Is managerial accounting the most importat business class – Is managerial accounting the most important business class? The question itself sparks debate. While many business disciplines are crucial, managerial accounting offers a unique lens through which to view and manage a company’s financial health. It’s not just about crunching numbers; it’s about using those numbers to inform strategic decisions, optimize operations, and ultimately drive profitability. This exploration delves into the core functions of managerial accounting, comparing it to other business disciplines and examining its limitations and future trends.

From pricing strategies and production planning to resource allocation and risk mitigation, managerial accounting provides the critical data businesses need to thrive. We’ll examine real-world examples illustrating the impact of both effective and ineffective managerial accounting practices, highlighting its crucial role in everything from operational efficiency to sustainable business practices. This analysis will reveal why many consider managerial accounting a cornerstone of successful business management.

The Role of Managerial Accounting in Business Decision-Making

Managerial accounting provides the crucial financial information businesses need to make informed decisions, optimize operations, and achieve strategic goals. Unlike financial accounting, which focuses on external reporting, managerial accounting is internally focused, providing data tailored to the specific needs of managers at all levels. This data drives effective planning, control, and decision-making within the organization.

Managerial accounting’s core functions support strategic business decisions in several key ways. It involves planning, controlling, and decision-making activities, all relying on the analysis of relevant costs and revenues. These functions are interwoven and constantly inform one another, creating a dynamic feedback loop that helps businesses adapt to changing circumstances.

Core Functions of Managerial Accounting and Their Support of Strategic Decisions

Managerial accounting encompasses several core functions. Cost accounting, for instance, meticulously tracks and analyzes the costs associated with producing goods or services. This detailed cost breakdown helps businesses understand profitability at different product or service levels, allowing for informed pricing strategies and efficient resource allocation. Budgeting and performance evaluation are also critical. Budgets act as a roadmap, outlining financial targets and resource allocation plans. Performance evaluation then compares actual results against these budgeted targets, identifying areas needing improvement and informing future strategic choices. Finally, decision analysis utilizes various techniques, such as break-even analysis or cost-volume-profit analysis, to assess the potential outcomes of different courses of action. This ensures that decisions are data-driven and strategically sound.

Examples of Managerial Accounting Data Informing Business Strategies

Managerial accounting data directly influences key strategic decisions. For example, detailed cost analysis, including direct materials, direct labor, and overhead, informs pricing strategies. A business might discover that a specific product’s production cost is significantly higher than anticipated, leading to a price adjustment to maintain profitability. Similarly, production planning benefits from accurate cost data and demand forecasting. Understanding the costs associated with different production volumes helps businesses optimize their output to meet demand while minimizing waste and maximizing efficiency. Resource allocation decisions, such as investing in new equipment or expanding into new markets, are also heavily influenced by managerial accounting data. Return on investment (ROI) calculations, for instance, allow businesses to compare the potential profitability of different investment opportunities and allocate resources accordingly.

Scenario: Preventing Significant Business Loss Through Accurate Managerial Accounting

Imagine a manufacturing company using managerial accounting to track inventory levels and production costs. Through rigorous cost accounting, they identify a consistent overestimation of finished goods inventory. Further investigation reveals a significant discrepancy in the actual production output compared to the reported figures. This discrepancy, if left unaddressed, could lead to substantial losses due to obsolete inventory and inaccurate production planning. By uncovering this issue through their robust managerial accounting system, the company can rectify the inventory reporting, adjust production schedules, and prevent potential losses.

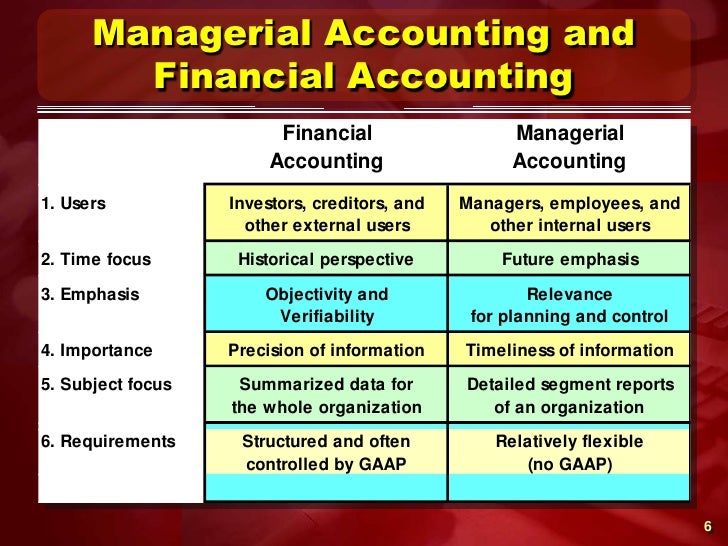

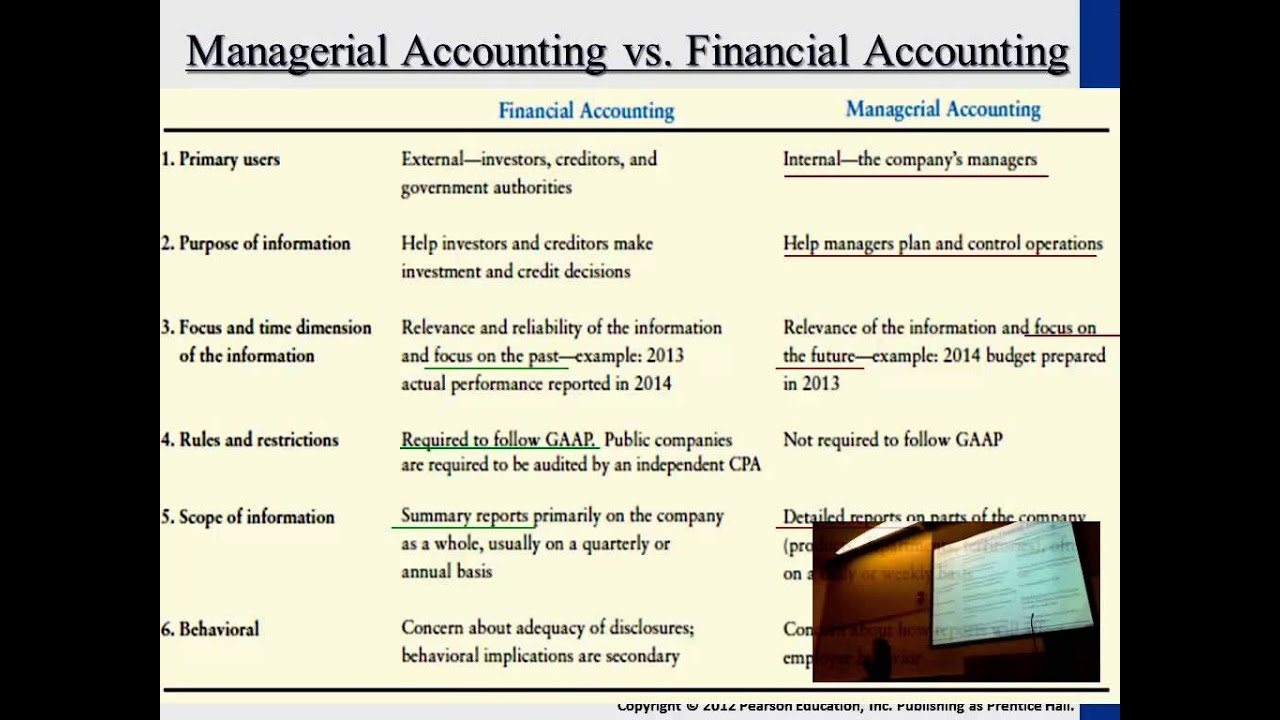

Comparison of Managerial and Financial Accounting

Managerial and financial accounting serve distinct purposes and cater to different audiences. Financial accounting focuses on creating financial statements (balance sheets, income statements, cash flow statements) for external stakeholders like investors, creditors, and regulatory bodies. These statements adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) and are historical in nature. Managerial accounting, in contrast, provides internal management with timely, relevant information to support decision-making. It is future-oriented, uses flexible reporting methods, and is not bound by GAAP or IFRS. The information generated is often tailored to specific needs and may include non-financial metrics.

Hypothetical Business Case Study: Impact of Poor Managerial Accounting Practices, Is managerial accounting the most importat business class

Consider a small bakery that fails to implement a robust cost accounting system. They lack detailed tracking of ingredient costs, labor hours, and overhead expenses. Consequently, they miscalculate their product costs, leading to underpricing of their goods and significant losses. Without accurate data on profitability, they struggle to identify their most profitable items and make informed decisions about product offerings. This lack of managerial accounting insight hinders their ability to compete effectively and ultimately impacts their long-term sustainability. Their inability to accurately forecast demand based on sales data also leads to significant waste from overproduction or underproduction. This highlights the critical role of accurate managerial accounting in ensuring business success.

Managerial Accounting’s Contribution to Business Performance: Is Managerial Accounting The Most Importat Business Class

Managerial accounting plays a pivotal role in enhancing business performance by providing crucial insights into costs, revenues, and profitability. Effective use of managerial accounting techniques allows businesses to make informed decisions, optimize operations, and ultimately, increase their bottom line. This section will explore how various managerial accounting tools contribute to improved business performance.

Effective Cost Accounting Methods and Operational Efficiency

Effective cost accounting methods are fundamental to improving operational efficiency and profitability. By accurately tracking and analyzing costs, businesses can identify areas of waste, inefficiencies, and opportunities for cost reduction. Techniques such as activity-based costing (ABC) move beyond simple allocation of overhead costs to pinpoint the actual cost drivers of various activities, enabling more precise pricing decisions and resource allocation. For example, a manufacturing company using ABC might discover that a specific product line is consuming disproportionately high resources in quality control, leading to a reassessment of production processes or pricing strategies. Similarly, standard costing allows businesses to compare actual costs against predetermined standards, highlighting variances that require investigation and corrective action. This proactive approach to cost management prevents small inefficiencies from accumulating into significant losses over time.

Performance Metrics in Managerial Accounting

Several key performance indicators (KPIs) are derived from managerial accounting data, offering a comprehensive view of business performance. These metrics provide insights into various aspects of the business, from operational efficiency to financial health. Examples include:

- Return on Investment (ROI): Measures the profitability of an investment relative to its cost. A high ROI indicates efficient resource utilization and strong profitability. For instance, a marketing campaign with a high ROI demonstrates effective allocation of marketing resources.

- Gross Profit Margin: Indicates the profitability of sales after deducting the cost of goods sold. A higher gross profit margin suggests better pricing strategies or efficient cost management. A company with a consistently high gross profit margin might be considered to have a strong competitive advantage.

- Net Profit Margin: Represents the overall profitability of a business after deducting all expenses. A higher net profit margin signifies better overall financial health and efficiency.

- Inventory Turnover: Measures how efficiently a company manages its inventory. A high inventory turnover ratio suggests efficient inventory management, minimizing storage costs and preventing obsolescence.

Budgeting and Forecasting for Business Objectives

Budgeting and forecasting are integral components of managerial accounting, providing a roadmap for achieving business objectives. Budgets serve as a planning tool, outlining anticipated revenues, expenses, and resource allocation. Forecasting, on the other hand, uses historical data and predictive models to estimate future performance. By combining these two tools, businesses can proactively manage resources, anticipate potential challenges, and make informed decisions to maximize profitability. For example, a company forecasting a significant increase in demand might proactively invest in additional production capacity or hire additional staff to meet the anticipated demand. Conversely, a budget shortfall might necessitate cost-cutting measures or adjustments to the business plan.

Key Performance Indicators (KPIs) Influenced by Managerial Accounting Data

Numerous KPIs are directly influenced by data generated through managerial accounting. These KPIs provide insights into various aspects of the business, allowing for continuous monitoring and improvement. Examples include:

- Cost of Goods Sold (COGS): Directly impacted by efficient inventory management and production processes, both areas managed with managerial accounting techniques.

- Operating Income: A key indicator of profitability, influenced by revenue generation and cost control, both central to managerial accounting.

- Sales Growth: Can be improved through pricing strategies and product mix analysis informed by managerial accounting data.

- Customer Acquisition Cost (CAC): Efficient marketing campaigns, monitored through managerial accounting, reduce CAC.

Comparison of Managerial Accounting Techniques

| Technique | Application | Benefits | Limitations |

|---|---|---|---|

| Cost-Volume-Profit (CVP) Analysis | Pricing decisions, break-even analysis | Simple, provides insights into profitability at different sales volumes | Assumes linear relationships, may not be accurate for complex products |

| Activity-Based Costing (ABC) | Product costing, identifying cost drivers | More accurate cost allocation, improves pricing and resource allocation | More complex and time-consuming than traditional costing methods |

| Budgeting | Planning, resource allocation, performance evaluation | Provides a framework for achieving business objectives, facilitates control | Can be rigid, may not adapt well to unexpected changes |

| Variance Analysis | Identifying performance deviations, corrective actions | Highlights areas needing improvement, enables proactive management | Requires accurate data and careful interpretation |

Comparing Managerial Accounting to Other Business Disciplines

Managerial accounting, while distinct, is deeply intertwined with other core business disciplines. Understanding its relationship with marketing, finance, and operations management reveals its crucial role in holistic business strategy and decision-making. Effective collaboration across these departments is essential for maximizing the value of managerial accounting insights.

Managerial accounting provides the quantitative backbone for informed strategic choices across various departments. Its data-driven approach allows for a more precise allocation of resources, improved efficiency, and ultimately, stronger profitability. The differences lie primarily in the focus and application of the data, rather than a fundamental conflict.

Managerial Accounting and Marketing

Marketing relies heavily on managerial accounting data for performance evaluation and strategic planning. Marketing campaigns’ ROI (Return on Investment) is calculated using cost accounting principles, allowing marketers to assess the effectiveness of various strategies. For example, a company launching a new product line would use managerial accounting data to analyze the projected costs of production, marketing, and distribution, and compare these against anticipated revenue streams to determine profitability. Divergence occurs in their primary objectives: marketing aims to increase sales and brand awareness, while managerial accounting focuses on measuring and controlling costs and optimizing resource allocation to achieve overall business objectives. The overlap exists in the shared goal of maximizing profitability, achieved through efficient marketing campaigns informed by cost-benefit analyses from managerial accounting.

Managerial Accounting and Finance

Both managerial accounting and finance deal with financial data, but their focus differs significantly. Finance concentrates on external reporting, capital budgeting, and financial risk management, while managerial accounting emphasizes internal reporting, cost control, and performance evaluation. The overlap is evident in budgeting and forecasting, where financial projections are informed by managerial accounting’s cost estimates and operational data. For instance, finance relies on managerial accounting’s cost projections to assess the feasibility of a new investment project. Divergence lies in the audience; financial accounting reports are intended for external stakeholders (investors, creditors), whereas managerial accounting reports are designed for internal use by managers.

Managerial Accounting and Operations Management

Operations management focuses on the efficient production and delivery of goods and services, while managerial accounting provides the tools to measure and improve operational efficiency. Cost accounting techniques, such as activity-based costing (ABC), are crucial in identifying cost drivers and optimizing operational processes. For example, analyzing the cost of producing each unit using ABC allows operations managers to identify areas for cost reduction and process improvement. The overlap is in their shared interest in optimizing efficiency and reducing costs. However, operations management concentrates on the physical processes of production and delivery, whereas managerial accounting provides the analytical framework for measuring and improving operational performance.

Interdisciplinary Collaboration Leveraging Managerial Accounting Insights

Effective collaboration between managerial accounting and other business disciplines is crucial for optimal business performance. Shared data and insights facilitate better decision-making, improved resource allocation, and enhanced operational efficiency. For example, a cross-functional team involving managerial accountants, marketing managers, and operations managers can collaborate to develop a comprehensive marketing plan that considers both marketing effectiveness and cost efficiency. This integrated approach ensures that marketing campaigns are not only effective in driving sales but also aligned with the overall financial goals of the organization.

Managerial Accounting’s Influence on Strategic Human Resource Management

Managerial accounting principles directly inform strategic human resource management decisions. Cost accounting data, for example, helps determine the cost-effectiveness of different compensation structures and employee benefits packages. Performance evaluation systems, often based on key performance indicators (KPIs) tracked by managerial accounting, drive decisions about promotions, bonuses, and training programs. Analyzing the cost of employee turnover informs decisions regarding employee retention strategies.

Managerial Accounting’s Contribution to Supply Chain Management and Logistics Optimization

Managerial accounting plays a crucial role in optimizing supply chain management and logistics. Cost accounting techniques help identify cost drivers within the supply chain, such as transportation, warehousing, and inventory management. These insights inform decisions about sourcing strategies, inventory levels, and logistics network design. For instance, analyzing the cost of different transportation modes can lead to selecting the most cost-effective option. Furthermore, tracking inventory costs allows for optimizing inventory levels to minimize holding costs while ensuring sufficient supply to meet demand.

Managerial Accounting Principles Supporting Sustainable Business Practices

Managerial accounting principles are instrumental in supporting sustainable business practices.

- Environmental Cost Accounting: Tracking and analyzing environmental costs associated with production, such as waste disposal and pollution control, allows for identifying areas for improvement and reducing the environmental impact of business operations.

- Life-Cycle Costing: Assessing the total cost of a product or service over its entire life cycle, from design to disposal, helps businesses make informed decisions about sustainable product design and resource management.

- Social Cost Accounting: Measuring the social impact of business decisions, such as employee well-being and community relations, allows for integrating social responsibility into business strategies and enhancing corporate social responsibility (CSR) reporting.

- Resource Consumption Tracking: Monitoring the consumption of resources, such as water and energy, allows for identifying areas for efficiency improvements and reducing the overall environmental footprint of the business.

- Carbon Footprint Accounting: Measuring and reporting a company’s greenhouse gas emissions helps businesses identify opportunities for emissions reduction and meet regulatory requirements related to climate change.

The Limitations and Challenges of Managerial Accounting

Managerial accounting, while a crucial tool for business decision-making, is not without its limitations and challenges. Its effectiveness hinges on the quality of data, the accuracy of assumptions, and the ethical considerations guiding its application. Furthermore, the rapidly evolving business landscape necessitates continuous adaptation of managerial accounting practices.

Potential Biases in Managerial Accounting Data and Methods

Managerial accounting data is susceptible to various biases. For example, the choice of cost allocation methods can significantly influence reported product costs, potentially leading to inaccurate pricing decisions. Similarly, the selection of performance metrics can inadvertently incentivize short-term gains over long-term sustainability. Furthermore, the reliance on historical data to predict future performance can be misleading if the underlying business environment undergoes significant changes. The subjective nature of certain estimations, such as the useful life of an asset or the salvage value, also introduces potential biases. These biases can be mitigated through careful selection of methods, regular review of assumptions, and incorporating diverse perspectives in the data analysis process.

Challenges of Implementing Managerial Accounting Systems in Dynamic Environments

Implementing and maintaining effective managerial accounting systems in rapidly changing business environments presents significant challenges. The constant influx of new technologies, shifting market demands, and globalization require systems that are flexible and adaptable. Traditional, static systems struggle to keep pace, leading to outdated information and ineffective decision-making. Furthermore, integrating new data sources and technologies, such as big data analytics and artificial intelligence, into existing systems can be complex and costly. The need for continuous training and upskilling of personnel to manage these evolving systems also adds to the challenges.

Ethical Considerations in the Use and Interpretation of Managerial Accounting Information

The ethical use and interpretation of managerial accounting information are paramount. Misrepresenting data, manipulating cost allocations, or selectively reporting performance metrics can have serious consequences. Managers must ensure the integrity of the data and avoid conflicts of interest that could compromise objectivity. Furthermore, transparency in reporting and accountability for the use of managerial accounting information are crucial for maintaining trust and ethical standards within the organization. Examples of unethical practices include manipulating inventory valuations to inflate profits or underreporting expenses to meet performance targets. These actions can lead to inaccurate financial reporting and potentially damage the company’s reputation and stakeholder relationships.

Technological Advancements and Their Impact on Managerial Accounting Practices

Technological advancements have profoundly impacted managerial accounting practices. The advent of enterprise resource planning (ERP) systems has streamlined data collection and processing, enabling real-time access to financial and operational information. Data analytics tools provide insights into business performance that were previously unavailable, facilitating more informed decision-making. Artificial intelligence and machine learning are increasingly being used for predictive modeling, forecasting, and automation of routine tasks, freeing up accountants to focus on more strategic activities. However, these advancements also raise new challenges, such as data security and the need for skilled personnel to manage and interpret complex data sets.

Mitigating Risks Associated with Sole Reliance on Managerial Accounting Data

Relying solely on managerial accounting data for decision-making can be risky. Managerial accounting focuses primarily on internal data and may not adequately capture external factors, such as market trends and competitive pressures. To mitigate this risk, decision-makers should supplement managerial accounting data with other sources of information, such as market research, customer feedback, and competitor analysis. A holistic approach that integrates both quantitative and qualitative data leads to more robust and informed decisions.

“Over-reliance on any single source of information, especially historical data, can lead to flawed predictions and ultimately, poor strategic decisions.”

“A balanced scorecard approach, incorporating financial and non-financial metrics, provides a more comprehensive view of business performance and reduces the risk associated with relying solely on financial data.”

Future Trends in Managerial Accounting

Managerial accounting is undergoing a rapid transformation driven by technological advancements and evolving business landscapes. The traditional role of the managerial accountant is expanding to encompass data analysis, strategic planning, and technological integration, requiring a new set of skills and expertise. This section explores the key future trends shaping the profession.

The Expanding Role of Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence (AI) are revolutionizing managerial accounting. AI-powered tools are automating routine tasks such as data entry, reconciliation, and report generation, freeing up accountants to focus on higher-value activities like strategic decision-making and performance analysis. Predictive analytics, using AI algorithms to forecast future performance based on historical data, is becoming increasingly important for budgeting, forecasting, and risk management. For example, companies like Netflix utilize AI-driven predictive analytics to anticipate customer preferences and optimize content creation and marketing strategies, directly influencing their managerial accounting processes. Real-time dashboards and interactive reporting tools, powered by AI and big data, provide managers with immediate insights into key performance indicators (KPIs), enabling faster and more informed decisions.

The Impact of Automation on Managerial Accounting Processes and Necessary Skills

Automation is streamlining many managerial accounting processes, leading to increased efficiency and accuracy. Robotic Process Automation (RPA) can automate repetitive tasks, reducing the risk of human error and freeing up accountants for more strategic roles. However, this shift also necessitates the development of new skills among accounting professionals. Future accountants will need strong analytical skills to interpret data generated by AI and automation tools, as well as proficiency in data visualization and communication to effectively present findings to management. The demand for expertise in areas such as data mining, machine learning, and cloud computing is growing rapidly. Companies are investing in training programs to upskill their existing accounting staff and attract talent with these in-demand skills.

Innovative Managerial Accounting Techniques Employed by Leading Companies

Leading companies are adopting innovative managerial accounting techniques to gain a competitive edge. Activity-based costing (ABC) is gaining traction, providing a more accurate picture of product costs by assigning overhead costs based on activities rather than volume. Companies like Toyota have successfully utilized ABC to optimize their manufacturing processes and reduce costs. Beyond ABC, companies are implementing integrated business planning (IBP) systems, combining sales, operations, and finance planning to improve forecast accuracy and optimize resource allocation. Furthermore, the use of cloud-based accounting software is becoming increasingly prevalent, providing real-time access to financial data and facilitating collaboration across departments and locations. These techniques allow for more agile and data-driven decision-making.

Adaptation of Managerial Accounting to Changing Regulatory Landscapes and Global Economic Conditions

The regulatory landscape and global economic conditions are constantly evolving, impacting managerial accounting practices. Companies must adapt to new accounting standards, such as IFRS 17 (Insurance Contracts), and comply with increasingly stringent regulations related to data privacy and cybersecurity. Global economic uncertainty necessitates the development of robust risk management strategies and the ability to adapt to fluctuating exchange rates and market conditions. Managerial accountants play a crucial role in navigating these challenges, providing accurate and timely financial information to support strategic decision-making in a volatile environment. For instance, companies operating internationally need accountants proficient in understanding and applying diverse accounting standards and regulations across different jurisdictions.

Visual Representation of the Future Evolution of Managerial Accounting

Imagine a dynamic, interconnected network. At the center is a core of traditional accounting principles and practices, represented by a sturdy, well-established tree trunk. Branching out from this core are vibrant, rapidly growing limbs representing advanced analytics, AI-powered tools, and automation technologies. These limbs are interconnected by a complex web of data flows, visualized as glowing lines connecting different points of the network. The leaves on these branches represent various outputs – insightful dashboards, predictive forecasts, real-time KPI monitoring, and strategic recommendations. The entire network is situated within a larger, ever-changing environment symbolized by a swirling, dynamic background representing the global economic and regulatory landscape. The overall image conveys a sense of growth, dynamism, and interconnectedness, highlighting the evolving and expanding role of managerial accounting in the future business environment.