Online payday loans with Chime bank offer a fast way to access cash, but understanding the implications is crucial. This guide explores the compatibility of Chime with online payday lenders, outlining the application process, potential benefits, and significant risks involved. We’ll examine interest rates, fees, and repayment terms, comparing payday loans to alternative financial solutions. Ultimately, we aim to equip you with the knowledge to make informed decisions about your financial needs.

We’ll delve into the specifics of using Chime for payday loan transactions, highlighting both successful and unsuccessful scenarios. This includes exploring security measures employed by reputable lenders and addressing potential challenges. A detailed comparison of various lenders, including their fees and interest rates, will help you assess the financial implications before applying. We will also cover alternative borrowing options and crucial legal considerations.

Understanding Chime Bank and Payday Loans

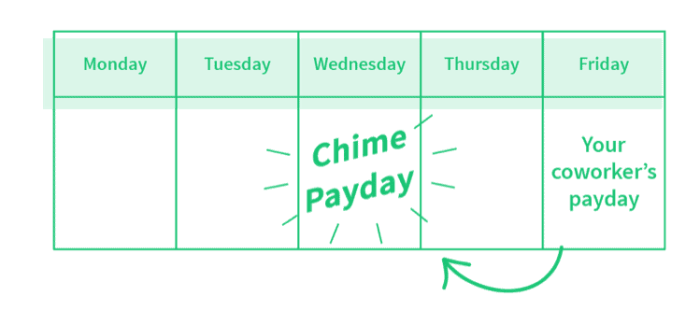

Chime is a financial technology company offering fee-free checking and savings accounts, known for its ease of use and accessibility. Understanding how Chime functions in relation to payday loans is crucial for individuals considering this borrowing option. Payday loans, on the other hand, are short-term, high-interest loans designed to be repaid on the borrower’s next payday. This guide will clarify the interplay between these two financial services.

Chime Bank Account Functionality

Chime accounts offer features relevant to receiving loan disbursements, primarily the ability to receive direct deposits. This means loan providers can directly transfer funds into a Chime account, offering a convenient and often faster method of receiving the loan amount compared to traditional bank transfers or paper checks. Chime also provides readily accessible mobile banking, allowing users to easily monitor their account balance and track loan repayments. The speed and convenience of Chime’s direct deposit system makes it an attractive option for borrowers seeking quick access to payday loan funds.

Characteristics of Online Payday Loans

Online payday loans typically involve high annual percentage rates (APRs), often exceeding 400%. Repayment terms are usually short, often due within two to four weeks. Fees, including origination fees and late payment penalties, can significantly increase the overall cost of the loan. Borrowers should carefully review all terms and conditions before accepting a payday loan to fully understand the financial implications. For example, a $500 payday loan with a 400% APR and a two-week repayment period could result in substantial fees and a total repayment amount significantly higher than the initial loan amount.

Comparison of Traditional and Online Payday Loan Providers

Traditional payday loan providers, often storefront locations, typically require in-person applications and may involve more stringent documentation requirements. Online platforms, conversely, streamline the application process, often requiring minimal paperwork and offering quick approval times. While both types of providers offer similar short-term, high-interest loans, online platforms often offer greater convenience and accessibility. However, borrowers should exercise caution and thoroughly research any online lender to ensure legitimacy and avoid scams. Transparency in fees and terms is crucial regardless of the provider’s format.

Online Payday Loan Application Process

The online payday loan application process generally involves several steps. First, the borrower will locate a lender and complete an online application, providing personal and financial information. Second, the lender will review the application and assess the borrower’s creditworthiness. Third, if approved, the lender will transfer the loan amount to the borrower’s designated bank account, often within one business day. Fourth, the borrower will be required to repay the loan according to the agreed-upon terms. Finally, failure to repay the loan on time can result in additional fees and potentially negative impacts on the borrower’s credit score. It is essential to carefully read and understand all loan terms before proceeding.

Compatibility of Chime Bank with Online Payday Loan Providers: Online Payday Loans With Chime Bank

Chime, a popular mobile-first banking platform, presents a unique dynamic when it comes to accessing payday loans. While Chime itself doesn’t offer payday loans, its compatibility with various online lenders varies. Understanding these nuances is crucial for borrowers considering this banking option. This section details the compatibility of Chime with online payday loan providers, potential challenges, and security considerations.

Online Payday Loan Providers Compatible with Chime

Determining which online payday loan providers explicitly support Chime for direct deposit can be challenging. Many lenders don’t publicly list specific compatible banks, opting instead for a broader statement regarding supported financial institutions. Direct contact with individual lenders is often necessary to confirm compatibility. However, some lenders with a reputation for broader compatibility may accept Chime, provided the account meets their specific requirements (such as age, credit history, and income verification). It’s important to note that this compatibility is not guaranteed and can change at any time.

Challenges and Limitations of Using Chime for Payday Loan Transactions

Several factors can impact the successful processing of payday loan transactions involving Chime. One common issue is the verification process. Some lenders may require additional verification steps for Chime accounts due to its unique structure as a mobile-only bank. This might involve longer processing times or a higher likelihood of application rejection. Another potential challenge arises from Chime’s routing and account numbers, which can sometimes be flagged by automated systems. This may trigger additional security checks or delays in receiving funds. Finally, the availability of instant funding, a common feature advertised by some payday lenders, may not always be guaranteed with Chime accounts.

Examples of Payday Loan Experiences with Chime

Successful Example: Sarah, a freelance writer, needed a short-term loan to cover unexpected car repairs. She applied through a lender known for accepting a wide range of banks. After providing the necessary documentation, including her Chime account details, her application was approved, and the funds were deposited into her Chime account within 24 hours.

Unsuccessful Example: John, a construction worker, applied for a payday loan using his Chime account with a less established lender. His application was initially rejected due to an automated system flagging his Chime account number. After contacting the lender directly and providing additional documentation, his application was eventually approved, but the process took significantly longer than expected.

Security Measures Employed by Reputable Online Payday Lenders

Reputable online payday lenders prioritize the security of their customers’ financial information. They typically employ robust encryption protocols (such as SSL/TLS) to protect data transmitted during the application and transaction processes. Multi-factor authentication, password policies, and regular security audits are additional measures employed to prevent unauthorized access and fraud. Furthermore, they comply with relevant data protection regulations, such as the Fair Credit Reporting Act (FCRA) and other state-specific laws, to safeguard sensitive customer data. While Chime itself employs its own security measures, choosing a reputable lender with strong security practices remains crucial for minimizing risks associated with payday loans.

Risks and Benefits of Using Chime for Online Payday Loans

Using Chime, a popular mobile banking app, with online payday loans presents a complex picture with both potential advantages and significant drawbacks. Understanding these aspects is crucial before considering this financial option. While the convenience of quick access to funds is appealing, the high costs and potential for debt traps must be carefully weighed.

High Interest Rates and Debt Cycles

Online payday loans are notorious for their extremely high interest rates, often expressed as Annual Percentage Rates (APRs) far exceeding those of traditional loans. These rates can easily reach triple digits, making it difficult to repay the loan within the short repayment period, typically two to four weeks. This frequently leads to a cycle of debt, where borrowers repeatedly take out new loans to cover the cost of repaying previous ones, accumulating substantial fees and interest along the way. The ease of access through apps like Chime can exacerbate this problem, making it simpler to fall into this trap. Missed payments can result in further fees and damage to credit scores, creating a significant financial burden.

Quick Access to Funds and Convenience

The primary benefit of online payday loans is their speed and convenience. Funds are often deposited directly into the borrower’s Chime account within minutes or hours of approval, offering immediate access to cash in emergency situations. The entire application process is typically completed online, eliminating the need for in-person visits to a lender. This speed and digital nature can be especially attractive to individuals facing urgent financial needs, who may not have access to traditional banking options or credit. The seamless integration with Chime simplifies the transaction process, making it quicker and easier than traditional methods.

Comparison of Payday Loan Providers

The following table compares the fees and interest rates of four fictional online payday loan providers. It is crucial to remember that these are examples and actual rates can vary significantly depending on the lender and the borrower’s creditworthiness. Always compare multiple offers before making a decision.

| Provider Name | APR | Fees | Repayment Terms |

|---|---|---|---|

| QuickCash Loans | 400% | $30 | 2 weeks |

| EasyMoney Advance | 350% | $25 | 1 month |

| RapidFunds Lending | 450% | $35 | 2 weeks |

| InstantCredit Solutions | 300% | $20 | 1 month |

Case Study: Responsible vs. Irresponsible Use

Let’s consider two fictional scenarios involving Sarah and John, both using Chime and online payday loans.

Sarah: Sarah unexpectedly faces a $500 car repair bill. She carefully researches payday loan providers, choosing one with a lower APR and fees. She borrows $500, repays it in full within the repayment period, and incurs a total of $75 in fees and interest. This demonstrates responsible use; Sarah acknowledges the cost, plans for repayment, and avoids long-term debt.

John: John also needs $500 for an unexpected expense. He borrows from multiple providers without fully understanding the fees and interest rates. He repeatedly rolls over loans, accumulating significant debt and incurring hundreds of dollars in fees. This represents irresponsible use, leading to a cycle of debt and financial hardship. John’s reliance on the quick access provided by Chime and online payday loans without proper planning results in severe financial consequences.

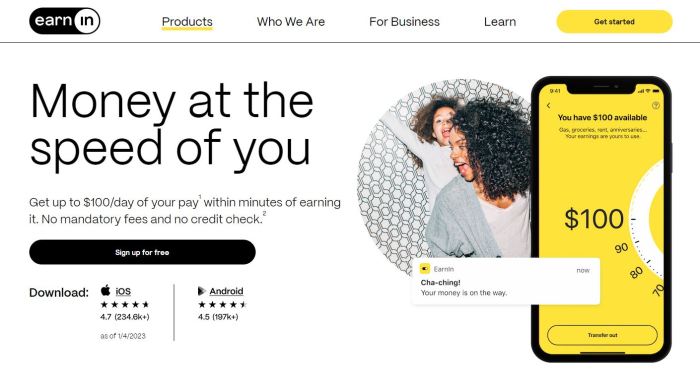

Alternatives to Payday Loans with Chime

Securing short-term funds shouldn’t always mean resorting to high-interest payday loans. Several alternatives offer more manageable repayment terms and lower overall costs. Exploring these options can significantly improve your financial well-being and prevent a cycle of debt. This section Artikels viable alternatives and compares them to payday loans.

Personal Loans

Personal loans, offered by banks and online lenders, provide a lump sum of money with fixed repayment schedules. Interest rates vary depending on creditworthiness, but they’re generally lower than payday loans. The application process involves a credit check and may require providing financial documentation. Repayment terms typically range from several months to several years, allowing for more manageable monthly payments.

Credit Union Loans

Credit unions, member-owned financial institutions, often offer more favorable loan terms than traditional banks. They may provide smaller loans with lower interest rates and more flexible repayment options, particularly for members with less-than-perfect credit. Membership requirements vary depending on the credit union, but the community-focused nature often translates to more personalized service and support.

Borrowing from Friends and Family

Borrowing from trusted friends or family members can be a helpful solution for short-term financial needs. This option avoids interest charges and allows for flexible repayment arrangements. However, it’s crucial to establish clear terms and a written agreement to maintain the relationship and avoid misunderstandings. Open communication about repayment expectations is essential.

Comparison of Payday Loans and Alternatives

The following table compares payday loans with personal loans, credit union loans, and borrowing from friends and family, highlighting key differences in interest rates, application processes, and repayment terms.

Feature

Payday Loan

Personal Loan

Credit Union Loan

Friends/Family

Interest Rate

Very High (Often 400% APR or more)

Moderate (Varies based on credit score)

Lower than Personal Loans (Varies based on credit union and member status)

Typically 0%

Application Process

Usually quick and easy, minimal documentation

More rigorous, credit check required, documentation needed

Similar to personal loans, may be slightly less stringent

Informal, based on trust

Repayment Terms

Short-term, typically due on next payday

Longer-term, typically months or years

Variable, often more flexible than personal loans

Negotiable, based on agreement

Advantages and Disadvantages of Alternative Financial Solutions

Each alternative financial solution presents unique advantages and disadvantages. Carefully weighing these factors is crucial in selecting the most suitable option.

Personal Loans: Advantages –

Convenient access to funds, fixed repayment schedule, potential for building credit history.

Personal Loans: Disadvantages –

Credit check required, potentially higher interest rates than credit unions, longer application process.

Credit Union Loans: Advantages –

Potentially lower interest rates, more personalized service, flexible repayment options.

Credit Union Loans: Disadvantages –

Membership requirements, may require a longer application process than payday loans.

Borrowing from Friends and Family: Advantages –

No interest charges, flexible repayment arrangements, strengthens relationships (if handled well).

Borrowing from Friends and Family: Disadvantages –

Potential strain on relationships if not handled carefully, lack of formal agreement can lead to misunderstandings, no credit building benefit.

Resources for Financial Literacy and Budgeting Assistance

Numerous resources are available to help individuals improve their financial literacy and create effective budgets. These include non-profit organizations like the National Foundation for Credit Counseling (NFCC), government websites offering financial education materials, and online budgeting tools. Seeking professional financial advice can also be beneficial for individuals facing complex financial challenges.

Legal and Regulatory Considerations

Online payday lending is a heavily regulated industry, and the legal landscape varies significantly across different states and regions. Understanding these regulations is crucial for both borrowers and lenders to avoid legal pitfalls and protect themselves from predatory practices. The use of Chime, a digital banking platform, in these transactions introduces additional legal complexities.

The legal framework governing online payday lending is primarily established at the state level in the United States. Many states have enacted specific laws that cap interest rates, limit the amount that can be borrowed, and regulate the terms and conditions of payday loans. Some states have even banned payday lending altogether. These laws are designed to protect consumers from exorbitant fees and the cycle of debt that can trap borrowers. In contrast, some states have more lenient regulations, leading to a higher concentration of payday lenders and potentially more aggressive lending practices. The variations in state laws create a patchwork of regulations, making it difficult for consumers to navigate the complexities of the industry. Furthermore, federal laws, such as the Truth in Lending Act (TILA), also play a role in regulating payday lending practices, ensuring transparency and fair disclosure of loan terms.

State-Specific Payday Lending Laws

Each state’s payday lending laws dictate allowable interest rates, loan amounts, and repayment terms. For example, some states may limit interest rates to a certain percentage, while others may have no cap, leading to potentially usurious interest rates. Similarly, loan amounts and repayment periods are often subject to state-specific regulations. Borrowers should research the specific laws in their state before considering a payday loan. Failure to comply with these laws can result in significant legal repercussions for both lenders and borrowers. For instance, a lender operating outside the bounds of a state’s regulations might face hefty fines or even criminal charges.

Legal Implications of Using Chime for Payday Loan Transactions, Online payday loans with chime bank

Using Chime for payday loan transactions doesn’t inherently create additional legal risks for borrowers, but it does introduce unique aspects. Chime’s status as a digital bank means that transactions are electronically processed, leaving a digital trail that could be scrutinized in legal disputes. Furthermore, the speed and ease of transactions facilitated by Chime could potentially contribute to a faster cycle of borrowing and repayment, increasing the risk of falling into debt. It’s crucial for borrowers to carefully review all loan terms and understand the potential implications of using Chime for these transactions, ensuring they are comfortable with the risks involved. Chime itself is not a lender and bears no direct legal responsibility for the terms or actions of payday loan providers.

Common Payday Loan Scams and Predatory Lending Practices

Numerous scams and predatory lending practices are associated with online payday loans. These include bait-and-switch tactics, where lenders advertise low interest rates but then charge significantly higher fees; hidden fees and charges that are not clearly disclosed upfront; and loans with extremely high interest rates that can quickly trap borrowers in a cycle of debt. Another common scam involves lenders demanding upfront fees or payments before disbursing the loan, essentially preying on desperate borrowers. Predatory lenders often target vulnerable individuals with poor credit or limited financial literacy.

Identifying and Avoiding Fraudulent Online Payday Loan Providers

To avoid fraudulent online payday loan providers, borrowers should carefully research lenders before applying for a loan. Check online reviews and ratings from reputable sources to assess the lender’s reputation. Be wary of lenders who pressure you to apply quickly or who make unrealistic promises. Always read the loan agreement carefully before signing, ensuring you fully understand all terms and conditions, including interest rates, fees, and repayment schedule. Avoid lenders who request personal information upfront without verifying their legitimacy. A legitimate lender will not demand upfront fees or payments before disbursing the loan. If something feels too good to be true, it probably is. Reporting suspected fraudulent activity to the appropriate authorities is crucial to protect yourself and others from potential harm.

Ultimate Conclusion

Securing a payday loan through Chime can provide quick access to funds, but it’s essential to weigh the potential benefits against the substantial risks of high interest rates and potential debt cycles. Understanding the intricacies of the application process, lender reputation, and available alternatives empowers you to make a responsible financial choice. Remember to thoroughly research lenders, compare interest rates and fees, and explore alternative solutions before committing to a payday loan.

Expert Answers

Can I get a payday loan with a Chime prepaid card?

Some online payday lenders accept Chime accounts for direct deposit, but not all. Always verify with the lender beforehand.

What are the typical fees associated with online payday loans?

Fees vary widely but can include origination fees, late payment fees, and potentially others. Always review the lender’s terms and conditions carefully.

How long does it take to receive funds after approval?

Funding times depend on the lender but are often faster than traditional loans, sometimes within one business day.

What happens if I can’t repay my payday loan on time?

Late payments can result in additional fees and negatively impact your credit score. Contact your lender immediately if you anticipate difficulties making a payment.

Are there any legal restrictions on payday loans?

Yes, payday loan regulations vary by state and region. It’s crucial to understand the laws in your area before applying.