Is real estate a specified service business? This question delves into the complex intersection of real estate activities and tax classifications. Understanding whether real estate falls under the “specified service business” designation is crucial for businesses operating in this sector, as it significantly impacts tax liabilities and regulatory compliance. This exploration will dissect the legal definitions, analyze various real estate activities, and examine the diverse tax implications across different jurisdictions.

We’ll navigate the intricacies of property management, brokerage, and development, comparing their classifications and outlining the potential benefits and drawbacks of being categorized as a specified service business. Real-world case studies will illuminate the practical implications of these classifications, highlighting the potential for legal challenges and differing interpretations of regulations. Ultimately, this comprehensive analysis will provide a clear understanding of how real estate businesses can navigate this complex landscape.

Defining “Specified Service Business”: Is Real Estate A Specified Service Business

The term “specified service business” lacks a universally consistent legal definition. Its meaning varies significantly depending on the jurisdiction and the specific tax or regulatory context. Understanding this variability is crucial for accurate classification and compliance. This section will explore the defining characteristics and tax implications associated with specified service businesses in various contexts.

A specified service business generally refers to a business providing services considered high-value, often requiring specialized skills or expertise. These services typically involve intellectual capital, professional judgment, and significant client interaction. The specific services included within this category differ across countries and even within a single country, depending on the legislation in question. This lack of uniformity necessitates careful examination of relevant laws and regulations for precise determination.

Legal Definitions of Specified Service Businesses, Is real estate a specified service business

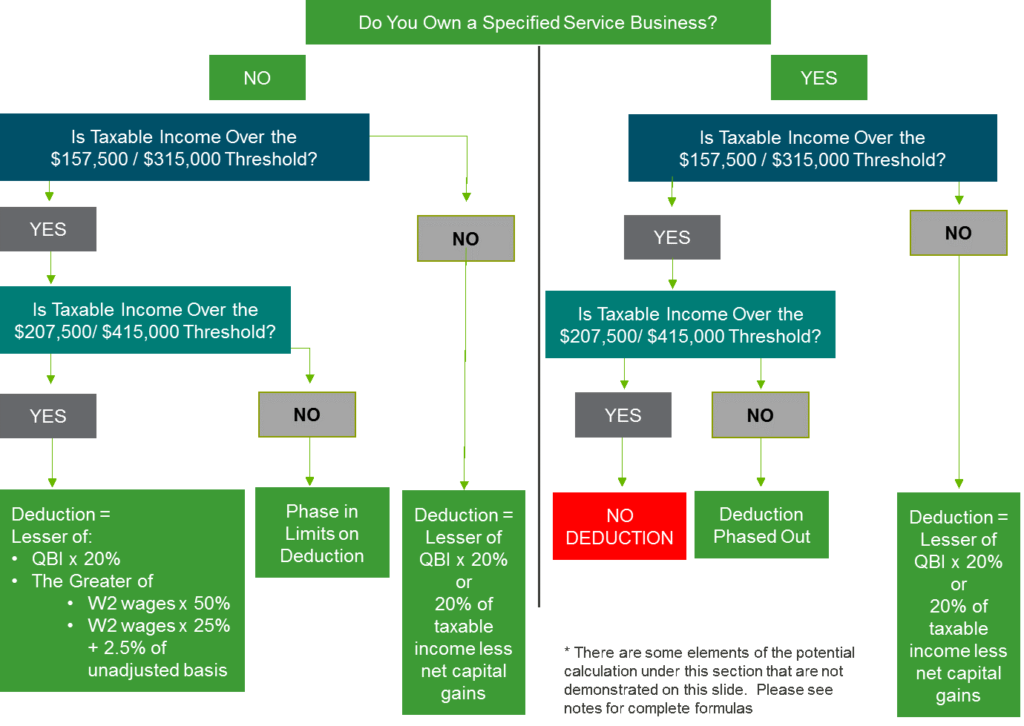

The legal definition of a specified service business is not standardized internationally. For instance, in the United States, the Internal Revenue Service (IRS) doesn’t explicitly use the term “specified service business” in a broad, codified definition. Instead, tax implications for businesses offering specific services are often addressed through individual tax codes and regulations related to self-employment taxes, qualified business income (QBI) deductions, and other provisions. Similarly, in the UK, the definition depends on the specific legislation, whether it’s related to VAT, corporation tax, or other tax schemes. In other jurisdictions, there may be specific legislation that defines a “specified service” or similar terminology within the context of taxation or other regulatory frameworks. Each country’s tax code needs individual examination.

Characteristics of Specified Service Businesses

Several characteristics commonly identify a specified service business. These include a high degree of professional expertise or specialized skills, significant client interaction and personalized service, a substantial proportion of revenue derived from services rather than goods, and a relatively high level of intangible assets (e.g., intellectual property, reputation). The business model typically involves direct engagement with clients, often requiring customized solutions and ongoing consultation. The emphasis is on the provision of expertise and value-added services, rather than mass-produced products.

Tax Implications for Specified Service Businesses

The tax implications for specified service businesses can differ significantly from other business structures. These differences often relate to deductions, tax rates, and reporting requirements. For example, some jurisdictions may offer specific tax incentives or deductions to encourage the growth of businesses in specified service sectors. Conversely, certain tax regimes may impose higher tax rates or stricter compliance requirements on businesses classified as providing specified services. The specific tax treatment depends heavily on the nature of the service, the legal structure of the business (sole proprietorship, partnership, LLC, corporation), and the applicable tax laws of the relevant jurisdiction. Careful tax planning is essential.

Examples of Specified Service Businesses

Industries commonly classified as, or possessing characteristics consistent with, specified service businesses include: legal services, accounting and financial services, medical services, engineering and architectural services, consulting services (management, IT, etc.), and design services (graphic, web, etc.). These industries are often characterized by high levels of specialized knowledge, personalized client service, and significant reliance on intellectual capital. The specific inclusion or exclusion from a “specified service business” classification is dependent on the individual legal and tax context.

Real Estate Activities and Their Classification

The real estate industry encompasses a broad range of activities, each with its own unique characteristics and implications for classification as a specified service business. Understanding these nuances is crucial for accurate tax reporting, regulatory compliance, and effective business planning. This section will detail various real estate activities, analyzing their classification under specified service business definitions and highlighting variations in governmental approaches.

Different jurisdictions employ varying criteria to define and categorize real estate activities. These discrepancies stem from differences in tax codes, licensing requirements, and overall economic policies. Consequently, a real estate activity deemed a specified service business in one location might not be classified as such elsewhere. This necessitates a careful examination of relevant regulations at both the federal and state/local levels.

Real Estate Activity Categorization

The following table organizes common real estate activities, illustrating their potential classification as specified service businesses, tax implications, and relevant regulations. Note that this information is for illustrative purposes and may not reflect the specific circumstances in all jurisdictions. Always consult with legal and tax professionals for accurate and up-to-date guidance.

| Activity | Classification (as Specified Service Business – Example) | Tax Implications (Example) | Relevant Regulations (Example) |

|---|---|---|---|

| Real Estate Brokerage | Potentially, depending on jurisdiction and specific business structure; often classified as a service business, but not necessarily a *specified* service business. | Income taxed as ordinary income; potential deductions for business expenses. Specific tax rates vary by jurisdiction. | State real estate licensing laws; federal and state tax codes; potentially, local business licensing requirements. |

| Property Management | Potentially; often classified as a service business. | Income taxed as ordinary income; deductions for property expenses, management fees, and other relevant business costs. | State licensing requirements for property managers; federal and state tax codes; lease agreements and relevant landlord-tenant laws. |

| Real Estate Development | Generally not considered a specified service business; primarily viewed as a business involving the sale of goods (developed properties). | Income from property sales taxed as capital gains or ordinary income depending on the holding period and other factors. Significant deductions are often possible for development costs. | Zoning laws; building codes; environmental regulations; federal and state tax codes. |

| Real Estate Appraisal | Often classified as a specified service business due to the specialized knowledge and expertise required. | Income taxed as ordinary income; deductions for business expenses. | State licensing or certification requirements for appraisers; federal and state tax codes; professional standards of practice. |

| Real Estate Investment Trusts (REITs) | Not directly classified as a specified service business; they are a specific type of investment vehicle with unique tax rules. | Complex tax structure with special provisions designed to incentivize investment in real estate. Distributions to shareholders are typically taxed as ordinary income. | Internal Revenue Code Section 856; state corporate tax laws; SEC regulations (if publicly traded). |

Tax Implications and Regulations

Classifying a real estate business as a specified service business (SSB) significantly impacts its tax obligations. These implications stem from the unique tax rules and regulations applied to SSBs, often resulting in different tax rates, deductions, and reporting requirements compared to other business structures. Understanding these differences is crucial for accurate tax planning and compliance.

Specific Tax Regulations for Specified Service Businesses

SSBs often face higher self-employment tax rates than other business types. This is because the self-employment tax, which funds Social Security and Medicare, typically applies to a larger portion of the business’s net earnings for SSBs. Additionally, certain deductions, such as those for qualified retirement plans, might have limitations or different rules for SSBs compared to non-SSBs. Furthermore, the Internal Revenue Service (IRS) may have specific reporting requirements for SSBs, necessitating more detailed record-keeping and potentially more complex tax filings. These regulations vary depending on the specific jurisdiction and may change over time; therefore, consulting with a tax professional is highly recommended.

Tax Benefits and Disadvantages for Real Estate SSBs

While SSBs generally face higher self-employment taxes, there can be offsetting advantages depending on individual circumstances. For example, certain tax credits or deductions might be available specifically to small businesses, including those classified as SSBs. However, the higher tax rates can significantly reduce the overall profitability of the business. Careful financial planning is essential to navigate these complexities and optimize tax efficiency. A thorough analysis of both potential benefits and disadvantages is necessary before making strategic business decisions.

Comparison of Tax Burdens: SSBs vs. Non-SSBs

The tax burden on a real estate SSB is generally higher than that on a similarly structured real estate business that isn’t classified as an SSB. This difference primarily arises from the higher self-employment tax rates and potential limitations on deductions. For example, a non-SSB might be able to deduct a larger portion of its business expenses, leading to a lower taxable income. Conversely, an SSB might face limitations on these deductions, resulting in a higher tax liability. This disparity highlights the importance of understanding the specific tax implications of each classification.

Hypothetical Scenario: Tax Liability Comparison

Let’s consider two real estate companies: “Property Pros,” classified as an SSB, and “Real Estate Solutions,” not classified as an SSB. Both companies report $200,000 in net profit. Assuming a simplified scenario with a 15% self-employment tax rate for non-SSBs and a 20% rate for SSBs, Property Pros would pay $40,000 in self-employment tax ($200,000 x 20%), while Real Estate Solutions would pay $30,000 ($200,000 x 15%). This difference, while simplified, illustrates the potential financial impact of SSB classification. Further differences would emerge depending on other deductions and applicable tax credits, highlighting the complexity of accurate tax comparisons.

Case Studies and Examples

The classification of real estate businesses as specified service businesses hinges on a nuanced understanding of applicable regulations and the specific activities undertaken. Misinterpretations can lead to significant tax implications and potential legal challenges. The following case studies illustrate the complexities involved and highlight the importance of accurate classification.

Case Study 1: Luxury Residential Brokerage

This case involves “Premier Properties,” a brokerage specializing in high-end residential real estate. Their services extend beyond traditional brokerage, including staging consultations, concierge services for international clients, and extensive marketing campaigns utilizing high-end photography and videography. Premier Properties argued that these additional services, exceeding the scope of a typical brokerage, qualified them as a specified service business. The tax authority, however, focused on the core activity of property brokerage, ultimately classifying them as a non-specified service business due to the significant revenue generated from standard brokerage commissions. This resulted in a higher overall tax burden compared to the anticipated lower rate for specified service businesses.

Case Study 2: Commercial Real Estate Development

“Cityscape Developments” is a company involved in the development of large-scale commercial properties, including office buildings and shopping malls. Their activities encompass land acquisition, project planning, construction management, and leasing. Cityscape argued for classification as a specified service business due to the significant planning and management expertise required. However, the tax authority classified them as a non-specified service business because their primary revenue stream derives from property sales and rentals, not from the service aspects alone. The company’s legal challenge based on the substantial professional services involved was ultimately unsuccessful due to the prevailing interpretation of the relevant regulations prioritizing revenue generation sources over the nature of the services provided.

Case Study 3: Property Management Company with Specialized Services

“Apex Property Management” manages a portfolio of residential and commercial properties. Beyond standard property management duties (rent collection, maintenance oversight), Apex offers specialized services like energy efficiency consulting and sustainable building practices implementation. They successfully argued for classification as a specified service business, highlighting the significant revenue generated from these specialized consulting services. The tax authority acknowledged the substantial proportion of revenue derived from these specialized services, aligning with the criteria for specified service business classification. This resulted in a lower tax liability compared to a standard classification.

Summary of Case Studies

| Company | Type of Real Estate Activity | Classification Decision | Tax Implications |

|---|---|---|---|

| Premier Properties | Luxury Residential Brokerage (with additional services) | Non-Specified Service Business | Higher tax burden |

| Cityscape Developments | Commercial Real Estate Development | Non-Specified Service Business | Higher tax burden; unsuccessful legal challenge |

| Apex Property Management | Property Management with Specialized Consulting Services | Specified Service Business | Lower tax liability |

Differing Interpretations and Legal Challenges

The case studies demonstrate how differing interpretations of regulations can significantly impact the classification of a real estate business. Ambiguity in the definition of “specified service” and the relative weighting of different revenue streams often lead to disputes. Legal challenges arising from classification disputes can be costly and time-consuming, requiring detailed documentation and expert legal advice. The outcome frequently depends on the specific facts of the case and the prevailing interpretation of the relevant tax authorities. Successful challenges often hinge on clearly demonstrating the predominance of specialized services and their contribution to revenue, aligning with the specific criteria Artikeld in the regulations.

Illustrative Examples of Real Estate Business Models

Understanding different real estate business models is crucial for determining their classification as specified service businesses. The classification impacts tax liabilities and regulatory compliance. The following examples illustrate the operational differences and consequent tax implications.

Traditional Real Estate Brokerage

This model involves facilitating real estate transactions between buyers and sellers, earning commissions on successful deals.

- Income Streams: Commissions earned on property sales, lease agreements, and other related services (e.g., property management referrals).

- Expenses: Brokerage fees, marketing and advertising costs, office rent, salaries for agents and administrative staff, professional licenses and insurance.

- Tax Implications: Generally classified as a service business, subject to income tax on commissions earned. Deductions are allowed for business-related expenses. The classification as a specified service business would depend on the specific jurisdiction and whether the brokerage meets the criteria defined by the relevant tax authorities. For example, if a significant portion of the brokerage’s income comes from services beyond traditional brokerage, it might be classified as a specified service business, leading to potential differences in tax rates or deductions.

Real Estate Investment Trust (REIT)

REITs are companies that own, operate, or finance income-producing real estate. They are required to distribute a significant portion of their taxable income to shareholders, thus avoiding corporate income tax at the REIT level.

- Income Streams: Rental income from properties, capital appreciation from property sales, and other income generated from real estate investments.

- Expenses: Property taxes, insurance, maintenance and repairs, mortgage interest, management fees, and other operating expenses.

- Tax Implications: While REITs themselves are not typically subject to corporate income tax (provided they meet specific distribution requirements), the income distributed to shareholders is taxed as ordinary income. The classification as a specified service business is generally not applicable to REITs, as their primary activity is investment and ownership, not the provision of a specified service. However, if a REIT provides significant ancillary services (like property management), that aspect of the business *might* be considered a specified service and taxed accordingly, although this would likely be a small portion of their overall operation.

Real Estate Development

This model involves acquiring land, obtaining permits, constructing buildings, and selling or leasing the completed properties.

- Income Streams: Revenue from the sale of completed properties, rental income from properties held for lease, and potentially income from construction management contracts.

- Expenses: Land acquisition costs, construction costs (labor, materials, permits), marketing and sales costs, financing costs (interest, loan fees), and administrative expenses.

- Tax Implications: This is typically classified as a business, potentially a specified service business if a substantial portion of the revenue is derived from construction management services rather than property sales. Tax implications depend on the structure of the development company (sole proprietorship, partnership, LLC, etc.) and the allocation of income and expenses. The business may be subject to income tax on profits, potentially at different rates depending on its classification as a specified service business.

Visual Representation

Imagine a Venn diagram. Three overlapping circles represent the three business models: Traditional Brokerage, REIT, and Real Estate Development. The Brokerage circle is heavily weighted towards “Service Provision,” with smaller segments for “Capital Investment” and “Property Ownership.” The REIT circle is primarily “Capital Investment,” with smaller portions dedicated to “Property Ownership” and minimal “Service Provision.” The Development circle emphasizes “Property Ownership” and “Capital Investment,” with a smaller portion allocated to “Service Provision” (primarily related to construction management if offered). The overlapping areas represent the instances where these models might share aspects, such as a brokerage firm also offering property management (overlapping Brokerage and REIT), or a developer holding some properties for rental income (overlapping Development and REIT). The size of each segment visually reflects the relative emphasis of each aspect within each business model.