Is EVGA going out of business? The question hangs heavy in the air for PC enthusiasts, especially considering EVGA’s long-standing reputation and significant presence in the graphics card market. This isn’t just about a single company; it reflects broader trends impacting the GPU industry, from cryptocurrency mining’s volatile influence to persistent supply chain disruptions. We delve into EVGA’s recent history, financial performance, and public statements to dissect the rumors and assess the likelihood of this prominent player exiting the market.

Analyzing EVGA’s trajectory requires examining several key factors. Their product line evolution, market share compared to competitors like ASUS, MSI, and Gigabyte, and the impact of fluctuating cryptocurrency prices all play crucial roles. Furthermore, understanding EVGA’s financial health, including revenue streams and debt levels, provides a clearer picture of their stability. We’ll also consider the broader GPU market landscape and how factors like supply chain issues and intense competition affect their position.

EVGA’s Recent History and Market Position

EVGA’s recent history is marked by a significant shift in its business strategy, culminating in its exit from the GPU market. Understanding this requires examining its product evolution, market share, collaborations, and key events over the past five years. This analysis provides context for the company’s current situation and future prospects.

EVGA’s Product Line Evolution (2019-2024)

EVGA’s product line remained largely consistent in its core offerings throughout this period: high-performance graphics cards, motherboards, power supplies, and peripherals. However, the emphasis shifted. In the early years, the focus was heavily on high-end enthusiast-grade graphics cards, often featuring custom cooling solutions and overclocking capabilities. Later, as the cryptocurrency mining boom subsided and the GPU market became more saturated, EVGA’s offerings diversified slightly to include more mid-range options and a greater emphasis on their power supply units, recognized for their quality and reliability. The company also continued to invest in its peripheral line, although this segment remained relatively smaller compared to its GPU and PSU offerings. The most significant change was the eventual cessation of GPU production in 2022, leaving the other product categories to define the company’s future.

EVGA’s Market Share and Competition

Precise market share data for EVGA is difficult to obtain publicly, as most market analysis firms focus on the overall GPU market rather than individual manufacturers’ detailed breakdowns. However, it’s widely acknowledged that EVGA held a substantial, though not dominant, position in the high-end and enthusiast GPU segments in North America. Competitors like ASUS, MSI, Gigabyte, and Sapphire held larger overall market shares, particularly in the broader consumer segment, due to their wider range of products and global distribution networks. EVGA’s strategy of focusing on a more niche, high-performance market segment allowed it to command premium prices but also limited its overall market reach.

Significant Partnerships and Collaborations

EVGA has historically maintained strong relationships with NVIDIA, primarily as a board partner. This partnership was crucial to EVGA’s success, allowing them access to NVIDIA’s latest GPU technology. While the exact terms of their agreements were not public, the relationship was long-standing and deeply impactful on EVGA’s product development and market positioning. Beyond this core partnership, EVGA’s collaborations have been less prominent, focusing more on individual component suppliers rather than large-scale partnerships with other technology companies.

Timeline of Key Events in EVGA’s History

To better understand EVGA’s trajectory, consider this simplified timeline:

| Year | Event | Significance |

|---|---|---|

| 2019 | Continued success in high-end GPU market. | Solidified position as a major player in the enthusiast segment. |

| 2020 | GPU shortage impacts market; EVGA maintains strong demand. | Highlights the strength of their brand loyalty and product quality. |

| 2021 | Cryptocurrency mining boom begins to decline. | Increased competition and market saturation begins to affect profitability. |

| 2022 | EVGA announces exit from the GPU market. | A major turning point, signaling a significant strategic shift for the company. |

| 2023-2024 | Focus shifts to power supplies and other peripheral products. | EVGA seeks to redefine its brand and market presence. |

Financial Performance and Stability

EVGA, being a privately held company, does not publicly release detailed financial statements. This lack of transparency makes a comprehensive analysis of its financial performance and stability challenging. However, we can glean some insights from industry reports, analyst estimations, and publicly available information regarding its market share and operational history.

EVGA’s revenue streams primarily originate from the sales of its graphics cards, motherboards, power supplies, and other PC components. The volatility of the PC hardware market, influenced by factors such as cryptocurrency mining trends, component shortages, and fluctuating consumer demand, presents a significant source of instability. Changes in GPU pricing and availability, for instance, directly impact EVGA’s revenue and profitability. Furthermore, reliance on a few key suppliers for crucial components introduces potential risks to the supply chain.

EVGA’s debt levels and credit rating are not publicly available due to its private status. Assessing its financial health therefore relies heavily on indirect indicators, such as its ability to consistently invest in research and development, maintain a strong brand reputation, and navigate market fluctuations.

Comparison with Similar Companies

The following table compares EVGA’s estimated market position and inferred financial health (based on publicly available information for comparable companies) to those of publicly traded competitors. It’s important to note that this comparison is based on estimations and inferences due to EVGA’s private status, and precise financial figures are unavailable for direct comparison.

| Company | Revenue (USD Billion, Estimate) | Market Share (Estimate) | Financial Stability (Inferred) |

|---|---|---|---|

| EVGA (Estimate) | 0.5 – 1.0 (Industry estimations) | Significant, but precise figures unavailable | Moderate to High (based on historical market presence) |

| MSI | ~2 (Based on recent financial reports) | High | High (Publicly traded with consistent revenue) |

| ASUS | ~15 (Based on recent financial reports) | Very High | High (Publicly traded with strong revenue streams) |

| Gigabyte | ~2 (Based on recent financial reports) | High | High (Publicly traded with consistent revenue) |

The Impact of the GPU Market

The GPU market’s volatility significantly impacted EVGA’s decision to exit the GPU market. Understanding the current market dynamics, including the influence of cryptocurrency mining, supply chain issues, and intense competition, is crucial to analyzing EVGA’s strategic retreat.

The GPU market is characterized by cyclical demand influenced by several factors, creating a challenging environment for manufacturers. High-end GPUs, particularly those suitable for gaming and professional applications, experience periods of intense demand followed by significant drops, often linked to technological advancements and economic conditions. This inherent instability makes long-term planning and profitability difficult for companies operating within this sector.

Cryptocurrency Mining’s Impact on EVGA

The boom and bust cycles of cryptocurrency mining significantly affected GPU manufacturers like EVGA. During periods of high cryptocurrency prices, demand for high-performance GPUs skyrocketed, leading to shortages and inflated prices. EVGA, like other manufacturers, benefited from this increased demand. However, the subsequent crashes in cryptocurrency values resulted in a massive surplus of GPUs, plummeting prices, and severely impacting profitability. This volatility made it difficult for EVGA to accurately predict demand and manage its inventory effectively, contributing to financial instability. The sudden shifts in market demand made long-term planning and investment decisions extremely risky.

Supply Chain Disruptions and EVGA’s Operations

The global supply chain disruptions experienced in recent years, exacerbated by the COVID-19 pandemic and geopolitical factors, presented significant challenges for EVGA. Component shortages, increased shipping costs, and logistical delays impacted production timelines and increased manufacturing costs. These disruptions made it difficult for EVGA to meet the fluctuating demand for GPUs, leading to production bottlenecks and potentially impacting customer satisfaction. The inability to consistently deliver products on time and at competitive prices further strained EVGA’s already challenging market position.

The Competitive Landscape and EVGA’s Position

EVGA operated in a highly competitive market dominated by major players like NVIDIA and AMD. While EVGA established a strong reputation for quality and customer service, it lacked the economies of scale and diversified product portfolio of its larger competitors. This limited its ability to absorb the shocks caused by market fluctuations and supply chain disruptions. The intense competition, coupled with the challenges described above, put significant pressure on EVGA’s margins and profitability, ultimately contributing to its decision to withdraw from the GPU market. The market’s consolidation towards larger players further exacerbated EVGA’s difficulties in maintaining a sustainable market share.

EVGA’s Public Statements and Actions

EVGA’s departure from the GPU market was not a sudden event but rather a culmination of several factors, all reflected in the company’s public communications and internal restructuring. Understanding these actions provides crucial insight into the reasons behind their decision and the potential implications for their future.

EVGA’s official statements regarding its future have been relatively limited, focusing primarily on the cessation of its NVIDIA GPU partnership and the subsequent winding down of its graphics card business. While they haven’t explicitly declared bankruptcy or liquidation, their pronouncements have consistently emphasized a shift away from GPU manufacturing and sales, leaving the door open for future endeavors, though without specifics. The lack of detailed public statements contributes to the ongoing speculation surrounding their long-term plans.

Official Statements Regarding EVGA’s Future

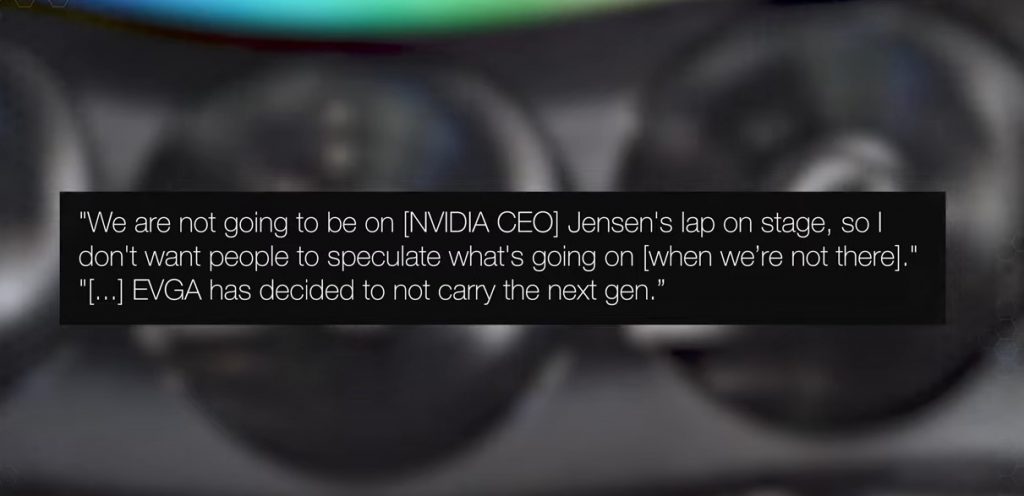

EVGA’s public communications have primarily been focused on informing customers and partners about the termination of their partnership with NVIDIA. These statements, disseminated through press releases and social media, highlighted the company’s decision to exit the graphics card market and emphasized a focus on other product lines. Specific details about these alternative product lines have remained scarce, fueling uncertainty about EVGA’s long-term vision. The overall tone of these statements was professional but lacked specifics regarding their strategic direction beyond the immediate cessation of GPU production and sales.

Changes in EVGA’s Leadership and Organizational Structure

While there haven’t been major public announcements regarding sweeping changes in EVGA’s top leadership, the shift away from GPU production likely involved significant internal restructuring. The downsizing of the teams directly involved in GPU design, manufacturing, and sales is a reasonable inference given the scale of their exit from that market segment. Specific details regarding layoffs or internal reorganization have not been publicly released by EVGA, but such actions would be expected as a consequence of their decision. This lack of transparency adds to the overall uncertainty surrounding the company’s internal operations.

Recent Product Announcements and Discontinuations

The most significant recent announcement from EVGA was the termination of their partnership with NVIDIA and the consequent discontinuation of their entire line of NVIDIA-based graphics cards. This marked a dramatic shift for the company, which had previously been a major player in the high-end GPU market. While EVGA continues to sell existing inventory and support existing products, there have been no new GPU product announcements. Their focus has clearly shifted away from this sector.

Actions Suggesting Future Plans

- Focus on Existing Product Lines: EVGA continues to support and sell products outside the GPU market, such as power supplies and motherboards, suggesting a strategy of focusing on these more established revenue streams.

- Strategic Partnerships: While not publicly announced, EVGA might be exploring strategic partnerships or acquisitions in other technology sectors to diversify their portfolio and reduce reliance on the volatile GPU market. This is a common strategy for companies seeking to adapt to changing market conditions.

- Internal Restructuring: The significant restructuring within the company, though not explicitly detailed, likely involves re-allocating resources and personnel to support their remaining product lines and explore new opportunities.

- Silence on Future Products: The lack of public announcements regarding new product lines could indicate a period of strategic planning and evaluation before launching any major initiatives. This cautious approach suggests a deliberate and potentially long-term strategy.

Speculation and Industry Analysis

The abrupt cessation of EVGA’s GPU partnership with NVIDIA fueled intense speculation regarding the company’s future. This wasn’t simply a matter of a contract expiring; the timing and the lack of clear communication from EVGA ignited concerns about potential financial difficulties or strategic shifts within the company. Analyzing these speculations requires examining various factors, including market trends, EVGA’s financial health, and the overall competitive landscape of the GPU market.

Reasons for Speculation about EVGA’s Future

The primary driver of speculation was the unexpected end of EVGA’s long-standing partnership with NVIDIA. This collaboration was crucial to EVGA’s success, forming the backbone of its product line and brand recognition. The lack of transparency surrounding the decision, coupled with the absence of a clear explanation from either company, further fueled uncertainty. Market observers pointed to potential factors like declining GPU sales, increased competition from other board partners, and possibly even internal financial pressures within EVGA as potential contributing factors. The relatively quiet exit from the market, without a significant public announcement detailing a new business strategy, only exacerbated the concerns. This contrasted sharply with typical industry practices where major players announce significant shifts in strategy with considerable fanfare.

Alternative Scenarios for EVGA’s Trajectory, Is evga going out of business

Several scenarios are plausible for EVGA’s future. One is a complete exit from the consumer hardware market, possibly focusing on other business ventures or a strategic acquisition. This aligns with the observation that the company quietly removed its GPU-related products from its website, suggesting a strategic retreat. Another scenario involves a pivot to a different market segment, perhaps focusing on niche products or services less reliant on GPU partnerships. Examples of this could include expanding into server-grade components or developing specialized hardware for specific industries. A third scenario involves a potential restructuring or sale, allowing EVGA to reorganize and continue operating under new ownership. This scenario would require addressing the underlying financial challenges and strategic issues that led to the speculation in the first place. Companies like Corsair, a competitor in the PC peripherals market, could be a potential buyer, given their existing market presence and potential synergies.

Potential Consequences for Consumers if EVGA Ceases Operations

If EVGA were to cease operations, consumers could face several consequences. The immediate impact would be a reduction in the availability of certain GPU models and potentially a rise in prices for remaining options. EVGA held a significant market share, and its departure would leave a gap in the supply chain. Furthermore, customers with EVGA products might experience difficulties accessing warranty support or repairs. The long-term consequences could include less competition in the market, potentially leading to higher prices and fewer choices for consumers. This aligns with established economic principles where reduced competition can lead to less innovation and higher prices for consumers. The loss of EVGA’s distinctive brand identity and its reputation for quality customer service would also be significant.

Hypothetical Scenario: EVGA’s Potential Future if it Remains in Business

A hypothetical scenario for EVGA’s continued existence could involve a diversification strategy. The company could leverage its existing brand recognition and technical expertise to expand into complementary markets, such as high-performance computing (HPC) solutions, custom PC builds, or even developing its own proprietary software and services. This would reduce its reliance on a single product category (GPUs) and mitigate the risk associated with fluctuations in the GPU market. Success in this scenario would depend on EVGA’s ability to adapt quickly, invest in research and development, and build strong partnerships with other technology companies. This strategy mirrors the diversification strategies employed by successful technology companies such as Samsung and LG, who have expanded beyond their core businesses to maintain market competitiveness. A focus on building a strong online presence and direct-to-consumer sales would also be crucial in this scenario.

Illustrative Examples: Is Evga Going Out Of Business

Several scenarios can illustrate potential outcomes for EVGA, ranging from a successful restructuring to a complete exit from the market and its subsequent impact. Examining these possibilities provides a clearer picture of the potential ramifications for both EVGA and the broader PC gaming community.

EVGA’s Successful Navigation of Challenges

A successful navigation of current challenges for EVGA would likely involve a strategic pivot. This might entail focusing on niche markets, such as high-end custom cooling solutions or specialized components for professional workstations, where competition is less fierce and profit margins potentially higher. Simultaneously, EVGA could leverage its strong brand reputation and existing customer loyalty to build new revenue streams, perhaps through expanded services like premium repair and maintenance programs, or even venturing into the creation of gaming peripherals. This scenario requires significant investment in research and development, coupled with shrewd marketing to re-position EVGA as a provider of premium, specialized products rather than a mass-market GPU manufacturer. Success hinges on EVGA’s ability to adapt quickly, innovate effectively, and effectively communicate its new value proposition to consumers. For example, Corsair successfully transitioned from primarily memory modules to a broader portfolio of PC components and peripherals, showcasing the potential for such a strategic shift.

Potential EVGA Restructuring

A potential EVGA restructuring could involve several key steps. First, a significant downsizing of its workforce might be necessary, focusing on streamlining operations and reducing overhead costs. This could involve layoffs in less profitable areas. Secondly, a divestment of non-core assets, such as potentially selling off less profitable product lines or facilities, would free up capital for reinvestment in core competencies. Thirdly, seeking strategic partnerships or alliances with other companies in the tech industry could provide access to new technologies, distribution channels, or financial resources. This could involve collaborations on manufacturing or joint ventures to develop new products. Finally, a potential restructuring might involve seeking additional funding through venture capital or private equity investment to support its transition to a new business model. This multi-faceted approach mirrors the restructuring efforts seen in other companies facing similar challenges, such as the automotive industry’s adaptation to electric vehicles.

Impact on the PC Gaming Community if EVGA Exits the Market

EVGA’s exit from the GPU market would undoubtedly impact the PC gaming community. The immediate effect would be reduced competition, potentially leading to higher prices and fewer choices for consumers. EVGA’s reputation for high-quality products and excellent customer service would be missed, leaving a void in the market for consumers seeking a premium experience. Furthermore, the availability of certain specialized products or components, particularly custom cooling solutions that EVGA excelled in, might decrease. This reduction in options could negatively impact PC builders seeking specific performance characteristics or aesthetics. The overall impact would be a less competitive and potentially more expensive market for PC gaming hardware, forcing consumers to consider alternative brands that may not offer the same level of quality or customer support. The situation could be analogous to the impact felt when a major car manufacturer ceases production, leaving a gap in the market that takes time to fill.

Visual Representation of the Impact on the GPU Market

Imagine a pie chart. Before EVGA’s potential exit, the chart shows several segments representing different GPU manufacturers (Nvidia, AMD, EVGA, etc.), each proportionally sized to its market share. After EVGA exits, the EVGA segment disappears. The remaining segments, representing other manufacturers, would increase in size, reflecting their increased market share. However, the overall pie remains the same size, representing the total market demand. This visual illustrates how EVGA’s absence would redistribute its market share among competitors, potentially leading to less competition and potentially higher prices for consumers. The redistribution might not be even; some competitors might benefit more than others, depending on their existing market position and product offerings. This would be further complicated by potential shifts in consumer preferences and purchasing behaviors in response to the altered market dynamics.