Keesler Federal Credit Union auto loans offer a compelling option for vehicle financing, boasting competitive interest rates and a streamlined application process. This in-depth guide explores everything you need to know, from understanding interest rate factors and eligibility requirements to navigating the repayment process and exploring available special offers. We’ll compare Keesler’s offerings to other financial institutions, analyze customer reviews, and address frequently asked questions to help you make an informed decision.

Whether you’re a first-time car buyer or looking to refinance, this comprehensive resource provides the clarity and insights necessary to confidently navigate the world of Keesler Federal Credit Union auto loans. We delve into the specifics of loan terms, fees, and eligibility criteria, ensuring you have all the information needed to secure the best possible financing for your next vehicle.

Keelser Federal Credit Union Auto Loan Interest Rates: Keesler Federal Credit Union Auto Loan

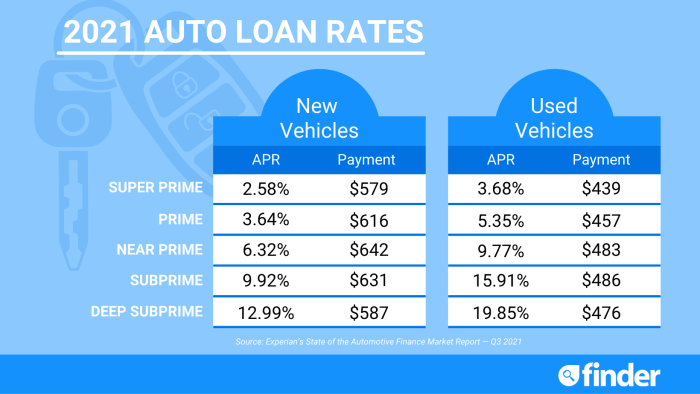

Securing an auto loan involves careful consideration of interest rates, a crucial factor determining the overall cost of borrowing. Understanding the interest rates offered by Keelser Federal Credit Union and how they compare to other financial institutions is essential for making an informed decision. This section details Keelser’s auto loan interest rates, influencing factors, and a comparison with competitors.

Keelser’s Auto Loan Interest Rates Compared to Competitors

The following table provides a comparison of approximate Annual Percentage Rates (APRs) for new auto loans offered by Keelser Federal Credit Union and other major credit unions in the area. It’s crucial to understand that these are estimates and actual rates may vary based on individual creditworthiness and loan specifics. Contact each institution directly for the most up-to-date information.

| Institution | 24-Month APR (Estimate) | 36-Month APR (Estimate) | 48-Month APR (Estimate) | 60-Month APR (Estimate) |

|---|---|---|---|---|

| Keelser Federal Credit Union | 4.5% – 8.5% | 5.0% – 9.0% | 5.5% – 9.5% | 6.0% – 10.0% |

| Credit Union A | 4.0% – 9.0% | 4.5% – 9.5% | 5.0% – 10.0% | 5.5% – 10.5% |

| Credit Union B | 5.0% – 10.0% | 5.5% – 10.5% | 6.0% – 11.0% | 6.5% – 11.5% |

*Note: These APRs are illustrative examples only and are subject to change. The ranges reflect potential variations based on credit score and other loan factors.*

Factors Influencing Keelser’s Auto Loan Interest Rates

Several factors contribute to the interest rate a borrower receives from Keelser Federal Credit Union. Understanding these factors can help borrowers improve their chances of securing a more favorable rate.

The most significant factor is the borrower’s credit score. A higher credit score generally indicates lower risk to the lender, resulting in a lower interest rate. For example, a borrower with a credit score above 750 might qualify for a significantly lower rate than a borrower with a score below 650.

The loan amount also plays a role. Larger loan amounts often carry slightly higher interest rates due to the increased risk for the lender. Similarly, the loan term affects the interest rate. Longer loan terms (e.g., 60 months) generally result in higher interest rates because of the extended period of risk for the lender.

Comparison to Banks and Other Financial Institutions

Keelser Federal Credit Union’s auto loan interest rates are generally competitive with those offered by banks and other financial institutions. However, credit unions, including Keelser, often offer lower rates and more personalized service than larger banks. This is because credit unions are member-owned, not-for-profit organizations, allowing them to prioritize member benefits over maximizing profits. Specific rate comparisons will depend on the current market conditions and the individual borrower’s credit profile. It’s always recommended to compare offers from multiple lenders before making a decision.

Keelser Federal Credit Union Auto Loan Application Process

Applying for an auto loan with Keesler Federal Credit Union is designed to be a straightforward process. This section details the steps involved, required documentation, and the benefits of pre-approval. Understanding these aspects will help you navigate the application smoothly and efficiently.

Auto Loan Application Steps

The application process for a Keesler Federal Credit Union auto loan involves several key steps. Following these steps will ensure a complete and timely application.

- Gather Required Documentation: Before starting the application, collect all necessary documents to expedite the process. This includes proof of income, residence, and vehicle information (more details below).

- Complete the Application: Access the online application portal or visit a branch to complete the application form. Provide accurate and complete information.

- Submit the Application: Submit your completed application form along with all supporting documentation. You can typically do this online, by mail, or in person.

- Credit Check and Approval: Keesler Federal Credit Union will review your application and conduct a credit check. The approval process may take a few business days.

- Loan Closing: Once approved, you’ll finalize the loan terms and sign the necessary documents. This may involve meeting with a loan officer.

- Funding and Disbursement: After the loan closes, the funds will be disbursed according to the agreed-upon terms, often directly to the car dealership.

Required Documentation

Providing the correct documentation is crucial for a smooth and efficient loan application. Incomplete applications may lead to delays.

- Proof of Income: Pay stubs, W-2 forms, tax returns, or other documentation demonstrating your income and employment stability.

- Proof of Residence: Utility bills, rental agreements, or other documents verifying your current address.

- Vehicle Information: Details about the vehicle you intend to purchase, including the make, model, year, VIN, and purchase price.

- Driver’s License or State-Issued ID: A valid form of government-issued identification.

- Credit Report (Optional, but Recommended): Reviewing your credit report beforehand can help you identify and address any potential issues that might affect your loan approval.

Pre-Approval Process and Benefits

Pre-approval offers several advantages for borrowers. It provides clarity and confidence during the car-buying process.

Pre-approval involves submitting a preliminary application to determine your eligibility for an auto loan and the potential loan amount you may qualify for. This allows you to shop for a vehicle with a clear understanding of your borrowing power. Benefits include:

- Knowing Your Budget: Pre-approval gives you a realistic budget for your car purchase, preventing you from exceeding your financial capabilities.

- Stronger Negotiating Position: Having pre-approval demonstrates your financial readiness to dealerships, giving you a stronger negotiating position when purchasing a vehicle.

- Faster Closing Process: The loan approval process is often faster for pre-approved applicants as much of the underwriting is already completed.

- Peace of Mind: Knowing you’re pre-approved reduces stress and uncertainty during the car buying process.

Keelser Federal Credit Union Auto Loan Repayment Options

Keelser Federal Credit Union offers flexible repayment options to suit your budget and financial circumstances. Understanding these options and how to make your payments is crucial for maintaining a healthy credit history and avoiding late payment fees. Choosing the right repayment plan can significantly impact your overall loan cost.

Keelser Federal Credit Union primarily offers monthly payment plans for auto loans. However, they may also offer bi-weekly payment options, allowing for more frequent, smaller payments. The choice between monthly and bi-weekly payments depends on your personal preferences and financial capabilities. Both options provide a clear and structured repayment schedule, ensuring you stay on track with your loan obligations.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule for a $20,000 auto loan over 60 months at a 5% APR. Note that this is a simplified example and actual payments may vary slightly due to rounding and other factors. For precise figures, always refer to your official loan agreement.

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000.00 | $377.42 | $83.33 | $294.09 | $19,705.91 |

| 2 | $19,705.91 | $377.42 | $82.11 | $295.31 | $19,410.60 |

| 3 | $19,410.60 | $377.42 | $80.88 | $296.54 | $19,114.06 |

| … | … | … | … | … | … |

| 60 | $377.42 | $377.42 | $1.57 | $375.85 | $0.00 |

Note: This is a simplified example and does not include any potential fees or charges. Consult with Keelser Federal Credit Union for the exact terms and conditions of your loan.

Available Repayment Methods

Keelser Federal Credit Union provides multiple convenient methods for making your auto loan payments. Selecting the method that best fits your lifestyle ensures timely payments and avoids potential late fees.

Members can choose from online banking, mail, or in-person payments. Online banking offers the convenience of scheduling automatic payments, ensuring you never miss a deadline. Mailing payments requires addressing the payment to the designated address provided by Keelser Federal Credit Union, including the loan account number for proper processing. In-person payments can be made at any Keelser Federal Credit Union branch during business hours.

Keelser Federal Credit Union Auto Loan Eligibility Requirements

Securing an auto loan from Keelser Federal Credit Union hinges on meeting specific eligibility criteria. These requirements are designed to assess the applicant’s creditworthiness and ability to repay the loan. Understanding these requirements is crucial before applying, ensuring a smoother and more successful application process.

Keelser Federal Credit Union, like most financial institutions, uses a multifaceted approach to determine loan eligibility. This involves reviewing the applicant’s credit history, income stability, and employment history. Meeting these criteria increases the likelihood of loan approval and securing favorable interest rates.

Minimum Credit Score Requirements

While Keelser Federal Credit Union doesn’t publicly advertise a specific minimum credit score, approval is generally more likely with a higher credit score. Applicants with scores in the good to excellent range (generally 670 and above) typically have a higher chance of approval and may qualify for better interest rates. Applicants with lower credit scores may still be considered, but they might face higher interest rates or stricter loan terms. It’s advisable to check your credit report before applying to understand your current standing. A higher credit score demonstrates a history of responsible financial management, increasing confidence in the applicant’s ability to repay the loan.

Income and Employment Verification Processes

Keelser Federal Credit Union requires verification of income and employment to ensure applicants have the financial capacity to manage monthly loan payments. This typically involves providing pay stubs, W-2 forms, or tax returns for income verification. Employment verification is usually done through contacting the applicant’s employer directly to confirm employment status, position, and length of service. Consistent income and stable employment history significantly enhance the chances of loan approval. Providing accurate and complete documentation during this process streamlines the application and reduces processing time.

Requirements for Individuals with Less-Than-Perfect Credit

Applicants with less-than-perfect credit may still qualify for an auto loan from Keelser Federal Credit Union, though the process might be more challenging. They may need to provide additional documentation to demonstrate their creditworthiness, such as evidence of improved financial management, such as debt reduction plans or consistent on-time payments. The interest rates offered to applicants with lower credit scores are generally higher to reflect the increased risk for the lender. Co-signing the loan with an individual who has a good credit history can also improve the chances of approval. It’s beneficial for individuals with less-than-perfect credit to explore options like credit counseling to improve their credit score before applying for a loan. This proactive approach demonstrates a commitment to responsible financial management, increasing the likelihood of a favorable outcome.

Keelser Federal Credit Union Auto Loan Fees and Charges

Understanding the fees associated with your Keelser Federal Credit Union auto loan is crucial for budgeting and financial planning. This section details the various fees you may encounter throughout the loan process, from application to repayment. Transparency in fees allows for informed decision-making and helps avoid unexpected costs.

Applicable Fees and Charges

Keelser Federal Credit Union likely charges several fees associated with its auto loans. While specific fees and amounts can vary based on the loan terms and your individual circumstances, the following table Artikels common fees you might encounter. It’s always recommended to confirm the exact fees and amounts with Keelser directly before finalizing your loan application.

| Fee Type | Description | Amount (Example) |

|---|---|---|

| Application Fee | Fee for processing your auto loan application. | $0 – $50 (This is an example, and the actual fee may vary or be waived.) |

| Origination Fee | A one-time fee charged for setting up your loan. This fee often covers administrative costs. | 1% – 3% of the loan amount (This is an example range, and the actual percentage may vary.) |

| Late Payment Fee | Charged when a payment is not received by the due date. | $25 – $50 (This is an example range, and the actual fee may vary.) |

| Returned Check Fee | Charged if a payment check is returned due to insufficient funds. | $25 – $35 (This is an example range, and the actual fee may vary.) |

Prepayment Penalties

Prepayment penalties are fees charged if you pay off your auto loan before the agreed-upon term. These penalties are designed to compensate the lender for lost interest income. Keelser Federal Credit Union’s policy on prepayment penalties should be clearly Artikeld in your loan agreement. It is important to review this information carefully before signing the loan documents to understand whether or not early repayment will incur additional costs. Some lenders waive prepayment penalties entirely, while others may charge a percentage of the remaining loan balance.

Disputing Charges

If you believe you have been charged incorrectly, it’s crucial to contact Keelser Federal Credit Union immediately. Their customer service department should have a clear process for disputing charges. Gather all relevant documentation, including your loan agreement, payment history, and any communication related to the disputed charge. Present your case clearly and concisely, providing evidence to support your claim. Keelser should investigate the matter and respond within a reasonable timeframe. If the dispute is not resolved to your satisfaction, you may have other avenues for recourse, depending on the nature of the dispute and your location.

Keelser Federal Credit Union Auto Loan Special Offers and Promotions

Keelser Federal Credit Union regularly offers special promotions on its auto loans to attract new members and reward existing ones. These promotions can significantly reduce the overall cost of borrowing, making purchasing a vehicle more affordable. The availability and specifics of these offers change periodically, so it’s crucial to check the credit union’s website or contact a representative for the most up-to-date information.

Currently, Keelser Federal Credit Union may be offering several attractive promotions. It’s important to note that these offers are subject to change and may have specific eligibility criteria. Always confirm the details with the credit union directly before making any financial decisions.

Current Auto Loan Promotions

The following are examples of potential promotions that Keelser Federal Credit Union *might* offer. These are illustrative and should not be considered a guarantee of current offers. Contact Keelser Federal Credit Union for the most current promotions.

- Reduced Interest Rate for New Members: New members joining Keelser Federal Credit Union might be eligible for a lower interest rate on their auto loan compared to standard rates. This incentive aims to attract new customers and grow the credit union’s membership base. For example, a new member might receive a rate of 3% APR instead of the standard 4.5% APR for a 60-month loan. The specific interest rate reduction and loan terms would be clearly defined in the offer.

- Loyalty Rewards Program: Existing members with a history of responsible borrowing and positive account standing may qualify for a reduced interest rate or other benefits on their auto loan. This rewards loyalty and encourages continued business with the credit union. A long-standing member might receive a 0.5% APR reduction on their auto loan, for example.

- Limited-Time Promotional Rate: Keelser Federal Credit Union may offer a special, reduced interest rate for a limited time, such as during specific months or holidays. This creates a sense of urgency and encourages applications within a set timeframe. The promotional rate might be available for a 6-month period, with a specific APR advertised during that time.

- Incentives for Purchasing a New or Used Vehicle from a Partner Dealership: The credit union might partner with local dealerships, offering members a lower interest rate or other perks if they finance their vehicle purchase through Keelser Federal Credit Union and purchase the vehicle from a participating dealership. This benefits both the credit union and the dealerships, increasing business for all parties. For example, a $500 rebate might be offered in conjunction with a lower APR.

Terms and Conditions of Special Offers

Each special offer will have its own specific terms and conditions. These will typically include the promotional period, the applicable interest rate, loan amounts, loan terms, and eligibility requirements. These details will be clearly Artikeld in the offer documentation provided by Keelser Federal Credit Union. It’s crucial to carefully review these terms before accepting any offer to fully understand the commitment and associated costs. For instance, a promotional rate might only apply to loans with a minimum loan amount and a maximum loan term.

Qualifying for Special Offers

Qualification for special offers typically involves meeting certain criteria set by Keelser Federal Credit Union. These criteria can include factors like membership status (new or existing), credit score, loan amount, loan term, and vehicle type. Meeting these criteria increases the likelihood of securing the promotional rate or benefit. For example, a minimum credit score of 680 might be required to qualify for a reduced interest rate, or the offer might be limited to new vehicles only. Contacting Keelser Federal Credit Union directly to inquire about current offers and eligibility is highly recommended.

Comparing Keelser’s Auto Loan with Other Loan Products

Choosing the right loan product for a vehicle purchase depends on individual financial circumstances and the specific features offered by Keelser Federal Credit Union. This section compares Keelser’s auto loans with other loan options, such as personal loans and home equity loans, to help you make an informed decision.

Keelser Federal Credit Union offers a variety of loan products, each designed for different purposes and with varying terms and conditions. Understanding the nuances of each can significantly impact your financial planning. Direct comparison allows for a clearer picture of which option best suits your needs and budget.

Keelser Loan Product Comparison

The following table compares the key features of Keelser’s auto loans with their personal and home equity loans. Note that specific interest rates and terms are subject to change and are based on individual creditworthiness and the prevailing market conditions. Always consult Keelser directly for the most up-to-date information.

| Feature | Auto Loan | Personal Loan | Home Equity Loan |

|---|---|---|---|

| Purpose | Vehicle purchase or refinancing | Debt consolidation, home improvements, major purchases | Home improvements, debt consolidation, major purchases |

| Collateral | The vehicle being financed | None (unsecured) | Your home (secured) |

| Interest Rates | Generally lower than personal loans, potentially higher than home equity loans | Generally higher than auto loans | Generally lower than auto and personal loans, but higher risk due to collateral |

| Loan Terms | Typically 24-72 months | Typically 12-60 months | Typically 5-15 years |

| Approval Process | May require proof of income, credit check, and vehicle information | May require proof of income and credit check | May require proof of income, credit check, and home appraisal |

| Fees | May include origination fees, late payment fees | May include origination fees, late payment fees | May include appraisal fees, closing costs |

Advantages and Disadvantages of Auto Loans vs. Other Options

Choosing between an auto loan and other financing methods requires careful consideration of the advantages and disadvantages of each. An auto loan offers a lower interest rate compared to a personal loan, but it requires collateral (the vehicle). A home equity loan has lower interest rates than both, but risks the home in case of default.

An auto loan is specifically designed for vehicle financing, often offering lower interest rates and longer repayment terms than personal loans. However, the vehicle serves as collateral, meaning it could be repossessed if payments are missed. Personal loans provide flexibility for various purposes but typically come with higher interest rates. Home equity loans leverage your home’s equity, offering lower interest rates but putting your home at risk.

Potential Tax Benefits of Auto Loans

While there are no direct tax deductions for auto loan interest, the interest paid might indirectly contribute to tax savings if the vehicle is used for business purposes. For self-employed individuals or business owners, a portion of the vehicle’s expenses, including interest payments, might be deductible as a business expense. This deduction would reduce taxable income, resulting in lower tax liability. However, strict IRS guidelines govern these deductions, and thorough documentation is necessary to claim them. Consulting a tax professional is advisable to determine eligibility and the appropriate amount of deduction.

Customer Reviews and Experiences with Keelser Auto Loans

Understanding customer feedback is crucial for assessing the quality of Keelser Federal Credit Union’s auto loan services. Analyzing both positive and negative reviews provides a comprehensive picture of the customer experience and highlights areas for potential improvement. This section summarizes the available feedback, focusing on common themes and providing illustrative examples.

Customer reviews regarding Keelser Federal Credit Union auto loans reveal a generally positive experience, although some areas require attention. Many borrowers praise the straightforward application process, competitive interest rates, and helpful customer service representatives. However, some negative comments highlight occasional delays in processing applications and a lack of transparency regarding certain fees.

Positive Customer Feedback, Keesler federal credit union auto loan

Positive reviews consistently mention the ease of the application process and the competitive interest rates offered by Keelser. Many customers appreciate the personalized service they receive from loan officers.

“The entire process was incredibly smooth and easy. I got approved quickly and the interest rate was much better than other lenders I checked.”

“I was impressed by the friendly and helpful staff. They answered all my questions patiently and made the whole experience stress-free.”

These positive comments suggest a strong level of customer satisfaction with the core aspects of Keelser’s auto loan services. The efficiency of the application process and the competitive pricing are key factors contributing to this positive perception.

Negative Customer Feedback and Complaint Resolution

While largely positive, some negative reviews exist. These primarily focus on occasional delays in loan processing and a lack of clarity regarding certain fees. Although specific instances are limited in publicly available data, the general concern suggests a need for improved communication and process optimization.

“The application process took longer than expected, which was frustrating.”

“I wish the fee structure was more transparent. Some fees weren’t clearly explained upfront.”

Keelser’s approach to addressing customer complaints is not explicitly detailed in publicly available information. However, a proactive approach to responding to negative feedback, perhaps through improved communication channels and proactive clarification of fees, could further enhance customer satisfaction and build trust. Addressing these issues transparently could mitigate future negative reviews.

Overall Customer Satisfaction

Based on the available feedback, overall customer satisfaction with Keelser Federal Credit Union’s auto loan services appears to be high. The majority of reviews highlight positive experiences with the application process, interest rates, and customer service. However, addressing the concerns regarding processing delays and fee transparency would further improve customer satisfaction and strengthen the credit union’s reputation. More comprehensive data on customer satisfaction scores from independent surveys or internal metrics would provide a more precise assessment.

Closing Summary

Securing a Keesler Federal Credit Union auto loan can be a straightforward process with the right information. By understanding the interest rates, application procedures, repayment options, and eligibility criteria, you can confidently navigate the financing process. Remember to compare Keesler’s offerings to other lenders and thoroughly review customer feedback to make the best choice for your financial needs. This guide provides a strong foundation for your decision, empowering you to find the perfect auto loan to suit your circumstances.

Key Questions Answered

What is the minimum loan amount offered by Keesler Federal Credit Union for auto loans?

This information isn’t consistently published and may vary. Contact Keesler directly for the most up-to-date details.

What happens if I miss a payment on my Keesler auto loan?

Late payment fees will apply, and your credit score may be negatively impacted. Contact Keesler immediately if you anticipate difficulty making a payment to explore potential solutions.

Can I prepay my Keesler auto loan without penalty?

Check your loan agreement for prepayment penalty information. Some loans may have penalties, while others may not. Contact Keesler to confirm.

Does Keesler offer auto loan refinancing?

Yes, they likely do. Contact Keesler directly to inquire about refinancing options for your existing auto loan.