Loans like Brigit offer a lifeline to those facing unexpected financial shortfalls. These apps provide small, short-term loans, often coupled with budgeting tools and financial tracking features. Their target audience is typically individuals with limited access to traditional credit or those needing quick financial assistance between paychecks. This guide delves into the specifics of these apps, comparing their features, outlining the application process, and exploring both the benefits and risks involved.

We’ll examine several key players in this space, comparing their interest rates, loan amounts, fees, and eligibility requirements. We’ll also discuss the user experience, exploring both positive and negative aspects reported by users. Understanding the regulatory landscape and consumer protections is crucial, as is exploring alternative financial solutions for those seeking short-term financial help.

Introduction to Brigit-like Loan Apps

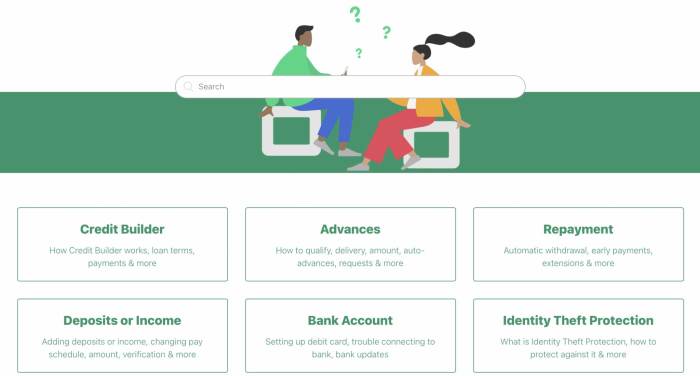

Brigit and similar financial technology (fintech) apps are designed to provide short-term financial relief and tools for better money management to individuals who may not have access to traditional banking services or struggle with managing their finances effectively. These apps offer a blend of lending services and budgeting features, aiming to empower users with greater control over their personal finances.

These apps primarily function by analyzing a user’s bank account transactions to assess their financial health and spending habits. Based on this analysis, they offer various services, providing a safety net during unexpected financial shortfalls. This approach differs significantly from traditional lending institutions, which often rely heavily on credit scores and extensive paperwork.

Core Functionality of Brigit and Similar Apps

Brigit-like apps offer a suite of features designed to help users manage their money more effectively and access small loans when needed. The core functionality revolves around providing small, short-term loans, often referred to as “cash advances,” to help users cover unexpected expenses or bridge gaps until their next payday. These loans typically come with smaller fees compared to payday loans and often integrate seamlessly with existing bank accounts.

Common Features of Brigit-like Loan Apps

A range of features are commonly integrated into these apps to enhance their utility beyond just loan provision. For instance, many include budgeting tools that help users track their income and expenses, identify areas where they can cut back, and create personalized spending plans. Financial tracking capabilities provide users with real-time insights into their financial situation, allowing them to monitor their account balances, upcoming bills, and overall financial progress. Some apps also offer savings goals features, allowing users to set targets and track their progress toward achieving them. Other apps may incorporate features like bill payment reminders, helping users stay on top of their financial obligations and avoid late fees. Finally, some also offer financial education resources, such as articles and tutorials, to help users improve their financial literacy.

Target Audience for Brigit-like Financial Services

The target audience for these apps is broad, encompassing individuals who often face financial challenges or lack access to traditional financial services. This includes young adults just starting out, those with limited credit history, individuals with irregular income streams, and those who may have difficulty accessing traditional loans due to poor credit scores. Essentially, these apps aim to serve the underserved and underbanked populations, providing a more accessible and convenient alternative to traditional financial institutions. The apps’ ease of use and integration with existing banking systems make them particularly appealing to those who are less comfortable with complex financial products or processes.

Comparison of Key Features

Choosing the right short-term loan app can significantly impact your financial well-being. Several apps offer similar services, but their features, fees, and eligibility criteria vary considerably. Understanding these differences is crucial for making an informed decision. This section compares three popular Brigit-like apps to illustrate these variations.

App Feature Comparison

This table summarizes key features of three popular short-term loan apps: Dave, Earnin, and Klover. Note that interest rates, fees, and eligibility requirements can change, so it’s essential to verify the current information on each app’s website before applying.

| App Name | Interest Rate | Maximum Loan Amount | Fees | Eligibility Criteria |

|---|---|---|---|---|

| Dave | Variable, often presented as a “membership fee” rather than interest | Up to $200 (depending on membership level and account history) | Monthly membership fee (varies), potential overdraft fees from linked bank account | Active checking account, direct deposit |

| Earnin | No interest charges, but tips are encouraged | Up to $500 (depending on employment history and account activity) | Optional tips to the app, potential fees from linked bank account for faster transfers | Active employment, direct deposit |

| Klover | Offers a paid “instant” cash advance option with fees, free advance options with delays | Up to $250 (depending on account history and income verification) | Fees vary depending on the advance type and speed of delivery, monthly subscription option available | Active checking account, regular income |

User Experience and App Design

The user experience across these apps differs significantly. Dave emphasizes simplicity and ease of use, with a clean interface and straightforward navigation. The app’s design prioritizes accessibility, making it easy for users to understand the terms and conditions and access their funds. Earnin, while functional, presents a slightly more cluttered interface, with more information displayed on the main screen. This can be overwhelming for some users, while others might appreciate the increased detail. Klover provides a middle ground, balancing simplicity with more comprehensive information about available features and options. The app offers a more visually appealing design compared to Earnin, but not as minimalist as Dave. Each app’s design reflects its target audience and overall approach to providing financial assistance. For instance, Dave focuses on the simplicity of its service, whereas Klover attempts to provide more advanced financial tools. The differences in design and user experience can influence a user’s overall satisfaction and comfort level with the app.

Loan Application Process and Requirements: Loans Like Brigit

Applying for a loan through a Brigit-like app generally involves a straightforward process designed for speed and convenience. These apps prioritize a quick approval process, often leveraging alternative data sources to assess creditworthiness beyond traditional credit scores. However, understanding the steps and requirements is crucial for a smooth application experience.

The typical application process involves several key steps. First, users download the app and create an account, providing basic personal information. Next, they connect their bank account to allow the app to assess their financial health. This usually involves secure authentication procedures. Following this, users specify the loan amount they need and the repayment terms. Finally, the app processes the application, potentially performing a soft credit check, and provides an instant decision regarding approval or rejection.

Documentation Requirements

Brigit-like apps typically require minimal documentation compared to traditional lenders. The primary requirement is access to the applicant’s bank account to verify income and spending patterns. This allows the app to assess the applicant’s ability to repay the loan. Some apps might request additional information, such as employment details or identification verification, but this is not always necessary. The streamlined process is a key differentiator for these apps.

Potential Application Challenges

Despite the simplified process, users may encounter challenges. One common issue is insufficient income or irregular cash flow. If the app’s algorithm determines the applicant’s income is insufficient to cover the loan repayment, the application might be rejected. Another potential challenge is a lack of sufficient banking history. Apps rely on recent transactional data to assess creditworthiness, so applicants with limited banking history might face difficulties. Finally, technical issues such as connectivity problems or app glitches can temporarily disrupt the application process. For instance, a user might experience an error message preventing them from connecting their bank account, delaying the application.

Financial Implications and Risks

Using loan apps like Brigit offers a seemingly convenient solution for short-term financial gaps, but understanding the potential financial implications is crucial before relying on them. While these apps can provide immediate access to funds, overlooking the associated costs and potential long-term effects can lead to a cycle of debt and financial instability. This section explores the benefits and drawbacks, emphasizing the importance of understanding the true cost of borrowing.

The primary benefit is the speed and accessibility of the funds. These apps often provide quicker access to small loans than traditional banks, proving useful in emergencies. However, this convenience comes at a cost. The significant drawback lies in the high interest rates and fees often associated with these services. Failing to understand these charges can lead to unexpected and substantial debt accumulation.

Annual Percentage Rate (APR) and Associated Fees

Understanding the Annual Percentage Rate (APR) is paramount when considering any loan, including those offered by apps like Brigit. The APR represents the total cost of borrowing, encompassing interest and fees, expressed as a yearly percentage. Many loan apps don’t explicitly advertise their APR but instead focus on smaller, seemingly less significant fees. However, these smaller fees can quickly accumulate, resulting in a much higher effective interest rate than initially perceived. For instance, a seemingly low daily or weekly fee can translate into a very high APR when compounded over time. It’s crucial to calculate the total cost of borrowing, including all fees, to understand the true financial burden. Comparing APRs across different loan apps is essential for making an informed decision. Always look beyond the advertised loan amount and focus on the overall cost.

Hypothetical Scenario: Consistent Use of Loan Apps

Consider Sarah, a young professional with a fluctuating income. She uses a loan app to cover unexpected car repairs, borrowing $100 with a daily fee of $1. Initially, this seems manageable. However, due to unforeseen circumstances, she needs to borrow again the following week, then again the week after. Over three months, her initial $100 loan balloons to a much larger amount, not only due to the accumulating daily fees but also because of the added loan amounts and associated fees each time. This illustrates the potential for a vicious cycle, where the convenience of the app masks the increasingly significant financial burden. While initially helpful in emergency situations, consistent reliance on such apps can quickly lead to substantial debt and hinder long-term financial stability. Conversely, if Sarah had been able to save even small amounts regularly, she could have avoided this situation entirely. This highlights the importance of building an emergency fund and practicing responsible financial planning to minimize reliance on high-cost short-term loans.

Alternatives to Brigit-like Loan Apps

Brigit and similar apps offer a convenient way to access small, short-term loans, but they aren’t the only option for individuals facing unexpected financial shortfalls. Several alternative financial solutions exist, each with its own advantages and disadvantages. Understanding these alternatives is crucial for making informed decisions about managing personal finances and avoiding potential debt traps. Choosing the right option depends heavily on individual circumstances, financial literacy, and the urgency of the need.

This section explores viable alternatives to Brigit-like loan apps, comparing their costs, accessibility, and overall suitability for various financial situations. We’ll analyze the pros and cons of each to help you determine the best path for your specific needs.

Comparison of Alternative Financial Solutions

The following table compares Brigit-like apps with several alternative financial solutions. It’s important to note that specific interest rates and fees can vary significantly between providers, and it’s always advisable to check the latest terms and conditions before committing to any financial product.

| Financial Solution | Cost (Typical) | Accessibility | Suitability |

|---|---|---|---|

| Brigit-like Apps (e.g., Dave, Cleo) | Subscription fees, overdraft fees, optional tip-based “loans” | Generally easy, requires bank account linking | Suitable for small, short-term needs; potential for recurring fees |

| Credit Unions | Varying interest rates on small loans; often lower than banks | Membership required; varies by location | Suitable for borrowers with good or fair credit; potentially better rates than other options |

| Payday Loans | Very high interest rates and fees; short repayment periods | Relatively easy access; minimal credit checks | Generally unsuitable due to high cost; can lead to a debt cycle |

| Personal Loans (Banks/Online Lenders) | Interest rates vary based on credit score; longer repayment periods | Credit check required; varies by lender | Suitable for larger amounts and longer repayment terms; requires good credit |

| Family/Friends | Interest-free (ideally); flexible repayment terms | Highly dependent on relationships and trust | Suitable for small amounts and strong relationships; informal agreement crucial |

| Negotiating with Creditors | Potential reduction in payments or fees; avoids late payment penalties | Requires direct communication with creditors | Suitable for managing existing debt; requires strong negotiation skills |

| Community Resources (Food Banks, Charities) | Often free or low-cost; may require proof of need | Varies by location and availability | Suitable for immediate needs such as food or housing assistance |

Regulatory Landscape and Consumer Protection

The regulatory environment surrounding short-term, small-dollar loan apps like Brigit is complex and varies significantly by jurisdiction. These apps often operate in a grey area, falling outside the traditional regulatory frameworks designed for banks and credit unions, yet impacting consumers’ financial well-being in substantial ways. This necessitates a careful examination of the existing regulations and the need for stronger consumer protections.

The lack of uniform national standards creates challenges for both regulators and consumers. While some states have robust consumer lending laws, others have less stringent regulations, leading to inconsistencies in interest rates, fees, and collection practices. This regulatory patchwork can result in uneven consumer protection across different regions.

State and Federal Regulations Governing Small-Dollar Loans, Loans like brigit

Many states have laws governing payday loans, installment loans, and other similar products, often setting limits on interest rates and fees. However, the classification of apps like Brigit as payday lenders or a different type of lender varies depending on the app’s specific features and the state’s legal definition. The Consumer Financial Protection Bureau (CFPB) plays a significant role at the federal level, monitoring compliance with federal consumer financial protection laws, including the Truth in Lending Act (TILA) and the Fair Debt Collection Practices Act (FDCPA). These laws require lenders to disclose key terms and conditions transparently and prohibit abusive debt collection tactics. However, the application of these laws to the rapidly evolving fintech landscape remains an ongoing challenge. For example, the definition of “interest” can be debated in relation to subscription fees charged by these apps, which can blur the lines of regulatory compliance.

Potential Risks to Consumers and Mitigation Strategies

Consumers using Brigit-like apps face several potential risks. High interest rates and fees can trap borrowers in a cycle of debt, particularly if they rely on the app repeatedly. The ease of access and quick approval process can also lead to overspending and financial mismanagement. Data privacy and security are further concerns; the apps often require access to sensitive financial information, raising the possibility of data breaches or misuse.

To mitigate these risks, consumers should carefully review the terms and conditions before using such apps, comparing interest rates and fees across multiple providers. Building a strong financial foundation through budgeting and saving is crucial to avoid over-reliance on these apps. Regularly monitoring credit reports and bank statements can help detect any suspicious activity. Consumers should also be aware of their rights under consumer protection laws and seek assistance from consumer advocacy groups or financial counselors if they encounter problems.

Consumer Protection Laws Applicable to Loan Apps

Several consumer protection laws apply to Brigit-like loan apps. The Truth in Lending Act (TILA) requires lenders to clearly disclose all fees and interest rates. The Electronic Funds Transfer Act (EFTA) protects consumers against unauthorized electronic fund transfers. The Fair Credit Reporting Act (FCRA) regulates how consumer credit information is collected, used, and disclosed. The Fair Debt Collection Practices Act (FDCPA) prevents abusive and unfair debt collection practices. State-specific laws often provide additional protections, such as limits on interest rates or restrictions on loan rollovers. Non-compliance with these laws can result in significant penalties for the lending apps. Understanding these laws is crucial for consumers to protect themselves from unfair lending practices and excessive fees.

Illustrative Examples of User Experiences

Understanding user experiences with Brigit-like loan apps is crucial for assessing their overall effectiveness and appeal. Positive experiences foster loyalty and positive reviews, while negative experiences can lead to app abandonment and damaging feedback. Examining both scenarios provides valuable insight into the app’s design and functionality.

Positive User Experience: Sarah’s Story

Sarah, a freelance graphic designer, experienced a period of unpredictable income. Anticipating a shortfall before her next payment, she downloaded a Brigit-like app. The app’s interface was intuitive and easy to navigate. Within minutes, she had linked her bank account and understood her spending habits visualized through clear charts and graphs. She appreciated the app’s instant cash advance feature, which provided a small, interest-free loan to cover her immediate expenses. The repayment was automatically deducted from her next paycheck without any hassle. The app also offered helpful budgeting tools and financial literacy resources, which Sarah found valuable in managing her finances more effectively. The entire process was seamless and stress-free, leaving Sarah feeling empowered and in control of her finances. This positive experience led her to recommend the app to her friends and leave a glowing five-star review.

Negative User Experience: Mark’s Story

Mark, a student working part-time, downloaded a similar app hoping to cover unexpected car repair costs. While the initial signup process was straightforward, he quickly encountered difficulties. The app’s loan approval process was unclear, with inconsistent messaging about eligibility requirements. He repeatedly attempted to upload supporting documents, but the app kept rejecting them due to unspecified technical issues. After several frustrating attempts, he finally secured a small loan, but the interest charges were significantly higher than he had anticipated, making the repayment a considerable burden. The app’s customer support was unhelpful and unresponsive, further adding to his frustration. The experience left Mark feeling exploited and distrustful of similar financial apps. He subsequently deleted the app and left a scathing one-star review, detailing his negative experience.

Impact of User Experiences on App Perceptions and Ratings

The contrasting experiences of Sarah and Mark illustrate how user perceptions and app ratings are directly shaped by the app’s functionality, ease of use, and customer support. Positive experiences, characterized by seamless transactions, helpful features, and responsive customer service, result in high user satisfaction, positive word-of-mouth marketing, and favorable app store ratings. Conversely, negative experiences, marked by technical glitches, unclear terms and conditions, high interest rates, and poor customer support, lead to user dissatisfaction, negative reviews, and damage to the app’s reputation. These experiences directly impact the app’s overall success and user base. Apps with consistently positive user experiences tend to thrive, while those with recurring negative feedback often struggle to attract and retain users.

Final Conclusion

Navigating the world of short-term loan apps requires careful consideration. While apps like Brigit offer convenient access to funds, understanding the associated fees, interest rates, and potential long-term financial implications is paramount. By comparing different options, understanding the application process, and being aware of consumer protections, you can make informed decisions that align with your financial well-being. Remember to explore alternative solutions and prioritize responsible borrowing practices.

Key Questions Answered

What is the typical repayment period for loans like Brigit?

Repayment periods vary depending on the app and the loan amount, but they’re generally short-term, often ranging from a few days to a couple of weeks.

Can I use these apps if I have bad credit?

Many Brigit-like apps don’t perform a traditional credit check, focusing instead on your bank account activity and income. However, eligibility criteria vary, so check individual app requirements.

Are there any hidden fees associated with these loans?

Always review the terms and conditions carefully. Some apps may charge membership fees, late payment fees, or other charges beyond the interest rate. Transparency is key.

How do these apps protect my personal data?

Reputable apps employ security measures to protect user data. However, it’s crucial to choose established apps with strong privacy policies and security protocols.