Mogo loan presents a compelling financial landscape, offering a unique blend of lending solutions. This guide delves into the intricacies of Mogo’s loan products, application processes, interest rates, repayment options, and customer experiences. We’ll also explore the financial implications, compare Mogo to its competitors, and examine the legal and regulatory aspects of using their services. Understanding these facets will empower you to make informed decisions about whether a Mogo loan is the right choice for your financial needs.

From its origins and key milestones to its current market position and customer demographics, we provide a detailed overview of Mogo’s operations. We analyze the various loan types offered, comparing them side-by-side with competing services to highlight key differences in terms, fees, and eligibility criteria. The application process, including required documentation and processing times, is thoroughly explained, along with a step-by-step guide to simplify the procedure.

Mogo Loan

Mogo is a Canadian fintech company offering a range of financial products and services, with a particular focus on providing alternative lending solutions. Their primary offering revolves around personal loans, but they also provide other financial tools aimed at improving their customers’ financial well-being. This overview will detail Mogo’s loan products, target market, history, and a comparison to competitor offerings.

Mogo Loan Products and Services

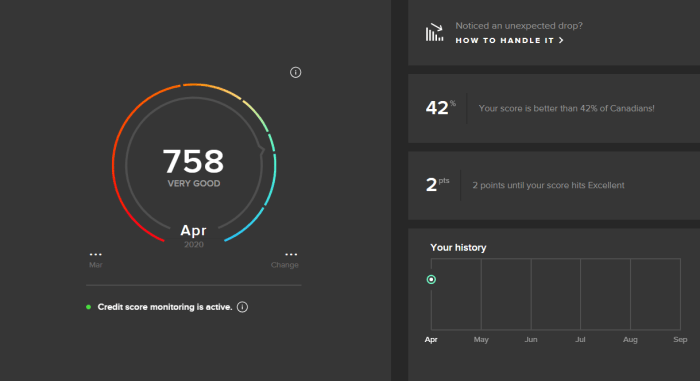

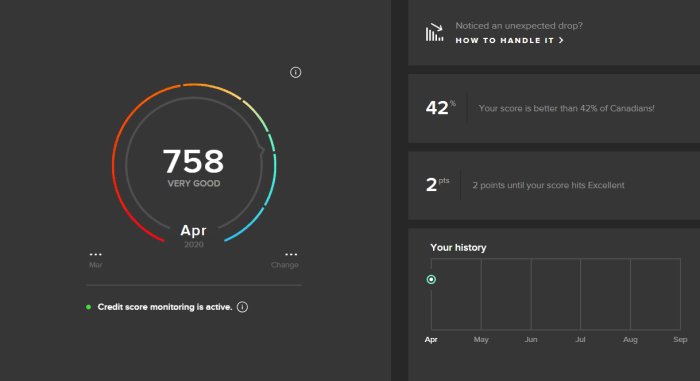

Mogo’s core offering is its personal loan product. These loans are designed to be accessible to individuals who may not qualify for traditional bank loans, offering a flexible and relatively quick application process. Loan amounts vary depending on individual creditworthiness and risk assessment. Beyond personal loans, Mogo also offers other services such as credit score monitoring, identity theft protection, and a rewards program tied to responsible financial behavior. These additional services are often bundled with their loan products or offered as standalone subscriptions, aiming to create a comprehensive financial management ecosystem for their users.

Mogo’s Target Market and Customer Demographics

Mogo primarily targets individuals with less-than-perfect credit scores or those who find it difficult to access traditional banking services. Their customer base typically includes young adults, those with limited credit history, and individuals who may have experienced past financial difficulties. This demographic often faces challenges obtaining loans from traditional lenders due to stricter credit requirements. Mogo positions itself as a more inclusive and accessible lender, catering to a segment of the population underserved by traditional financial institutions.

Mogo’s History, Founding, and Key Milestones

Founded in 2003, Mogo initially focused on providing prepaid Visa cards. Over time, they expanded their product offerings, entering the lending space with the introduction of their personal loan product. Key milestones include securing significant funding rounds, expanding their operations across Canada, and launching their various financial wellness tools. The company’s evolution demonstrates a strategic shift towards becoming a more comprehensive financial technology provider rather than solely a lender.

Comparison of Mogo Loans to Competitor Offerings

The following table compares Mogo’s personal loans to offerings from some of its key competitors. Note that interest rates and loan amounts can vary based on individual circumstances and creditworthiness. The data presented here represents a general overview and should not be considered financial advice.

| Lender | Loan Amount | Interest Rate (APR) | Repayment Terms |

|---|---|---|---|

| Mogo | $200 – $35,000 (Variable) | Variable, dependent on credit score | 3-60 months |

| LoanConnect | $1,000 – $50,000 | Variable, dependent on credit score | 6-60 months |

| Fresh Start Finance | $500 – $15,000 | Variable, dependent on credit score | 12-48 months |

| FundsCanada | $500 – $35,000 | Variable, dependent on credit score | 6-60 months |

Mogo Loan

Mogo offers a variety of loan products designed to help individuals manage their finances. Understanding the application process is crucial for a smooth and efficient experience. This section details the steps involved, required documentation, eligibility criteria, and typical processing times for a Mogo loan application.

Application Process Steps

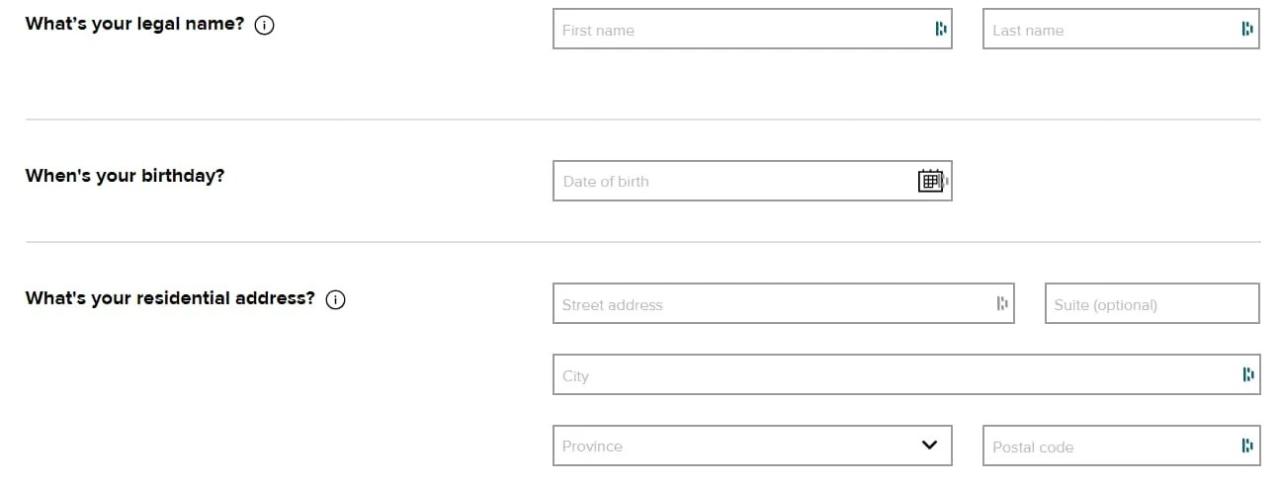

Applying for a Mogo loan is generally a straightforward online process. The specific steps may vary slightly depending on the type of loan, but the overall procedure remains consistent. Careful attention to detail during each step ensures a quicker application review.

- Visit the Mogo Website: Begin by navigating to the official Mogo website and locating the loan application section. This usually involves clicking on a prominent button or link related to loans or financing.

- Choose a Loan Product: Select the loan type that best suits your financial needs. Mogo typically offers various loan options with differing terms and interest rates. Carefully compare these options to make an informed decision.

- Complete the Application Form: Fill out the online application form accurately and completely. This typically involves providing personal information, employment details, and financial information. Ensure all data entered is correct to avoid delays.

- Upload Required Documents: Upload the necessary supporting documentation as requested. This often includes proof of income (pay stubs, tax returns), identification (driver’s license, passport), and potentially bank statements. Using clear, legible documents speeds up the verification process.

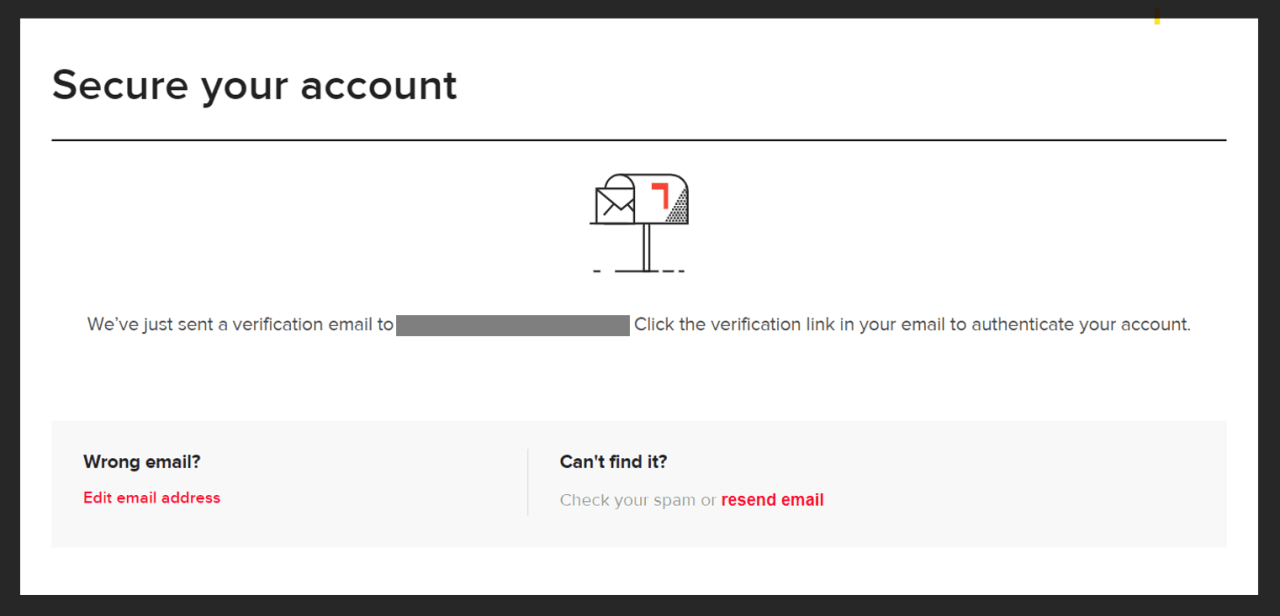

- Submit the Application: Once you’ve reviewed all the information and uploaded the necessary documents, submit your application. You will usually receive an immediate acknowledgement of receipt.

- Review and Approval: Mogo will review your application. This typically involves verifying the information you provided. The approval process time varies but is generally relatively quick.

- Loan Disbursement: If approved, the loan funds will be disbursed according to the agreed-upon terms. This might involve a direct deposit into your bank account.

Required Documentation and Eligibility Criteria

The specific documentation required and eligibility criteria may differ based on the loan type and applicant’s circumstances. However, generally, applicants should expect to provide evidence of their identity, income, and creditworthiness. Meeting the eligibility requirements significantly increases the chances of loan approval.

- Proof of Identity: A valid government-issued ID such as a driver’s license or passport is typically required.

- Proof of Income: Documentation demonstrating consistent income, such as pay stubs, bank statements, or tax returns, is usually necessary.

- Credit Report: Mogo will likely review your credit report to assess your creditworthiness. A good credit score generally improves your chances of approval.

- Bank Statements: Bank statements may be required to verify your financial stability and ability to repay the loan.

Typical Processing Time

The time it takes to process a Mogo loan application varies depending on several factors, including the completeness of the application, the verification of documents, and the applicant’s credit history. While Mogo aims for quick processing, applicants should expect a timeframe ranging from a few days to a couple of weeks. Providing complete and accurate information from the outset helps expedite the process. For example, an application with all required documents submitted correctly might be processed within a week, while an incomplete application could take significantly longer.

Mogo Loan

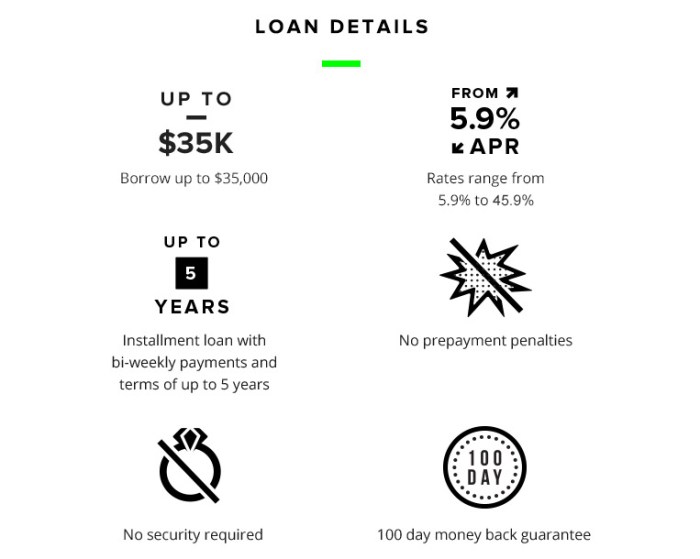

Mogo offers various loan products designed to help individuals manage their financial needs. Understanding the interest rates and fees associated with these loans is crucial for making informed borrowing decisions. This section details Mogo’s loan calculation methods and associated costs.

Mogo Loan Interest Rate Calculation

Mogo’s interest rates are not publicly fixed and vary based on several factors. These factors include the borrower’s creditworthiness, the loan amount requested, the loan term, and prevailing market conditions. Mogo utilizes a proprietary algorithm that assesses these factors to determine an individual’s interest rate. This means that two borrowers requesting the same loan amount may receive different interest rates depending on their individual credit profiles. The algorithm considers factors like credit score, debt-to-income ratio, and repayment history. The higher the perceived risk to Mogo, the higher the interest rate offered.

Mogo Loan Examples: Interest Rates and Loan Amounts

The following table provides illustrative examples of potential interest rates for different loan amounts. It is important to note that these are examples only and your actual interest rate may differ. Always check the specific terms offered to you by Mogo before accepting a loan.

| Loan Amount | Interest Rate (APR) | Loan Term (Months) | Estimated Monthly Payment |

|---|---|---|---|

| $1,000 | 15% – 25% | 12 | $90 – $150 (approx.) |

| $5,000 | 10% – 20% | 36 | $170 – $300 (approx.) |

| $10,000 | 8% – 18% | 60 | $200 – $400 (approx.) |

*Note: The APR (Annual Percentage Rate) reflects the total cost of borrowing, including interest and fees. The estimated monthly payments are approximate and do not include any potential fees.*

Mogo Loan Fees

Mogo may charge various fees associated with its loans. These fees can significantly impact the overall cost of borrowing. It’s crucial to understand these charges before proceeding with a loan application.

| Fee Type | Description | Amount |

|---|---|---|

| Origination Fee | A fee charged for processing your loan application. | Varies; Often a percentage of the loan amount. |

| Late Payment Fee | Charged if a payment is made after the due date. | Varies; Check your loan agreement for specifics. |

| Returned Payment Fee | Charged if a payment is returned due to insufficient funds. | Varies; Check your loan agreement for specifics. |

| Early Repayment Fee (Potential) | Some loan agreements may include a fee for paying off the loan early. | Varies; Check your loan agreement for specifics. May be zero in some cases. |

*Note: Always review your loan agreement carefully to understand the specific fees applicable to your loan.*

Mogo Loan

Mogo offers various loan products designed to meet diverse financial needs. Understanding the repayment options, potential consequences of missed payments, and the payment process is crucial for responsible borrowing and successful loan management. This section details the key aspects of Mogo loan repayment.

Mogo Loan Repayment Options

Mogo provides borrowers with flexible repayment options, tailored to individual circumstances and loan amounts. These options typically include regular scheduled payments, often monthly, spread across the loan term. The specific repayment schedule will be Artikeld in the loan agreement and will depend on factors such as the loan amount, interest rate, and the chosen repayment period. Borrowers should carefully review their loan agreement to understand their specific repayment terms.

Consequences of Late or Missed Payments

Late or missed loan payments can have several significant financial consequences. These include late payment fees, which can add considerably to the total loan cost. More severely, consistent late payments can negatively impact a borrower’s credit score, making it harder to secure future loans or credit at favorable rates. In some cases, repeated defaults may lead to debt collection actions, potentially impacting a borrower’s financial standing and even leading to legal action. It’s crucial to prioritize timely payments to avoid these repercussions.

Mogo Loan Payment Process

Mogo typically offers several convenient methods for making loan payments. These often include online payments through the Mogo platform, automated payments linked to a bank account, and potentially payments via mail. The specific payment methods available will be detailed in the loan agreement. Borrowers are encouraged to utilize the preferred method to ensure timely and accurate payments. Contacting Mogo customer service can clarify any questions regarding the payment process or preferred methods.

Repayment Scenarios and Impact on Total Loan Cost

Understanding different repayment scenarios and their impact on the total loan cost is vital for financial planning. Consider these examples:

- Scenario 1: On-Time Payments: Making all payments on time as scheduled results in the lowest total loan cost, as only the agreed-upon interest is accrued. This minimizes financial strain and maintains a positive credit history.

- Scenario 2: One Missed Payment: Missing a single payment can incur late fees, increasing the total loan cost. This also negatively impacts the credit score, albeit minimally compared to repeated defaults.

- Scenario 3: Multiple Missed Payments: Repeated missed payments significantly increase the total loan cost due to accumulating late fees and potential penalties. This severely damages the credit score and can lead to debt collection efforts.

The total loan cost is directly influenced by the adherence to the repayment schedule. Consistent on-time payments are crucial for minimizing the overall financial burden.

Mogo Loan

Mogo offers a range of financial products, including personal loans. Understanding customer experiences is crucial for assessing the platform’s overall effectiveness and reliability. This section summarizes customer reviews and feedback from various sources to provide a comprehensive overview of the Mogo loan experience.

Customer Reviews and Experiences with Mogo Loans

Customer reviews of Mogo loans are mixed, reflecting the diverse experiences of borrowers. Positive feedback frequently highlights the speed and ease of the application process, with many users praising the quick approval times and efficient disbursement of funds. The availability of online tools and resources for managing the loan is also often cited as a positive aspect. Conversely, negative reviews often center on high interest rates compared to other lenders and concerns about the transparency of fees. Some users also report difficulties in contacting customer support. These experiences are consistent across multiple review platforms, including Trustpilot, Google Reviews, and the Better Business Bureau.

Positive and Negative Aspects of Mogo Loans Based on Customer Feedback

Positive aspects frequently mentioned include the streamlined application process, rapid approval times, and convenient online account management. Borrowers appreciate the ease of accessing funds and the generally user-friendly platform. Negative feedback often focuses on the comparatively high interest rates, which can make the loan more expensive in the long run. The lack of flexibility in repayment options and reported difficulties contacting customer support are also recurring complaints. Furthermore, some users express concerns about the clarity of the terms and conditions, suggesting potential areas for improvement in transparency.

Comparison of Mogo Loan Experiences with Other Lending Platforms

Comparing Mogo to other lending platforms reveals both similarities and differences. Like many online lenders, Mogo prioritizes a fast and convenient application process. However, unlike some competitors offering lower interest rates or more flexible repayment options, Mogo’s higher rates and potentially less flexible terms can be a significant drawback for certain borrowers. Platforms like LendingClub or Upstart, for example, are often praised for their competitive interest rates and broader range of loan options. However, these platforms may have a more rigorous application process, potentially leading to longer approval times. The choice between Mogo and other lenders ultimately depends on the individual borrower’s priorities and financial circumstances.

Summary of Key Themes from Customer Reviews

| Theme | Positive Aspects | Negative Aspects | Overall Impression |

|---|---|---|---|

| Application Process | Fast, easy, convenient online application | N/A | Generally positive |

| Interest Rates | N/A | High compared to competitors | Negative for many |

| Customer Support | N/A | Difficult to contact, slow response times | Negative |

| Transparency | User-friendly online account management | Lack of clarity regarding fees and terms | Mixed |

Mogo Loan

Mogo offers various loan products designed to meet diverse financial needs. However, understanding the financial implications and inherent risks is crucial before committing to a Mogo loan. Borrowing money, while offering immediate solutions, can have significant long-term consequences if not managed responsibly. This section explores the potential financial burdens and risks associated with Mogo loans.

Financial Implications of Mogo Loans

Taking out a Mogo loan involves several financial implications that borrowers must carefully consider. The most obvious is the repayment obligation, which includes both the principal loan amount and accumulated interest. High interest rates, a common feature of many short-term loans, can dramatically increase the total cost of borrowing. Furthermore, loan fees, such as origination fees or late payment penalties, can add to the overall expense. These additional costs can significantly impact a borrower’s budget, potentially leading to financial strain if not properly planned for. Failure to budget adequately for loan repayments can result in missed payments, negatively affecting credit scores and potentially triggering debt collection actions.

Risks Associated with Mogo Loans

Borrowing money inherently carries risks. High interest rates are a primary concern with Mogo loans, as they can quickly escalate the total amount owed. This is particularly true for short-term loans, where a higher interest rate is often charged to compensate for the perceived higher risk. Repeated borrowing to cover existing loan repayments, a cycle known as debt cycling, can trap borrowers in a continuous loop of debt, making it increasingly difficult to become financially stable. Accumulating multiple loans simultaneously can further exacerbate this problem, leading to overwhelming debt levels and potentially severe financial hardship.

Long-Term Financial Consequences of Loan Defaults

Defaulting on a Mogo loan can have severe long-term financial repercussions. Late or missed payments will negatively impact a borrower’s credit score, making it difficult to obtain future loans or credit cards at favorable interest rates. Creditors may pursue legal action to recover the outstanding debt, potentially leading to wage garnishment or the seizure of assets. The resulting damage to credit history can significantly impede financial progress for years to come, making it harder to secure mortgages, rent apartments, or even obtain employment in certain fields. For example, a default on a $5,000 loan with a high interest rate could result in thousands of dollars in additional charges and severely impact creditworthiness for seven years or more.

Impact of Different Repayment Plans on Total Loan Cost

Consider a hypothetical Mogo loan of $2,000 with a 20% annual interest rate. We can illustrate the impact of different repayment plans on the total cost.

Scenario 1: A short repayment plan of 6 months might involve higher monthly payments, approximately $360 per month. However, the total interest paid would be relatively lower, perhaps around $200.

Scenario 2: A longer repayment plan, say 12 months, would result in lower monthly payments of approximately $185. However, the total interest paid would be significantly higher, potentially reaching $400 due to the extended repayment period.

This simple example demonstrates that while longer repayment plans offer lower monthly payments, they ultimately increase the total cost of the loan due to accumulated interest. A visual representation would show two lines on a graph; one steep, representing the short repayment plan with high monthly payments but lower overall cost, and one shallower, representing the longer repayment plan with lower monthly payments but higher overall cost. The total cost would be clearly indicated at the end of each line. The graph would visually demonstrate the trade-off between monthly payment burden and total loan cost.

Mogo Loan Alternatives and Comparisons

Mogo offers a convenient platform for personal loans, but it’s crucial to explore alternative options to find the best fit for individual financial needs. This section compares Mogo loans with several alternatives, highlighting key features, advantages, and disadvantages to aid informed decision-making.

Alternative Loan Options

Several alternatives to Mogo loans exist, each catering to different financial situations and risk profiles. These include traditional bank loans, credit unions, online lenders, and peer-to-peer (P2P) lending platforms. Each option presents unique benefits and drawbacks regarding interest rates, fees, application processes, and eligibility requirements.

Mogo Loan vs. Alternative Loan Options: A Comparison

The following table compares Mogo loans with other common loan types. Note that specific interest rates and fees vary based on individual creditworthiness and loan terms. This table provides a general overview and should not be considered exhaustive.

| Loan Type | Interest Rates | Fees | Advantages | Disadvantages |

|---|---|---|---|---|

| Mogo Loan | Variable, typically higher than traditional bank loans | Origination fees may apply; potential for late payment penalties | Fast and convenient online application process; potential for flexible repayment options | Higher interest rates compared to some alternatives; potential for higher fees |

| Traditional Bank Loan | Generally lower than Mogo or online lenders | May include origination fees and other closing costs | Lower interest rates; potentially longer repayment terms; established reputation and security | Stricter eligibility requirements; longer application process; may require collateral |

| Credit Union Loan | Often competitive rates; member benefits | Fees vary depending on the credit union; may be lower than bank loans | Competitive interest rates; potential for better customer service; community focus | Membership requirements; limited availability depending on location |

| Online Lender Loan | Rates vary widely; can be higher or lower than traditional banks | Fees vary significantly; some may have prepayment penalties | Fast and convenient application process; potentially wider range of loan amounts | Higher interest rates in some cases; less personal service; potential for predatory lending practices (important to research lenders carefully) |

| Peer-to-Peer (P2P) Lending | Rates vary based on borrower creditworthiness; potentially competitive | Fees vary depending on the platform; may include origination fees | Potential for competitive rates; access to funding when traditional options are unavailable | Higher risk; less regulation than traditional lenders; potential for difficulty in resolving disputes |

Considerations for Choosing a Loan

Choosing the right loan depends on several factors, including credit score, loan amount needed, repayment terms, and the borrower’s comfort level with different lending platforms. Borrowers should carefully compare interest rates, fees, and terms before making a decision. It’s also advisable to check reviews and compare multiple lenders to secure the best possible loan offer. Understanding one’s financial situation and long-term repayment capabilities is crucial for responsible borrowing.

Mogo Loan

Mogo provides loan products and operates within a complex regulatory landscape. Understanding its legal and regulatory compliance is crucial for both the company and its borrowers. This section details Mogo’s adherence to relevant laws and its commitment to responsible lending practices.

Mogo’s Compliance with Lending Regulations

Mogo’s lending practices are subject to various federal and provincial laws and regulations, depending on the jurisdiction in which the loan is originated and the borrower resides. These regulations typically cover aspects such as interest rates, loan terms, collection practices, and responsible lending guidelines. Mogo must comply with all applicable consumer protection laws and regulations, including those related to advertising, disclosure, and fair lending. Failure to comply can result in significant penalties and reputational damage. Specific regulations vary by location and are subject to change. Borrowers should consult with legal professionals for specific legal advice related to their loan agreements.

Mogo’s Data Privacy and Security Policies

Mogo’s data privacy and security policies are designed to protect the personal and financial information of its borrowers. These policies align with relevant data protection laws, such as PIPEDA (Personal Information Protection and Electronic Documents Act) in Canada and other applicable international and regional legislation. Mogo implements various security measures to safeguard borrower data from unauthorized access, use, disclosure, alteration, or destruction. These measures may include encryption, firewalls, intrusion detection systems, and regular security audits. Mogo’s privacy policy Artikels how it collects, uses, and discloses personal information, and provides borrowers with mechanisms to access, correct, or delete their data.

Mogo’s Consumer Protection Measures

Mogo incorporates several consumer protection measures into its lending practices. These measures aim to ensure fair and transparent lending, protect borrowers from predatory lending practices, and provide avenues for dispute resolution. Examples of these measures might include clear and concise loan agreements, accessible customer service channels for addressing inquiries and complaints, and adherence to responsible lending guidelines to assess borrower affordability. Mogo may also offer financial literacy resources or tools to help borrowers manage their debt effectively. The specific consumer protection measures implemented by Mogo can vary depending on the loan product and the applicable jurisdiction.

Key Legal Considerations for Mogo Loan Borrowers

Understanding the legal aspects of your loan is crucial. The following points highlight key legal considerations for borrowers using Mogo loans:

- Review the Loan Agreement Carefully: Before signing any loan agreement, thoroughly review all terms and conditions, including interest rates, fees, repayment schedules, and any potential penalties for late payments.

- Understand Your Rights and Obligations: Familiarize yourself with your rights as a borrower under applicable consumer protection laws. Understand your obligations regarding repayment and the consequences of default.

- Maintain Accurate Records: Keep copies of all loan documents, payment confirmations, and communications with Mogo. This documentation is essential in case of any disputes.

- Address Concerns Promptly: If you have any concerns or disputes regarding your loan, contact Mogo’s customer service department immediately to attempt resolution. Consider seeking legal advice if necessary.

- Be Aware of Collection Practices: Understand Mogo’s debt collection practices and your rights if you fall behind on payments. Be aware of any potential legal consequences of default.

Closure

Navigating the world of personal loans requires careful consideration of various factors. This comprehensive exploration of Mogo loan has illuminated the key aspects to consider, from interest rates and fees to repayment options and potential risks. By understanding the intricacies of Mogo’s offerings, comparing them to alternatives, and being aware of the legal and regulatory framework, you can make an informed decision aligned with your financial goals. Remember to always assess your financial situation thoroughly before committing to any loan agreement.

Essential Questionnaire

What credit score is needed for a Mogo loan?

Mogo’s credit score requirements vary depending on the loan type and amount. Generally, a higher credit score improves your chances of approval and may result in more favorable terms.

Can I pre-qualify for a Mogo loan without impacting my credit score?

Mogo offers pre-qualification tools that typically perform a soft credit check, which doesn’t usually affect your credit score. However, a full credit check is conducted only after you formally apply for a loan.

What happens if I miss a Mogo loan payment?

Missing a payment will likely result in late fees and could negatively impact your credit score. Contact Mogo immediately if you anticipate difficulties making a payment to explore possible solutions.

How long does it take to receive funds after loan approval?

The timeframe for receiving funds varies, but Mogo typically aims for quick disbursement once the application is approved and all necessary documentation is received.