How to search for biggest businesses in a certain area is a question many face – whether for market research, investment opportunities, or simply satisfying curiosity. This guide unravels the complexities of pinpointing the largest companies within a specific geographic region, providing a systematic approach to finding the data you need and interpreting it effectively. We’ll explore various search methods, data sources, and analytical techniques, equipping you with the skills to navigate this challenge successfully.

From defining your search area precisely using radius searches, zip codes, or custom polygons, to leveraging online directories and databases like government resources, commercial platforms, and industry-specific listings, we’ll cover it all. We’ll also demonstrate how to refine your search using filters, Boolean operators, and other advanced techniques to isolate the biggest players. Crucially, we’ll address how to validate your findings, handle data limitations, and visualize your results for clearer insights. Prepare to unlock the secrets to identifying the giants within any given area.

Defining the Search Area

Accurately defining your search area is crucial when identifying the biggest businesses in a specific location. The method you choose significantly impacts the results you obtain, influencing both the comprehensiveness and accuracy of your findings. Selecting the appropriate method depends on the level of precision required, the availability of data, and the complexity of the area you’re targeting.

Defining your geographic search area involves several methods, each with its own strengths and weaknesses. Understanding these nuances is key to conducting effective research.

Radius Searches

Radius searches utilize a central point (typically an address or coordinates) and a specified radius distance to define a circular search area. This method is straightforward and easy to understand. For example, you might search for businesses within a 5-mile radius of a specific city center.

The advantages of radius searches include simplicity and ease of use. They are readily available in most business data platforms and mapping tools. However, a significant disadvantage is the inherent inaccuracy, particularly in areas with irregular boundaries. A radius search might include areas outside the actual target region, while excluding relevant businesses just outside the circle.

Zip Code Searches

Using zip codes to define your search area offers a convenient and widely understood method. Zip codes represent relatively well-defined geographic regions, simplifying the search process.

The main advantage is its simplicity and widespread use. Zip code data is readily available and easily integrated into most search tools. However, zip codes can be quite large and encompass diverse areas, potentially leading to the inclusion of irrelevant businesses or the exclusion of those located near the boundaries. Furthermore, zip code boundaries may not align perfectly with actual city limits or other relevant geographic features.

City Limits Searches

Defining your search area using precise city limits provides a more accurate representation of the target region compared to zip codes or radius searches. This method requires access to accurate city boundary data, which may be obtained from government sources or mapping services.

The advantage is the higher accuracy compared to other methods. It allows for a focused search, ensuring that only businesses within the city’s official boundaries are included. The primary disadvantage is the need for access to precise boundary data, which may not always be readily available or easily integrated into all search tools. Maintaining up-to-date city boundary data is also crucial, as these boundaries can change over time.

Custom Polygons

For maximum precision, custom polygons allow you to draw a free-form shape encompassing the exact area of interest. This method is particularly useful for irregular-shaped areas or regions that don’t conform to standard geographic boundaries. This requires access to mapping tools that allow for polygon creation and data input.

Custom polygons offer unparalleled accuracy in defining your search area. You can precisely target specific neighborhoods, commercial zones, or any other irregular geographic area. The major disadvantage is the increased complexity and time required to create and manage the polygon. It also demands specialized tools and a good understanding of geographic information systems (GIS).

Comparison of Search Area Definition Methods

| Method | Accuracy | Ease of Use | Data Requirements |

|---|---|---|---|

| Radius Search | Low to Moderate | High | Central point and radius distance |

| Zip Code Search | Moderate | High | Zip code(s) |

| City Limits Search | High | Moderate | Precise city boundary data |

| Custom Polygon | High | Low | Mapping tool and polygon coordinates |

Identifying Relevant Data Sources: How To Search For Biggest Businesses In A Certain Area

Locating the largest businesses in a specific area requires access to reliable data on business size. This data, typically expressed as revenue or employee count, isn’t always publicly available and requires strategic sourcing from various online resources. Understanding the strengths and weaknesses of different data sources is crucial for accurate and comprehensive results.

Identifying suitable data sources involves exploring both publicly accessible and commercially available options. Each source offers varying levels of detail, accuracy, and ease of access, necessitating a careful evaluation before selection. The choice of data source will heavily influence the comprehensiveness and reliability of your findings.

Government Databases

Government agencies often collect business data for statistical purposes. These databases can provide a valuable, albeit sometimes incomplete, picture of business activity within a region. Data may include business registrations, tax filings, and employment statistics. However, the level of detail and timeliness can vary significantly depending on the specific agency and the reporting requirements. For instance, the U.S. Census Bureau provides detailed economic data at various geographic levels, including county-level business statistics, while similar agencies exist in other countries, offering comparable information. The strengths lie in their official nature and broad geographic coverage, but weaknesses include potential delays in data updates and limitations in the types of businesses captured.

Commercial Databases

Commercial databases, such as those offered by Dun & Bradstreet (D&B) or ZoomInfo, compile business information from multiple sources and offer more comprehensive profiles than many government databases. These databases often include detailed financial information, employee counts, and contact details. However, access typically requires a subscription, which can be costly. The accuracy and completeness of data depend on the diligence of the data provider in updating and verifying information. While these sources offer significantly richer datasets, they come at a financial cost and might not cover every business in a given area, particularly smaller or newer ones.

Industry-Specific Directories

Numerous industry-specific directories exist, focusing on particular sectors like manufacturing, retail, or technology. These directories may offer detailed information on companies within their specific industry, but their coverage is limited to that sector. For example, a directory focused on the healthcare industry might provide extensive data on hospitals and clinics but offer little information on businesses in other sectors. Their strengths lie in the specialized nature of their data, while their weaknesses are their limited scope and potential lack of comprehensive business size information beyond industry-specific metrics.

Refining Search Criteria

Locating the largest businesses within a specific area requires more than just a broad search. Refining your search criteria is crucial for isolating the most relevant results and avoiding an overwhelming volume of less pertinent data. This involves strategically using filters based on business size and leveraging advanced search operators to hone your search query.

Effective filtering and the application of advanced search operators significantly reduce the time spent sifting through irrelevant information, allowing you to quickly identify the key players in your target area. This section will detail various methods to refine your search, focusing on practical application and achievable results.

Filtering by Business Size Metrics

Several key metrics can be used to filter for business size. These metrics provide a quantifiable measure of a company’s scale and allow for precise targeting. The availability of these filters will depend on the specific data source you are using.

- Revenue Thresholds: Filtering by revenue allows you to target companies exceeding a specific annual revenue figure. For example, you could filter for businesses with annual revenue over $100 million to isolate only the largest players. This approach is particularly useful when financial data is readily available.

- Employee Counts: Another effective metric is employee count. You can specify a minimum number of employees to identify companies with large workforces. For instance, searching for businesses with over 500 employees will likely yield a list of substantial organizations.

- Market Capitalization: For publicly traded companies, market capitalization provides a robust indicator of size. This represents the total market value of a company’s outstanding shares. Filtering by market cap allows you to focus on businesses with a high valuation, suggesting significant size and influence.

Utilizing Advanced Search Operators

Advanced search operators dramatically enhance the precision of your search queries. These operators allow you to combine s, specify requirements, and exclude unwanted terms.

- Boolean Operators: Boolean operators (AND, OR, NOT) allow you to combine search terms with specific logical relationships. For example, “manufacturing AND New York AND revenue > $50 million” will return results for manufacturing companies in New York with revenue exceeding $50 million. The “AND” operator ensures all three conditions are met.

- Wildcard Characters: Wildcard characters (* or ?) allow for flexible searching. The asterisk (*) replaces any number of characters, while the question mark (?) replaces a single character. For instance, “Manufactur*” would return results for “Manufacturing,” “Manufacturers,” and similar terms. This is helpful when you are unsure of the exact spelling or have variations in company names.

Step-by-Step Guide: Finding the Largest Businesses

Let’s assume we want to find the largest technology companies in Silicon Valley with over 1,000 employees. This example will demonstrate the practical application of the previously discussed techniques. Note that the specific steps may vary depending on the search engine or database used.

- Define Search Terms: Identify key terms: “technology companies,” “Silicon Valley.”

- Apply Size Filters: Set the employee count filter to “>1000”.

- Utilize Boolean Operators: Combine search terms using the “AND” operator: “technology companies AND Silicon Valley AND employees > 1000”.

- Refine Results: Review the results and further refine your search based on initial findings. You might add additional filters or use wildcard characters to capture variations in company names or descriptions.

- Analyze Results: Critically evaluate the results to ensure they align with your definition of “largest.” Consider factors beyond employee count, such as revenue or market capitalization, for a comprehensive assessment.

Analyzing Search Results

Identifying the largest businesses in a specific area requires careful analysis of the gathered data. Simply compiling a list of potential candidates isn’t sufficient; rigorous validation is crucial to ensure accuracy and reliability. This involves cross-referencing information from multiple sources and critically evaluating potential discrepancies.

Data discrepancies are common when researching business size and location. Different data providers may use varying methodologies, leading to inconsistencies. For instance, one source might report employee count, while another uses revenue figures as a proxy for size. Furthermore, location data can be inaccurate, especially for businesses with multiple locations or those operating remotely.

Validating Business Size and Location

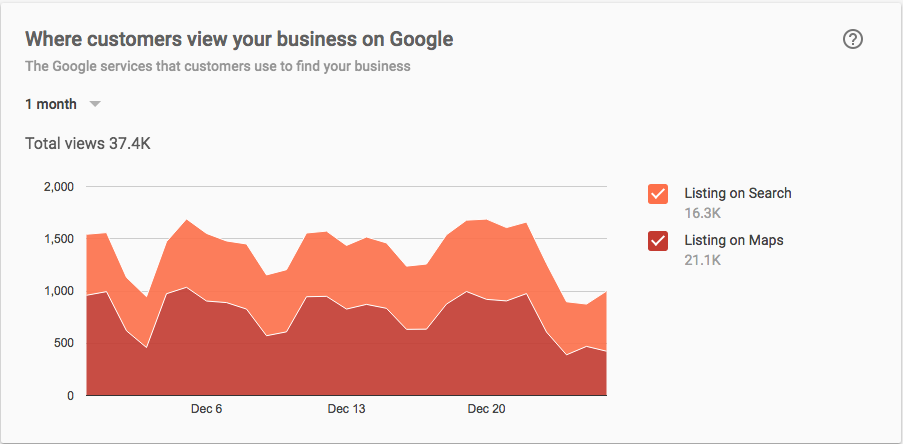

Verifying the accuracy of a business’s reported size and location necessitates a multi-faceted approach. This involves checking against multiple independent sources and critically assessing the consistency of the information. For example, comparing employee counts reported on a company website with those listed on LinkedIn can reveal discrepancies. Similarly, confirming a business’s physical address through online mapping services like Google Maps or Bing Maps helps verify location accuracy. Discrepancies might arise due to outdated information, mergers, acquisitions, or simply errors in data entry. For instance, a company’s reported employee count might be inflated on their website for marketing purposes, while a more accurate figure could be found in their SEC filings (if publicly traded). Conversely, a business might report a headquarters address while its main operations are located elsewhere.

A Checklist for Verifying Information Reliability

A structured approach to verifying the reliability of gathered information is essential. The following checklist helps ensure a comprehensive evaluation:

- Source Verification: Identify the source of each data point and assess its credibility. Consider the source’s reputation, methodology, and potential biases.

- Data Consistency: Cross-reference information from multiple sources. Look for inconsistencies or discrepancies that might indicate errors or outdated information.

- Date of Information: Check the date of the information to ensure it’s current. Business size and location can change rapidly.

- Triangulation of Data: Use at least three independent sources to verify critical data points, such as business size and location. This helps minimize the impact of errors in individual sources.

- Contact Verification: Where possible, try to contact the business directly to verify information. This might involve phone calls, emails, or visits to the physical location.

- Public Records: Check relevant public records, such as business registration documents or tax filings, for further verification.

Following this checklist helps minimize the risk of relying on inaccurate or misleading information, ultimately leading to a more reliable assessment of the largest businesses in the target area.

Visualizing the Results

Data visualization is crucial for understanding the distribution and relative importance of the largest businesses within a defined area. A well-designed visualization transforms raw data into easily digestible insights, allowing for quick identification of patterns and key players. This section explores effective methods for visualizing the largest businesses, focusing on map-based representations and chart types to highlight key characteristics.

Effective visualization requires a multifaceted approach. Combining different visual elements allows for a richer understanding of the data than any single method could provide.

Map Visualization of Business Locations and Sizes

A custom map provides an excellent visual representation of the geographical distribution of large businesses. Imagine a map of a hypothetical city, perhaps “Springfield,” where each business is represented by a marker. The size of each marker corresponds to the business’s revenue or employee count – a larger circle indicates a larger business. For example, a massive corporation like “Springfield Power Plant” would be represented by a significantly larger marker than a smaller local bakery. Different colors could be used to further categorize businesses (e.g., manufacturing, retail, services). The map would clearly show business clusters, areas of high concentration, and isolated larger players. This immediate visual representation aids in understanding spatial relationships and market dominance.

Bar Charts for Comparing Business Sizes

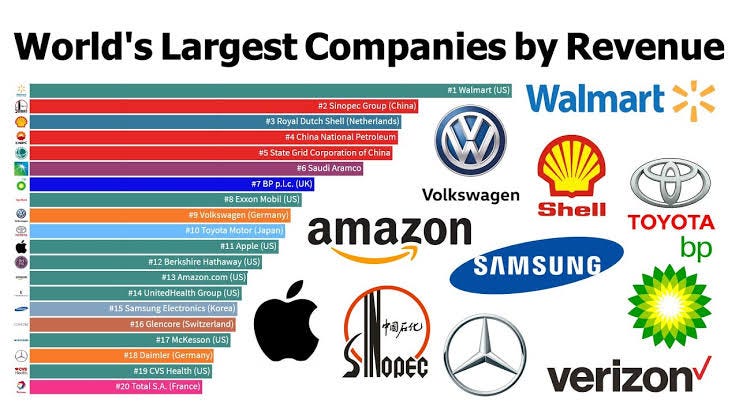

Bar charts effectively compare the sizes of different businesses. A horizontal bar chart, with business names on the vertical axis and revenue or employee count on the horizontal axis, allows for easy comparison of the largest entities. The longest bar would represent the largest business, and the lengths of the other bars would be proportional to their respective sizes. For instance, the chart might clearly show that “Springfield Power Plant” has significantly higher revenue than all other businesses, while a series of smaller bars represent a range of smaller businesses with varying revenues.

Pie Charts for Illustrating Market Share

A pie chart provides a clear visual representation of the market share held by each of the largest businesses. Each slice of the pie represents a single business, with the size of the slice proportional to its revenue or market share. This allows for a quick understanding of the relative dominance of each business within the overall market. For example, a large slice might represent “Springfield Nuclear Power Plant” indicating its significant market share, while smaller slices would represent the smaller businesses. This is particularly useful for highlighting the concentration of market power.

Color-Coding for Categorization and Size Ranges, How to search for biggest businesses in a certain area

Color-coding enhances the clarity and interpretability of the visualizations. On the map, different colors can represent different business categories (e.g., blue for technology, red for retail, green for manufacturing). Additionally, color gradients can represent size ranges. For example, on the bar chart, businesses with revenue above a certain threshold could be colored dark blue, while those below that threshold could be light blue, allowing for immediate visual differentiation of size categories. This color-coding system, consistently applied across visualizations, enhances comprehension and facilitates pattern recognition.

Handling Data Limitations

Finding comprehensive and accurate data on all businesses within a specific area is often challenging. Many datasets are incomplete, contain inaccuracies, or lack the necessary granularity for a truly exhaustive analysis of the largest businesses. Understanding these limitations and employing appropriate strategies to mitigate their impact is crucial for obtaining reliable results.

Data limitations frequently manifest as incomplete business registries, inconsistent reporting standards across different sources, and the exclusion of privately held companies from publicly available databases. Furthermore, the definition of “largest” itself can be ambiguous, depending on whether you prioritize revenue, employee count, or asset value. These challenges necessitate a nuanced approach to data analysis, incorporating techniques for data imputation, error correction, and the strategic use of proxy variables.

Incomplete or Inaccurate Data Sources

Dealing with incomplete or inaccurate data requires a multi-pronged approach. First, critically evaluate the reliability of each data source. Consider factors such as the source’s reputation, data collection methodology, and frequency of updates. Cross-referencing information from multiple sources can help identify inconsistencies and potential errors. For example, comparing employee counts from a government database with revenue figures from a commercial database can reveal discrepancies that require further investigation. Data cleaning techniques, such as outlier detection and removal, can help to minimize the impact of inaccurate data points. Where possible, contact the data providers directly to clarify ambiguities or obtain missing information. Finally, acknowledge the limitations of the data in your analysis and interpretations.

Estimating Business Size with Limited Data

When precise data on revenue, employee count, or assets is unavailable, various estimation methods can be employed. One approach is to use proxy variables. For instance, if revenue data is missing, the size of a business’s physical premises (obtained through satellite imagery or property records) might serve as a reasonable proxy, particularly for businesses with a significant physical presence, like retail stores or manufacturing plants. Another method involves using publicly available information, such as news articles or company websites, to infer approximate size. For example, a news report mentioning a significant expansion or a large hiring drive could indicate substantial growth. It’s important to clearly state the assumptions and limitations of any estimations made in the final analysis. A sensitivity analysis, testing the robustness of the results to different estimation methods, is recommended. For instance, if using property size as a proxy for revenue, explore how changes in the assumed relationship between property size and revenue affect the ranking of the largest businesses.