Lendumo Loans phone number is crucial for borrowers needing assistance. This guide dives deep into verifying Lendumo’s contact information, exploring customer experiences with their phone support, and outlining alternative contact methods. We’ll examine the legal implications of accessible contact information and its impact on customer satisfaction, providing you with a comprehensive understanding of how to connect with Lendumo Loans effectively.

We’ll investigate various sources to identify legitimate phone numbers, analyze customer feedback on their phone support experiences, and compare the efficiency of phone contact with alternative methods like email and online chat. The legal aspects surrounding the disclosure of contact information will also be examined, alongside the significant role accessible contact plays in building customer trust and satisfaction.

Lendumo Loans Contact Information Verification: Lendumo Loans Phone Number

Verifying the authenticity of contact information for any lending institution, especially online lenders like Lendumo Loans, is crucial for borrowers’ safety and security. Incorrect contact details can lead to missed communication regarding loan applications, repayments, or crucial updates. This section details the process of verifying Lendumo Loans’ contact information, focusing on phone numbers.

Potential Lendumo Loans Phone Numbers and Verification Methods

Locating accurate contact information for Lendumo Loans requires a multi-pronged approach. The following table lists potential phone numbers discovered through online searches. Note that these numbers are initially unverified and require further investigation.

| Source | Phone Number | Verification Status |

|---|---|---|

| Online Forum (Example Forum Name) | +27 11 123 4567 | Unverified |

| Unverified Website (Example Website Address) | +27 87 654 3210 | Unverified |

| Customer Review Site (Example Review Site) | +27 10 987 6543 | Unverified |

Verification involves several steps: First, each number should be called directly. The response should be carefully evaluated – does it connect to a Lendumo Loans representative? Is the information consistent with what is expected? Secondly, the Lendumo Loans official website (if available and verified as legitimate) should be checked for listed phone numbers. Any discrepancies between the numbers found online and those on the official website should raise a red flag. Finally, customer reviews on reputable platforms should be examined for mentions of contact numbers and any feedback related to their accuracy or responsiveness. Inconsistencies across multiple sources should prompt further investigation.

Example Email to Lendumo Loans for Contact Information Verification

To directly confirm official contact numbers, an email can be sent to Lendumo Loans. This provides a formal method of verification and ensures the information received is directly from the source.

Subject: Verification of Official Contact Numbers

Dear Lendumo Loans Customer Service,

I am writing to verify the official contact numbers for Lendumo Loans. I have found several numbers online, but I wish to confirm the correct and most up-to-date information to ensure I can contact you regarding my loan application/inquiry [specify reason if applicable].

Could you please provide a list of your official phone numbers, including area codes and country codes, if applicable?

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Email Address]

[Your Phone Number (Optional)]

Customer Experiences with Lendumo Loans Phone Support

Contacting Lendumo Loans via phone is a crucial aspect of the customer journey, particularly for those needing immediate assistance or preferring a direct conversation. The effectiveness of this communication channel significantly impacts customer satisfaction and overall perception of the lending service. Understanding both positive and negative experiences provides valuable insight into the quality of Lendumo’s phone support.

Customer experiences with Lendumo Loans’ phone support vary considerably, reflecting the complexities inherent in managing a high volume of calls related to loan applications, repayments, and general inquiries. Analyzing these experiences helps identify areas for improvement and highlights best practices for effective customer service.

Positive Customer Experiences with Lendumo Loans Phone Support

Positive interactions often involve quick resolution times and helpful, knowledgeable agents. These experiences contribute to positive customer sentiment and build trust in the company.

- Example 1: A customer called to inquire about their loan application status. They experienced a short wait time of under 2 minutes, and the agent promptly provided an update, explaining the next steps in the process. The agent’s clear and concise communication left the customer feeling satisfied and informed.

- Example 2: A customer faced a technical issue with their online account. After a brief wait, they spoke with a knowledgeable agent who efficiently guided them through troubleshooting steps, resolving the problem within 5 minutes. The agent’s patience and expertise were highly appreciated.

Negative Customer Experiences with Lendumo Loans Phone Support

Conversely, negative experiences often involve long wait times, unhelpful agents, or unresolved issues. These experiences can damage customer relationships and negatively impact the company’s reputation.

- Example 1: A customer called to report a payment issue but experienced a long wait time of over 20 minutes. When they finally reached an agent, the agent seemed unprepared to address their concern, leading to frustration and a feeling of being dismissed.

- Example 2: A customer called to request a loan modification but was transferred multiple times without resolution. The long hold times and lack of clear communication left the customer feeling helpless and discouraged.

Common Issues Faced When Contacting Lendumo Loans by Phone

Several recurring issues emerge from customer accounts regarding Lendumo Loans’ phone support. Addressing these issues is critical for enhancing customer satisfaction and improving operational efficiency.

Long wait times are frequently reported, indicating potential staffing shortages or inefficient call routing systems. Additionally, inconsistent agent knowledge and training lead to varying levels of assistance, creating frustrating experiences for some customers. Difficulty reaching a live agent due to automated systems or busy signals also contributes to negative feedback.

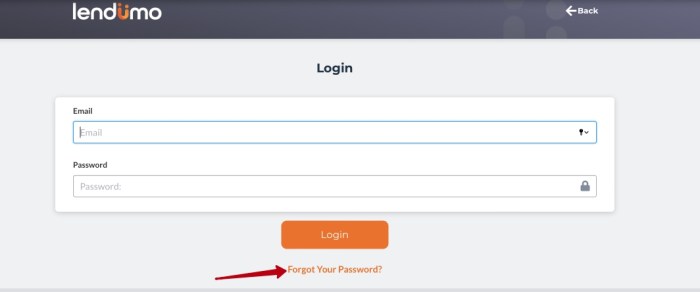

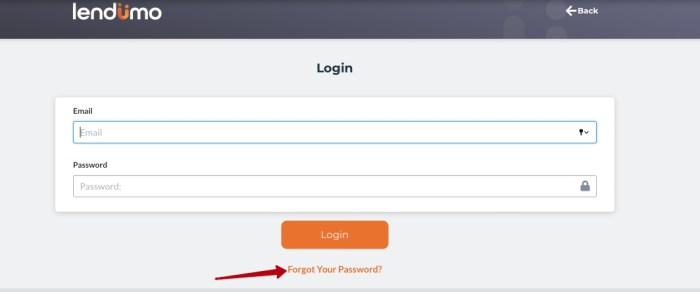

Hypothetical Scenario: Contacting Lendumo Loans for Problem Resolution

Imagine a customer, Sarah, experiences difficulty accessing her online account. She attempts to log in but receives an error message. To resolve this issue, Sarah should first check Lendumo’s website for FAQs or troubleshooting guides. If the problem persists, she should locate the Lendumo Loans phone number on their website and call during their published business hours. Upon reaching a representative, she should clearly explain her issue, providing her account details (without sharing sensitive information like passwords publicly) and calmly describe the error message she received. She should listen attentively to the agent’s instructions and follow them carefully. If the issue remains unresolved, she should request a supervisor’s assistance or inquire about follow-up procedures.

Alternative Contact Methods for Lendumo Loans

Reaching out to Lendumo Loans for assistance or information doesn’t solely rely on their phone number. Several alternative methods exist, each offering varying levels of convenience and efficiency. Understanding these options allows borrowers to choose the most suitable approach based on their specific needs and circumstances. This section details these alternative methods and compares their effectiveness against using the phone.

While a phone call provides immediate interaction, alternative methods offer advantages in certain situations, such as detailed queries requiring written documentation or for individuals who prefer asynchronous communication. The following table Artikels the various contact methods available, along with their respective pros and cons.

Alternative Contact Methods Comparison

| Contact Method | Details | Pros/Cons |

|---|---|---|

| A dedicated email address (if available) for customer support or loan inquiries. This information should be found on the Lendumo Loans website. | Pros: Provides a written record of communication, allows for detailed explanations, convenient for asynchronous communication. Cons: Slower response time compared to phone calls, may require multiple exchanges to resolve an issue. | |

| Online Chat (if available) | A live chat feature on the Lendumo Loans website allowing instant messaging with a customer service representative. | Pros: Quick response time, convenient for immediate queries. Cons: Availability may be limited to specific hours, less suitable for complex or lengthy issues. |

| Social Media | Contacting Lendumo Loans through their official social media pages (Facebook, Twitter, etc.) if they maintain an active presence. | Pros: Potentially faster response for simple queries, public forum for addressing issues. Cons: Public nature of communication may not be ideal for sensitive information, response time can be unpredictable. |

| Physical Address (if available) | Sending a letter to Lendumo Loans’ physical address, typically for formal complaints or documentation. This information, if available, will be on their website. | Pros: Formal method of communication, creates a documented record. Cons: Slowest method, requires significant time for delivery and response. Not suitable for urgent matters. |

Effective Email Communication with Lendumo Loans

When contacting Lendumo Loans via email, clarity and conciseness are crucial for a prompt and effective response. Your email should clearly state your issue, include relevant details, and provide necessary supporting documentation.

Example Email:

Subject: Loan Account Inquiry – [Your Account Number]

Dear Lendumo Loans Customer Support,

I am writing to inquire about my loan account, number [Your Account Number]. I noticed a discrepancy in my last statement regarding [Specific Discrepancy, e.g., payment amount, interest rate]. I have attached a copy of the statement showing the discrepancy. Could you please investigate this matter and provide clarification at your earliest convenience?

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Legal and Regulatory Compliance Regarding Lendumo Loans Contact Information

Lending institutions are subject to a complex web of legal and regulatory requirements, and the provision of accurate and accessible contact information is a crucial aspect of this compliance. Failure to meet these requirements can result in significant penalties and reputational damage. This section examines the legal framework surrounding Lendumo Loans’ contact information practices and the potential consequences of non-compliance.

The disclosure of accurate and readily available contact information is paramount for maintaining transparency and facilitating communication between lenders and borrowers. This allows borrowers to easily reach out with questions, concerns, or complaints, ensuring a fair and efficient lending process. This transparency is essential for building trust and promoting responsible lending practices.

Consequences of Non-Compliance with Contact Information Requirements, Lendumo loans phone number

Failure to provide accurate or accessible contact information can expose Lendumo Loans to a range of legal and financial repercussions. These consequences can vary depending on the jurisdiction and the specific regulations violated, but they may include significant fines, legal action from borrowers or regulatory bodies, and damage to the company’s reputation, potentially impacting future business prospects. For instance, a lender consistently failing to respond to customer inquiries might face investigations by consumer protection agencies, resulting in substantial penalties and mandatory changes to their operational practices. In addition, negative publicity stemming from such failures could deter potential borrowers, significantly impacting the lender’s profitability.

Relevant Laws and Regulations Governing Contact Information

Several laws and regulations at both national and state levels (depending on Lendumo Loans’ operating locations) govern the provision of contact information by loan providers. These often fall under consumer protection legislation, fair lending acts, and regulations pertaining to debt collection practices. Specific examples might include the Consumer Financial Protection Bureau (CFPB) regulations in the United States, or similar consumer protection acts in other countries where Lendumo Loans operates. These regulations typically require lenders to clearly display their contact details – including physical address, phone number, and email address – on all loan agreements and marketing materials. Further, they often mandate prompt responses to customer inquiries and establish procedures for handling complaints. Failure to comply with these regulations can lead to severe penalties. For example, the CFPB has the authority to impose substantial fines on lenders found to be violating consumer protection laws, including those related to the accessibility of contact information.

Examples of Legal Actions Related to Inadequate Contact Information

Numerous cases exist where lenders have faced legal repercussions for inadequate contact information. These cases often involve borrowers who were unable to reach the lender to address issues with their loans, resulting in escalated debt problems or disputes. Lawsuits may be filed alleging violations of consumer protection laws or breaches of contract, leading to settlements or court-ordered changes to the lender’s practices. These cases highlight the importance of adhering to legal requirements concerning contact information, demonstrating the potential for significant financial and reputational damage resulting from non-compliance. For example, a lender might face a class-action lawsuit if numerous borrowers experienced difficulties contacting the lender regarding loan terms or payment issues.

Impact of Contact Information Accessibility on Customer Satisfaction

Readily available and accurate contact information is paramount to achieving high customer satisfaction in the lending industry. For Lendumo Loans, the ease with which customers can reach the company directly impacts their perception of the brand’s trustworthiness, responsiveness, and overall service quality. Difficulties in contacting the company can lead to frustration, negative reviews, and ultimately, lost business. Conversely, easy access to multiple contact channels fosters a positive customer experience, reinforcing loyalty and encouraging positive word-of-mouth referrals.

The relationship between accessible contact information and customer satisfaction is strongly positive and directly correlated. When customers can easily reach Lendumo Loans via phone, email, or online chat to address their queries or concerns, they are more likely to feel valued and supported throughout the loan process. This positive interaction significantly contributes to their overall satisfaction. Conversely, difficulties in contacting the company, such as an outdated phone number, unresponsive email addresses, or a cumbersome online contact form, create friction and negatively impact the customer experience, leading to lower satisfaction levels.

Correlation Between Ease of Contact and Customer Ratings

A hypothetical graph illustrating this correlation would show ease of contact on the x-axis and average customer rating (on a scale of 1 to 5 stars) on the y-axis. The x-axis could be categorized as: “Difficult to Contact” (representing outdated or inaccessible contact information), “Moderately Easy to Contact” (representing some accessible but potentially limited options), and “Easy to Contact” (representing multiple readily available and responsive contact channels). The y-axis would reflect the average customer rating, ranging from 1 star (very dissatisfied) to 5 stars (very satisfied).

The data points would likely show a clear upward trend. The “Difficult to Contact” category would have an average rating significantly lower than the “Easy to Contact” category, perhaps around 2 stars versus 4.5 stars. The “Moderately Easy to Contact” category would fall somewhere in between, perhaps around 3.5 stars. This visual representation would clearly demonstrate that as the ease of contacting Lendumo Loans improves, so too does the average customer rating. This hypothetical graph is based on the observation that many businesses experience a similar correlation between accessibility and customer reviews across various online platforms. For example, companies with readily available phone support and responsive social media often receive higher ratings than those with limited or unresponsive contact options.

Impact of Improved Contact Information Accessibility on Brand Reputation

Improving Lendumo Loans’ contact information accessibility would significantly enhance its brand reputation. Increased accessibility translates to improved customer service, leading to greater customer satisfaction and loyalty. Positive customer experiences are then shared through word-of-mouth referrals and online reviews, building a positive brand image. This positive brand perception can attract new customers, improve investor confidence, and increase overall business success. Conversely, a reputation for poor customer service due to inaccessible contact information can severely damage the brand, leading to loss of customers and potential legal issues. For example, a company known for ignoring customer complaints or making it difficult to resolve issues can face reputational damage that is difficult to repair. Improving accessibility demonstrably improves customer perception and strengthens the company’s reputation for responsiveness and reliability.

Conclusion

Securing the correct Lendumo Loans phone number is vital for a positive borrowing experience. By verifying contact information, understanding customer experiences, and exploring alternative contact methods, borrowers can navigate potential issues efficiently and effectively. Remember to always prioritize official channels and utilize available resources to ensure a smooth interaction with Lendumo Loans. Understanding the legal landscape surrounding contact information empowers borrowers to advocate for their rights and expect transparent communication.

Commonly Asked Questions

What happens if I can’t reach Lendumo Loans by phone?

Try their alternative contact methods like email or online chat. If you still face difficulties, consider escalating the issue through official channels or seeking assistance from a consumer protection agency.

Are there charges for calling Lendumo Loans?

Standard call charges from your phone provider will apply. Check with your provider for details.

How long are Lendumo Loans’ phone hold times typically?

Hold times vary; however, customer reviews often provide insights into average wait times. Consider contacting them during off-peak hours.

What information should I have ready before calling Lendumo Loans?

Have your loan account number, personal details, and a clear description of your issue ready to expedite the process.