How to start a nonmedical home care business in Texas? The Lone Star State presents a significant opportunity for entrepreneurs in the burgeoning home care industry. Demand for in-home assistance continues to rise, driven by an aging population and a preference for aging in place. This comprehensive guide navigates the essential steps, from securing the necessary licenses and insurance to building a thriving business and cultivating a strong reputation within the Texas market. We’ll cover everything from legal requirements and financial planning to marketing strategies and staff management, equipping you with the knowledge to launch your successful home care agency.

Successfully launching a home care business requires meticulous planning and execution. Understanding the intricacies of Texas regulations, building a robust team, and establishing a strong client base are all critical components. This guide breaks down each stage into manageable steps, offering practical advice and actionable strategies to help you navigate the complexities of starting and growing your business. We’ll delve into specific details, including business structure options, marketing approaches, and effective staff training methods, ensuring you’re well-prepared for the challenges and rewards of this rewarding venture.

Licensing and Legal Requirements in Texas: How To Start A Nonmedical Home Care Business In Texas

Starting a non-medical home care business in Texas requires navigating a specific regulatory landscape. Understanding and fulfilling all licensing and legal obligations is crucial for both operational legality and client safety. Failure to comply can result in significant penalties, including fines and business closure. This section details the necessary steps and requirements.

Obtaining Necessary Licenses and Permits

The Texas Department of Aging and Disability Services (DADS) regulates home and community-based services. While specific licensing requirements vary depending on the services offered (e.g., personal care, companion care, homemaking), most non-medical home care agencies in Texas must register with the state. This involves completing an application, undergoing a background check, and potentially meeting specific staffing requirements. The process generally includes submitting detailed information about the business structure, ownership, and planned operations. The application is then reviewed by DADS, and if approved, the agency receives a license to operate. The renewal process typically involves annual submission of updated information and potentially further inspections.

Legal Requirements and Regulations

Texas law mandates adherence to various regulations, including but not limited to background checks for all employees, maintaining accurate client records, complying with HIPAA regulations (for any protected health information), and adhering to specific safety standards within the home care setting. These regulations aim to ensure the safety and well-being of clients receiving home care services. Insurance requirements, such as general liability and professional liability insurance, are also essential for protecting the business from potential lawsuits. Furthermore, understanding and complying with the Texas Workforce Commission’s regulations concerning employee classification and wage payments is crucial.

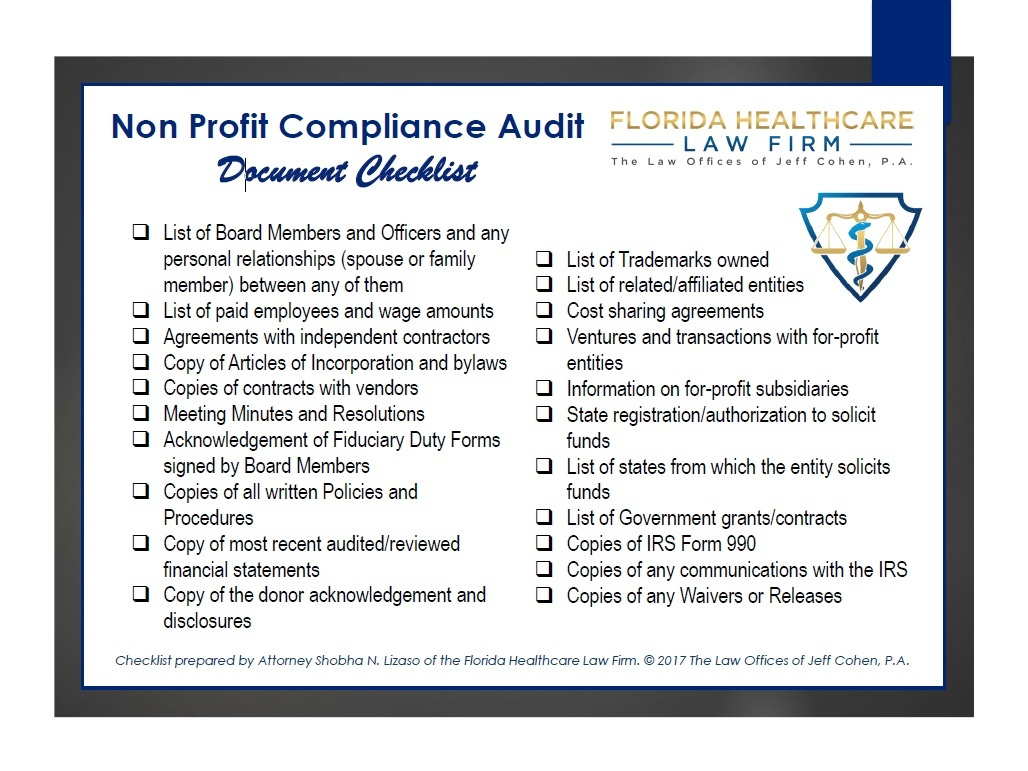

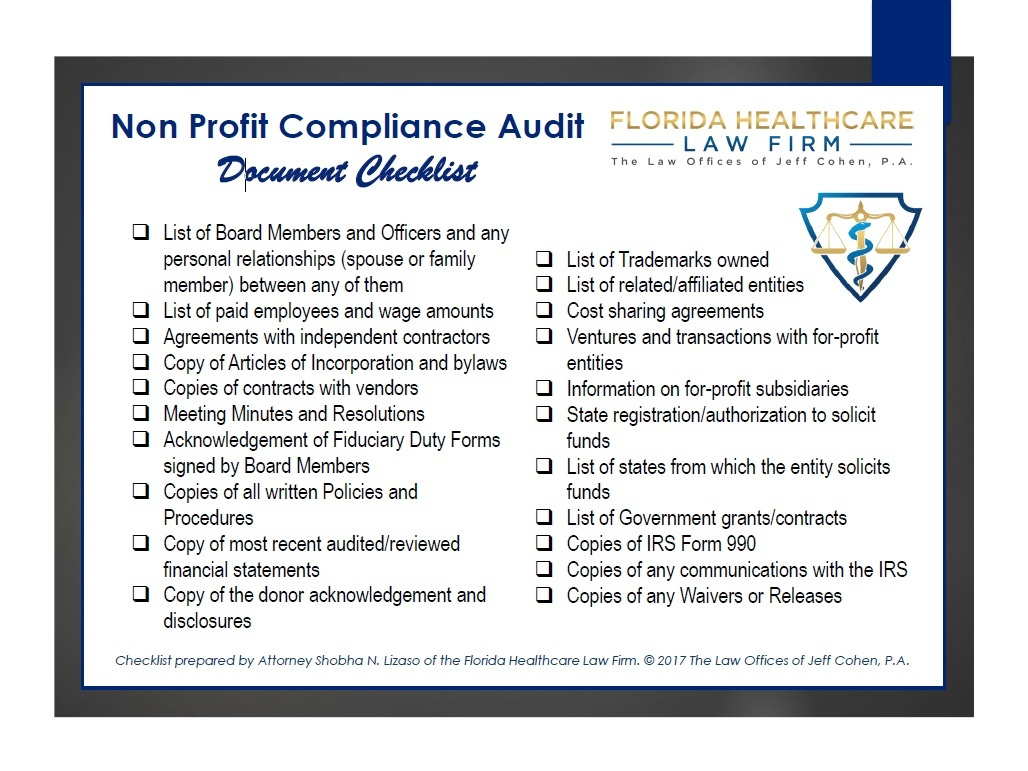

Checklist of Documents for the Application Process

Before beginning the application process, it is essential to gather all necessary documents. This ensures a smooth and efficient application review. A comprehensive checklist would include:

- Completed application form (obtained from DADS).

- Business plan outlining the scope of services, target market, and operational procedures.

- Proof of business registration (e.g., Articles of Incorporation or assumed name certificate).

- Detailed financial statements, including projected income and expenses.

- Background checks for all owners, managers, and employees.

- Proof of liability insurance.

- Detailed description of the agency’s quality assurance plan.

- Copies of any relevant contracts with clients or subcontractors.

Sample Business Plan Section: Legal Compliance

A robust business plan should include a dedicated section addressing legal compliance. This section should demonstrate a clear understanding of all relevant Texas regulations and the agency’s commitment to adhering to them. This section should include:

A detailed description of all relevant licenses and permits, including application status and expected renewal dates.

A summary of key legal requirements, such as background check procedures, record-keeping practices, and insurance coverage.

A description of the agency’s internal compliance program, outlining procedures for ensuring ongoing adherence to all relevant laws and regulations. This might include regular internal audits and staff training on legal updates.

A contingency plan to address potential legal challenges or violations.

Business Structure and Registration

Choosing the right business structure for your Texas home care agency is a crucial first step. The structure you select will significantly impact your liability, taxation, and administrative burden. This section details the common business structures available in Texas and their implications for home care agencies.

Business Structure Options for Texas Home Care Agencies

Texas offers several business structures, each with unique advantages and disadvantages. The most common choices for home care agencies include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations (S-corps and C-corps). The optimal structure depends on factors like liability concerns, tax implications, and administrative complexity.

Sole Proprietorship

A sole proprietorship is the simplest structure, where the business and the owner are legally indistinguishable. This means the owner is personally liable for all business debts and obligations. While easy to set up, this lack of liability protection is a significant drawback for a home care agency, which faces potential legal risks.

Partnership

A partnership involves two or more individuals sharing ownership and responsibility. Like sole proprietorships, partners typically face personal liability for business debts. While sharing responsibilities can be beneficial, disagreements among partners can be problematic.

Limited Liability Company (LLC)

An LLC offers a crucial advantage: limited liability. This means the personal assets of the owners are protected from business debts and lawsuits. LLCs also offer flexibility in taxation, allowing for pass-through taxation (like a sole proprietorship or partnership) or corporate taxation. This makes them a popular choice for home care agencies.

Corporation (S-Corp and C-Corp)

Corporations, including S-corps and C-corps, offer the strongest liability protection. However, they involve more complex setup and administrative requirements, including corporate filings and stricter regulatory compliance. S-corps offer pass-through taxation, while C-corps are subject to double taxation (taxation at the corporate level and again on dividends). For a home care agency, the added complexity might outweigh the benefits unless there are significant investors involved.

Registering Your Business with the Texas Secretary of State

Registering your business with the Texas Secretary of State is a critical step in establishing your legal presence. The specific steps vary depending on the chosen business structure.

For an LLC, you’ll need to file the Certificate of Formation with the Secretary of State, including details like the business name, registered agent, and operating agreement. For a corporation, the process involves filing the Articles of Incorporation. Sole proprietorships and partnerships generally don’t require state-level registration, although local registration or permits may be needed. The Texas Secretary of State website provides detailed instructions and forms for each business structure.

Tax Implications of Different Business Structures

The tax implications significantly vary depending on the chosen structure. Sole proprietorships and partnerships report business income and expenses on the owner’s personal income tax return (Schedule C). LLCs typically choose to be taxed as pass-through entities, similar to sole proprietorships and partnerships, unless they elect to be taxed as corporations. S-corporations also use pass-through taxation, while C-corporations face double taxation. Understanding these differences is essential for accurate tax filing and financial planning.

Comparison of Business Structures for Texas Home Care Agencies

| Structure | Registration Process | Tax Implications | Advantages/Disadvantages |

|---|---|---|---|

| Sole Proprietorship | Simple registration, possibly only local permits required. | Pass-through taxation; reported on personal income tax return. | Easy to set up; but unlimited personal liability. |

| Partnership | Generally simple registration, possibly only local permits required. | Pass-through taxation; reported on partners’ personal income tax returns. | Shared responsibilities; but unlimited personal liability for partners. |

| LLC | File Certificate of Formation with the Texas Secretary of State. | Pass-through taxation (default) or corporate taxation (if elected). | Limited liability; flexible taxation; relatively easy to manage. |

| S-Corp | File Articles of Incorporation with the Texas Secretary of State; obtain S-Corp election from the IRS. | Pass-through taxation; potential tax advantages for owner-employees. | Strong liability protection; potential tax benefits; but more complex to manage than LLC. |

| C-Corp | File Articles of Incorporation with the Texas Secretary of State. | Double taxation (corporate tax and shareholder dividends tax). | Strong liability protection; better for attracting investors; but complex and higher tax burden. |

Insurance and Bonding

Protecting your non-medical home care business in Texas requires a comprehensive insurance strategy. Failure to secure adequate coverage can lead to significant financial losses and legal liabilities. This section Artikels the essential insurance policies and bonding requirements for operating a successful and legally compliant home care agency in the state.

Required Insurance Coverage for Texas Home Care Businesses

Texas law doesn’t explicitly list every required insurance policy for non-medical home care agencies, but several are crucial for protecting your business and employees. The specific needs will vary depending on the size and scope of your operations, but generally include general liability insurance, worker’s compensation insurance, and potentially commercial auto insurance if you provide transportation services. Failing to secure appropriate coverage exposes your business to substantial financial risk in the event of accidents, injuries, or lawsuits.

Obtaining Liability and Worker’s Compensation Insurance

General liability insurance protects your business from financial losses due to third-party claims of bodily injury or property damage. Worker’s compensation insurance is mandatory in Texas for employers with employees and covers medical expenses and lost wages for employees injured on the job. The process for obtaining these policies typically involves contacting an insurance broker or agent specializing in home care businesses. They will assess your specific risks and recommend appropriate coverage levels and policy options. You’ll need to provide information about your business operations, number of employees, and the services you provide. The application process includes providing accurate information and potentially undergoing a risk assessment. Premiums are determined based on your risk profile.

Surety Bonds and Their Importance

While not always mandated by state law for all home care agencies, surety bonds can be crucial for securing contracts, demonstrating financial responsibility, and building trust with clients and referral sources. A surety bond protects clients against potential financial losses caused by the negligence or dishonesty of your business. Obtaining a surety bond involves applying through a surety bond company. They will assess your creditworthiness and the risk associated with your business. The cost of the bond is typically a percentage of the bond amount, and it is renewable annually. Having a surety bond can significantly enhance your credibility and attract more clients.

Examples of Suitable Insurance Policies

Several insurance providers offer policies tailored for home care agencies. These policies often include comprehensive general liability coverage, worker’s compensation, and potentially professional liability (errors and omissions) insurance, which protects against claims of negligence or mistakes in providing care. It’s essential to compare quotes from multiple insurers to find the best coverage at a competitive price. Consider policies that offer flexible payment options and strong customer service. Remember that the specific policy details and coverage amounts should be tailored to your business’s individual needs and risk profile. Consult with an experienced insurance broker to ensure you have adequate protection.

Marketing and Client Acquisition

Securing clients is crucial for the success of any home care business. A well-defined marketing strategy is essential to reach potential clients and build a thriving business in the competitive Texas market. This involves a multi-faceted approach encompassing online visibility, community engagement, and strategic networking.

Developing a comprehensive marketing strategy requires understanding your target audience (elderly individuals, families with aging parents, etc.) and tailoring your messaging to their specific needs and concerns. Consider factors like geographical location, demographics, and the types of care services offered when defining your ideal client profile. This understanding will inform all subsequent marketing efforts.

Marketing Strategy for the Texas Home Care Market

A successful marketing strategy in Texas should leverage both online and offline channels. Focusing solely on one area will likely limit your reach and potential client base. A balanced approach is key. For example, a strong online presence can generate leads across the state, while local networking builds trust and credibility within specific communities. Furthermore, understanding the nuances of the Texas market, such as the prevalence of specific demographics or healthcare needs in certain regions, will allow for more targeted and effective campaigns. For instance, focusing marketing efforts in areas with a large senior population might yield better results than targeting areas with fewer elderly residents.

Building a Strong Online Presence and Generating Leads

Establishing a professional website is paramount. The website should clearly Artikel your services, qualifications, and licensing information. Consider incorporating client testimonials to build trust and credibility. Search engine optimization () is crucial to ensure your website ranks highly in search results when potential clients search for “home care in [city/county] Texas.” This involves optimizing website content with relevant s and building high-quality backlinks from reputable sources. Additionally, active social media engagement on platforms like Facebook and Nextdoor can foster connections with potential clients and the community. Paid advertising campaigns on Google Ads and social media can further amplify your reach and drive targeted traffic to your website. Finally, online directories specifically for home care providers can increase your visibility and accessibility to potential clients.

Networking and Community Engagement Approaches

Networking is vital for building relationships and referrals. Attend local health fairs, senior center events, and community gatherings to connect with potential clients and referral sources such as hospitals, doctors’ offices, and assisted living facilities. Building relationships with these organizations can create a steady stream of referrals. Participating in local business organizations and chambers of commerce can also expand your network and increase brand visibility. Consider sponsoring local events or charities to enhance community engagement and build goodwill. Direct mail marketing to specific demographics within your service area can also be an effective method, particularly in areas with limited internet access.

Marketing Channels: Costs and Benefits

Before implementing any marketing strategy, it’s important to assess the potential costs and benefits of each channel. The following list Artikels several options:

- Website Development: Cost: Varies greatly depending on complexity. Benefits: Increased visibility, 24/7 availability, professional image.

- : Cost: Ongoing monthly fees. Benefits: Organic, long-term lead generation.

- Social Media Marketing: Cost: Varies depending on platform and ad spend. Benefits: Targeted reach, direct engagement with potential clients.

- Paid Advertising (Google Ads, Social Media Ads): Cost: Pay-per-click model. Benefits: Rapid lead generation, highly targeted campaigns.

- Networking Events: Cost: Varies depending on event type and attendance. Benefits: Relationship building, direct client interaction.

- Print Advertising (Local Newspapers, Flyers): Cost: Varies depending on publication and circulation. Benefits: Local reach, tangible marketing material.

- Referral Programs: Cost: Incentives for referrals. Benefits: Cost-effective, high-quality leads from trusted sources.

- Online Directories: Cost: Varies depending on platform and listing features. Benefits: Increased online visibility and accessibility.

The optimal marketing mix will depend on your budget, target audience, and business goals. A balanced approach combining online and offline strategies is generally recommended for optimal results. Regularly analyzing the performance of different channels will allow you to optimize your marketing spend and maximize your return on investment.

Hiring and Training Staff

Building a successful home care agency in Texas hinges on recruiting, training, and retaining high-quality caregivers. A robust hiring process ensures you employ compassionate and competent individuals, while a comprehensive training program equips them with the skills and knowledge necessary to provide exceptional care. This section details the essential steps involved in building your caregiving team.

Recruiting and Hiring Caregivers

The process of recruiting caregivers begins with defining your ideal candidate profile. This includes specifying required certifications, experience levels, and personality traits. Effective recruitment strategies involve utilizing online job boards, networking within the healthcare community, and partnering with local colleges and vocational schools offering relevant programs. Once applications are received, a thorough screening process is crucial, involving reviewing resumes and conducting initial phone interviews to filter candidates. Successful candidates then proceed to in-person interviews, where their experience, skills, and suitability for the agency’s culture are assessed. Reference checks and background checks are mandatory before extending job offers.

Background Checks and Training Requirements

Texas law mandates specific background checks for home care workers. These typically include criminal background checks, fingerprinting, and potentially abuse registries checks. The exact requirements may vary depending on the specific services offered and the client’s needs. Beyond background checks, providing comprehensive training is crucial. This training must cover topics such as client interaction techniques, personal care assistance, medication management (if applicable), safety procedures (including fall prevention and infection control), emergency response protocols, and understanding of relevant state regulations. Texas does not have a state-mandated training program for home care aides, but agencies should establish their own rigorous training programs that meet or exceed industry best practices. Consider using a combination of classroom instruction, hands-on training, and online modules to ensure comprehensive learning. Regular continuing education opportunities further enhance caregiver skills and knowledge.

Sample Employee Handbook

An employee handbook serves as a valuable resource for both new and existing employees. It Artikels company policies and procedures, ensuring consistency and clarity. A comprehensive handbook would include sections on:

- Company Mission, Vision, and Values

- Employee Classification and Compensation

- Work Hours, Scheduling, and Time Off

- Attendance and Punctuality Policies

- Dress Code and Professional Conduct

- Client Confidentiality and HIPAA Compliance

- Safety Procedures and Emergency Protocols

- Disciplinary Actions and Termination Procedures

- Grievance Procedures

- Equal Opportunity Employer Statement

The handbook should be reviewed and updated regularly to reflect changes in company policy or relevant legislation.

Caregiver Training Program

A well-structured training program is essential for ensuring caregiver competency and client safety. The program should incorporate both theoretical knowledge and practical skills training. Key components include:

- Client Interaction: Training on effective communication techniques, empathy, active listening, and respectful interaction with clients and their families.

- Personal Care Assistance: Practical training on tasks such as bathing, dressing, grooming, toileting, and mobility assistance, emphasizing safety and client dignity.

- Medication Management (if applicable): Detailed training on safe medication administration practices, including proper identification, dosage, and recording procedures, only if the agency is providing this service and caregivers are appropriately certified.

- Safety Procedures: Comprehensive training on fall prevention techniques, infection control protocols, emergency response procedures, and the proper use of assistive devices.

- Emergency Response: Training on recognizing and responding to medical emergencies, including CPR and first aid, as well as procedures for contacting emergency medical services.

- Texas State Regulations: Training on relevant Texas state regulations pertaining to home care services, ensuring compliance with all applicable laws.

The training program should include regular assessments to evaluate caregiver understanding and competency. Ongoing mentorship and supervision are also crucial to ensure the continued development and performance of caregivers.

Financial Planning and Management

Launching a non-medical home care business in Texas requires meticulous financial planning to ensure long-term viability. This involves projecting startup costs, ongoing expenses, and revenue streams to determine profitability and secure necessary funding. Effective cash flow management and competitive pricing strategies are crucial for success.

Financial Projections for the First Year

A comprehensive financial projection for the first year should include both startup costs and ongoing operational expenses. Startup costs might encompass licensing fees, insurance premiums, marketing materials, initial office supplies, and any necessary vehicle purchases or modifications. Ongoing expenses include rent or mortgage payments, staff salaries and benefits, utilities, insurance renewals, marketing and advertising, accounting and legal fees, and supplies. Revenue projections should be based on realistic estimates of client acquisition, service rates, and service volume. For example, a business anticipating serving 10 clients at an average monthly rate of $3,000 would project $360,000 in annual revenue. However, this projection must account for potential variations in client acquisition and seasonal fluctuations in demand. A detailed spreadsheet or financial modeling software can be instrumental in creating these projections. Consider including a contingency plan to address unexpected expenses or revenue shortfalls.

Cash Flow Management Strategies

Maintaining positive cash flow is essential for a home care business. Strategies include meticulous invoicing and timely collection of payments from clients. Establishing clear payment terms and utilizing automated invoicing systems can streamline this process. Careful management of expenses is also vital. Negotiating favorable terms with suppliers, monitoring utility usage, and exploring cost-saving measures for insurance and other services can contribute to improved cash flow. Securing a line of credit or small business loan can provide a safety net for unexpected expenses or periods of low revenue. Regularly reviewing cash flow statements and projecting future cash needs allows for proactive adjustments to spending and revenue generation strategies. For instance, delaying non-essential purchases or accelerating marketing efforts during slow periods can help maintain a healthy cash flow.

Pricing Services Competitively

Pricing services competitively requires a careful balance between profitability and attracting clients. Research competitor pricing in your area to understand the market rate for similar services. Factor in your operational costs, desired profit margin, and the value your services offer. Consider offering tiered pricing packages to cater to different client needs and budgets. For instance, you could offer basic care packages at a lower price point and premium packages with additional services at a higher price. Transparency in pricing and clearly outlining all included services helps build trust with clients. Regularly review and adjust your pricing structure to account for changes in operational costs and market conditions. A detailed cost analysis, including labor, supplies, and overhead, is crucial for determining a profitable pricing strategy.

Developing a Comprehensive Budget

A comprehensive budget provides a roadmap for financial management. It should detail both projected income and expenses, broken down into categories such as labor, supplies, rent, marketing, and administrative costs. This budget should be developed monthly, quarterly, and annually, allowing for regular monitoring and adjustments. The budget should also incorporate contingency funds to address unexpected expenses or revenue shortfalls. Regularly comparing actual results to the budgeted amounts helps identify areas needing improvement. For example, if marketing expenses exceed the budget, it may indicate a need to refine marketing strategies. Similarly, if labor costs are higher than anticipated, it might necessitate a review of staffing levels or employee compensation. Using budgeting software or spreadsheets can simplify the process and facilitate accurate tracking and analysis.

Operations and Service Delivery

The smooth operation of a non-medical home care business hinges on efficient scheduling, clear communication, meticulous record-keeping, and robust safety protocols. Effective management in these areas ensures client satisfaction, regulatory compliance, and the long-term success of the business. This section details the key operational aspects necessary for providing high-quality home care services in Texas.

Daily Operations and Scheduling

Efficient scheduling is crucial for optimizing caregiver utilization and meeting client needs. A well-designed scheduling system should consider caregiver availability, client preferences, service requirements (duration and frequency), and travel times between client locations. Software solutions designed for home care agencies can greatly assist in this process, allowing for real-time updates, automated reminders, and optimized route planning. Manually managing schedules, especially with a growing client base, can quickly become unwieldy and lead to scheduling conflicts and caregiver burnout. Implementing a robust system from the outset is a proactive measure that contributes to operational efficiency and client satisfaction.

Client Communication and Record-Keeping

Maintaining open and consistent communication with clients and their families is paramount. This includes regular updates on caregiver schedules, service delivery, and any significant changes in the client’s condition. Documentation is equally vital. Detailed records of services provided, client interactions, and any observed changes in the client’s health or well-being must be meticulously maintained. These records serve as a crucial reference for caregivers, family members, and regulatory agencies, ensuring continuity of care and accountability. Using a secure, HIPAA-compliant electronic health record (EHR) system is highly recommended to streamline record-keeping and ensure data privacy.

Client Safety and Well-being Procedures

Prioritizing client safety is non-negotiable. Comprehensive safety protocols should be established and consistently implemented. These should include background checks for all caregivers, ongoing training in safety procedures (e.g., fall prevention, medication administration, emergency response), regular safety inspections of clients’ homes, and a clear procedure for reporting and responding to accidents or incidents. A detailed risk assessment should be conducted for each client to identify potential hazards and develop personalized safety plans. Regular communication with clients and their families regarding safety concerns is also essential.

Client Information Management and Confidentiality

Protecting client privacy and maintaining confidentiality is crucial and legally mandated. All client information, including medical history, personal details, and service records, must be treated with the utmost discretion and stored securely. Access to client information should be strictly limited to authorized personnel, and all staff should receive comprehensive training on HIPAA regulations and data privacy best practices. A secure electronic system for storing and accessing client information is essential, and physical records should be kept in locked cabinets. Regular audits should be conducted to ensure compliance with privacy regulations.

Emergency Response Procedures

A well-defined emergency response plan is vital for handling unexpected situations. The plan should include:

- Immediate Action: Assess the situation, provide immediate first aid if necessary, and contact emergency services (911) if required.

- Notification: Notify the client’s family, physician, and other relevant parties immediately.

- Documentation: Meticulously document the incident, including the time, date, location, events leading up to the emergency, actions taken, and the outcome. This documentation is crucial for legal and insurance purposes.

- Follow-up: After the emergency, conduct a thorough review of the incident to identify any areas for improvement in the emergency response plan or safety protocols.

- Reporting: Report the incident to relevant regulatory bodies as required by Texas law.

Regular training drills and simulations should be conducted to ensure staff are prepared to handle emergencies effectively. The plan should be readily accessible to all staff and reviewed regularly.

Compliance and Regulatory Updates

Navigating the regulatory landscape for non-medical home care in Texas requires consistent vigilance. Failure to maintain compliance can result in significant penalties, including fines, license revocation, and legal action. Understanding the key regulatory bodies and their evolving requirements is crucial for the long-term success and sustainability of your business.

The Texas Department of Aging and Disability Services (DADS) plays a central role in overseeing the non-medical home care industry. However, other agencies, such as the Texas Workforce Commission (TWC) for employment regulations and the Texas Department of Insurance (TDI) for insurance compliance, also have relevant jurisdiction. Staying abreast of changes in their rules and guidelines is paramount.

Key Regulatory Bodies and Their Requirements

The Texas Department of Aging and Disability Services (DADS) is the primary regulatory body for non-medical home care in Texas. They establish licensing requirements, define standards of care, and conduct inspections. Understanding and adhering to their regulations regarding background checks for employees, client record-keeping, service delivery protocols, and reporting requirements is essential. The Texas Workforce Commission (TWC) dictates employment regulations, including minimum wage, overtime pay, and worker’s compensation insurance. Compliance with these laws is vital to avoid legal repercussions. The Texas Department of Insurance (TDI) regulates insurance requirements, ensuring appropriate coverage for liability and workers’ compensation. Maintaining adequate insurance is critical to protect both the business and its employees.

Importance of Staying Updated on Regulatory Changes, How to start a nonmedical home care business in texas

Regulatory changes are frequent in the healthcare sector. Failure to adapt to these changes promptly can lead to non-compliance, resulting in penalties, legal disputes, and reputational damage. For instance, a change in background check requirements could render your existing processes invalid, leading to fines and operational disruptions. Similarly, updates to service delivery protocols could impact your ability to provide care and maintain client satisfaction. Staying informed ensures that your business operates legally and efficiently.

Strategies for Ensuring Ongoing Compliance

Implementing a robust compliance program is crucial. This involves designating a compliance officer, establishing clear internal policies and procedures aligned with all relevant regulations, and conducting regular staff training. Regular internal audits should be conducted to identify any gaps in compliance. Furthermore, subscribing to industry newsletters, attending relevant conferences, and consulting with legal professionals specializing in healthcare regulations can ensure you stay informed about upcoming changes. Proactive engagement with regulatory bodies, such as attending workshops and proactively seeking clarification on ambiguous regulations, can minimize risks.

System for Tracking Regulatory Changes and Ensuring Adherence

A dedicated system for tracking regulatory updates is necessary. This could involve creating a centralized database or using a subscription service that provides alerts on regulatory changes. The system should clearly Artikel the specific regulations relevant to your business, track deadlines for compliance, and document all actions taken to ensure adherence. Regular reviews of the system and updates to internal policies and procedures based on the tracked changes are crucial to maintaining ongoing compliance. This system should include a mechanism for recording training sessions and assigning compliance responsibilities to specific personnel. Finally, a process for documenting all compliance-related activities and maintaining a detailed audit trail is vital for demonstrating compliance to regulatory bodies.

Building a Strong Brand and Reputation

In the competitive Texas home care market, a strong brand and stellar reputation are paramount for attracting clients and ensuring long-term success. Building trust and establishing credibility are crucial for attracting both clients and referral sources, ultimately leading to sustained growth and profitability. This involves a multifaceted approach encompassing brand identity, client relations, online reputation management, and exceptional customer service.

Creating a distinct brand identity involves more than just a logo. It’s about crafting a comprehensive image that resonates with your target audience – potential clients and their families. This includes defining your brand’s values, mission, and unique selling propositions (USPs). What sets your agency apart from competitors? Is it specialized care for a specific condition, a commitment to personalized service, or a unique approach to staff training?

Brand Identity Development

Developing a strong brand identity involves a cohesive strategy across various touchpoints. This includes designing a professional logo and color scheme that reflects your brand values. Consistent use of your logo and brand colors across all marketing materials, website, and even staff uniforms builds brand recognition. Consider developing a brand voice – the tone and style of your communication – that is consistent across all platforms, whether it’s friendly and approachable or formal and professional. This consistent brand messaging strengthens your identity and builds trust with your target audience. For instance, a home care agency specializing in Alzheimer’s care might adopt a calm and reassuring brand voice, while an agency focused on active aging might use a more energetic and vibrant tone.

Client and Referral Source Relationship Management

Nurturing positive relationships with clients and referral sources is critical for long-term success. Proactive communication, personalized attention, and consistent follow-up are essential. Regularly check in with clients to assess their satisfaction and address any concerns promptly. For referral sources, such as hospitals, doctors’ offices, and social workers, build relationships by providing regular updates on clients and offering educational materials. Hosting events or workshops for referral sources can further strengthen these relationships. Consider creating a referral program that incentivizes referrals. For example, offering a small bonus for each successful referral can significantly boost your client base.

Online Reputation Management

In today’s digital age, online reviews significantly influence potential clients’ decisions. Actively monitor your online presence across various platforms, including Google My Business, Yelp, and other review sites. Respond to both positive and negative reviews professionally and promptly. Addressing negative reviews constructively shows potential clients that you value feedback and are committed to resolving issues. Encourage satisfied clients to leave positive reviews by providing excellent service and making it easy for them to share their experiences online. Tools and services specializing in reputation management can automate some of this process and offer insights into your online reviews.

Customer Service Excellence

Excellent customer service is the cornerstone of a successful home care business. It encompasses all aspects of the client experience, from the initial consultation to ongoing care. Empathetic communication, personalized care plans, and responsive staff are crucial. Invest in training your staff on customer service best practices, including active listening, conflict resolution, and effective communication. Regularly solicit client feedback to identify areas for improvement. Implement systems to track and address client concerns promptly. A commitment to providing exceptional customer service fosters loyalty and positive word-of-mouth referrals, which are invaluable in building a strong reputation.