How to value a retail business? It’s a question that hinges on far more than just crunching numbers. Successfully valuing a retail business requires a deep dive into its operational efficiency, market position, and future potential. This guide provides a comprehensive framework, walking you through the key financial and qualitative factors that influence a retail business’s worth, ultimately equipping you with the knowledge to make informed decisions.

From analyzing income statements and balance sheets to understanding intangible assets like brand reputation and customer loyalty, we’ll explore every facet of the valuation process. We’ll compare and contrast various valuation methods, including discounted cash flow (DCF) analysis and market multiples, demonstrating their practical application in the context of a retail setting. By the end, you’ll be equipped to confidently approach the complex task of valuing any retail business.

Understanding the Retail Business Model

A thorough understanding of the retail business model is crucial for accurate valuation. This involves analyzing several key aspects, from the target customer to the pricing strategy, to paint a complete picture of the business’s operational efficiency and market position. This section will delve into these crucial elements.

Target Market and Customer Base

The target market defines the specific group of consumers the retail business aims to serve. This includes demographic information (age, gender, income, location), psychographic information (lifestyle, values, interests), and buying behaviors. A well-defined target market allows for focused marketing efforts and product development. For example, a high-end boutique specializing in organic cotton clothing would target a customer base with a higher disposable income and a strong interest in sustainable fashion, likely residing in affluent urban areas. Conversely, a discount retailer focusing on everyday essentials would target a broader customer base with a focus on price sensitivity. Understanding the size, growth potential, and loyalty of the customer base is critical to valuation.

Unique Selling Proposition (USP)

The unique selling proposition (USP) differentiates the retail business from its competitors. This could be superior product quality, exceptional customer service, a convenient location, exclusive brands, a unique shopping experience, or a combination of factors. A strong USP is essential for attracting and retaining customers and commanding premium pricing. For instance, a bookstore that offers personalized recommendations and author events has a USP that goes beyond simply selling books. Similarly, a grocery store emphasizing locally sourced produce and sustainable practices appeals to environmentally conscious consumers. The strength and defensibility of the USP directly impact the business’s long-term viability and valuation.

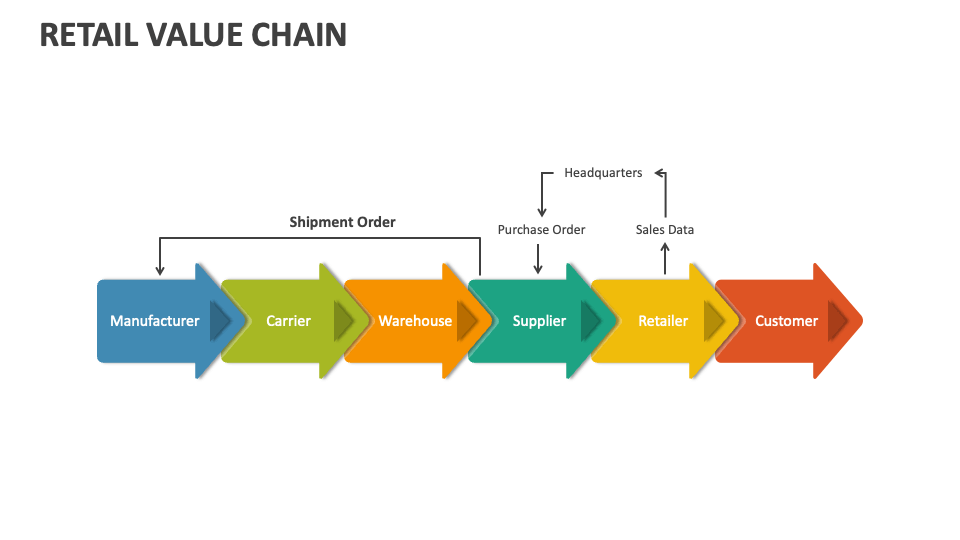

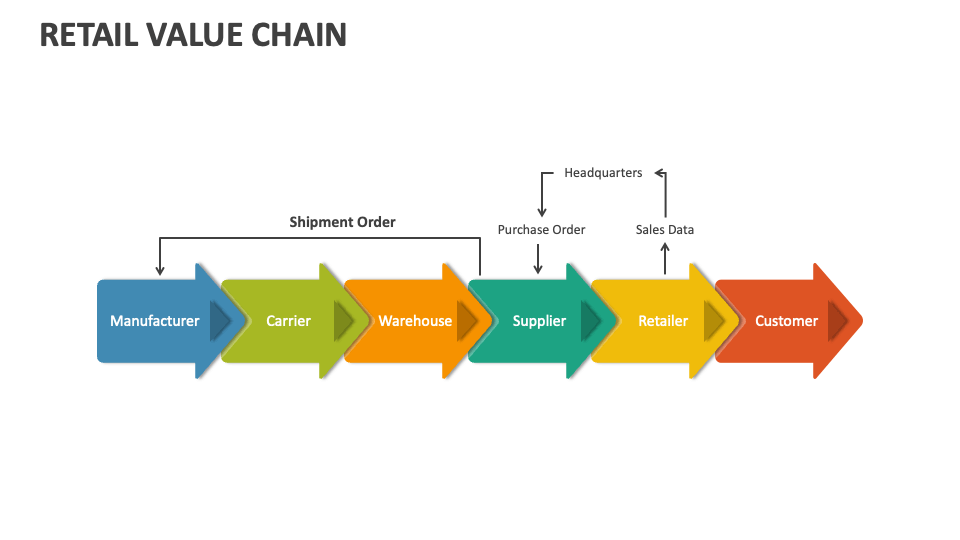

Supply Chain and Inventory Management, How to value a retail business

The efficiency of the supply chain and inventory management significantly impacts profitability. This involves analyzing the sourcing of goods, warehousing, logistics, and inventory control systems. Effective inventory management minimizes storage costs, reduces waste from spoilage or obsolescence, and ensures sufficient stock to meet customer demand. A business with a well-optimized supply chain and sophisticated inventory management system will typically have higher profit margins and a stronger valuation. Consider a retailer using just-in-time inventory management, minimizing storage costs while ensuring product availability. Conversely, a retailer with inefficient inventory control may face losses due to stockouts or excessive holding costs.

Revenue Streams

Retail businesses generate revenue primarily through the sale of goods. However, additional revenue streams may include services (e.g., gift wrapping, delivery, repairs), loyalty programs, and potentially advertising or partnerships. Analyzing the proportion of revenue from each stream provides insights into the business’s diversification and resilience. For example, a furniture store might generate additional revenue through interior design services, while a coffee shop could benefit from selling pastries and merchandise alongside its core offerings. A diverse revenue stream often indicates a more stable and valuable business.

Pricing Strategy Comparison

Understanding the business’s pricing strategy relative to competitors is essential. This involves analyzing pricing models (e.g., cost-plus, value-based, competitive pricing), discounts, promotions, and overall price competitiveness.

| Retailer | Pricing Model | Average Price Point | Promotional Strategies |

|---|---|---|---|

| Business A | Value-Based | $50 | Seasonal Sales, Loyalty Discounts |

| Business B | Competitive | $45 | Frequent Price Matches, Coupons |

| Business C | Cost-Plus | $55 | Limited Promotions, Emphasis on Quality |

| Competitor X | Value-Based | $48 | Membership Program, Bundled Offers |

Assessing Financial Performance

A thorough assessment of a retail business’s financial performance is crucial for accurate valuation. This involves a detailed examination of the income statement, balance sheet, and cash flow statement over a period of at least three years to identify trends and assess the business’s financial health. Analyzing these statements reveals the profitability, liquidity, and solvency of the business, providing a strong foundation for determining its fair market value.

Income Statement Analysis

The income statement, also known as the profit and loss (P&L) statement, shows the business’s revenues, costs, and profits over a specific period. Analyzing the income statement for the past three years allows for the identification of trends in revenue growth, cost control, and profitability. For example, a consistent increase in gross profit margin indicates effective pricing and cost management, while a declining net profit margin may suggest increasing operating expenses or reduced sales prices. Specific line items such as cost of goods sold (COGS), operating expenses (rent, salaries, utilities), and interest expenses should be carefully scrutinized for unusual fluctuations or trends. Comparing these figures to industry benchmarks provides further context and reveals areas for potential improvement.

Balance Sheet Analysis

The balance sheet provides a snapshot of the business’s assets, liabilities, and equity at a specific point in time. Key assets to examine include inventory, accounts receivable (money owed to the business), and property, plant, and equipment (PP&E). Liabilities include accounts payable (money owed by the business), loans, and other debts. Analyzing the balance sheet reveals the business’s financial position, liquidity (ability to meet short-term obligations), and solvency (ability to meet long-term obligations). A high level of current assets relative to current liabilities indicates strong liquidity, while a healthy equity-to-asset ratio suggests a stable financial structure. Examining trends in these ratios over the three-year period highlights the business’s financial stability and growth trajectory. For instance, a consistently increasing level of inventory might indicate slow-moving products or inefficient inventory management.

Cash Flow Statement Analysis

The cash flow statement tracks the movement of cash into and out of the business over a period. It’s divided into operating, investing, and financing activities. Operating activities reflect cash flows from the business’s core operations. Investing activities include purchases and sales of long-term assets. Financing activities relate to debt, equity, and dividends. Analyzing the cash flow statement reveals the business’s ability to generate cash from operations, its capital expenditures, and its reliance on external financing. A strong positive cash flow from operations is a crucial indicator of financial health and sustainability. For example, a consistent decrease in cash flow from operations despite increasing profits could indicate issues with accounts receivable collection or increased inventory holding costs.

Key Financial Ratios

Financial ratios provide a standardized way to compare the financial performance of different businesses. Analyzing these ratios over time reveals trends and helps assess the business’s strengths and weaknesses.

| Ratio | Formula | Description | Example |

|---|---|---|---|

| Gross Profit Margin | (Revenue – COGS) / Revenue | Measures the profitability of sales after deducting the cost of goods sold. | A gross profit margin of 40% indicates that 40% of revenue remains after covering the cost of goods sold. |

| Net Profit Margin | Net Profit / Revenue | Measures the overall profitability of the business after all expenses are deducted. | A net profit margin of 10% indicates that 10% of revenue remains as net profit. |

| Return on Assets (ROA) | Net Profit / Total Assets | Measures how efficiently the business uses its assets to generate profit. | An ROA of 5% indicates that for every $100 of assets, the business generates $5 in profit. |

| Current Ratio | Current Assets / Current Liabilities | Measures the business’s ability to meet its short-term obligations. | A current ratio of 2:1 indicates that the business has twice as many current assets as current liabilities. |

Trends in Financial Performance

Analyzing the trends in the financial statements and ratios over the three-year period is crucial for understanding the business’s performance trajectory. For instance, a consistent increase in revenue coupled with a declining net profit margin might suggest that the business is experiencing increasing operating costs, which need to be investigated further. Similarly, a decreasing current ratio could indicate potential liquidity problems, requiring a closer look at accounts receivable and payable management. Identifying these trends and their underlying causes is essential for accurately assessing the business’s value. A business with consistently improving financial performance will generally command a higher valuation than one with declining performance.

Analyzing Market Conditions

A thorough understanding of the market is crucial for accurately valuing a retail business. This involves assessing the competitive landscape, the business’s market position, macroeconomic influences, and identifying both threats and opportunities. Failing to consider these factors can lead to a significantly misvalued business.

Competitive Landscape of the Retail Sector

The retail sector is fiercely competitive, characterized by a diverse range of business models, from large multinational corporations to small independent stores. Competition can be based on price, product differentiation, customer service, location, and brand recognition. Analyzing the competitive landscape involves identifying key competitors, their strengths and weaknesses, and their market strategies. For example, a small bookstore might face competition from large chain bookstores, online retailers like Amazon, and even e-book platforms. Understanding the competitive dynamics is essential for determining the business’s ability to maintain or increase its market share.

Market Share Comparison

Comparing the subject business’s market share to its main competitors provides a clear indication of its relative strength and potential for future growth. This involves calculating the business’s market share (revenue divided by total market revenue) and comparing it to the market share of its closest competitors. For instance, if a local bakery holds a 15% market share in its area, while its two main competitors hold 25% and 30% respectively, it highlights a need for strategies to increase market penetration or to differentiate its offerings to attract more customers. A larger market share generally indicates a stronger competitive position and potentially higher valuation.

Macroeconomic Factors Affecting Business Value

Macroeconomic factors, such as inflation, interest rates, consumer confidence, and economic growth, significantly impact retail businesses. High inflation can reduce consumer spending, while rising interest rates can increase borrowing costs for businesses. Conversely, strong economic growth and high consumer confidence can lead to increased sales and higher valuations. For example, during a recession, a discount retailer might see increased sales while a luxury goods retailer might experience a significant decline. These macroeconomic trends must be considered when assessing the long-term prospects and value of a retail business.

Market Threats and Opportunities

Identifying potential threats and opportunities within the market is crucial for assessing the business’s future potential. Threats might include increased competition, changing consumer preferences, economic downturns, or supply chain disruptions. Opportunities might include emerging market segments, technological advancements, or favorable government regulations. For instance, the rise of e-commerce presents both a threat and an opportunity for brick-and-mortar stores; it’s a threat because it diverts sales, but an opportunity if the business can successfully integrate online sales into its model.

SWOT Analysis of the Retail Business

A SWOT analysis provides a structured framework for assessing the business’s internal strengths and weaknesses, as well as external opportunities and threats.

- Strengths: Strong brand recognition, loyal customer base, efficient operations, experienced management team, unique product offerings.

- Weaknesses: High operating costs, limited product range, outdated technology, poor customer service, dependence on a single supplier.

- Opportunities: Expanding into new markets, launching new products, improving online presence, adopting new technologies, strategic partnerships.

- Threats: Increased competition, changing consumer preferences, economic downturn, supply chain disruptions, unfavorable government regulations.

A comprehensive SWOT analysis helps to identify areas where the business excels and areas that need improvement, ultimately informing the valuation process. It highlights potential risks and opportunities that could significantly impact the business’s future performance and, therefore, its value.

Evaluating Intangible Assets

Intangible assets represent a significant portion of a retail business’s value, often exceeding the value of its tangible assets. These non-physical assets contribute significantly to the business’s profitability and long-term sustainability. Accurately assessing these intangible assets is crucial for a fair valuation.

Brand Reputation and Customer Loyalty

A strong brand reputation and loyal customer base are invaluable assets. A well-established brand commands premium prices, attracts new customers more easily, and fosters repeat business. Customer loyalty programs, positive online reviews, and consistent brand messaging all contribute to a strong brand reputation. For example, a retailer with a long history of excellent customer service and high-quality products will likely command a higher valuation than a newer competitor with a less-established reputation. The value of brand reputation can be estimated by comparing the business’s pricing power to competitors, analyzing customer retention rates, and considering the cost of building a similar brand from scratch.

Location Value

The location of a retail business significantly impacts its value. A prime location with high foot traffic and visibility can dramatically increase sales and profitability. Conversely, an unfavorable location with limited accessibility or competition can hinder growth. Factors to consider include proximity to target demographics, accessibility by car and public transport, visibility from major roads, and the presence of complementary businesses. A retail store located in a bustling shopping mall will typically have a higher valuation than one in a remote area with low traffic. Real estate appraisals and comparable sales data can help determine the value contribution of a specific location.

Intellectual Property

The presence of intellectual property, such as patents, trademarks, or proprietary software, can significantly enhance a retail business’s value. Patents protect unique inventions or processes, while trademarks safeguard brand names and logos. Proprietary software can provide a competitive advantage by automating processes or offering unique features. The value of intellectual property is determined by its potential to generate future revenue and protect against competition. For instance, a retailer with a patented product design might command a higher valuation than a competitor using generic designs. The value of intellectual property can be estimated using discounted cash flow analysis or comparable transactions involving similar intellectual property.

Management Team and Experience

The quality of the management team is a crucial intangible asset. An experienced and effective management team can drive growth, improve efficiency, and navigate challenges more effectively. A team with a proven track record of success will enhance the business’s overall value. Consider the team’s industry expertise, leadership skills, and track record of achieving business objectives. A retail business with a highly skilled and experienced management team is likely to attract higher valuations than one with less experienced leadership. This aspect is often assessed qualitatively, based on the team’s resumes, references, and interviews.

Key Relationships

Strong relationships with suppliers and customers are essential for a successful retail business. These relationships can provide access to preferential pricing, secure supply chains, and foster customer loyalty. These relationships are often difficult to quantify directly but contribute significantly to the overall business value.

- Supplier Relationships: Exclusive supply agreements, long-standing partnerships with reliable suppliers, and preferential pricing arrangements all contribute to a business’s competitive advantage and profitability.

- Customer Relationships: A loyal customer base, strong customer retention rates, and positive customer reviews all indicate strong customer relationships, contributing to sustained revenue streams.

Determining Valuation Methods

Valuing a retail business requires a multifaceted approach, employing various methods to arrive at a robust and defensible valuation. The selection of appropriate methods depends on factors such as the business’s size, stage of development, profitability, and the availability of comparable data. This section will explore two primary valuation methods: discounted cash flow (DCF) analysis and market multiples, comparing their strengths and weaknesses and demonstrating their application in a retail context.

Discounted Cash Flow (DCF) Analysis

DCF analysis is an intrinsic valuation method that estimates the present value of future cash flows generated by the business. It’s considered a rigorous approach, as it directly assesses the business’s inherent ability to generate cash. The process involves projecting future free cash flows (FCF), determining an appropriate discount rate (reflecting the risk associated with the investment), and then discounting those future cash flows back to their present value. The sum of these present values represents the estimated enterprise value of the business.

Applying the DCF Method to a Retail Business

To illustrate, consider a hypothetical retail business with projected FCFs of $100,000, $120,000, and $150,000 for the next three years, followed by a stable growth rate of 3% per year thereafter. Assume a discount rate of 10%. The calculation would involve discounting each year’s FCF back to its present value using the formula:

PV = FV / (1 + r)^n

Where:

* PV = Present Value

* FV = Future Value (FCF)

* r = Discount Rate

* n = Number of years

Applying this formula to each year’s FCF, and then calculating the terminal value (the present value of all future cash flows beyond the explicit projection period), would yield the total enterprise value. For simplicity, we’ll omit the detailed calculation here, but the process involves calculating the present value of each year’s FCF and the terminal value, then summing them to arrive at the total enterprise value. The terminal value is often calculated using a perpetuity growth model.

Comparable Company Analysis

Market multiples, such as Price-to-Earnings (P/E) ratio, Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Sales (P/S) ratio, provide a relative valuation approach. Comparable company analysis involves identifying publicly traded companies with similar business models, size, and market characteristics to the target retail business. By analyzing the valuation multiples of these comparable companies, a valuation range can be established for the target business. This method relies on the principle that similar companies should trade at similar multiples.

Examples of Retail Business Transactions and Valuation Multiples

Understanding the valuation multiples achieved in comparable transactions provides crucial context for the valuation process.

- A small clothing boutique with annual revenue of $500,000 might sell for a P/S multiple of 1.5-2.0x, resulting in a valuation range of $750,000-$1,000,000.

- A larger grocery store chain with strong EBITDA margins could command an EV/EBITDA multiple of 8-10x, depending on market conditions and growth prospects.

- A regional department store chain experiencing declining sales might trade at a lower P/S multiple, perhaps 0.5-1.0x, reflecting the inherent risk.

These examples illustrate the variability in valuation multiples across different retail segments and business performance. The selection of appropriate comparable companies and the adjustment of multiples based on specific company characteristics are critical steps in this process.

Comprehensive Valuation Report

A comprehensive valuation report should present a clear and concise summary of the valuation process, including:

- A description of the retail business and its operations.

- A detailed analysis of the financial statements, including key profitability and cash flow metrics.

- An assessment of the market conditions and competitive landscape.

- The application of both DCF analysis and comparable company analysis, including a clear explanation of the assumptions and methodologies used.

- A reconciliation of the valuation results from different methods and a justification of the final valuation recommendation.

- A discussion of the uncertainties and limitations inherent in the valuation process.

The report should provide a range of valuation estimates, acknowledging the inherent uncertainties in forecasting future performance and market conditions. This transparent and comprehensive approach strengthens the credibility and usefulness of the valuation.

Considering Risk and Uncertainty: How To Value A Retail Business

Valuing a retail business requires a thorough assessment of inherent risks and uncertainties. These factors can significantly impact the final valuation, potentially leading to substantial over- or undervaluation if not properly considered. Ignoring risk can result in a flawed valuation and potentially disastrous investment decisions. A robust valuation process incorporates a comprehensive risk analysis and adjusts the valuation accordingly.

Potential Risks in Retail Businesses

Retail businesses face a multitude of risks, broadly categorized into economic, competitive, and operational factors. Economic downturns, for instance, directly impact consumer spending, leading to reduced sales and profitability. Changes in consumer preferences, driven by trends, technological advancements, or shifting demographics, can render existing inventory obsolete or decrease demand for specific products. Increased competition from established players or new entrants can erode market share and profitability. Operational risks include supply chain disruptions, inventory management issues, and unforeseen events like natural disasters or pandemics. These risks, acting independently or in combination, can significantly influence a business’s future performance and thus its value.

Risk Mitigation Strategies

Effective risk mitigation involves proactive measures to reduce the likelihood and impact of potential threats. Diversification of product lines can lessen the impact of changes in consumer preferences. Strong relationships with suppliers can help mitigate supply chain disruptions. Robust inventory management systems minimize losses due to obsolescence or spoilage. A well-defined marketing strategy can help maintain market share in a competitive landscape. Insurance policies can provide financial protection against unforeseen events. Furthermore, a strong financial position with sufficient cash reserves provides a buffer against economic downturns. These strategies aim to reduce the overall risk profile of the business and improve its resilience.

Impact of Uncertainty on Valuation

Uncertainty introduces ambiguity into future projections, making accurate forecasting challenging. Factors like fluctuating interest rates, unpredictable economic growth, and unpredictable consumer behavior contribute to this uncertainty. This uncertainty necessitates the use of probabilistic methods in valuation, moving beyond simple discounted cash flow models to incorporate a range of possible outcomes. A higher degree of uncertainty typically leads to a lower valuation, reflecting the increased risk associated with the investment. For example, a retail business operating in a volatile market with rapidly changing consumer trends will likely be valued lower than a similar business in a more stable market.

Sensitivity Analysis

A sensitivity analysis demonstrates how changes in key assumptions affect the valuation. This involves systematically varying input parameters (e.g., sales growth rate, profit margins, discount rate) and observing their impact on the final valuation. This analysis highlights the most critical assumptions and identifies areas of greatest uncertainty.

| Parameter | Base Case | Optimistic Scenario | Pessimistic Scenario | Valuation Impact |

|---|---|---|---|---|

| Sales Growth Rate | 5% | 7% | 3% | +15%, -10% |

| Profit Margin | 10% | 12% | 8% | +20%, -15% |

| Discount Rate | 10% | 8% | 12% | +25%, -20% |

The table illustrates a simplified sensitivity analysis. A real-world analysis would involve a more extensive set of parameters and a more detailed examination of their interdependencies. The results demonstrate how seemingly small changes in assumptions can significantly alter the valuation.

Adjusting Valuation for Risk and Uncertainty

Adjusting the valuation to reflect risk and uncertainty involves several approaches. One common method is to increase the discount rate used in discounted cash flow models. A higher discount rate reflects the increased risk associated with the investment and reduces the present value of future cash flows. Another approach is to use scenario planning, which involves developing multiple valuation scenarios based on different assumptions about future conditions. This approach provides a range of possible valuations, highlighting the uncertainty associated with the assessment. Finally, real options analysis can be employed to value the flexibility embedded in the business, such as the option to expand, contract, or abandon certain operations. These adjustments aim to provide a more realistic and conservative valuation that accurately reflects the risks and uncertainties inherent in the retail business.