Patelco personal loan rates are a key consideration for anyone seeking financing. Understanding these rates, along with the associated fees and loan terms, is crucial for making an informed borrowing decision. This guide delves into the specifics of Patelco’s personal loan offerings, comparing them to competitors and providing insights into factors influencing your interest rate. We’ll explore various loan types, eligibility criteria, the application process, and ultimately, help you navigate the complexities of securing a personal loan from Patelco.

We’ll examine the different loan amounts and terms available, highlighting the impact of your credit score on the interest rate you’ll receive. We’ll also look at repayment options, associated fees, and provide real-world examples to illustrate how these factors interact to determine your overall loan cost. By the end, you’ll have a clearer picture of whether a Patelco personal loan is the right financial choice for you.

Patelco Personal Loan Overview

Patelco Credit Union offers a range of personal loan products designed to meet diverse financial needs. These loans provide borrowers with access to funds for various purposes, from debt consolidation to home improvements or unexpected expenses. Understanding the specifics of Patelco’s personal loan offerings, eligibility requirements, and application process is crucial for prospective borrowers seeking a suitable financing solution.

Types of Patelco Personal Loans

Patelco likely offers several types of personal loans, although the exact offerings may vary. These could include unsecured personal loans (not backed by collateral), secured personal loans (backed by collateral, potentially resulting in lower interest rates), and potentially specialized loans tailored to specific needs like debt consolidation or auto financing. It’s recommended to check Patelco’s official website for the most up-to-date and precise information on their current loan product offerings. Contacting a Patelco representative directly can also clarify available options.

Eligibility Criteria for Patelco Personal Loans

Eligibility for a Patelco personal loan hinges on several factors. Generally, applicants need to be a member of Patelco Credit Union, demonstrating a history of responsible financial management. This often includes a minimum credit score requirement, a stable income stream, and a satisfactory debt-to-income ratio. Specific requirements regarding minimum income, credit history length, and acceptable debt levels will vary based on the loan type and amount sought. Detailed eligibility criteria are usually Artikeld on Patelco’s website or can be obtained by contacting their loan department.

Patelco Personal Loan Application Process

Applying for a Patelco personal loan typically involves several steps. First, potential borrowers will need to gather necessary documentation, including proof of income, identification, and potentially other financial records. Next, they’ll complete a loan application, either online or in person at a Patelco branch. Patelco will then review the application and supporting documents, assessing the applicant’s creditworthiness and eligibility. If approved, the loan terms, including interest rate and repayment schedule, will be finalized, and the funds will be disbursed according to the agreed-upon terms. The entire process may take several days or weeks, depending on the complexity of the application and the volume of loan requests Patelco is processing.

Checking Patelco Personal Loan Rates Online

While Patelco may not publicly display exact personal loan interest rates online due to their individualized nature, their website likely provides a range of rates or an interest rate calculator. This calculator usually requires inputting the desired loan amount, loan term, and potentially other financial information to generate an estimated interest rate. It’s important to note that this is only an estimate, and the final interest rate offered will depend on the applicant’s individual credit profile and financial circumstances. Contacting Patelco directly for a personalized rate quote is the most reliable way to determine the exact interest rate you would qualify for.

Interest Rates and Fees

Patelco Credit Union offers personal loans with competitive interest rates, but the exact cost depends on several factors, including your creditworthiness, the loan amount, and the loan term. Understanding these rates and associated fees is crucial for making an informed borrowing decision. This section details Patelco’s personal loan interest rates and fees, comparing them to those of other major credit unions to provide a comprehensive overview.

Patelco’s personal loan interest rates are not publicly listed as a fixed rate, unlike some other financial institutions. Instead, they are determined on a case-by-case basis, taking into account the applicant’s credit score and financial history. Generally, borrowers with higher credit scores will qualify for lower interest rates. This personalized approach ensures that the interest rate reflects the individual risk associated with each loan. Similarly, the loan amount and term also influence the final interest rate, with longer loan terms often resulting in higher overall interest paid, although monthly payments may be lower.

Patelco Personal Loan Rate Examples

While precise rates are not publicly available, we can illustrate potential scenarios. A borrower with excellent credit (a FICO score above 750) might qualify for an APR as low as 7% on a $10,000 loan with a 36-month term. Conversely, a borrower with a fair credit score (around 650) might receive an APR closer to 12% for the same loan amount and term. These are illustrative examples and actual rates will vary. It’s essential to apply directly to Patelco to receive a personalized rate quote.

Patelco Personal Loan Fees

Patelco may charge fees associated with personal loans. These fees can include origination fees, which are a percentage of the loan amount, and late payment fees, which are assessed for missed or late payments. Early repayment penalties are not typically charged by Patelco. It’s crucial to review the loan agreement carefully to understand all applicable fees before accepting the loan. Contacting Patelco directly for specific fee information related to your situation is advisable.

Comparison of Patelco Rates with Competitors

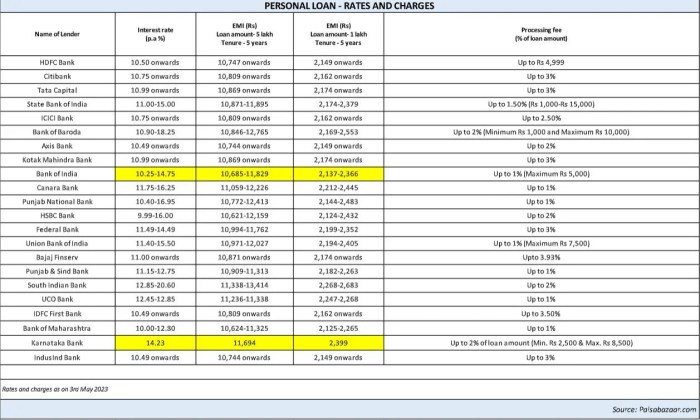

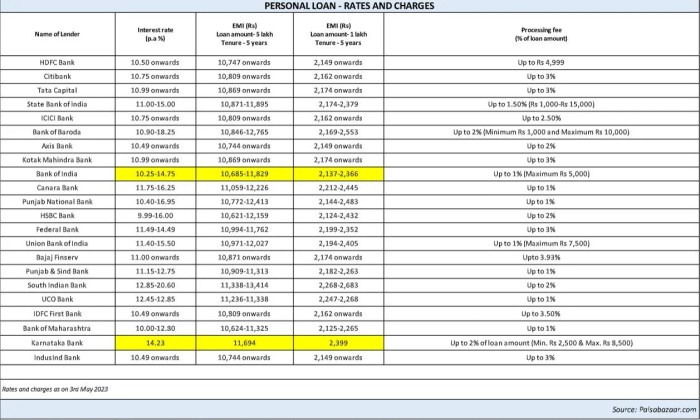

The following table compares Patelco’s estimated rates with those of other major credit unions. Note that these rates are estimates based on publicly available information and may not reflect current rates or the specific rates offered to individual borrowers. Actual rates will vary based on creditworthiness and other factors.

| Lender | APR | Loan Term (Months) | Fees |

|---|---|---|---|

| Patelco Credit Union (Estimate – Excellent Credit) | 7% – 10% | 12-60 | Potential origination fee and late payment fees; specifics vary by loan |

| Alliant Credit Union (Estimate) | 8% – 14% | 12-60 | Potential origination fee and late payment fees; specifics vary by loan |

| Navy Federal Credit Union (Estimate) | 9% – 15% | 24-72 | Potential origination fee and late payment fees; specifics vary by loan |

| PenFed Credit Union (Estimate) | 7.5% – 13% | 12-60 | Potential origination fee and late payment fees; specifics vary by loan |

Loan Terms and Repayment Options

Patelco offers a range of personal loan terms and repayment options designed to suit individual financial needs and circumstances. Understanding these options is crucial for selecting a loan that aligns with your budget and repayment capabilities. Careful consideration of loan terms and repayment schedules will ensure a smooth and manageable repayment process.

Patelco personal loans typically offer varying loan terms, expressed in months, allowing borrowers to choose a repayment period that best fits their financial situation. Shorter loan terms usually result in higher monthly payments but lower overall interest paid, while longer terms mean lower monthly payments but higher total interest costs. Repayment options are structured to provide flexibility, ensuring that borrowers can comfortably manage their debt.

Available Loan Terms

Patelco’s personal loan terms typically range from 12 to 60 months, although the exact range may vary depending on the loan amount and the borrower’s creditworthiness. A shorter term, such as 12 months, would necessitate larger monthly payments but would result in less interest paid over the life of the loan. Conversely, a longer term, such as 60 months, would lead to smaller monthly payments but significantly more interest paid overall. Borrowers should carefully weigh the advantages and disadvantages of each term length before making a decision.

Repayment Options

Patelco primarily offers fixed-payment personal loans. This means the borrower makes the same monthly payment amount throughout the loan’s term. This predictable payment structure simplifies budgeting and financial planning. While variable-payment options are not typically offered for Patelco personal loans, the fixed payment amount remains consistent, providing financial stability for the borrower.

Repayment Schedule Examples

Let’s consider two hypothetical scenarios to illustrate different repayment schedules:

| Loan Amount | Loan Term (Months) | Approximate Monthly Payment | Total Interest Paid (Estimate) |

|---|---|---|---|

| $5,000 | 24 | $225 | $500 |

| $10,000 | 60 | $200 | $2000 |

*Note: These are illustrative examples only. Actual monthly payments and total interest paid will vary depending on the specific interest rate offered, which is determined by Patelco’s credit assessment.*

Factors Affecting Repayment Amounts

Understanding the factors that influence your monthly payment is essential for responsible borrowing. Before applying for a Patelco personal loan, it’s advisable to carefully consider these elements:

- Loan Amount: Larger loan amounts naturally result in higher monthly payments.

- Loan Term: Longer loan terms lead to lower monthly payments but higher total interest costs.

- Interest Rate: A higher interest rate will increase the monthly payment amount.

- Credit Score: A higher credit score typically qualifies you for a lower interest rate, resulting in lower monthly payments.

Factors Influencing Interest Rates

Patelco personal loan interest rates are determined by a combination of factors, reflecting the lender’s assessment of the risk involved in extending credit to a specific borrower. Understanding these factors can help borrowers improve their chances of securing a more favorable interest rate.

Several key elements influence the interest rate a borrower receives on a Patelco personal loan. These factors are interconnected and contribute to the overall risk profile presented by the applicant. The more favorable the profile, the lower the interest rate is likely to be.

Credit Score Impact

A borrower’s credit history significantly impacts their interest rate. Lenders use credit scores, such as FICO scores, to gauge creditworthiness. A higher credit score indicates a lower risk of default, leading to a lower interest rate. Conversely, a lower credit score suggests a higher risk, resulting in a higher interest rate or even loan denial. For example, a borrower with a credit score above 750 might qualify for a significantly lower interest rate compared to someone with a score below 600. The difference can be several percentage points, leading to substantial savings over the loan’s life.

Loan Amount and Term Influence

The loan amount and term also affect the interest rate and the total interest paid. Larger loan amounts often carry slightly higher interest rates because they represent a greater risk for the lender. Similarly, longer loan terms generally result in higher total interest paid, even if the interest rate remains the same, because interest accrues over a longer period. For instance, a $10,000 loan over 3 years will have a lower total interest cost than the same loan spread over 5 years, assuming the interest rate is constant.

Credit Score and Interest Rate Relationship, Patelco personal loan rates

Imagine a graph with the credit score on the horizontal axis and the interest rate on the vertical axis. The line representing the relationship would slope downward. As the credit score increases, the interest rate decreases. This downward slope illustrates the inverse relationship between credit score and interest rate. A high credit score (e.g., 750 and above) would correspond to a low interest rate (e.g., a rate in the lower range offered by Patelco), while a low credit score (e.g., below 600) would correspond to a high interest rate (e.g., a rate at the higher end of Patelco’s offered range, or potentially loan rejection). The slope of the line may not be perfectly linear, but the overall trend is clear: better credit leads to better rates.

Customer Experiences and Reviews

Understanding real customer experiences is crucial when evaluating any financial product, especially personal loans. Patelco Credit Union, like any lender, receives a range of feedback regarding its personal loan rates and the overall application process. Examining both positive and negative experiences provides a balanced perspective on customer satisfaction.

Analyzing online reviews and testimonials reveals a mixed bag of experiences. While many customers praise Patelco for its competitive rates and straightforward application, others express frustration with certain aspects of the process or perceived inconsistencies in rate offerings. It’s important to remember that individual experiences can be influenced by various factors, including credit score, loan amount, and the specific circumstances of each applicant.

Positive Customer Experiences with Patelco Personal Loan Rates

Several customers have reported positive experiences with Patelco’s personal loan rates. These positive reviews often highlight the competitiveness of the rates offered compared to other lenders, making Patelco an attractive option for those seeking affordable borrowing.

- One customer shared their experience of securing a loan with a significantly lower interest rate than initially anticipated, allowing them to comfortably manage their repayments.

- Another customer praised the transparency of the rate quotation process, stating that the provided rate was consistent with the final loan agreement, avoiding any unpleasant surprises.

- Several reviews mentioned the helpfulness and responsiveness of Patelco’s customer service representatives in guiding them through the application and rate clarification process.

Negative Customer Experiences with Patelco Personal Loan Rates

Conversely, some negative experiences relate to perceived inconsistencies in rate offerings or difficulties in the application process. While these instances are less frequent, they provide valuable insight into areas for potential improvement.

- A few customers reported receiving higher interest rates than initially expected, citing a lack of clear explanation for the discrepancy.

- Others expressed frustration with the length of the application process or the perceived lack of flexibility in loan terms.

- Some reviews mentioned challenges in contacting customer service representatives for rate-related inquiries or clarification.

Summary of Overall Customer Satisfaction

Overall, customer satisfaction regarding Patelco personal loan rates and the application process appears to be mixed. While many customers report positive experiences with competitive rates and helpful customer service, a notable minority express concerns about inconsistencies in rate offerings and aspects of the application process. A thorough review of individual experiences suggests that a proactive approach to addressing customer feedback could significantly improve overall satisfaction.

While Patelco offers competitive rates for many borrowers, inconsistencies in rate application and occasional difficulties in the application process are recurring themes in customer reviews. Clearer communication and a more streamlined application process could significantly enhance customer satisfaction.

Final Conclusion

Securing a personal loan requires careful consideration of various factors, and Patelco personal loan rates are no exception. This guide has provided a detailed overview of Patelco’s offerings, enabling you to compare their rates and terms with those of other lenders. By understanding the influence of your credit score, loan amount, and loan term on your interest rate, you can make a more informed decision. Remember to carefully review all terms and conditions before committing to a loan, and always explore alternative options to ensure you’re getting the best possible deal. Armed with this knowledge, you can confidently navigate the personal loan landscape and secure the financing you need.

FAQ Corner: Patelco Personal Loan Rates

What is the minimum credit score required for a Patelco personal loan?

Patelco doesn’t publicly state a minimum credit score. Approval depends on a variety of factors, including credit history, income, and debt-to-income ratio. It’s best to contact Patelco directly.

Can I pre-qualify for a Patelco personal loan without impacting my credit score?

Patelco may offer a pre-qualification process that doesn’t affect your credit score. Check their website or contact them directly to confirm.

What happens if I miss a payment on my Patelco personal loan?

Missing payments will likely result in late fees and negatively impact your credit score. Contact Patelco immediately if you anticipate difficulty making a payment to explore options.

Does Patelco offer personal loans for debt consolidation?

Yes, Patelco personal loans can be used for debt consolidation. Check their website for details on eligibility and terms.