Motive loan number: a seemingly simple phrase, yet one that holds significant weight in the financial world. Understanding its nuances is crucial, whether you’re a financial professional navigating complex transactions, a researcher delving into data analysis, or simply a curious individual seeking to unravel the mysteries of financial terminology. This guide explores the multifaceted nature of “motive loan number,” examining its potential meanings, associated data, security implications, legal frameworks, and visual representations of its information flow. We’ll delve into practical applications and address potential pitfalls to ensure a comprehensive understanding.

From deciphering its various interpretations within different financial contexts to understanding the security protocols needed to protect sensitive data, this exploration aims to provide a clear and concise understanding of this often-overlooked yet critical element within the financial landscape. We’ll cover everything from the data points associated with a motive loan number to the legal ramifications of mishandling such information, offering a holistic perspective for professionals and enthusiasts alike.

Understanding “Motive Loan Number”

The term “motive loan number” isn’t a standard financial term. Its meaning depends entirely on the context in which it’s used. It likely represents a unique identifier associated with a loan, but the “motive” component suggests a focus on the reason or purpose behind the loan. This could be linked to internal tracking systems within a lending institution or a specific project or initiative. Without further context, precise interpretation is impossible.

The phrase’s ambiguity requires careful consideration of the surrounding information to understand its intended meaning. It’s crucial to analyze the source and the overall communication to deduce its correct interpretation. Misinterpreting this term could lead to confusion or errors in financial record-keeping or analysis.

Possible Interpretations of “Motive Loan Number”

The phrase “motive loan number” might be used in several ways. It could be a custom designation within a company’s internal loan management system, categorizing loans based on their intended use. For example, a company might use “motive loan number” to distinguish between loans for capital expenditures, research and development, or acquisitions. Alternatively, it could be a reference number linked to a specific loan application, where the “motive” part relates to the applicant’s stated purpose for needing the loan. In a regulatory context, it might be a code indicating the reason for a loan’s approval or denial.

Examples of Contexts Where “Motive Loan Number” Might Appear

This phrase might appear in internal company documents, such as loan application forms, internal memos, or financial reports. It could also be found in databases used to track loan applications and their progress. A specific example could be a spreadsheet where each row represents a loan, with a column labeled “Motive Loan Number” providing a unique identifier alongside other loan details like the amount, interest rate, and borrower information. Another example could be a report summarizing loans issued for specific purposes, using the “motive loan number” to group and analyze the data.

Scenarios Where a “Motive Loan Number” Could Be Relevant

Consider a scenario where a company is tracking the success of loans given to small businesses for expansion. Each loan could receive a unique “motive loan number” which allows for efficient analysis of the growth of businesses receiving this type of funding. The company could then use this data to inform future lending decisions. Another scenario might involve a bank using a “motive loan number” system to categorize loans based on risk profiles. Loans for high-risk ventures might receive a different “motive loan number” prefix compared to low-risk loans, facilitating internal risk management.

Implications of Using or Encountering This Term, Motive loan number

The use of a non-standard term like “motive loan number” carries several implications. It could lead to inconsistencies in data management and reporting if not properly defined and documented. It might also create difficulties in communication and collaboration between different departments or organizations. Finally, it could pose challenges for auditing and regulatory compliance if the meaning and usage of the term are not clearly established and consistently applied. Proper documentation and a clear definition are essential to avoid these potential issues.

Data Associated with “Motive Loan Number”

A Motive loan number, assuming it refers to a unique identifier within a lending platform or system called “Motive,” serves as a key to access a wealth of associated data points crucial for loan management, risk assessment, and financial reporting. Understanding this interconnected data is vital for both lenders and borrowers. This section details the common data points linked to a Motive loan number and their relationships within a broader financial context.

The Motive loan number acts as a central reference point, linking various pieces of information related to a specific loan. This interconnectedness allows for efficient tracking, analysis, and management of the loan lifecycle, from application to repayment.

Data Points Associated with a Motive Loan Number

The following table Artikels potential data points commonly associated with a Motive loan number. These data points are interconnected and provide a comprehensive view of the loan.

| Data Point | Description | Potential Source |

|---|---|---|

| Borrower Information | Name, address, contact details, Social Security Number (SSN) or equivalent, employment history, credit score. | Loan application, credit bureaus, identity verification services. |

| Loan Details | Loan amount, interest rate, loan term, repayment schedule, origination date, loan type (e.g., personal, business, auto). | Loan agreement, Motive’s internal database. |

| Financial History | Payment history (on-time, late, missed), outstanding balance, total interest paid, total amount repaid. | Motive’s internal database, borrower’s bank statements (with permission). |

| Collateral (if applicable) | Description of collateral (e.g., vehicle identification number (VIN), property address), appraisal value. | Loan agreement, appraisal reports. |

Hypothetical Database Schema

A relational database schema designed to manage data associated with Motive loan numbers might include the following tables and attributes. This schema exemplifies how the data points described above could be organized for efficient data management and retrieval.

Note: This is a simplified example, and a real-world schema would likely be more complex, incorporating additional tables and attributes to accommodate specific business requirements and regulatory compliance.

Table: Loans

motive_loan_number(INT, PRIMARY KEY): Unique identifier for each loan.borrower_id(INT, FOREIGN KEY referencing Borrowers table): Links to borrower information.loan_amount(DECIMAL): The total amount of the loan.interest_rate(DECIMAL): Annual interest rate.loan_term(INT): Loan duration in months.origination_date(DATE): Date the loan was issued.loan_type(VARCHAR): Type of loan (e.g., personal, business).

Table: Borrowers

borrower_id(INT, PRIMARY KEY): Unique identifier for each borrower.name(VARCHAR): Borrower’s full name.address(VARCHAR): Borrower’s address.ssn(VARCHAR): Social Security Number or equivalent.

Table: Payments

payment_id(INT, PRIMARY KEY): Unique identifier for each payment.motive_loan_number(INT, FOREIGN KEY referencing Loans table): Links to the corresponding loan.payment_date(DATE): Date of the payment.payment_amount(DECIMAL): Amount of the payment.

Security and Privacy Concerns: Motive Loan Number

The misuse of a Motive Loan Number (MLN) presents significant security and privacy risks, potentially leading to financial loss, identity theft, and reputational damage for both borrowers and lenders. The sensitive nature of the data associated with an MLN necessitates robust security measures to protect against unauthorized access, use, disclosure, disruption, modification, or destruction.

Protecting the confidentiality of information related to an MLN requires a multi-layered approach encompassing technological safeguards, robust data governance policies, and employee training. Failure to implement these measures can expose individuals and organizations to a range of vulnerabilities, from simple data breaches to sophisticated phishing attacks.

Potential Security Risks Associated with MLN Misuse

Unauthorized access to an MLN could enable malicious actors to gain access to sensitive personal and financial information linked to the loan application. This could facilitate identity theft, fraudulent loan applications, or even the manipulation of loan terms and conditions. For example, a compromised MLN could be used to access credit reports, change addresses associated with the loan, or even initiate unauthorized withdrawals. The potential for financial and reputational damage is considerable.

Methods for Protecting MLN Confidentiality

Protecting the confidentiality of MLN data requires a combination of technical and procedural controls. Encryption of data both in transit and at rest is paramount. Strong password policies and multi-factor authentication should be implemented to restrict access to systems containing MLN information. Regular security audits and penetration testing are crucial to identify and mitigate vulnerabilities. Data loss prevention (DLP) tools can monitor and prevent sensitive data from leaving the organization’s controlled environment. Furthermore, access control lists should be carefully managed, limiting access to MLN data to only authorized personnel on a need-to-know basis.

Best Practices for Handling Data Containing MLN Information

Effective handling of MLN data requires a comprehensive strategy. The following best practices should be implemented:

- Data Minimization: Collect only the minimum necessary MLN-related data.

- Access Control: Implement strict access control measures, granting access only to authorized personnel.

- Data Encryption: Encrypt all MLN data both in transit and at rest.

- Regular Security Audits: Conduct regular security audits and penetration testing to identify vulnerabilities.

- Employee Training: Provide regular training to employees on data security best practices and the importance of protecting MLN information.

- Incident Response Plan: Develop and regularly test an incident response plan to handle data breaches effectively.

- Data Disposal: Securely dispose of MLN data when it is no longer needed.

Comparison of Security Protocols Applicable to MLN Data

Various security protocols can be employed to protect MLN data. These include encryption algorithms like AES-256, access control mechanisms like role-based access control (RBAC), and network security measures like firewalls and intrusion detection systems. The choice of specific protocols depends on the sensitivity of the data, the regulatory environment, and the organization’s risk tolerance. For instance, a financial institution handling high-value loans might opt for more stringent security measures than a smaller lending organization. A comparison might involve evaluating the computational overhead of different encryption algorithms versus their security strength, or the trade-offs between granular access control and administrative complexity. The selection process should involve a thorough risk assessment to determine the optimal balance between security and usability.

Legal and Regulatory Aspects

The use and disclosure of “motive loan number” information are subject to a complex web of legal and regulatory requirements, varying significantly depending on jurisdiction and the specific context of data handling. Failure to comply with these regulations can lead to severe penalties, including substantial fines, legal action from affected individuals, and reputational damage. Understanding these legal frameworks is crucial for responsible data management.

The legal landscape surrounding financial data, particularly loan-related information, is heavily regulated to protect consumer privacy and prevent fraud. Key legislation often involves data protection laws, consumer credit laws, and regulations specific to the financial industry. These laws dictate how such data can be collected, stored, used, and disclosed, placing strict limitations on unauthorized access and dissemination.

Relevant Laws and Regulations

Numerous laws and regulations govern the handling of sensitive financial data like “motive loan numbers.” These often include, but are not limited to, the Fair Credit Reporting Act (FCRA) in the United States, the General Data Protection Regulation (GDPR) in the European Union, and various state and national privacy laws globally. Each jurisdiction has its own specific requirements concerning data security, consent, and the permitted purposes of data processing. For instance, the FCRA dictates how consumer credit information can be collected, used, and disclosed, while GDPR focuses on individual rights to access, correct, and delete personal data. Compliance requires a thorough understanding of the applicable laws in each relevant jurisdiction where data is processed or stored.

Potential Legal Consequences of Non-Compliance

Violating regulations pertaining to “motive loan number” information can result in a range of serious consequences. These can include substantial financial penalties, levied by regulatory bodies for breaches of data protection or consumer credit laws. Furthermore, individuals whose data has been mishandled may pursue legal action, potentially leading to significant legal costs and reputational harm for the responsible entity. In severe cases, criminal charges may be brought against individuals or organizations responsible for intentional or reckless violations. The severity of the consequences will depend on the nature and extent of the violation, as well as the jurisdiction involved.

Examples of Scenarios Leading to Legal Issues

Several scenarios could trigger legal issues related to “motive loan numbers.” For example, unauthorized access to a database containing this information, resulting in a data breach, would likely violate data protection laws and potentially lead to significant fines and legal action. Similarly, the unauthorized disclosure of “motive loan number” information to third parties without proper consent would constitute a violation of privacy rights and potentially breach contractual obligations. Another scenario could involve the use of this information for purposes beyond those explicitly consented to by the data subject, such as using it for targeted advertising without prior authorization. These scenarios highlight the critical importance of implementing robust data security measures and obtaining explicit consent before processing sensitive financial information.

Achieving Compliance with Relevant Laws

Compliance with relevant laws when handling “motive loan number” data requires a multi-faceted approach. This includes implementing strong data security measures to prevent unauthorized access and breaches, obtaining explicit consent from individuals before collecting and using their data, and ensuring data is only processed for specified, legitimate purposes. Regular audits and assessments are crucial to verify compliance with applicable regulations. Furthermore, establishing clear data retention policies and procedures for secure data disposal are essential. Maintaining accurate records of data processing activities and being able to demonstrate compliance to regulatory bodies are also vital aspects of a robust compliance program. Finally, engaging with legal professionals specializing in data privacy and consumer credit laws is highly recommended to ensure adherence to all applicable regulations.

Visual Representation of Data Flow

Understanding the flow of information associated with a motive loan number is crucial for transparency, security, and regulatory compliance. Visual representations help clarify complex data pathways and interactions. This section details various visual methods to depict the movement and relationships of data linked to a motive loan number.

Flowchart Illustrating Information Flow

A flowchart provides a clear, step-by-step visualization of the typical data flow involving a motive loan number. This visual representation helps understand the sequence of events and the different actors involved in the process.

- Loan Application: The process begins with a loan application submitted by the borrower, containing personal and financial information.

- Motive Loan Number Assignment: Upon successful application review, a unique motive loan number is generated and assigned to the application.

- Data Entry into System: The application details, including the motive loan number, are entered into the lender’s database system.

- Credit Check and Verification: The lender performs a credit check and verifies the borrower’s information using the motive loan number as a reference.

- Loan Approval/Rejection: Based on the credit check and verification, the loan application is either approved or rejected.

- Loan Disbursement: If approved, the loan amount is disbursed to the borrower, with the transaction recorded using the motive loan number.

- Repayment Tracking: The motive loan number is used to track loan repayments and manage the borrower’s account.

- Data Archiving: Once the loan is fully repaid or closed, the associated data, including the motive loan number, is archived for record-keeping and compliance purposes.

Hypothetical Scenario and Data Flow Diagram

Let’s consider a scenario where John applies for a loan. The data flow can be represented using a diagram with various shapes and arrows.

The diagram would consist of:

* Rectangles: Representing processes (e.g., “Loan Application Submitted,” “Credit Check,” “Loan Approved,” “Loan Disbursement”).

* Parallelograms: Representing input/output (e.g., “Loan Application,” “Credit Report,” “Loan Funds”).

* Diamonds: Representing decision points (e.g., “Loan Approved?”).

* Arrows: Indicating the direction of data flow.

The motive loan number would be a key identifier, shown throughout the diagram, following the application through each stage. For instance, an arrow from “Loan Application Submitted” would lead to “Motive Loan Number Assigned,” which in turn would connect to “Data Entry into System,” and so on. Each step would be clearly labeled, and the motive loan number would be visibly linked to the data at each stage.

Relationship Between Motive Loan Number and Other Data Elements

A visual representation, such as an Entity-Relationship Diagram (ERD), can illustrate the connections between a motive loan number and other key data elements. This diagram would show the motive loan number as a central entity, linked to other entities such as borrower information (name, address, contact details), loan details (amount, interest rate, repayment schedule), and transaction history (payment dates, amounts). The relationships would be represented by lines connecting the entities, with labels indicating the type of relationship (one-to-one, one-to-many, etc.). For instance, one motive loan number would be linked to one borrower, but one borrower could have multiple motive loan numbers (if they’ve taken multiple loans). Similarly, one motive loan number would be associated with numerous transaction records reflecting payments over the loan’s life.

Summary

In conclusion, the seemingly simple “motive loan number” reveals a complex web of interconnected financial data, security concerns, and legal considerations. Understanding its implications, from data protection best practices to legal compliance, is vital for anyone involved in financial transactions or data management. By navigating the intricacies Artikeld in this guide, individuals and organizations can ensure the responsible and secure handling of this crucial information, minimizing risks and maximizing efficiency.

Q&A

What is the purpose of a motive loan number?

The purpose depends on the context. It might serve as a unique identifier for a specific loan, tracking its origin and purpose, or it could be a code related to the reason for the loan request (e.g., business expansion, home improvement).

How is a motive loan number different from a loan account number?

A motive loan number might be a sub-identifier within a broader loan account number system, providing additional context or specificity about the loan’s intended use. A loan account number is typically the primary identifier for tracking the financial aspects of the loan.

Where can I find my motive loan number?

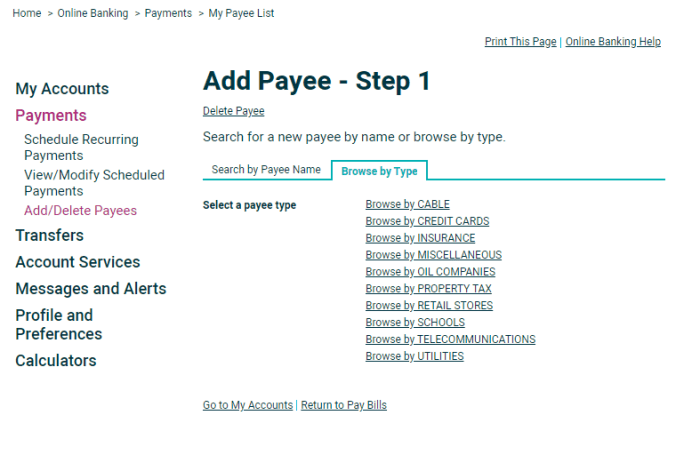

The location varies depending on the lender and the system they use. It might be found on loan documents, statements, or within online banking portals. Contacting your lender directly is the most reliable method.

What happens if my motive loan number is compromised?

Compromise could lead to identity theft, fraudulent activities, and potential financial losses. Report the incident immediately to your lender and relevant authorities.