Is coffee a business expense? The answer, surprisingly, isn’t always a simple yes or no. The tax deductibility of your daily caffeine fix hinges on several factors, from the context of the purchase to meticulous record-keeping. This guide navigates the complexities of claiming coffee costs, exploring scenarios where it’s a legitimate write-off and situations where it’s firmly in the realm of personal expenses. We’ll delve into IRS guidelines, explore different business structures, and offer practical advice for documenting your coffee purchases to ensure a smooth tax season.

Understanding the rules surrounding coffee expenses is crucial for small business owners and large corporations alike. The line between a deductible business expense and a non-deductible personal one can be surprisingly blurry. This guide provides clarity, offering real-world examples and hypothetical scenarios to illustrate the nuances of claiming coffee on your tax return. We’ll also cover the implications of different accounting methods and how to appropriately categorize coffee expenses in your accounting system. By the end, you’ll be equipped to confidently navigate the world of coffee and taxes.

Tax Deductibility of Coffee Expenses: Is Coffee A Business Expense

The Internal Revenue Service (IRS) allows deductions for business expenses, but the line between personal and business expenses can be blurry, especially with seemingly minor items like coffee. Understanding the IRS guidelines on deductibility is crucial for maximizing tax benefits while remaining compliant. This section clarifies the rules surrounding coffee expenses and provides practical examples to illustrate the key distinctions.

IRS Guidelines on Coffee Expense Deductibility

The IRS generally allows the deduction of ordinary and necessary business expenses. To be deductible, an expense must be both common and accepted in your industry and helpful and appropriate for your business. Coffee expenses can qualify if they directly relate to a business activity, such as client meetings or employee morale. However, purely personal coffee consumption is not deductible. The key lies in demonstrating a direct connection between the coffee purchase and a legitimate business function. The burden of proof rests with the taxpayer to substantiate these claims.

Examples of Deductible and Non-Deductible Coffee Expenses

Deductible coffee expenses typically involve situations where the coffee is provided to clients or employees as part of a business function. For example, providing coffee at a client meeting to foster a positive business relationship is generally deductible. Similarly, providing coffee in the office to boost employee morale and productivity could also be considered a deductible business expense.

Conversely, coffee purchased for personal consumption at home or during a personal errand is not deductible. Simply enjoying a cup of coffee at your desk while working on personal tasks does not qualify as a business expense. The determining factor is whether the coffee purchase directly supports a business activity.

Distinguishing Between Personal and Business Coffee Consumption

Consider these scenarios: Scenario A: You meet a potential client at a café and purchase two coffees, one for yourself and one for the client. The cost of both coffees could be considered a deductible business expense as they directly facilitated a business meeting. Scenario B: You purchase a large coffee for yourself on your way to work. This is a personal expense and not deductible. Scenario C: You purchase a coffee maker and coffee beans for your office to provide coffee for employees. This purchase is likely deductible as it contributes to employee morale and productivity. The key difference lies in the direct connection to a business activity.

Documentation Required for Coffee Expense Deductions

To support a deduction for coffee expenses, maintain meticulous records. This typically includes receipts, invoices, or credit card statements clearly indicating the date, amount, and purpose of the purchase. Detailed descriptions are essential, especially when claiming larger amounts. For example, a receipt simply stating “coffee” is insufficient; a more detailed description such as “Coffee purchased for client meeting with John Smith at The Coffee Bean & Tea Leaf” is significantly stronger evidence. Maintaining a well-organized expense log, linking each coffee purchase to a specific business activity, further strengthens your position during an audit.

Hypothetical Tax Scenario: Coffee Expense Deductibility

Imagine a small business owner, Sarah, who runs a consulting firm. During the year, Sarah incurred the following coffee-related expenses:

* $50 – Coffee purchased for client meetings (receipts available)

* $100 – Coffee maker and coffee for the office (invoice available)

* $75 – Personal coffee purchases (no documentation)

Only the $50 spent on client meetings and the $100 spent on the office coffee maker and supplies are deductible. The $75 spent on personal coffee is not. Therefore, Sarah can deduct $150 in coffee-related expenses on her tax return. This deduction will reduce her taxable income, resulting in lower tax liability. It is crucial to maintain accurate records to support these deductions.

Coffee Expenses in Different Business Contexts

The deductibility of coffee expenses hinges significantly on the business context. Factors such as business size, the recipient of the coffee (employee or client), and the purpose of purchase (office use or client meetings) all play a crucial role in determining the tax implications. Understanding these nuances is vital for accurate financial reporting and maximizing tax benefits.

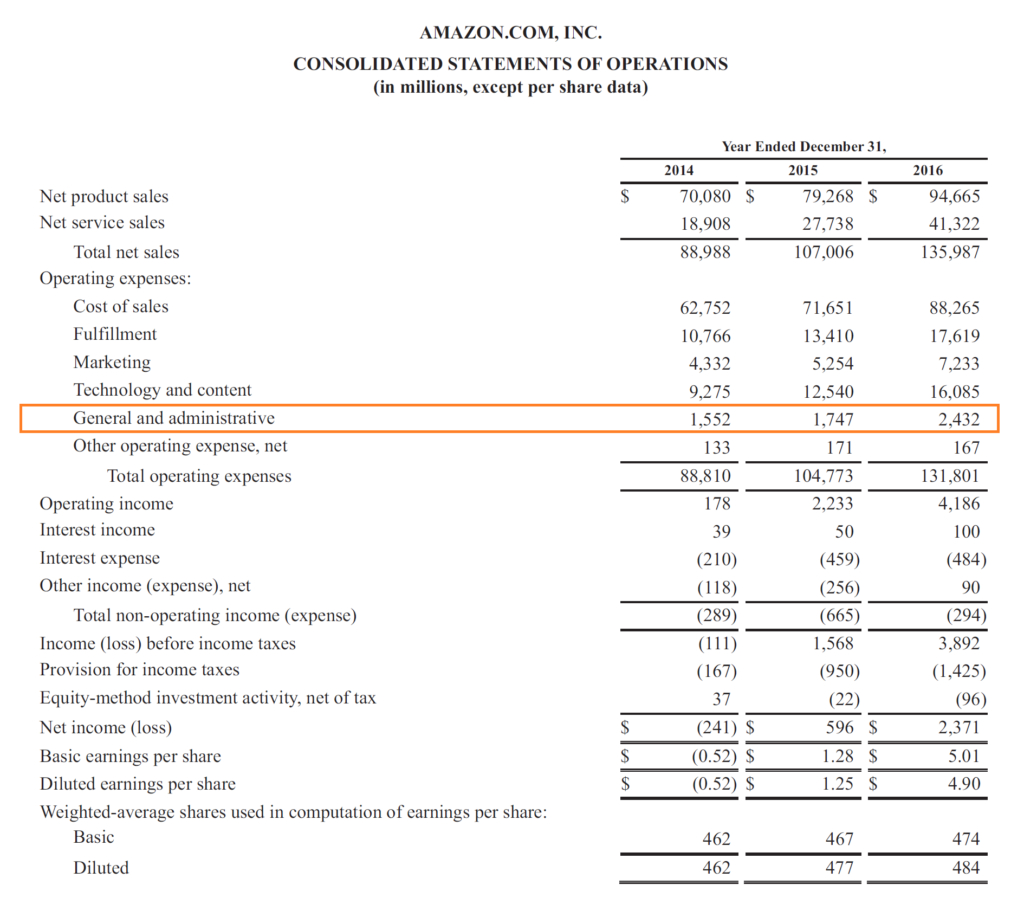

Coffee Expense Deductibility: Small Businesses vs. Large Corporations

While the underlying principle—that ordinary and necessary business expenses are deductible—applies to both small businesses and large corporations, the practical application differs. Small businesses often face simpler accounting processes, and the documentation requirements for coffee expenses might be less stringent. Large corporations, however, operate under more complex accounting structures and internal controls, requiring more meticulous record-keeping and potentially stricter justifications for expense claims. For example, a small bakery might easily deduct the cost of coffee for its employees without extensive documentation, whereas a multinational corporation would likely need to demonstrate that coffee purchases align with specific departmental budgets and business objectives. The IRS scrutiny might also differ; a small business might face less intense auditing than a large corporation.

Tax Implications: Providing Coffee to Employees vs. Clients

Providing coffee to employees is generally considered a de minimis benefit, meaning it’s a small, insignificant benefit that’s not subject to taxation for both the employer and employee. However, there are limits; excessive or lavish coffee provisions could be considered taxable compensation. Providing coffee to clients, on the other hand, is treated differently. The cost of coffee served to clients during business meetings is typically considered a deductible business expense, provided it’s directly related to generating business income. The key distinction lies in the primary purpose: employee coffee fosters morale and productivity, while client coffee aims to cultivate relationships and secure business deals.

Accounting Treatment: Office Coffee vs. Client Meeting Coffee, Is coffee a business expense

Coffee purchased for office use is generally categorized as an operating expense and deducted as such. The accounting treatment is straightforward, usually recorded as an office supply or miscellaneous expense. Conversely, coffee purchased specifically for client meetings is often categorized as a marketing or entertainment expense, and its deductibility might be subject to certain limitations, depending on the applicable tax laws and regulations. For example, the cost of coffee served at a lavish client dinner might be partially deductible, while the cost of coffee offered at a casual business meeting is likely fully deductible. Proper documentation, such as receipts and meeting notes, is crucial for justifying the expense.

Impact of Accounting Methods: Cash vs. Accrual

The choice between cash and accrual accounting methods affects the timing of expense recognition. Under cash accounting, coffee expenses are deducted in the period the payment is made. Under accrual accounting, expenses are deducted when they are incurred, regardless of when payment is made. For example, if a company orders coffee on December 31st but receives and pays for it in January, the expense is recorded in December under accrual accounting and in January under cash accounting. This difference can impact the company’s tax liability for the relevant tax year.

Tax Implications of Coffee Expenses Across Business Structures

| Business Structure | Deductibility of Office Coffee | Deductibility of Client Meeting Coffee | Additional Considerations |

|---|---|---|---|

| Sole Proprietorship | Generally deductible as an ordinary and necessary business expense. | Generally deductible, subject to limitations on entertainment expenses. | Expenses are reported on the owner’s personal income tax return. |

| Partnership | Generally deductible as an ordinary and necessary business expense. | Generally deductible, subject to limitations on entertainment expenses. | Expenses are reported on the partnership’s tax return and allocated to partners. |

| LLC | Generally deductible as an ordinary and necessary business expense. | Generally deductible, subject to limitations on entertainment expenses. | Deductibility depends on the LLC’s tax classification (pass-through or corporate). |

| Corporation | Generally deductible as an ordinary and necessary business expense. | Generally deductible, subject to limitations on entertainment expenses. | Expenses are reported on the corporation’s tax return. |

Reasonable vs. Excessive Coffee Expenses

Determining whether coffee expenses are legitimate business deductions hinges on the concept of reasonableness. The IRS scrutinizes expenses, ensuring they align with ordinary and necessary business practices. While a daily cup of coffee might be considered acceptable, extravagant purchases or excessive spending are unlikely to pass muster.

Examples of Reasonable and Excessive Coffee Expenditures

Reasonable coffee expenses typically involve purchasing coffee for meetings with clients or employees, or providing coffee for staff in a breakroom. For example, a small business owner might spend $20 per week on coffee for client meetings, or $50 per month on coffee and supplies for the office. Excessive spending, conversely, might involve purchasing high-end specialty coffees daily for personal consumption, or regularly buying expensive equipment like a high-end espresso machine solely for personal use. A business owner expensing $500 per month on personal coffee consumption, or $2,000 on a top-of-the-line espresso machine used primarily at home, would likely be flagged as excessive.

Factors Influencing the Determination of Reasonable Coffee Expenses

Several factors influence the IRS’s assessment of reasonable coffee expenses. Industry norms play a significant role; a tech startup might have higher acceptable coffee costs than a small accounting firm due to the prevalence of caffeine-fueled work environments in the tech industry. Business size is another key factor; larger companies with more employees will naturally have higher coffee expenses than smaller businesses. Location also matters; coffee prices vary geographically, and expenses should reflect the local cost of living. Finally, the specific business purpose is paramount; coffee purchased for client meetings is more easily justified than coffee for personal consumption.

Hypothetical Scenario Involving Excessive Coffee Expenses and Potential Tax Consequences

Imagine a small marketing agency owner who regularly charges $200 per month in coffee expenses to the business. This includes daily high-end lattes for themselves, and occasional coffees for employees. However, they rarely use the expense to entertain clients or have official meetings. If audited, the IRS might disallow a significant portion of these expenses, potentially resulting in additional tax liability, penalties, and interest. The agency owner could face an underpayment penalty, which could be 20% of the underpaid tax.

Strategies for Documenting Coffee Purchases to Ensure Reasonableness

Meticulous record-keeping is crucial. Maintain detailed receipts for all coffee purchases, clearly indicating the date, vendor, amount, and the business purpose. For instance, a receipt should specify “Coffee for client meeting with Acme Corp” instead of simply “Coffee.” Consider using accounting software to track expenses systematically. Regularly review expenses to identify any potential excesses. This proactive approach demonstrates a commitment to accurate financial reporting and minimizes the risk of IRS scrutiny.

Flowchart for Determining Reasonableness of Coffee Expenses

[A flowchart would be inserted here. It would visually represent a decision-making process. The flowchart would begin with a question such as “Was the coffee purchased for a business purpose?” If yes, it would proceed to questions such as “Was the purchase amount reasonable considering industry norms, business size, and location?” If yes, the expense would be deemed reasonable. If no, it would lead to the conclusion that the expense is excessive and not deductible. The flowchart would utilize yes/no decisions and branching paths to guide the user to a final determination.]

Coffee as a Business Entertainment Expense

The deductibility of coffee expenses as part of business entertainment hinges on several factors, primarily whether the coffee purchase directly relates to furthering business interests and meets the IRS’s criteria for entertainment expenses. While seemingly minor, coffee can be a legitimate business expense if properly documented and within reasonable limits. Understanding these limitations is crucial for tax compliance.

The Internal Revenue Service (IRS) places significant restrictions on deducting business entertainment expenses. Generally, only 50% of business entertainment expenses are deductible. This means that if you spend $10 on coffee during a client meeting, you can only deduct $5. Furthermore, the entertainment must be directly related to the active conduct of your trade or business. Simply enjoying coffee with colleagues doesn’t qualify; the meeting must have a clear business purpose. Excessive or lavish spending on coffee, regardless of the context, is unlikely to be fully deductible.

Deductible Coffee Expenses During Client Meetings

Coffee purchased during client meetings can be a deductible business entertainment expense provided the meeting serves a clear business purpose, such as closing a deal, negotiating a contract, or building a professional relationship. For example, purchasing coffee for a client during a presentation of your company’s services is likely deductible. Similarly, buying coffee for a prospective client during a preliminary meeting to discuss potential collaboration is also potentially deductible. The key is establishing a direct link between the coffee purchase and a specific business activity aimed at generating income or profit.

Documentation Requirements for Coffee as Business Entertainment

Adequate documentation is essential to substantiate any business expense claim, including coffee purchased for client meetings. This typically involves maintaining detailed records, such as receipts, credit card statements, or expense reports. These records should clearly indicate the date, amount, location of the purchase, the names of individuals involved in the meeting, and a concise description of the business purpose of the meeting. For example, a receipt from a coffee shop, combined with a calendar entry detailing the client meeting and its objective, provides sufficient evidence. Vague entries or lack of supporting documentation will likely lead to the IRS disallowing the deduction.

Coffee Expenses: Internal vs. Client Meetings

The deductibility of coffee purchased for internal meetings differs significantly from that of client meetings. While coffee purchased for internal meetings might be considered an ordinary and necessary business expense (potentially deductible under other categories like office supplies), it is less likely to qualify as a deductible business entertainment expense. The IRS generally does not consider internal meetings as “entertainment.” Therefore, coffee bought for a team brainstorming session, while a legitimate business expense, would likely be treated differently from coffee bought for a client meeting aimed at securing a new contract. The former would be subject to the usual rules governing office supplies and similar expenses, while the latter is subject to the 50% limitation for business entertainment.

Illustrative Examples of Coffee Expense Documentation

Proper documentation is crucial for successfully claiming coffee expenses as tax-deductible business costs. Failing to maintain adequate records can result in the disallowance of these expenses by tax authorities. The following examples illustrate the necessary information for different scenarios and highlight the consequences of insufficient documentation.

Essential Information for Coffee Expense Receipts

A valid coffee expense receipt should include several key pieces of information to support a deduction. This ensures clarity and allows for easy verification during tax audits. Missing even one critical element can jeopardize the claim.

- Date of Purchase: The date the coffee was purchased, ensuring it aligns with the relevant tax period.

- Vendor Name and Address: Clearly identifies the business from which the coffee was purchased.

- Description of Goods or Services: Specifies the type of coffee purchased (e.g., “Latte,” “Coffee Beans,” “Office Coffee Supplies”). For larger purchases, a detailed itemized list might be necessary.

- Quantity and Unit Price: The number of items purchased and the cost per item.

- Total Amount: The final cost of the purchase, including any applicable taxes.

- Payment Method: Indicates how the purchase was paid (e.g., credit card, cash, company check).

- Business Purpose: A brief explanation of the business reason for the purchase (e.g., “Client meeting,” “Office supplies,” “Employee morale”). This is crucial.

Illustrative Receipt Examples

Below are three examples demonstrating different business contexts for coffee expenses.

Example 1: Office Coffee Supplies

Date: October 26, 2024

Vendor: Office Depot

Address: 123 Main Street, Anytown, CA 91234

Description: 1 x 5lb Bag of Office Coffee

Quantity: 1

Unit Price: $25.00

Total: $25.00

Payment: Company Credit Card

Business Purpose: Office Coffee for Employees

Example 2: Client Meeting

Date: November 15, 2024

Vendor: Starbucks

Address: 456 Oak Avenue, Anytown, CA 91234

Description: 2 x Lattes

Quantity: 2

Unit Price: $5.00 each

Total: $10.00

Payment: Company Credit Card

Business Purpose: Meeting with Potential Client, John Smith

Example 3: Employee Perk

Date: December 1, 2024

Vendor: Local Coffee Shop

Address: 789 Pine Lane, Anytown, CA 91234

Description: Gift Card for Employee Appreciation

Quantity: 1

Unit Price: $20.00

Total: $20.00

Payment: Company Check

Business Purpose: Employee Appreciation – December Team Meeting

Scenario: Disallowed Coffee Expense

Imagine a scenario where an employee claims a coffee expense with only a handwritten note stating “Coffee for client meeting – $10.” This lacks essential details such as the date, vendor, and payment method. Without a proper receipt or sufficient supporting documentation, the tax authorities are unlikely to allow the deduction. The lack of verifiable information makes it impossible to confirm the legitimacy and business purpose of the expense.

Maintaining Organized Coffee Expense Records

Maintaining organized records of all coffee expenses is crucial for successful tax preparation and potential audits. A dedicated expense tracking system, either manual or digital, is recommended. This could involve a spreadsheet, accounting software, or a dedicated expense tracking app. All receipts should be filed chronologically and easily accessible. This systematic approach simplifies the process of compiling expense reports at tax time and significantly reduces the risk of disallowed deductions.

Categorizing Coffee Expenses in a Business Accounting System

Coffee expenses should be categorized appropriately within a business accounting system. Common categories might include “Office Supplies,” “Client Entertainment,” or “Employee Benefits.” Consistent categorization ensures accurate financial reporting and simplifies the process of analyzing business expenditures. The specific category will depend on the context of the coffee purchase, as demonstrated in the receipt examples above.