Is business trends and outlook survey mandatory? The question itself sparks debate, touching upon legal obligations, economic benefits, and the burden placed on businesses. Understanding the nuances of mandatory surveys requires navigating a complex landscape of regulations, varying across jurisdictions and industries. This exploration delves into the legal frameworks underpinning these surveys, examining the penalties for non-compliance and the diverse types of surveys employed. We’ll also weigh the benefits against the potential costs, considering alternative data sources and the impact on businesses of all sizes.

This analysis dissects the purpose and benefits of participating in such surveys, showcasing how the data informs crucial government policy decisions and aids in forecasting economic trends. We will examine different survey methodologies, data collection techniques, and the critical role of survey design in ensuring reliable results. Finally, we’ll explore strategies for minimizing the impact of mandatory surveys and highlight alternative data sources for businesses seeking a comprehensive understanding of market trends.

Legal and Regulatory Aspects of Business Surveys: Is Business Trends And Outlook Survey Mandatory

Mandatory business surveys, while crucial for economic planning and policy-making, operate within a complex legal framework. Understanding the legal basis for these surveys, potential penalties for non-compliance, and variations across industries and jurisdictions is vital for businesses to ensure compliance and avoid potential repercussions. This section Artikels the key legal and regulatory considerations surrounding mandatory business surveys.

Legal Basis for Mandatory Business Surveys

The legal basis for mandatory business surveys varies significantly across jurisdictions. Many countries empower their statistical agencies or government departments to collect data deemed necessary for public interest. This authority is typically derived from legislation that explicitly grants the power to mandate participation in surveys and defines the scope of data collection. The legal justification often centers on the need for accurate economic indicators, effective policy formulation, and the monitoring of national performance. These laws frequently incorporate provisions to protect respondent confidentiality and data security.

Penalties for Non-Compliance with Mandatory Business Surveys

Non-compliance with mandatory business surveys carries various penalties, depending on the specific legislation and jurisdiction. These penalties can range from administrative fines to criminal charges. Administrative fines are common, often calculated based on the size of the business and the severity of the non-compliance. In some cases, repeat offenders may face escalating penalties. More serious violations can lead to criminal prosecution, resulting in significant fines or even imprisonment. Furthermore, non-compliance can damage a business’s reputation and credibility, leading to potential difficulties in securing future contracts or funding.

Examples of Laws and Regulations Mandating Business Surveys

Several countries have specific laws and regulations mandating business surveys. For example, the U.S. has various acts authorizing data collection by agencies like the Bureau of Labor Statistics (BLS) and the Census Bureau. The U.K. relies on legislation like the Statistics and Registration Service Act 2007. Similarly, the European Union has regulations protecting data privacy while allowing for mandatory data collection for statistical purposes. These laws often Artikel the types of data that can be collected, the methods of collection, and the protections afforded to respondents. The specific requirements and penalties vary depending on the legislation and the agency conducting the survey.

Comparison of Mandatory Survey Requirements Across Industries

The requirements for mandatory business surveys often differ across industries. Industries considered strategically important, such as finance, energy, or healthcare, may face more stringent requirements and more frequent surveys than others. This is because data from these sectors is crucial for macroeconomic stability and public welfare. The type of data collected also varies. For example, manufacturing businesses might be surveyed on production volumes, while financial institutions might be asked to report on lending activity. This differentiation reflects the specific needs of policymakers in monitoring different sectors of the economy.

Comparative Table of Mandatory Business Survey Regulations

| Country | Relevant Law/Regulation | Penalties for Non-Compliance | Affected Industries |

|---|---|---|---|

| United States | Various Acts (e.g., those authorizing data collection by BLS and Census Bureau) | Administrative fines, potential legal action | Broad range, including manufacturing, retail, finance |

| United Kingdom | Statistics and Registration Service Act 2007 | Fines, legal proceedings | Various, depending on specific surveys |

| European Union | EU regulations on statistical data collection (with GDPR considerations for data privacy) | Vary by member state, potentially including fines and legal action | Wide range, subject to EU-level statistical needs |

| Canada | Statistics Act | Fines | Various, including agriculture, manufacturing, services |

The Purpose and Benefits of Business Trend Surveys

Business trend surveys serve as crucial tools for understanding the current economic landscape and anticipating future developments. By gathering data directly from businesses, these surveys provide valuable insights that benefit both the private and public sectors, facilitating informed decision-making and promoting economic growth. The benefits extend beyond simple data collection; they contribute to a more robust and resilient economy.

Business trend surveys offer significant economic advantages to participating businesses. Access to aggregated data provides a competitive edge, allowing companies to benchmark their performance against industry peers and identify areas for improvement. Furthermore, understanding broader economic trends enables businesses to make more strategic decisions regarding investment, resource allocation, and future planning, mitigating risks and maximizing opportunities. This proactive approach can lead to increased profitability and sustained growth.

Economic Benefits of Participation

Participating in business trend surveys offers several direct and indirect economic benefits. Direct benefits include improved market understanding, enabling better resource allocation and more effective marketing strategies. Indirect benefits arise from the improved policy environment fostered by accurate economic data. For instance, a business that accurately anticipates a downturn due to survey data might adjust its inventory levels, avoiding costly overstocking. Conversely, a positive outlook revealed by the survey might encourage expansion and investment. The cumulative effect of informed business decisions across the economy leads to greater overall efficiency and productivity.

Survey Data’s Influence on Government Policy

Government agencies utilize data from business trend surveys to inform crucial policy decisions. For example, data on employment trends and anticipated hiring patterns can influence decisions regarding unemployment benefits, job training programs, and fiscal stimulus packages. Similarly, data on inflation expectations and consumer spending can inform monetary policy decisions by central banks. The impact of the 2008 financial crisis highlighted the critical need for accurate, real-time data; surveys played a key role in understanding the severity and nature of the crisis, informing subsequent government responses. This demonstrates how accurate data, collected through surveys, is vital in shaping effective policy responses to economic challenges.

Scenario: A Business Benefiting from Survey Participation

Imagine a small manufacturing company specializing in producing sustainable packaging. Participation in a business trend survey reveals a growing consumer preference for eco-friendly products and a projected increase in demand for sustainable packaging solutions. Armed with this information, the company can strategically invest in expanding its production capacity, develop new product lines catering to this growing market segment, and confidently seek additional investment. This proactive approach, based on survey data, positions the company for significant growth and market leadership within its niche.

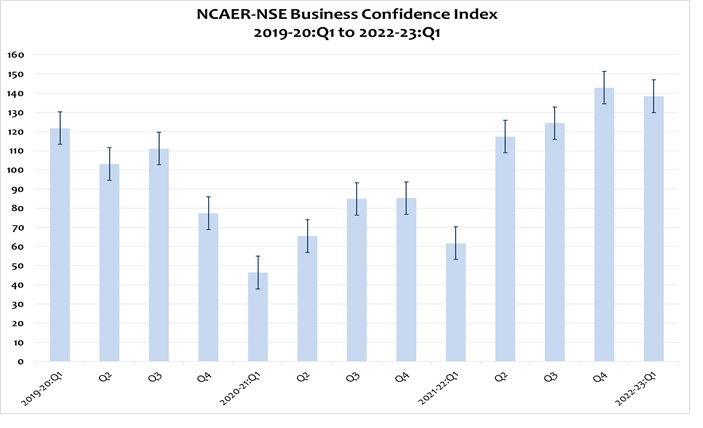

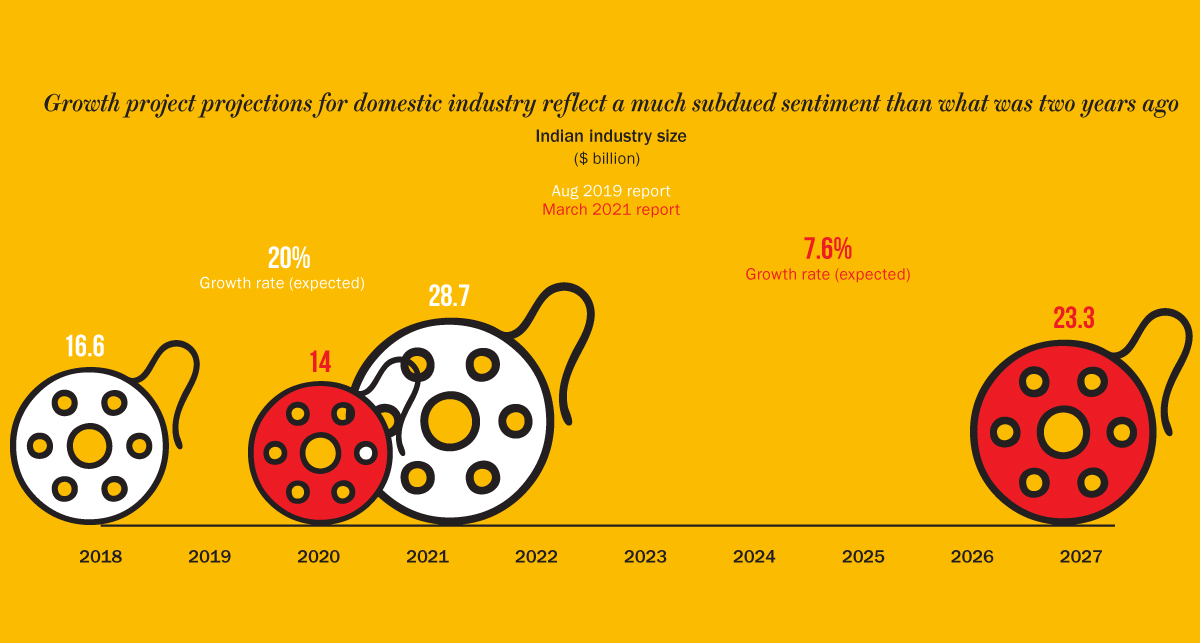

Business Surveys and Economic Forecasting

Business surveys are invaluable tools for forecasting economic trends. By tracking key indicators such as sales expectations, investment plans, and employment intentions, economists can construct leading indicators that predict future economic activity. These indicators are crucial for anticipating potential economic downturns or booms, enabling businesses and governments to take preventative or proactive measures. For example, a decline in business investment intentions signaled by a survey might precede an actual economic slowdown, providing businesses time to adjust their strategies and governments time to implement stabilizing policies.

Utilizing Survey Data: Business Applications

Businesses leverage survey data in numerous ways:

- Market Research and Product Development: Understanding consumer preferences and trends helps businesses develop new products and services that meet market demand.

- Strategic Planning and Resource Allocation: Survey data informs decisions about investment, expansion, and resource allocation, maximizing efficiency and profitability.

- Risk Management: Anticipating economic downturns and market shifts enables businesses to mitigate risks and protect their financial stability.

- Competitive Analysis: Benchmarking performance against industry peers helps identify areas for improvement and gain a competitive advantage.

- Sales Forecasting and Inventory Management: Accurate sales forecasts based on survey data optimize inventory levels, reducing costs and minimizing waste.

Types of Business Trend and Outlook Surveys

Business trend and outlook surveys come in various forms, each designed to gather specific information using tailored methodologies. Understanding these differences is crucial for interpreting survey results accurately and applying them effectively to business strategy. The choice of survey type depends heavily on the objectives, target audience, resources available, and the desired level of detail.

Government-Led Business Surveys

Government agencies frequently conduct large-scale surveys to track macroeconomic indicators, assess industry performance, and inform policy decisions. These surveys often employ rigorous methodologies to ensure representativeness and accuracy. The U.S. Census Bureau’s Annual Retail Trade Survey, for example, uses a stratified sampling technique to collect data from a representative sample of retail businesses across the country, providing insights into sales, employment, and inventory levels. Data collection relies on mailed questionnaires, online forms, and telephone interviews, with robust quality control measures in place to minimize errors. The resulting data is often publicly available and used by economists, researchers, and businesses to understand broader economic trends.

Industry-Specific Business Surveys

These surveys focus on particular sectors, providing detailed insights into specific trends and challenges. For example, the Semiconductor Industry Association might conduct a survey focusing on chip manufacturers, examining production capacity, sales forecasts, and investment plans. Methodologies can vary, from online questionnaires targeting members to more in-depth interviews with key executives. Data sources might include direct responses from businesses, supplemented by publicly available industry data and expert analysis. The reliability of these surveys hinges on the participation rate and the accuracy of responses provided by industry players. A high response rate, combined with clear survey design, boosts the validity of the results.

Academic and Research-Based Business Surveys

Universities and research institutions often conduct surveys to explore specific business phenomena, testing hypotheses and contributing to academic literature. These surveys frequently employ advanced statistical techniques and rigorous sampling methods. For example, a study on the impact of e-commerce on small businesses might use a combination of quantitative surveys and qualitative interviews to gather both numerical data and rich contextual information. Data collection may involve online questionnaires, in-person interviews, and even focus groups, ensuring a multi-faceted approach to data gathering. The design and analysis are typically subject to peer review, enhancing the reliability and validity of findings.

Custom Business Surveys

These surveys are tailored to the specific needs of individual companies or organizations. A company might commission a survey to assess customer satisfaction, gauge employee morale, or explore market potential for a new product. Methodologies range from simple online questionnaires to more complex multi-stage surveys incorporating different data collection methods. The data sources are often proprietary and specific to the organization commissioning the survey. The reliability and validity depend heavily on the survey’s design, the quality of the sample, and the accuracy of data analysis. For instance, a poorly designed customer satisfaction survey could yield misleading results and misinform strategic decision-making.

Comparison of Survey Types

| Survey Type | Methodology | Data Sources |

|---|---|---|

| Government-Led | Stratified sampling, probability sampling, questionnaires, telephone interviews, online forms | Direct responses from businesses, administrative data |

| Industry-Specific | Targeted sampling, online questionnaires, interviews, industry reports | Direct responses, industry publications, publicly available data |

| Academic/Research | Random sampling, mixed-methods approach (quantitative and qualitative), statistical analysis | Surveys, interviews, focus groups, existing datasets |

| Custom | Various, depending on objectives; online questionnaires, interviews, focus groups | Direct responses, internal company data, market research reports |

Impact of Mandatory Surveys on Businesses

Mandatory business surveys, while offering valuable insights for policymakers and researchers, can impose significant burdens on participating businesses. The extent of this burden varies considerably depending on factors such as business size, industry, and the complexity of the survey itself. Understanding these impacts is crucial for designing effective and efficient data collection strategies.

Burden on Businesses Due to Mandatory Surveys

Mandatory surveys demand significant resources from businesses, impacting both operational efficiency and profitability. The time commitment alone can be substantial, requiring employees to gather data, complete questionnaires, and potentially undergo training to ensure accurate responses. This diverted time could otherwise be dedicated to core business activities, potentially leading to lost productivity and missed opportunities. For instance, a small retailer might spend several hours compiling sales data for a mandatory economic survey, time that could have been used serving customers or managing inventory. Larger companies, while possessing more resources, may still experience significant disruptions due to the sheer volume of data required and the need to coordinate responses across multiple departments.

Costs Associated with Mandatory Business Surveys

Compliance with mandatory surveys translates into tangible costs. Direct costs include the salaries of employees involved in data collection and reporting, the cost of software or other tools used for data management, and potentially the fees paid to external consultants for assistance in completing the survey. Indirect costs are equally significant and often harder to quantify. These include lost productivity, potential errors in data collection leading to costly revisions, and the opportunity cost of time spent on the survey rather than revenue-generating activities. For example, a manufacturing company might need to temporarily halt a production line to accurately record relevant data, resulting in lost production time and revenue. The cumulative effect of these costs can be substantial, particularly for smaller businesses with limited resources.

Strategies to Minimize the Impact of Mandatory Surveys

Businesses can implement several strategies to mitigate the negative impacts of mandatory surveys. Effective planning is paramount, involving a dedicated team to oversee the survey process, allocate sufficient time and resources, and develop clear protocols for data collection. Utilizing existing data management systems can streamline the process and reduce the need for manual data entry. Training employees on the specific requirements of the survey can minimize errors and ensure accurate reporting. Leveraging technology, such as automated data extraction tools, can significantly reduce the time and effort required for data collection. Finally, proactive communication with the surveying body can clarify ambiguities and address concerns before they escalate into major problems.

Impact of Mandatory Surveys: Small Businesses vs. Large Corporations

The impact of mandatory surveys disproportionately affects small businesses. Large corporations generally possess more resources, dedicated personnel, and sophisticated data management systems to handle the demands of such surveys. They can more easily absorb the costs and dedicate staff to manage the process. Small businesses, however, often lack these resources, and the burden of compliance can be significantly more challenging, potentially impacting their viability. A small business might find the time commitment of a mandatory survey overwhelming, diverting valuable resources from other critical tasks, while a large corporation might allocate the task to a specialized department with minimal disruption to core operations.

Potential Impacts of Mandatory Surveys on Businesses

The following points summarize the potential positive and negative impacts of mandatory business surveys:

- Negative Impacts: Increased administrative burden, financial costs (direct and indirect), loss of productivity, potential for errors, diversion of resources from core business activities, potential for competitive disadvantage if information is revealed.

- Positive Impacts: Improved data-driven decision-making based on industry trends, potential for government support or policy changes based on survey findings, opportunity to benchmark performance against industry peers, enhanced understanding of regulatory landscape, potential for identification of areas for improvement and growth.

Alternative Data Sources for Business Trend Analysis

Businesses increasingly rely on data-driven decision-making. While mandatory surveys offer valuable insights, they often lack the granularity or timeliness needed for agile responses to evolving market conditions. Exploring alternative data sources expands a company’s analytical capabilities, providing a more comprehensive understanding of business trends. This section examines several such sources, comparing their strengths and weaknesses relative to mandatory surveys.

Alternative Data Sources Overview, Is business trends and outlook survey mandatory

A range of alternative data sources can supplement or even replace mandatory surveys for business trend analysis. These sources offer diverse perspectives and often provide more granular, real-time information. However, it’s crucial to understand their limitations and biases before integrating them into a comprehensive analysis strategy. Careful consideration of data quality and reliability is paramount.

Strengths and Weaknesses of Alternative Data Sources

Each alternative data source possesses unique strengths and weaknesses. For example, social media data offers real-time sentiment analysis but can be noisy and prone to biases. Conversely, transactional data provides precise sales figures but may lack context regarding consumer motivations. A balanced approach involves leveraging the strengths of multiple sources to mitigate individual weaknesses.

Reliability and Validity Compared to Mandatory Surveys

The reliability and validity of alternative data sources vary considerably compared to mandatory surveys. Mandatory surveys, while potentially time-consuming and costly, generally offer higher levels of data quality and representativeness due to their structured design and larger sample sizes. Alternative data sources, however, often offer greater timeliness and granularity, providing insights into specific market segments or consumer behaviors that mandatory surveys might miss. The choice depends on the specific business need and the trade-off between accuracy and speed.

Integrating Data from Multiple Sources

Integrating data from multiple sources requires a robust data management and analysis strategy. This involves data cleaning, standardization, and the application of appropriate analytical techniques. For example, combining social media sentiment with sales data can provide a nuanced understanding of consumer responses to a new product launch. Similarly, combining web analytics with economic indicators can provide a more comprehensive forecast of future demand. The key is to develop a holistic view by considering the interplay between different data sets.

Alternative Data Sources Table

| Data Source | Characteristics |

|---|---|

| Social Media Data (e.g., Twitter, Facebook, Instagram) | Real-time sentiment analysis, consumer feedback, brand mentions; susceptible to bias, noisy data, requires sophisticated analysis techniques. |

| Web Analytics (e.g., Google Analytics) | Website traffic, user behavior, conversion rates; provides insights into online consumer behavior, limited offline data. |

| Transactional Data (e.g., Point-of-Sale systems) | Sales figures, purchase patterns, customer demographics; precise quantitative data, limited qualitative insights. |

| Economic Indicators (e.g., GDP, inflation, unemployment) | Macroeconomic trends, market conditions; provides context for business performance, may not reflect micro-level trends. |

| Search Engine Data (e.g., Google Trends) | Search volume, trending topics; reflects consumer interest, may not directly translate to sales. |

| Competitor Analysis (e.g., market share, pricing strategies) | Competitive landscape, market positioning; provides insights into competitor activities, requires thorough research. |