Payday loans in northport al – Payday loans in Northport, AL, offer a quick solution for urgent financial needs, but understanding the implications is crucial. This guide explores the availability of payday lenders in Northport, the associated costs, and the regulatory landscape governing these loans. We’ll delve into the potential risks and benefits, offering insights into responsible borrowing practices and exploring alternative financial solutions.

Navigating the world of short-term loans requires careful consideration. We’ll examine the interest rates, fees, and loan amounts commonly offered by lenders in Northport, AL, along with the necessary requirements for loan approval. Understanding the legal protections afforded to borrowers is equally important, and we’ll clarify the state and local regulations impacting payday lending practices in the area.

Understanding Payday Loan Availability in Northport, AL

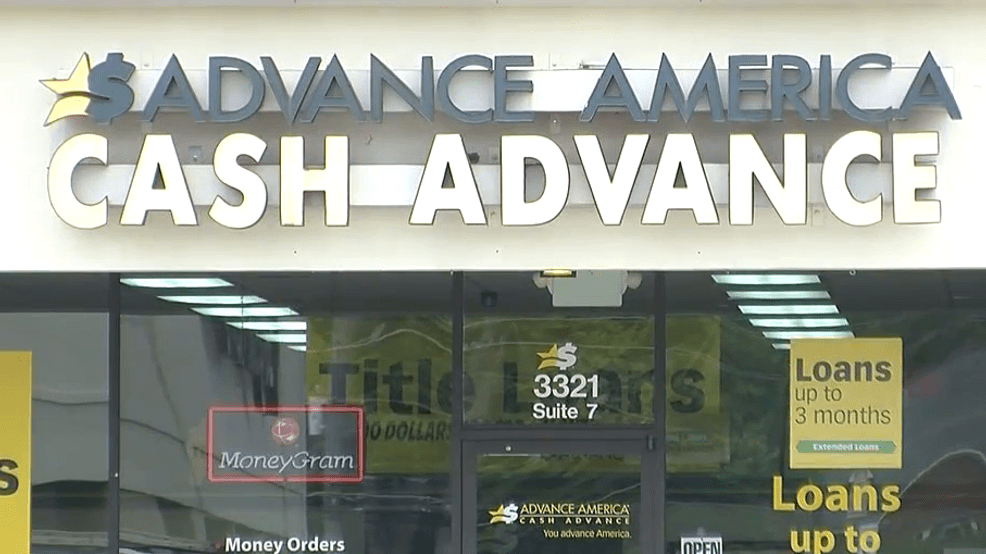

Securing a payday loan in Northport, Alabama, involves understanding the landscape of available lenders, their offered loan terms, and the eligibility requirements. This information is crucial for borrowers to make informed decisions and avoid potential pitfalls associated with high-interest short-term borrowing. Accurate data on specific lenders and their practices can be challenging to obtain consistently, as this information changes frequently. The following details represent a general overview based on commonly observed practices within the payday lending industry.

Payday Loan Provider Count in Northport, AL

Precisely determining the number of payday loan providers actively operating in Northport, AL, at any given time requires continuous real-time monitoring of business licenses and operational status. This data is not publicly compiled in a readily accessible format. However, based on general observations of similar-sized municipalities in Alabama, it’s reasonable to estimate that several lenders, potentially ranging from three to ten, might operate within the city limits or its immediate vicinity. This number can fluctuate due to business openings, closures, and changes in licensing.

Typical Loan Amounts Offered in Northport, AL

Payday loans in Northport, AL, typically range from $100 to $500. The maximum loan amount may vary slightly depending on the individual lender and the borrower’s demonstrated ability to repay. Borrowers should always confirm the maximum loan amount with the specific lender they intend to use. Larger loan amounts are less common due to the short repayment period associated with payday loans.

Interest Rates and Fees Charged by Payday Loan Providers in Northport, AL

Interest rates and fees for payday loans in Northport, AL, are subject to state regulations and individual lender policies. Direct comparison across lenders is difficult due to the lack of centralized, publicly available data. The following table provides a hypothetical example to illustrate the potential range of costs. Actual rates and fees should be verified directly with each lender before obtaining a loan.

| Lender Name | Loan Amount | APR | Fees |

|---|---|---|---|

| Example Lender A | $300 | 400% | $60 |

| Example Lender B | $500 | 350% | $75 |

| Example Lender C | $200 | 450% | $50 |

| Example Lender D | $400 | 380% | $80 |

Note: These APRs and fees are examples and may not reflect the actual rates and fees charged by any specific lender in Northport, AL. Always verify these details with the lender directly.

Common Requirements for Obtaining a Payday Loan in Northport, AL

Generally, obtaining a payday loan in Northport, AL, requires meeting several criteria. These typically include: being at least 18 years old, possessing a valid government-issued ID, providing proof of income (pay stubs or bank statements), having an active checking account, and providing a valid contact number. Lenders may also conduct credit checks, although this is not always a requirement. Specific requirements can vary across lenders, so it’s essential to confirm the specific requirements with each lender before applying.

Regulatory Landscape of Payday Lending in Northport, AL: Payday Loans In Northport Al

Payday lending in Northport, Alabama, is subject to a complex interplay of state and federal regulations. Understanding these regulations is crucial for both lenders and borrowers to ensure compliance and protect consumer rights. While Northport itself doesn’t have specific ordinances governing payday loans, it falls under the jurisdiction of Alabama state law, which significantly impacts the practices of payday lenders operating within its borders.

The regulatory framework governing payday lending in Alabama aims to balance the availability of short-term credit with the need to prevent predatory lending practices. This involves setting limits on loan amounts, interest rates, and fees, as well as establishing consumer protection measures to safeguard borrowers from excessive debt. However, the effectiveness of these regulations is a subject of ongoing debate, with some arguing that they are insufficient to protect vulnerable borrowers.

Interest Rate and Fee Limitations

Alabama law dictates specific limitations on the interest rates and fees that payday lenders can charge. These limitations are designed to prevent exorbitant costs that could trap borrowers in a cycle of debt. While the exact figures can fluctuate slightly due to potential changes in legislation, the state generally caps the amount of interest and fees a lender can charge on a payday loan. Exceeding these legal limits can result in significant penalties for the lender. Borrowers should carefully review the loan agreement to ensure compliance with state regulations. Understanding these limits is crucial for making informed borrowing decisions and avoiding unexpectedly high costs.

Consumer Protection Laws

Several consumer protection laws in Alabama are designed to protect borrowers from unfair or deceptive payday lending practices. These laws often mandate clear and concise disclosure of all loan terms and conditions, including interest rates, fees, and repayment schedules. They may also provide borrowers with the right to cancel a loan within a specific timeframe, or impose restrictions on the number of consecutive payday loans a borrower can obtain. Additionally, the laws may establish procedures for resolving disputes between borrowers and lenders, offering avenues for redress in cases of alleged violations. These protections are designed to empower borrowers and promote responsible lending practices.

Relevant Government Agencies

Several government agencies play a crucial role in overseeing and regulating payday lending in Alabama, and by extension, in Northport. These agencies are responsible for enforcing state and federal laws, investigating complaints, and taking action against lenders who violate regulations.

- Alabama State Banking Department: This agency is primarily responsible for licensing and regulating financial institutions, including payday lenders, within the state. They enforce state laws related to interest rates, fees, and other aspects of payday lending.

- Alabama Attorney General’s Office: The Attorney General’s office has the authority to investigate complaints of unfair or deceptive business practices, including those related to payday lending. They can pursue legal action against lenders who violate consumer protection laws.

- Consumer Financial Protection Bureau (CFPB): While primarily a federal agency, the CFPB also plays a role in overseeing payday lending practices. They enforce federal laws related to consumer financial protection and can investigate complaints against lenders operating across state lines.

Consumer Experiences with Payday Loans in Northport, AL

Payday loans, while offering a seemingly quick solution to immediate financial needs, often present a complex reality for residents of Northport, Alabama. Understanding the reasons behind their use, the associated risks, and available alternatives is crucial for promoting responsible financial practices within the community.

Common Reasons for Payday Loan Usage in Northport, AL

Residents of Northport may turn to payday loans for various reasons, often stemming from unexpected expenses or shortfalls in income. These can include emergency medical bills, car repairs, or unexpected home maintenance costs. The short-term nature of these loans makes them appealing to those facing immediate financial pressure, even if the long-term consequences are less favorable. A lack of access to traditional credit or savings accounts also contributes significantly to reliance on payday loans. Many individuals may lack the credit history or financial stability required to secure loans from banks or credit unions.

Potential Risks and Drawbacks of Payday Loans for Northport Residents

The high-interest rates and short repayment periods associated with payday loans are major drawbacks. These loans can quickly escalate into a cycle of debt, trapping borrowers in a continuous loop of borrowing to repay previous loans. Missed payments can lead to further fees and penalties, exacerbating the financial burden. The potential impact on credit scores is also a significant concern. Defaulting on a payday loan can negatively affect a borrower’s credit rating, making it even more difficult to secure future credit.

The high interest rates and short repayment periods characteristic of payday loans can easily lead to a debt cycle. Borrowers may find themselves repeatedly taking out new loans to cover the fees and interest on previous loans, creating a spiral of debt that is difficult to escape.

Scenario Illustrating Financial Implications of a Payday Loan

Let’s consider a scenario where a Northport resident, Sarah, needs $300 for an unexpected car repair. She obtains a payday loan with a 15-day repayment period and a 15% interest rate (typical of payday loan interest rates). The total amount due after 15 days would be $345 ($300 + $45 interest). If Sarah cannot repay the loan in full within the 15-day period, she may face additional fees and penalties, potentially leading to a much larger debt burden. This scenario highlights the importance of carefully considering the potential costs before taking out a payday loan.

Exploring Alternative Financial Solutions in Northport, AL

Northport residents facing financial hardship should explore alternative solutions before resorting to payday loans. Credit counseling agencies can provide guidance on budgeting, debt management, and exploring options for debt consolidation or repayment plans. Local charities and non-profit organizations often offer financial assistance programs, including emergency funds for essential expenses. Banks and credit unions may offer small loans with more manageable interest rates and repayment terms compared to payday lenders, though they may require a better credit history. Additionally, exploring options like negotiating payment plans with creditors or seeking assistance from family and friends can provide temporary relief.

Financial Literacy and Payday Loans in Northport, AL

Payday loans, while offering quick access to cash, often present significant financial risks for Northport residents. Understanding responsible borrowing practices and available resources for financial education is crucial to mitigating these risks and achieving long-term financial stability. This section Artikels practical steps for responsible borrowing, identifies local resources, and explores the potential long-term consequences of relying on payday loans.

Responsible Borrowing Practices Related to Payday Loans

Before considering a payday loan, Northport residents should carefully evaluate their financial situation and explore alternative options. Borrowing responsibly involves understanding the total cost of the loan, including fees and interest, and ensuring repayment is feasible without jeopardizing essential expenses. A thorough budget analysis is essential to determine if the loan can be repaid within the stipulated timeframe. Failing to do so can lead to a cycle of debt that is difficult to escape. Consider delaying the purchase or seeking alternative financing if repayment seems uncertain.

Financial Education and Budgeting Assistance Resources in Northport, AL, Payday loans in northport al

Several organizations offer financial education and budgeting assistance to Northport residents. These resources can provide valuable tools and guidance to manage finances effectively and avoid the need for high-cost loans like payday advances. Examples include local credit unions, non-profit organizations focused on financial literacy, and government-sponsored programs that offer free or low-cost financial counseling. These organizations typically provide workshops, individual consultations, and online resources covering budgeting, debt management, and credit building. Contacting the United Way or local community centers can provide information about such programs in the Northport area.

Long-Term Consequences of Relying on Payday Loans

The high interest rates and fees associated with payday loans can quickly escalate into a cycle of debt. Repeated borrowing can lead to significant financial strain, impacting credit scores, hindering long-term financial goals (such as saving for a home or retirement), and potentially causing stress and anxiety. In the long term, relying on payday loans for ongoing expenses can create a precarious financial situation, making it increasingly difficult to achieve financial stability. For instance, a seemingly small loan can snowball into a substantial debt burden, making it difficult to meet essential expenses like rent, utilities, and groceries.

Debt Management and Credit Counseling in Northport, AL

Debt management and credit counseling services can help Northport residents struggling with payday loan debt. These services offer guidance on creating a budget, negotiating with creditors, and developing a plan to repay debts strategically. They can also provide education on responsible credit use and strategies to improve credit scores. Many credit counseling agencies operate on a non-profit basis, providing affordable or free services to those who qualify. The challenge for Northport residents, as with many other communities, is often accessing these services due to limited awareness, transportation barriers, or a lack of available programs within the immediate area. However, exploring online resources and contacting national credit counseling organizations can provide access to support, even if local options are limited.

Economic Impact of Payday Lending in Northport, AL

Payday lending’s influence on Northport’s economic health is a complex issue, demanding a nuanced examination of its potential benefits and drawbacks. While offering short-term financial relief to some residents, the high interest rates and potential for debt traps raise concerns about its overall contribution to the community’s economic well-being. This section will explore the multifaceted economic impact of payday lending in Northport, considering its correlation with poverty, comparing it to similar communities, and projecting potential long-term consequences.

Payday loan usage and poverty rates exhibit a strong correlation in many communities, and Northport is likely no exception. Individuals facing financial hardship, often due to low income or unexpected expenses, may turn to payday loans as a last resort. However, the cyclical nature of these loans—high interest accumulating quickly—can exacerbate existing financial instability, potentially trapping individuals in a cycle of debt and hindering their ability to improve their economic circumstances. This perpetuates a cycle of poverty, impacting not only individual households but also the broader community’s economic health.

Correlation Between Payday Loan Usage and Poverty Rates in Northport, AL

A comprehensive study comparing payday loan usage data with poverty statistics in Northport would be necessary to establish a definitive correlation. However, anecdotal evidence and national trends suggest a strong link. For example, areas with higher poverty rates often have a greater concentration of payday lending businesses, indicating a higher demand for these services among low-income populations. This is consistent with findings in other cities across the United States where high poverty rates are often coupled with a high density of payday lenders. Further research utilizing local census data and payday lending transaction records could provide more concrete evidence for Northport specifically.

Comparison of Economic Effects with Other Comparable Communities

To effectively assess the economic effects of payday lending in Northport, a comparative analysis with similar communities in Alabama or the Southeast is crucial. This would involve comparing poverty rates, average household income, and the prevalence of payday lending businesses across these areas. Such a comparison could highlight whether Northport experiences disproportionately negative impacts or if the effects are consistent with national trends. The presence of strong regulatory frameworks in some communities compared to others could also provide valuable insights into the potential for mitigating negative consequences.

Hypothetical Model: Long-Term Consequences of High Payday Loan Usage

The following table presents a hypothetical model illustrating the potential long-term consequences of high payday loan usage on Northport’s economy. This is a simplified model and actual impacts could vary depending on numerous factors, including regulatory changes and economic shifts.

| Scenario | Payday Loan Usage | Economic Indicator 1: Household Disposable Income | Economic Indicator 2: Small Business Failures |

|---|---|---|---|

| High Payday Loan Usage (Status Quo) | High volume of loans with high default rates | Decreased due to high interest payments and debt | Increased due to reduced consumer spending and loan defaults from business owners |

| Moderate Reduction in Payday Loan Usage | Reduced volume of loans with improved repayment rates | Slightly increased due to less debt burden | Stable or slightly decreased due to increased consumer spending |

| Significant Reduction in Payday Loan Usage | Low volume of loans with minimal default rates | Substantially increased due to higher savings and spending | Decreased due to improved consumer spending and increased business confidence |

This model suggests that high payday loan usage could negatively impact household disposable income and contribute to small business failures, ultimately hindering Northport’s economic growth. Conversely, a significant reduction in payday loan usage, potentially achieved through improved financial literacy programs and alternative lending options, could lead to improved economic indicators.

Ending Remarks

Securing a payday loan in Northport, AL, should be a carefully considered decision. While these loans can provide immediate relief, understanding the potential long-term financial consequences is vital. This guide has explored the landscape of payday lending in Northport, highlighting the importance of responsible borrowing, exploring alternative financial options, and emphasizing the need for financial literacy. By making informed choices, residents can navigate their financial situations effectively and avoid the pitfalls of a debt cycle.

FAQ Guide

What happens if I can’t repay my payday loan in Northport?

Failure to repay can lead to late fees, increased debt, and potential damage to your credit score. Contact your lender immediately to discuss options like repayment plans.

Are there any credit checks for payday loans in Northport?

Many payday lenders don’t perform traditional credit checks, but they may review your bank statements and employment history to assess your ability to repay.

Where can I find reputable payday lenders in Northport?

Research lenders online, check reviews, and compare interest rates and fees before choosing a provider. Consider seeking advice from a financial advisor.

What are the alternatives to payday loans in Northport?

Explore options like credit unions, small personal loans from banks, or borrowing from friends and family. Consider creating a budget and seeking financial counseling.