MHDC loan requirements can seem daunting, but understanding the eligibility criteria, necessary documentation, and property stipulations is key to securing financing. This guide breaks down the process, clarifying income limits, credit score needs, and debt-to-income ratios. We’ll explore the application process, insurance requirements, and potential pitfalls to avoid, empowering you to navigate the path to homeownership with confidence.

From acceptable forms of income verification to understanding the appraisal process and various loan terms, we aim to provide a comprehensive overview. We’ll delve into the specifics of different MHDC loan programs, comparing and contrasting their features to help you make informed decisions. This detailed analysis will equip you with the knowledge necessary to successfully apply for an MHDC loan.

Eligibility Criteria for MHDC Loans

Securing a loan through the Maryland Department of Housing and Community Development (MHDC) requires meeting specific eligibility criteria. These criteria ensure that the program effectively serves its intended purpose of providing affordable homeownership opportunities to qualified Maryland residents. Understanding these requirements is crucial for prospective borrowers to determine their eligibility and prepare a successful application.

Income Limits for MHDC Loan Applicants

MHDC loan programs have income limits that vary based on household size, location within Maryland, and the specific loan program. These limits are designed to target assistance to those who need it most, ensuring that the program’s resources are allocated effectively. Income limits are regularly updated, so it’s essential to check the MHDC website for the most current figures. Generally, higher income limits are available in areas with higher costs of living. For example, a family of four in Montgomery County might have a significantly higher income limit than a similar family in a rural county. Applicants must provide documentation to verify their income, such as pay stubs, tax returns, or W-2 forms. Exceeding the income limit for a particular program will disqualify an applicant from that program, though they may still be eligible for other programs with higher limits.

Credit Score Requirements for MHDC Loans

While MHDC programs are designed to be accessible to a wider range of borrowers, a minimum credit score is usually required. The specific credit score threshold varies depending on the loan program and the level of risk involved. For instance, first-time homebuyer programs might have more lenient credit score requirements than programs for experienced homeowners. However, a higher credit score generally leads to better loan terms and interest rates. Applicants with lower credit scores may still qualify but might be required to meet stricter conditions, such as a larger down payment or a higher interest rate. Improving one’s credit score before applying can significantly enhance the chances of approval and secure more favorable loan terms.

Debt-to-Income Ratio Restrictions Imposed by MHDC

The debt-to-income (DTI) ratio, which represents the proportion of monthly income dedicated to debt payments, is a critical factor in MHDC loan eligibility. A lower DTI ratio indicates a greater capacity to manage additional debt, such as a mortgage. MHDC typically imposes limits on the acceptable DTI ratio, and exceeding this limit can result in loan application denial. The specific DTI ratio limit varies based on the program and other factors like credit score and down payment. For example, a program targeting low-income borrowers might allow a higher DTI ratio than a program designed for more financially stable applicants. Reducing debt before applying can improve the DTI ratio and increase the chances of loan approval.

Acceptable and Unacceptable Forms of Documentation for Income Verification

Accurate income verification is essential for MHDC loan applications. Acceptable forms of documentation typically include: recent pay stubs (at least two months), W-2 forms (for the past two years), tax returns (for the past two years), bank statements showing regular deposits, and self-employment income documentation (including profit and loss statements). Unacceptable forms of documentation generally include: estimates of income, undocumented cash income, and documents that lack verifiable information. It’s crucial to provide complete and accurate documentation to avoid delays or rejection of the application. Incomplete or inaccurate documentation can lead to significant delays in the processing of the application and may even result in denial.

Comparison of Eligibility Requirements for Different MHDC Loan Programs

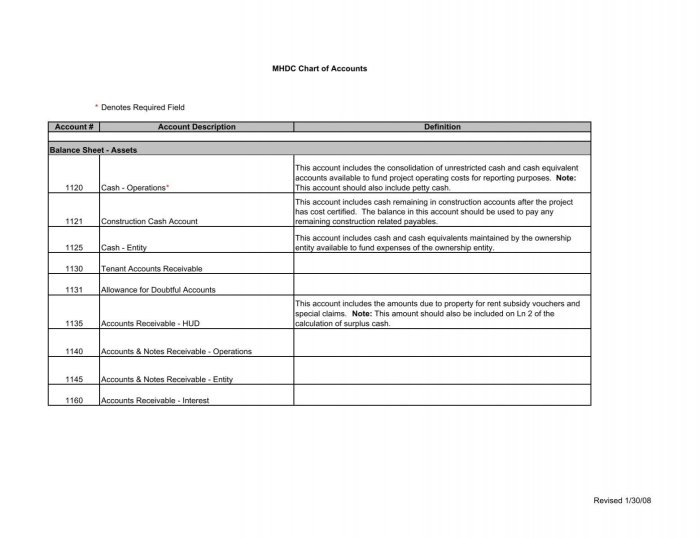

The following table compares the eligibility requirements for three hypothetical MHDC loan programs. Note that these are examples, and actual requirements vary depending on the specific program and are subject to change. Always refer to the official MHDC website for the most up-to-date information.

| Program Name | Income Limit (Family of 4) | Minimum Credit Score | Maximum DTI Ratio |

|---|---|---|---|

| First-Time Homebuyer Program | $100,000 | 620 | 43% |

| Homeowner Assistance Program | $120,000 | 650 | 40% |

| Rural Development Program | $90,000 | 600 | 45% |

Required Documentation for MHDC Loan Application

Applying for an MHDC loan requires submitting a comprehensive set of documents to verify your identity, income, and the property’s details. Providing complete and accurate documentation is crucial for a smooth and timely loan processing. Incomplete or inaccurate information can lead to delays, loan denial, or even legal repercussions.

Checklist of Required Documents

The following checklist Artikels the essential documents needed for your MHDC loan application. Remember to meticulously review each document for accuracy and completeness before submission. Missing or flawed documentation will significantly hinder the application process.

- Valid Government-Issued Identification: This is fundamental for verifying your identity. Acceptable forms include a driver’s license, passport, or national identity card. Ensure the identification is current and clearly displays your full legal name, photograph, and date of birth.

- Proof of Income: This demonstrates your ability to repay the loan. Acceptable forms include pay stubs (at least two months), W-2 forms (for the past two years), tax returns (for the past two years), or bank statements showing consistent income deposits. Self-employed individuals will need to provide additional documentation, such as business tax returns and profit and loss statements.

- Proof of Residence: This verifies your current address. Acceptable forms include a utility bill (gas, electricity, water), bank statement, or rental agreement. The document must display your name and current address and be dated within the last three months.

- Property Appraisal: An independent appraisal is required to determine the fair market value of the property you intend to purchase. This appraisal should be conducted by a qualified and licensed appraiser.

- Credit Report: A credit report provides a detailed history of your credit behavior. This report will be used to assess your creditworthiness and determine your eligibility for the loan. You can obtain a copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion.

- Loan Application Form: This official form will require detailed information about your personal finances, employment history, and the property you wish to purchase. Complete this form accurately and thoroughly.

Obtaining and Submitting Required Documents

Gathering the necessary documents requires careful planning and organization. Obtain copies of each document well in advance of your application deadline. Ensure all copies are clear, legible, and complete. Many documents can be obtained online or directly from the issuing institution. For example, you can typically download your credit report online from the credit bureau’s website. Pay stubs can be obtained from your employer’s payroll department. For documents that require official seals or signatures, allow ample time for processing. Organize all documents chronologically or categorically to ensure efficient submission.

Consequences of Incomplete or Inaccurate Documentation

Submitting incomplete or inaccurate documentation can result in significant delays in processing your loan application. The MHDC may request additional information or clarification, delaying the approval process. In some cases, incomplete or inaccurate information may lead to outright rejection of your application. Providing false information is a serious offense and can have severe legal consequences.

Examples of Acceptable Identification Documents

Acceptable forms of identification include, but are not limited to: a current driver’s license issued by a state or territory within the United States; a valid U.S. passport; a U.S. military identification card; a state-issued identification card. All documents must bear your current photograph and signature.

Property Requirements for MHDC Loans

Securing an MHDC loan hinges not only on your financial standing but also on the suitability of the property you intend to purchase or refinance. This section details the specific property requirements that must be met to qualify for MHDC financing. Understanding these requirements is crucial for a smooth and successful loan application process.

Eligible Property Types

MHDC loans typically support the purchase or refinance of various residential properties. These commonly include single-family homes, townhouses, condominiums, and manufactured homes. However, specific eligibility criteria may vary depending on the loan program and the property’s location. For example, some programs may have restrictions on the age of the property or the type of construction. It’s essential to confirm the precise requirements with MHDC before submitting an application. Properties deemed uninhabitable or those located in high-risk areas might be excluded.

The Appraisal Process and its Significance

A professional appraisal is a critical component of the MHDC loan application process. An independent, licensed appraiser assesses the property’s fair market value, considering factors like location, size, condition, and comparable sales in the area. The appraisal report provides crucial information for determining the loan-to-value (LTV) ratio, a key factor in loan approval. A low LTV ratio, indicating a larger down payment, generally improves the chances of loan approval and may result in a more favorable interest rate. Discrepancies between the purchase price and the appraised value can significantly impact the loan approval process, potentially requiring adjustments to the purchase price or a larger down payment.

Property Insurance Requirements

Comprehensive property insurance is mandatory for securing an MHDC loan. This insurance protects the lender’s investment in case of unforeseen events like fire, theft, or natural disasters. The policy must meet MHDC’s minimum coverage requirements, typically including dwelling coverage, liability coverage, and other necessary protections. Proof of insurance must be provided before loan closing. Failure to maintain adequate insurance coverage can lead to loan default and potential foreclosure.

Examples of Ineligible Properties

Several property types generally do not qualify for MHDC financing. These include properties with significant structural damage, those located in floodplains or areas prone to natural disasters without adequate mitigation measures, and properties with known environmental hazards. Properties used for commercial purposes or those that violate local building codes are also typically ineligible. Furthermore, properties with outstanding liens or other encumbrances may require resolution before loan approval.

Comparison of Property Requirements Across MHDC Loan Types

| Loan Type | Property Type | Maximum LTV | Appraisal Requirements |

|---|---|---|---|

| Fixed-Rate Mortgage | Single-family homes, townhouses, condos | 95% (may vary) | Professional appraisal required |

| Adjustable-Rate Mortgage | Single-family homes, townhouses, condos | 90% (may vary) | Professional appraisal required |

| Manufactured Home Loan | Manufactured homes | 80% (may vary) | Professional appraisal required, specific to manufactured homes |

| Refinance Loan | Existing single-family homes, townhouses, condos | 80% (may vary) | Professional appraisal required |

Loan Amounts and Terms for MHDC Loans

The maximum loan amount available through the MHDC (assuming MHDC refers to a specific mortgage provider; replace with the actual name if different) depends on several key factors, ensuring responsible lending practices and aligning with the borrower’s financial capacity. Understanding these factors is crucial for applicants to accurately assess their borrowing potential.

Several interconnected factors influence the maximum loan amount. These include the applicant’s credit score, income stability and level, debt-to-income ratio (DTI), the appraised value of the property, and the type of MHDC loan program applied for. A higher credit score, consistent and substantial income, a low DTI, and a property appraisal reflecting a higher value all contribute to a larger maximum loan amount. Different MHDC loan programs may also have varying maximum loan limits based on factors like property type or location. For instance, loans for newly constructed homes might have higher limits than those for existing properties. The loan-to-value (LTV) ratio, representing the percentage of the property’s value covered by the loan, also plays a significant role, typically capped at a certain percentage to mitigate risk.

Loan Terms and Interest Rates

MHDC loans offer a range of terms, allowing borrowers to tailor their repayment schedules to their financial situations. Loan terms typically involve a specified repayment period, often spanning 15 to 30 years, and an interest rate that determines the total cost of borrowing. Interest rates are dynamic, influenced by prevailing market conditions and the borrower’s creditworthiness. Generally, longer repayment periods result in lower monthly payments but higher overall interest costs. Conversely, shorter terms lead to higher monthly payments but lower total interest paid.

For example, a 30-year loan will have lower monthly payments compared to a 15-year loan with the same principal amount and interest rate. However, the total interest paid over the life of the 30-year loan will be significantly higher. Borrowers should carefully weigh these factors to choose a term that aligns with their financial goals and risk tolerance.

Examples of Loan Scenarios

To illustrate, consider three hypothetical scenarios:

Scenario 1: A borrower with excellent credit secures a $250,000 loan at a 4% interest rate over 30 years. Their monthly payment would be approximately $1,193. Scenario 2: The same borrower chooses a 15-year term for the same loan amount and interest rate. Their monthly payment would increase to roughly $1,887, reflecting the shorter repayment period. Scenario 3: A borrower with a lower credit score might receive the same $250,000 loan but at a higher interest rate of 5%, resulting in a monthly payment of approximately $1,342 over 30 years.

Comparison of Interest Rates Across MHDC Loan Programs

MHDC may offer different loan programs (e.g., fixed-rate, adjustable-rate, first-time homebuyer programs) with varying interest rates. Fixed-rate loans offer consistent monthly payments throughout the loan term, providing predictability. Adjustable-rate mortgages (ARMs) have interest rates that fluctuate based on market indices, potentially leading to lower initial payments but increased uncertainty over the loan’s lifespan. First-time homebuyer programs may offer lower interest rates or other incentives to encourage homeownership. Specific interest rate differences between these programs would be Artikeld in the MHDC’s official documentation.

Loan Amounts and Corresponding Monthly Payments

The following table illustrates a sample of loan amounts and their corresponding monthly payments, assuming a fixed interest rate of 4% and varying loan terms. These figures are for illustrative purposes only and actual payments will depend on individual circumstances and prevailing interest rates.

| Loan Amount | 15-Year Monthly Payment (4% Interest) | 20-Year Monthly Payment (4% Interest) | 30-Year Monthly Payment (4% Interest) |

|---|---|---|---|

| $150,000 | $1,166 | $972 | $716 |

| $200,000 | $1,555 | $1,296 | $955 |

| $250,000 | $1,943 | $1,620 | $1,194 |

| $300,000 | $2,332 | $1,944 | $1,433 |

The MHDC Loan Application Process

Securing an MHDC loan involves a multi-step process that requires careful preparation and attention to detail. Understanding each stage, from initial application to final closing, is crucial for a smooth and successful loan application. This section Artikels the key steps involved, the role of intermediaries, potential rejection reasons, and a guide to completing the application form.

The MHDC Loan Application Steps, Mhdc loan requirements

The MHDC loan application process is typically broken down into several key stages. Successfully navigating these stages requires diligent preparation and clear communication with your chosen lender or broker.

- Pre-qualification: Before formally applying, it’s advisable to get pre-qualified. This involves providing basic financial information to a lender or broker to receive an estimate of how much you can borrow. This helps you focus your property search within your affordable range.

- Formal Application Submission: Once you’ve found a suitable property, submit a formal application to your chosen lender or broker. This involves completing the MHDC loan application form thoroughly and accurately, providing all the necessary documentation.

- Loan Underwriting: The lender will review your application, verify your information, and assess your creditworthiness. This stage involves a comprehensive assessment of your financial situation, including income, debt, and credit history.

- Property Appraisal: An independent appraisal of the property will be conducted to determine its market value. This ensures the property’s value justifies the loan amount requested.

- Loan Approval/Rejection: Based on the underwriting and appraisal, the lender will issue a decision on your loan application. Approval leads to the next stages, while rejection necessitates addressing the identified concerns.

- Loan Closing: Upon approval, the final steps involve signing all the necessary loan documents, paying closing costs, and transferring the funds to complete the property purchase.

The Role of Mortgage Brokers and Lenders

Mortgage brokers act as intermediaries, connecting borrowers with multiple lenders to find the best loan terms. Lenders, on the other hand, directly assess and approve loan applications. While both play crucial roles, brokers offer broader access to various loan options, while lenders handle the direct loan processing and underwriting. Choosing between a broker and a direct lender depends on individual preferences and circumstances.

Common Reasons for Loan Application Rejection and Mitigation Strategies

Loan applications can be rejected due to several factors. These often include insufficient income, poor credit history, high debt-to-income ratio, or issues with the property itself (e.g., inadequate appraisal value). Proactive steps, such as improving credit scores, reducing debt, and securing a larger down payment, can significantly increase the chances of approval. Thoroughly reviewing your financial situation and addressing any potential weaknesses before applying is crucial.

Completing the MHDC Loan Application Form: A Step-by-Step Guide

Completing the MHDC loan application form accurately is paramount. Inaccurate or incomplete information can delay the process or lead to rejection.

- Personal Information: Accurately fill in all personal details, including name, address, contact information, and employment history.

- Financial Information: Provide comprehensive details about your income, assets, liabilities, and debts. This includes bank statements, pay stubs, and tax returns.

- Property Information: Provide complete details about the property you intend to purchase, including address, purchase price, and intended use.

- Loan Details: Specify the loan amount, loan term, and desired interest rate. Clearly state your understanding of the loan terms and conditions.

- Review and Submission: Carefully review the completed form for accuracy before submitting it. Ensure all supporting documentation is included.

Understanding MHDC Loan Insurance

Securing an MHDC loan often involves mortgage insurance, a crucial element protecting the lender against potential losses should you default on your payments. Understanding the types, costs, and cancellation conditions of this insurance is vital for responsible homeownership. This section clarifies the intricacies of MHDC loan insurance.

Types of Mortgage Insurance for MHDC Loans

MHDC loans may require different types of mortgage insurance depending on the loan-to-value ratio (LTV), the borrower’s credit score, and other risk factors assessed by the lender. Common types include Private Mortgage Insurance (PMI) and Mortgage Insurance Premium (MIP) for government-backed loans. The specific type required will be detailed in your loan agreement. Some MHDC loans might also involve other forms of insurance, such as flood insurance or hazard insurance, depending on the property’s location and risk profile.

Costs Associated with MHDC Loan Insurance

The cost of MHDC loan insurance varies significantly based on the type of insurance, the loan amount, the LTV ratio, and the borrower’s creditworthiness. PMI premiums are typically expressed as a percentage of the loan amount and are paid monthly as part of your mortgage payment. MIP premiums can be paid upfront or as an annual percentage of the loan amount. It’s crucial to obtain a detailed breakdown of all insurance costs from your lender before finalizing your loan agreement to accurately budget for these expenses. For example, a PMI premium might range from 0.5% to 1% of the loan amount annually, while MIP premiums vary depending on the loan type and term.

Circumstances Under Which MHDC Loan Insurance May Be Cancelled

MHDC loan insurance can be cancelled under specific circumstances. For PMI, cancellation typically occurs when the borrower’s equity in the home reaches a certain threshold, usually 20% of the home’s value. This means that once you’ve paid down enough of your loan, the lender no longer considers you a high-risk borrower and cancels the insurance. For MIP, cancellation rules vary depending on the specific loan program, and some loans may require insurance for the life of the loan. Prepayment of the loan may also affect insurance cancellation policies, so it’s crucial to consult your loan agreement and lender for precise details.

Comparison of Different Mortgage Insurance Options

Different mortgage insurance options present varying costs and cancellation terms. PMI is typically offered by private insurance companies, while MIP is backed by the government. PMI often has more flexible cancellation terms based on equity, while MIP cancellation depends on specific government loan programs. The choice between them often depends on the borrower’s circumstances and the type of loan obtained. While PMI premiums can be higher initially, the potential for earlier cancellation might make it more appealing for some borrowers. Conversely, MIP might offer lower premiums in the long run, especially if cancellation is less likely.

Mortgage Insurance Cost Comparison

| Insurance Type | Premium Type | Typical Annual Cost Range | Cancellation Conditions |

|---|---|---|---|

| Private Mortgage Insurance (PMI) | Monthly or Annual | 0.5% – 1% of loan amount | Typically cancelled when equity reaches 20% |

| Mortgage Insurance Premium (MIP) | Upfront or Annual | Varies by loan program | Varies by loan program; may be required for the life of the loan |

| Flood Insurance | Annual | Varies by location and coverage | Can be cancelled if property is no longer in a flood zone (requires re-evaluation) |

| Hazard Insurance (Homeowner’s Insurance) | Annual | Varies by location, coverage, and property value | Generally not cancelled unless coverage is no longer needed (e.g., property is sold) |

Ultimate Conclusion: Mhdc Loan Requirements

Securing an MHDC loan requires careful preparation and a thorough understanding of the requirements. By meticulously addressing each aspect—from meeting eligibility criteria and gathering necessary documentation to navigating the application process and understanding insurance implications—you significantly increase your chances of approval. Remember, proactive planning and attention to detail are crucial for a smooth and successful home-buying journey. This guide provides the foundation; now it’s time to put your knowledge into action.

Popular Questions

What happens if my application is rejected?

MHDC will typically provide a reason for rejection. Common causes include insufficient income, poor credit score, or failing to meet property requirements. Review the feedback and address any shortcomings before reapplying.

Can I use a co-signer for an MHDC loan?

The possibility of using a co-signer depends on the specific MHDC loan program. It’s best to check the program guidelines or contact MHDC directly to confirm.

What if my property needs repairs before I can qualify?

Some MHDC programs may offer assistance with repairs, but this varies. You may need to secure financing separately for necessary repairs before applying for an MHDC loan. Check the program’s specific guidelines for details.

How long does the MHDC loan application process typically take?

The timeframe varies, but generally expect several weeks to a few months, depending on factors like the complexity of your application and the availability of necessary documentation. Prompt submission of all required documents can help expedite the process.