Online loans like Spotloan offer a quick solution for urgent financial needs, but understanding the nuances is crucial. This guide delves into the world of short-term online lending, comparing Spotloan to its competitors, exploring the legal landscape, and ultimately empowering you to make informed borrowing decisions. We’ll examine interest rates, eligibility requirements, and the application process, equipping you with the knowledge to navigate this often complex financial terrain.

From comparing various lenders and their loan products to understanding the potential risks and benefits, we aim to provide a balanced perspective. We’ll also explore responsible borrowing practices and offer alternatives to online loans, ensuring you have a holistic understanding of your financial options.

Spotloan Alternatives

Spotloan offers short-term loans, but several alternatives exist, each with varying terms and eligibility requirements. Choosing the right lender depends on individual financial circumstances and needs. This comparison helps understand the differences between Spotloan and other online loan providers.

Spotloan and Competitor Comparison

Understanding the nuances of different online loan providers is crucial for making informed borrowing decisions. The following table compares Spotloan with three other online lenders, focusing on key aspects like interest rates, loan amounts, repayment terms, and fees. Note that interest rates and fees can vary based on individual creditworthiness and loan specifics. Always check the lender’s website for the most up-to-date information.

| Feature | Spotloan | OppLoans | Avant | LendingClub |

|---|---|---|---|---|

| Interest Rate (APR) | Varies, typically high (check website for current rates) | Varies, typically lower than Spotloan (check website for current rates) | Varies, potentially competitive (check website for current rates) | Varies widely depending on credit score (check website for current rates) |

| Loan Amount | Generally smaller loan amounts | Higher loan amounts available than Spotloan | Offers a wider range of loan amounts | Offers a wide range of loan amounts, from small to large |

| Repayment Terms | Relatively short repayment periods | Longer repayment terms often available | Flexible repayment terms available | Various repayment terms to choose from |

| Fees | May include origination fees and other charges (check website for details) | May include origination fees (check website for details) | May include origination fees (check website for details) | May include origination fees (check website for details) |

Eligibility Criteria for Online Loan Providers

Eligibility requirements for online loans vary significantly across lenders. Understanding these requirements before applying is essential to avoid wasted time and potential credit inquiries.

Spotloan, OppLoans, Avant, and LendingClub all have specific criteria regarding credit score, income, and employment history. These criteria are often used to assess the risk associated with lending to a particular applicant. Generally, higher credit scores and stable income lead to better loan terms and higher approval chances. However, each lender has its own internal scoring system and underwriting process. Specific requirements can be found on each lender’s website.

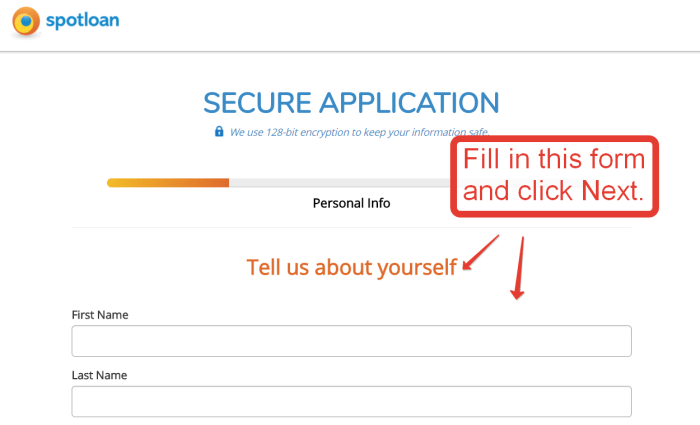

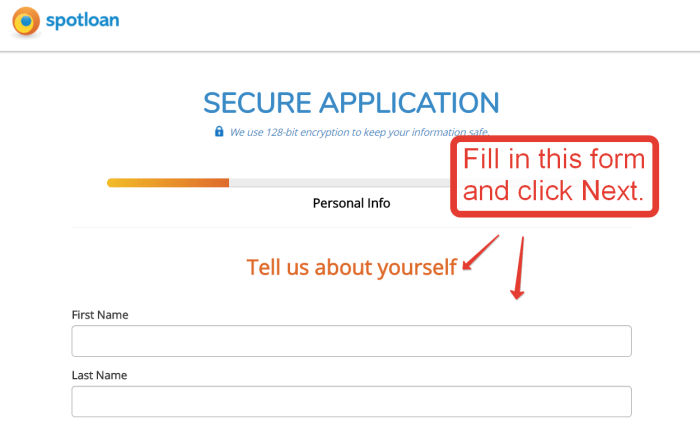

Application Process Comparison: Spotloan and OppLoans

The application processes for different online lenders vary in their complexity and user experience. This flowchart illustrates a simplified comparison between Spotloan and OppLoans.

A flowchart comparing Spotloan and OppLoans application processes would show a parallel comparison. Both would start with the initial application form, requiring basic personal and financial information. Spotloan’s process might involve a more rigorous verification process, possibly including multiple data checks and potentially longer processing times. OppLoans, on the other hand, might streamline this process through faster automated verification methods, resulting in quicker approval times. Both would lead to either loan approval, with a clear Artikel of terms, or rejection, with explanations or suggestions for improvement. The visual differences would highlight the speed and complexity variations between the two lenders.

Understanding Spotloan’s Loan Products

Spotloan offers short-term installment loans designed to bridge financial gaps until borrowers’ next payday. Unlike payday loans, which typically require repayment in a single lump sum, Spotloan provides a more manageable repayment schedule spread over several weeks or months. This installment structure is a key differentiator, aiming to reduce the risk of borrowers falling into a cycle of debt. However, it’s crucial to understand the specific terms and conditions before applying.

Spotloan primarily offers one type of loan: a short-term installment loan. This loan is characterized by its relatively small loan amount, typically ranging from a few hundred to a few thousand dollars, and a repayment period that stretches over several weeks or months, usually less than a year. The interest rates are significantly higher than those offered by traditional banks or credit unions, reflecting the higher risk associated with this type of lending. The application process is generally quick and online-based, with approval decisions often made within minutes.

Spotloan Loan Features and Benefits

Spotloan’s installment loans are structured to provide a more manageable repayment plan compared to traditional payday loans. The extended repayment period reduces the pressure on borrowers to repay the full amount within a short timeframe, potentially mitigating the risk of default. This structure, while helpful for some, doesn’t eliminate the potential for financial hardship if the borrower fails to manage their finances effectively. The online application process is convenient, offering accessibility for borrowers who may not have easy access to traditional banking services. However, the convenience should be weighed against the higher interest rates and potential for long-term financial implications.

Suitable and Unsuitable Scenarios for Spotloan

A Spotloan might be suitable for individuals facing unexpected expenses, such as a sudden medical bill or car repair, who need a short-term financial bridge until their next paycheck. For example, a person experiencing a minor car accident requiring immediate repair could utilize a Spotloan to cover the cost, repaying it over several weeks as their income allows. Conversely, Spotloan is not a suitable solution for long-term financial problems or large debts. Someone facing significant credit card debt or needing funds for a major purchase like a home appliance should explore alternative financing options, such as personal loans from banks or credit unions, which generally offer lower interest rates and longer repayment terms. Using a Spotloan to consolidate existing high-interest debt may also not be beneficial, as the high interest rates could exacerbate the debt problem.

Potential Risks and Drawbacks of Spotloan

The following points highlight potential risks and drawbacks associated with using Spotloan:

- High Interest Rates: Spotloan’s interest rates are significantly higher than those of traditional lenders. This can lead to a substantial increase in the total amount repaid compared to the initial loan amount.

- Debt Cycle Risk: If not managed carefully, the repayment schedule might still prove challenging, potentially leading to a cycle of borrowing to repay existing loans.

- Impact on Credit Score: While Spotloan may report payments to credit bureaus, missed payments can negatively impact credit scores, making it harder to obtain credit in the future.

- Fees and Charges: Beyond interest, there may be additional fees associated with the loan, increasing the overall cost.

- Limited Loan Amounts: The loan amounts are relatively small, potentially insufficient for significant financial emergencies.

The Legal and Regulatory Landscape of Online Lending

Online lending, while offering convenient access to credit, operates within a complex framework of state and federal laws designed to protect consumers from predatory practices. These regulations aim to ensure transparency, fair lending, and responsible borrowing. Understanding this legal landscape is crucial for both borrowers and lenders to navigate the online lending market safely and effectively.

The online lending industry is subject to a patchwork of federal and state laws. At the federal level, the Truth in Lending Act (TILA) mandates clear disclosure of loan terms, including APR, fees, and repayment schedules. The Consumer Financial Protection Bureau (CFPB) oversees compliance with TILA and other federal consumer financial protection laws, investigating complaints and enforcing regulations against unfair, deceptive, or abusive acts or practices. State laws vary considerably, with some states having stricter regulations than others concerning interest rates, fees, and licensing requirements for online lenders. This variation necessitates careful research by borrowers to understand the specific legal protections available in their state.

State and Federal Laws Governing Online Lending Practices

Federal laws, primarily enforced by the CFPB, establish minimum standards for transparency and consumer protection in lending. These include requirements for clear disclosure of loan terms, limitations on certain fees, and restrictions on abusive debt collection practices. However, states often impose additional regulations, setting interest rate caps, licensing requirements for lenders, and specific rules regarding loan advertising and marketing. For example, some states prohibit payday loans altogether, while others have strict limits on the amount that can be lent and the fees that can be charged. Borrowers should check their state’s attorney general website or consumer protection agency for specific regulations affecting online lenders operating within their jurisdiction. Failure to comply with these laws can result in significant penalties for lenders, including fines and legal action.

Identifying Predatory Lending Practices, Online loans like spotloan

Several red flags can signal predatory lending practices in online loan offers. Excessively high interest rates far exceeding market averages, hidden fees, and unclear loan terms are all significant warning signs. Aggressive sales tactics, pressure to borrow more than needed, and difficulty in understanding the loan agreement should raise concerns. Loans with prepayment penalties that discourage early repayment also indicate potentially predatory practices. Furthermore, lenders who require access to your bank account without clear explanation should be approached with extreme caution. Borrowers should always compare offers from multiple lenders and thoroughly review loan documents before signing any agreement.

Filing a Complaint Against an Online Lender

Consumers who believe they have been treated unfairly by an online lender can file complaints with several agencies. The CFPB is a primary resource for addressing complaints about unfair, deceptive, or abusive acts or practices. State attorneys general offices also handle complaints related to consumer finance, including online lending. Additionally, the Better Business Bureau (BBB) can help mediate disputes between consumers and businesses. When filing a complaint, it’s essential to document all interactions with the lender, including loan agreements, communication records, and payment history. Providing detailed information will assist regulatory agencies in investigating the complaint effectively and determining appropriate action. It’s also advisable to keep copies of all submitted documentation for your records.

Financial Literacy and Responsible Borrowing: Online Loans Like Spotloan

Taking out an online loan, like those offered by Spotloan or similar services, can provide quick access to funds, but it’s crucial to approach borrowing responsibly. Understanding your financial situation and the terms of the loan is paramount to avoiding potential financial hardship. This section will guide you through assessing your needs, budgeting effectively, and comparing loan offers to make informed decisions.

Assessing your financial needs and determining the suitability of an online loan involves a careful evaluation of your current financial standing and future projections. Before considering any loan, it’s essential to understand the full implications of borrowing, including interest rates, fees, and repayment schedules.

Assessing Financial Needs and Loan Suitability

Determining if an online loan is the right solution requires a thorough assessment of your current financial situation. This involves evaluating your income, expenses, existing debts, and the purpose of the loan. If the loan is for a non-essential purchase, careful consideration should be given to delaying the purchase or finding alternative funding sources. If the loan is for an emergency, explore all other options first, such as utilizing savings or seeking financial assistance from family or friends. Only after exhausting these alternatives should an online loan be considered. A realistic assessment of your ability to repay the loan on time is critical. Failing to repay can result in penalties, increased debt, and damage to your credit score.

Creating a Personal Budget and Tracking Expenses

Effective financial management begins with creating and adhering to a personal budget. This involves carefully tracking all income and expenses over a period of time, typically a month. This allows for identification of areas where spending can be reduced. A simple budgeting method involves listing all monthly income sources, then categorizing all expenses (housing, food, transportation, entertainment, etc.). Subtracting total expenses from total income reveals your monthly surplus or deficit. Tools like budgeting apps or spreadsheets can simplify this process. For example, a spreadsheet could include columns for date, category, description, and amount, allowing for easy tracking and analysis of spending habits. Regularly reviewing your budget allows for adjustments based on changes in income or expenses.

Comparing Interest Rates and Fees from Different Lenders

Before committing to a loan, it is vital to compare offers from multiple lenders. Interest rates and fees vary significantly, and choosing the most favorable terms can save you substantial money over the loan’s lifetime. The Annual Percentage Rate (APR) is a key indicator of the total cost of borrowing. The APR includes the interest rate and other fees, providing a comprehensive picture of the loan’s cost. Carefully examine the loan agreement for any hidden fees or penalties. Compare APRs from various lenders to identify the most competitive offer. For example, if Lender A offers a loan with a 10% APR and Lender B offers a similar loan with a 15% APR, Lender A is the more cost-effective option. Remember to factor in all fees when comparing loan offers, not just the interest rate. A lower interest rate with high fees might be more expensive than a slightly higher interest rate with lower fees.

Alternatives to Online Loans

High-interest online loans like Spotloan can trap borrowers in a cycle of debt. Fortunately, several alternatives offer more favorable terms and responsible financial practices. Exploring these options empowers consumers to make informed decisions and improve their long-term financial health. Understanding the advantages and disadvantages of each alternative is crucial for selecting the best solution for individual circumstances.

Several alternative financial solutions exist, providing viable options to high-interest online loans. These alternatives often prioritize responsible lending practices and aim to help borrowers build a stronger financial foundation.

Credit Unions

Credit unions are member-owned financial cooperatives offering a range of financial products, including loans. They often have lower interest rates and more flexible terms than payday lenders or online loan providers like Spotloan. Membership requirements vary depending on the credit union, but generally involve a connection to a specific employer, community group, or geographic area.

Credit unions typically offer a more personalized lending experience, prioritizing member needs over profit maximization. This often translates to more lenient eligibility requirements and a greater willingness to work with borrowers facing financial challenges. However, the loan amounts available might be smaller than those offered by some online lenders, and the application process can be slightly more involved.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer lending platforms connect borrowers directly with individual investors. These platforms offer an alternative to traditional banks and online lenders, often providing a more competitive interest rate environment. Borrowers submit loan applications, and investors review and fund the loans based on the borrower’s creditworthiness and the loan terms.

P2P lending can offer competitive interest rates, potentially lower than those found with Spotloan-type services. However, the approval process can be more stringent, requiring a strong credit history. Furthermore, the terms and conditions of P2P loans can vary significantly depending on the platform and the individual investor.

Budgeting Apps and Financial Counseling

Budgeting apps and financial counseling services don’t directly provide loans, but they can be invaluable tools for managing finances and avoiding the need for high-interest loans. These resources help individuals track expenses, create budgets, and develop strategies for debt management.

Budgeting apps and financial counseling provide a proactive approach to financial health. By improving financial literacy and responsible spending habits, individuals can reduce their reliance on high-cost loans. While these resources don’t provide immediate financial relief like a loan, they offer long-term solutions for achieving financial stability and avoiding debt traps.

Building Good Credit

Improving creditworthiness is crucial for accessing more favorable loan terms in the future. Several strategies contribute to building good credit, including consistently paying bills on time, maintaining low credit utilization, and diversifying credit accounts.

Consistent on-time payments are the most significant factor in credit scoring. Keeping credit utilization (the amount of credit used relative to the total available credit) low also improves credit scores. Diversifying credit accounts by using a mix of credit cards and loans demonstrates responsible credit management. Monitoring credit reports regularly and addressing any errors can also significantly improve credit scores over time. Consider using a secured credit card if you have limited or damaged credit history; responsible use can build your credit rating.

Summary

Securing a loan should be a well-informed decision. By understanding the intricacies of online lenders like Spotloan, comparing options, and prioritizing responsible borrowing, you can navigate the world of short-term financing with confidence. Remember to carefully weigh the pros and cons, explore alternatives, and always prioritize your long-term financial well-being. Making informed choices empowers you to manage your finances effectively and avoid potential pitfalls.

User Queries

What is the typical APR for online loans like Spotloan?

APR for online loans varies significantly depending on the lender, your credit score, and the loan terms. It’s often much higher than traditional loans. Always check the APR before committing.

Can I get an online loan with bad credit?

Some online lenders specialize in loans for borrowers with bad credit, but expect higher interest rates and stricter terms. Improving your credit score before applying can significantly improve your chances of securing a more favorable loan.

What happens if I miss a payment on an online loan?

Missing payments can result in late fees, increased interest charges, and damage to your credit score. Contact your lender immediately if you anticipate difficulty making a payment to explore possible solutions.

Are there hidden fees associated with online loans?

Carefully review the loan agreement for any hidden fees or charges. Legitimate lenders will clearly Artikel all fees upfront. Be wary of lenders who are unclear about their fee structure.