OK Loans Rocky Mount NC – the term itself sparks curiosity. Does “OK” signify a specific lender, a type of loan, or simply a positive connotation? This guide unravels the meaning behind this search term, exploring the various loan options available in Rocky Mount, North Carolina. We’ll delve into finding reputable lenders, navigating the application process, understanding loan terms, and practicing responsible borrowing. We’ll also address the regulatory landscape and highlight resources for financial literacy, ensuring you’re well-equipped to make informed decisions about your financial future.

Understanding the nuances of local lending is crucial for securing the best possible loan terms. This involves not only researching different lenders and comparing their offers but also possessing a solid grasp of financial principles and the legal framework governing lending practices in North Carolina. This guide serves as your comprehensive resource to navigate this process effectively and confidently.

Understanding “OK Loans Rocky Mount NC”

The search term “OK Loans Rocky Mount NC” suggests a user is looking for loan services in Rocky Mount, North Carolina, and the inclusion of “OK” likely indicates a preference or familiarity with a specific lender or a perception of the loan terms as acceptable or satisfactory. The ambiguity of “OK” necessitates exploring various interpretations to fully understand the user’s intent.

The term’s implication is a search for quick and potentially convenient access to financing options within a specific geographical area. The user’s familiarity with the term “OK Loans” might stem from prior experience, local advertising, or word-of-mouth recommendations. The absence of a specific lender name implies a broader search, possibly indicating an exploratory phase in the loan application process.

Possible Interpretations of “OK”, Ok loans rocky mount nc

The word “OK” in this context can have several meanings. It might represent a lender’s name, a shorthand for a perceived positive experience (“OK” loans meaning loans deemed acceptable), or simply a general term reflecting the user’s acceptance of the loan’s terms and conditions. Understanding the nuances of this term requires consideration of the user’s search history and broader online behavior. For instance, “OK” might be associated with a specific local lender using this term in its branding, implying brand recognition and customer familiarity. Alternatively, the user might be using “OK” as a general descriptor of their preferred loan characteristics – quick approval, manageable interest rates, etc.

Types of Loans Offered in Rocky Mount, NC

Rocky Mount, NC, like many other cities, likely offers a diverse range of loan products catering to various financial needs. These could include:

- Payday Loans: Short-term, high-interest loans designed to be repaid on the borrower’s next payday. These are often used for emergency expenses.

- Personal Loans: Unsecured loans with variable interest rates and repayment terms, used for various purposes such as debt consolidation, home improvements, or medical expenses. Creditworthiness plays a significant role in approval and interest rates.

- Auto Loans: Loans specifically for purchasing vehicles, with the vehicle itself serving as collateral. Interest rates and terms vary depending on the vehicle’s value, the borrower’s credit history, and the loan amount.

- Mortgage Loans: Long-term loans used to finance the purchase of a home, with the property serving as collateral. These loans typically have lower interest rates than shorter-term loans but involve significant financial commitment.

- Small Business Loans: Loans specifically for starting or expanding a small business. These loans often require a detailed business plan and demonstration of financial viability.

The specific types of loans available and the terms offered will vary significantly between lenders. It’s crucial for potential borrowers to carefully compare offers from multiple lenders before committing to a loan.

Locating Loan Providers

Finding reliable loan providers in Rocky Mount, NC, requires a strategic approach. This involves utilizing various resources to identify potential lenders, diligently verifying their legitimacy, and comparing their offerings to secure the best terms for your financial needs. Failing to thoroughly investigate lenders can lead to unfavorable interest rates, hidden fees, and potentially predatory lending practices.

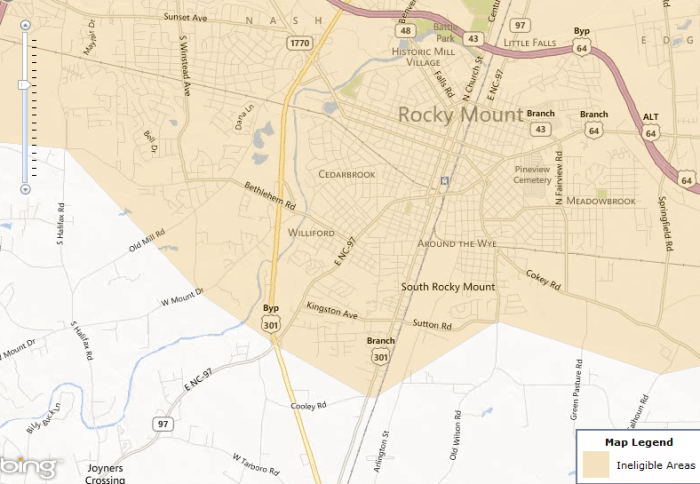

Several avenues exist for discovering loan providers in Rocky Mount, NC, using the search term “OK Loans Rocky Mount NC” or similar phrases. Online search engines like Google, Bing, and DuckDuckGo are primary resources. These searches should yield results including local lenders’ websites, online loan marketplaces, and potentially reviews and comparisons from financial websites. Additionally, checking local business directories and contacting the Rocky Mount Chamber of Commerce can provide valuable leads on local financial institutions offering loans. Word-of-mouth referrals from trusted sources within the community can also be a helpful way to identify reputable loan providers.

Verifying Loan Provider Legitimacy and Reputation

Verifying the legitimacy and reputation of any loan provider is crucial before engaging in any financial transactions. Several methods can be employed to assess a lender’s trustworthiness. First, check the Better Business Bureau (BBB) website for any complaints or ratings associated with the lender. A thorough review of online reviews on platforms like Google Reviews, Yelp, and Trustpilot can provide insights into customer experiences. It’s also advisable to confirm the lender’s licensing and registration with the relevant state authorities, ensuring they are operating legally. Furthermore, scrutinizing the lender’s website for transparency regarding fees, interest rates, and repayment terms is essential. Avoid lenders who are vague or evasive about these critical aspects of their services. Finally, consult with a financial advisor for an independent assessment of a lender’s reputation and the terms of any loan offer.

Comparing Loan Providers

Comparing various loan providers is essential to secure the most favorable terms. This involves analyzing interest rates, fees, and repayment terms. The following table provides a hypothetical comparison; actual rates and terms will vary depending on the lender and the borrower’s creditworthiness. Remember to always obtain multiple quotes before making a decision.

| Provider Name | Interest Rate | Fees | Repayment Terms |

|---|---|---|---|

| Example Lender A | 8% APR | $100 origination fee | 36 months |

| Example Lender B | 10% APR | $50 origination fee + 2% monthly | 24 months |

| Example Lender C | 9% APR | No origination fee | 48 months |

| Example Lender D | 7% APR | $75 origination fee + 1% monthly | 36 months |

Loan Application Process

Securing a loan from a lender in Rocky Mount, NC, involves a series of steps designed to assess your creditworthiness and determine your eligibility for the loan amount and terms you’re seeking. Understanding this process can streamline your application and increase your chances of approval. The process generally involves several key stages, from initial application to final loan disbursement.

The typical loan application process requires several key steps and the submission of specific documentation. Lenders use this information to evaluate your financial situation and determine your ability to repay the loan. Failing to provide complete and accurate information can delay or prevent loan approval.

Required Documentation for Loan Applications

Loan providers in Rocky Mount, NC, typically require various documents to verify your identity, income, and creditworthiness. The specific documents requested may vary depending on the type of loan and the lender’s policies, but common requirements include proof of identity, income verification, and credit history information. Providing these documents efficiently contributes to a smoother application process.

- Proof of Identity: This typically includes a government-issued photo ID, such as a driver’s license or passport.

- Proof of Income: Lenders will require documentation demonstrating your income and ability to repay the loan. This might include pay stubs, tax returns, bank statements, or proof of self-employment income.

- Credit Report: A credit report provides a history of your borrowing and repayment behavior. Lenders use this to assess your creditworthiness and determine the risk associated with lending you money. A good credit score significantly improves your chances of loan approval.

- Proof of Residence: Documentation such as a utility bill or lease agreement is often required to verify your address.

- Additional Documents: Depending on the loan type, additional documents might be needed. For example, a mortgage application might require proof of homeownership or appraisal documentation.

Sample Loan Application Form

The following is a sample loan application form using HTML form elements. Note that this is a simplified example and actual application forms may be more extensive and include additional fields. This example demonstrates the common elements found in many loan applications.

Loan Terms and Conditions

Understanding the terms and conditions of a loan is crucial for borrowers in Rocky Mount, NC, to make informed decisions and avoid unexpected financial burdens. These terms significantly impact the overall cost and repayment schedule of the loan. Failing to understand them can lead to difficulties in managing repayments and potentially negative credit consequences.

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) represents the total cost of borrowing, expressed as a yearly percentage. It includes the interest rate plus any other fees associated with the loan, such as origination fees or processing charges. A higher APR means a higher overall cost. For example, a $10,000 loan with a 10% APR will cost more over the loan’s lifetime than the same loan with a 5% APR. Borrowers should carefully compare APRs from different lenders to secure the most favorable terms.

Origination Fees

Origination fees are upfront charges lenders assess to cover the administrative costs of processing the loan application. These fees can vary significantly depending on the lender and the type of loan. For instance, a lender might charge a flat fee of $500, or a percentage of the loan amount, such as 1%. These fees are typically added to the principal loan amount, increasing the total amount borrowed.

Prepayment Penalties

Prepayment penalties are fees charged to borrowers who repay their loan in full before the scheduled maturity date. These penalties can deter borrowers from refinancing or paying off their loans early if they find a better opportunity. The penalty might be a percentage of the outstanding loan balance or a fixed amount, and it can significantly affect the overall cost savings of early repayment. For example, a 2% prepayment penalty on a $20,000 loan balance would result in a $400 penalty.

Loan Agreement Types

Different loan agreements come with varying terms and conditions. Common types include secured loans (backed by collateral, such as a car or house), unsecured loans (not backed by collateral), and installment loans (repaid in fixed monthly payments). Secured loans typically offer lower interest rates due to the reduced risk for the lender, while unsecured loans generally have higher interest rates. Installment loans provide a structured repayment plan, whereas other loan types might have more flexible repayment options. The specific terms, including APR, origination fees, and prepayment penalties, will differ depending on the loan type and lender.

Scenario: Impact of Loan Terms

Consider two borrowers, both seeking a $15,000 loan. Borrower A secures a loan with a 7% APR, a $200 origination fee, and no prepayment penalty. Borrower B gets a loan with a 12% APR, a $100 origination fee, and a 3% prepayment penalty. Over the life of the loan, Borrower A will pay significantly less in interest despite the higher origination fee. However, if Borrower B repays the loan early, the prepayment penalty will add substantially to their total cost, potentially negating any savings from a lower origination fee. This illustrates how different terms can drastically impact the overall cost and effectiveness of a loan.

Financial Literacy and Responsible Borrowing

Taking out a loan, whether for personal use or business purposes, is a significant financial decision. Understanding responsible borrowing practices is crucial to ensure you can manage repayments effectively and avoid falling into debt traps. This section will provide guidance on responsible borrowing and debt management, emphasizing the importance of credit scores and providing valuable resources for financial literacy.

Responsible borrowing involves careful planning and awareness of your financial capabilities. It’s not just about securing the loan; it’s about understanding the long-term implications of repayment. This includes considering the total cost of the loan, including interest and fees, and ensuring your monthly payments align with your budget. Failing to do so can lead to financial stress and potential default.

Understanding Credit Scores and Their Impact on Loan Approval

Your credit score is a numerical representation of your creditworthiness, based on your past borrowing and repayment history. Lenders use credit scores to assess the risk associated with lending you money. A higher credit score typically indicates a lower risk, leading to more favorable loan terms, such as lower interest rates and potentially higher loan amounts. Conversely, a lower credit score may result in higher interest rates, smaller loan amounts, or even loan rejection. Maintaining a good credit score is therefore vital for securing favorable loan terms. Factors contributing to your credit score include payment history (paying bills on time), amounts owed (keeping credit utilization low), length of credit history (having accounts open for a longer period), new credit (avoiding too many new credit applications), and credit mix (having a variety of credit accounts).

Resources for Financial Literacy and Consumer Protection

Access to reliable financial information is crucial for making informed borrowing decisions. Several resources are available to enhance financial literacy and protect consumers from predatory lending practices.

- The Consumer Financial Protection Bureau (CFPB): The CFPB is a U.S. government agency dedicated to protecting consumers in the financial marketplace. They offer educational resources, tools, and complaint assistance related to various financial products, including loans. Their website provides a wealth of information on topics like credit scores, debt management, and avoiding predatory lending.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides financial education and credit counseling services. They can help individuals create a budget, manage debt, and improve their credit scores. They offer both in-person and online counseling.

- MyFICO: MyFICO is a website that provides access to your FICO credit score and educational resources on credit management. Understanding your FICO score is essential for monitoring your creditworthiness and making informed financial decisions.

- Local Libraries and Community Colleges: Many libraries and community colleges offer free or low-cost workshops and resources on financial literacy, budgeting, and debt management.

Regulatory Environment for Lending in North Carolina

The lending landscape in North Carolina is governed by a complex interplay of state and federal regulations designed to protect consumers from predatory practices while fostering a healthy financial market. Understanding these regulations is crucial for both borrowers and lenders to ensure fair and transparent transactions. Failure to comply can result in significant penalties.

State and Federal Regulations Governing Lending in North Carolina

North Carolina’s lending practices are subject to both state and federal laws. At the federal level, the Truth in Lending Act (TILA), the Fair Credit Reporting Act (FCRA), and the Fair Debt Collection Practices Act (FDCPA) are paramount. TILA mandates clear disclosure of loan terms, including APR, fees, and payment schedules. The FCRA protects consumer credit information, while the FDCPA regulates debt collection methods. At the state level, the North Carolina Commissioner of Banks oversees the licensing and regulation of lenders, ensuring compliance with state laws regarding interest rates, fees, and other lending practices. Specific regulations vary depending on the type of loan (e.g., payday loans, installment loans, title loans). The North Carolina General Statutes contain detailed provisions regarding usury laws and licensing requirements for lenders operating within the state. These regulations aim to prevent exorbitant interest rates and deceptive practices.

Predatory Lending Practices and Associated Risks

Predatory lending involves unfair, deceptive, or abusive lending practices that exploit vulnerable borrowers. These practices can lead to a cycle of debt, financial hardship, and even foreclosure. Common predatory lending tactics include excessively high interest rates, undisclosed fees, balloon payments, and deceptive marketing. The risks associated with predatory lending are significant, potentially leading to substantial financial losses, damaged credit scores, and legal repercussions for borrowers. For example, a borrower might find themselves trapped in a high-interest loan with escalating fees, making repayment nearly impossible. This can result in the loss of assets, such as a home or vehicle, and long-term damage to their financial well-being.

Identifying Red Flags Indicating a Predatory Lender

Several red flags can signal a potentially predatory lender. These include lenders who pressure borrowers into quick decisions, offer loans with unclear terms and conditions, charge excessive fees, or use aggressive collection tactics. Unusually high interest rates compared to market averages, lack of transparency about fees and charges, and difficulty understanding the loan contract are all warning signs. Additionally, lenders who target vulnerable populations, such as the elderly or those with poor credit, may be engaging in predatory practices. For instance, a lender offering a loan with an APR significantly higher than those offered by reputable institutions should be viewed with caution. Similarly, a lender who demands immediate decisions or uses high-pressure sales tactics is likely operating unethically. Consumers should always thoroughly research lenders, compare loan offers, and seek independent financial advice before committing to any loan.

Visual Representation of Loan Information: Ok Loans Rocky Mount Nc

Visual representations are crucial for understanding the complexities of loan agreements. Graphs and charts can effectively communicate the relationship between key variables, allowing borrowers to make informed decisions. Clear visualizations simplify complex financial information, making it more accessible and understandable.

Loan Amount, Interest Rate, and Total Repayment Cost Relationship

A three-dimensional bar chart would effectively illustrate the relationship between loan amount, interest rate, and total repayment cost. The x-axis would represent the loan amount (e.g., in increments of $5,000), the y-axis would represent the interest rate (e.g., in percentage points), and the z-axis would represent the total repayment cost. Each bar’s height would visually depict the total repayment cost for a given loan amount and interest rate. This visualization allows for a direct comparison of different loan scenarios, showing how changes in loan amount and interest rate impact the overall cost. For example, a taller bar for a larger loan amount at a higher interest rate would immediately show the significantly higher total repayment cost compared to a smaller loan with a lower interest rate.

Comparison of Repayment Schedules for Different Loan Types

A line graph is ideal for comparing repayment schedules of various loan types. The x-axis would represent the time period (e.g., months or years), and the y-axis would represent the remaining loan balance. Multiple lines would be plotted, each representing a different loan type (e.g., a short-term loan with a higher monthly payment and a long-term loan with a lower monthly payment). The graph would clearly show how the remaining balance decreases over time for each loan type. The steepness of the line would indicate the repayment speed; a steeper line indicates faster repayment. For instance, a short-term loan’s line would decline more rapidly than a long-term loan’s line, visually demonstrating the faster repayment despite higher monthly payments. The graph could also include markers showing the total interest paid over the loan’s lifetime for each loan type, providing a clear visual comparison of the total cost.

Conclusion

Securing a loan in Rocky Mount, NC, requires careful planning and informed decision-making. By understanding the different loan types available, comparing lender offers, and adhering to responsible borrowing practices, you can navigate the process with confidence. Remember to always verify the legitimacy of lenders, read loan agreements thoroughly, and seek assistance from financial literacy resources if needed. Making informed choices empowers you to manage your finances effectively and achieve your financial goals.

Key Questions Answered

What credit score is needed for loan approval in Rocky Mount, NC?

Credit score requirements vary widely depending on the lender and loan type. Generally, higher credit scores improve your chances of approval and secure better interest rates.

What types of collateral might be required for a loan?

Collateral requirements depend on the loan type. Secured loans often require collateral like a car or property, while unsecured loans do not.

Where can I find free credit counseling in Rocky Mount, NC?

Contact your local credit union or search online for non-profit credit counseling agencies in your area. The National Foundation for Credit Counseling (NFCC) is a good resource.

What are the potential consequences of defaulting on a loan?

Consequences can include damage to your credit score, debt collection actions, and potential legal repercussions depending on the loan agreement.