How to sell a service business? It’s a question many entrepreneurs grapple with, balancing the emotional attachment to their creation with the desire for financial gain and a new chapter. This guide navigates the complexities of selling a service-based business, offering a practical, step-by-step approach to maximizing value and ensuring a smooth transition. From valuing your business and crafting a compelling marketing strategy to finding the right buyer and navigating the legal complexities, we’ll cover it all.

Successfully selling a service business requires more than just a strong bottom line; it demands a strategic approach that encompasses careful planning, effective marketing, and shrewd negotiation. This guide will equip you with the knowledge and tools to confidently navigate each stage of the process, from preparing your business for sale to completing the transaction and ensuring a seamless handover.

Valuing Your Service Business

Accurately valuing your service business is crucial for various reasons, including selling, securing financing, or attracting investors. A fair market value reflects the business’s true worth based on its financial performance, market position, and future potential. Understanding the different valuation methods and key metrics is essential for a successful transaction.

Methods for Determining Fair Market Value

Several methods exist for determining the fair market value of a service-based business. The most common approaches consider the business’s profitability, its potential for future growth, and comparable transactions in the market. The best method often depends on the specific circumstances of the business and the intended use of the valuation. A combination of methods is frequently used to arrive at a comprehensive and robust valuation.

Key Financial Metrics Used in Business Valuation

Several key financial metrics are instrumental in determining a service business’s value. These metrics provide insights into the business’s profitability, efficiency, and overall financial health. Analyzing these metrics helps potential buyers understand the business’s past performance and project its future earnings.

- Revenue: Total income generated from service provision. Consistent revenue growth indicates a healthy and stable business.

- Net Profit Margin: The percentage of revenue remaining after deducting all expenses. A higher net profit margin indicates greater profitability and efficiency.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): A measure of a company’s operating profitability. It’s useful for comparing businesses with different capital structures.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer. A lower CAC indicates efficient marketing and sales strategies.

- Customer Lifetime Value (CLTV): The predicted revenue a customer will generate throughout their relationship with the business. A high CLTV indicates customer loyalty and repeat business.

Case Study: Valuing a Marketing Consultancy

Consider a marketing consultancy with annual revenue of $500,000 and a net profit margin of 20%. Using a simple multiple of earnings approach (a common method for valuing service businesses), and assuming a multiple of 3x net income, the valuation would be calculated as follows:

Net Income = $500,000 * 0.20 = $100,000

Business Value = $100,000 * 3 = $300,000

This valuation could be adjusted based on factors such as market conditions, competition, and the consultancy’s unique selling propositions. For example, if the consultancy has a strong reputation and a high retention rate, a higher multiple might be justified.

Simple Spreadsheet for Business Valuation

The following spreadsheet demonstrates a simplified calculation of business value based on revenue and profit margins. Remember that this is a basic model and doesn’t account for all factors influencing valuation. A professional valuation should consider more comprehensive data and methodologies.

| Metric | Value |

|---|---|

| Annual Revenue | [Enter Revenue] |

| Net Profit Margin (%) | [Enter Profit Margin] |

| Net Profit | = Annual Revenue * (Net Profit Margin/100) |

| Multiple of Earnings | [Enter Multiple – typically 2-5 for service businesses] |

| Business Value | = Net Profit * Multiple of Earnings |

Note: The “Multiple of Earnings” is a crucial factor and depends on various aspects including industry benchmarks, growth prospects, and risk assessment. Professional valuation services should be considered for a more accurate and comprehensive evaluation.

Marketing and Sales Strategies

Successfully selling a service business hinges on a robust marketing and sales strategy. This goes beyond simply having a great service; it requires effectively reaching your target audience, communicating your value proposition, and converting leads into paying clients. A well-defined strategy, encompassing digital marketing, strategic pricing, and a compelling campaign, is crucial for growth and profitability.

Effective Digital Marketing Techniques for Service Businesses

Digital marketing offers unparalleled opportunities for service businesses to connect with potential clients. Unlike product-based businesses, service businesses often rely heavily on building trust and demonstrating expertise. Therefore, the chosen digital marketing techniques should reflect this need. Content marketing, search engine optimization (), and social media marketing are particularly effective. Content marketing, through blog posts, case studies, and informative videos, establishes thought leadership and builds credibility. ensures your website ranks highly in search engine results, driving organic traffic. Social media platforms allow for direct engagement with potential clients, fostering relationships and showcasing your expertise. Paid advertising on platforms like Google Ads and social media can further accelerate growth by targeting specific demographics and interests.

Pricing Strategies for Service Offerings

Choosing the right pricing strategy is critical for profitability and attracting the right clients. Several approaches exist, each with its advantages and disadvantages. Value-based pricing focuses on the perceived value your service delivers to the client, often commanding a higher price. Cost-plus pricing involves calculating all costs and adding a markup for profit. Competitive pricing involves analyzing competitors’ prices and adjusting accordingly. Hourly rates are common, offering simplicity but potentially limiting scalability. Project-based pricing provides clarity for both client and provider but requires accurate estimation. Subscription-based pricing offers recurring revenue but necessitates a consistent service delivery model. The optimal strategy often depends on the type of service, target market, and business goals. For example, a high-end consulting firm might employ value-based pricing, while a freelance writer might use hourly rates.

Creating a Compelling Marketing Campaign

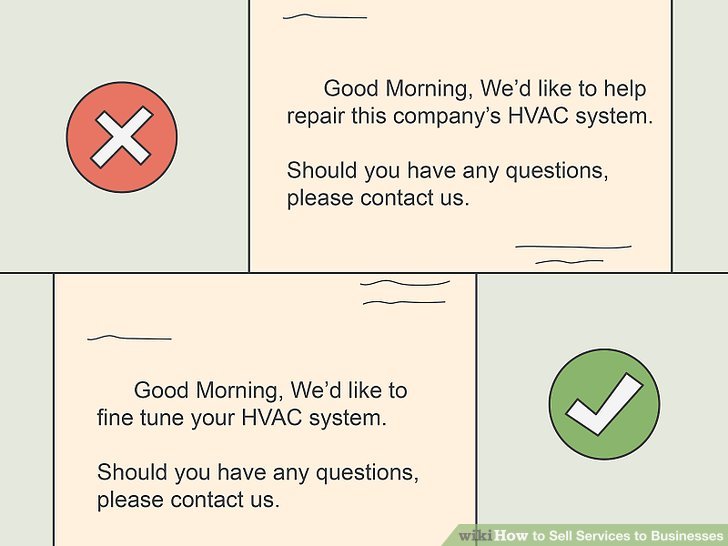

A successful marketing campaign requires a structured approach. First, clearly define your target audience, their needs, and pain points. Then, craft a unique value proposition that highlights how your service solves those problems. Next, select the most appropriate marketing channels (discussed below). Develop compelling marketing materials, such as website copy, social media posts, and email newsletters, that consistently communicate your value proposition. Implement a tracking system to monitor key metrics like website traffic, lead generation, and conversion rates. Finally, analyze the results and make necessary adjustments to optimize the campaign’s effectiveness. A successful campaign, such as one launched by a local plumbing company using targeted Facebook ads and local , might show a significant increase in leads and booked appointments within a few months.

Potential Marketing Channels for Service Businesses

Selecting the right marketing channels is crucial for reaching your target audience effectively. Each channel presents unique advantages and disadvantages.

- Website: Pros: Establishes online presence, showcases expertise, provides contact information. Cons: Requires ongoing maintenance and updates.

- Search Engine Optimization (): Pros: Drives organic traffic, builds long-term brand visibility. Cons: Requires time and expertise to achieve high rankings.

- Social Media Marketing: Pros: Direct engagement with potential clients, builds brand awareness. Cons: Requires consistent content creation and community management.

- Email Marketing: Pros: Targeted communication, nurtures leads, builds relationships. Cons: Requires a permission-based email list and effective email copywriting.

- Paid Advertising (PPC): Pros: Fast results, targeted reach. Cons: Requires ongoing budget investment.

- Content Marketing (Blog, Case Studies): Pros: Establishes thought leadership, builds trust and credibility. Cons: Requires consistent content creation and promotion.

- Networking and Referrals: Pros: Builds strong relationships, generates high-quality leads. Cons: Requires active participation in industry events and building strong relationships.

Finding the Right Buyer

Successfully selling a service business hinges on identifying and attracting the right buyer. The ideal buyer will possess the financial resources, strategic alignment, and operational expertise to not only acquire your business but also to ensure its continued growth and profitability. Failing to target the right buyer can lead to protracted negotiations, lower sale prices, and ultimately, a failed transaction.

Ideal Buyer Profiles for Service Businesses

Understanding the characteristics of ideal buyers is crucial. These characteristics vary depending on the type of service business. For instance, a tech consulting firm might attract different buyers than a landscaping business. Generally, however, ideal buyers fall into two main categories: strategic buyers and private investors. Each possesses distinct advantages and disadvantages for the seller.

Strategic Buyers versus Private Investors

Strategic buyers, such as competitors or larger companies in the same industry, often offer the highest purchase price due to synergies and potential for increased market share. They are motivated by integrating the acquired business into their existing operations, leveraging its client base, and enhancing their service offerings. However, the acquisition process can be more complex and time-consuming due to extensive due diligence and regulatory approvals.

Private investors, including private equity firms and high-net-worth individuals, are primarily interested in financial returns. They may lack the operational expertise to manage the service business directly, leading to a potentially less demanding integration process. However, their purchase price might be lower than that offered by a strategic buyer, and they may implement significant changes to operations focusing on cost-cutting and efficiency improvements.

Potential Buyer Profile: Marketing Agency

Consider a hypothetical marketing agency specializing in social media management for small businesses. An ideal strategic buyer could be a larger marketing firm seeking to expand its service offerings into a new niche or geographic market. This buyer would value the agency’s existing client base, its established brand reputation, and the expertise of its employees. Alternatively, a private equity firm focused on acquiring profitable small businesses might also be interested, primarily driven by the agency’s consistent revenue stream and potential for growth. A suitable private investor would possess significant capital and understand the value of intangible assets like client relationships and brand recognition.

Networking Effectively to Find Potential Buyers

Networking is paramount in finding the right buyer. Actively participating in industry events, conferences, and online forums allows for direct engagement with potential buyers and intermediaries. Building relationships with investment bankers specializing in service business acquisitions provides access to a wider pool of potential buyers. Utilizing online platforms and professional networking sites like LinkedIn can also broaden your reach and facilitate connections with interested parties. A well-crafted business profile highlighting the key strengths and value proposition of your service business is crucial for attracting potential buyers. Furthermore, engaging with industry analysts and consultants can provide valuable insights into market trends and buyer preferences, helping to refine your target buyer profile and optimize your sales strategy.

Preparing Your Business for Sale: How To Sell A Service Business

Preparing your service business for sale is crucial for maximizing its value and attracting the right buyer. A well-prepared business presents a compelling investment opportunity, leading to a smoother and more profitable transaction. This involves improving its financial health, meticulously documenting its operations, and ensuring all legal and administrative aspects are in order.

Improving the Financial Health of a Service Business

Before putting your service business on the market, bolstering its financial health is paramount. Potential buyers scrutinize financial performance intensely, seeking consistent revenue growth, healthy profit margins, and a strong cash flow. Improving these key metrics directly impacts the business valuation. This involves streamlining operations to reduce unnecessary expenses, optimizing pricing strategies to enhance profitability, and improving collection processes to minimize outstanding invoices. A healthy balance sheet demonstrates stability and attracts serious buyers. For example, a service business might identify and eliminate underperforming service lines, renegotiate contracts with suppliers to secure better rates, or implement a more efficient invoicing system to speed up payment collection.

Maintaining Accurate Financial Records

Maintaining meticulous and accurate financial records is not merely a matter of compliance; it’s fundamental to a successful sale. Comprehensive financial statements, including profit and loss statements, balance sheets, and cash flow statements, are essential for demonstrating the business’s financial performance and stability. Accurate records provide transparency, build trust with potential buyers, and support the valuation process. Inconsistent or incomplete records raise red flags and can significantly devalue the business. Consider using accounting software to automate record-keeping and ensure accuracy. A clear audit trail shows the business’s financial history in detail, answering any questions a potential buyer may have.

Preparing Your Business for Sale: A Checklist

A structured approach to preparing your business for sale significantly streamlines the process. The following checklist Artikels key steps to ensure a smooth transition:

- Review and update financial statements: Ensure all financial records are accurate, complete, and up-to-date.

- Assess and improve operational efficiency: Identify and address any inefficiencies in your operations to boost profitability.

- Clean up outstanding debts and accounts receivable: Minimize outstanding invoices and address any outstanding debts.

- Document all business processes and procedures: Create comprehensive documentation to ensure a smooth handover.

- Review and update all contracts and agreements: Ensure all contracts are current and compliant with relevant regulations.

- Identify and address any potential legal or regulatory issues: Proactively address any potential issues to avoid complications during the sale.

- Prepare a comprehensive business plan: This will help attract potential buyers and justify your asking price.

- Secure professional advice: Consult with legal and financial professionals to ensure a smooth and successful sale.

Essential Documents for the Sales Process

Having the necessary documents readily available simplifies the due diligence process and expedites the sale. The following table Artikels essential documents and their importance:

| Document Type | Description | Importance | Where to Find |

|---|---|---|---|

| Financial Statements (3-5 years) | Profit & Loss, Balance Sheet, Cash Flow Statement | Demonstrates financial health and performance | Accounting software, accountant |

| Tax Returns (3-5 years) | Federal, state, and local tax returns | Verifies financial information and compliance | Tax professional, tax filing software |

| Contracts and Agreements | Client contracts, supplier agreements, lease agreements | Highlights ongoing obligations and revenue streams | Filing system, legal counsel |

| Business Licenses and Permits | All relevant licenses and permits required to operate | Ensures legal compliance and operational legitimacy | Government agencies, business records |

| Insurance Policies | Liability, property, and other relevant insurance policies | Protects the business and buyer from potential risks | Insurance provider, insurance broker |

| Employee Records | Employment contracts, payroll records, employee handbooks | Provides information on employee compensation and benefits | Human Resources department, payroll provider |

| Intellectual Property Documents | Patents, trademarks, copyrights, etc. | Protects and values intangible assets | Legal counsel, intellectual property registry |

| Marketing Materials | Brochures, website, marketing campaigns | Showcases the business’s branding and marketing efforts | Marketing department, website |

Negotiating the Sale

Selling a service business involves navigating complex negotiations. A successful sale hinges on a thorough understanding of common tactics, legal considerations, and the key terms within the sale agreement. Preparation and professional guidance are crucial for maximizing the value received and ensuring a smooth transaction.

Common Negotiation Tactics in Business Sales

Negotiations in business sales often involve strategic maneuvering from both buyer and seller. Buyers may attempt to undervalue the business by focusing on weaknesses or emphasizing market risks. Sellers, conversely, may overemphasize strengths and minimize potential challenges. Understanding these tactics allows for more effective counter-strategies. For instance, a buyer might try to negotiate a lower price by highlighting a recent dip in revenue. A seller should be prepared to counter this by demonstrating the temporary nature of the dip and highlighting the long-term growth potential of the business, supported by robust financial data and a well-defined business plan. Similarly, sellers may need to manage buyer expectations regarding the transition period, offering realistic timelines and outlining clear support strategies to ensure a smooth handover.

Importance of Legal Representation During Negotiations

Legal representation is paramount during business sale negotiations. A lawyer specializing in business transactions provides invaluable expertise in interpreting contracts, identifying potential risks, and protecting the seller’s interests. They ensure all agreements are legally sound, protecting against future disputes and liabilities. Their involvement is particularly crucial in reviewing and negotiating the terms and conditions of the sale agreement, ensuring that the seller’s rights and obligations are clearly defined and adequately protected. A lawyer can also help to anticipate and address potential legal complexities that might arise during the transition process. For example, they can assist in navigating issues related to intellectual property, non-compete agreements, and the transfer of liabilities.

Key Terms and Conditions of a Typical Business Sale Agreement, How to sell a service business

A typical business sale agreement includes several key terms and conditions. These typically involve the purchase price, payment terms (e.g., upfront payment, installments, escrow), the definition of assets included in the sale (including intellectual property, client lists, and contracts), representations and warranties (statements made by the seller about the business), indemnification (protection against future liabilities), and closing conditions (e.g., satisfactory completion of due diligence). The agreement also typically includes clauses outlining non-compete agreements, confidentiality provisions, and post-closing obligations of both parties. For example, a seller might agree to a non-compete clause to prevent them from starting a competing business within a specific geographical area and time frame. Conversely, the buyer might require the seller to provide a certain level of support during a transition period to ensure business continuity.

Negotiation Process Flowchart

A flowchart illustrating the negotiation process would begin with Initial Contact, leading to a Due Diligence phase. This is followed by Negotiation of Terms, culminating in a finalized Agreement. Each stage involves several sub-steps, including information exchange, offer and counter-offer, and legal review. The flowchart would visually represent the iterative nature of negotiations, with potential loops back to earlier stages based on disagreements or the need for clarification. For instance, a disagreement on the purchase price might necessitate revisiting the valuation process or a deeper examination of the financial statements. Once all terms are agreed upon and the legal review is complete, the final agreement is signed, marking the successful conclusion of the negotiation phase.

Legal and Financial Aspects

Selling a service business involves navigating a complex landscape of legal and financial considerations. Understanding these aspects is crucial for a smooth and successful transaction, maximizing your return and minimizing potential risks. Failure to address these elements properly can lead to significant delays, disputes, and even the collapse of the sale.

Legal Requirements for Selling a Business

The legal requirements for selling a service business vary depending on location and the specific structure of the business (sole proprietorship, partnership, LLC, corporation, etc.). Generally, this involves ensuring all necessary documentation is in order, including contracts, licenses, permits, and intellectual property rights. Compliance with relevant tax laws and regulations is paramount, requiring careful attention to tax implications throughout the sales process. For example, transferring ownership might trigger capital gains taxes, and accurate financial records are essential for calculating these correctly. Consultations with legal professionals experienced in business sales are strongly recommended to ensure full compliance and avoid potential legal challenges.

Types of Business Sale Agreements

Several types of agreements govern the sale of a service business. The most common include asset sales, where the buyer purchases the business’s assets, and stock sales, where the buyer acquires the ownership shares of the company. Asset sales offer greater protection to the seller from future liabilities associated with the business, while stock sales transfer all ownership, including liabilities, to the buyer. Other less common structures, such as merger or acquisition agreements, might also be relevant depending on the specific circumstances. The choice of agreement significantly impacts the tax implications and the level of risk transfer between buyer and seller. A skilled legal advisor can guide you in selecting the most appropriate structure for your situation.

Role of Legal and Financial Advisors

Legal and financial advisors play indispensable roles in the sale process. Legal counsel ensures compliance with all applicable laws and regulations, drafts and reviews contracts, and protects the seller’s interests throughout negotiations. Financial advisors provide valuations, analyze financial statements, structure the deal to optimize tax implications, and assist with due diligence. Their expertise minimizes risk, ensures a fair deal, and streamlines the entire process. Engaging these professionals proactively, rather than reactively, is crucial for a successful outcome. Their involvement can be the difference between a smooth, profitable sale and a costly, protracted legal battle.

Potential Legal and Financial Pitfalls

Several pitfalls can derail a service business sale. These include inadequate due diligence, leading to unforeseen liabilities; inaccurate valuation, resulting in an unfair price; poorly drafted contracts, creating ambiguity and disputes; and failure to address intellectual property rights, potentially jeopardizing future business prospects. Unforeseen tax liabilities, arising from incorrect calculations or non-compliance, can also significantly reduce the net proceeds from the sale. Ignoring these potential problems can lead to substantial financial losses and legal complications. Thorough preparation, coupled with professional guidance, is essential to avoid these pitfalls and ensure a successful transaction.

Transitioning Ownership

Successfully transferring ownership of a service business requires meticulous planning and execution. A smooth transition protects the business’s value, maintains client relationships, and ensures employee morale remains high. Ignoring these aspects can lead to significant financial losses and reputational damage.

The process involves a series of interconnected steps, each demanding careful consideration. Failing to address any one area can jeopardize the entire transition.

Steps Involved in Transferring Ownership

Transferring ownership involves a multi-stage process. These steps are not necessarily linear; some may overlap or require revisiting. Careful coordination is essential for a successful handover.

- Valuation and Pricing: Accurately valuing the business is crucial. This involves assessing factors like revenue, profitability, client contracts, and employee expertise. A professional valuation is often recommended to ensure fairness and avoid disputes.

- Legal Documentation: The sale agreement must be legally sound and comprehensive. This includes clearly defining the assets being transferred, payment terms, non-compete clauses, and liabilities assumed by the buyer.

- Due Diligence: Both the buyer and seller should conduct thorough due diligence. The buyer verifies the business’s financial health and operational efficiency, while the seller ensures the buyer has the necessary resources and commitment.

- Client Communication: Inform clients of the impending change in ownership well in advance. Assure them of continued service quality and maintain open communication throughout the transition.

- Employee Transition: Engage employees early in the process. Address their concerns, clarify their roles under the new ownership, and offer support during the transition.

- Handoff and Training: Provide comprehensive training to the buyer and their team on all aspects of the business, including operational procedures, client management, and financial systems.

- Post-Sale Support: Offer a period of post-sale support to the buyer to ensure a smooth handover and address any unforeseen issues. This demonstrates commitment and protects the business’s reputation.

Strategies for a Smooth Transition for Clients and Employees

Maintaining positive relationships with clients and employees is vital during a business transition. A well-planned approach minimizes disruption and ensures continued loyalty.

- Transparent Communication: Open and honest communication is key. Inform clients and employees about the sale early and address their concerns proactively.

- Client Retention Plan: Develop a strategy to retain clients. This may involve personal communication, special offers, or guarantees of continued service quality.

- Employee Engagement: Involve employees in the transition process. Solicit their feedback, address their concerns, and provide opportunities for input.

- Retention Incentives: Offer incentives to retain key employees. This could include bonuses, increased benefits, or opportunities for professional development.

Best Practices for Managing the Transition Period

Effective management during the transition period is crucial for a successful outcome. This involves proactive planning, clear communication, and diligent oversight.

- Establish a Timeline: Create a detailed timeline outlining key milestones and deadlines for each stage of the transition.

- Assign Responsibilities: Clearly define roles and responsibilities for both the seller and buyer to avoid confusion and duplication of effort.

- Regular Monitoring: Regularly monitor the transition process to identify and address any potential problems early on.

- Documentation and Record-Keeping: Maintain meticulous records of all transactions, communications, and agreements throughout the transition.

Examples of Successful Business Transitions

While specific details of successful transitions are often confidential, the underlying principles remain consistent. For instance, a well-documented transition involving a large accounting firm might include a phased handover of client portfolios, detailed training programs for the new staff, and ongoing consultation periods to ensure the seamless continuation of services. Similarly, a smaller marketing agency’s success might hinge on personal client outreach, a strong employee retention strategy, and a clear communication plan. The common thread is proactive planning and a focus on minimizing disruption for all stakeholders.