Loan calculator Affinity Credit Union offers a powerful tool for prospective borrowers. Understanding its features and functionality is key to making informed financial decisions. This calculator helps navigate the complexities of various loan types, from auto loans to home equity lines of credit, providing clear estimations of monthly payments and total interest. By inputting key details like loan amount, interest rate, and loan term, users can quickly assess the financial implications of different borrowing scenarios.

This guide will walk you through using the Affinity Credit Union loan calculator effectively, highlighting its strengths and limitations. We’ll explore how to interpret the results, compare different loan options, and understand the factors that affect loan affordability. Ultimately, this resource aims to empower you to use this tool to confidently make the best borrowing decisions for your financial future.

Affinity Credit Union Loan Calculator Overview

The Affinity Credit Union loan calculator is a user-friendly online tool designed to provide quick estimates of loan payments and total costs. It simplifies the loan application process by allowing potential borrowers to explore various loan scenarios before formally applying. This empowers users to make informed financial decisions by understanding the potential implications of different loan terms and interest rates.

The calculator streamlines the process of determining affordability and helps users compare various loan options. Understanding the estimated monthly payments and total interest paid allows for better budget planning and responsible borrowing.

Supported Loan Types

The Affinity Credit Union loan calculator likely supports several common loan types. While the precise offerings may vary, it’s reasonable to assume the calculator handles at least auto loans, personal loans, and potentially home equity loans. These loan types cover a wide range of borrowing needs, from financing a vehicle purchase to consolidating debt or funding home improvements. Specific loan types supported should be confirmed directly on the Affinity Credit Union website.

Key Input Fields

To generate accurate loan payment estimates, the calculator requires several key input values from the user. These typically include the loan amount (the principal sum borrowed), the annual interest rate (the cost of borrowing the money, expressed as a percentage), and the loan term (the length of the loan, usually expressed in months or years). Additional fields may be included to reflect specific loan characteristics, such as any upfront fees or additional charges. Providing accurate information in these fields is crucial for obtaining a reliable estimate.

Feature Comparison of Loan Calculators

The following table compares the Affinity Credit Union loan calculator (assuming typical features) with two other major credit union loan calculators (examples only; specific features may vary depending on the credit union’s offerings). This comparison highlights potential differences in functionality and user experience.

| Feature | Affinity Credit Union | Example Credit Union A | Example Credit Union B |

|---|---|---|---|

| Loan Types Supported | Auto, Personal, Home Equity (potential) | Auto, Personal, Home Equity, Business | Auto, Personal |

| Interest Rate Input | Annual Percentage Rate (APR) | APR, Adjustable Rate (potential) | APR |

| Loan Term Options | Flexible term lengths (months/years) | Flexible, with pre-set options | Pre-set term options only |

| Additional Fee Inclusion | Potential inclusion of origination fees | Includes origination fees and closing costs | Does not include additional fees |

| Amortization Schedule | Potential display of amortization schedule | Displays detailed amortization schedule | No amortization schedule provided |

Using the Affinity Credit Union Loan Calculator: Loan Calculator Affinity Credit Union

The Affinity Credit Union loan calculator is a user-friendly tool designed to help members estimate their monthly payments and total loan costs before applying for a loan. Understanding how to use this calculator effectively can significantly aid in financial planning and responsible borrowing. This section provides a step-by-step guide on utilizing the calculator and interpreting its results.

Calculator Usage Steps

To begin using the Affinity Credit Union loan calculator, navigate to the designated section on their website. You will typically find a form requiring you to input several key pieces of information. The accuracy of your results directly depends on the precision of these inputs.

- Loan Amount: Enter the total amount you wish to borrow. For example, if you are seeking a $20,000 auto loan, you would enter “20000”.

- Interest Rate: Input the annual interest rate offered by Affinity Credit Union for your chosen loan type. This rate is usually expressed as a percentage (e.g., 5.5%).

- Loan Term: Specify the length of your loan in months or years. A 60-month loan is equivalent to a 5-year loan. This significantly influences your monthly payment.

- Calculate: Once all necessary fields are populated, click the “Calculate” or similar button to generate your results.

Interpreting Calculator Results

After inputting the loan details and clicking “Calculate,” the calculator will display several key figures. Understanding these figures is crucial for making informed borrowing decisions.

- Monthly Payment: This shows your estimated monthly payment amount. This is the amount you will be required to pay each month over the loan term.

- Total Interest Paid: This represents the total amount of interest you will pay over the life of the loan. It’s essential to understand this figure as it shows the additional cost beyond the principal loan amount.

- Total Payment: This is the sum of the principal loan amount and the total interest paid. It represents the total cost of the loan.

For example, a $20,000 loan with a 5.5% interest rate over 60 months might result in a monthly payment of approximately $376, a total interest paid of $2,560, and a total payment of $22,560.

Adjusting Input Parameters

The calculator’s strength lies in its ability to demonstrate the impact of changes in loan parameters. By altering the input values, you can observe how different loan terms affect your monthly payments and total cost.

For instance, increasing the loan term from 60 months to 72 months will typically lower the monthly payment but increase the total interest paid. Conversely, increasing the interest rate will lead to higher monthly payments and total interest. Experimenting with these variables allows you to find a balance that aligns with your budget and financial goals.

Loan Affordability Flowchart

The following describes a flowchart illustrating the process of using the calculator to assess loan affordability. Imagine a diagram with boxes and arrows.

[Start] –> [Input Loan Amount] –> [Input Interest Rate] –> [Input Loan Term] –> [Calculate] –> [Review Monthly Payment] –> [Compare to Budget] –> [Affordable? (Yes/No)] –> [Yes: Proceed with Loan Application] –> [No: Adjust Loan Parameters or Explore Alternatives] –> [End]

Loan Calculator Accuracy and Limitations

The Affinity Credit Union loan calculator provides estimates based on the information you input. While designed to be helpful, it’s crucial to understand that these are estimations, not guaranteed loan terms. Several factors influence the accuracy of the calculator’s projections, and certain limitations exist.

The accuracy of the loan calculator’s estimations depends heavily on the data you provide. Inaccurate or incomplete input will lead to inaccurate results. For example, providing an incorrect credit score or income level will significantly impact the calculated interest rate and monthly payment. Furthermore, the calculator relies on current interest rates and lending criteria, which are subject to change. Any changes occurring after you use the calculator will affect the actual loan terms you receive.

Factors Influencing Accuracy

The calculator’s accuracy hinges on several key factors. These include the completeness and accuracy of the user-supplied data (income, credit score, loan amount, and loan term), the prevailing interest rates at the time of calculation, and the credit union’s current lending policies. Minor inaccuracies in the input data can lead to noticeable differences in the calculated results. For instance, a slight underestimation of your debt-to-income ratio could lead to a higher estimated interest rate than you might actually qualify for.

Calculator Assumptions and Limitations

The Affinity Credit Union loan calculator operates under several assumptions. It assumes that your creditworthiness remains consistent throughout the loan application process. It also assumes that you meet all other eligibility requirements beyond the factors considered in the calculation. The calculator does not account for unforeseen circumstances, such as changes in your employment status or unexpected financial difficulties. It also doesn’t incorporate potential closing costs or other associated fees that might be part of the final loan agreement. Therefore, the calculated monthly payment is a simplified representation and might not fully reflect all costs associated with the loan.

Potential Discrepancies Between Calculator Results and Actual Loan Terms

Discrepancies between the calculator’s results and the final loan terms offered by Affinity Credit Union are possible. These discrepancies can arise from several factors, including changes in interest rates, updated credit reports reflecting changes in your credit score, additional fees not included in the calculator, or the credit union’s internal review process uncovering additional information not initially provided. For example, the calculator might estimate a lower interest rate based on your initial credit score, but a more recent credit report could show a lower score, resulting in a higher interest rate offer. The final loan approval and terms are subject to the credit union’s underwriting guidelines.

Situations Where the Calculator Might Not Be Suitable

The loan calculator is a useful tool for initial estimations, but it should not be the sole basis for making financial decisions. It is not suitable for determining loan eligibility definitively. For instance, individuals with complex financial situations, such as significant outstanding debts or irregular income streams, should consult directly with a loan officer at Affinity Credit Union. The calculator also doesn’t account for individual circumstances that may affect loan approval, such as bankruptcies or foreclosures. Individuals in these situations should seek personalized guidance. Moreover, the calculator’s accuracy diminishes significantly when dealing with non-standard loan types or unique loan requests.

Comparing Loan Options with the Calculator

The Affinity Credit Union loan calculator allows for a side-by-side comparison of different loan types, empowering borrowers to make informed financial decisions. By inputting the same loan amount, term, and other relevant details, users can quickly see how interest rates and loan structures impact the total cost of borrowing. This comparison is crucial for understanding the financial implications of each option and choosing the most suitable loan for their individual circumstances.

The calculator facilitates a clear understanding of the differences between fixed-rate and variable-rate loans. Fixed-rate loans offer predictable monthly payments throughout the loan term, while variable-rate loans have fluctuating payments based on market interest rate changes. This comparison helps borrowers assess their risk tolerance and financial stability in relation to potential interest rate fluctuations.

Fixed-Rate vs. Variable-Rate Loan Comparison

The following table illustrates a sample comparison of a $20,000 loan over 5 years, using both fixed and variable rate scenarios. Note that these are examples and actual rates will vary based on creditworthiness and market conditions.

| Loan Type | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| Fixed-Rate | 7% | $391.32 | $3,479.20 |

| Variable-Rate (Initial Rate: 6%) | 6% (Assumed to increase to 8% after 2 years) | Variable (Approximately $360.00 initially, increasing to approximately $408.00 after 2 years) | Variable (Potentially higher than fixed-rate loan due to rate increase) |

The calculator simplifies the complex calculations involved in determining monthly payments and total interest paid. This allows borrowers to quickly assess the long-term financial commitment of each loan option without needing advanced financial expertise. By comparing these figures, borrowers can easily identify which loan option aligns best with their budget and financial goals.

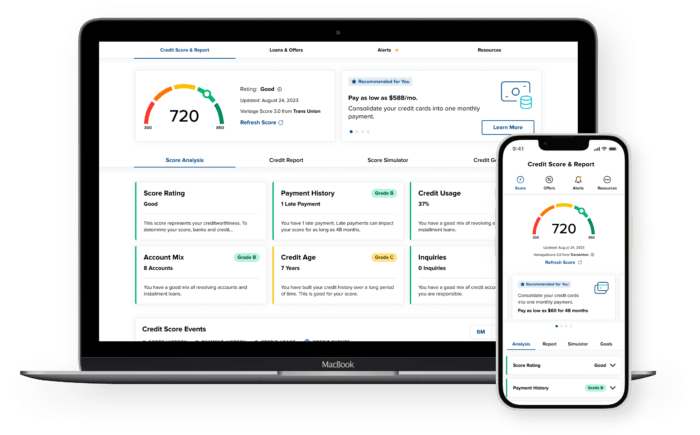

Factors Beyond Calculator Output

While the loan calculator provides valuable insights into loan costs, it’s crucial to consider factors beyond its output. Your credit score significantly influences the interest rate you’ll qualify for. A higher credit score typically results in lower interest rates and more favorable loan terms. Similarly, your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income, plays a crucial role in loan approval. A lower DTI generally increases your chances of approval and may lead to better loan terms. Ignoring these factors can lead to an inaccurate assessment of loan affordability and feasibility. For example, even if the calculator shows an affordable monthly payment, a high DTI might prevent loan approval, rendering the calculator’s results irrelevant in that specific case.

Accessibility and User Experience

The Affinity Credit Union loan calculator’s user experience is crucial for its effectiveness. A well-designed interface ensures ease of use for all potential borrowers, while accessibility features cater to users with disabilities, promoting inclusivity and financial empowerment. This section analyzes the calculator’s interface, accessibility, and potential improvements to enhance the overall user experience.

The user interface should prioritize clarity and simplicity. A clean layout with intuitive navigation is key to a positive user experience. Features such as clear labeling of input fields, concise instructions, and immediate feedback mechanisms can significantly improve usability. The visual design should be uncluttered, using consistent fonts and colors to ensure readability and visual appeal. Furthermore, responsive design ensures usability across various devices, from desktops to smartphones.

Interface and Navigation

The Affinity Credit Union loan calculator’s interface should be evaluated for its ease of navigation and intuitive design. Ideally, the calculator features a straightforward layout with clearly labeled input fields for loan amount, interest rate, loan term, and any other relevant variables. Users should be able to easily input their data and understand the resulting calculations. Progress indicators or loading bars could enhance the user experience, especially for complex calculations. Furthermore, a clear display of the calculated results, including monthly payments, total interest paid, and amortization schedule, is essential. The use of visual aids like charts or graphs to represent the data could further improve comprehension.

Accessibility Features for Users with Disabilities

Accessibility is paramount for inclusivity. The loan calculator should adhere to WCAG (Web Content Accessibility Guidelines) standards to ensure usability for individuals with visual, auditory, motor, or cognitive impairments. This includes providing alternative text for images, ensuring sufficient color contrast, offering keyboard navigation, and supporting screen readers. Consideration should be given to providing options for adjusting font sizes and styles, as well as offering transcripts or captions for any audio or video content. Compliance with these guidelines is essential for making the calculator accessible to a wider audience. For example, sufficient color contrast between text and background is crucial for users with low vision.

Suggestions for Improving User Experience

Several improvements could enhance the user experience. Implementing a “save and load” functionality would allow users to save their progress and return to the calculator later. Adding a “what-if” scenario feature would enable users to explore different loan options by easily adjusting variables and observing the impact on the results. Providing detailed explanations of the calculations and terminology used would increase transparency and understanding. Finally, integrating the calculator with other Affinity Credit Union services, such as online application forms, could streamline the loan application process.

Pros and Cons of the Calculator’s Design and Functionality, Loan calculator affinity credit union

A balanced assessment of the calculator’s strengths and weaknesses is necessary.

- Pros: Intuitive interface (assuming a well-designed interface), clear results display, potentially responsive design for multiple devices.

- Cons: Lack of accessibility features (if not implemented), absence of “what-if” scenario analysis, potentially missing a “save and load” feature, insufficient explanations of calculations or financial terminology.

Closure

The Affinity Credit Union loan calculator provides a valuable resource for anyone considering a loan. By understanding its capabilities and limitations, you can leverage its power to compare loan options and make informed decisions. Remember that while the calculator offers valuable estimations, it’s crucial to consider your individual financial situation, including your credit score and debt-to-income ratio, before committing to any loan. Use this tool as a starting point for a comprehensive financial planning process.

FAQ Explained

What types of loans does the Affinity Credit Union loan calculator support?

It typically supports various loan types, including auto loans, personal loans, and home equity loans. The exact options available may vary; check the calculator directly.

Is the calculator’s estimate the final loan amount I’ll receive?

No, the calculator provides an estimate. Your final loan terms will depend on your credit score, income, and other factors assessed by Affinity Credit Union during the formal application process.

What if I don’t see my desired loan type in the calculator?

Contact Affinity Credit Union directly. They may offer loan types not included in the online calculator or can guide you to the appropriate resources.

How often is the loan calculator updated?

Check the Affinity Credit Union website for information on update frequency. Interest rates and other factors can change, so always refer to the most current version.