How to track mileage for business is a crucial skill for self-employed individuals and business owners. Accurately tracking your mileage allows you to claim legitimate tax deductions, improving your bottom line. This guide delves into various methods, from manual logbooks to sophisticated mileage tracking apps, helping you choose the best approach for your needs. We’ll explore the nuances of differentiating business from personal mileage, navigating IRS guidelines, and understanding reimbursement policies. By the end, you’ll be confident in accurately tracking your business mileage and maximizing your tax benefits.

We’ll cover essential aspects like creating effective mileage logs, utilizing mileage tracking software, and understanding the legal and tax implications of inaccurate record-keeping. We’ll also explore different mileage reimbursement policies and how to calculate reimbursements based on the IRS standard mileage rate. Finally, we’ll examine the role of GPS tracking devices and compare different available technologies to help you optimize your mileage tracking process.

Methods for Tracking Mileage: How To Track Mileage For Business

Accurately tracking business mileage is crucial for maximizing tax deductions and maintaining clear financial records. There are two primary methods: manual tracking using a mileage log, and automated tracking via dedicated apps. Choosing the right method depends on individual preferences, technological comfort, and the volume of business travel.

Manual Mileage Logs versus Automated Mileage Tracking Apps

Manual mileage logging involves meticulously recording each trip’s details in a dedicated logbook or spreadsheet. This method offers complete control and transparency but can be time-consuming and prone to errors. Automated mileage tracking apps, conversely, utilize GPS technology to automatically record trips, eliminating manual entry and reducing the likelihood of mistakes. However, they require a smartphone or other compatible device and may have limitations regarding data accuracy or privacy.

Creating a Manual Mileage Log Using a Spreadsheet

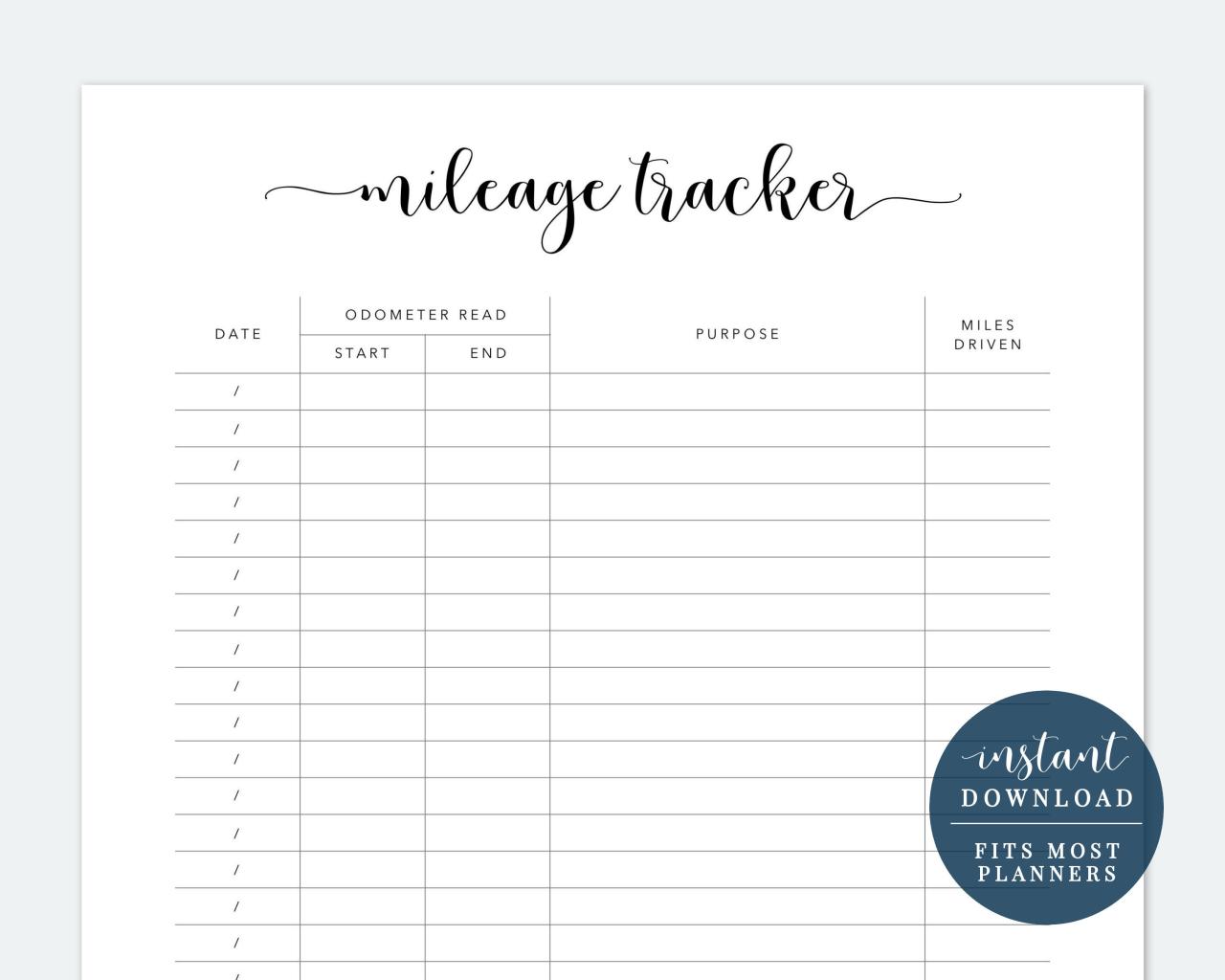

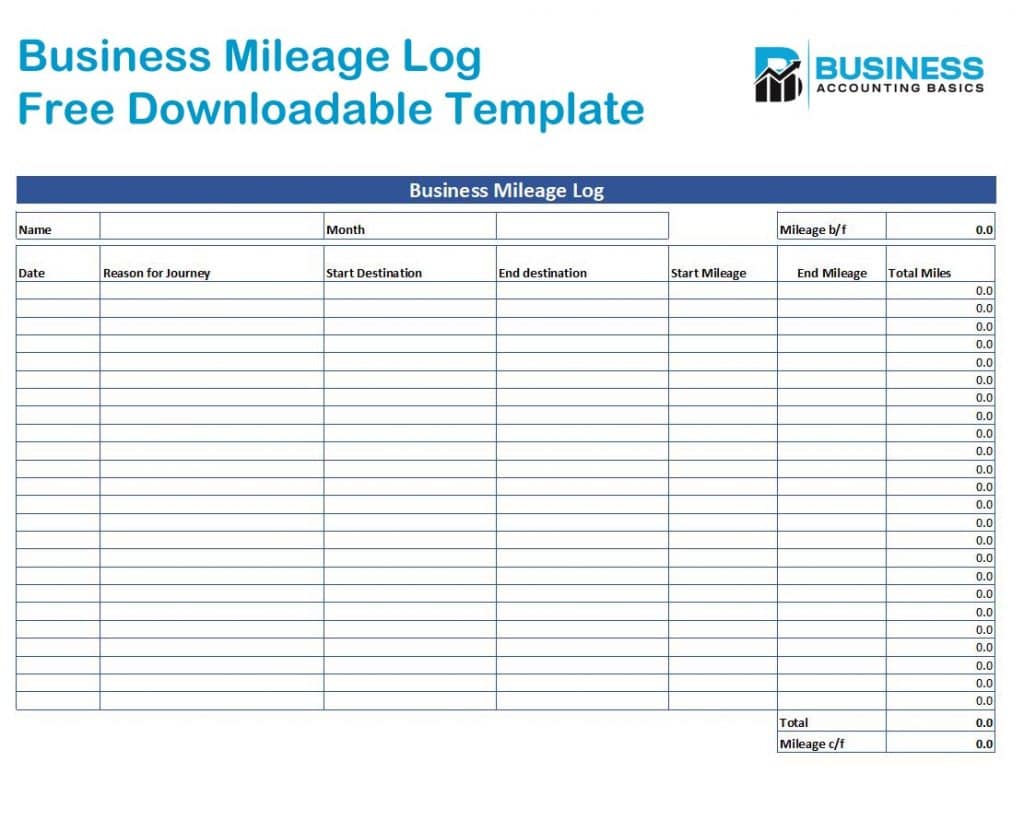

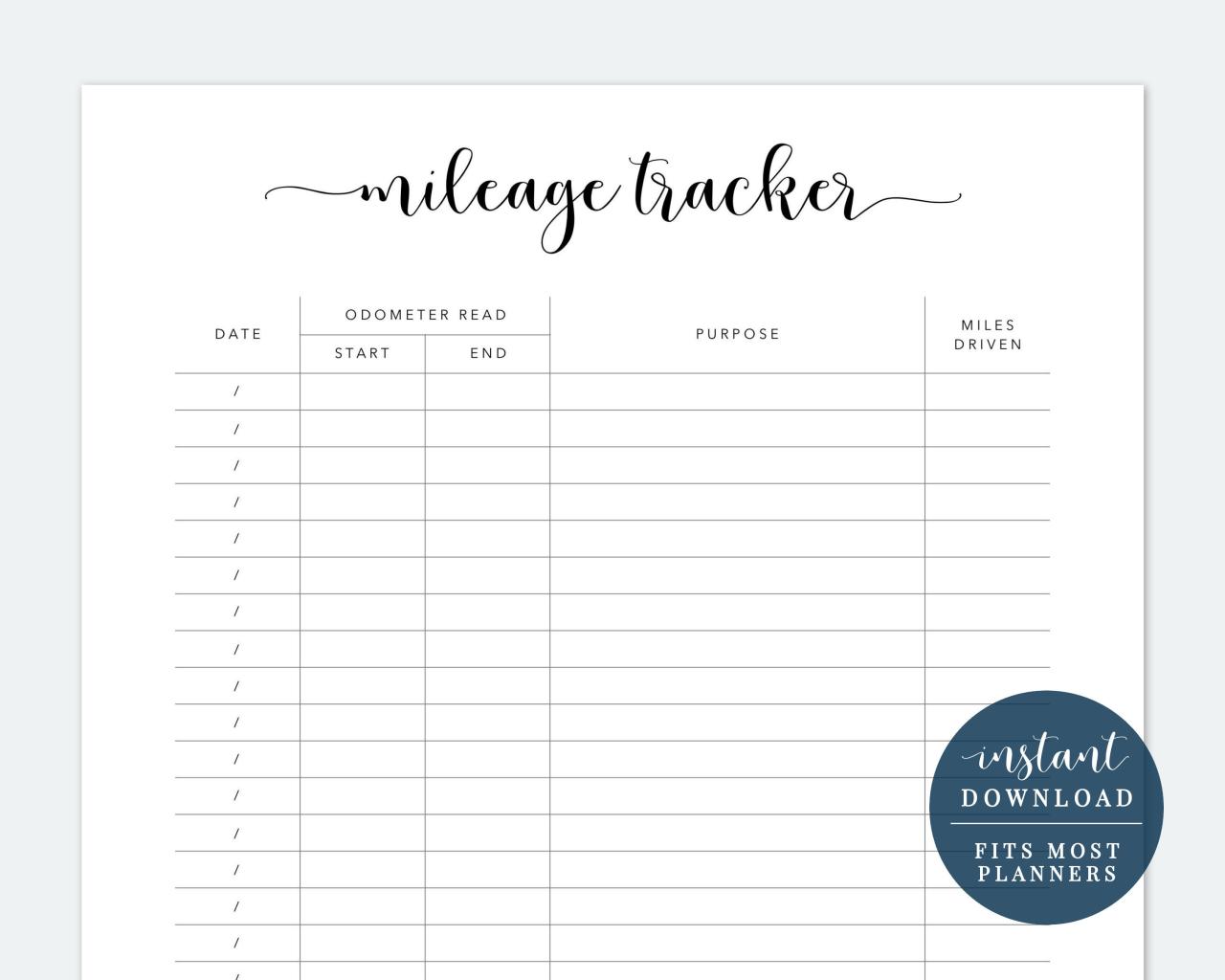

A simple spreadsheet offers a straightforward method for manual mileage tracking. The following steps Artikel the creation of a basic log:

First, create a new spreadsheet in your preferred program (e.g., Microsoft Excel, Google Sheets). Then, create a table with four columns:

| Date | Starting Odometer Reading | Ending Odometer Reading | Business Miles Driven |

|---|---|---|---|

| 2024-10-27 | 12345 | 12400 | 55 |

| 2024-10-28 | 12400 | 12520 | 120 |

For each business trip, record the date, the odometer reading at the start of the trip, the odometer reading at the end of the trip, and calculate the difference to determine the business miles driven. Remember to only include miles driven for business purposes. Regularly back up your spreadsheet to prevent data loss.

Examples of Popular Mileage Tracking Apps and Their Key Features

Several mobile applications streamline mileage tracking. Each offers unique features and benefits. Consider these examples:

The selection of the appropriate app depends on individual needs and preferences. Factors to consider include ease of use, features offered, and cost.

- App A:

- Pros: Intuitive interface, automatic trip detection, robust reporting features.

- Cons: Subscription fee, limited free features.

- App B:

- Pros: Free version available, integrates with accounting software.

- Cons: Can be less accurate than GPS-based apps, requires manual entry for some trips.

- App C:

- Pros: Excellent accuracy, detailed reporting capabilities.

- Cons: Steeper learning curve, higher subscription cost.

The Importance of Accurate Record-Keeping and Potential Consequences of Inaccurate Tracking

Maintaining accurate mileage records is paramount. Inaccurate tracking can lead to several negative consequences, including:

Inaccurate records can lead to missed tax deductions, resulting in a higher tax burden. Furthermore, audits by tax authorities can uncover discrepancies, potentially leading to penalties and interest charges. It is crucial to maintain meticulous records and ensure all entries are accurate and verifiable. Consider keeping supporting documentation, such as receipts or client invoices, to corroborate your mileage claims.

Identifying Business vs. Personal Mileage

Accurately distinguishing between business and personal mileage is crucial for claiming legitimate tax deductions. Failure to do so can result in IRS penalties and audits. This section details various scenarios to help you confidently categorize your trips.

The Internal Revenue Service (IRS) allows self-employed individuals and small business owners to deduct a portion of their vehicle expenses, including mileage, as a business expense. However, only mileage driven for business purposes is deductible. Properly separating business from personal use is essential for accurate tax reporting and avoiding potential complications.

Examples of Business Mileage

Several situations clearly define mileage as business-related. These examples illustrate common scenarios where the deduction is readily applicable.

- Travel to client meetings: Driving to a client’s office or job site for a consultation, presentation, or service provision is unequivocally business mileage.

- Commuting between multiple business locations: If you operate from multiple offices or work sites, the travel between these locations is considered business mileage.

- Travel to industry conferences or trade shows: Attending events relevant to your business, including travel to and from the event, qualifies as business mileage.

- Deliveries or pickups for business purposes: Mileage incurred while transporting goods or materials directly related to your business operations is deductible.

- Business errands (e.g., bank deposits, supply purchases): Trips solely for business-related errands, such as depositing business funds or acquiring necessary supplies, are deductible.

Examples of Personal Mileage

Conversely, personal trips are not deductible. These examples illustrate situations where mileage is not considered a business expense.

- Commuting to and from your primary place of business: The daily commute between your home and your main workplace is generally considered personal mileage and is not deductible.

- Personal errands (e.g., grocery shopping, visiting friends): Trips unrelated to your business are personal and cannot be deducted.

- Vacations or leisure travel: Any travel undertaken for personal enjoyment or relaxation is not deductible.

- Travel to and from social events: Attending social gatherings or events unrelated to your business is considered personal travel.

- Trips to pick up children from school or other personal appointments: These are purely personal activities and do not qualify for business mileage deductions.

The Importance of Separating Business and Personal Trips for Tax Purposes

Maintaining meticulous records separating business and personal mileage is paramount. The IRS scrutinizes mileage deductions, and inaccurate reporting can lead to significant penalties, including back taxes and interest. Accurate record-keeping protects you from potential audits and ensures compliance.

Accurate record-keeping is your best defense against IRS scrutiny. Maintain detailed logs to substantiate your deductions.

Decision-Making Flowchart for Classifying a Trip

A flowchart can simplify the process of classifying a trip. This visual aid clarifies the decision-making process.

Flowchart:

Start -> Is the primary purpose of the trip business-related? -> Yes: Business Mileage -> No: Personal Mileage -> End

Note: This is a simplified flowchart. Complex situations may require further consideration.

IRS Guidelines for Deducting Business Mileage Expenses

The IRS provides specific guidelines for deducting business mileage. Understanding these guidelines is crucial for accurate reporting.

The IRS uses a standard mileage rate to calculate the deductible amount. This rate changes annually and is adjusted to reflect the cost of operating a vehicle. Taxpayers can choose to use either the standard mileage rate or the actual expenses method. The standard mileage rate is often simpler to use, while the actual expense method might be more beneficial in certain circumstances. However, meticulous record-keeping of all expenses is required for the actual expense method. Consult a tax professional for guidance on which method best suits your situation.

Legal and Tax Implications

Accurate mileage tracking isn’t just about efficient expense management; it’s crucial for complying with tax laws and avoiding potential penalties. The IRS requires meticulous record-keeping to substantiate any business mileage deductions claimed on your tax return. Failing to meet these requirements can lead to significant financial repercussions.

Requirements for Substantiating Business Mileage Deductions

To successfully deduct business mileage, you must provide sufficient evidence to prove the legitimacy of your claims. This involves documenting both the business purpose of each trip and the total distance traveled. The IRS scrutinizes these records, so maintaining detailed and accurate information is paramount. Simply stating you drove for business purposes is insufficient; you must provide verifiable proof. This documentation serves as a safeguard against audits and ensures the successful processing of your tax return.

Acceptable Documentation for Mileage Tracking, How to track mileage for business

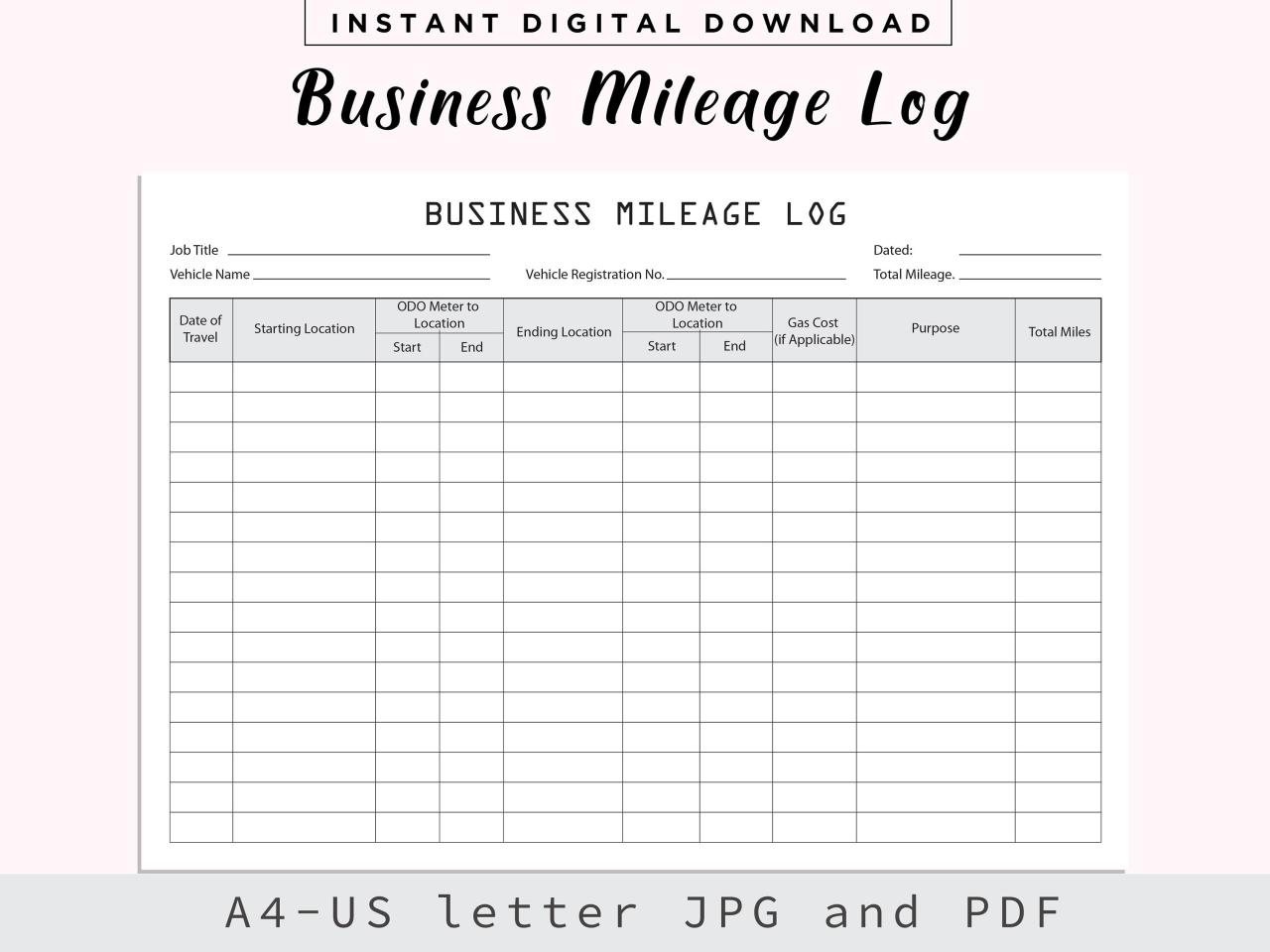

Several methods provide acceptable documentation for mileage tracking. A detailed mileage log is the most common and effective method. This log should include the date, starting and ending odometer readings, purpose of the trip, destination, and the number of business miles driven. Supporting documentation such as client invoices, appointment schedules, or delivery receipts can further strengthen your claim by corroborating the business purpose of your travel. GPS tracking data from a smartphone or dedicated GPS device can also serve as supporting evidence, providing a verifiable record of your routes and distances. Digital mileage tracking apps often automatically record this information, simplifying the process and reducing the risk of errors.

Implications of Failing to Maintain Accurate Mileage Records

Inaccurate or incomplete mileage records can result in significant tax implications. The IRS may disallow your entire mileage deduction if they find your records insufficient or unreliable. This can lead to a substantial increase in your tax liability and potentially trigger penalties. Furthermore, if discrepancies are discovered during an audit, it can damage your credibility with the tax authorities and potentially lead to further scrutiny of your financial records. Maintaining accurate records not only protects you from penalties but also simplifies the tax filing process, ensuring a smooth and efficient experience.

Potential Penalties for Inaccurate Mileage Reporting

Inaccurate mileage reporting can result in several penalties. These penalties can include:

- Disallowance of the deduction: The IRS may completely reject your mileage deduction claim.

- Accuracy-related penalty: A penalty of 20% of the underpayment can be applied if the inaccuracy is deemed intentional or due to negligence.

- Interest charges: Interest accrues on any unpaid tax resulting from the disallowed deduction.

- Audit: Inaccurate reporting can trigger a full tax audit, leading to a thorough examination of your financial records and potential penalties for other inaccuracies.

The severity of the penalty depends on the nature and extent of the inaccuracy. Intentional misrepresentation of mileage will attract stricter penalties than unintentional errors. However, even unintentional errors due to poor record-keeping can result in substantial financial burdens. Therefore, proactive and accurate mileage tracking is crucial to avoid these potential consequences.

Mileage Reimbursement Policies

Establishing a clear and fair mileage reimbursement policy is crucial for businesses, ensuring employees are compensated appropriately for using their personal vehicles for work-related purposes. A well-defined policy minimizes disputes, maintains employee morale, and ensures compliance with tax regulations. This section will explore various aspects of mileage reimbursement policies, including different reimbursement rates, calculation methods, and key elements of a fair policy.

Examples of Company Mileage Reimbursement Policies

Different companies adopt diverse approaches to reimbursing employee mileage. Some may adhere strictly to the IRS standard mileage rate, while others offer a fixed rate or a more generous reimbursement. Understanding these variations is key to establishing a competitive and equitable policy.

- Company A: Reimburses employees at the IRS standard mileage rate, adjusted annually. This ensures compliance and simplifies accounting.

- Company B: Offers a fixed rate of $0.50 per mile, regardless of the IRS rate. This simplifies administration but may not always reflect actual expenses.

- Company C: Uses a tiered system, with higher reimbursement rates for employees traveling longer distances or in areas with higher fuel costs. This acknowledges variations in expenses.

- Company D: Reimburses employees based on a combination of the IRS rate and a per diem for meals and lodging on overnight trips. This comprehensive approach covers multiple expenses.

Calculating Mileage Reimbursement Using the IRS Standard Mileage Rate

The IRS standard mileage rate provides a convenient and widely accepted method for calculating business mileage reimbursement. This rate is updated annually and reflects the average cost of operating a vehicle, including fuel, maintenance, and depreciation.

To calculate reimbursement, simply multiply the total number of business miles driven by the current IRS standard mileage rate. For example, if an employee drove 500 business miles and the current IRS rate is $0.58 per mile, the reimbursement would be $500 * $0.58 = $290.

The formula for calculating mileage reimbursement using the IRS standard mileage rate is: Total Business Miles x IRS Standard Mileage Rate = Total Reimbursement

Key Elements of a Fair and Effective Mileage Reimbursement Policy

A fair and effective mileage reimbursement policy should be transparent, easy to understand, and consistent with tax regulations. Key elements include:

- Clear Definition of Business Mileage: The policy should clearly define what constitutes business mileage to avoid ambiguity and disputes.

- Specified Reimbursement Rate: The policy must state the reimbursement rate clearly, whether it’s the IRS rate, a fixed rate, or a tiered system.

- Method of Payment: The policy should specify how reimbursement will be paid, such as through payroll, expense reports, or other methods.

- Record-Keeping Requirements: The policy should Artikel the necessary documentation employees need to submit to claim reimbursement, such as mileage logs.

- Regular Review and Updates: The policy should be reviewed and updated periodically to reflect changes in IRS rates and business needs.

Comparison of Company Mileage Reimbursement Policies

The following table summarizes the different approaches to mileage reimbursement discussed earlier.

| Company | Reimbursement Rate | Method of Payment | Policy Highlights |

|---|---|---|---|

| Company A | IRS Standard Mileage Rate (Annual Adjustment) | Payroll Deduction | Simple, compliant, and transparent. |

| Company B | $0.50 per mile (Fixed Rate) | Expense Reimbursement | Simplified administration, may not reflect actual costs. |

| Company C | Tiered System (based on distance and location) | Expense Reimbursement | Accounts for variations in expenses. |

| Company D | IRS Standard Mileage Rate + Per Diem | Expense Reimbursement | Comprehensive approach covering multiple expenses. |

Technology and Tools for Mileage Tracking

Efficient mileage tracking is crucial for accurate business expense reporting. Manual methods are prone to errors and inconsistencies, highlighting the need for reliable technological solutions. This section explores various technological tools available, focusing on GPS tracking devices and mileage tracking apps, examining their advantages, disadvantages, and comparative functionalities.

GPS Tracking Devices for Mileage Tracking

GPS tracking devices offer a highly accurate method for recording mileage driven for business purposes. These devices utilize satellite signals to pinpoint the vehicle’s location at regular intervals, continuously recording its movements. This data is then compiled into detailed reports showing the distance traveled, time spent driving, and even speed. The collected data can be downloaded via various methods, often through a dedicated software platform or mobile app provided by the device manufacturer. Data analysis can then be performed to distinguish business trips from personal use, generating reports suitable for tax purposes or reimbursement claims.

Advantages and Disadvantages of GPS Tracking for Business Mileage

Using GPS tracking for business mileage presents several benefits and drawbacks.

- Advantages: High accuracy in mileage recording, automated data collection eliminating manual entry, detailed reports for easy expense management, potential for improved route optimization and fuel efficiency monitoring, and increased security features like geofencing (setting virtual boundaries to monitor vehicle location).

- Disadvantages: Initial cost of purchasing and installing the device, ongoing subscription fees for data access and software, potential privacy concerns regarding constant location tracking, and reliance on a consistent GPS signal which may be affected by geographical location or environmental factors.

Comparison of GPS Tracking Devices and Software Solutions

The market offers a variety of GPS tracking devices and software, each with varying features and pricing. Choosing the right solution depends on individual needs and budget.

- Example Device A (Hypothetical): Features include real-time tracking, geofencing, detailed reporting, driver behavior monitoring; Pricing: $100 initial cost + $20/month subscription.

- Example Device B (Hypothetical): Features include mileage tracking, trip history, basic reporting; Pricing: $50 initial cost + $10/month subscription.

- Example Software C (Hypothetical): Integrates with multiple GPS devices, advanced reporting and analytics, expense management tools; Pricing: $30/month per user.

Functionality Comparison of Mileage Tracking Apps

The following diagram visually compares the core functionalities of three hypothetical mileage tracking apps.

Diagram Description: Imagine a table with three columns, each representing a different mileage tracking app (App X, App Y, App Z). The rows represent key features: Automatic Mileage Tracking (Yes/No), Manual Mileage Entry (Yes/No), GPS Tracking Integration (Yes/No), Tax Report Generation (Yes/No), Expense Categorization (Yes/No), Cloud Storage (Yes/No). Each cell indicates whether the app offers that specific feature (Yes) or not (No). For example, App X might have “Yes” for all features, App Y might lack GPS integration and expense categorization, and App Z might only offer basic automatic mileage tracking and manual entry.