provide alerts for significant changes or potential problems. Maintaining accurate and updated business information across all credit bureaus minimizes reporting errors. Furthermore, regularly reviewing financial statements and credit utilization ratios helps identify areas for improvement and prevents excessive debt accumulation. These consistent efforts ensure a healthy and strong business credit profile over the long term.

Understanding and Avoiding Business Credit Repair Scams

Navigating the world of business credit repair can be challenging, and unfortunately, unscrupulous individuals and companies prey on business owners seeking to improve their credit profiles. Understanding the tactics used by these fraudulent services is crucial to protecting your business and your finances. This section will detail common characteristics of scams, provide guidance on identifying legitimate services, and offer practical advice on avoiding these potentially costly pitfalls.

Characteristics of Fraudulent Business Credit Repair Services

Fraudulent business credit repair services often employ high-pressure sales tactics, making grandiose promises they cannot deliver. They frequently advertise quick fixes and guaranteed results, which are unrealistic in the context of legitimate credit repair. These services may also operate anonymously or lack transparency regarding their processes and fees. Their claims often lack substantiation and are unsupported by verifiable evidence or case studies. For example, a fraudulent service might promise to erase legitimate negative marks from your credit report within days, a feat impossible under the Fair Credit Reporting Act (FCRA). They may also demand upfront payment for services without providing a clear contract outlining deliverables and a refund policy.

Identifying Legitimate Credit Repair Companies

Legitimate credit repair companies operate with transparency and adhere to legal regulations. They will clearly Artikel their services, fees, and timelines, providing a detailed contract before commencing work. They focus on disputing inaccurate or unverifiable negative items on your business credit report, rather than making false claims about erasing legitimate negative information. Reputable companies often have verifiable client testimonials and positive reviews from independent sources. Furthermore, they will not guarantee specific results, as the outcome of a credit repair effort depends on several factors, including the nature of the negative information and the credit reporting agencies’ policies. A legitimate company will emphasize a long-term strategy to improve your credit profile, rather than promising overnight miracles.

Red Flags Indicating Potential Scams

Several red flags should alert you to the possibility of a scam. These include unsolicited offers promising unrealistic results, high-pressure sales tactics that encourage immediate decisions, upfront payment demands without a clear contract, vague or unclear service descriptions, and a lack of transparency about the company’s background and qualifications. For example, if a company claims to be able to remove legitimate bankruptcies from your report, this is a major red flag. Another warning sign is if the company avoids providing references or refuses to answer specific questions about their methods. Finally, be wary of services that pressure you to sign up immediately without allowing time for research and due diligence.

Protecting Yourself from Business Credit Repair Scams

Protecting yourself from business credit repair scams requires diligence and careful research. Thoroughly investigate any company before engaging its services. Check for online reviews and complaints, verify their licensing and registration, and ensure they have a clear and transparent business structure. Never pay for services upfront without a detailed contract that Artikels the services provided, the fees charged, and a clear refund policy. Understand that legitimate credit repair takes time and effort, and there are no shortcuts to building good business credit. Remember that reputable companies will focus on disputing inaccurate information and building positive credit history through responsible financial practices, rather than making unsubstantiated promises.

Checklist of Questions to Ask Potential Credit Repair Services

Before engaging any business credit repair service, it is crucial to ask the following questions:

- What specific services do you offer, and how will you address the negative items on my business credit report?

- What is your fee structure, and are there any hidden costs?

- Can you provide references from previous clients?

- What is your process for disputing inaccurate information with the credit bureaus?

- What is your refund policy?

- Are you licensed and registered to operate in my state/jurisdiction?

- How long have you been in business, and what is your track record of success?

- Can you provide a detailed contract outlining all services and fees before I commit to your services?

- What are the potential risks and limitations of your services?

- What is your process for communication and updates throughout the credit repair process?

Illustrating the Impact of Business Credit on Business Growth

A strong business credit profile is not merely a financial metric; it’s a cornerstone of sustainable business growth. It unlocks opportunities, enhances credibility, and ultimately fuels expansion. The positive correlation between robust business credit and increased business success is undeniable, influencing everything from securing financing to attracting investors.

Access to favorable financing is the lifeblood of expansion for many businesses. A high business credit score opens doors to a wider range of financing options, including loans with lower interest rates, lines of credit with higher limits, and more favorable terms from lenders. This translates directly into increased capital available for strategic investments, leading to business expansion and increased profitability. Conversely, poor business credit can severely restrict access to capital, hindering growth potential and even leading to business failure.

Favorable Financing Fuels Business Growth

Businesses with excellent credit scores often find themselves in a position of strength. They can negotiate better loan terms, secure more favorable interest rates, and access a broader array of financial products. This allows for strategic investments in areas such as equipment upgrades, expansion into new markets, hiring key personnel, and research and development. The increased capital injection, obtained through favorable financing, directly contributes to revenue growth, market share expansion, and overall business success. The cost savings from lower interest rates alone can significantly boost profitability.

Examples of Businesses Benefiting from Excellent Business Credit

Consider a rapidly growing tech startup that leveraged its strong business credit to secure a substantial loan for developing a new software platform. This investment enabled them to significantly expand their market reach and capture a larger share of the industry. Alternatively, a small manufacturing company with a history of responsible financial management secured a line of credit to purchase new, more efficient machinery. This resulted in increased production capacity, lower operating costs, and improved profitability, allowing for further expansion and hiring. These are just two examples of how businesses with good credit can translate their financial health into tangible growth.

A Business’s Journey to Credit Improvement and Success

Let’s follow the journey of “GreenThumb Gardens,” a small landscaping business. Initially, their business credit score was low due to inconsistent payments and a lack of established credit history. (Illustrate this with a low-lying line graph representing their initial revenue and a low bar representing their credit score). They began by meticulously tracking their finances, paying all bills on time, and establishing business credit accounts. (Show this with a visual representation of a spreadsheet or accounting software interface). They also worked to correct any errors on their business credit reports. (Show a before-and-after image of a credit report, highlighting the improvements). Over time, their credit score steadily improved. (Show the improved credit score with a visual representation of a steadily rising bar graph). This improvement allowed them to secure a small business loan to purchase new equipment. (Show an image of the new equipment). This investment led to increased efficiency, enabling them to take on more clients and expand their service offerings. (Illustrate the growth trajectory with a rising line graph showcasing revenue increases over time). Their revenue increased significantly, and they were able to hire additional staff, further fueling their growth. (Show an image of the GreenThumb Gardens team). The improved credit score also enhanced their reputation and attracted new clients, creating a positive feedback loop. The narrative concludes with GreenThumb Gardens as a thriving, successful business, a direct result of their diligent efforts to improve their business credit.