John Deere loan calculator simplifies the process of financing your next agricultural purchase. Understanding your financing options is crucial for successful farm management, and this guide breaks down the various John Deere loan types – from purchase loans to lease agreements – comparing interest rates, terms, and down payment requirements. We’ll explore how factors like your credit score and down payment impact your monthly payments and overall cost, providing a clear picture of your financial obligations. This comprehensive guide also compares John Deere financing to other lenders, equipping you with the knowledge to make informed decisions.

Navigating the world of agricultural financing can be complex. This guide aims to demystify the process by offering a step-by-step walkthrough of a hypothetical John Deere loan calculator, demonstrating how different inputs affect your final loan terms. We’ll cover repayment options, potential penalties for late payments, and offer valuable resources to ensure you’re well-prepared for your next investment.

Understanding John Deere Loan Options

Securing financing for agricultural equipment is a crucial step in the purchasing process. John Deere offers a range of financing options tailored to the diverse needs of farmers and agricultural businesses, allowing for flexibility in managing cash flow and optimizing investments. Understanding the nuances of these options is essential for making informed decisions that align with your financial goals and operational requirements.

John Deere provides several financing solutions, each with its own set of terms, conditions, and benefits. The choice between a purchase loan, lease agreement, or other financing options depends heavily on factors such as the length of intended equipment use, budget constraints, and long-term financial planning.

John Deere Financing Options: Purchase Loans, Leases, and More

John Deere’s financing options primarily revolve around purchase loans and lease agreements. Purchase loans provide ownership of the equipment upon completion of the loan term, while leases offer the use of the equipment for a specified period. Other options may include tailored financing programs designed for specific equipment types or customer needs, often incorporating features such as deferred payments or variable interest rates.

Comparison of John Deere Financing Options

The key differences between John Deere’s financing options lie in ownership, cost structure, and long-term implications. Purchase loans offer the benefit of eventual equipment ownership and potential tax advantages associated with depreciation. However, they typically require a larger upfront investment and involve higher overall costs due to interest accumulation over the loan term. Leases, on the other hand, generally involve lower monthly payments and require a smaller initial investment. However, at the end of the lease term, the lessee does not own the equipment and may face additional costs if they wish to extend the lease or purchase the equipment. Other financing programs offered by John Deere can provide customized solutions that address specific financial situations, but their terms and conditions will vary widely.

Interest Rates and Loan Terms

Interest rates and loan terms for John Deere financing vary depending on the type of loan, the equipment being financed, the borrower’s creditworthiness, and prevailing market conditions. Generally, longer loan terms result in lower monthly payments but higher overall interest costs. Conversely, shorter loan terms lead to higher monthly payments but lower total interest paid. Creditworthiness plays a significant role in determining the interest rate offered; borrowers with strong credit histories typically qualify for lower interest rates. It’s important to note that interest rates are subject to change, and it is advisable to obtain the most current information directly from John Deere Financial or an authorized dealer.

Summary of John Deere Financing Options

| Loan Type | Interest Rate Range | Loan Term Options | Typical Down Payment |

|---|---|---|---|

| Purchase Loan | Variable; dependent on creditworthiness and market conditions (e.g., 4% – 10%) | 12 to 84 months, often longer for larger purchases | 10% – 30%, often higher for larger purchases or lower credit scores |

| Lease Agreement | Variable; dependent on creditworthiness and market conditions (e.g., 5% – 12%) | 24 to 60 months, typically shorter terms | Typically lower than purchase loans, potentially 0% – 10% |

| Other Financing Programs | Variable; highly dependent on specific program terms | Varies greatly based on program design | Varies greatly based on program design |

Factors Affecting John Deere Loan Calculations: John Deere Loan Calculator

Securing financing for John Deere equipment involves several key factors that significantly influence the final loan terms. Understanding these factors allows prospective buyers to make informed decisions and potentially negotiate better loan options. This section details the primary elements affecting your John Deere loan calculations, focusing on their impact on both monthly payments and the total interest paid over the loan’s lifespan.

Credit Score’s Influence on Interest Rates

Your credit score is a crucial determinant of the interest rate you’ll receive on a John Deere loan. Lenders assess your creditworthiness based on this score, reflecting your history of repaying debts. A higher credit score demonstrates lower risk to the lender, resulting in a more favorable interest rate. Conversely, a lower credit score indicates higher risk, leading to a higher interest rate and consequently, higher monthly payments and total interest paid over the loan term.

For example, consider two farmers, both applying for a $100,000 loan for a new tractor. Farmer A has an excellent credit score of 780, while Farmer B has a fair credit score of 650. Farmer A might qualify for an interest rate of 5%, while Farmer B might receive a rate of 8%. Over a five-year loan term, this 3% difference translates to a substantial difference in total interest paid and monthly payments. Farmer A would pay significantly less in interest and have lower monthly installments.

Equipment Value and Loan Amount

The value of the John Deere equipment you’re financing directly impacts the loan amount and, subsequently, your monthly payments. A higher equipment value allows for a larger loan, increasing both the monthly payment and the total interest paid. Conversely, a lower equipment value results in a smaller loan, reducing both monthly payments and overall interest.

For instance, financing a $150,000 combine will necessitate a larger loan than financing a $75,000 tractor. The larger loan for the combine will result in higher monthly payments and accumulate more interest over the repayment period. This highlights the importance of carefully considering the equipment’s value and its alignment with your budget and financing capabilities.

Down Payment’s Impact on Loan Amount and Interest

The down payment you make significantly influences the loan amount. A larger down payment reduces the loan amount, resulting in lower monthly payments and less total interest paid. A smaller down payment, or no down payment, increases the loan amount, leading to higher monthly payments and increased overall interest costs.

To illustrate, imagine purchasing a $100,000 tractor. With a 20% down payment ($20,000), the loan amount is $80,000. However, with a 10% down payment ($10,000), the loan amount increases to $90,000. This difference in loan amount will directly impact the monthly payment and the total interest accrued over the loan’s lifetime. The larger the down payment, the smaller the loan and the less interest you will pay.

Loan Term’s Effect on Monthly Payments and Total Interest

The loan term, or repayment period, also affects both monthly payments and total interest. A longer loan term (e.g., 7 years) results in lower monthly payments but higher total interest paid over the life of the loan. Conversely, a shorter loan term (e.g., 3 years) leads to higher monthly payments but lower total interest.

Choosing a longer loan term might seem appealing due to lower monthly payments, but it’s crucial to consider the significantly higher overall interest cost. A shorter loan term, while demanding higher monthly payments, ultimately saves money on interest in the long run. The optimal loan term depends on your financial situation and risk tolerance.

Using a John Deere Loan Calculator (Hypothetical)

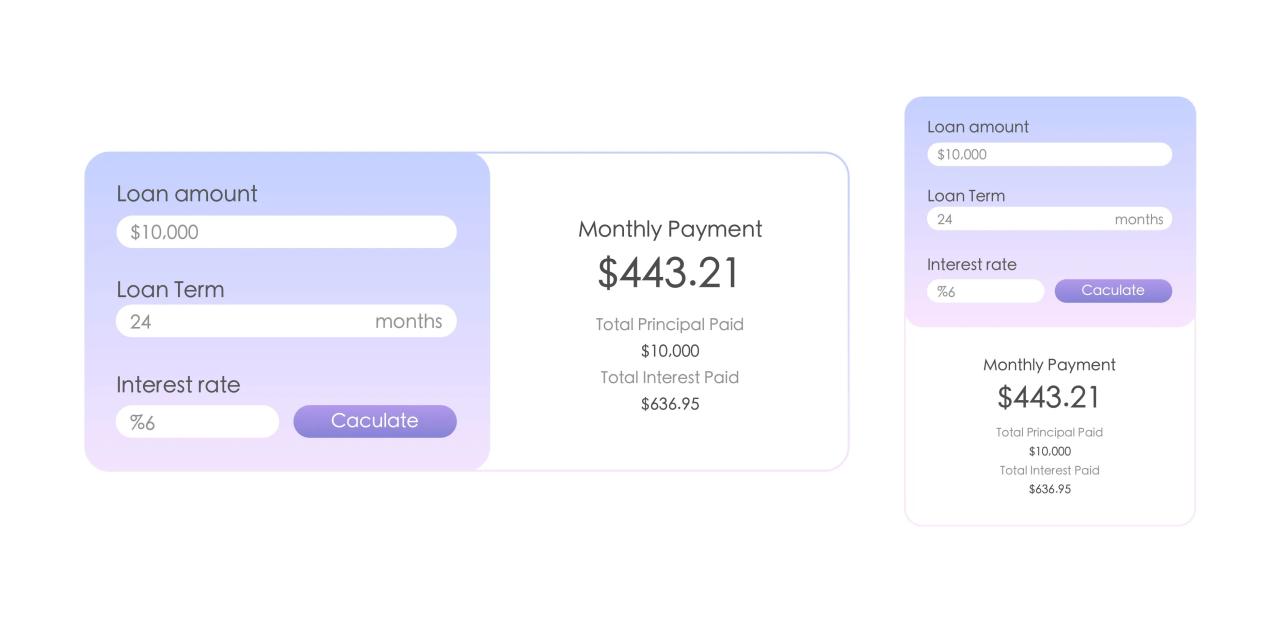

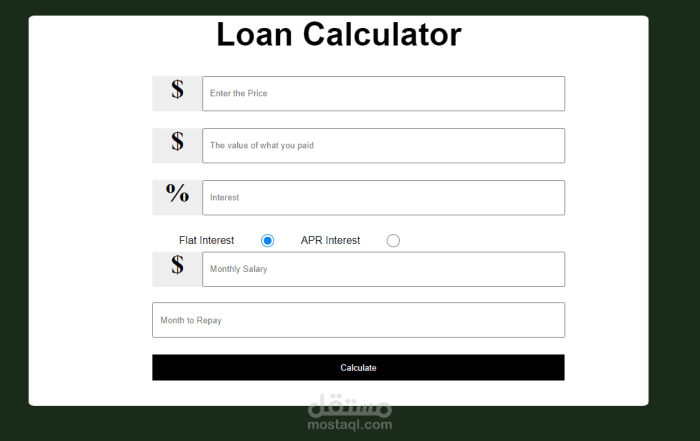

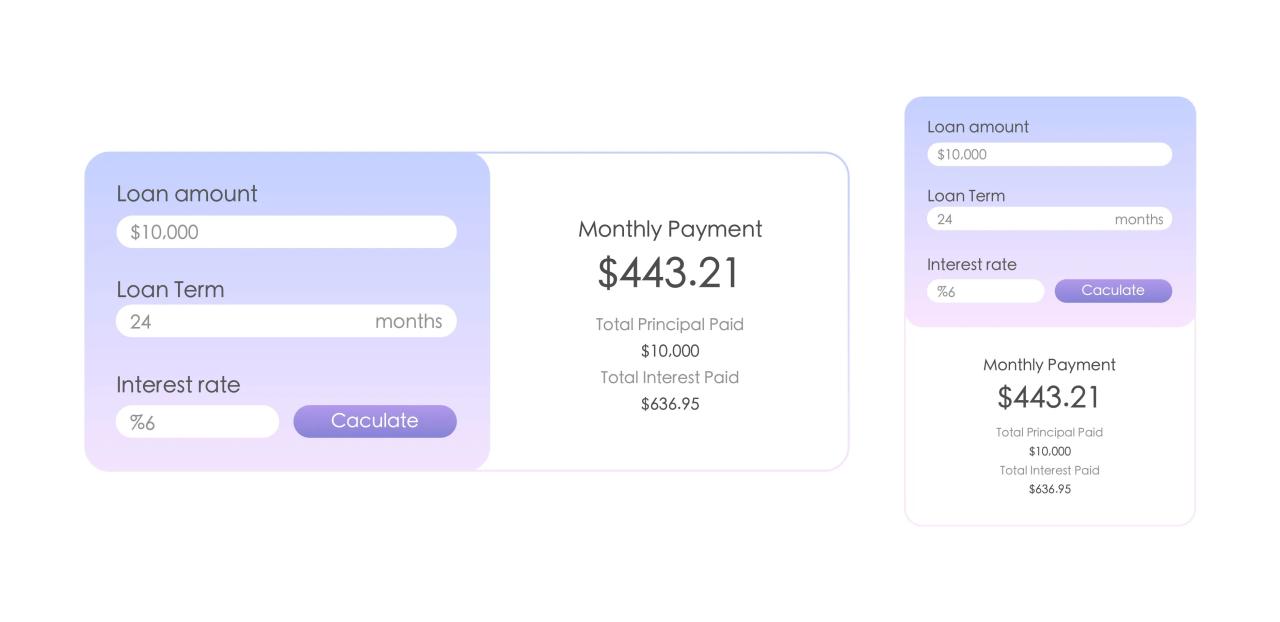

Understanding how to use a John Deere loan calculator can significantly simplify the process of financing your agricultural equipment. This hypothetical example demonstrates the functionality of such a calculator, allowing you to explore different financing scenarios and make informed decisions. We will use a simplified calculator with key input fields to illustrate the process.

Hypothetical John Deere Loan Calculator Usage

This section provides a step-by-step guide on using a hypothetical John Deere loan calculator. The calculator will allow you to input specific financial details to receive an estimate of your monthly payments and total loan cost. Understanding these calculations empowers you to choose the financing option that best suits your budget and financial goals.

- Enter Equipment Price: Begin by entering the total price of the John Deere equipment you intend to purchase. For this example, let’s assume the equipment costs $100,000.

- Input Down Payment: Next, input the amount of your down payment. A larger down payment will typically result in lower monthly payments and a reduced total interest paid. Let’s assume a down payment of $20,000.

- Specify Interest Rate: Enter the annual interest rate offered by John Deere Financial or your chosen lender. Interest rates fluctuate, so it’s crucial to use the current rate provided. For this example, we’ll use an interest rate of 6%.

- Select Loan Term: Choose the loan term, typically expressed in months or years. Longer loan terms generally result in lower monthly payments but increase the total interest paid over the life of the loan. Let’s select a 60-month (5-year) loan term.

- Calculate and Review Results: After inputting all the necessary information, click the “Calculate” button. The calculator will then display your estimated monthly payment and the total cost of the loan, including principal and interest.

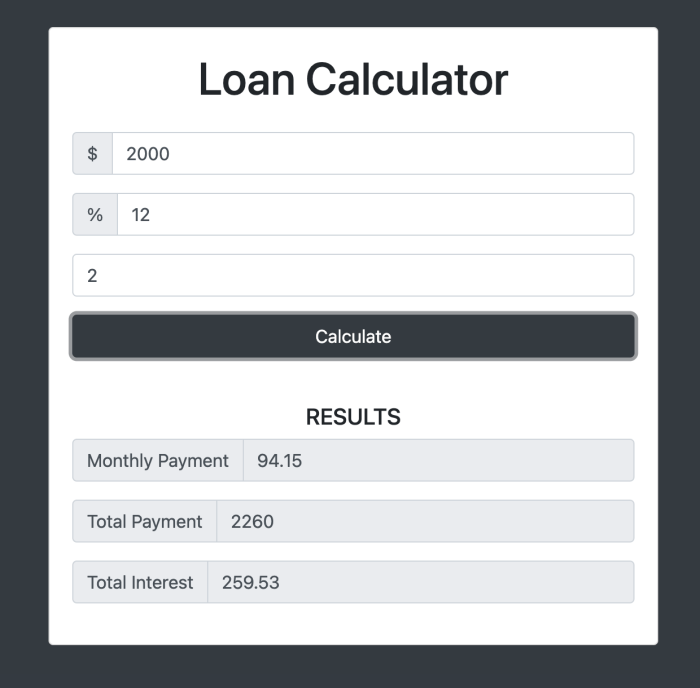

Example Calculation and Impact of Variable Changes

Let’s illustrate the impact of changing variables. Using the initial values above ($100,000 equipment price, $20,000 down payment, 6% interest rate, 60-month term), the hypothetical calculator might show a monthly payment of approximately $1,432.82 and a total loan cost of approximately $86,000 (principal and interest).

Now, let’s explore the impact of changing some variables:

- Increasing the Down Payment: If we increase the down payment to $30,000, the monthly payment would decrease, reducing the total interest paid over the life of the loan.

- Extending the Loan Term: Extending the loan term to 72 months (6 years) would lower the monthly payment but increase the total interest paid.

- Higher Interest Rate: An increase in the interest rate to 7% would result in higher monthly payments and a higher total loan cost.

By experimenting with different values in the hypothetical John Deere loan calculator, you can determine the financing option that best fits your financial situation. Remember that these are hypothetical examples, and actual loan terms and interest rates may vary depending on your creditworthiness and John Deere’s current offerings. Always consult with a John Deere Financial representative for the most accurate and up-to-date information.

Comparing John Deere Financing with Other Options

Choosing the right financing option for agricultural equipment is crucial, impacting both short-term cash flow and long-term profitability. While John Deere offers competitive financing packages, comparing their offerings to those of other manufacturers and financial institutions provides a clearer picture of the best value proposition. This section analyzes the advantages and disadvantages of various financing options, facilitating a more informed decision-making process.

John Deere Financing

John Deere offers various financing plans, often tailored to the specific needs of farmers. These plans typically include options for fixed-rate and variable-rate loans, as well as lease agreements. The terms and interest rates offered often depend on creditworthiness, the type of equipment purchased, and the overall economic climate. A key advantage is the potential for streamlined purchasing, as financing is handled directly through the dealership. However, interest rates may not always be the most competitive compared to other financial institutions.

- Advantage: Convenience and potential for bundled services with equipment purchase.

- Disadvantage: Interest rates might not always be the lowest available.

Financing from Other Agricultural Equipment Manufacturers

Manufacturers like Case IH, New Holland, and Kubota also provide financing options for their equipment. These financing schemes often mirror those offered by John Deere, with variations in interest rates and loan terms. A significant factor to consider is whether the manufacturer offers any incentives or discounts bundled with their financing packages. Comparing these offers alongside John Deere’s options allows for a comprehensive assessment of value.

- Advantage: Potential for manufacturer-specific incentives and bundled services.

- Disadvantage: Interest rates and terms can vary significantly between manufacturers.

Financing from Financial Institutions

Banks and credit unions represent a third avenue for financing agricultural equipment. These institutions typically offer a broader range of loan products, potentially including lower interest rates than those offered directly by equipment manufacturers. However, the application process might be more stringent and require more documentation. The advantage lies in the competitive interest rates, but the disadvantage is a potentially more complex application process.

- Advantage: Potentially lower interest rates and greater flexibility in loan terms.

- Disadvantage: More rigorous application process and potentially more paperwork.

Scenario: Comparing Total Financing Costs

Let’s consider a hypothetical scenario: a farmer needs to finance a $100,000 tractor. John Deere offers a 5-year loan at 6% interest, while a local bank offers a similar loan at 5% interest. Using a loan amortization calculator (readily available online), we can determine the total cost of each loan.

The John Deere loan would result in higher total interest payments compared to the bank loan. While the exact figures depend on the specific loan terms and amortization schedule, the difference in interest rates would translate to a substantial difference in the overall cost of financing over the life of the loan. For instance, the total interest paid on the John Deere loan might be approximately $15,000, while the bank loan might only incur around $12,500 in interest. This illustrates the importance of comparing financing options before committing to a purchase. This example is illustrative; actual interest amounts will vary based on prevailing market rates and individual creditworthiness.

Understanding Loan Repayment and Potential Penalties

John Deere financing offers various repayment structures, each with its own implications for borrowers. Understanding these options and the potential consequences of missed payments is crucial for responsible financial management. Failing to meet payment obligations can result in significant financial penalties and damage to credit scores.

John Deere typically offers several repayment options, including fixed-rate loans with regular monthly payments spread over a predetermined term. The specific options available will depend on the loan amount, the type of equipment purchased, and the borrower’s creditworthiness. Some loans might offer balloon payments, requiring a larger final payment at the end of the loan term. Others may allow for accelerated payments, enabling borrowers to pay off the loan more quickly and potentially reduce the total interest paid. It’s essential to carefully review the loan agreement to fully understand the repayment schedule and any associated fees.

Late Payment Consequences

Late or missed payments on a John Deere loan can trigger several negative consequences. These consequences can significantly impact the borrower’s finances and credit history. The most immediate consequence is the accrual of late payment fees. These fees can vary depending on the loan agreement but are typically a percentage of the missed payment or a fixed dollar amount. Beyond fees, late payments can negatively impact your credit score, making it more difficult to secure loans or other forms of credit in the future. Repeated late payments can lead to loan default, resulting in the repossession of the purchased equipment.

Examples of Financial Impact of Late Payments

Let’s consider a hypothetical scenario: A farmer takes out a $50,000 John Deere loan with a monthly payment of $1,000. If they miss one payment, they might incur a late fee of $50 (1% of the missed payment). Missing two payments could result in a $100 late fee, and the lender might start charging interest on the missed payments, significantly increasing the total debt. Repeated missed payments could eventually lead to default, resulting in the repossession of the equipment, and potentially further legal and financial repercussions. The impact of late payments can quickly escalate from a minor inconvenience to a major financial burden.

Best Practices for Managing Loan Repayments

Effective loan management requires proactive planning and diligent tracking. Setting up automatic payments is a simple yet highly effective strategy to avoid missed payments. Creating a budget that incorporates the loan payment as a non-negotiable expense ensures sufficient funds are allocated for repayment. Regularly reviewing the loan statement helps identify any discrepancies or potential issues early on. Open communication with the lender is vital; contacting them immediately if financial difficulties arise can help explore potential solutions and prevent default. Maintaining a healthy financial cushion allows for unexpected expenses without compromising loan payments. By implementing these strategies, borrowers can significantly reduce the risk of late payments and their associated financial penalties.

Additional Resources and Support

Finding the right financing for your John Deere equipment is a significant decision. To help you navigate this process and ensure you have access to the information and support you need, John Deere provides a variety of resources. These resources are designed to empower you with the knowledge to make informed choices and manage your loan effectively.

Understanding your financing options and accessing support when needed is crucial for a positive experience. John Deere offers several avenues to obtain further information and assistance throughout your loan journey, from initial application to repayment. This section details these resources and support options.

John Deere Financing Website

The official John Deere financing website serves as a central hub for all financing-related information. This website contains detailed explanations of various loan programs, interest rates, and terms. It also includes frequently asked questions (FAQs) and downloadable brochures that provide a comprehensive overview of the financing process. The site is user-friendly and designed to guide customers through the application process. Customers can also access their account information and manage their loan online through this website.

John Deere Financial Customer Service, John deere loan calculator

John Deere Financial offers dedicated customer service representatives who are available to answer questions and provide assistance. These representatives can help customers understand their loan agreements, manage payments, and resolve any issues that may arise. Contact information, including phone numbers and email addresses, is readily available on the John Deere financing website and loan documents.

Dealer Support

John Deere dealers play a crucial role in providing support to customers. Dealers can assist with the application process, explain loan options, and answer questions about financing. They also serve as a point of contact for addressing any issues or concerns related to loan repayments. Dealers are knowledgeable about John Deere financing products and can provide personalized guidance based on individual customer needs.

Frequently Asked Questions (FAQ) Section

The John Deere financing website features a comprehensive FAQ section addressing common questions about loan applications, interest rates, repayment terms, and other related topics. This section is regularly updated to reflect the latest information and policy changes. The FAQ section is designed to provide quick and easy access to answers to frequently asked questions, saving customers time and effort. Customers can search the FAQ section by or browse through the categorized questions.

Loan Repayment Support

John Deere Financial understands that unforeseen circumstances can sometimes affect loan repayments. For customers experiencing difficulty making payments, various support options are available. These may include options such as payment deferrals, modified repayment plans, and other tailored solutions designed to help customers get back on track. Contacting John Deere Financial customer service is the first step in accessing these support options. Representatives will work with customers to create a manageable repayment plan that considers their individual circumstances.

Final Review

Securing financing for agricultural equipment is a significant investment. By understanding the nuances of John Deere loan calculators and comparing various financing options, you can make informed decisions that align with your budget and long-term financial goals. Remember to carefully consider all factors – interest rates, loan terms, and potential penalties – before committing to a loan. With careful planning and a thorough understanding of your financing options, you can confidently invest in the equipment needed to cultivate your farm’s success.

FAQ Section

What happens if I miss a John Deere loan payment?

Missing payments can result in late fees, negatively impact your credit score, and potentially lead to loan default. Contact John Deere immediately if you anticipate difficulties making a payment.

Can I refinance my John Deere loan?

Depending on your loan terms and current financial situation, refinancing may be an option. Contact John Deere or a financial institution to explore this possibility.

What documents do I need to apply for a John Deere loan?

Typically, you’ll need proof of income, credit history information, and details about the equipment you’re financing. John Deere will provide a specific list of required documents during the application process.

Where can I find a John Deere loan calculator?

John Deere’s official website or your local John Deere dealer should provide access to a loan calculator or financing information.