Loan signing agent resume creation requires a strategic approach to highlight key skills and experience. Crafting a compelling resume summary, showcasing relevant skills (both hard and soft), and detailing impactful accomplishments are crucial for securing interviews. This guide provides a step-by-step process for building a resume that effectively communicates your qualifications and value to potential employers in the loan signing industry.

We’ll explore the essential components of a successful loan signing agent resume, including the optimal structure, the importance of quantifiable achievements, and how to present your education and certifications to best advantage. Furthermore, we’ll delve into optional sections that can elevate your application and increase your chances of landing your dream role.

Resume Summary/Objective

A compelling resume summary or objective statement is crucial for grabbing a hiring manager’s attention and showcasing your qualifications for a Loan Signing Agent position. A well-crafted statement concisely highlights your key skills and experience, making you stand out from other applicants. The choice between a summary and an objective depends on your experience level. Generally, experienced professionals opt for a summary, while those with less experience often use an objective statement.

A strong summary focuses on accomplishments and quantifiable results, demonstrating your value to a potential employer. An effective objective statement, on the other hand, clearly states your career goals and how your skills align with the specific requirements of the job. Both should be tailored to each individual application to maximize their impact.

Resume Summary Example

A highly organized and detail-oriented Loan Signing Agent with 5+ years of experience in handling a high volume of loan signings, ensuring accuracy and compliance with all regulatory requirements. Proven ability to manage schedules effectively, maintain excellent client relationships, and provide exceptional customer service. Proficient in various loan document types, including purchase, refinance, and reverse mortgages. Dedicated to maintaining the highest levels of professionalism and integrity in every transaction.

Resume Objective Statement Examples

The following are three alternative objective statements, each targeting a different aspect of the loan signing agent role:

- Objective 1 (Focus on Experience): To leverage my extensive experience in loan document preparation and notarization to contribute to a dynamic team, ensuring efficient and accurate loan closings.

- Objective 2 (Focus on Specific Loan Type): To secure a Loan Signing Agent position specializing in refinance mortgages, utilizing my expertise in complex loan documentation and regulatory compliance to deliver exceptional service to clients.

- Objective 3 (Focus on Geographic Area): To obtain a Loan Signing Agent position within the greater Los Angeles area, leveraging my proven ability to manage a high volume of signings while maintaining a meticulous attention to detail and exceeding client expectations.

Comparison of Objective Statement Effectiveness

Each objective statement has strengths and weaknesses. Objective 1, focusing on experience, is broad and suitable for many applications but may lack the specificity to truly stand out. Objective 2, targeting refinance mortgages, is more focused and demonstrates specialized knowledge, making it ideal for applications specifically seeking that expertise. However, it limits its applicability to other loan types. Objective 3, focusing on geography, is highly targeted, ideal for local opportunities but may exclude consideration for remote or broader geographic areas. The most effective approach often involves tailoring the objective statement (or summary) to directly address the specific requirements and preferences Artikeld in the job description. A generic statement will likely be less effective than one specifically addressing the employer’s needs.

Skills Section

Loan Signing Agents require a unique blend of technical proficiency and interpersonal skills to ensure smooth and legally compliant loan closings. This section details the essential skills needed for success in this role, categorized for clarity and impact. Quantifiable achievements demonstrate the practical application of these skills.

The following table Artikels the key hard and soft skills necessary for a successful Loan Signing Agent. These skills are critical for efficient and accurate document processing, client interaction, and adherence to legal regulations.

Essential Skills for Loan Signing Agents

| Hard Skills | Soft Skills |

|---|---|

| Notary Public Skills (including proper notarization procedures, record-keeping, and compliance with state laws) | Excellent Communication Skills (both written and verbal, ensuring clear and concise interaction with clients and stakeholders) |

| Document Preparation and Management (handling various loan documents, ensuring accuracy and completeness) | Professionalism and Etiquette (maintaining a courteous and respectful demeanor in all interactions) |

| Data Entry and Accuracy (meticulous data entry into relevant systems with minimal errors) | Time Management and Organization (efficiently scheduling and managing appointments, prioritizing tasks) |

| Knowledge of Loan Documents (understanding various loan document types and their significance) | Problem-Solving Skills (identifying and resolving issues promptly and efficiently) |

| Technology Proficiency (familiarity with various software and electronic signing platforms) | Adaptability and Flexibility (adjusting to changing schedules and client needs) |

| Legal Compliance (adherence to all relevant laws and regulations, including those related to privacy and security) | Client Relationship Management (building rapport with clients and fostering trust) |

| Understanding of Loan Processes (familiarity with the loan closing process from start to finish) | Attention to Detail (meticulous accuracy in handling sensitive documents and information) |

| Record Keeping and Archiving (maintaining accurate and organized records of all signings) | Integrity and Ethical Conduct (upholding the highest ethical standards in all professional interactions) |

| Travel and Transportation (reliable transportation and ability to travel to various locations) | Stress Management (handling pressure and deadlines calmly and effectively) |

| Financial Literacy (basic understanding of financial terminology and concepts relevant to loan documents) | Self-Motivation and Independence (working independently and managing own workload effectively) |

Quantifiable Achievements

Demonstrating quantifiable achievements showcases the impact of your skills. The following examples illustrate how to quantify your accomplishments:

- Notary Public Skills: Maintained a 100% accuracy rate in notarizations over 500 signings, ensuring legal compliance and client satisfaction. No errors or discrepancies were reported.

- Document Preparation and Management: Successfully processed and prepared over 300 loan packages per year, consistently meeting deadlines and maintaining accuracy in document completion. This resulted in zero client complaints related to document errors.

- Data Entry and Accuracy: Achieved a 99.9% accuracy rate in data entry for over 1000 loan signings, minimizing errors and improving efficiency in the overall loan closing process. This resulted in reduced processing time and improved client satisfaction.

Importance of Notary Public Skills and Legal Compliance

Notary Public skills are fundamental to a Loan Signing Agent’s role. Accuracy and adherence to state and federal regulations are paramount. Errors can lead to significant legal and financial repercussions for both the agent and the involved parties. This includes proper identification verification, witness attestation, and accurate record-keeping, all performed within the framework of applicable laws and regulations. Understanding and upholding these legal requirements is crucial for maintaining professionalism and trust.

Experience Section

This section details my experience as a Loan Signing Agent, highlighting my proficiency in handling diverse loan types and maintaining high-volume signing schedules while ensuring accuracy and client satisfaction. My experience demonstrates a consistent ability to meet tight deadlines, navigate complex documentation, and provide exceptional customer service in a fast-paced environment.

Loan Signing Agent, Acme Notary Services

During my tenure at Acme Notary Services, I focused on high-volume signing assignments, averaging 15-20 signings per week. My responsibilities included managing a diverse client base, scheduling appointments, preparing for signings, and ensuring accurate and timely completion of all required documentation. My strong organizational skills and attention to detail were crucial in maintaining a high success rate and minimizing errors.

Below are three significant accomplishments achieved during my time at Acme Notary Services:

- Situation: Experienced a sudden surge in signing requests due to a promotional campaign launched by a major mortgage lender. Task: Manage the increased workload while maintaining the high standard of accuracy and professionalism. Action: Implemented a new scheduling system utilizing a color-coded calendar to prioritize appointments and efficiently manage my time. I also proactively communicated with clients to manage expectations and ensure smooth signings. Result: Successfully completed all signings within the required timeframe, maintaining a 100% accuracy rate and receiving positive feedback from clients and the mortgage lender. This led to increased referrals and a stronger professional reputation.

- Situation: Encountered a complex refinance loan requiring meticulous attention to detail due to the presence of multiple parties and numerous documents. Task: Ensure accurate completion of the signing process, adhering to all regulatory requirements and minimizing the risk of errors. Action: Thoroughly reviewed all documents prior to the signing, clarifying any ambiguities with the involved parties. I meticulously guided the borrowers through each document, ensuring their complete understanding and consent. Result: Successfully completed the complex refinance signing without any errors, earning praise from the lender for my professionalism and expertise. This demonstrated my ability to handle challenging situations effectively.

- Situation: A client experienced a last-minute scheduling conflict, requiring a significant adjustment to my daily schedule. Task: Reschedule the appointment efficiently and minimize disruption to other scheduled signings. Action: Quickly contacted the client to explore alternative times, proactively communicated the change to other clients whose appointments might be affected, and adjusted my schedule accordingly, prioritizing the needs of all parties involved. Result: Successfully accommodated the client’s needs without compromising the quality of service provided to other clients, demonstrating flexibility and excellent problem-solving skills.

Loan Signing Agent, Premier Loan Solutions

At Premier Loan Solutions, my focus shifted towards handling a wider variety of loan types, including purchase loans, refinance loans, HELOCs, and reverse mortgages. This role demanded a deep understanding of different loan documents and the ability to adapt to diverse client needs and situations.

Here are three significant accomplishments from my time at Premier Loan Solutions:

- Situation: Assigned a reverse mortgage signing for an elderly client who required additional assistance understanding the complex terms and conditions. Task: Explain the loan documents clearly and concisely, ensuring the client fully understood the implications before signing. Action: I utilized plain language and provided clear explanations of each document section. I answered all the client’s questions patiently and thoroughly, ensuring complete comprehension before proceeding with the signing. Result: The client expressed gratitude for my patience and clear explanations, leading to a successful signing and a positive client experience. This showcased my ability to adapt my communication style to different client needs and successfully navigate complex loan types.

- Situation: Faced a situation where a critical document was missing from the loan package just before a scheduled signing. Task: Resolve the issue quickly and efficiently to avoid delaying the closing. Action: Immediately contacted the lender to report the missing document and worked collaboratively to locate and obtain it electronically. I then communicated with the client to update them on the situation and reschedule the signing for the earliest possible time. Result: Successfully resolved the issue within a short timeframe, minimizing disruption to the client and preventing a potential closing delay. This demonstrated my proactive approach to problem-solving and my ability to maintain effective communication with all stakeholders.

- Situation: Needed to manage a high volume of signings involving diverse loan types within a short timeframe due to a seasonal peak. Task: Maintain accuracy and efficiency while handling a demanding workload. Action: Prioritized signings based on urgency and complexity, efficiently managed my time and resources, and implemented a rigorous quality control process to ensure accuracy. Result: Successfully completed all signings on time and without errors, exceeding expectations and demonstrating my ability to perform under pressure.

Education and Certifications: Loan Signing Agent Resume

For loan signing agents, a strong educational background, coupled with relevant certifications, significantly enhances credibility and marketability. Highlighting these aspects on your resume demonstrates professionalism and commitment to accuracy and legal compliance, crucial for building trust with clients and lenders. This section should showcase not only formal education but also any specialized training directly related to the role.

Including your Notary Public certification is paramount. It’s the cornerstone of a loan signing agent’s qualifications, legally authorizing you to perform the critical task of notarizing loan documents. Furthermore, additional certifications and training programs can significantly differentiate you from other applicants and demonstrate a commitment to professional development.

Notary Public Certification and Relevant Training

The Notary Public certification is the most important certification for a loan signing agent. It validates your legal authority to witness signatures, administer oaths, and perform other notarial acts required during the loan signing process. This certification should be prominently displayed on your resume, including the state where you are commissioned and the expiration date. Mentioning any relevant training received in notary practices, including continuing education credits, further reinforces your competence and commitment to upholding legal standards. For example, specifying completion of a course on “Best Practices for Loan Signing Agents” or a similar program adds value to your qualifications.

Educational Background and its Relevance

Even if your formal education isn’t directly related to loan signing, it can still be valuable to include on your resume. Relevant skills gained through previous studies, such as attention to detail, organizational skills, or customer service experience, translate directly to the demands of the job. For instance, a degree in business administration can highlight your understanding of financial transactions, while a background in law can demonstrate familiarity with legal processes. The key is to demonstrate how your education equipped you with transferable skills essential for success as a loan signing agent. For example:

“My background in paralegal studies instilled in me a meticulous attention to detail and a deep understanding of legal documents, crucial skills for accurate and efficient loan signing.”

Additional Certifications and Training Programs

Several certifications and training programs can enhance a loan signing agent’s resume and demonstrate a commitment to professional excellence. These programs often cover topics such as: loan document preparation and review, best practices for client interaction, understanding of loan-related terminology, and risk management in loan signings. Examples include certifications offered by the National Notary Association (NNA) such as the Loan Signing System or other specialized training courses focusing on specific aspects of the loan signing process. Completing such programs shows potential employers that you’re dedicated to staying current with industry best practices and committed to providing high-quality service.

Resume Design and Formatting

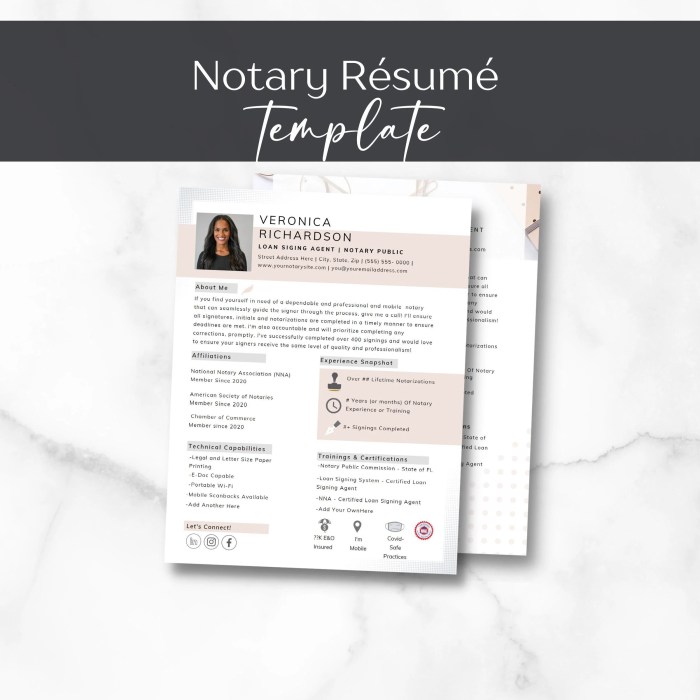

A well-designed resume is crucial for making a strong first impression on potential employers. It’s your first opportunity to showcase your skills and experience in a visually appealing and easily digestible format. A poorly formatted resume, regardless of its content, can quickly lead to rejection. Therefore, careful attention to design and formatting is essential for maximizing your chances of landing an interview.

A clean and professional resume template provides a consistent structure and visual appeal, making your information easily accessible to the recruiter. Avoid overly busy or distracting templates; simplicity is key. Templates with clear section headings, ample white space, and a consistent font style create a professional and readable document. Choosing the right template can significantly enhance the overall impact of your resume.

Suitable Fonts and Formatting Styles

Selecting appropriate fonts and formatting styles is vital for readability and visual appeal. Clean, easily readable fonts like Calibri, Arial, or Times New Roman are generally recommended. Avoid using overly decorative or difficult-to-read fonts. Consistent font sizes should be used throughout the document, with headings slightly larger than the body text for improved visual hierarchy. Use bolding sparingly to highlight key skills or accomplishments, and maintain consistent formatting for similar information (e.g., dates, job titles). Bullet points should be used consistently for listing information, improving scannability.

Key Elements of a Visually Appealing Resume

The visual appeal and readability of a resume significantly impact how recruiters perceive a candidate. A well-designed resume facilitates easy information processing, leading to a more positive evaluation. Consider these five key elements:

- Clear and Concise Headings: Use clear, concise headings to delineate different sections of your resume (e.g., Summary, Experience, Skills, Education). This improves readability and allows recruiters to quickly locate specific information.

- Adequate White Space: White space, or the empty space around text and elements, is crucial for improving readability and preventing a cluttered look. Sufficient margins and spacing between sections enhance the visual appeal and prevent the resume from appearing cramped.

- Consistent Formatting: Maintain consistent formatting throughout the resume, including font size, style, spacing, and bullet points. Consistency creates a professional and polished appearance.

- Logical Section Order: Organize the sections of your resume logically, typically starting with a summary or objective, followed by experience, skills, education, and certifications. This ensures a smooth flow of information.

- Easy-to-Read Font: Choose a font that is easy to read and visually appealing, avoiding overly stylized or decorative fonts. Standard fonts like Arial, Calibri, or Times New Roman are good choices.

Visual Description of a Well-Designed Resume

Imagine a resume with clean, crisp lines and ample white space surrounding blocks of text. The headings for each section (Summary, Experience, Skills, etc.) are clearly visible, perhaps in a slightly larger and bolder font than the body text, setting them apart visually. Sections are separated by a small amount of space, not overwhelming but sufficient to distinguish them. The overall effect is one of clarity and professionalism, with the information presented in a logical and easy-to-follow manner. The use of bullet points enhances readability and helps the reader quickly scan and absorb key information. The absence of excessive bolding or italics ensures that the resume does not appear cluttered or distracting. The font is clean and legible, further enhancing the overall positive impression.

Additional Sections (Optional)

Including additional sections on your Loan Signing Agent resume can strengthen your application by showcasing relevant skills and experiences beyond your core responsibilities. These optional sections can help you stand out from other candidates and highlight aspects of your profile that might not be fully captured in the standard sections. Strategic inclusion of these sections can significantly impact the overall impression your resume makes on potential employers.

Professional Affiliations

Professional affiliations demonstrate your commitment to the industry and your network within it. Membership in relevant organizations shows you’re actively engaged in professional development and staying current with best practices. For example, inclusion of affiliations like the National Notary Association (NNA) or the American Association of Notaries (AAN) signals credibility and professionalism. Listing certifications obtained through these organizations, such as the NNA’s Certified Loan Signing Agent (CLSA) designation, further enhances the value of this section. Including the dates of membership or certification adds concrete detail and shows the duration of your commitment. If you hold leadership positions within any organizations, be sure to highlight this as well.

Awards and Recognition

This section showcases achievements and accolades that highlight your exceptional performance and skills. Including awards, such as “Loan Signing Agent of the Year” from a previous employer or recognition for high volume and accuracy, demonstrates your capabilities and dedication. Awards or recognition from professional organizations further validates your expertise and commitment to the field. For instance, an award for maintaining a perfect signing record for a specific period can be a powerful testament to your reliability and attention to detail. Quantifiable achievements are especially impactful; for example, stating “Recognized for completing over 500 signings with a 100% accuracy rate in 2023” provides concrete evidence of your success.

Volunteer Experience, Loan signing agent resume

While seemingly unrelated, volunteer experience can demonstrate valuable soft skills applicable to loan signing. If you’ve volunteered in roles requiring meticulous attention to detail, strong communication, or working independently, these experiences translate well to the responsibilities of a Loan Signing Agent. For instance, volunteering as a treasurer for a local organization highlights your organizational skills and financial responsibility, which are crucial for handling sensitive loan documents. Similarly, volunteer work involving client interaction, such as assisting at a community center, showcases your ability to interact professionally and build rapport with clients, an essential skill for a successful loan signing agent. Mentioning the organization, your role, and a brief description of your responsibilities provides context and demonstrates the transferable skills gained.

Final Conclusion

Creating a high-impact loan signing agent resume involves more than simply listing your skills and experience. It’s about strategically showcasing your abilities and accomplishments in a way that resonates with hiring managers. By following the guidelines Artikeld in this guide, you can craft a resume that effectively communicates your value and sets you apart from the competition. Remember to tailor your resume to each specific job application, highlighting the skills and experiences most relevant to the position.

Questions and Answers

What font should I use for my resume?

Use clean and easily readable fonts like Times New Roman, Arial, or Calibri. Avoid overly decorative or difficult-to-read fonts.

How long should my resume be?

Aim for one page if possible, especially for early-career professionals. Two pages are acceptable for experienced professionals with extensive relevant experience.

Should I include a cover letter?

A cover letter is generally recommended, allowing you to personalize your application and further highlight your qualifications.

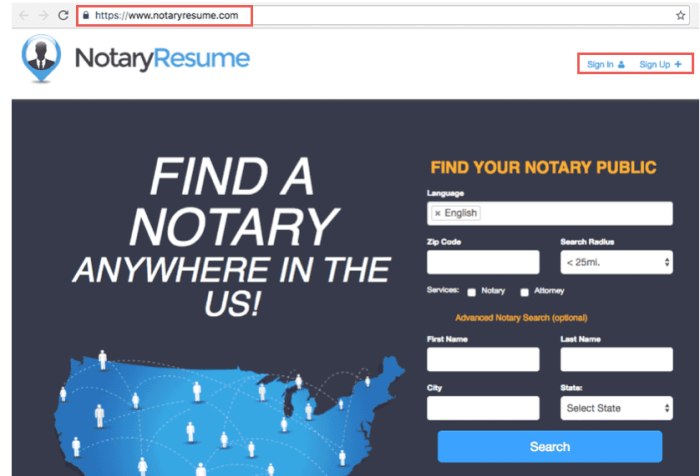

Where can I find loan signing agent jobs?

Check online job boards (Indeed, LinkedIn), company websites, and networking sites specifically targeting the loan signing industry.