Payday loans Ashland KY represent a complex financial landscape for residents. This guide delves into the realities of accessing these short-term loans, exploring the providers, regulations, and potential long-term financial implications. We’ll examine the application process, compare interest rates, and highlight alternative financial solutions available to those facing short-term financial hardship in Ashland, Kentucky. Understanding the intricacies of payday loans is crucial for making informed decisions about your financial well-being.

We’ll analyze the legal framework governing payday lending in Kentucky, investigate the potential consequences of default, and identify resources available to protect borrowers. Through real-world examples and hypothetical scenarios, we’ll illustrate the potential pitfalls and benefits of using payday loans, providing a balanced perspective to help you navigate this often-challenging financial terrain.

Payday Loan Providers in Ashland, KY

Securing a payday loan can provide short-term financial relief, but it’s crucial to understand the terms and conditions before borrowing. Borrowers in Ashland, Kentucky, have access to several payday loan providers, each with its own set of fees and repayment schedules. Choosing the right lender requires careful comparison and consideration of individual financial circumstances.

Payday Loan Providers in Ashland, KY

Finding a comprehensive list of *every* payday lender operating in Ashland, KY, publicly and reliably is challenging due to the constantly shifting nature of the industry and limited publicly available data. The following table represents a sample of potential providers, and it’s crucial to verify their current operational status independently before applying. This information should not be considered exhaustive.

| Provider Name | Address | Phone Number | Website |

|---|---|---|---|

| (Provider Name 1 – Example) | (Address – Example: 123 Main St, Ashland, KY 41101) | (Phone Number – Example: (606) 555-1212) | (Website – Example: www.examplepaydayloan.com) |

| (Provider Name 2 – Example) | (Address – Example: 456 Elm St, Ashland, KY 41101) | (Phone Number – Example: (606) 555-1213) | (Website – Example: www.anotherpaydayloan.com) |

| (Provider Name 3 – Example) | (Address – Example: 789 Oak St, Ashland, KY 41101) | (Phone Number – Example: (606) 555-1214) | (Website – Example: www.yetanotherpaydayloan.com) |

Interest Rate Comparison

Interest rates for payday loans vary significantly depending on the lender, the loan amount, and the borrower’s creditworthiness. It is imperative to compare offers from multiple lenders before committing to a loan. The following is a hypothetical comparison to illustrate the potential range of interest rates; actual rates will vary. Always confirm the APR (Annual Percentage Rate) with the lender directly.

| Provider Name (Example) | Loan Amount (Example) | Interest Rate (Example – APR) | Total Repayment (Example) |

|---|---|---|---|

| Provider A | $300 | 400% | $400 |

| Provider B | $300 | 350% | $375 |

| Provider C | $300 | 450% | $450 |

Note: These are hypothetical examples and do not represent actual rates offered by any specific lender. Payday loan interest rates can be extremely high, leading to a significant increase in the total amount repaid.

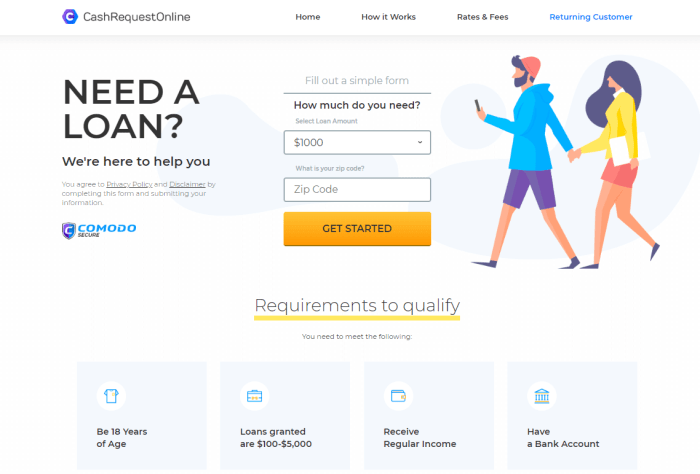

Typical Payday Loan Application Process in Ashland, KY

The application process for a payday loan generally involves several steps. First, the borrower will need to provide personal information, including identification, proof of income, and bank account details. The lender will then review the application and assess the borrower’s creditworthiness. If approved, the loan will be disbursed, typically within one business day. Repayment is usually due on the borrower’s next payday. Specific requirements and procedures may vary slightly between lenders. It’s important to carefully read and understand the loan agreement before signing. Failure to repay the loan on time can result in additional fees and penalties.

Regulations and Legal Aspects of Payday Lending in Ashland, KY

Payday lending in Ashland, Kentucky, is subject to both state and federal regulations designed to protect consumers from predatory lending practices. Understanding these laws is crucial for both borrowers and lenders to ensure compliance and avoid potential legal repercussions. The specifics can be complex, so it’s always advisable to consult with legal professionals for personalized guidance.

Payday lending in Kentucky is governed primarily by state law, specifically Kentucky Revised Statutes (KRS) Chapter 288, which regulates small loans. These regulations Artikel licensing requirements for lenders, interest rate caps, loan amounts, and other key aspects of the lending process. Local ordinances in Ashland may further restrict or regulate payday lending activities, though these are generally less significant than state-level laws. It is important to note that the regulatory landscape for payday loans is constantly evolving, and changes may occur. Staying informed about the latest updates is vital.

Consequences of Defaulting on a Payday Loan in Ashland, KY

Failure to repay a payday loan in Ashland, Kentucky, can lead to several serious consequences. Lenders may pursue various collection methods, including repeated phone calls, letters, and potentially legal action. Legal action could result in a judgment against the borrower, potentially leading to wage garnishment, bank account levies, or the seizure of assets. Furthermore, late payments and defaults can significantly damage a borrower’s credit score, making it difficult to obtain credit in the future for mortgages, car loans, or even credit cards. The accumulation of late fees and interest can quickly escalate the debt, making it even harder to repay. These financial consequences can have far-reaching effects on an individual’s financial stability and overall well-being.

Consumer Protection Agencies and Resources in Ashland, KY

Borrowers facing difficulties with payday loans in Ashland have access to several consumer protection agencies and resources. The Kentucky Attorney General’s office provides resources and handles complaints related to consumer fraud and unfair business practices, including those involving payday lenders. The Consumer Financial Protection Bureau (CFPB) is a federal agency that oversees consumer financial products and services, including payday loans. They offer educational materials, complaint filing mechanisms, and guidance for consumers dealing with debt problems. Local credit counseling agencies in Ashland can also offer assistance with budgeting, debt management, and developing strategies to navigate financial challenges. These agencies often provide free or low-cost services to help individuals manage their debt effectively and avoid further financial difficulties. It is important to seek help early if struggling with repayment, as proactive measures can often mitigate the long-term consequences of default.

Financial Implications of Payday Loans in Ashland, KY

Payday loans, while offering a seemingly quick solution to immediate financial needs, often carry significant long-term financial consequences for residents of Ashland, KY. The high interest rates and fees associated with these loans can create a debt cycle that is difficult to escape, leading to further financial hardship. Understanding these implications is crucial for making informed financial decisions.

Potential Long-Term Financial Consequences of Repeated Payday Loan Use

Repeated reliance on payday loans can lead to a dangerous cycle of debt. The high interest rates, typically exceeding 400% APR, quickly accumulate, making it challenging to repay the loan on time. Missed payments result in additional fees and penalties, further increasing the debt burden. This can snowball, impacting credit scores, making it difficult to obtain credit for larger purchases like a car or a home, and potentially leading to legal action from creditors. Individuals may find themselves continually borrowing to cover previous loan payments, a situation known as a debt trap. This can severely restrict access to essential resources and negatively affect overall financial well-being. For example, a resident of Ashland needing $300 might find themselves paying back significantly more than double that amount due to accumulated interest and fees.

Alternative Financial Solutions for Residents of Ashland, KY Facing Short-Term Financial Difficulties, Payday loans ashland ky

Several alternatives to payday loans exist for Ashland residents facing temporary financial difficulties. These options generally offer more manageable repayment terms and lower overall costs. Credit unions often provide small-dollar loans with more favorable interest rates and flexible repayment plans. Community action agencies and non-profit organizations frequently offer financial assistance programs, including budgeting counseling and emergency financial aid. Negotiating with creditors to create a payment plan can prevent further debt accumulation. Exploring options like borrowing from family or friends, though requiring careful consideration of relationships, can provide a less expensive solution. Finally, seeking guidance from a certified financial advisor can help individuals develop a personalized financial plan to manage their short-term and long-term financial needs.

Comparison of Payday Loan Costs to Other Short-Term Borrowing Options

The following table compares the cost of a payday loan to other short-term borrowing options, illustrating the significant differences in interest rates, fees, and total cost. These figures are illustrative and may vary based on the specific lender and borrower circumstances. It is crucial to compare offers from multiple lenders before committing to any loan.

| Loan Type | Interest Rate (APR) | Fees | Total Cost (Example: $300 Loan) |

|---|---|---|---|

| Payday Loan | 400% – 700% | $15 – $30 per $100 borrowed | $450 – $700 or more |

| Credit Union Small Loan | 18% – 24% | Variable, often lower than payday loan fees | $350 – $400 |

| Bank Overdraft Protection | Varies, but often less than payday loans | Variable fees per transaction | Varies significantly, but potentially less than payday loans |

| Borrowing from Family/Friends | 0% – Negotiated | None or agreed upon | $300 |

Experiences of Payday Loan Borrowers in Ashland, KY

Payday loans, while offering a seemingly quick solution to immediate financial needs, often present borrowers with a complex web of challenges. The experiences of individuals utilizing these services in Ashland, KY, vary greatly, but common threads of financial strain and unforeseen consequences frequently emerge. Understanding these experiences is crucial for evaluating the impact of payday lending on the community.

A Fictional Narrative Illustrating the Challenges of Payday Loans

Sarah, a single mother working as a waitress in Ashland, faced an unexpected car repair bill. Her usual savings were depleted, and her next paycheck was still a week away. A local payday lender offered a seemingly easy solution: a $300 loan due on her next payday, with a hefty $60 fee. Sarah, desperate, accepted. However, unforeseen circumstances – a bout of illness that forced her to miss several shifts – prevented her from repaying the loan on time. The lender applied additional fees, quickly escalating the debt. Sarah found herself trapped in a cycle of borrowing, struggling to keep up with the accumulating interest and fees, further jeopardizing her financial stability. This fictional narrative highlights the vulnerability of borrowers facing unexpected expenses and the potential for payday loans to exacerbate existing financial difficulties.

A Hypothetical Scenario Demonstrating Negative Impact on Credit Score

Consider Mark, a construction worker in Ashland, who borrowed $500 from a payday lender. He initially planned to repay the loan within two weeks. However, due to a project delay, he missed the repayment deadline. The lender reported the missed payment to credit bureaus. This negative mark on his credit report significantly lowered his credit score, impacting his ability to secure future loans, rent an apartment, or even obtain a favorable interest rate on a car loan. This scenario illustrates how even a single missed payment on a payday loan can have long-lasting and far-reaching consequences on a borrower’s financial life. The impact extends beyond the immediate debt, affecting future opportunities and potentially creating a cycle of debt.

Potential Social and Economic Impacts of Payday Lending on the Ashland, KY Community

The prevalence of payday lending in Ashland can contribute to a cycle of poverty and financial instability within the community. High interest rates and fees disproportionately affect low-income individuals and families, forcing them to allocate a significant portion of their income towards debt repayment. This reduced disposable income can limit access to essential resources like healthcare, education, and nutritious food. Furthermore, the concentration of payday lenders in certain neighborhoods can exacerbate existing economic disparities, creating a financial burden on vulnerable populations. The cumulative effect can negatively impact the overall economic health and social well-being of the Ashland community. Reduced consumer spending and increased financial stress can lead to a decline in local businesses and a decrease in the overall quality of life.

Visual Representation of Payday Loan Data for Ashland, KY

Visual representations of data can effectively communicate complex information about payday lending in Ashland, Kentucky, offering insights into interest rates and repayment success rates. By presenting this information graphically, we can better understand the financial landscape for borrowers and lenders in the area. The following visualizations are illustrative examples, based on hypothetical data, to demonstrate the potential for such representations. Real-world data would need to be collected and analyzed to create accurate and reliable graphs.

Average Interest Rates Charged by Payday Lenders in Ashland, KY

A bar graph would effectively illustrate the average annual percentage rates (APRs) charged by different payday lenders operating in Ashland, KY. The horizontal axis (x-axis) would list the names of the various lenders, while the vertical axis (y-axis) would represent the average APR, expressed as a percentage. Each bar would correspond to a specific lender, with its height representing the average APR charged by that lender. For example, a bar reaching 400% on the y-axis would indicate that the lender represented by that bar charges an average APR of 400%. The graph’s title would be “Average Annual Percentage Rates (APRs) of Payday Loans in Ashland, KY,” and a clear legend would indicate the units used on the y-axis. Data points would be clearly labeled for easy interpretation. This visual representation allows for easy comparison of interest rates across different lenders, enabling consumers to make informed choices.

Proportion of Payday Loan Borrowers in Ashland, KY Who Successfully Repay vs. Default

A pie chart would be a suitable visual to represent the proportion of payday loan borrowers in Ashland, KY who successfully repay their loans versus those who default. The entire pie would represent the total number of borrowers. One segment would represent the percentage of borrowers who successfully repaid their loans, while the other segment would represent the percentage of borrowers who defaulted. For instance, one segment might be 60% representing successful repayments, labeled “Successful Repayments (60%)”, and the other segment would be 40% representing defaults, labeled “Defaults (40%)”. The title of the pie chart would be “Payday Loan Repayment Success Rate in Ashland, KY”. The percentages would be clearly indicated within each segment, and a legend would clarify the meaning of each segment. This visualization would quickly communicate the overall repayment success rate in Ashland, KY, highlighting the potential risks associated with payday loans.

Concluding Remarks

Navigating the world of payday loans Ashland KY requires careful consideration. While these loans can offer short-term relief, the potential for long-term financial difficulties is significant. This guide has aimed to provide a comprehensive overview of the process, regulations, and potential consequences, empowering you to make informed choices. Remember to explore alternative financial solutions and prioritize responsible borrowing practices to protect your financial future.

Question Bank: Payday Loans Ashland Ky

What is the maximum loan amount for payday loans in Ashland, KY?

Kentucky state law dictates the maximum loan amount, which you should verify with individual lenders as it can vary. It’s crucial to borrow only what you can comfortably repay.

What happens if I can’t repay my payday loan on time?

Late payments can result in significant fees and negatively impact your credit score. Contact your lender immediately if you anticipate difficulty repaying to explore potential options like repayment plans. Failure to repay can lead to legal action.

Are there any fees associated with payday loans in Ashland, KY?

Yes, payday loans typically involve various fees, including origination fees and late payment fees. These fees can substantially increase the overall cost of the loan. Always review the loan agreement carefully before signing.

Where can I find help if I’m struggling with debt from payday loans?

Several consumer credit counseling agencies and non-profit organizations offer free or low-cost debt counseling and financial literacy programs. Contact your local consumer protection agency for referrals and assistance.