How to start a business in Mississippi? This comprehensive guide navigates the complexities of launching a venture in the Magnolia State, covering everything from choosing the right business structure and securing necessary licenses to understanding state regulations and funding options. We’ll delve into the specifics of Mississippi’s business environment, providing actionable steps and valuable resources to help you build a successful enterprise.

From understanding the diverse business structures available—sole proprietorships, LLCs, partnerships, and corporations—to navigating the intricacies of Mississippi’s tax system and securing funding, this guide provides a clear roadmap. We’ll explore effective marketing strategies tailored to the Mississippi market and offer insights into hiring and managing employees within the state’s legal framework. By the end, you’ll have a solid foundation for launching and growing your business in Mississippi.

Business Structure in Mississippi

Choosing the right business structure is a crucial first step for any entrepreneur in Mississippi. The structure you select significantly impacts your liability, taxation, and administrative burden. Understanding the nuances of each option is vital for long-term success. This section will compare the four most common business structures: sole proprietorships, LLCs, partnerships, and corporations.

Sole Proprietorship in Mississippi

A sole proprietorship is the simplest business structure, characterized by a single owner who isn’t legally separate from the business. This means the owner directly receives all profits but also bears full personal liability for business debts and obligations. In Mississippi, registering a sole proprietorship is generally straightforward, typically involving obtaining the necessary licenses and permits for your specific industry. Tax implications are relatively simple, as profits are reported on the owner’s personal income tax return (Schedule C).

Limited Liability Company (LLC) in Mississippi

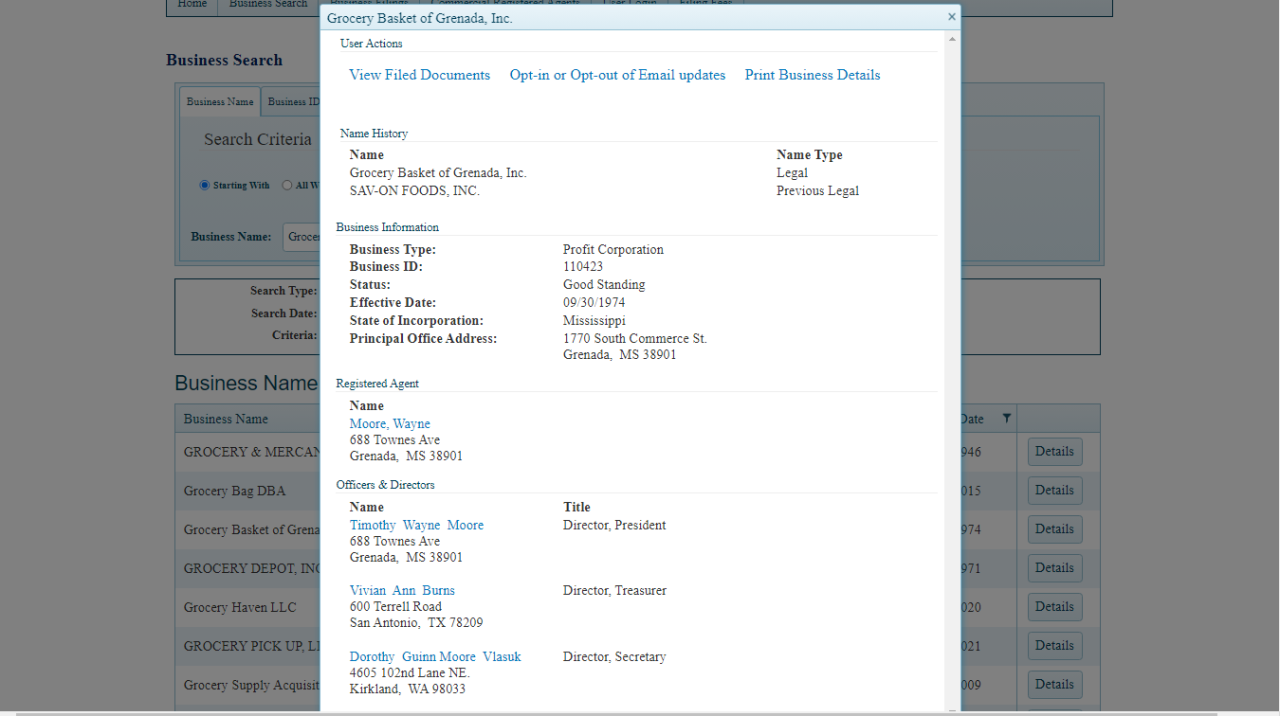

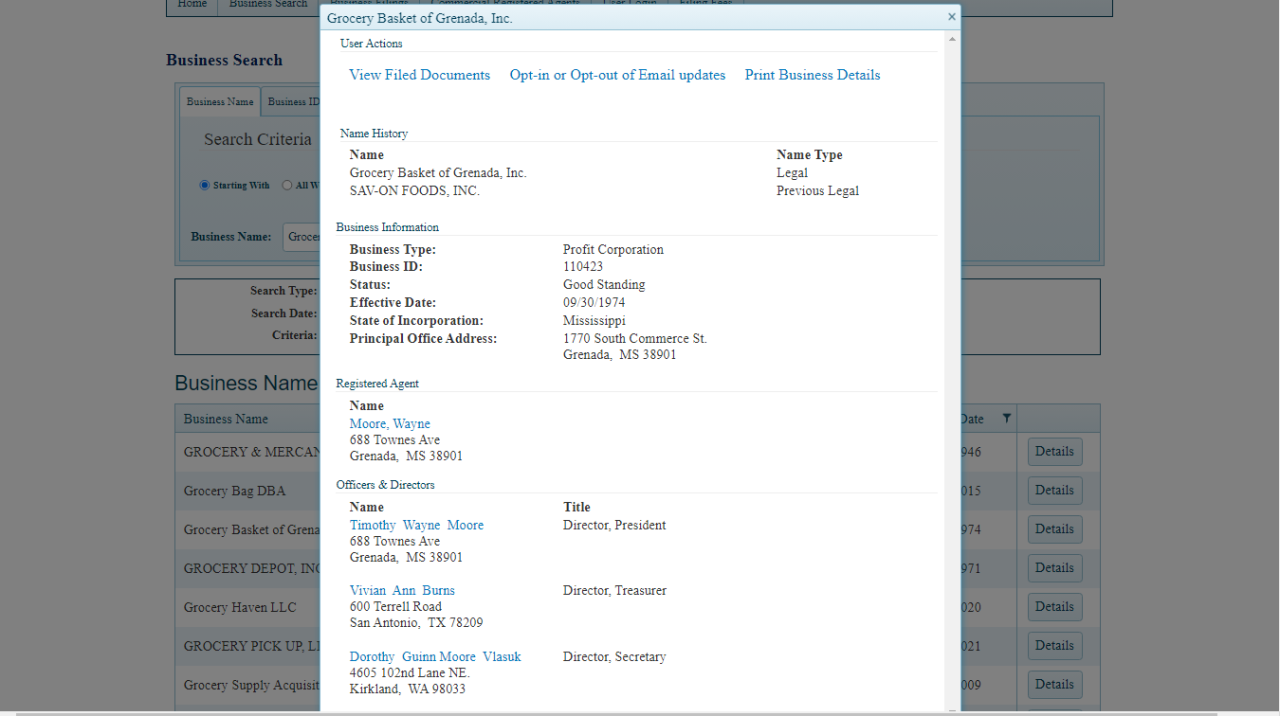

An LLC offers a blend of partnership and corporate structures. Owners, known as members, enjoy limited liability, meaning their personal assets are generally protected from business debts. Mississippi LLCs can be managed by members (member-managed) or designated managers (manager-managed). The taxation of an LLC in Mississippi can vary; it can be taxed as a pass-through entity (similar to a sole proprietorship or partnership), or it can elect to be taxed as a corporation. Formation requires filing articles of organization with the Mississippi Secretary of State.

Partnership in Mississippi

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Like sole proprietorships, general partnerships offer limited liability protection; partners are personally liable for business debts. Mississippi recognizes several types of partnerships, including general partnerships, limited partnerships (LPs), and limited liability partnerships (LLPs). LLPs offer some liability protection to individual partners. Taxation is generally pass-through, with profits and losses reported on the partners’ individual tax returns. Formal registration may be required depending on the type of partnership.

Corporation in Mississippi

Corporations are considered separate legal entities from their owners (shareholders). This separation provides significant liability protection; shareholders are generally not personally liable for the corporation’s debts. Corporations in Mississippi can be either S corporations or C corporations. C corporations face double taxation—profits are taxed at the corporate level and again when distributed to shareholders as dividends. S corporations avoid this double taxation, with profits and losses passed through to the shareholders’ personal income tax returns. Forming a corporation in Mississippi requires more complex procedures, including filing articles of incorporation with the Secretary of State.

Comparison of Business Structures in Mississippi

The following table summarizes the key differences between the four business structures:

| Business Structure | Liability Protection | Taxation | Registration Process |

|---|---|---|---|

| Sole Proprietorship | None; owner is personally liable | Pass-through; reported on owner’s personal income tax return | Obtain necessary licenses and permits |

| LLC | Limited liability; protects personal assets | Pass-through or corporate, depending on election | File articles of organization with the Mississippi Secretary of State |

| Partnership | Limited or no liability, depending on the type of partnership | Pass-through; reported on partners’ personal income tax returns | May require formal registration depending on the type of partnership |

| Corporation (C Corp or S Corp) | Significant liability protection; shareholders are generally not personally liable | C Corp: Double taxation; S Corp: Pass-through | File articles of incorporation with the Mississippi Secretary of State; more complex process than LLC formation |

Mississippi Business Licenses and Permits

Navigating the process of obtaining the necessary licenses and permits to operate a business in Mississippi can seem daunting, but understanding the requirements specific to your industry simplifies the task considerably. The Mississippi Secretary of State’s office and the relevant professional licensing boards are crucial resources throughout this process. Failure to obtain the correct permits can result in significant fines and legal issues, emphasizing the importance of thorough research and accurate application.

Obtaining business licenses and permits in Mississippi varies significantly depending on the type of business and its location. Certain licenses are mandated at the state level, while others are managed at the county or municipal level. This necessitates checking with both state and local authorities to ensure complete compliance. The complexity also increases with the specific industry, with some sectors facing more stringent regulatory oversight than others.

Types of Mississippi Business Licenses and Permits by Industry

Mississippi’s licensing and permitting requirements are diverse, reflecting the variety of businesses operating within the state. For example, restaurants require food service permits and health inspections, while construction companies need contractor’s licenses and potentially specific permits for particular projects. Retail businesses may need sales tax permits and possibly zoning permits depending on location. Professional services, such as law or medicine, demand state-specific professional licenses.

Examples of Common Business Licenses and Permits

- General Business License: Many Mississippi cities and counties require a general business license, regardless of industry. This license usually involves registering your business with the local government and paying an associated fee.

- Sales Tax Permit: If your business sells tangible goods or services subject to Mississippi sales tax, you’ll need a sales tax permit to collect and remit taxes to the Mississippi Department of Revenue.

- Occupational Licenses: Professionals like doctors, lawyers, cosmetologists, and contractors require specific occupational licenses issued by their respective state boards. These often involve passing examinations and meeting specific experience requirements.

- Food Service Permits: Restaurants and other food establishments need permits from the Mississippi State Department of Health, ensuring compliance with food safety regulations.

- Building Permits: Construction projects, renovations, or even significant alterations to existing structures often require building permits from the local municipality.

- Alcohol Permits: Businesses selling or serving alcoholic beverages need licenses from the Mississippi Department of Revenue’s Alcoholic Beverage Control Division.

Checklist for Obtaining Licenses and Permits in Mississippi

Before starting your business, systematically gather the necessary documentation and complete the following steps:

- Identify Required Licenses and Permits: Research state and local requirements based on your business type and location. Consult the Mississippi Secretary of State’s website and your local government’s website.

- Complete Applications: Download and accurately fill out all necessary application forms. Ensure all information is complete and accurate to avoid delays.

- Gather Supporting Documents: Collect any required supporting documentation, such as proof of business registration, insurance certificates, and identification.

- Pay Fees: Submit the appropriate fees for each license or permit. Fees vary depending on the type of license and the governing body.

- Submit Applications: Submit completed applications and supporting documents to the appropriate agencies. Methods of submission vary; some may be online, while others may require in-person submission.

- Receive and Maintain Licenses: Once approved, carefully store and maintain your licenses and permits. Ensure you understand renewal requirements and deadlines.

Relevant Mississippi State Websites and Contact Information

The Mississippi Secretary of State’s website serves as a primary resource for business information. Additional resources include the Mississippi Department of Revenue for tax-related permits and the Mississippi State Department of Health for food service permits. Contact information for these and other relevant agencies can be found on their respective websites. It’s crucial to verify all information directly with the relevant authorities, as regulations and procedures can change.

Mississippi State Regulations and Compliance

Starting a business in Mississippi requires understanding and adhering to various state regulations to ensure legal compliance and operational success. Failure to comply can result in penalties, fines, and even business closure. This section Artikels key regulatory areas and the relevant state agencies involved.

Environmental Regulations

Mississippi’s environmental regulations aim to protect the state’s natural resources. Businesses, particularly those in manufacturing, agriculture, and waste management, must comply with these rules. The Mississippi Department of Environmental Quality (MDEQ) is the primary agency responsible for enforcing these regulations. Key areas include air quality, water quality, waste disposal, and hazardous materials handling. Businesses should consult the MDEQ website for specific permit requirements and compliance guidelines relevant to their industry. For example, a manufacturing facility would need permits to manage wastewater discharge, while a farm might need permits for pesticide application. Non-compliance can lead to significant fines and legal action.

Labor Laws and Regulations

Mississippi’s labor laws protect employees’ rights and ensure fair working conditions. The Mississippi Department of Employment Security (MDES) is the primary agency responsible for enforcing these regulations. Key areas include minimum wage, overtime pay, worker’s compensation, and workplace safety. Businesses must comply with federal labor laws as well as state-specific regulations. For instance, businesses must provide workers’ compensation insurance and maintain a safe working environment, adhering to OSHA guidelines. Failure to comply can result in significant fines, lawsuits, and reputational damage.

Tax Regulations, How to start a business in mississippi

Mississippi has various taxes that businesses must comply with, including state income tax, sales tax, and franchise tax. The Mississippi Department of Revenue (DOR) is the primary agency responsible for administering and enforcing these taxes. Businesses must register with the DOR and file tax returns regularly. Accurate and timely tax filings are crucial to avoid penalties and interest charges. The DOR provides detailed information and resources on various tax regulations on their website. For example, businesses must collect and remit sales tax on most goods and services sold within the state. Understanding the intricacies of Mississippi’s tax system is vital for financial stability and legal compliance.

Other Key Regulatory Agencies

Beyond the agencies already mentioned, several other state agencies play a role in business regulation. The Mississippi Secretary of State’s office oversees business registrations and filings. The Mississippi Insurance Department regulates insurance companies and agents operating within the state. The Mississippi Public Service Commission regulates utilities. Businesses should familiarize themselves with the specific regulations of these agencies that pertain to their operations. Understanding the roles and responsibilities of these agencies ensures comprehensive regulatory compliance.

Funding and Financing Your Mississippi Business: How To Start A Business In Mississippi

Securing adequate funding is crucial for the success of any new business venture in Mississippi. Entrepreneurs have several avenues to explore, each with its own advantages and disadvantages. Understanding these options and the resources available to support Mississippi businesses is key to navigating the funding landscape. This section details the various funding options available, highlighting the pros and cons of each and providing examples of resources within the state.

Funding Options for Mississippi Businesses

Mississippi entrepreneurs can access funding through a variety of sources, including loans, grants, and investments. Loans provide capital that must be repaid, while grants offer non-repayable funding often based on specific criteria. Investors provide capital in exchange for equity or other forms of ownership in the business. The best option depends heavily on the nature of the business, the entrepreneur’s financial situation, and the business’s growth potential.

Loans for Mississippi Businesses

Several institutions offer loans specifically designed for small businesses in Mississippi. These include traditional banks, credit unions, and government-backed loan programs like those offered through the Small Business Administration (SBA). SBA loans, for example, often come with more favorable terms than conventional loans, including lower interest rates and longer repayment periods. The application process typically involves a detailed business plan, financial statements, and a credit check. Banks and credit unions will assess creditworthiness and the business’s potential for success before approving a loan.

Grants for Mississippi Businesses

Grants are a desirable funding source because they don’t require repayment. However, securing grants is often competitive, and eligibility requirements can be stringent. Many state and local organizations offer grants to Mississippi businesses, focusing on specific industries or demographics. The Mississippi Development Authority (MDA) is a key resource for identifying and applying for grants related to economic development and business growth. Grant applications often require detailed proposals outlining the project’s goals, budget, and anticipated impact.

Investors for Mississippi Businesses

Seeking investment capital involves giving up a portion of ownership in exchange for funding. This can be through angel investors, venture capitalists, or crowdfunding platforms. Angel investors are typically high-net-worth individuals who invest in early-stage companies. Venture capitalists are firms that invest in businesses with high-growth potential. Crowdfunding allows entrepreneurs to raise capital from a large number of individuals online. Each of these investment avenues has unique requirements and expectations regarding the business’s potential for return on investment.

Resources for Securing Funding in Mississippi

Several resources are available to assist Mississippi entrepreneurs in securing funding. The Mississippi Development Authority (MDA) provides extensive support, including guidance on loan and grant applications, business planning assistance, and connections to investors. The Mississippi Small Business Development Center (MS SBDC) offers free business counseling and training, helping entrepreneurs develop strong business plans crucial for securing funding. Local chambers of commerce and SCORE chapters also provide valuable resources and mentorship.

Comparison of Funding Sources

| Funding Source | Pros | Cons | Eligibility & Application |

|---|---|---|---|

| Bank Loans | Relatively accessible; established lending processes. | Requires strong credit; involves debt repayment; interest charges apply. | Credit check, business plan, financial statements; varies by lender. |

| SBA Loans | Favorable terms (lower rates, longer repayment); government backing. | Complex application process; stringent eligibility requirements. | Detailed business plan, financial statements, credit check; SBA approval required. |

| Grants | Non-repayable funding; can significantly boost resources. | Highly competitive; specific eligibility criteria; often limited funds. | Compelling grant proposal; adherence to specific guidelines; varies by grantor. |

| Angel Investors | Access to capital; potential mentorship and networking opportunities. | Loss of equity; potential for investor influence; finding investors can be challenging. | Strong business plan; compelling pitch; network connections. |

| Venture Capital | Significant capital injection; potential for rapid growth. | High equity surrender; demanding reporting requirements; investor control. | Detailed business plan; strong track record; high growth potential demonstration. |

| Crowdfunding | Access to diverse funding sources; early market validation. | Requires significant marketing effort; success not guaranteed; platform fees apply. | Compelling campaign; strong social media presence; clear reward structure. |

Mississippi Business Location and Infrastructure

Choosing the right location for your Mississippi business is crucial for success. Factors such as demographics, access to infrastructure, and the cost of living significantly impact operational costs, customer reach, and employee recruitment. A well-informed decision in this area can lay a strong foundation for growth and profitability.

Selecting a business location in Mississippi requires careful consideration of several key factors. The state’s diverse geography and economic landscape offer a range of options, each with its own advantages and disadvantages. Understanding these nuances is essential for making a strategic choice that aligns with your business goals and resources.

Factors Influencing Business Location Selection in Mississippi

The decision of where to establish your business in Mississippi should be data-driven. Consideration should be given to the target market, the availability of skilled labor, proximity to suppliers and transportation networks, and the overall cost of operation. Analyzing demographic data, such as population density, age distribution, income levels, and consumer spending habits within potential areas, will help determine market viability. Infrastructure considerations include access to reliable utilities (electricity, water, internet), transportation networks (roads, rail, ports), and the availability of suitable industrial or commercial spaces. Finally, the cost of living, including rent, utilities, and employee wages, significantly impacts operational expenses and profitability. A thorough cost-benefit analysis comparing different locations is vital.

Resources for Finding Suitable Business Locations in Mississippi

Several resources are available to assist entrepreneurs in identifying suitable business locations within Mississippi. The Mississippi Development Authority (MDA) provides comprehensive information on available properties, incentives, and support programs for businesses. Local chambers of commerce and economic development organizations offer valuable insights into specific communities and their respective business environments. Online real estate listings and commercial property databases provide detailed information on available spaces, lease terms, and pricing. Utilizing these resources allows entrepreneurs to systematically evaluate different options and select the most suitable location based on their specific business needs.

Securing a Business Location in Mississippi: A Step-by-Step Guide

Securing a business location involves several key steps. First, identify potential locations based on the factors discussed previously. This involves researching areas that align with your target market, operational needs, and budget. Next, conduct due diligence on each potential location. This includes verifying zoning regulations, examining the condition of the property, and assessing environmental concerns. The next step involves negotiating lease terms or purchasing the property. Lease agreements should be carefully reviewed by legal counsel to ensure that they protect your business interests. Finally, obtain all necessary permits and licenses to legally operate in the chosen location. This might involve contacting local authorities and following specific procedures depending on the type of business and the location. A checklist outlining each step can help streamline this process.

Marketing and Sales Strategies for Mississippi Businesses

Successfully marketing and selling products or services in Mississippi requires a nuanced understanding of the state’s diverse demographics, economic landscape, and consumer preferences. Strategies that work well in larger metropolitan areas may not be as effective in smaller towns and rural communities. A tailored approach, considering both the specific target audience and the unique characteristics of the Mississippi market, is crucial for maximizing return on investment.

Effective marketing in Mississippi necessitates a multi-faceted approach that combines digital strategies with traditional methods. The state’s relatively diverse population, encompassing both urban and rural areas, necessitates a flexible marketing plan capable of reaching various demographic groups through multiple channels. Understanding the specific needs and preferences of each target market segment is paramount to successful campaign execution.

Understanding the Mississippi Market and Consumer Preferences

Mississippi’s market is characterized by a blend of urban and rural populations, with distinct consumer preferences varying across regions. For example, coastal communities might show greater interest in tourism-related businesses, while agricultural regions may prioritize products and services supporting farming and related industries. Analyzing demographic data, such as income levels, age distribution, and cultural influences within specific areas, provides valuable insights into consumer behavior and helps tailor marketing messages for maximum impact. Understanding local cultural nuances and values is also critical for building trust and rapport with potential customers. A campaign that resonates with the values of a rural community will differ significantly from one aimed at a more urban population.

Effective Marketing Channels for Mississippi Businesses

Reaching Mississippi consumers effectively requires a diverse marketing strategy that utilizes a mix of online and offline channels. While digital marketing is essential for broader reach, traditional methods remain highly effective in certain areas.

Digital Marketing Strategies

Digital marketing offers businesses the opportunity to reach a wide audience through targeted campaigns. Utilizing search engine optimization () to improve website ranking in search results is crucial. Social media marketing, particularly on platforms like Facebook and Instagram, can be highly effective in engaging with potential customers. Paid advertising campaigns on these platforms allow for precise targeting based on demographics and interests, ensuring that marketing budgets are used efficiently. Email marketing remains a powerful tool for nurturing leads and building customer relationships.

Traditional Marketing Strategies

Despite the rise of digital marketing, traditional methods remain relevant in Mississippi. Local newspaper advertising and community events can be highly effective in reaching specific geographic areas. Radio advertising, particularly in smaller communities with limited internet access, can be a valuable tool. Direct mail marketing, while potentially more expensive, can be highly targeted and effective in building brand awareness and driving sales. Sponsoring local events and partnering with community organizations can enhance brand visibility and build positive relationships within specific areas.

Examples of Successful Mississippi Marketing Campaigns

While specific details of successful campaigns are often proprietary, several examples illustrate effective strategies. A hypothetical example would be a locally owned restaurant chain leveraging social media to showcase its Mississippi-grown ingredients and community involvement. This approach appeals to the growing consumer preference for locally sourced products and supports the restaurant’s brand image as a community partner. Another example could be a tourism-focused business using targeted digital advertising to reach specific demographic groups interested in Mississippi’s natural beauty or historical sites. This allows the business to maximize its marketing budget by focusing on the most receptive audience segments.

Hiring and Managing Employees in Mississippi

Successfully navigating the complexities of hiring and managing employees is crucial for any Mississippi business to thrive. Understanding Mississippi’s labor laws and best practices for employee relations will significantly impact your company’s productivity, morale, and legal compliance. This section Artikels key legal requirements and provides practical guidance for building a strong and productive workforce.

Mississippi Minimum Wage and Overtime

Mississippi’s minimum wage is currently set by the federal government, which means employers must pay at least the federal minimum wage. As of 2024, this is $7.25 per hour. There are no state-level minimum wage laws exceeding this federal standard. Employers should also be aware of federal overtime regulations, which typically require payment of 1.5 times the regular hourly rate for hours worked beyond 40 in a single workweek. Exemptions exist for certain employee classifications (e.g., executive, administrative, professional), but careful consideration is needed to ensure compliance. Misclassifying employees to avoid overtime pay can lead to significant legal penalties.

Worker’s Compensation Insurance in Mississippi

Worker’s compensation insurance is mandatory in Mississippi for most employers. This insurance covers medical expenses and lost wages for employees injured on the job. Failure to carry adequate worker’s compensation insurance exposes businesses to significant financial liability should an employee suffer a workplace injury. The Mississippi Workers’ Compensation Commission oversees the system, providing guidelines and resources for employers. Employers should consult with an insurance provider to determine the appropriate coverage for their specific business needs and employee demographics.

Creating Compliant Employee Handbooks and Employment Contracts

Employee handbooks and employment contracts serve as crucial tools for outlining expectations, policies, and procedures within a Mississippi business. A well-drafted handbook clearly communicates company policies on topics such as attendance, dress code, performance expectations, and disciplinary procedures. Employment contracts, often used for specific roles or executive positions, define the terms of employment, including compensation, benefits, and responsibilities. Both handbooks and contracts should adhere to Mississippi’s employment laws to avoid potential legal disputes. Consult with an attorney specializing in employment law to ensure your documents are legally sound and protect your business’s interests. For instance, a handbook should explicitly state that employment is “at-will,” meaning either the employer or employee can terminate the relationship at any time for any legal reason, unless a contract specifies otherwise.

Best Practices for Managing Employees and Fostering a Positive Work Environment

Creating a positive work environment is essential for attracting and retaining talented employees in Mississippi. This involves several key strategies. Regular performance reviews provide opportunities for feedback, goal setting, and addressing performance issues proactively. Providing opportunities for professional development, such as training and mentorship programs, demonstrates a commitment to employee growth. Open communication channels, including regular team meetings and opportunities for employee input, foster a sense of collaboration and inclusivity. Implementing a fair and consistent disciplinary process ensures employees are treated equitably and provides a framework for addressing misconduct. Recognizing and rewarding employee contributions, through bonuses, promotions, or public acknowledgment, reinforces positive behaviors and boosts morale. Furthermore, fostering a culture of respect and inclusivity, where employees feel valued and supported, leads to increased productivity and reduced employee turnover. A company-sponsored employee assistance program (EAP) can also provide valuable resources for employees facing personal or professional challenges.