Is Landstar going out of business? This question, fueled by recent industry challenges and economic uncertainty, has many stakeholders concerned. Analyzing Landstar’s financial performance, market position, and operational efficiency reveals a complex picture. While the company faces headwinds common to the trucking and logistics sector—including driver shortages, fluctuating fuel costs, and economic downturns—a closer examination of its strategic initiatives and customer relationships paints a more nuanced portrait. This analysis delves into Landstar’s current situation, exploring its strengths, weaknesses, and potential future trajectories.

We’ll dissect Landstar’s financial health, comparing its performance to competitors and examining key trends in revenue, profitability, and debt. We’ll also investigate the impact of industry-wide challenges, such as fuel price volatility and driver shortages, on Landstar’s operations and explore its mitigation strategies. Furthermore, we’ll assess Landstar’s operational efficiency, its capacity utilization, and its ability to adapt to changing market demands. Finally, we’ll look at Landstar’s strategic initiatives, its customer relationships, and its overall brand reputation to provide a comprehensive understanding of its current standing and future prospects.

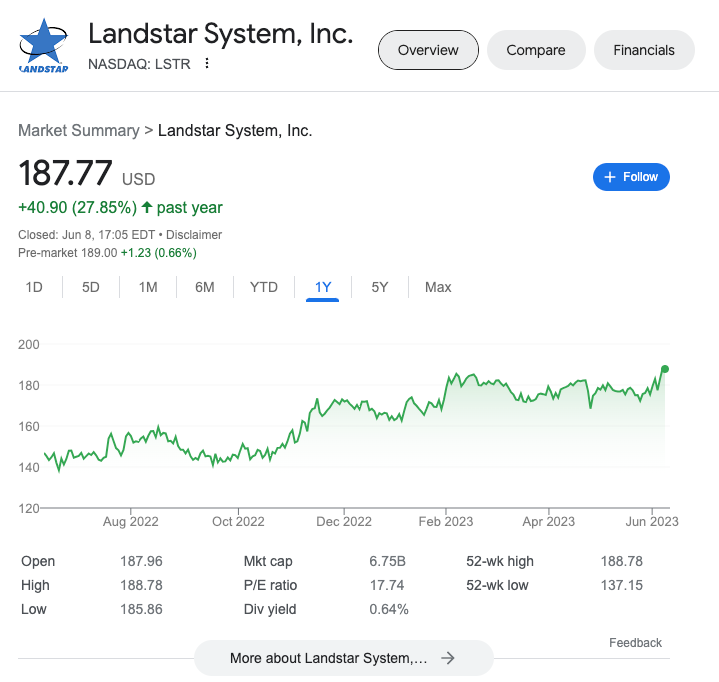

Landstar’s Financial Performance

Landstar System, Inc. (LSTR) operates as a less-than-truckload (LTL) and truckload (TL) transportation company. Analyzing its financial performance requires examining key metrics like revenue, profitability, and debt levels, comparing these to competitors, and assessing the impact of recent strategic shifts. This analysis focuses on publicly available financial reports and industry data.

Landstar’s Revenue, Profitability, and Debt Levels

Landstar’s revenue has generally shown consistent growth over the past several years, although the rate of growth has fluctuated depending on broader economic conditions and industry trends. Profit margins, while healthy compared to some competitors, have experienced some volatility, influenced by factors such as fuel costs and driver compensation. Debt levels have remained relatively manageable, indicating a conservative financial approach. Detailed analysis of specific years requires referencing Landstar’s 10-K filings with the Securities and Exchange Commission (SEC). For example, a review of the 2022 10-K would reveal specific figures for revenue, operating income, net income, and debt-to-equity ratio, providing a precise snapshot of its financial health during that period. This data should then be compared to previous years to establish trends.

Comparison to Major Competitors

A direct comparison of Landstar’s financial performance to major competitors like Schneider National (SNDR) and Old Dominion Freight Line (ODFL) reveals both strengths and weaknesses. While precise numerical comparisons require accessing financial statements from each company, general observations can be made. For example, Landstar’s business model, which relies heavily on independent contractors, may result in lower fixed costs compared to companies with large fleets of company-owned trucks. This could translate to higher profit margins during periods of high demand but could also lead to reduced control over operational efficiency. Conversely, companies with larger company-owned fleets may have more consistent operational control but may face higher fixed costs during periods of low demand. A detailed comparative analysis would involve constructing a table showing key financial ratios (e.g., return on assets, return on equity, operating margin) for each company over a period of several years.

Changes in Landstar’s Financial Strategy

Landstar’s financial strategy has remained relatively consistent over recent years, emphasizing a focus on its agent-owner model. However, adjustments have been made in response to market conditions. For instance, Landstar may have implemented strategies to mitigate the impact of fluctuating fuel prices, such as fuel surcharges or hedging strategies. Furthermore, changes in driver compensation and recruitment strategies would impact operating expenses and profitability. Analyzing the company’s investor relations materials and SEC filings would provide specific details on any significant shifts in their financial approach and the resulting impact on their financial health. For example, a change in their capital expenditure strategy, focusing more on technology investments or fleet upgrades, would directly influence the company’s cash flow and long-term profitability. These adjustments are crucial in understanding the evolution of Landstar’s financial performance and long-term prospects.

Market Conditions and Industry Trends: Is Landstar Going Out Of Business

The trucking and logistics industry is a dynamic sector significantly impacted by macroeconomic factors, technological advancements, and evolving consumer demands. Landstar, operating within this competitive landscape, faces both challenges and opportunities that directly influence its financial performance and long-term viability. Understanding the current market conditions and industry trends is crucial to assessing Landstar’s prospects.

The industry is characterized by intense competition, fluctuating fuel prices, persistent driver shortages, and cyclical economic sensitivities. These factors interact in complex ways, creating a volatile environment for companies like Landstar. The company’s unique business model, relying heavily on independent owner-operators, presents both advantages and vulnerabilities in this context.

Impact of Macroeconomic Factors on Landstar, Is landstar going out of business

The interplay of fuel prices, driver shortages, and economic downturns significantly affects Landstar’s operations. Fuel costs represent a substantial expense for trucking companies, directly impacting profitability. Driver shortages lead to increased competition for available drivers, driving up wages and potentially impacting service levels. Economic downturns reduce shipping volumes, leading to lower demand for trucking services.

| Factor | Impact on Landstar | Mitigation Strategies | Potential Outcomes |

|---|---|---|---|

| Fuel Price Volatility | Increased operating costs, reduced profit margins, pressure on pricing strategies. | Fuel surcharges, fuel efficiency initiatives (e.g., route optimization, driver training), hedging strategies. | Improved fuel cost management, potentially mitigated impact on profitability, but subject to market fluctuations. |

| Driver Shortages | Increased driver wages, difficulty in securing capacity, potential service disruptions. | Competitive compensation and benefits packages, driver recruitment and retention programs, technology-driven solutions (e.g., driver apps, automated dispatch). | Improved driver retention, potentially stabilized capacity, but increased labor costs. |

| Economic Downturns | Reduced shipping volumes, decreased demand for trucking services, lower revenue. | Diversification of customer base, cost-cutting measures, strategic partnerships. | Resilience to economic fluctuations, potentially reduced revenue volatility, but requires proactive management. |

Comparison of Landstar’s Business Model with Competitors

Landstar’s agent-owner-operator model distinguishes it from competitors employing company-owned fleets or relying solely on third-party carriers. This model offers advantages such as reduced capital expenditure on equipment and drivers, increased flexibility in adjusting capacity to demand, and potentially lower fixed costs. However, it also creates vulnerabilities. The company’s reliance on independent contractors means less direct control over operations and potentially higher reliance on market rates for securing capacity during periods of high demand or driver shortages. In contrast, companies with large company-owned fleets have more control but face higher fixed costs and less flexibility. Companies relying heavily on third-party carriers may experience less control over service quality and pricing. The inherent risks associated with each model are significantly influenced by market conditions, with Landstar’s model presenting a unique balance of advantages and vulnerabilities.

Landstar’s Operational Efficiency and Capacity

Landstar System’s operational efficiency and capacity are crucial factors determining its profitability and competitiveness within the trucking and logistics industry. A thorough examination of its fleet size, driver network, technological infrastructure, and capacity utilization reveals both strengths and weaknesses that influence its overall performance and ability to navigate fluctuating market demands.

Landstar’s operational efficiency hinges on its unique business model, relying heavily on a vast network of independent owner-operators. This decentralized structure presents both opportunities and challenges, influencing the company’s overall capacity and responsiveness to market shifts.

Landstar’s Operational Strengths and Weaknesses

Landstar’s operational performance is a complex interplay of strengths and weaknesses. Understanding these aspects is vital to assessing its overall efficiency and capacity.

- Strengths: Landstar’s extensive independent contractor network provides significant flexibility and scalability. This allows them to rapidly adjust capacity in response to changing market demands. The company’s technology platform facilitates efficient load matching and communication, streamlining operations. Their focus on specialized services, such as oversized and heavy haul, allows them to command premium pricing in niche markets.

- Weaknesses: Dependence on independent contractors introduces variability in service quality and operational consistency. Attracting and retaining qualified owner-operators can be challenging in a competitive labor market. The decentralized nature of the network can make centralized oversight and quality control more difficult. The company’s reliance on a vast network can also make it more susceptible to disruptions from external factors like fuel price volatility or driver shortages.

Fleet Size, Driver Network, and Technology Infrastructure

Precise data on Landstar’s fleet size is not publicly available in a consistently updated format. However, it is known that Landstar does not own its trucks; instead, it relies on a large network of independent owner-operators. The size of this network fluctuates based on market demand and the availability of drivers. Landstar’s technological infrastructure plays a key role in connecting shippers with available carriers, optimizing routes, and managing freight. This technology includes their proprietary transportation management system (TMS), which facilitates efficient communication and load matching. The effectiveness of this system directly impacts the company’s ability to efficiently utilize its driver network and respond to fluctuations in demand. While Landstar invests in technology to improve efficiency, the age and technological sophistication of the independent owner-operators’ trucks vary significantly, potentially impacting overall operational consistency and fuel efficiency.

Capacity Utilization and Adaptability to Changing Demand

Landstar’s capacity utilization is directly tied to the number of available owner-operators and the volume of freight available. The company’s ability to effectively manage its capacity in response to changing demand is a critical factor in its financial performance. In periods of high demand, Landstar can leverage its large network to increase capacity. However, securing enough drivers to meet sudden surges in demand can be challenging, potentially leading to missed opportunities or increased costs. Conversely, during periods of low demand, Landstar may experience underutilization of its network, impacting profitability.

Hypothetical Scenario: Sudden Surge in Demand

Imagine a sudden surge in demand due to a major natural disaster requiring significant logistical support for relief efforts. Landstar, with its large network, could potentially respond more quickly than companies with smaller, company-owned fleets. However, the speed and effectiveness of this response would depend on the immediate availability of owner-operators willing and able to take on additional loads, the capacity of Landstar’s technology infrastructure to handle increased traffic, and the potential for increased fuel costs. If Landstar is unable to secure enough drivers or experiences significant technological bottlenecks, it could lose market share to competitors better positioned to handle the surge.

Hypothetical Scenario: Sudden Drop in Demand

A sudden economic downturn could lead to a significant drop in freight demand. In this scenario, Landstar’s reliance on independent contractors becomes a double-edged sword. While it can reduce its operational costs by scaling down its network, it also risks losing valuable drivers to competitors who may offer more consistent work. The ability of Landstar to effectively manage its network during periods of low demand and maintain driver loyalty would be crucial for its long-term survival.

Landstar’s Strategic Initiatives and Future Plans

Landstar System’s strategic initiatives are focused on leveraging its existing strengths while adapting to the evolving landscape of the transportation and logistics industry. This involves investments in technology, expansion into new markets, and a continued emphasis on its agent-owner model. These efforts aim to enhance operational efficiency, improve customer service, and drive sustainable growth.

Landstar’s recent strategic initiatives and investments primarily revolve around technological advancements and operational enhancements to maintain a competitive edge. The company recognizes the importance of data analytics and digital tools in optimizing its network, improving pricing strategies, and enhancing communication with its agents and customers. This commitment to technology underpins their long-term vision for scalability and profitability.

Technological Investments and Digital Transformation

Landstar has consistently invested in upgrading its technology infrastructure. This includes implementing advanced transportation management systems (TMS), enhancing its digital platforms for improved communication and collaboration, and developing data analytics capabilities to better understand market trends and optimize resource allocation. These investments are aimed at streamlining operations, reducing costs, and providing customers with real-time visibility into their shipments. For example, the implementation of a new TMS has resulted in more efficient routing, reduced fuel consumption, and improved on-time delivery performance. This has led to enhanced customer satisfaction and a stronger competitive position in the market.

Expansion into New Markets and Service Offerings

While Landstar maintains a strong presence in its core markets, it continues to explore opportunities for expansion into new geographic regions and service verticals. This may involve strategic partnerships or acquisitions to broaden its service offerings and access new customer segments. For example, exploring specialized freight transportation services or expanding into international logistics could represent future growth avenues. These expansion plans are carefully evaluated to ensure alignment with Landstar’s core competencies and overall business strategy. Successful expansion into new markets would diversify revenue streams and reduce reliance on existing markets.

Maintaining and Enhancing the Agent-Owner Model

Landstar’s agent-owner model is a core component of its business strategy. The company continually invests in programs and initiatives to support and attract high-quality agents. This includes providing training and development opportunities, offering financial incentives, and fostering a collaborative environment. Strengthening this model is crucial for maintaining Landstar’s competitive advantage and ensuring the long-term success of the company. The agent-owner model provides flexibility and scalability, allowing Landstar to adapt quickly to changing market demands. Continued investment in this model will be critical for future growth and stability.

Landstar’s Long-Term Vision and Sustainable Growth Strategies

Landstar’s long-term vision centers on maintaining its position as a leading provider of transportation and logistics solutions. This involves a commitment to technological innovation, operational excellence, and a strong focus on customer satisfaction. The company aims to achieve sustainable growth by diversifying its revenue streams, expanding into new markets, and continually improving its operational efficiency. This long-term vision relies heavily on the continued success of its agent-owner model and strategic investments in technology. Landstar envisions a future where its technology-driven platform allows for seamless integration with customers’ supply chains, providing a comprehensive and efficient transportation and logistics solution. Achieving this vision requires continuous adaptation to market dynamics and proactive investment in innovation.

Customer Relationships and Brand Reputation

Landstar System’s success hinges on strong customer relationships and a positive brand reputation. Maintaining these is crucial for attracting and retaining both clients and employees in a competitive transportation and logistics market. This section analyzes Landstar’s customer base, loyalty factors, recent changes in satisfaction, and the overall impact of its brand on business performance.

Landstar’s customer base is diverse, encompassing a wide range of shippers across various industries. Key clients are typically those with consistent, high-volume shipping needs, valuing Landstar’s independent agent network and flexible service offerings. Customer loyalty is driven by several factors including the personalized service provided by independent agents, the company’s reliable and efficient operations, and its commitment to transparent communication and proactive problem-solving. Long-term partnerships are common, built on trust and mutual benefit.

Customer Satisfaction Trends

While precise, publicly available data on Landstar’s customer satisfaction levels is limited, anecdotal evidence and industry reports suggest generally high satisfaction rates. However, fluctuations may occur due to factors such as economic downturns impacting shipping volumes, occasional operational challenges, or changes in specific agent performance. For example, periods of high freight demand can sometimes lead to temporary capacity constraints, potentially affecting delivery times and customer satisfaction scores. Conversely, effective investment in technology and operational improvements often leads to positive feedback and improved scores. Continuous monitoring and feedback mechanisms are vital for maintaining and improving customer satisfaction.

Brand Reputation and Its Impact

Landstar’s brand reputation is built on its independent agent model, emphasizing personalized service and flexibility. This model fosters strong relationships with both customers and agents, contributing to customer loyalty and agent retention. The company’s commitment to safety and sustainability also positively impacts its brand perception. Public perception generally views Landstar as a reliable and trustworthy logistics provider. However, any negative publicity regarding operational issues or safety incidents could negatively affect its reputation. Maintaining consistent quality of service and proactive communication are crucial for mitigating reputational risks. Positive reviews and testimonials from satisfied customers, coupled with a strong presence at industry events, help to solidify Landstar’s positive brand image.