Occu loan payment management is crucial for maintaining financial stability. Understanding the nuances of occupational loans, from various repayment schedules and interest rates to the impact on your credit score, is key to responsible borrowing. This guide explores different loan types, budgeting strategies, alternative payment options like refinancing and consolidation, and resources for those facing payment difficulties. We’ll also delve into the long-term financial implications of occupational loan debt and how to navigate potential challenges effectively.

This comprehensive overview will equip you with the knowledge and tools to make informed decisions about your occupational loan, ensuring you manage your payments effectively and protect your financial future. We’ll cover everything from creating a realistic budget that incorporates your loan payments to exploring strategies for minimizing interest and navigating potential difficulties with your lender.

Understanding Occupational Loan Payments: Occu Loan Payment

Occupational loans, designed to help professionals finance their education, training, or practice establishment, come with unique repayment structures and considerations. Understanding these aspects is crucial for effective financial planning and avoiding potential pitfalls. This section will delve into the key features of occupational loan payments, providing clarity on various loan types, repayment schedules, and influential factors.

Types of Occupational Loans

Occupational loans encompass a range of financial products tailored to specific professional needs. Common types include student loans for medical, dental, or law school; loans for continuing education courses relevant to a profession; and business loans for setting up a practice or clinic. Each type typically carries different eligibility criteria, interest rates, and repayment terms. For instance, a student loan for medical school might have a longer repayment period than a shorter-term loan for a professional development course. The specific terms will depend on the lender and the borrower’s creditworthiness.

Occupational Loan Repayment Schedules

Repayment schedules for occupational loans vary considerably depending on the loan type, lender, and loan amount. Some loans may offer graduated repayment plans, where payments start low and gradually increase over time, often aligning with anticipated income growth. Others may have fixed repayment schedules with consistent monthly payments throughout the loan term. Income-driven repayment plans, often available for student loans, adjust payments based on the borrower’s income and family size. A common repayment schedule might involve monthly payments over a period of 5 to 25 years, depending on the loan amount and interest rate. Longer repayment periods generally lead to higher total interest paid.

Factors Influencing Occupational Loan Payment Amounts

Several factors significantly influence the amount of monthly payments on an occupational loan. The principal loan amount is a primary determinant: larger loans naturally lead to higher payments. The interest rate is another crucial factor; higher interest rates result in greater overall costs and larger monthly payments. The loan term also plays a role; longer loan terms result in smaller monthly payments but lead to significantly higher total interest paid over the life of the loan. Finally, the repayment plan chosen, such as graduated or income-driven repayment, will also affect the monthly payment amount. For example, a $100,000 loan with a 5% interest rate over 10 years will have a much higher monthly payment than the same loan over 20 years, although the total interest paid will be considerably less over the shorter term.

Interest Rates on Occupational Loans

Interest rates on occupational loans vary widely depending on factors such as the borrower’s credit score, the type of loan, the lender, and the prevailing economic conditions. Student loans, particularly those backed by government programs, often have lower interest rates than unsecured business loans. A borrower with an excellent credit history will generally qualify for lower interest rates compared to someone with a poor credit history. For example, a government-backed student loan might carry an interest rate of 4-7%, while a private business loan for a new practice could range from 8-15% or even higher, depending on the risk assessment of the lender. It is crucial to compare rates from multiple lenders before committing to a loan.

Managing Occupational Loan Payments

Effective management of occupational loan payments is crucial for maintaining good financial health and avoiding potential negative consequences. This section Artikels practical strategies for budgeting, minimizing interest, and preventing payment issues. Understanding these strategies will empower you to navigate your occupational loan responsibly.

Sample Budget Incorporating Occupational Loan Payments

Creating a realistic budget is the cornerstone of successful loan repayment. A comprehensive budget should account for all income and expenses, ensuring sufficient funds are allocated for your occupational loan payment. Consider using budgeting apps or spreadsheets to track your finances effectively. Below is a sample budget illustrating how to incorporate an occupational loan payment:

| Income | Amount |

|---|---|

| Monthly Salary | $4,000 |

| Expenses | Amount |

| Housing | $1,200 |

| Utilities | $300 |

| Food | $500 |

| Transportation | $200 |

| Occupational Loan Payment | $500 |

| Other Expenses | $300 |

| Total Expenses | $3000 |

| Net Income (After Expenses) | $1000 |

This example demonstrates a scenario where a significant portion of the monthly income is allocated to the occupational loan payment. Adjusting the amounts based on your personal income and expenses is essential. Remember to always prioritize essential expenses before allocating funds to discretionary spending.

Strategies for Minimizing Occupational Loan Interest Payments

Minimizing interest payments can significantly reduce the overall cost of your loan. Several strategies can help achieve this goal.

- Make extra payments: Even small extra payments can reduce the principal balance quicker, leading to lower interest charges over the life of the loan.

- Refinance your loan: If interest rates have fallen since you took out the loan, refinancing could lower your monthly payments and overall interest paid.

- Pay off the loan early: Paying off the loan before the scheduled maturity date will eliminate future interest charges.

For example, if you consistently make extra payments of $100 per month on a $10,000 loan, you’ll significantly shorten the repayment period and reduce the total interest paid compared to only making the minimum payment.

Consequences of Missed or Late Occupational Loan Payments

Missed or late payments can have severe consequences. These include:

- Increased interest charges: Late payment fees and penalties can substantially increase the overall cost of borrowing.

- Damaged credit score: Late payments are reported to credit bureaus, negatively impacting your creditworthiness and making it harder to obtain future loans or credit.

- Loan default: Repeated missed payments can lead to loan default, resulting in the lender taking legal action to recover the debt. This can involve wage garnishment or legal proceedings.

- Collection agency involvement: The lender may sell the debt to a collection agency, which will aggressively pursue payment.

A single missed payment can have a ripple effect, impacting your financial standing for years to come. Consistent and timely payments are paramount.

Step-by-Step Guide for Setting Up Automatic Occupational Loan Payments

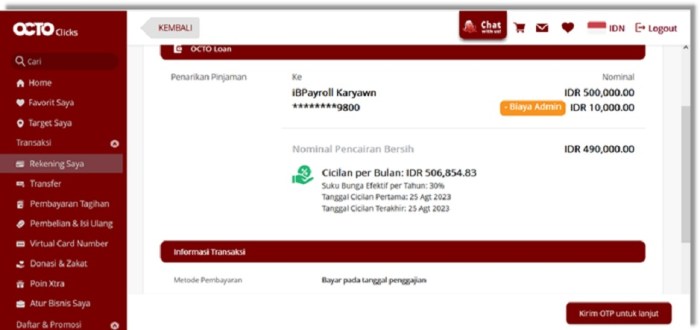

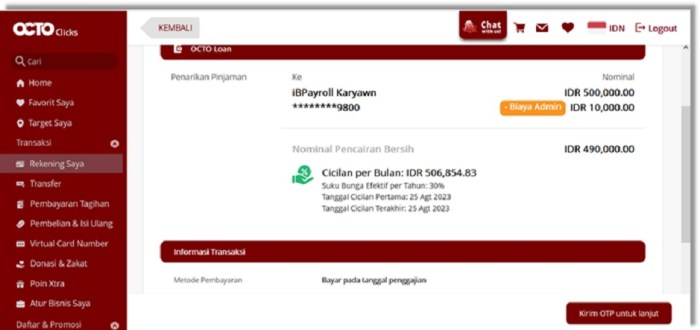

Automating your loan payments provides convenience and helps ensure timely payments, avoiding potential penalties.

- Contact your lender: Inquire about the options for setting up automatic payments. Most lenders offer online banking portals or allow you to schedule automatic deductions from your checking or savings account.

- Gather necessary information: You’ll need your loan account number, bank account details (account number and routing number), and potentially other identifying information.

- Enroll in automatic payments: Follow your lender’s instructions to enroll in the automatic payment program. This typically involves providing the required information through their online portal or by phone.

- Verify the setup: Confirm the automatic payments are set up correctly by reviewing your account statement or contacting your lender.

- Monitor your account: Regularly check your bank account and loan statement to ensure payments are being processed as scheduled.

Setting up automatic payments simplifies the loan repayment process and minimizes the risk of missed payments. Remember to maintain sufficient funds in your account to cover the scheduled payments.

Occupational Loan Payment Options

Choosing the right payment plan for your occupational loan is crucial for managing your finances effectively and avoiding potential financial strain. Several options exist, each with its own set of advantages and disadvantages. Understanding these options empowers you to make informed decisions that align with your individual circumstances and financial goals.

Refinancing Occupational Loans, Occu loan payment

Refinancing involves replacing your existing occupational loan with a new one, often at a more favorable interest rate or with more manageable terms. This can be beneficial if interest rates have fallen since you initially took out the loan, or if you need to extend the repayment period to lower your monthly payments. However, refinancing might involve additional fees and could potentially extend the overall repayment period, leading to a higher total interest paid over the life of the loan.

Consolidating Occupational Loans

Loan consolidation combines multiple occupational loans into a single loan with a new interest rate and repayment schedule. This simplifies repayment by reducing the number of monthly payments and potentially lowering the overall interest rate. However, consolidation might result in a longer repayment term, increasing the total interest paid. Furthermore, eligibility requirements for consolidation loans can be stringent.

Extended Repayment Plans

Some lenders offer extended repayment plans, allowing borrowers to stretch their loan repayment period over a longer timeframe. This results in lower monthly payments, making the loan more manageable in the short term. However, extending the repayment period generally increases the total interest paid over the loan’s lifetime. This option might be suitable for borrowers facing temporary financial hardship.

Table of Occupational Loan Payment Options

| Option Name | Interest Rate Impact | Payment Flexibility | Eligibility Requirements |

|---|---|---|---|

| Refinancing | Potentially lower, but may increase if new rate is higher | Can adjust term length, potentially lowering monthly payments | Good credit score, sufficient income, loan-to-value ratio |

| Consolidation | Potentially lower, depending on the new loan’s terms | Simplified payment schedule with a single monthly payment | Good credit score, multiple qualifying loans, sufficient income |

| Extended Repayment Plan | Higher total interest paid over the life of the loan | Lower monthly payments | Generally requires contacting the lender and demonstrating need |

Examples of Suitable Situations

Refinancing might be ideal for borrowers who secured their occupational loan at a high interest rate and now qualify for a lower one. Consolidation is a good choice for individuals juggling multiple occupational loans, seeking simplification and potentially a lower overall interest rate. An extended repayment plan can provide temporary relief for borrowers experiencing financial difficulties, allowing them to manage their payments more comfortably while potentially incurring higher overall interest costs. Careful consideration of the long-term implications of each option is vital before making a decision.

Resources for Occupational Loan Payment Assistance

Facing difficulty in managing occupational loan payments can be stressful, but various resources exist to help borrowers navigate these challenges. Understanding the options available and knowing how to effectively communicate with lenders is crucial for securing the necessary assistance. This section details the resources available to borrowers struggling with occupational loan repayments, focusing on government programs, non-profit organizations, and effective communication strategies.

Government Programs Offering Loan Payment Assistance

Several government programs may offer assistance to individuals experiencing financial hardship and struggling to meet their occupational loan obligations. These programs often provide financial aid, loan modification options, or counseling services. Eligibility criteria vary depending on the specific program and individual circumstances. It’s crucial to research the programs available in your region and carefully review the eligibility requirements. For example, some programs might target specific professions or income levels. Others may focus on individuals affected by natural disasters or unexpected job losses. Contacting your local government agencies or the relevant federal departments is the best way to determine which programs might be applicable to your situation.

Non-Profit Organizations Providing Loan Payment Assistance

Many non-profit organizations dedicate their resources to assisting individuals facing financial difficulties, including those struggling with occupational loan repayments. These organizations often provide financial counseling, debt management services, and advocacy support. Some may offer direct financial assistance, while others focus on connecting borrowers with appropriate resources and negotiating with lenders on their behalf. Researching local and national non-profit organizations specializing in consumer debt or financial literacy can uncover valuable support systems. These organizations frequently provide free or low-cost services, making them accessible to a wider range of borrowers. Their expertise in navigating complex financial situations can be invaluable in finding solutions.

Effective Communication with Lenders Regarding Payment Issues

Proactive and clear communication with your lender is essential when facing occupational loan payment difficulties. Before falling behind on payments, contact your lender to explain your situation and explore potential solutions. Document all communication, including dates, times, and the individuals you spoke with. Clearly Artikel your financial challenges and propose potential solutions, such as a temporary payment reduction, an extended repayment plan, or a loan modification. Be prepared to provide supporting documentation, such as proof of income reduction or medical expenses. Maintain a respectful and professional tone throughout your interactions, even if you are facing frustration. A collaborative approach often yields better results than a confrontational one. Remember to follow up on any agreements made in writing to ensure clarity and avoid future misunderstandings.

Questions to Ask When Seeking Assistance with Occupational Loan Payments

Before contacting a lender or assistance program, it’s helpful to have a clear understanding of your situation and what you need. Preparing a list of questions will help you efficiently gather the necessary information and make informed decisions.

- What programs or assistance options are available to me given my current financial situation?

- What documentation is required to apply for assistance?

- What are the eligibility criteria for each program or assistance option?

- What are the potential consequences of not making my loan payments?

- What repayment options are available if I qualify for assistance?

- What is the process for applying for assistance and how long does it take?

- What are the fees or interest rates associated with any assistance program?

- What are my rights as a borrower under applicable laws and regulations?

- What is the lender’s policy regarding late payments and default?

- What support services are available to help me manage my finances in the future?

The Impact of Occupational Loan Payments on Personal Finances

Occupational loan payments significantly influence personal finances, impacting both short-term budgeting and long-term financial health. Understanding these effects is crucial for responsible borrowing and effective financial planning. Failure to manage occupational loan debt can lead to serious financial difficulties.

Occupational Loan Payments and Credit Scores

Occupational loan payments directly affect credit scores. Consistent on-time payments contribute positively to a credit score, demonstrating responsible borrowing behavior to lenders. Conversely, missed or late payments negatively impact credit scores, potentially making it harder to secure future loans or credit at favorable interest rates. The severity of the negative impact depends on the frequency and extent of the delinquency. For example, consistently late payments can significantly lower a credit score, potentially leading to higher interest rates on future loans and even impacting insurance premiums. Conversely, maintaining a history of on-time payments can improve credit scores, potentially leading to lower interest rates and improved financial opportunities.

Long-Term Financial Implications of Occupational Loan Debt

Occupational loan debt, if not managed effectively, can have significant long-term financial implications. High interest rates can lead to substantial accumulation of interest over the loan term, increasing the total repayment amount considerably. This can restrict future financial goals such as saving for a down payment on a house, investing in retirement, or paying for children’s education. Furthermore, prolonged debt can lead to financial stress and potentially affect overall well-being. For example, a $10,000 occupational loan with a high interest rate might end up costing significantly more than the initial loan amount due to accumulated interest over several years. This could severely limit the borrower’s ability to save and invest in other crucial areas of their financial life.

Impact of Different Repayment Strategies on Long-Term Financial Well-being

Different repayment strategies impact long-term financial well-being differently. Choosing a shorter repayment term, while resulting in higher monthly payments, ultimately reduces the total interest paid over the life of the loan. This significantly improves long-term financial health by minimizing the overall cost of borrowing. Conversely, opting for a longer repayment term results in lower monthly payments, but the total interest paid increases significantly, potentially hindering long-term financial goals. For example, a borrower could compare the total cost of a loan repaid over 3 years versus 5 years, clearly demonstrating the substantial difference in total interest paid. Careful consideration of monthly affordability versus long-term cost savings is essential.

Visual Representation of Occupational Loan Payments and Overall Financial Health

A visual representation could be a pie chart. The chart would show the allocation of an individual’s monthly income. One segment represents occupational loan payments, another represents essential expenses (housing, food, transportation), and other segments represent savings, investments, and discretionary spending. A healthy financial picture would show a smaller segment for loan payments compared to other segments, indicating responsible debt management. Conversely, a large loan payment segment would indicate potential financial strain and the need for adjustments in spending habits or repayment strategies. The size of the loan payment segment would directly correlate with the overall size of the “financial health” segment. A larger “financial health” segment, encompassing savings, investments, and reduced debt, indicates a better overall financial condition.

Summary

Successfully navigating occupational loan payments requires proactive planning and a clear understanding of your financial obligations. By carefully considering the various loan types, repayment options, and available resources, you can effectively manage your debt and build a strong financial foundation. Remember, proactive communication with your lender and diligent budgeting are crucial for long-term financial well-being. Don’t hesitate to seek assistance if you encounter difficulties – resources are available to help you through challenging times.

FAQ

What happens if I miss an occu loan payment?

Missing a payment can result in late fees, negatively impact your credit score, and potentially lead to loan default. Contact your lender immediately if you anticipate difficulties.

Can I negotiate my occu loan payment terms?

Yes, contact your lender to discuss potential options such as modifying your payment plan or exploring alternative repayment arrangements. Be prepared to explain your circumstances.

Where can I find help with occu loan payment difficulties?

Numerous non-profit credit counseling agencies and government programs offer assistance. Your lender may also have internal hardship programs.

How do occu loan payments affect my credit score?

Consistent on-time payments improve your credit score, while missed or late payments significantly lower it. Your credit report will reflect your payment history.