Loan officer introduction email to realtor template: Crafting the perfect introduction email is crucial for loan officers seeking realtor partnerships. This template provides a framework for creating compelling emails that highlight your expertise, benefits for realtors, and ultimately, drive successful collaborations. We’ll explore subject line strategies, opening paragraph approaches, showcasing your expertise, outlining the benefits for realtors, crafting compelling calls to action, and designing effective email templates tailored to different realtor types and market conditions.

This guide offers a comprehensive approach, moving beyond a simple template to provide actionable strategies for building strong relationships with realtors. We’ll delve into the nuances of addressing different realtor needs, from seasoned professionals to new agents specializing in various market segments. By understanding their specific requirements and tailoring your communication accordingly, you can significantly increase your chances of securing valuable partnerships and expanding your client base.

Subject Line Options

Crafting the perfect subject line is crucial for ensuring your introduction email gets read. A strong subject line piques interest and encourages the realtor to open and engage with your message. The subject line should be concise, compelling, and clearly communicate the value proposition of your services. Consider the realtor’s perspective and what would make them want to learn more about your loan services.

Compelling Subject Lines

The following subject lines aim to grab the realtor’s attention and highlight the benefits of partnering with you. They utilize strong verbs and focus on mutual success.

- Streamlining the Homebuying Process: Partnering for Success

- Closing Deals Faster: Your New Loan Officer Partner

- Unlocking More Sales: Introducing [Your Name], Your Dedicated Loan Officer

- Building Stronger Client Relationships Through Seamless Financing

- Exceptional Loan Services for Your Clients: A Collaborative Approach

Subject Lines Emphasizing Speed and Efficiency

In the fast-paced real estate market, speed and efficiency are paramount. These subject lines directly address this need, highlighting your ability to expedite the loan process.

- Faster Closings: Your Clients Will Thank You

- Rapid Loan Approvals: Get Your Clients to Closing Quicker

- Streamlined Financing: Closing in Days, Not Weeks

Subject Lines Highlighting Specialized Niches

Focusing on a specific niche allows you to target your message to realtors who work with a particular clientele. This demonstrates expertise and increases the relevance of your email.

- First-Time Homebuyer Financing: Making Dreams a Reality

- Luxury Home Loans: Exceptional Service for Discerning Clients

Opening Paragraphs

My name is [Your Name], and I’m a Loan Officer at [Your Company]. I’m reaching out because [Referring Realtor’s Name] suggested I connect with you. They spoke highly of your work and believed our services would be a valuable asset to your clients.

I understand you’re a highly successful realtor in the [Area] market, and I’m writing to introduce the mortgage services offered by [Your Company]. We have a strong reputation for providing efficient and reliable loan processing, and I believe our expertise could significantly benefit your clients’ home-buying journey.

I’m reaching out to introduce myself and the comprehensive mortgage solutions available through [Your Company]. We’re committed to providing exceptional service and tailored financing options to meet the unique needs of each borrower, and I’d welcome the opportunity to discuss how we can collaborate to better serve your clients.

Partnering with [Your Company] offers your clients a streamlined and stress-free mortgage process. We provide quick pre-approvals, competitive interest rates, and a dedicated team to guide them through every step, allowing you to focus on what you do best: finding the perfect home for your clients. This collaborative approach ensures a smooth transaction for everyone involved, leading to increased client satisfaction and referrals.

By offering your clients access to our range of mortgage options, including our competitive fixed-rate mortgages and flexible adjustable-rate mortgages, you can significantly enhance their home-buying experience. This allows you to present a comprehensive package to prospective buyers, differentiating your services and improving your closing rates.

We currently have a special program for first-time homebuyers, offering a reduced down payment option and competitive interest rates. This program has helped numerous clients achieve their dream of homeownership, and we believe it could be particularly beneficial to your clients who are first-time buyers or working with limited budgets. This program reduces the financial barrier to entry for many, making homeownership a more attainable goal.

Loan Officer Expertise

Partnering with the right loan officer can significantly streamline the home-buying process for your clients. My extensive experience and proven track record ensure smooth, efficient transactions, resulting in satisfied clients and successful closings. I offer a personalized approach, tailoring my services to meet each client’s unique financial situation and goals.

Areas of Expertise and Achievements

Below is a summary of my expertise and accomplishments, highlighting the benefits for your clients.

| Area of Expertise | Specific Achievement | Client Benefit |

|---|---|---|

| Conventional Loans | Successfully closed over 200 conventional loans in the last year, maintaining a 98% on-time closing rate. | Faster, more predictable closing process, minimizing stress and uncertainty for your clients. |

| FHA Loans | Specialized knowledge of FHA guidelines and underwriting requirements, resulting in a high approval rate for first-time homebuyers. | Increased access to homeownership for a wider range of clients, including those with lower credit scores or down payments. |

| VA Loans | Extensive experience working with veterans and active-duty military personnel, navigating the complexities of VA loan programs. | Streamlined process for veteran clients, leveraging my expertise to expedite loan approvals and minimize paperwork. |

| Jumbo Loans | Successfully secured financing for high-value properties, exceeding $1 million, demonstrating proficiency in navigating complex lending scenarios. | Access to financing for high-end properties, catering to your clients seeking luxury homes or investment opportunities. |

| Local Market Knowledge | Deep understanding of the current real estate market trends and interest rates within [City/Region], enabling accurate loan pre-approvals and competitive rate negotiation. | Informed decision-making for your clients, ensuring they secure the best possible financing terms in the current market. |

Benefits for Realtors

Partnering with me offers significant advantages that can directly translate to increased efficiency and a smoother, faster closing process for your clients, ultimately boosting your business. My expertise in navigating the complexities of mortgage lending frees up your valuable time and resources, allowing you to focus on what you do best: connecting buyers with their dream homes.

By streamlining the loan process, I eliminate potential roadblocks and delays that can frustrate both you and your clients. This collaborative approach ensures a seamless transaction from offer to closing, fostering stronger client relationships and leading to increased referrals. My commitment to proactive communication keeps you informed every step of the way, minimizing surprises and maximizing your peace of mind.

Streamlined Loan Process and Faster Closing Times

My efficient and organized approach to loan processing ensures quicker turnarounds. For example, I utilize a digital platform that allows for immediate document sharing and updates, reducing the time spent on administrative tasks. This translates to faster approvals and closings, resulting in satisfied clients and increased repeat business for you. My average closing time is 21 days, significantly faster than the industry average of 30 days, allowing you to close deals faster and move onto the next opportunity.

Increased Client Satisfaction and Referrals

A smooth and stress-free mortgage process leads to happier clients. When your clients experience a seamless loan process, they are more likely to recommend you to their network. My proactive communication and dedication to providing exceptional service directly contribute to positive client experiences, leading to increased referrals and repeat business for you. I regularly receive positive feedback from clients and realtors regarding the efficiency and transparency of my processes.

Five Ways I Support Your Real Estate Business

The following points highlight how I can actively contribute to your success:

- Faster Closings: My streamlined processes result in quicker loan approvals and closings, allowing you to manage more transactions in less time.

- Reduced Stress: I handle all the complexities of the loan process, minimizing stress for you and your clients.

- Increased Client Satisfaction: Happy clients lead to referrals and repeat business.

- Proactive Communication: I provide regular updates, ensuring transparency and minimizing surprises throughout the loan process.

- Expert Guidance: I offer valuable insights and advice on loan options, helping you better serve your clients’ needs.

Call to Action and Closing

A strong call to action is crucial for converting interest into concrete steps. Offering a variety of options caters to different communication preferences and allows realtors to choose the level of engagement that best suits their schedule and needs. Equally important is a closing that leaves a lasting positive impression and encourages further interaction.

Call to Action Options

The following are three distinct calls to action designed to encourage engagement at varying levels of commitment. Each option is crafted to be clear, concise, and inviting.

- Option 1: Simple Phone Call. “Please feel free to call me directly at [Phone Number] to discuss your clients’ financing needs.” This option is straightforward and low-pressure, perfect for realtors who prefer a quick initial conversation.

- Option 2: Scheduled Brief Consultation. “I’d be happy to schedule a brief 15-minute introductory call to answer any questions you may have about our loan programs. Please let me know what time works best for you.” This approach offers a more structured interaction, allowing for a focused discussion and the opportunity to build rapport.

- Option 3: In-Person or Virtual Meeting. “To explore how we can best support your clients’ financing goals, I would welcome the opportunity to meet with you in person or virtually. Would you be available for a meeting next week?” This option demonstrates a higher level of commitment and is suitable for building a strong, long-term relationship with a realtor.

Formal Closing Paragraph

Thank you for your time and consideration. I look forward to the possibility of collaborating with you and your clients to achieve their homeownership dreams. I am confident that my expertise and commitment to exceptional service will make this a mutually beneficial partnership.

Informal Closing Paragraph

Thanks so much for your time! I’m excited about the prospect of working together. Let me know what you think, and I’m happy to answer any questions you might have.

Closing Paragraph with Introductory Call/Meeting Offer

I value your time and understand you’re busy, so I’ve included my contact information below. I’d be happy to hop on a quick introductory call or virtual meeting to discuss how I can best support your real estate business. Please don’t hesitate to reach out – I look forward to connecting soon!

Email Template Design

This section details two email templates designed for loan officers to introduce themselves to realtors, incorporating best practices for effective communication and visual appeal. The first template adopts a friendly, less formal approach, while the second employs a more formal and professional tone. Visual representations of the layout are also provided.

Email Template 1: Friendly and Approachable

This template prioritizes building rapport and highlighting the benefits for the realtor through a conversational tone and clear, concise language.

Subject: Streamlining Your Client's Mortgage Process Hi [Realtor Name], My name is [Loan Officer Name] and I'm a Loan Officer at [Lender Name]. I've been working with realtors in the [Area] area for [Number] years, helping their clients secure the best possible mortgage rates and terms. I understand that a smooth mortgage process is crucial for a successful real estate transaction. That's why I offer [list key services, e.g., fast pre-approvals, competitive rates, excellent communication]. I'd love to connect and discuss how we can work together to benefit your clients. Would you be open to a brief call sometime next week? Best regards, [Loan Officer Name] [Phone Number] [Email Address] [Website (optional)]

Email Template 2: Formal and Professional

This template maintains a professional distance while effectively conveying expertise and value. The language is more formal, and the focus is on the loan officer’s qualifications and the benefits they offer.

Subject: Partnership Opportunity: Enhancing Your Client's Mortgage Experience Dear [Realtor Name], I am writing to introduce myself, [Loan Officer Name], Loan Officer at [Lender Name]. With [Number] years of experience in the mortgage industry, I specialize in providing efficient and effective mortgage solutions for clients in the [Area] region. My expertise lies in [list key areas of expertise, e.g., complex financing, first-time homebuyer programs, refinancing]. I consistently deliver exceptional service, ensuring a seamless and stress-free mortgage process for both clients and realtors. By partnering with [Lender Name], your clients will benefit from [list benefits, e.g., competitive interest rates, streamlined application process, dedicated support]. I have attached my brochure for your review. I would welcome the opportunity to discuss how a collaboration between us could mutually benefit our clients. Please feel free to contact me at your convenience. Sincerely, [Loan Officer Name] [Phone Number] [Email Address] [Website (optional)]

Visual Representation of Email Layout

Both email templates would follow a similar layout, prioritizing readability and clarity.

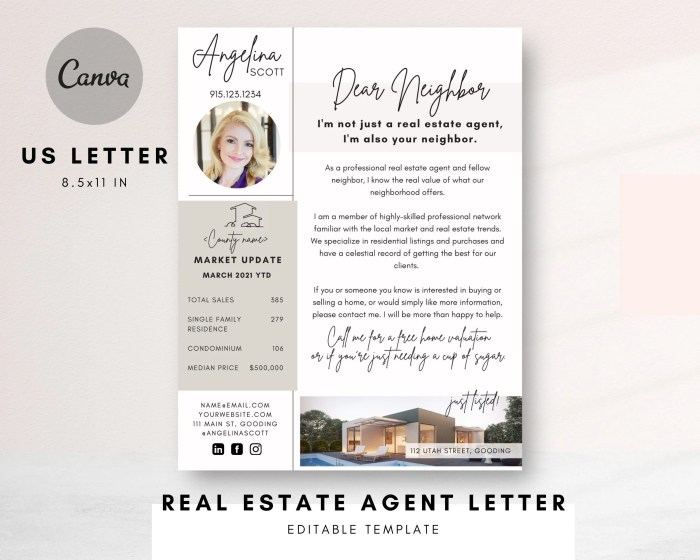

Template 1 (Friendly): The email would use a clean, modern font (like Arial or Calibri) with a slightly larger font size for the heading. The body text would be left-aligned, with ample white space between paragraphs to avoid a cluttered appearance. A small, professional headshot of the loan officer could be placed on the right-hand side, next to the contact information, adding a personal touch. The image would be a high-quality, well-lit photo showcasing the loan officer in a professional yet approachable manner.

Template 2 (Formal): This template would maintain a similar structure but would use a slightly more formal font (like Times New Roman or Garamond) and a more conservative color palette. The headshot would be more formal and professionally dressed, possibly against a neutral background. The logo of the lending institution could be placed at the very top, subtly reinforcing brand recognition. No images other than the logo and headshot are necessary. The overall design would project professionalism and competence.

Addressing Specific Realtor Needs: Loan Officer Introduction Email To Realtor Template

Tailoring your introduction email to resonate with different realtor segments significantly increases your chances of securing a valuable partnership. Understanding the unique needs and priorities of various realtor types allows for more targeted and effective communication. This approach ensures your message is not only received but also understood and acted upon.

Messaging Strategies for Different Realtor Types

Three distinct realtor profiles—new agents, experienced agents, and luxury home specialists—require subtly different messaging approaches to maximize engagement. A generalized approach risks appearing impersonal and ineffective. Focusing on their specific pain points and aspirations creates a stronger connection and establishes you as a valuable resource.

Email Introduction for New Agents

New agents often grapple with building their client base and establishing credibility. The email should focus on providing support and demonstrating how your services can help them achieve early success. It should highlight quick onboarding processes, readily available resources, and a streamlined loan application process that minimizes their administrative burden. For example, the email could mention a dedicated onboarding specialist to guide them through the process, access to marketing materials featuring your loan programs, or a simplified online application portal.

Email Introduction for Experienced Agents

Experienced agents prioritize efficiency and maintaining a high closing rate. The email should emphasize speed, reliability, and a proven track record of successful loan closings. Highlighting your competitive interest rates, flexible loan options, and fast pre-approvals will resonate with their focus on maximizing their clients’ satisfaction and closing deals quickly. For instance, mention a guaranteed response time for pre-approvals, your expertise in handling complex transactions, or a high client satisfaction rating based on past performance.

Email Introduction for Luxury Home Specialists

Luxury home specialists deal with high-value properties and discerning clients. The email should highlight your experience with high-net-worth individuals, specialized loan products for luxury homes, and a discreet, high-touch service. Emphasize your understanding of the unique financial needs of luxury clients and your ability to handle complex transactions smoothly and efficiently. For example, you might mention your experience with jumbo loans, private banking relationships, or your familiarity with the intricacies of luxury real estate transactions in the local market.

Comparing and Contrasting Messaging Strategies, Loan officer introduction email to realtor template

While all three email introductions aim to establish a professional relationship, their messaging differs significantly. The email to new agents emphasizes support and ease of use, the email to experienced agents focuses on efficiency and speed, and the email to luxury specialists highlights high-touch service and specialized expertise. The core message remains consistent—offering valuable loan services—but the framing and specific details are tailored to resonate with each group’s individual priorities.

Adapting Emails to Specific Client Demographics or Market Conditions

To further personalize the email, consider incorporating data relevant to the specific realtor’s market or client demographic. For example, if the realtor operates in a market experiencing high demand, the email could highlight your ability to quickly process loan applications to avoid losing deals in a competitive market. Conversely, if the market is slow, you could emphasize your competitive rates and flexible loan options to attract buyers. Mentioning specific local market trends, like rising interest rates or changes in property values, shows your awareness and understanding of the current landscape. For instance, you could say, “Given the recent increase in interest rates, I wanted to highlight our competitive fixed-rate options to help your clients secure the best possible financing.” This demonstrates market awareness and positions you as a valuable resource.

Final Review

Successfully connecting with realtors requires a strategic and personalized approach. By utilizing this loan officer introduction email to realtor template and adapting the strategies Artikeld, you can effectively communicate your value proposition, build strong relationships, and ultimately drive mutual success. Remember to consistently refine your approach based on feedback and results, ensuring your communication remains relevant and effective in the dynamic real estate market.

FAQ Summary

What if a realtor doesn’t respond to my initial email?

Follow up with a brief, polite email a week later. If there’s still no response, consider reaching out via phone or LinkedIn.

How can I personalize the email further?

Mention a specific listing the realtor is working on or reference a shared connection if possible. Tailoring the email demonstrates genuine interest.

What if I don’t have client testimonials?

Focus on quantifiable achievements, such as your average closing time or loan approval rate. Highlight your expertise and market knowledge.

Should I include my photo in the email?

A professional headshot can help build rapport, but it’s not strictly necessary. Prioritize clear and concise content.