How to sell a business in California? It’s a question many entrepreneurs face, a journey fraught with legal complexities, financial intricacies, and the emotional weight of letting go. Successfully navigating this process requires meticulous planning, a strategic approach to finding the right buyer, and a deep understanding of California’s unique legal and regulatory landscape. This guide provides a comprehensive roadmap, outlining each crucial step from preparing your business for sale to finalizing the transaction and managing post-sale considerations.

From valuing your business accurately, considering factors like revenue, assets, and market conditions, to understanding the nuances of different sale structures – asset sale versus stock sale – we’ll equip you with the knowledge to make informed decisions. We’ll also delve into the crucial role of legal counsel and financial advisors, guiding you through negotiations, structuring the sale agreement, and addressing potential post-sale liabilities. Finally, we’ll explore California-specific regulations and tax implications, ensuring a smooth and legally sound transaction.

Preparing Your California Business for Sale

Selling a business in California requires meticulous preparation to maximize its value and ensure a smooth transaction. This involves a multifaceted approach encompassing financial documentation, legal compliance, and a thorough understanding of your business’s worth. Neglecting any of these steps can significantly impact the sale price and the overall process.

Financial Documentation and Legal Compliance

Preparing comprehensive financial records is paramount. Lenders and potential buyers will scrutinize these documents to assess the business’s financial health and profitability. This includes at least three years of tax returns, profit and loss statements, balance sheets, and cash flow statements. All financial records must be accurate, consistent, and readily accessible. Legal compliance is equally critical; ensure all necessary licenses, permits, and registrations are up-to-date and in order. Any outstanding legal issues or potential liabilities must be addressed proactively to avoid complications during the sale process. Failure to do so could significantly devalue the business or even halt the sale altogether. For instance, unresolved lawsuits or non-compliance with environmental regulations can be major deterrents to potential buyers.

Maintaining a Clean Audit Trail

A clean audit trail is essential for demonstrating the accuracy and reliability of your financial records. This involves maintaining meticulous records of all financial transactions, including invoices, receipts, bank statements, and payment records. A well-organized system makes it easier for buyers to verify the financial information provided, increasing their confidence in the business’s value. Using accounting software can significantly streamline this process and help maintain a clear audit trail. For example, using software with automated reconciliation features reduces the risk of human error and ensures that all transactions are properly documented.

California Business Valuation

Valuing a California business involves a multifaceted approach, considering various factors. Common methods include asset-based valuation (considering the fair market value of tangible and intangible assets), income-based valuation (estimating future earnings), and market-based valuation (comparing the business to similar businesses that have recently sold). The final valuation will depend on the specific characteristics of the business, its industry, and prevailing market conditions. For example, a technology startup with high growth potential might command a higher valuation based on its future earnings potential than a mature, established business with stable but lower earnings. Factors such as revenue growth, profitability, market share, and the overall economic climate all influence the final valuation. Engaging a professional business valuation expert is highly recommended to ensure an accurate and defensible valuation.

Essential Documents Checklist

A comprehensive checklist of documents is crucial for a smooth sale. This includes:

- Three to five years of tax returns

- Profit and loss statements for the past three years

- Balance sheets for the past three years

- Cash flow statements for the past three years

- Business licenses and permits

- Contracts with suppliers and customers

- Employment agreements

- Lease agreements (if applicable)

- Intellectual property registrations (if applicable)

- Detailed list of assets and liabilities

- Business plan (including market analysis and financial projections)

Having these documents readily available will streamline the due diligence process and significantly expedite the sale. Omitting crucial documents can delay the process and potentially jeopardize the sale.

Finding the Right Buyer for Your California Business

Selling a California business requires identifying and attracting the ideal buyer. The right buyer will possess the financial resources, industry expertise, and strategic vision to successfully continue and potentially grow your business. This process involves understanding different buyer profiles and employing effective marketing and networking strategies.

Types of Potential Buyers

Identifying the appropriate buyer type is crucial for a successful sale. Different buyer types have varying motivations and acquisition strategies. Understanding these differences allows you to tailor your marketing efforts and expectations. For instance, a strategic buyer might be a competitor looking to expand market share, while a financial buyer seeks a profitable investment opportunity.

- Strategic Buyers: These buyers are often competitors, companies in related industries, or businesses seeking vertical or horizontal integration. Their primary motivation is strategic advantage, such as gaining market share, accessing new technologies, or expanding their product or service offerings. They are typically willing to pay a premium for the synergies and strategic value your business offers.

- Financial Buyers: Financial buyers, such as private equity firms or individual investors, focus on the financial returns of an investment. They evaluate businesses based on key financial metrics like profitability, cash flow, and growth potential. Their primary motivation is financial gain, and they may be less concerned with the strategic fit of the business within their existing portfolio.

- Private Equity Firms: These firms manage investment funds and actively seek to acquire and improve businesses for resale at a profit. They often have access to significant capital and operational expertise, making them attractive buyers for larger or more complex businesses. They typically look for businesses with strong growth potential and established management teams.

Attracting Potential Buyers

Attracting the right buyer necessitates a multi-pronged approach combining online marketing and networking. A well-crafted marketing strategy should highlight your business’s strengths and appeal to the target buyer profile. A passive approach is often insufficient; proactive outreach is crucial.

- Online Marketing: Utilizing online platforms like business-for-sale listing websites (e.g., BizBuySell, FE International) can significantly expand your reach to a broader pool of potential buyers. A professional website showcasing your business’s key features, financial performance, and growth potential is essential. Targeted online advertising can further enhance visibility to specific buyer demographics.

- Networking: Leveraging your professional network, industry contacts, and business relationships is vital. Attending industry events, trade shows, and conferences can provide opportunities to connect with potential buyers and brokers. Direct outreach to businesses that might be strategically interested in your company can also yield positive results. Building relationships with business brokers who specialize in the sale of businesses in your industry can also be beneficial.

Methods of Advertising a Business for Sale

Several methods exist for advertising a business for sale in California. Each method has its own advantages and disadvantages regarding cost, reach, and level of control. Selecting the appropriate approach depends on factors such as the size and complexity of the business, the target buyer profile, and the desired level of confidentiality.

- Business Brokerage Services: Engaging a business broker can streamline the sale process by handling marketing, negotiations, and due diligence. Brokers possess extensive experience and networks within the business sales community. However, their services come at a cost, typically a percentage of the sale price.

- Online Marketplaces: Online marketplaces provide a cost-effective way to reach a large number of potential buyers. These platforms often have features for showcasing business listings and managing inquiries. However, they may require some level of self-marketing and management of the sale process.

- Private Sale: A private sale involves directly marketing the business to potential buyers without the involvement of a broker or online marketplace. This approach provides greater control over the sale process and potentially reduces costs. However, it may require more effort in marketing and managing the transaction.

Confidentiality in the Sale Process

Maintaining confidentiality throughout the sale process is paramount. Disclosing sensitive business information prematurely can jeopardize negotiations and potentially damage your business’s reputation. A well-structured confidentiality agreement is essential to protect your intellectual property, financial data, and customer information. This agreement should be signed by all parties involved in the sale process before any sensitive information is disclosed. Furthermore, limiting the distribution of confidential information only to serious potential buyers helps to safeguard your business’s interests.

Negotiating and Structuring the Sale

Selling a California business involves intricate negotiations and meticulous structuring of the sale agreement. A well-negotiated deal protects both the seller and buyer, ensuring a smooth transition and maximizing value for all parties. Understanding common negotiation tactics and the legal framework is crucial for a successful outcome.

Common Negotiation Tactics in Business Sales

Effective negotiation in business sales requires a strategic approach. Both buyers and sellers employ various tactics to achieve their desired outcomes. These tactics often involve leveraging information, setting deadlines, and understanding the other party’s motivations. For instance, a seller might use a “good cop/bad cop” approach, where one representative presents a tough stance while another offers concessions. Buyers might employ a “lowball” offer, hoping to secure a lower price. Conversely, sellers might use the tactic of “anchoring,” setting a high initial asking price to influence subsequent negotiations. Understanding these tactics and developing counter-strategies is key to achieving a favorable outcome. Experienced negotiators are adept at identifying and responding to these strategies.

Structuring a California Business Sale Agreement

Structuring a business sale agreement in California requires careful consideration of several key legal and financial aspects. A step-by-step approach ensures a comprehensive and legally sound document. The process typically begins with a letter of intent (LOI), outlining the key terms of the sale. This non-binding agreement sets the stage for further negotiations and due diligence. Next, the parties conduct due diligence, thoroughly investigating the business’s financials, legal compliance, and operational aspects. This process helps identify potential risks and liabilities. Once due diligence is complete, the final sale agreement is drafted. This legally binding document details the purchase price, payment terms, representations and warranties, indemnification clauses, and closing conditions. Key legal considerations include compliance with California’s corporate laws, tax implications, and intellectual property rights. Failure to address these issues adequately can lead to significant legal disputes post-sale.

Comparison of Business Sale Structures

Different structures for selling a business offer distinct advantages and disadvantages. The choice depends heavily on the seller’s goals and the specifics of the business.

| Structure | Assets Transferred | Tax Implications | Liability Transfer |

|---|---|---|---|

| Asset Sale | Specific assets of the business (e.g., equipment, inventory, intellectual property) | Seller pays capital gains tax on the sale of assets. Buyer may deduct depreciation on purchased assets. | Seller generally remains liable for pre-sale liabilities unless explicitly addressed in the agreement. |

| Stock Sale | All shares of the company’s stock | Seller pays capital gains tax on the sale of stock. Buyer inherits all liabilities of the corporation. | Buyer assumes all liabilities of the corporation. |

| Merger | The buyer’s company merges with the seller’s company, resulting in a single entity. | Tax implications vary depending on the structure of the merger. | Buyer generally assumes all liabilities of the seller’s company. |

| Limited Liability Company (LLC) Sale | The ownership interests in the LLC are transferred. | Seller pays capital gains tax on the sale of membership interests. Buyer inherits the LLC’s liabilities. | Buyer assumes all liabilities of the LLC. |

Role of Legal Counsel and Financial Advisors

Navigating the complexities of selling a California business necessitates expert guidance. Legal counsel provides critical support in drafting and reviewing contracts, ensuring compliance with relevant laws, and protecting the seller’s interests. Financial advisors play a crucial role in valuing the business, structuring the sale transaction to optimize tax efficiency, and advising on financial aspects of the deal. Their expertise helps both the buyer and seller make informed decisions throughout the process, leading to a more favorable and legally sound outcome. Engaging these professionals is a crucial investment in ensuring a successful business sale.

Closing the Sale and Post-Sale Considerations

Successfully navigating the closing process and addressing post-sale considerations are crucial for a smooth transition and minimizing potential liabilities. This involves understanding the legal requirements, fulfilling necessary paperwork, and planning for the future. Failing to adequately address these aspects can lead to unforeseen complications and financial losses for both the seller and the buyer.

The closing of a California business sale involves a series of steps culminating in the transfer of ownership. These steps typically include finalizing the purchase agreement, conducting a thorough due diligence review, ensuring all required regulatory approvals are obtained, and finally, transferring the ownership and assets to the buyer. This process often involves legal counsel and experienced business brokers to ensure all aspects are handled correctly and legally. The precise steps will vary depending on the complexity of the business and the terms negotiated in the purchase agreement. Careful documentation at each stage is essential to avoid disputes later.

Steps Involved in Closing a California Business Sale

The closing process requires meticulous attention to detail. A failure to complete any step correctly can lead to delays, disputes, or even invalidate the entire transaction. Therefore, it is advisable to seek professional legal advice throughout this process. A well-structured checklist can assist in ensuring a smooth transition.

- Finalizing the Purchase Agreement: This involves reviewing and agreeing upon the final terms and conditions of the sale, including the purchase price, payment terms, and asset transfer details.

- Due Diligence Completion: The buyer’s final due diligence should be completed to verify the accuracy of the information provided by the seller during the initial stages of the sale.

- Regulatory Approvals: Depending on the nature of the business, various regulatory approvals may be required before the sale can be finalized. This could include permits, licenses, and approvals from relevant state and local agencies.

- Asset Transfer: The transfer of all business assets, including physical assets, intellectual property, and customer lists, to the buyer must be legally documented and executed.

- Funds Transfer: The transfer of funds from the buyer to the seller should be conducted securely and according to the agreed-upon payment terms. This often involves escrow services to protect both parties.

- Documentation Filing: All necessary documents, including the finalized purchase agreement and asset transfer documents, must be properly filed with the relevant authorities.

Post-Sale Checklist

Post-sale tasks are equally important as they ensure a clean break and prevent future liabilities. A comprehensive checklist helps organize these tasks and minimizes the risk of overlooking crucial steps.

- Filing necessary tax documents with the IRS and California Franchise Tax Board.

- Notifying relevant parties, such as employees, customers, and suppliers, about the change in ownership.

- Transferring domain names, email addresses, and social media accounts.

- Updating banking information and ensuring smooth financial transitions.

- Reviewing and canceling existing contracts and leases.

- Returning any company property or equipment not transferred to the buyer.

Potential Post-Sale Liabilities and Mitigation Strategies

Even after the sale, the seller may face potential liabilities. Understanding these and implementing preventative measures is critical for protecting personal assets.

- Tax Liabilities: Ensure all taxes are paid up to the date of the sale to avoid future assessments.

- Environmental Liabilities: If the business involved hazardous materials or environmental concerns, the seller may be liable for cleanup costs. Environmental audits can mitigate this risk.

- Contractual Liabilities: Review all existing contracts to ensure there are no outstanding obligations or potential breaches after the sale.

- Employee-Related Liabilities: Ensure all employment-related obligations, including severance pay and benefits, are fulfilled before the sale is finalized.

Non-Compete Agreements and Their Implications, How to sell a business in california

Non-compete agreements restrict the seller from starting a competing business within a specific geographical area and time frame. These agreements are common in business sales, particularly for businesses with established customer bases or unique intellectual property.

Example: A non-compete agreement might stipulate that the seller cannot open a competing bakery within a 25-mile radius of the sold bakery for a period of two years. Violation of a non-compete agreement can result in legal action and financial penalties.

Another Example: A software company seller might agree not to develop or sell competing software for five years following the sale, protecting the buyer’s intellectual property and market position. The enforceability of non-compete agreements depends on various factors, including the reasonableness of the restrictions and the specific state laws.

California-Specific Legal and Regulatory Considerations

Selling a business in California involves navigating a complex web of state-specific regulations and laws. Understanding these legal and regulatory aspects is crucial for a smooth and successful transaction, minimizing potential risks and ensuring compliance. Failure to do so can lead to significant delays, financial penalties, and even legal disputes.

Key California Regulations and Laws Impacting Business Sales

California’s legal framework governing business sales encompasses various statutes and regulations impacting different aspects of the transaction. These include, but are not limited to, the California Corporations Code, which governs the formation, operation, and dissolution of corporations; the California Franchise Tax Board’s regulations concerning tax implications; and the California Secretary of State’s requirements for business entity filings. Specific regulations will vary depending on the type of business being sold (e.g., sole proprietorship, partnership, LLC, corporation) and the industry in which it operates. For instance, businesses operating in regulated industries like healthcare or finance will face additional compliance requirements. Careful due diligence and legal counsel are essential to ensure complete understanding and adherence to all applicable laws.

The Role of the California Secretary of State in Business Transfers

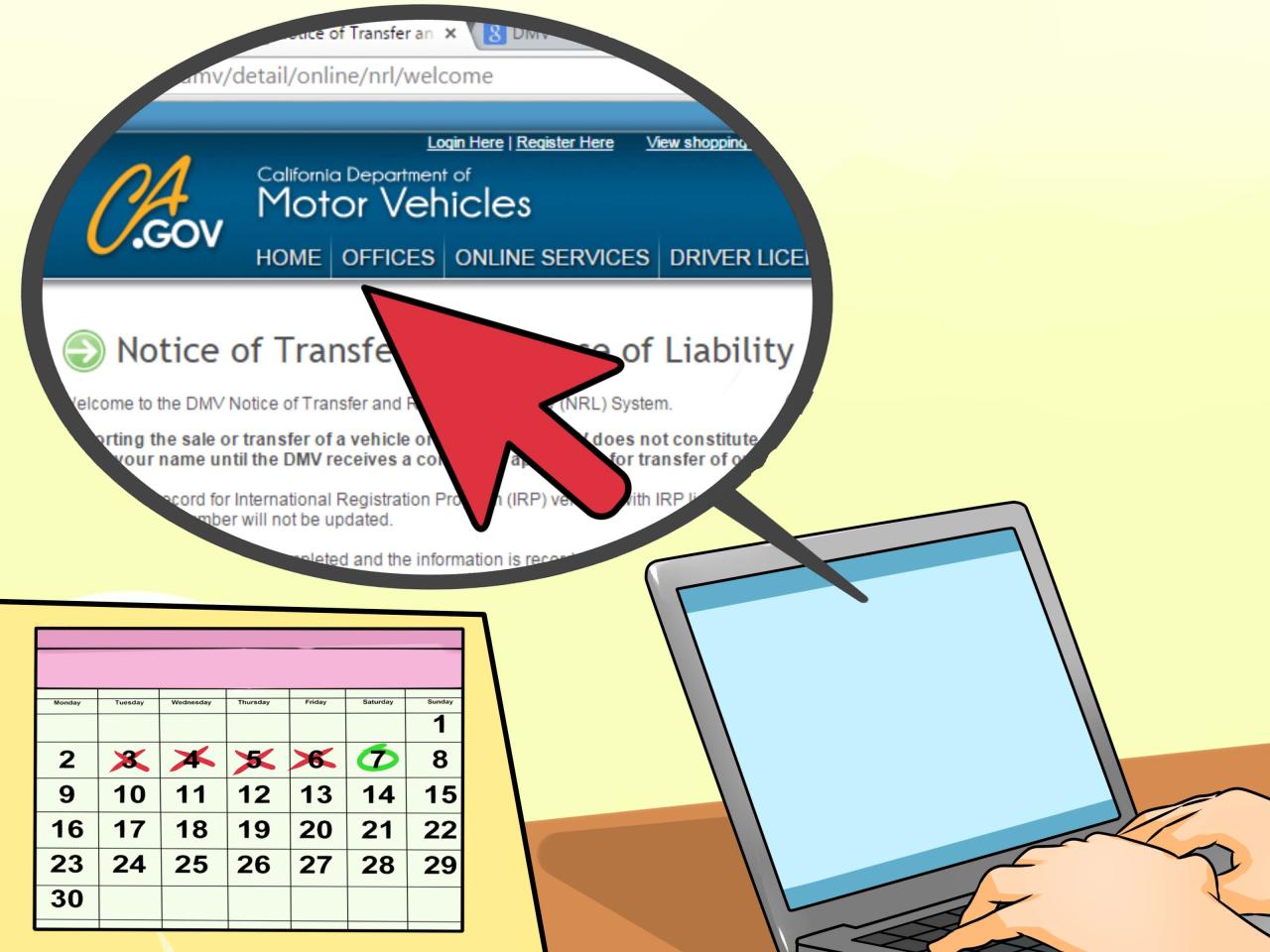

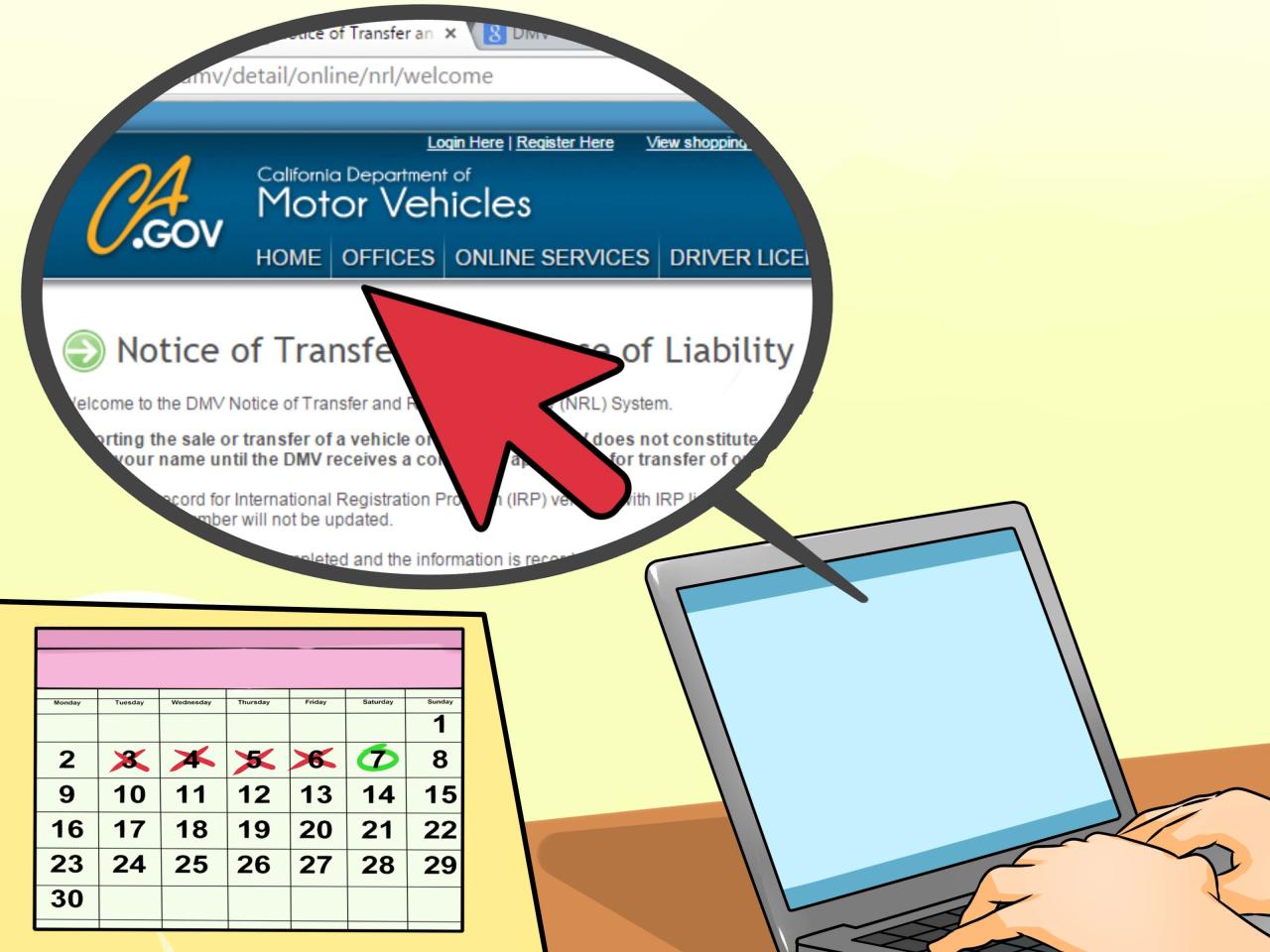

The California Secretary of State plays a significant role in business transfers, primarily concerning the legal documentation and filings required to change ownership. When a business changes hands, the necessary paperwork must be filed with the Secretary of State to update the business’s official records, reflecting the change in ownership. This typically involves filing amended articles of incorporation or statements of information, depending on the business entity type. Failure to file the appropriate paperwork can lead to legal complications and potential penalties. The Secretary of State’s website provides detailed information and forms for these filings, which are often crucial for maintaining the legal standing and operational continuity of the business post-sale.

Tax Implications of Selling a Business in California

Selling a business in California has significant tax implications for both the seller and the buyer. The seller may be subject to capital gains taxes on the profit from the sale, potentially at both the state and federal levels. The calculation of these taxes depends on various factors, including the holding period of the business, the business’s structure, and the method of sale (e.g., asset sale versus stock sale). The buyer may face tax liabilities related to the acquisition of assets or stock, depending on the transaction structure. Furthermore, various sales taxes and other state-specific levies may apply. Professional tax advice from a qualified CPA specializing in business transactions is strongly recommended to navigate these complexities and optimize tax strategies for both parties. For example, a carefully structured sale might allow for tax deferral or advantageous tax treatment.

Transferring Business Licenses and Permits

The process of transferring business licenses and permits in California varies depending on the specific license or permit and the local jurisdiction. Some licenses and permits are easily transferable with a simple application and fee, while others may require a more extensive review process. The seller and buyer should collaborate closely to initiate the transfer process well in advance of the closing date. They should contact the relevant regulatory agencies to understand the specific requirements for transferring each license or permit, including any necessary applications, fees, and background checks. Delays in transferring licenses and permits can disrupt business operations after the sale, impacting the buyer’s ability to operate seamlessly. Therefore, proactive planning and coordination are vital to ensure a smooth transition.

Illustrative Examples of Successful Business Sales in California: How To Sell A Business In California

This section details two distinct successful business sales in California, highlighting their strategies, challenges, and outcomes. Analyzing these examples illuminates how industry sector influences the sales process and provides valuable insights for prospective sellers.

Successful Sale of a Tech Startup in Silicon Valley

This example focuses on “InnovateTech,” a Silicon Valley-based software company specializing in AI-powered data analytics. InnovateTech, after five years of rapid growth, decided to sell to a larger, publicly traded competitor. Their annual revenue was approximately $15 million, with a strong customer base and a patented technology. The sale process involved a targeted approach, focusing on companies with complementary technologies and a need to expand their data analytics capabilities. InnovateTech leveraged its strong network of investors and industry contacts to attract potential buyers. A significant challenge was managing the confidentiality of sensitive information throughout the due diligence process. This was overcome through the use of sophisticated non-disclosure agreements and a carefully selected team of legal and financial advisors. The successful sale resulted in a significant return on investment for the founders and early investors. The transaction valued InnovateTech at $75 million, highlighting the premium placed on innovative technology companies in the competitive Silicon Valley market. The tech industry’s fast-paced nature and focus on innovation meant a quicker sale cycle compared to more traditional businesses.

Successful Sale of a Family-Owned Winery in Napa Valley

This case study involves “Vineyard Vista,” a family-owned and operated winery in Napa Valley, established over three generations. Vineyard Vista had a strong reputation for producing high-quality wines, but faced challenges related to succession planning and increasing operational costs. The family decided to sell the business to secure their financial future and ensure the winery’s continued success. The sales process was more complex, requiring a deeper understanding of the wine industry’s unique characteristics, including the importance of brand reputation, vineyard land value, and existing distribution channels. Finding the right buyer—one who valued the winery’s heritage and would maintain its quality standards—was crucial. The challenge of balancing the emotional attachment to the family legacy with the financial realities of the sale was addressed through careful family counseling and a clear understanding of their goals. The sale was ultimately successful, with Vineyard Vista being acquired by a larger wine conglomerate for $20 million. The transaction included provisions to ensure the continued use of the family’s name and winemaking techniques, preserving their legacy. The slower pace of the sale reflected the nature of the agricultural and luxury goods industry, where buyer due diligence and relationship building take precedence.