Is tracfone going out of business 2023 – Is Tracfone going out of business in 2023? This question, fueled by recent industry shifts and economic uncertainty, has many prepaid wireless customers concerned. This in-depth analysis explores Tracfone’s financial health, market position, and future prospects, examining its business strategies and the external factors influencing its viability. We’ll delve into customer perception, potential scenarios, and ultimately, answer the burning question on everyone’s mind.

We’ll dissect Tracfone’s recent performance, comparing key metrics like revenue and market share against major competitors. This includes an analysis of its business model, operational changes, and the impact of technological advancements and regulatory changes. We’ll also consider broader economic trends and the competitive landscape to paint a comprehensive picture of Tracfone’s future.

Tracfone’s Recent Financial Performance and Market Position

Tracfone Wireless, now a subsidiary of Verizon, operates within a highly competitive prepaid wireless market. Analyzing its recent financial performance requires understanding its integration into Verizon’s broader operations and its overall market standing against significant players like Metro by T-Mobile and Cricket Wireless. Publicly available financial data specifically for Tracfone as a standalone entity is limited since its acquisition.

Tracfone’s Financial Performance and Market Share Data

Access to precise, recent financial data for Tracfone is restricted due to its incorporation into Verizon’s reporting. Verizon’s financial reports encompass Tracfone’s performance within its broader prepaid wireless segment, making it difficult to isolate Tracfone’s specific revenue, profitability, and market share. However, we can infer some aspects of its performance through industry analyses and market trends. Analysts often use indirect methods to estimate the performance of subsidiaries, combining market share data with industry-wide revenue figures.

Tracfone’s Customer Base and Acquisition/Churn Trends

While exact customer numbers are not publicly disclosed, Tracfone historically boasted a substantial customer base, a significant factor in its attractiveness to Verizon. Estimating current customer acquisition and churn rates requires analyzing market trends in the prepaid sector. Factors such as competitive pricing, network quality, and promotional offers significantly influence these metrics. Higher churn rates suggest customers are switching to competitors, indicating potential weaknesses in Tracfone’s offerings. Conversely, strong customer acquisition indicates successful marketing strategies and competitive pricing. Without access to internal Tracfone data, only broad estimations can be made.

Comparison with Major Competitors

Direct comparison of Tracfone’s KPIs against competitors like Metro by T-Mobile and Cricket Wireless is challenging due to the lack of publicly available, segregated Tracfone data. However, industry reports often provide comparative analyses of the broader prepaid market, allowing for some indirect inferences about Tracfone’s relative performance. These reports generally highlight aspects like average revenue per user (ARPU), customer acquisition costs, and churn rates for major prepaid carriers. Analyzing these broader trends can offer some context for understanding Tracfone’s competitive position.

Key Performance Indicator (KPI) Comparison (2020-2022 – Estimated), Is tracfone going out of business 2023

The following table presents estimated KPIs for Tracfone and its major competitors. Note that these figures are estimates based on publicly available data and industry analysis, and may not perfectly reflect Tracfone’s actual performance due to the lack of specific, publicly available data.

| KPI | Tracfone (Estimated) | Metro by T-Mobile (Estimated) | Cricket Wireless (Estimated) |

|---|---|---|---|

| Annual Revenue (USD Millions) | Data unavailable; part of Verizon’s reporting | Data unavailable; requires access to T-Mobile’s financial statements | Data unavailable; requires access to AT&T’s financial statements |

| Average Revenue Per User (ARPU) | Estimate needed, based on industry averages and market share | Estimate needed, based on industry averages and market share | Estimate needed, based on industry averages and market share |

| Customer Churn Rate (%) | Estimate needed, based on industry averages and market share | Estimate needed, based on industry averages and market share | Estimate needed, based on industry averages and market share |

| Customer Acquisition Cost (CAC) | Estimate needed, based on industry averages and market share | Estimate needed, based on industry averages and market share | Estimate needed, based on industry averages and market share |

Analysis of Tracfone’s Business Strategy and Operations

Tracfone Wireless, a major player in the prepaid wireless market, operates on a distinct business model characterized by its focus on affordability and accessibility. Understanding its strategy requires examining its distribution channels, pricing tactics, and responses to technological and regulatory shifts. This analysis will explore the key elements of Tracfone’s operational structure and its current market position.

Tracfone’s Business Model and Operations

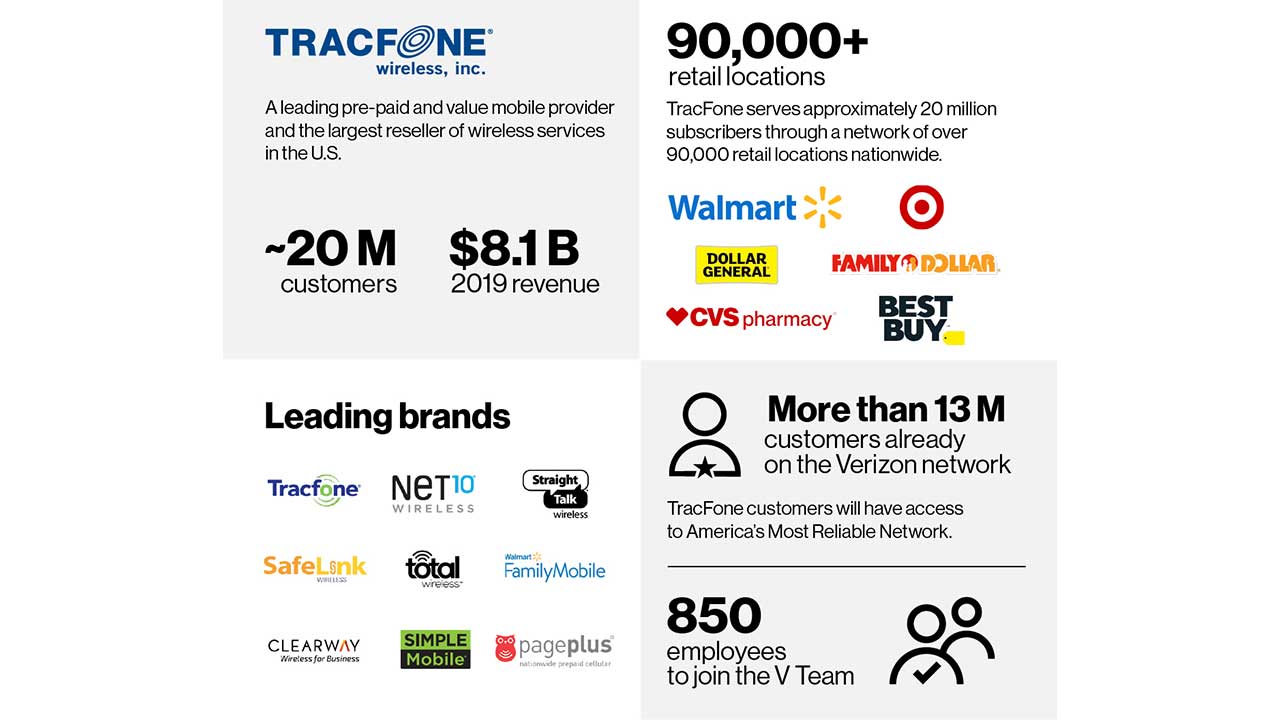

Tracfone’s core business model revolves around providing prepaid wireless services at competitive price points. This strategy targets price-sensitive consumers who may not be interested in or able to afford traditional contract-based plans. The company achieves this affordability through strategic partnerships with major network carriers, leveraging their infrastructure while maintaining its own branding and distribution network. Its distribution channels are extensive, including partnerships with major retailers like Walmart, Target, and numerous smaller independent stores. This widespread availability makes Tracfone services easily accessible to a broad consumer base. Pricing strategies typically involve a variety of plans with varying talk time, data allowances, and text messaging options, catering to a range of user needs and budgets. This tiered approach allows Tracfone to capture a significant share of the prepaid market.

Recent Changes in Tracfone’s Operational Structure and Management

While specific details about internal restructuring and management changes at Tracfone are often not publicly released in detail, the company’s ownership by Verizon and subsequent integration into Verizon’s broader operations has likely resulted in significant internal adjustments. This integration may involve streamlining operations, consolidating resources, and potentially altering management structures to optimize efficiency and synergy within the larger Verizon ecosystem. These changes are largely behind-the-scenes and don’t always translate into readily available public information.

Impact of Technological Advancements and Regulatory Changes

Technological advancements, such as the increasing demand for high-speed data and the rise of 5G networks, present both challenges and opportunities for Tracfone. To remain competitive, Tracfone must adapt its service offerings to meet these evolving demands. This necessitates investments in network infrastructure and the development of data-intensive plans. Regulatory changes, particularly those concerning net neutrality and data privacy, also significantly impact Tracfone’s operations. The company must comply with all applicable regulations and ensure its practices align with evolving legal frameworks. Failure to adapt to these changes could negatively impact its market position and profitability.

Strengths and Weaknesses of Tracfone’s Current Business Strategy

Tracfone’s success hinges on several key strengths and weaknesses in its current business strategy. Understanding these factors is crucial to assessing its long-term viability.

- Strengths: Wide distribution network, competitive pricing, strong brand recognition among price-sensitive consumers, established relationships with major network carriers.

- Weaknesses: Potential for lower profit margins due to its low-cost pricing strategy, dependence on major carriers for network infrastructure, vulnerability to technological disruptions and changes in consumer preferences, potential challenges in competing with more feature-rich plans from larger carriers.

Assessment of External Factors Affecting Tracfone’s Viability

Tracfone’s future hinges not only on its internal strategies but also on the dynamic external environment of the prepaid wireless market. Understanding the broader market trends, competitive pressures, and macroeconomic factors is crucial to assessing its long-term viability. This section analyzes these external influences, highlighting both threats and opportunities.

Prepaid Wireless Market Trends

The prepaid wireless market is characterized by intense competition and evolving consumer preferences. Growth is driven by price-sensitive consumers seeking flexible plans, and the market has seen increased adoption of data-centric plans. However, market saturation in some regions and the increasing prevalence of bundled services (e.g., mobile phone + streaming services) present challenges. The rise of Mobile Virtual Network Operators (MVNOs) also adds to the competitive pressure, offering diverse and often cheaper plans. Recent reports suggest a shift towards more premium prepaid plans with increased data allowances, indicating a gradual move away from the strictly budget-focused segment. This evolution requires companies like Tracfone to adapt their offerings to cater to these shifting consumer demands.

Competitive Landscape Analysis

Tracfone operates in a highly competitive market dominated by major players like Verizon, AT&T, and T-Mobile, as well as numerous smaller MVNOs. The entry of new players, particularly those offering innovative technologies or aggressive pricing strategies, poses a significant threat. Existing competitors continuously refine their offerings, introducing new data plans, enhancing network coverage, and leveraging bundling strategies to attract and retain customers. For example, the aggressive expansion of 5G networks by major carriers creates pressure on Tracfone to either invest heavily in upgrading its network infrastructure or risk losing customers to competitors offering superior network speed and reliability. The strategies of these competitors, including targeted marketing campaigns and loyalty programs, necessitate Tracfone’s continuous adaptation to remain competitive.

Macroeconomic Factors

Macroeconomic conditions significantly influence consumer spending patterns and the telecommunications sector. Inflationary pressures can lead to reduced disposable income, impacting consumer willingness to pay for wireless services. A recessionary environment could further exacerbate this effect, pushing consumers towards cheaper alternatives or forcing them to reduce their overall spending on non-essential services. Conversely, periods of economic growth can lead to increased demand for wireless services, presenting opportunities for expansion. For instance, a potential recession could force Tracfone to focus on its most cost-effective plans to maintain market share. Conversely, economic growth could allow Tracfone to explore higher-margin services.

External Threats and Opportunities for Tracfone

| Threat | Opportunity |

|---|---|

| Increased competition from established carriers and new MVNOs offering innovative plans and aggressive pricing. | Expansion into underserved markets with tailored prepaid plans. |

| Economic downturn leading to reduced consumer spending on non-essential services. | Development of value-added services and partnerships to enhance offerings. |

| Inflationary pressures impacting consumer purchasing power. | Focus on cost optimization and efficiency improvements to maintain profitability. |

| Technological advancements requiring significant investments in network infrastructure. | Leveraging technological advancements to offer innovative features and improved services. |

| Shifting consumer preferences towards more premium prepaid plans. | Expansion of premium prepaid plans with enhanced features and data allowances. |

Examination of Tracfone’s Customer Base and Brand Perception: Is Tracfone Going Out Of Business 2023

Tracfone’s success hinges on understanding its customer base and maintaining a positive brand perception. Analyzing these aspects provides crucial insights into the company’s current market position and future viability. This section delves into the demographics of Tracfone’s typical customer, examines its brand image, and analyzes customer feedback to pinpoint areas for improvement.

Tracfone’s customer base is characterized by price sensitivity and a preference for prepaid wireless service. The typical Tracfone user is likely to be budget-conscious, potentially seeking a cost-effective alternative to traditional contract-based plans. This demographic often includes individuals with limited incomes, families managing tight budgets, and those seeking temporary or supplemental phone service. Further, the customer base is likely to be diverse in age, ethnicity, and geographic location, reflecting the widespread availability of Tracfone’s services. A significant portion may also include individuals who are less tech-savvy and prefer simple, straightforward plans.

Tracfone’s Brand Image and Reputation

Tracfone’s brand image is largely associated with affordability and simplicity. Marketing efforts often emphasize the low cost of its prepaid plans and the ease of use of its services. However, this focus on affordability can also contribute to a perception of lower quality or less reliable service compared to more established carriers. Online reviews frequently mention issues with customer service, network coverage, and data speeds. While Tracfone may be viewed favorably by budget-conscious consumers, it faces challenges in improving its reputation for overall service quality. This necessitates a strategic shift towards enhancing customer service and network performance to counter negative perceptions.

Analysis of Customer Reviews and Feedback

Customer reviews consistently highlight both positive and negative aspects of Tracfone’s services. Positive feedback frequently centers on the affordability and simplicity of the plans, with many users appreciating the prepaid model and its flexibility. Negative reviews, however, often cite poor customer service experiences, including long wait times, difficulty resolving issues, and unhelpful representatives. Network coverage and data speeds are also recurring points of criticism, with users in certain areas reporting unreliable service or slower speeds compared to competitors. These reviews suggest a need for Tracfone to invest in improving its customer service infrastructure, expanding its network coverage, and enhancing its data network performance.

Visual Representation of the Customer Profile

Imagine a visual representation: a diverse group of individuals of varying ages and backgrounds are depicted. Each person has a speech bubble above their head. Some bubbles contain positive comments such as “Affordable!”, “Easy to use!”, “Good for emergencies!”. Other bubbles show negative comments such as “Poor customer service”, “Spotty coverage”, “Slow data”. The overall image conveys the diverse nature of the customer base and highlights both their needs (affordability, simplicity) and their pain points (customer service, network reliability, data speeds). This visual emphasizes the need for Tracfone to address the negative feedback to retain and attract customers.

Exploration of Potential Future Scenarios for Tracfone

Tracfone’s future hinges on several interconnected factors, including its ability to adapt to the evolving telecommunications landscape, its success in attracting and retaining customers, and its response to competitive pressures. Several plausible scenarios can be envisioned, each with unique implications for the company, its customers, and its employees.

The following analysis explores three potential future scenarios for Tracfone, ranging from optimistic to pessimistic, and Artikels potential strategic responses the company could employ.

Scenario 1: Continued Growth and Market Consolidation

This scenario envisions Tracfone successfully navigating the challenges of the prepaid market and leveraging its existing strengths to achieve continued growth. This could involve strategic partnerships with other players in the industry, expansion into new markets or service offerings (such as enhanced data plans or bundled services), and a strong focus on customer retention through improved customer service and loyalty programs. Success in this scenario would likely involve a sustained increase in market share and profitability, leading to potential acquisitions or mergers. Tracfone’s employees would benefit from job security and potential growth opportunities, while customers would enjoy a wider range of services and potentially lower prices due to increased competition. This scenario mirrors the success of other prepaid carriers who have adapted to changing market dynamics and invested in improving their service offerings. For example, Mint Mobile’s strategic use of celebrity endorsements and its focus on affordable plans have allowed it to carve out a significant niche in the market.

Scenario 2: Stagnation and Market Share Erosion

This scenario assumes Tracfone fails to adapt effectively to the evolving market dynamics. This could result from a failure to innovate, a decline in customer satisfaction, or an inability to compete effectively with larger, more established carriers offering more comprehensive and competitive plans. In this scenario, Tracfone’s market share could decline, leading to reduced profitability and potential job losses. Customers might experience reduced service quality or higher prices, potentially leading to customer churn. This scenario could be compared to the struggles of smaller regional carriers that failed to adapt to the rise of national carriers and the increased demand for data-intensive services. Their inability to invest in network infrastructure and innovative offerings ultimately led to their decline or acquisition.

Scenario 3: Acquisition or Merger

This scenario considers the possibility of Tracfone being acquired by a larger telecommunications company or merging with another carrier. This could be driven by a number of factors, including Tracfone’s valuable customer base, its existing network infrastructure, or its strategic position in the prepaid market. An acquisition or merger could lead to significant changes for Tracfone’s employees and customers, including potential job losses, changes in service offerings, and adjustments to pricing strategies. The outcome would depend largely on the acquiring company’s strategy and its integration plans. Similar examples include the acquisition of smaller wireless carriers by larger corporations to expand their market reach and customer base.

Hypothetical Press Release Announcing a Significant Development

FOR IMMEDIATE RELEASE

Tracfone Announces Strategic Partnership with [Partner Company Name] to Expand Service Offerings and Enhance Customer Experience

[City, State] – [Date] – Tracfone Wireless, Inc., a leading provider of wireless communication services, today announced a strategic partnership with [Partner Company Name], a [Partner Company Description]. This collaboration will enable Tracfone to significantly expand its service offerings, providing customers with [Specific examples of new services or improvements, e.g., access to faster 5G networks, enhanced international calling options, innovative data packages].

“[Quote from Tracfone CEO about the partnership and its benefits for customers and the company],” said [CEO Name], CEO of Tracfone Wireless, Inc. “[Quote from Partner Company CEO about the synergy and mutual benefits of the partnership].”

This partnership marks a significant milestone in Tracfone’s ongoing commitment to providing affordable and reliable wireless communication services to its customers. The enhanced services will begin rolling out on [Date].