Navigant Credit Union auto loan rates are a key factor for anyone considering financing a vehicle. Understanding these rates, along with the associated fees, loan terms, and repayment options, is crucial for making an informed financial decision. This guide delves into the specifics of Navigant’s auto loan offerings, comparing them to competitors and providing helpful examples to illustrate the potential costs and benefits.

We’ll explore the various types of auto loans available, eligibility requirements, and the application process. We’ll also examine factors influencing interest rates, such as credit score and loan term, and highlight any special offers or promotions Navigant might be running. By the end, you’ll have a comprehensive understanding of Navigant’s auto loan landscape and be better equipped to determine if it’s the right choice for your needs.

Navigant Credit Union Auto Loan Overview: Navigant Credit Union Auto Loan Rates

Navigant Credit Union offers a range of auto loan options designed to help members finance their vehicle purchases. Understanding the types of loans available, eligibility requirements, and the application process is crucial for a smooth and successful financing experience. This overview provides a comprehensive guide to Navigant’s auto loan services.

Types of Auto Loans Offered by Navigant Credit Union

Navigant Credit Union likely offers a variety of auto loan products to cater to different needs and financial situations. These may include new car loans, used car loans, and potentially loans for recreational vehicles (RVs) or motorcycles. Specific loan terms, interest rates, and available features will vary depending on the type of vehicle, the borrower’s creditworthiness, and the prevailing market conditions. It’s recommended to directly contact Navigant Credit Union or visit their website for the most up-to-date information on their current loan offerings.

Eligibility Criteria for a Navigant Auto Loan, Navigant credit union auto loan rates

Eligibility for a Navigant Credit Union auto loan typically involves meeting certain financial and credit requirements. These may include a minimum credit score, a stable income source, and a satisfactory debt-to-income ratio. Specific requirements can vary, and pre-qualification may be necessary to determine eligibility before formally applying. Factors such as employment history, length of residency, and the type of vehicle being financed will also influence the approval process.

The Application Process for a Navigant Auto Loan

Applying for a Navigant auto loan generally involves completing an application form, providing necessary documentation, and undergoing a credit check. The application form will require personal information, employment details, and information about the vehicle being financed. Supporting documents may include proof of income, residence, and identification. The credit check assesses the applicant’s creditworthiness to determine the loan’s terms and interest rate. Once the application is complete and reviewed, Navigant Credit Union will notify the applicant of their decision.

Checking Your Pre-Approval Status

To check your pre-approval status for a Navigant auto loan, you should first determine if Navigant offers a pre-approval option on their website or through their mobile app. If available, you would typically need to complete a simplified application providing basic information. The pre-approval process is designed to provide an estimate of your loan eligibility without a full credit check. After submitting your pre-approval application, you can typically check the status by logging into your online account or contacting Navigant Credit Union’s customer service department. Keep in mind that pre-approval is not a guarantee of loan approval, and the final approval depends on the complete application and supporting documentation.

Interest Rates and Fees

Navigant Credit Union offers competitive auto loan interest rates, but the precise rate you receive depends on several factors. Understanding these factors and comparing Navigant’s rates to those of other institutions is crucial for securing the best possible financing for your vehicle. This section will detail Navigant’s interest rate structure, associated fees, and provide illustrative examples to clarify the cost of borrowing.

Navigant’s auto loan interest rates are generally competitive with other credit unions, often falling within a similar range. However, direct comparisons are difficult due to variations in loan terms, applicant creditworthiness, and the specific type of vehicle being financed. Many credit unions advertise rate ranges rather than fixed rates, making a precise, blanket comparison challenging. Factors such as the prevailing interest rate environment and the credit union’s internal lending policies also contribute to rate fluctuations.

Factors Influencing Navigant Auto Loan Interest Rates

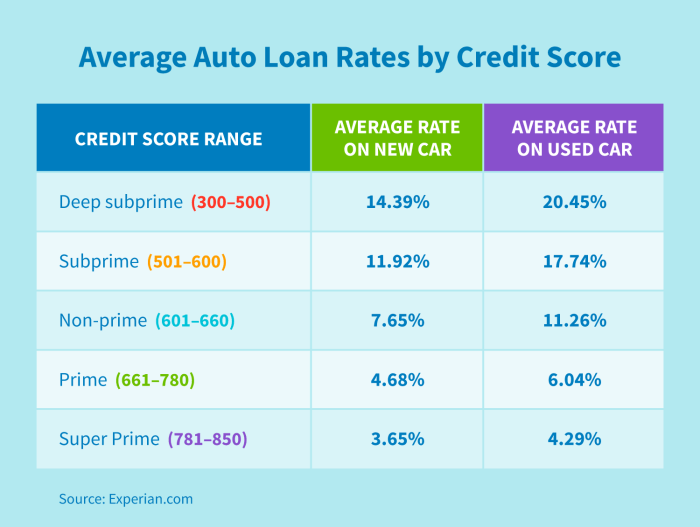

Several key factors determine the interest rate a borrower receives from Navigant. These include the applicant’s credit score, the loan-to-value ratio (LTV), the loan term, and the type of vehicle being financed. A higher credit score generally qualifies borrowers for lower interest rates, reflecting lower perceived risk for the lender. Similarly, a lower LTV (a smaller loan amount relative to the vehicle’s value) often results in a lower interest rate. Longer loan terms typically carry higher interest rates due to the increased risk for the lender over a longer period. Finally, the type of vehicle (new or used) can influence the rate, with new vehicles often commanding lower rates due to their perceived higher resale value.

Associated Fees

While Navigant strives for transparency, it’s essential to inquire about all associated fees during the loan application process. While origination fees are uncommon with Navigant, potential fees might include late payment fees, returned check fees, and potentially early payoff penalties (although these are less frequent). The specific fees and their amounts should be clearly Artikeld in the loan agreement. It is always advisable to carefully review the loan documents before signing to understand all costs involved.

Loan Scenarios and Examples

The following table illustrates three hypothetical auto loan scenarios with varying interest rates, loan amounts, and terms, demonstrating how these factors influence monthly payments. Remember, these are examples and your actual rate and monthly payment may differ based on your individual circumstances.

| Loan Amount | Interest Rate | Loan Term (Months) | Monthly Payment (Estimate) |

|---|---|---|---|

| $20,000 | 4.5% | 60 | $370 |

| $30,000 | 5.0% | 72 | $480 |

| $15,000 | 3.9% | 48 | $340 |

Loan Terms and Repayment Options

Navigant Credit Union offers a range of loan terms and repayment options to suit diverse financial situations and borrowing needs. Understanding these options is crucial for selecting a loan that aligns with your budget and long-term financial goals. Careful consideration of loan term length significantly impacts the total cost of borrowing.

Choosing the right loan term involves balancing affordability with the overall cost of the loan. Shorter terms lead to higher monthly payments but lower overall interest paid, while longer terms result in lower monthly payments but significantly higher interest costs over the life of the loan. Navigant’s flexible repayment options allow borrowers to customize their loan to their specific financial circumstances.

Available Loan Terms

Navigant typically offers auto loans with terms ranging from 36 months to 72 months. The specific terms available may vary depending on factors such as the borrower’s credit score, the vehicle’s age and condition, and the loan amount. A pre-approval process will clarify the available terms for a specific applicant. For example, a borrower with excellent credit might qualify for a 36-month loan at a lower interest rate, while a borrower with less-than-perfect credit might be offered a 60 or 72-month loan at a higher rate.

Repayment Options

Navigant’s repayment options typically include monthly installments automatically deducted from a borrower’s checking or savings account. Borrowers can usually make additional principal payments at any time without penalty, accelerating loan payoff and reducing total interest paid. Some borrowers may also explore options like bi-weekly payments to further shorten the loan term. Contacting Navigant directly is essential to confirm available options and any associated fees.

Implications of Loan Term Length

Choosing a shorter loan term (e.g., 36 months) means higher monthly payments but significantly lower total interest paid over the life of the loan. Conversely, a longer loan term (e.g., 72 months) results in lower monthly payments, but the total interest paid will be substantially higher. The following comparison illustrates this:

Consider a $20,000 auto loan with a 5% interest rate:

- 36-Month Loan: Higher monthly payment, but significantly lower total interest paid (approximately $1,800).

- 60-Month Loan: Lower monthly payment, but substantially higher total interest paid (approximately $3,500).

- 72-Month Loan: Lowest monthly payment, but the highest total interest paid (approximately $4,700).

These figures are illustrative and actual amounts will vary based on the specific interest rate, loan amount, and any applicable fees. It is crucial to perform individual calculations based on your specific loan offer.

Special Offers and Promotions

Navigant Credit Union frequently updates its auto loan offerings with special promotions designed to provide members with significant savings and benefits. These promotions can vary in terms of interest rates, loan terms, and eligibility criteria, so it’s crucial to check the official Navigant Credit Union website or contact a loan officer for the most up-to-date information. While specific offers are subject to change, we can Artikel the general types of promotions typically available.

Eligibility for these promotions often depends on factors such as credit score, loan amount, vehicle type, and membership status. Some promotions might target first-time buyers, while others may be geared towards members refinancing existing auto loans. Meeting specific criteria is essential to qualify for the reduced rates or other incentives.

Current Promotional Rates

Navigant Credit Union frequently offers reduced interest rates for a limited time. These reduced rates are typically applied to new auto loans and may be subject to specific vehicle types or loan amounts. For example, a past promotion might have offered a 2.99% APR for new car loans of $25,000 or less, for a 60-month term, to members with a credit score above 750. These promotional rates represent a significant savings compared to the standard interest rates. It is important to note that the specific APR, loan amount, and term will vary depending on the promotion and the borrower’s qualifications.

Incentives for Members

Participating in Navigant Credit Union’s auto loan promotions provides several key benefits to members. These benefits typically include lower monthly payments due to reduced interest rates, resulting in substantial long-term savings. Additionally, some promotions might offer other incentives such as waived loan origination fees or other closing costs. These added benefits can significantly reduce the overall cost of financing a vehicle.

Summary of Key Promotional Features

To summarize, here is a general overview of the features commonly found in Navigant Credit Union’s auto loan promotions. Note that these are examples and specific details vary by promotion.

- Reduced Interest Rates: Lower APRs compared to standard rates.

- Waived Fees: Potential elimination of loan origination fees or other closing costs.

- Limited-Time Offers: Promotions are typically available for a specific period.

- Eligibility Requirements: Specific credit score, loan amount, and membership criteria apply.

- Significant Savings: Potential for substantial savings on interest payments over the life of the loan.

Customer Experience and Reviews

Navigant Credit Union prioritizes a positive and transparent borrowing experience. We strive to make the auto loan process straightforward and efficient, from application to repayment. Positive customer feedback is crucial to our ongoing improvement and commitment to providing exceptional service.

Positive Customer Testimonial

“I recently secured an auto loan through Navigant Credit Union, and I couldn’t be happier with the entire experience. The online application was simple and intuitive, and I received a quick pre-approval. My loan officer, Sarah, was incredibly helpful and answered all my questions patiently. She explained the terms clearly and helped me choose the best loan option for my financial situation. The entire process, from application to funding, was remarkably smooth and efficient. I highly recommend Navigant Credit Union for anyone looking for a hassle-free auto loan experience.” – John S., satisfied borrower.

Customer Service Channels

Navigant Credit Union offers multiple channels for borrowers to access support and information. These include a dedicated customer service phone line staffed by knowledgeable representatives available during extended business hours, a secure online member portal providing 24/7 access to account information and loan details, and a comprehensive FAQ section on our website addressing frequently asked questions. Email support is also available for non-urgent inquiries.

Loan Modifications and Hardship Situations

Navigant Credit Union understands that unforeseen circumstances can impact a borrower’s ability to make timely payments. We offer a range of options for borrowers facing financial hardship, including loan modifications such as extending the loan term or temporarily reducing monthly payments. The process begins with contacting our dedicated loan assistance team who will work with the borrower to assess their situation and explore available solutions. Each case is evaluated individually, considering the borrower’s circumstances and financial capabilities. For example, a borrower experiencing temporary unemployment might be eligible for a short-term payment deferral, while a borrower facing a prolonged financial challenge may be offered a loan modification extending the repayment period. Documentation supporting the hardship claim is typically required.

Disputing Loan Statement Errors

If a borrower identifies any errors or inaccuracies on their loan statement, they should immediately contact Navigant Credit Union’s customer service department. A formal written dispute should be submitted, including a detailed explanation of the discrepancy and supporting documentation, if available. Navigant will investigate the matter thoroughly and provide a written response within a reasonable timeframe, typically within 10 business days. If the error is confirmed, Navigant will promptly correct the statement and provide the borrower with an amended version. The process is designed to ensure fairness and transparency, addressing any discrepancies effectively and efficiently.

Comparison with Competitors

Choosing the right auto loan requires careful consideration of rates, terms, and fees. This section compares Navigant Credit Union’s auto loan offerings with those of two major competitors in its operational area, highlighting key differences to aid your decision-making process. Note that specific rates and terms are subject to change and depend on individual creditworthiness and loan specifics. Always check the latest information directly with the lenders.

Direct comparison of financial institutions requires careful consideration of numerous factors beyond simple interest rates. Factors such as loan processing speed, customer service responsiveness, and the availability of additional financial products and services should be included in a holistic assessment. This analysis focuses on readily available public information and should not be considered exhaustive financial advice.

Competitor Analysis: Rates, Terms, and Fees

To provide a clear comparison, we will analyze Navigant Credit Union alongside two hypothetical competitors, “Apex Bank” and “Summit Lending.” The following table summarizes key features of their auto loan offerings. Please note that the data presented is for illustrative purposes only and should not be considered definitive. Actual rates and terms will vary based on applicant qualifications and prevailing market conditions.

| Feature | Navigant Credit Union | Apex Bank | Summit Lending |

|---|---|---|---|

| APR (Annual Percentage Rate) – Example for a 60-month loan | 6.5% (Example – Subject to change) | 7.0% (Example – Subject to change) | 6.8% (Example – Subject to change) |

| Loan Terms (Months) | 24, 36, 48, 60, 72 | 24, 36, 48, 60 | 36, 48, 60, 72, 84 |

| Loan Fees | Origination fee (Example: $100 – check for specifics), possible early repayment penalty | Origination fee (Example: $150 – check for specifics), possible early repayment penalty | No origination fee (Example), possible early repayment penalty |

| Additional Services | Online account access, mobile app, financial planning resources (Example) | Online account access, mobile app (Example) | Online account access, pre-approval options (Example) |

| Minimum Credit Score (Example) | 660 (Example – Subject to change) | 680 (Example – Subject to change) | 650 (Example – Subject to change) |

Illustrative Examples

Understanding the financial implications of an auto loan requires examining concrete examples. The following scenarios illustrate how loan amount, term length, interest rate, and credit score impact monthly payments and total loan cost. We will use hypothetical examples for clarity; your actual rates may vary.

Loan Payment Calculation

Let’s consider a $25,000 auto loan with a 60-month term and a 5% annual interest rate. Using a standard loan amortization formula, the monthly payment can be calculated. While the precise formula is complex, online calculators readily provide the result. In this case, the estimated monthly payment would be approximately $471. This figure represents the principal and interest payment. Additional fees, such as origination fees, may increase the total monthly payment.

Total Loan Cost Breakdown

Over the 60-month loan term, the total interest paid on the $25,000 loan at a 5% interest rate would be approximately $3,260. Adding this to the principal amount, the total cost of the loan comes to $28,260. This demonstrates that the total cost significantly exceeds the initial loan amount due to accumulated interest. It highlights the importance of considering the total cost when comparing loan options.

Credit Score Impact on Interest Rate

A borrower’s credit score significantly influences the interest rate offered. A higher credit score typically indicates lower risk to the lender, resulting in a lower interest rate. For instance, a borrower with an excellent credit score (750 or above) might qualify for a 5% interest rate, while a borrower with a fair credit score (650-699) might receive a higher rate, perhaps 7% or more. This difference in interest rates can substantially affect the total cost of the loan over its lifetime. A higher interest rate translates to larger monthly payments and significantly more interest paid over the loan term. For example, a $25,000 loan at 7% interest over 60 months would result in a higher monthly payment of approximately $494 and a total interest paid of approximately $4,640, increasing the total cost to $29,640.

Sample Amortization Schedule

The following text-based table illustrates a simplified amortization schedule for a $25,000 loan at 5% interest over 60 months. Note that actual schedules may vary slightly due to rounding.

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|—|—|—|—|—|—|

| 1 | $25,000.00 | $471.00 | $104.17 | $366.83 | $24,633.17 |

| 2 | $24,633.17 | $471.00 | $102.64 | $368.36 | $24,264.81 |

| 3 | $24,264.81 | $471.00 | $101.10 | $369.90 | $23,894.91 |

| … | … | … | … | … | … |

| 58 | $1,146.60 | $471.00 | $4.78 | $466.22 | $680.38 |

| 59 | $680.38 | $471.00 | $2.84 | $468.16 | $212.22 |

| 60 | $212.22 | $212.22 | $212.22 | $0.00 | $0.00 |

This table demonstrates how each monthly payment is allocated between interest and principal, with a larger portion of the payment going towards interest in the early months and a larger portion towards principal in later months. The final payment may differ slightly due to rounding.

Concluding Remarks

Securing an auto loan can feel daunting, but with a clear understanding of the available options and associated costs, the process becomes significantly more manageable. Navigant Credit Union offers a range of auto loan products, each with its own set of terms and conditions. By carefully considering factors like interest rates, loan terms, and repayment options, you can choose the loan that best aligns with your financial situation and long-term goals. Remember to compare offers from multiple lenders to ensure you’re getting the most competitive rate possible.

FAQ Corner

What is the minimum credit score required for a Navigant auto loan?

Navigant’s minimum credit score requirement varies depending on the loan type and applicant’s financial profile. It’s best to contact them directly to determine your eligibility.

Does Navigant offer pre-approval for auto loans?

Yes, Navigant typically offers pre-approval to give borrowers an estimate of their potential loan terms and interest rate before formally applying.

Can I refinance my existing auto loan with Navigant?

Possibly. Navigant’s refinancing options depend on several factors; contacting them directly is recommended to explore this possibility.

What happens if I miss a payment on my Navigant auto loan?

Missing a payment will likely result in late fees and can negatively impact your credit score. Contact Navigant immediately if you anticipate difficulty making a payment to discuss potential options.