How to switch PayPal from business to personal? It’s a question many entrepreneurs and small business owners grapple with. This seemingly simple process involves more than just a few clicks; it requires understanding the implications for your finances, taxes, and future business operations. Switching from a business account to a personal account fundamentally alters how you manage your money and interact with PayPal’s services, impacting transaction limits, fees, and available features. This guide will walk you through the entire process, from eligibility requirements to post-switch considerations, ensuring a smooth transition.

We’ll delve into the key differences between PayPal business and personal accounts, outlining the limitations of each and providing a clear comparison. We’ll then detail the step-by-step procedure for switching, offering a checklist to ensure you’ve covered all bases. We’ll also address potential issues, provide troubleshooting solutions, and discuss the crucial legal and tax implications involved. Finally, we’ll offer advice on security best practices to protect your financial information post-switch.

Understanding PayPal Account Types

Choosing between a PayPal Business and Personal account is a crucial step for anyone using the platform. The right account type significantly impacts your ability to manage finances, accept payments, and access specific features. Understanding the core differences between these accounts is essential for optimizing your PayPal experience. This section will detail the key distinctions to help you make an informed decision.

PayPal Business and Personal Account Differences

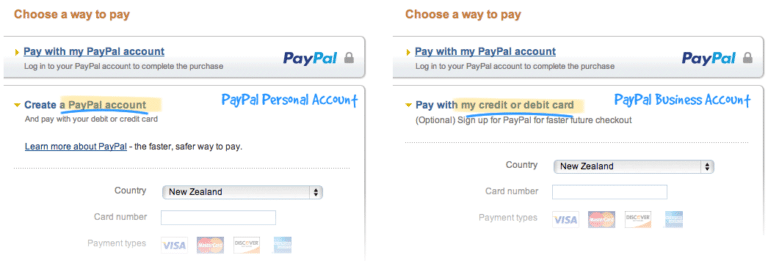

PayPal Business and Personal accounts cater to different user needs. A Personal account is designed for individuals making and receiving payments for personal transactions, while a Business account offers a wider range of features geared towards managing business finances. These differences extend to transaction limits, fees, and available tools.

Limitations of Each Account Type

Personal accounts typically have lower transaction limits compared to Business accounts. They also lack features crucial for businesses, such as invoicing tools, mass payments, and advanced reporting capabilities. Business accounts, while offering more comprehensive features, often come with higher fees depending on the transaction volume and specific services used.

Comparison of PayPal Account Types

The following table provides a concise comparison of PayPal Business and Personal accounts, highlighting key differences in transaction limits, fees, and available features. Note that specific fees and limits can vary based on location and account activity.

| Account Type | Transaction Limits | Fees | Features |

|---|---|---|---|

| Personal | Generally lower limits on sending and receiving money. Specific limits vary by country and account history. May encounter restrictions on large or frequent transactions. | Lower fees for basic transactions. Fees may apply for international transfers or currency conversions. | Basic sending and receiving of money. Limited reporting tools. No invoicing or mass payment options. |

| Business | Higher transaction limits, allowing for larger volumes of payments. Limits are often adjusted based on account history and verification. | Higher fees for certain transactions and services. Fees may vary based on transaction type, volume, and processing method. Subscription fees for additional features may apply. | Invoicing, mass payments, advanced reporting, integration with other business tools, buyer protection, and seller protection programs. |

Eligibility for Switching

Switching your PayPal account from a business to a personal account isn’t always straightforward. It hinges on several factors, and understanding these is crucial to avoid potential complications down the line. PayPal’s terms of service govern this process, and failing to meet the requirements can result in account limitations or even closure.

Eligibility primarily depends on your current business activity and future intentions. PayPal assesses whether your business operations have ceased completely and whether you’ll need any business-related features in the future. Simply deciding you no longer want a business account isn’t sufficient; you must meet specific criteria. For example, if you still have outstanding transactions, outstanding balances, or unresolved disputes associated with your business account, PayPal will likely not allow the switch until these are resolved.

Requirements for Switching Account Types

To successfully switch from a business to a personal account, you’ll generally need to meet several conditions. These often include having no outstanding payments, no active business-related activities, and a clean transaction history free of significant issues or violations of PayPal’s user agreement. The exact requirements might vary slightly depending on your region and specific account history. Contacting PayPal support directly is recommended to ascertain the precise steps and prerequisites for your situation. This ensures compliance and avoids any unexpected account limitations or closures. Ignoring these requirements could result in your account remaining a business account despite your request for a change.

Situations Where Switching is Beneficial or Detrimental

Switching to a personal account can be advantageous if your business operations have permanently ceased, and you no longer require the features offered by a business account, such as invoicing or mass payments. This simplifies your financial management and removes the complexities associated with maintaining a business account. However, switching could be detrimental if you anticipate resuming business activities in the future, as you’ll need to re-apply for a business account, which may involve additional verification steps and time. This also applies if you regularly receive business payments or use business-specific PayPal features.

For instance, a freelancer who has completed all their contracts and doesn’t plan on freelancing again might find switching to a personal account beneficial. Conversely, a small business owner who is simply taking a temporary break from active sales might find it more efficient to maintain their business account to avoid the hassle of re-registration later. The decision should be based on a careful assessment of your current and future financial needs.

Impact on Existing Business Transactions and Customer Relationships

Switching from a business to a personal account can affect your existing business transactions and customer relationships. While PayPal may allow the switch, it’s crucial to understand the potential implications. For example, your business email address associated with your PayPal business account may no longer be functional after the switch. This could disrupt communication with clients expecting invoices or updates via that email. Furthermore, your customer base might perceive a change in professionalism or legitimacy if the associated email address or account type changes. Transparency with your customers about the account change is advisable to maintain trust and avoid confusion. This might involve informing them of the new payment details associated with your personal account.

The Switching Process

Switching your PayPal account from a Business account to a Personal account involves a straightforward process, but it’s crucial to understand the implications before proceeding. This transition affects how you receive payments, manage taxes, and access certain features. Carefully review the steps Artikeld below to ensure a smooth transition.

The process of changing your PayPal account type from Business to Personal primarily involves requesting the change through your PayPal account settings. PayPal generally reviews the request and, provided you meet the eligibility criteria, will make the switch. Remember that certain information, like your tax details, might be removed or altered during the conversion. It is advisable to back up any relevant data before starting the process.

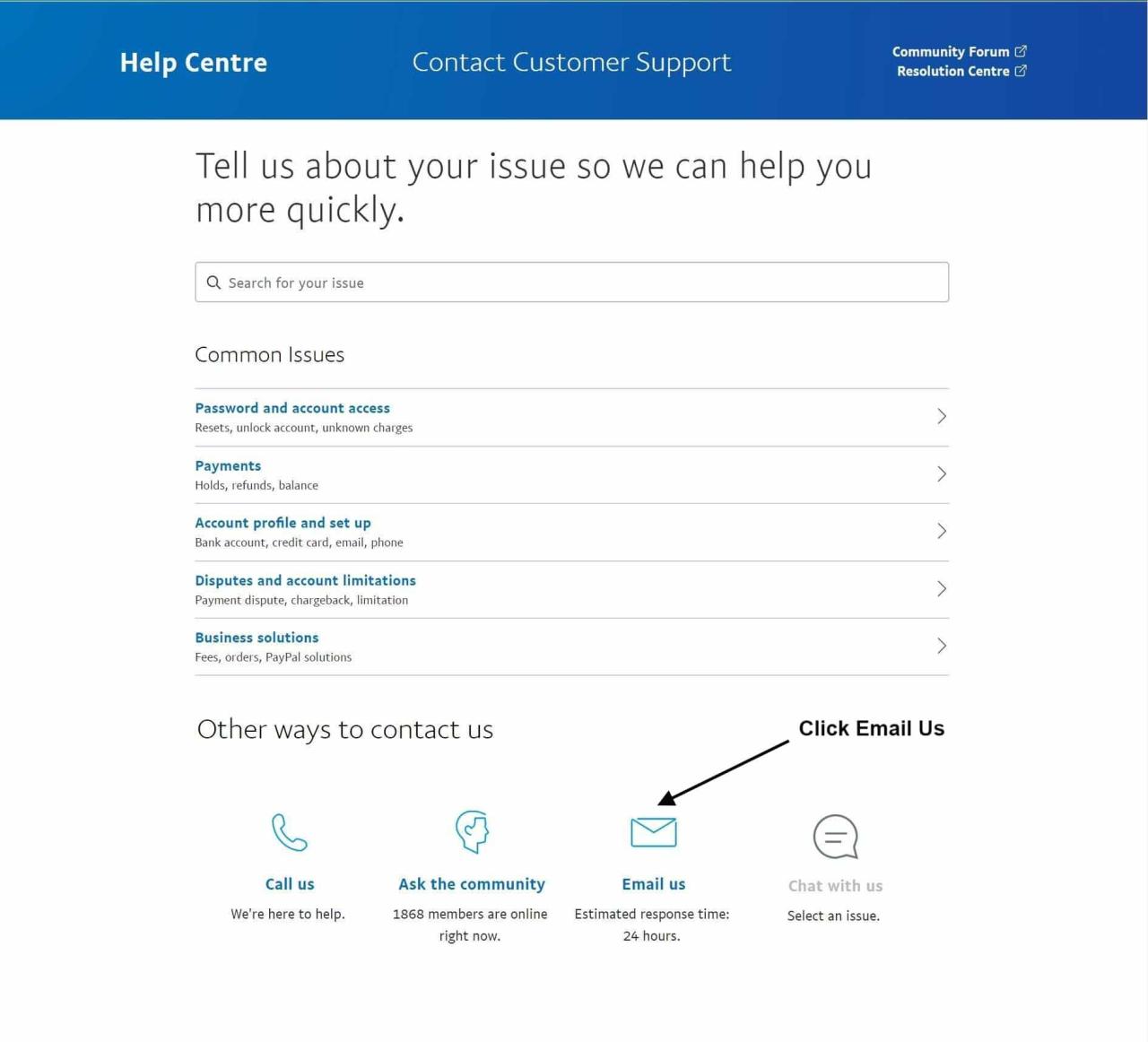

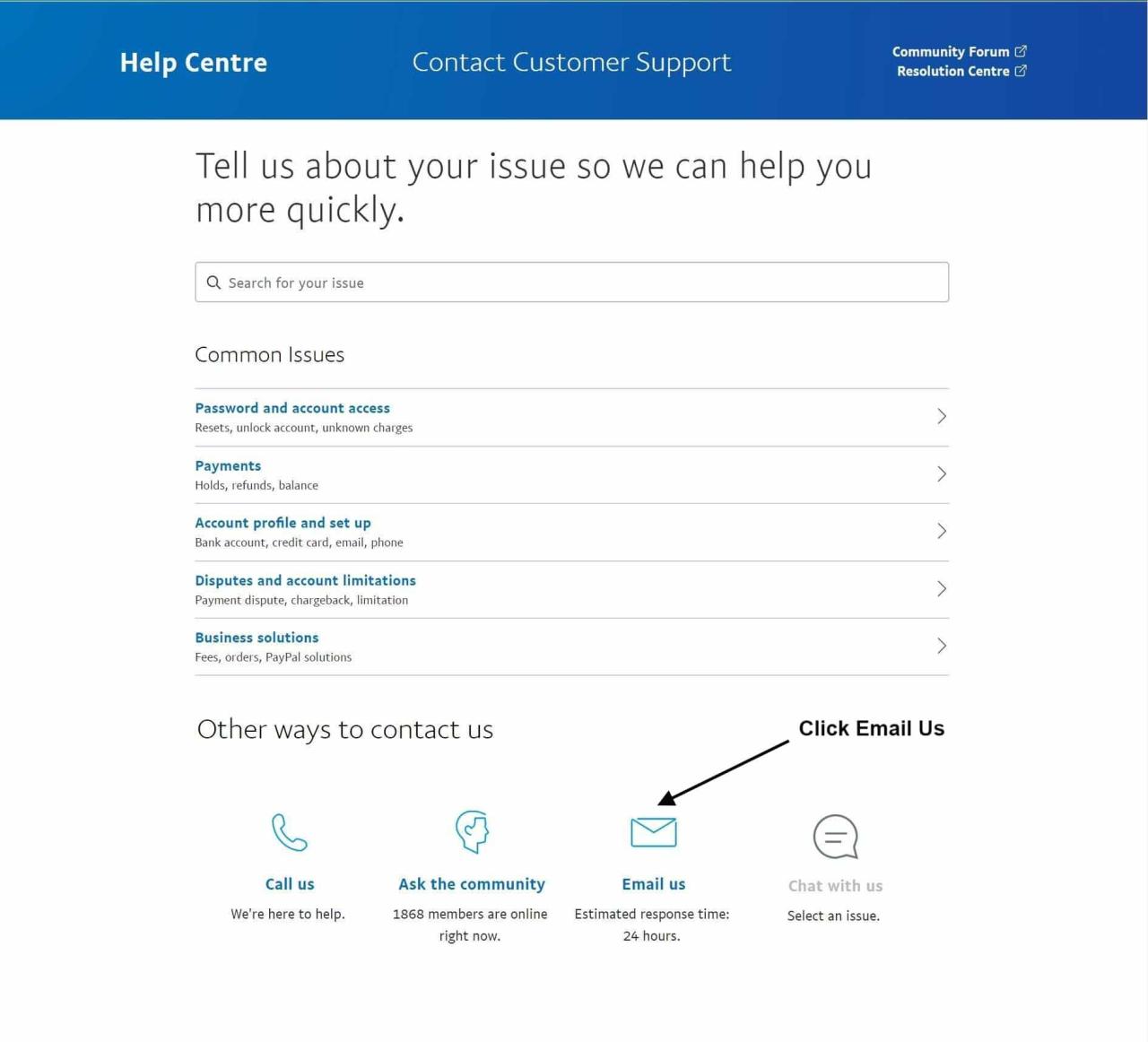

Steps to Switch from a Business to Personal Account

The following steps detail the process of switching your PayPal account type. It’s important to complete each step accurately to avoid delays or complications.

- Log in to your PayPal Business Account: Access your PayPal account using your registered email address and password. Ensure you are logged into the Business account you wish to convert.

- Navigate to Account Settings: Locate the “Settings” section within your PayPal account. This is usually accessible through a gear icon or a link in the account overview.

- Locate Account Type Options: Within the Settings, find the section related to your account type. The exact wording may vary, but it will typically involve options for managing or changing your account type.

- Request the Change to Personal: Initiate the request to change your account type from Business to Personal. You’ll likely need to confirm this action through a secondary verification method, such as a code sent to your registered email or phone number.

- Review and Confirm: PayPal will usually present a summary of the changes involved in switching to a Personal account. Carefully review this information, ensuring you understand the implications before proceeding. Confirm the change once you are satisfied.

- Wait for PayPal’s Confirmation: PayPal will process your request. The timeframe for completion can vary but usually takes a few business days. You’ll receive a notification once the conversion is complete.

- Review Your Updated Account: After receiving confirmation, log back into your account to verify that the switch has been successfully completed and that your account reflects the Personal account type.

Checklist Before Switching

Before initiating the switch, it’s highly recommended to complete the following checklist. This will help ensure a smoother transition and prevent potential issues.

- Backup Important Data: Save any crucial transaction records, business information, and settings. This precaution is vital in case any data is lost or altered during the conversion.

- Settle Outstanding Transactions: Complete all pending payments and transactions to avoid complications during the account type change. This ensures a clean transition.

- Review Your Payment Methods: Confirm that your preferred payment methods are still linked and functioning correctly after the switch. Update or remove any that are no longer needed.

- Understand Tax Implications: Be aware of the tax implications associated with switching from a Business to a Personal account. Consult with a tax professional if needed to understand the impact on your tax filings.

- Contact PayPal Support if Needed: If you encounter any difficulties or have questions during the process, contact PayPal’s customer support for assistance.

Managing Funds and Transactions During the Switch

Converting your PayPal business account to a personal account requires careful consideration of your existing financial activity. Understanding how to manage outstanding payments and pending transactions is crucial to avoid disruptions and potential complications. Proper planning ensures a smooth transition and minimizes any negative impact on your financial operations.

The process of switching account types necessitates managing outstanding payments, pending transactions, and recurring subscriptions. Failure to address these aspects could result in payment delays, account limitations, or even temporary service suspensions. It’s essential to review all pending transactions and ensure they are processed before initiating the switch. Outstanding payments should be collected, and any expected incoming payments should be carefully monitored. Recurring payments, such as subscriptions, require specific attention, as they may be affected by the account type change.

Outstanding Payments and Pending Transactions

Before initiating the conversion, meticulously review all outstanding payments and pending transactions associated with your business account. This includes invoices awaiting payment, payments sent but not yet received by recipients, and any pending refunds. It’s advisable to resolve all outstanding issues to prevent complications during the switch. For example, if you have an outstanding invoice, ensure you collect the payment before converting your account. Similarly, if you’ve sent a payment that’s still pending, monitor its status and ensure its successful completion. Addressing these issues proactively minimizes the risk of discrepancies or delays after the conversion.

Implications for Existing Subscriptions and Recurring Payments

Recurring payments and subscriptions linked to your business account will be affected by the conversion to a personal account. PayPal’s terms of service may require adjustments or even cancellation of these subscriptions. Contacting the service providers for these subscriptions is crucial to understand their policies regarding account type changes. For example, if you have a monthly subscription for a business software, you’ll need to update the payment information with the new personal account details or potentially resubscribe under the personal account. Failure to do so could result in service interruptions.

Transferring Funds Between Accounts (If Necessary)

In certain situations, transferring funds between your existing business account and a newly created personal account might be necessary. This could involve moving funds from your business account’s balance to your personal account before initiating the conversion, or vice versa, depending on your specific circumstances. This process typically involves initiating a transfer within the PayPal interface, and the transfer time will depend on PayPal’s policies and the chosen transfer method.

The following flowchart illustrates a simplified process:

Flowchart: Transferring Funds Between PayPal Accounts

[Imagine a flowchart here. The flowchart would begin with a “Start” box. The next box would be a decision box: “Do you need to transfer funds?”. If “Yes,” the flow would proceed to a box indicating “Log in to your PayPal Business Account.” Then, there would be a box for “Initiate a funds transfer to your Personal Account,” followed by a box for “Confirm the transfer.” A final box would indicate “Transfer Complete.” If the answer to the decision box is “No,” the flow would directly proceed to a box indicating “Proceed with Account Conversion.”]

Potential Issues and Troubleshooting

Switching your PayPal account from business to personal can sometimes present unforeseen challenges. Understanding potential problems and their solutions can help ensure a smooth transition. This section Artikels common issues encountered during the conversion process and provides practical solutions to resolve them.

While PayPal generally aims for a straightforward conversion, delays or errors can occur. These are often linked to outstanding transactions, account balances, or inconsistencies in the information provided. Proactive preparation and careful attention to detail can significantly minimize the risk of encountering these problems.

Account Balance Discrepancies

Discrepancies between your reported balance and PayPal’s records can impede the conversion process. This often stems from pending transactions, disputes, or unreconciled payments. PayPal may temporarily halt the conversion until these discrepancies are resolved.

Incomplete or Inconsistent Information

Providing inaccurate or incomplete information during the conversion process can lead to delays or rejection of the switch. Ensuring all required fields are accurately completed with up-to-date information is crucial for a successful conversion.

Pending Transactions and Disputes

Active transactions, particularly those involving refunds or disputes, can prevent a successful conversion. PayPal requires all transactions to be finalized before the account type can be changed. Resolving any outstanding issues before initiating the switch is essential.

| Problem | Solution |

|---|---|

| Account balance discrepancies | Reconcile your records with PayPal’s statement. Resolve any pending transactions or disputes. Contact PayPal support if discrepancies persist. |

| Incomplete or inconsistent information | Carefully review all information provided during the conversion process. Ensure accuracy and completeness of all details, including address, contact information, and tax information (if applicable). |

| Pending transactions and disputes | Complete all pending transactions. Resolve any outstanding disputes before initiating the account type change. Contact buyers or sellers to resolve issues promptly. |

| Conversion request denied | Review the reason for denial provided by PayPal. Address the identified issue(s) and resubmit the request. Contact PayPal support for clarification if needed. |

| Unexpected delays in processing | Allow sufficient processing time. Check your email for updates from PayPal. Contact PayPal support if the delay is excessive or unexplained. |

Post-Switch Considerations

Converting your PayPal account from business to personal significantly alters its functionality. Understanding the limitations imposed and exploring alternative solutions is crucial for maintaining smooth financial operations, especially if you continue to conduct business activities. This section details the implications of this switch and provides guidance on managing your finances effectively.

Switching to a personal account inherently restricts several features beneficial for business operations. You lose access to features designed for invoicing, expense tracking, and managing multiple payments from different clients. Furthermore, PayPal’s seller protection, which safeguards business accounts against fraudulent transactions and chargebacks, is no longer available. The ability to accept payments from international clients may also be limited, depending on your account settings and PayPal’s policies.

Limitations of Personal Accounts for Business Activities

A personal PayPal account is primarily intended for personal transactions, such as sending and receiving money from friends or family. Using it for business purposes can expose you to risks. PayPal’s terms of service may prohibit significant business activity on a personal account, potentially leading to account suspension or limitations. For instance, consistently receiving large sums of money from multiple sources, characteristic of business transactions, could trigger account reviews and potential restrictions. Accurate record-keeping for tax purposes also becomes significantly more challenging without the dedicated tools provided by a business account.

Alternative Payment Solutions for Continued Business Operations

If you continue to operate a business after switching to a personal PayPal account, you should consider alternative payment processing solutions. These alternatives offer features better suited for business transactions and provide better protection against risks. Several options exist, each with its own strengths and weaknesses.

- Square: Square offers a range of point-of-sale (POS) systems, both physical and online, making it suitable for various business types. Its user-friendly interface and low transaction fees make it a popular choice for small businesses. Square also provides robust reporting tools for managing finances.

- Stripe: Stripe is a popular choice for online businesses, offering a developer-friendly API and customizable payment solutions. Its focus on online payments makes it ideal for e-commerce businesses and those operating primarily through digital channels. It also provides advanced fraud prevention tools.

- Shopify Payments: Integrated directly into the Shopify e-commerce platform, Shopify Payments streamlines the payment process for online stores. It offers seamless integration with other Shopify features and provides a comprehensive suite of tools for managing online sales.

Accessing Transaction History and Account Statements After Conversion

Even after converting to a personal account, your transaction history remains accessible. You can view your transaction history by logging into your PayPal account and navigating to the “Activity” section. This section displays all past transactions, including payments sent and received, along with dates and amounts. PayPal also provides the option to download your transaction history as a CSV file for easier record-keeping and tax preparation. Account statements summarizing your financial activity over specific periods can usually be accessed and downloaded from the same section, providing a consolidated overview of your transactions.

Legal and Tax Implications

Switching your PayPal account from business to personal carries significant legal and tax implications. Understanding these implications is crucial to avoid potential penalties and ensure compliance with relevant regulations. Failing to properly manage the transition can lead to complications with both your legal standing and your tax obligations. Accurate record-keeping is paramount throughout the entire process.

The primary difference lies in how income and expenses are reported to tax authorities. Business accounts necessitate more detailed record-keeping and potentially more complex tax filings compared to personal accounts. This stems from the different accounting methods and tax regulations applied to business versus personal income. The transition itself may trigger specific reporting requirements, depending on your location and the nature of your business activities.

Tax Reporting Differences

Business PayPal accounts typically require meticulous record-keeping of all income and expenses related to the business. This information is then used to prepare business tax returns, which often involve more complex forms and schedules than personal tax returns. For example, a sole proprietor using a business PayPal account might need to file Schedule C (Profit or Loss from Business) with their personal income tax return, detailing all business income and expenses. In contrast, personal PayPal accounts generally only report income earned from sales or services as miscellaneous income on the individual’s personal tax return. The complexity increases further with different business structures (e.g., LLC, S-corp, C-corp), each requiring specific tax forms and reporting procedures. Ignoring these differences can lead to underreporting of income or improper deduction of expenses, resulting in penalties and interest from tax authorities.

Maintaining Accurate Financial Records

Regardless of whether you have a business or personal PayPal account, maintaining accurate and detailed financial records is essential. This includes keeping records of all transactions, including dates, amounts, descriptions, and any relevant supporting documentation (e.g., invoices, receipts). For business accounts, this is legally mandated for tax purposes and helps in managing the business effectively. For personal accounts, while the legal requirements are less stringent, thorough record-keeping helps prevent disputes and ensures accurate reporting of income to tax authorities. Digital tools like spreadsheet software or accounting apps can streamline the process of tracking transactions and generating reports. Regularly reconciling your PayPal account with your bank statements is another crucial step in maintaining accuracy.

Potential Legal Ramifications

Switching from a business to a personal PayPal account might trigger legal implications, especially if you haven’t correctly handled the dissolution of your business or if you continue to conduct business activities through your personal account. This could lead to legal challenges related to contract enforcement, liability issues, or compliance with regulations. For example, if you fail to properly dissolve your business and continue operating under the previous business name after switching to a personal account, you might face legal action from creditors or other parties involved in your business operations. Similarly, conducting business activities through a personal account may expose you to personal liability for business debts or legal issues. Consult with legal counsel to ensure a smooth and legally sound transition.

Security Considerations After the Switch: How To Switch Paypal From Business To Personal

Switching your PayPal account from business to personal necessitates a reassessment of your security practices. A personal account, while offering simplicity, may present different vulnerabilities compared to a business account with its potentially more robust security features. Therefore, proactively strengthening your security posture is crucial to protect your personal financial information.

Protecting your financial information requires a multi-layered approach encompassing password management, account monitoring, and awareness of potential phishing attempts. Neglecting these measures can expose your account to unauthorized access and potentially lead to financial loss. The following sections detail specific steps you can take to enhance your security.

Strong Password Practices

Implementing strong and unique passwords is paramount. Avoid using easily guessable passwords like birthdays or common words. Instead, utilize a password manager to generate complex, random passwords for your PayPal account and other online services. A strong password should ideally include a mix of uppercase and lowercase letters, numbers, and symbols, and be at least 12 characters long. Password managers not only generate strong passwords but also securely store them, eliminating the need to remember numerous complex combinations. For example, LastPass, 1Password, and Bitwarden are popular and reputable password management tools. Regularly updating your passwords, even those generated by a password manager, is also a good security practice.

Account Monitoring and Alerts

Regularly monitoring your PayPal account for suspicious activity is vital. Enable email and/or mobile notifications for all account activity, including login attempts, transactions, and address changes. This allows you to promptly identify and address any unauthorized access. Review your account statements frequently, comparing them to your own records to detect discrepancies. If you notice any unfamiliar transactions or login attempts from unrecognized locations, immediately contact PayPal’s customer support to report the issue and secure your account. Prompt action is key to minimizing potential losses.

Phishing and Scam Awareness

Be vigilant against phishing scams. Phishing attempts often involve fraudulent emails or text messages appearing to be from legitimate sources, such as PayPal. These messages typically try to trick you into revealing your login credentials or other sensitive information. Never click on links or open attachments from suspicious emails. Always access your PayPal account directly through the official website, and verify the website’s security certificate (look for the padlock icon in the address bar). If you are unsure about the authenticity of a communication claiming to be from PayPal, contact PayPal directly through their official website or phone number to verify. Remember, PayPal will never ask for your password or other sensitive information via email or text message.

Two-Factor Authentication (2FA), How to switch paypal from business to personal

Enable two-factor authentication (2FA) for an added layer of security. 2FA requires a second verification method, such as a code sent to your phone or email, in addition to your password. This makes it significantly more difficult for unauthorized individuals to access your account, even if they obtain your password. Most reputable online services, including PayPal, offer 2FA as a security feature; its activation is highly recommended. The added security provided by 2FA significantly reduces the risk of account compromise.