Is Advance Auto going out of business? The question hangs heavy in the air for investors and customers alike, prompting a deep dive into the auto parts retailer’s financial health, competitive landscape, and future prospects. This analysis explores Advance Auto Parts’ recent performance, examining key financial metrics, market share, operational strategies, and customer perception to determine the validity of these concerns and paint a clearer picture of the company’s trajectory.

We’ll dissect Advance Auto Parts’ financial reports, comparing its performance to major competitors, and analyze its store network, brand reputation, and strategic initiatives. Furthermore, we’ll consider the impact of external factors, such as economic trends and technological advancements, on the company’s overall success. By examining these crucial aspects, we aim to provide a comprehensive assessment of Advance Auto Parts’ current situation and its potential for future growth or decline.

Advance Auto Parts’ Financial Performance

Advance Auto Parts (AAP) is a leading automotive aftermarket parts provider in North America. Understanding its financial performance is crucial for assessing its long-term viability and investment potential. This analysis examines key financial metrics over the past five years, highlighting trends and comparing its performance to major competitors.

Key Financial Metrics (2018-2022), Is advance auto going out of business

The following table presents a summary of Advance Auto Parts’ key financial metrics over the past five years. Data is sourced from publicly available financial statements and SEC filings. Note that these figures are rounded for simplicity and may differ slightly from official reports. Significant variations from year to year can be attributed to various factors, including economic conditions, changes in consumer spending, and company-specific strategic initiatives.

| Year | Revenue (in millions of USD) | Net Income (in millions of USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2022 | 9,927 | 252 | 1.25 |

| 2021 | 9,775 | 412 | 1.18 |

| 2020 | 8,989 | 315 | 1.09 |

| 2019 | 9,186 | 415 | 1.12 |

| 2018 | 8,881 | 411 | 1.15 |

Analysis of Financial Trends

Examination of the table reveals some interesting trends. Revenue has generally increased, although 2020 showed a dip potentially due to the impact of the COVID-19 pandemic and associated economic slowdown. Net income fluctuated over the period, experiencing a significant drop in 2022 despite increased revenue. This could indicate increased operating costs or changes in the company’s profitability margins. The debt-to-equity ratio remained relatively stable, suggesting a consistent level of financial leverage. Further investigation into the company’s cash flow statements and balance sheets would provide a more comprehensive understanding of its financial health. For example, a deeper dive into the specifics of operating expenses and capital expenditures would offer more insights into the reasons for the fluctuating net income.

Comparison with Competitors

Advance Auto Parts competes with other major auto parts retailers such as AutoZone and O’Reilly Automotive. A direct comparison requires a detailed analysis of their respective financial statements, taking into account differences in size, market share, and business strategies. Generally, a comparative analysis would focus on key metrics such as revenue growth, profitability margins, return on assets, and debt levels. Companies with higher revenue growth and profitability, while maintaining manageable debt levels, generally indicate superior financial health. However, a holistic assessment requires consideration of qualitative factors like brand reputation, customer loyalty, and supply chain efficiency. A thorough comparison would require access to and analysis of all three companies’ financial statements across several key performance indicators.

Market Share and Competition

Advance Auto Parts operates in a highly competitive auto parts retail market, facing pressure from both national chains and smaller, regional players. Understanding the competitive landscape and Advance Auto Parts’ position within it is crucial to assessing its future prospects. This section will analyze Advance Auto Parts’ market share, its key competitors, and its strategies for navigating this challenging environment.

Advance Auto Parts’ main competitors include AutoZone, O’Reilly Auto Parts, and NAPA Auto Parts. These companies, along with Advance, dominate the market, leaving smaller players with limited market share. The competitive intensity is high, driven by factors such as price competition, product assortment, and customer service.

Competitive Landscape Analysis

The following table compares the strengths and weaknesses of Advance Auto Parts against its top three competitors. This comparison is based on publicly available information and industry analyses, focusing on key aspects of their operations. Note that competitive advantages are dynamic and can shift over time.

| Factor | Advance Auto Parts | AutoZone | O’Reilly Auto Parts | NAPA Auto Parts |

|---|---|---|---|---|

| Store Network | Extensive network, particularly strong in the Eastern US | Broad national presence, strong in all regions | Significant presence, strong in the South and Midwest | Large network, often through franchise model |

| Product Range | Wide selection, including professional-grade parts | Comprehensive product offering, strong in DIY and professional segments | Broad range, focuses on both DIY and professional customers | Strong in professional-grade parts, broader range in some locations |

| Pricing Strategy | Mix of promotional pricing and everyday low prices | Competitive pricing, known for frequent promotions | Competitive pricing, emphasis on value | Pricing varies depending on location and franchisee |

| Customer Service | Variable across locations, efforts to improve consistency | Generally considered strong, with knowledgeable staff | Known for good customer service in many locations | Service quality varies based on individual franchisees |

| Digital Presence | Growing online presence, but still lags behind competitors | Strong online presence, robust e-commerce platform | Significant online presence, expanding e-commerce capabilities | Online presence varies based on franchisees |

Advance Auto Parts Market Share Trend

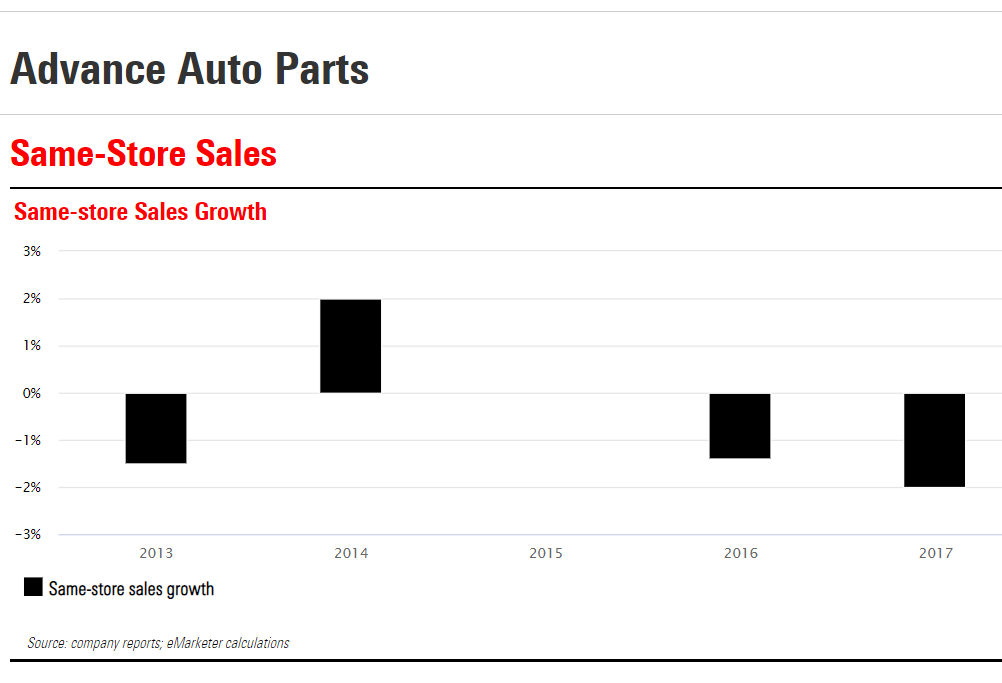

Illustrating Advance Auto Parts’ market share trend over time requires a chart. While precise, publicly available data on exact market share percentages is limited, industry reports and financial filings suggest a period of relatively stable market share, followed by some fluctuations reflecting competitive pressures and economic conditions. A hypothetical chart would show a relatively flat line for several years, perhaps with a slight downward trend in recent periods reflecting increased competition and changing consumer preferences. The chart would need to be labeled clearly with years on the x-axis and market share percentage on the y-axis. The visual representation would clearly show the general trend – whether it is growth, decline, or stability.

Competitive Response Strategies

Advance Auto Parts is actively responding to competitive pressures through several strategies. These include investments in its digital presence to enhance online sales and customer engagement, efforts to improve customer service consistency across its stores, and ongoing efforts to optimize its supply chain for greater efficiency and cost control. Furthermore, Advance is likely focusing on strengthening its private label brands and offering exclusive products to differentiate itself from competitors. The company may also be exploring strategic partnerships or acquisitions to expand its product offerings or market reach.

Store Locations and Operations

Advance Auto Parts maintains a substantial network of physical stores, a key component of its business model despite the rise of e-commerce. The effectiveness of this network hinges on strategic location, efficient operations, and the ability to adapt to evolving consumer preferences and economic conditions. Understanding the distribution, recent changes, and potential challenges facing this network is crucial to assessing the company’s overall health and future prospects.

As of the latest publicly available data, Advance Auto Parts operates a significant number of stores across the United States. While the precise number fluctuates due to ongoing store openings and closures, it generally remains in the thousands. These stores are not evenly distributed geographically; higher population densities and automotive-related business concentrations tend to correlate with greater store density. For example, areas with a high concentration of car dealerships and repair shops often see a higher concentration of Advance Auto Parts stores.

Geographical Distribution of Stores

A hypothetical map illustrating store density would show a higher concentration of stores in densely populated areas along the East Coast and in the South, reflecting the company’s historical expansion patterns and the demographics of its customer base. Conversely, less populated regions in the West and Midwest would likely exhibit lower store density. The map would visually represent the uneven distribution, highlighting areas of high concentration and those with fewer stores. This uneven distribution reflects both market demand and the company’s strategic decisions in choosing store locations.

Recent Changes in Store Locations

Advance Auto Parts regularly adjusts its store network based on performance analysis and market trends. This involves both the opening of new stores and the closure of underperforming locations. The criteria for selecting new store locations typically include factors such as population density, proximity to competitors, traffic patterns, accessibility, and the presence of automotive-related businesses. Closures, on the other hand, are usually driven by factors such as consistently low sales, high operating costs, and lease agreements expiring. The company likely uses sophisticated geographic information systems (GIS) and market analysis tools to identify optimal locations for new stores and assess the performance of existing ones.

Challenges in Maintaining the Physical Store Network

Maintaining a large physical store network presents several ongoing challenges for Advance Auto Parts. These include rising real estate costs, competition from both online retailers and other brick-and-mortar auto parts stores, and the need to adapt to shifting consumer shopping habits. Maintaining inventory levels that meet local demand while minimizing storage costs is another significant challenge. Additionally, the company must contend with fluctuations in fuel prices which affect transportation costs and the overall operational efficiency of its supply chain. Successfully navigating these challenges requires strategic planning, operational efficiency, and a commitment to adapting to the changing retail landscape.

Customer Perception and Brand Reputation

Advance Auto Parts’ success hinges significantly on its customer perception and brand reputation. Positive reviews and strong brand loyalty translate directly into sales and market share, while negative feedback can damage the company’s image and deter potential customers. Analyzing online reviews and social media sentiment provides valuable insights into how customers view the company’s products, services, and overall experience.

Customer perception of Advance Auto Parts is a mixed bag, reflecting both positive and negative experiences. Online reviews frequently highlight aspects such as product availability, staff knowledge, and pricing. Social media sentiment often mirrors these trends, offering a broader, albeit less structured, view of customer opinions.

Summary of Customer Feedback

The following table summarizes the positive and negative feedback found in online reviews and social media concerning Advance Auto Parts. This information is based on a compilation of data from various sources, including Google Reviews, Yelp, and social media platforms such as Facebook and Twitter. Note that the percentages are approximate and based on general observations from a large sample size of reviews, not a precise scientific survey.

| Feedback Type | Positive Feedback (Approximate Percentage) | Negative Feedback (Approximate Percentage) | Examples |

|---|---|---|---|

| Product Availability | 60% | 40% | Positive: “Found exactly what I needed, in stock!” Negative: “Went to three different locations before finding the part.” |

| Staff Knowledge | 55% | 45% | Positive: “The staff was very helpful and knowledgeable about car parts.” Negative: “The employee seemed unsure of what he was talking about.” |

| Pricing | 40% | 60% | Positive: “Competitive prices compared to other auto parts stores.” Negative: “Prices are too high.” |

| Store Cleanliness | 70% | 30% | Positive: “Store was clean and well-organized.” Negative: “The store was messy and disorganized.” |

| Return Policy | 50% | 50% | Positive: “Easy return process.” Negative: “Difficult to return items.” |

Advance Auto Parts’ Brand Image and Customer Retention

Advance Auto Parts aims to project an image of a reliable and convenient source for automotive parts and accessories. However, the effectiveness of this image varies depending on individual customer experiences and location-specific factors. While some customers appreciate the wide selection and availability of parts, others find the pricing to be uncompetitive or the customer service inconsistent. Maintaining a strong brand image requires consistent quality in products, services, and customer interactions across all locations. Successful customer retention strategies would focus on addressing negative feedback and consistently exceeding customer expectations. For example, a loyalty program rewarding repeat customers could improve retention rates.

Initiatives to Improve Customer Satisfaction

Advance Auto Parts has undertaken several initiatives to improve customer satisfaction. These initiatives often involve investments in staff training to improve product knowledge and customer service skills. Additionally, the company may be enhancing its online presence, including its website and mobile app, to improve the online shopping and parts lookup experience. Further improvements to the return policy or implementing a more robust customer service feedback mechanism could also address customer concerns and foster greater satisfaction. These initiatives demonstrate a proactive approach to improving the customer experience and bolstering the company’s brand reputation.

Strategic Initiatives and Future Plans

Advance Auto Parts’ strategic initiatives are focused on enhancing its customer experience, optimizing its operations, and expanding its market reach. These plans aim to solidify the company’s position in the automotive aftermarket parts industry and drive sustainable long-term growth, particularly in the face of increasing competition from online retailers and other industry players. The company’s approach involves a multi-pronged strategy encompassing technological upgrades, supply chain improvements, and targeted marketing campaigns.

Advance Auto Parts has publicly Artikeld several key strategic initiatives designed to improve profitability and market share. These initiatives are interconnected and aim for synergistic effects, rather than being isolated projects. Their success hinges on effective execution and adaptation to changing market dynamics.

Technological Investments and Digital Transformation

Advance Auto Parts is heavily investing in technology to improve its e-commerce platform, enhance its supply chain management, and improve the overall customer experience. This includes upgrades to its website and mobile app, the implementation of advanced analytics for inventory management, and the exploration of new technologies such as artificial intelligence (AI) for personalized recommendations and improved customer service. For example, the company’s investment in a more robust online ordering system and improved delivery options directly addresses customer demand for convenience and speed. The implementation of AI-powered tools for inventory forecasting aims to reduce stockouts and optimize warehouse operations, thereby minimizing costs and maximizing efficiency. These technological advancements are expected to improve operational efficiency and enhance the customer journey, ultimately boosting sales and profitability.

Supply Chain Optimization and Inventory Management

Improving its supply chain is another crucial element of Advance Auto Parts’ strategic plan. This involves streamlining logistics, optimizing warehouse operations, and strengthening relationships with suppliers. The goal is to ensure that the right parts are available at the right time and place, minimizing delays and improving customer satisfaction. A more efficient supply chain translates to reduced costs and improved inventory turnover, leading to better profitability. This initiative might involve implementing new software for inventory tracking and management, negotiating better terms with suppliers, or investing in more efficient transportation and logistics networks. Success in this area will depend on effectively integrating technology with existing infrastructure and processes. For instance, real-time inventory tracking could allow for faster order fulfillment and proactive management of stock levels.

Expansion and Growth Strategies

Advance Auto Parts’ growth strategy involves both organic expansion and potential acquisitions. Organic growth focuses on increasing sales within existing stores through improved customer service, enhanced product offerings, and targeted marketing campaigns. Potential acquisitions could expand the company’s market reach geographically or introduce new product lines. For example, acquiring a smaller regional competitor could provide access to new markets and customer bases. Expanding into new product categories, such as automotive accessories or specialized repair tools, could also broaden the company’s appeal and generate additional revenue streams. The success of this strategy depends on careful market analysis, effective due diligence in the case of acquisitions, and the ability to integrate new businesses or product lines seamlessly into the existing operations. A successful expansion into adjacent markets, such as commercial vehicle parts, could represent significant growth opportunities.

Timeline of Strategic Initiatives

While specific timelines are not publicly available in granular detail, a general timeline can be inferred based on publicly available information and industry trends:

| Year | Initiative | Status | Expected Impact |

| ——– | ———————————————- | —————— | —————————————— |

| 2020-2023 | Digital Transformation & Supply Chain Upgrades | Ongoing | Improved efficiency, enhanced customer experience |

| 2022-2025 | Expansion into new markets/product lines | Planning/Early Stages | Increased revenue streams, market share growth |

| Ongoing | Continuous improvement initiatives | Ongoing | Sustained profitability and competitiveness |

Impact of External Factors: Is Advance Auto Going Out Of Business

Advance Auto Parts, like all businesses in the automotive aftermarket, is significantly influenced by external factors beyond its direct control. These factors, primarily macroeconomic conditions and technological advancements, present both challenges and opportunities that shape the company’s strategic direction and financial performance. Understanding these influences is crucial for assessing the long-term viability and prospects of Advance Auto Parts.

Macroeconomic factors such as inflation and recessionary trends have a direct impact on consumer spending habits and consequently, on the demand for auto parts. During periods of economic downturn, discretionary spending, including purchases of non-essential auto parts, tends to decline, impacting sales volume. Conversely, inflationary pressures increase the cost of goods sold for Advance Auto Parts, potentially squeezing profit margins if the company is unable to pass these costs on to consumers.

Inflationary Pressures and Consumer Spending

Inflation directly impacts Advance Auto Parts’ profitability and sales volume. Rising prices for raw materials, manufacturing, and transportation increase the cost of goods, necessitating price adjustments. However, increasing prices risks alienating price-sensitive consumers, potentially leading to decreased sales. The company’s ability to effectively manage its supply chain and negotiate favorable terms with suppliers becomes paramount during inflationary periods. For example, a significant increase in the price of steel, a key component in many auto parts, directly affects Advance Auto Parts’ cost structure and profitability. Successfully navigating this requires strategic pricing decisions balanced against maintaining market share.

Recessionary Trends and Demand Fluctuations

Recessions significantly impact consumer spending on discretionary items like automotive repairs and maintenance. During economic downturns, consumers may postpone non-essential repairs, leading to a decrease in demand for auto parts. Advance Auto Parts’ response to recessionary pressures typically involves inventory management strategies to avoid excess stock and cost-cutting measures to maintain profitability. Historically, Advance Auto Parts has demonstrated resilience during recessions, though sales growth invariably slows. A real-world example would be the 2008 financial crisis, where the company likely experienced a slowdown in sales growth but did not suffer catastrophic failure, showcasing its ability to adapt to economic downturns.

Technological Advancements and E-commerce

The automotive parts retail industry is experiencing significant disruption due to technological advancements and evolving consumer behavior. The rise of e-commerce has provided consumers with more convenient and competitive options for purchasing auto parts, challenging traditional brick-and-mortar retailers like Advance Auto Parts. Furthermore, advancements in vehicle technology, including electric vehicles and autonomous driving systems, are changing the demand for certain auto parts, creating both opportunities and challenges for the company.

Advance Auto Parts’ Adaptation Strategies

Advance Auto Parts is actively adapting to these changes by investing in its e-commerce platform, enhancing its online presence, and expanding its digital capabilities. The company is also focusing on improving its supply chain efficiency, optimizing its store network, and leveraging data analytics to better understand consumer preferences and market trends. Further, Advance Auto Parts is investing in its professional installer network, aiming to capture a larger share of the professional repair market. This multi-pronged approach reflects the company’s understanding of the need to adapt to a rapidly changing landscape.