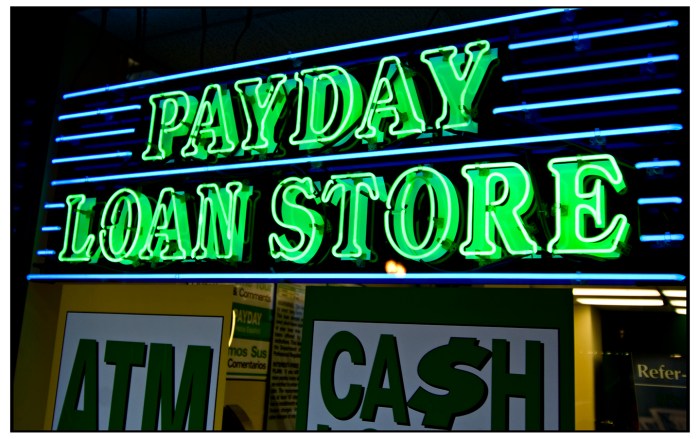

Payday loans Olathe KS offer quick cash, but understanding the implications is crucial. This guide navigates the landscape of payday lenders in Olathe, Kansas, exploring the application process, legal regulations, potential risks, and viable alternatives. We’ll delve into the interest rates, loan amounts, required documentation, and the potential consequences of default. Furthermore, we’ll examine safer financial options and resources available to Olathe residents facing short-term financial challenges.

From comparing lenders and their offerings to navigating the complexities of Kansas state regulations, we aim to provide a comprehensive resource empowering you to make informed decisions about your financial well-being. We’ll cover everything from the application steps and required documents to exploring responsible alternatives and accessing valuable community resources.

Payday Loan Providers in Olathe, KS

Securing a payday loan can provide short-term financial relief, but it’s crucial to understand the terms and conditions before borrowing. Choosing a reputable lender is paramount to avoid predatory practices and high-interest rates. This section details some payday loan providers operating in Olathe, Kansas, highlighting key aspects of their services. Remember to always compare offers and carefully review the loan agreement before signing.

Payday Loan Provider Information in Olathe, KS

Finding accurate and up-to-date information on payday loan providers can be challenging, as availability and specifics change frequently. The following table provides information based on publicly available data; however, it is recommended to verify this information directly with the providers before making any financial decisions. Always check for licensing and legitimacy before engaging with any lending institution.

| Provider Name | Address | Phone Number | Website |

|---|---|---|---|

| (Provider Name 1 – Replace with actual provider name) | (Address – Replace with actual address) | (Phone Number – Replace with actual phone number) | (Website – Replace with actual website) |

| (Provider Name 2 – Replace with actual provider name) | (Address – Replace with actual address) | (Phone Number – Replace with actual phone number) | (Website – Replace with actual website) |

| (Provider Name 3 – Replace with actual provider name) | (Address – Replace with actual address) | (Phone Number – Replace with actual phone number) | (Website – Replace with actual website) |

Interest Rates and Loan Amounts, Payday loans olathe ks

Interest rates for payday loans in Olathe, KS, vary significantly depending on the lender and the specific loan terms. Some lenders may advertise lower initial rates, but hidden fees can inflate the overall cost. It’s essential to compare the Annual Percentage Rate (APR) rather than just the stated interest rate to accurately assess the true cost of borrowing. For example, one lender might advertise a 15% interest rate, but with added fees, the APR could be significantly higher, perhaps exceeding 300%. Another lender might offer a slightly higher initial interest rate but with fewer fees, resulting in a lower overall APR. Always carefully examine the loan agreement to understand all associated charges.

Typical loan amounts offered by payday loan providers in Olathe, KS, usually range from $100 to $500, though this can vary. The maximum loan amount may be influenced by state regulations and the lender’s internal policies. Borrowers should be aware that these loans are designed for short-term needs and should not be considered a long-term solution for financial difficulties. The high interest rates and short repayment periods can create a debt cycle if not managed carefully.

Loan Application Process: Payday Loans Olathe Ks

Securing a payday loan in Olathe, KS, involves a straightforward yet crucial application process. Understanding the steps and required documentation is vital for a smooth and successful loan application. Failure to provide the necessary information can lead to delays or rejection.

The application process typically involves several key steps, each requiring careful attention to detail. Accuracy and completeness are essential for a timely approval.

Payday Loan Application Steps in Olathe, KS

The typical steps involved in applying for a payday loan in Olathe, Kansas, are Artikeld below. While specific steps may vary slightly depending on the lender, this provides a general overview of the process.

- Initial Inquiry: Contacting a lender, either online or in person, to inquire about loan terms and eligibility criteria.

- Application Completion: Filling out the loan application form, providing accurate personal and financial information.

- Document Submission: Submitting the required supporting documentation to verify income and identity.

- Credit Check (May Vary): Some lenders may perform a credit check, although this isn’t always a requirement for payday loans.

- Loan Approval/Denial: Receiving notification from the lender regarding the approval or denial of the loan application.

- Loan Disbursement: If approved, receiving the loan funds, typically deposited directly into the applicant’s bank account.

- Repayment: Understanding and adhering to the repayment schedule, typically due on the borrower’s next payday.

Required Documentation for Payday Loan Applications in Olathe, KS

Lenders in Olathe, KS, require specific documentation to verify the applicant’s identity, income, and ability to repay the loan. Providing this information promptly and accurately is crucial for a quick and successful application.

| Document Type | Description | Purpose | Example |

|---|---|---|---|

| Government-Issued ID | Valid driver’s license, state ID card, or passport. | Verifies applicant’s identity. | Kansas Driver’s License |

| Proof of Income | Pay stubs, bank statements, or tax returns. | Demonstrates ability to repay the loan. | Recent pay stubs showing consistent income. |

| Bank Account Information | Checking account number and routing number. | Facilitates loan disbursement and repayment. | Checking account statement with account and routing numbers. |

| Proof of Address | Utility bill, bank statement, or rental agreement. | Verifies applicant’s residency. | Current utility bill showing applicant’s address. |

Online Payday Loan Application Process

Applying for a payday loan online can be convenient, but it also presents potential challenges. Understanding the process and potential pitfalls is crucial for a successful application.

- Locate a Lender: Find a reputable online payday lender operating in Kansas.

- Navigate the Website: Familiarize yourself with the lender’s website and application process.

- Complete the Application: Carefully fill out the online application form, ensuring accuracy in all fields. Common challenges include typos and incorrect information.

- Upload Documents: Scan and upload the required documents as specified by the lender. Potential challenges include file size limits and incompatible file formats.

- Review and Submit: Double-check all information for accuracy before submitting the application. Submitting an incomplete application can delay the process.

- Await Approval: The lender will review the application and notify the applicant of their decision. Delays can occur due to high application volume or missing information.

- Receive Funds (if Approved): If approved, the funds will typically be deposited directly into the applicant’s bank account. Delays may occur due to bank processing times.

Regulations and Legal Aspects

Payday loans in Olathe, Kansas, are subject to specific state regulations designed to protect borrowers from predatory lending practices. Understanding these regulations and the potential consequences of non-payment is crucial for responsible borrowing. Failure to comply with the terms of a loan can lead to significant financial hardship.

Kansas has specific statutes governing payday loans, aiming to balance access to credit with consumer protection. These regulations dictate aspects like loan amounts, interest rates, and the number of rollovers allowed. Non-compliance can result in severe penalties for both the lender and the borrower.

Kansas Payday Loan Regulations

The following bullet points summarize key aspects of Kansas payday loan regulations. It’s important to note that these regulations are subject to change, and borrowers should always consult the most up-to-date information from the Kansas Office of the State Bank Commissioner or a qualified legal professional before entering into a payday loan agreement.

- Loan Amount Limits: Kansas law typically limits the amount a borrower can receive in a payday loan. The exact limit may vary but is generally capped to prevent excessive debt.

- Interest Rate Caps: Kansas imposes limitations on the interest rates that payday lenders can charge. These caps aim to prevent exorbitant interest costs from burdening borrowers.

- Loan Term Restrictions: The length of a payday loan is typically restricted to a relatively short period, usually a few weeks, to discourage long-term reliance on these high-cost loans.

- Rollover Restrictions: The number of times a payday loan can be rolled over (extended) is often limited. Repeated rollovers significantly increase the total cost of borrowing.

- Collection Practices: Kansas regulates the collection practices of payday lenders, prohibiting harassment and other abusive tactics.

- Licensing Requirements: Payday lenders in Kansas must obtain and maintain a license from the state. This licensing process ensures compliance with state regulations.

Consequences of Defaulting on a Payday Loan

Defaulting on a payday loan in Olathe, KS, can have severe financial consequences. These consequences extend beyond simply damaging your credit score. Late fees, collection agency involvement, and legal action are all potential outcomes.

- Increased Debt: Late fees and additional charges accumulate rapidly, significantly increasing the total amount owed.

- Damaged Credit Score: A default will be reported to credit bureaus, negatively impacting your credit score and making it harder to obtain credit in the future – impacting mortgages, car loans, and even credit cards.

- Collection Agency Involvement: Lenders often turn delinquent accounts over to collection agencies, which can aggressively pursue repayment, potentially impacting your employment and personal life.

- Legal Action: In some cases, lenders may pursue legal action to recover the debt, resulting in wage garnishment or the seizure of assets.

Hypothetical Scenario: The Burden of Multiple Payday Loans

Imagine Sarah, a single mother working a minimum wage job in Olathe. She takes out a $500 payday loan to cover unexpected car repairs. Unable to repay the loan in full on time, she rolls it over, incurring additional fees. Facing another unexpected expense, she takes out a second payday loan from a different lender. Now, she’s juggling two high-interest loans, with escalating fees and shrinking income to cover them. The debt snowball effect leaves her struggling to meet basic needs, potentially leading to a cycle of debt and further loan applications. This illustrates the dangerous spiral that can result from relying on multiple payday loans.

Alternatives to Payday Loans

Securing short-term financial assistance doesn’t always necessitate a payday loan. Several alternatives offer comparable benefits with potentially fewer drawbacks for Olathe, KS residents. Understanding these options empowers informed decision-making and helps avoid the high-interest traps often associated with payday lending.

Choosing the right financial solution depends on individual circumstances, the amount of money needed, and the repayment timeframe. This section explores three viable alternatives to payday loans, comparing their advantages and disadvantages against traditional payday loans to facilitate a more informed choice.

Alternative Financial Solutions for Short-Term Needs

The following table Artikels three alternative financial solutions readily available to residents of Olathe, KS, facing short-term financial difficulties. Each option presents a distinct approach to managing immediate cash flow needs, offering varying levels of accessibility and potential long-term financial implications.

| Solution | Description | Pros | Cons |

|---|---|---|---|

| Small Personal Loan from a Credit Union or Bank | These loans are typically offered by credit unions and banks, providing a fixed amount of money with a predetermined repayment schedule and interest rate. | Lower interest rates compared to payday loans; structured repayment plan; improves credit score with timely payments. | More stringent credit requirements; longer application process; may require collateral or a co-signer. |

| Credit Card Cash Advance | Many credit cards allow you to withdraw cash, though usually with a higher interest rate and fees than regular purchases. | Quick access to funds; readily available if you already possess a credit card. | High interest rates; fees; can negatively impact credit score if not managed carefully; interest accrues immediately. |

| Borrowing from Family or Friends | This involves requesting a loan from trusted individuals in your personal network. | Potentially lower interest rates or no interest at all; flexible repayment terms; strengthens personal relationships (if handled responsibly). | Can strain relationships if not managed carefully; lack of formal agreement may lead to misunderstandings; may not be a feasible option for everyone. |

Comparison of Payday Loans vs. Alternative Solutions

Payday loans, while offering quick access to cash, are often characterized by extremely high interest rates and short repayment periods. This can create a cycle of debt that is difficult to escape. In contrast, the alternative solutions presented above generally offer lower interest rates, more manageable repayment plans, and a less damaging impact on credit scores.

The key difference lies in the long-term financial consequences. While payday loans provide immediate relief, they often lead to a snowball effect of debt, whereas alternatives like personal loans or borrowing from family and friends can be structured for responsible repayment and avoid such pitfalls. Credit card cash advances represent a middle ground, offering convenience but demanding careful management to avoid accumulating substantial debt.

Decision-Making Flowchart for Choosing a Financial Solution

The following flowchart illustrates a simplified decision-making process for selecting between a payday loan and an alternative financial solution. This process considers factors such as urgency, credit score, and access to alternative funding sources.

Flowchart Description: The flowchart begins with the question “Do you need immediate funds?”. If yes, it branches to “Do you have good credit?”. If yes, it suggests exploring personal loans or credit card cash advances. If no, it suggests considering borrowing from family or friends as a last resort before considering a payday loan. If the answer to “Do you need immediate funds?” is no, it suggests exploring alternative options with less urgency. Each decision point highlights the need for careful consideration of the long-term financial implications of each choice.

Financial Literacy Resources

Access to reliable financial literacy resources is crucial for Olathe, KS residents to build strong financial habits and avoid the high-cost cycle of payday loans. Understanding budgeting, saving, and responsible credit management empowers individuals to make informed financial decisions and achieve long-term financial stability. The following resources offer valuable tools and support to help navigate financial challenges.

Reputable Financial Literacy Resources in Olathe, KS

1. Kansas Consumer Credit Counseling Service (KCCCS): KCCCS offers free and low-cost credit counseling, debt management, and financial education services. They provide personalized guidance to help individuals create a budget, manage debt, and improve their financial well-being. Contact: (800) 442-2277 or visit their website (address would be inserted here if available; a search for “Kansas Consumer Credit Counseling Service” will yield the current contact information). KCCCS can help individuals develop a plan to manage their finances effectively, reducing reliance on high-interest loans like payday loans.

2. Consumer Financial Protection Bureau (CFPB): The CFPB is a federal agency dedicated to protecting consumers’ financial interests. Their website provides a wealth of free resources, including educational materials, tools, and guides on various financial topics such as budgeting, saving, credit reports, and debt management. Contact: Visit consumerfinance.gov. The CFPB’s resources equip individuals with the knowledge and tools to make informed financial choices, decreasing the likelihood of needing a payday loan.

3. National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that connects individuals with certified credit counselors. They offer various services, including budgeting workshops, debt management plans, and financial education programs. Contact: Find a local NFCC member agency by visiting nfcc.org. The NFCC’s services can provide personalized support to address financial challenges and build a path toward financial independence, eliminating the need for short-term, high-interest loans.

4. Johnson County Library System: Many public libraries offer free access to financial literacy resources, including books, workshops, and online courses. Contact: Visit the Johnson County Library website (address would be inserted here if available; a search for “Johnson County Library System” will yield the current contact information) to check for available programs. The library provides convenient access to valuable information that can enhance financial knowledge and empower individuals to make responsible financial decisions.

5. Local Banks and Credit Unions: Many financial institutions in Olathe offer free financial workshops or one-on-one consultations with financial advisors. Contact your local bank or credit union to inquire about available resources. These institutions often provide personalized advice and support tailored to individual circumstances, helping individuals avoid the trap of payday loans by offering alternative financial solutions.

Community Resources for Financial Assistance

Finding reliable financial assistance in Olathe, Kansas, is crucial for individuals facing financial hardship and seeking alternatives to high-interest payday loans. Several community organizations offer support and resources to help manage finances and navigate difficult economic situations. These resources can provide a safety net, preventing reliance on predatory lending practices.

Accessing these resources effectively involves understanding the services offered and tailoring your approach to your specific needs. Open communication with the organizations is key to receiving the most appropriate assistance. Careful planning and budgeting, often facilitated by these organizations, are vital for long-term financial stability.

Olathe Community Organizations Offering Financial Assistance

The following organizations provide financial assistance and counseling services to residents of Olathe, Kansas. It’s important to contact them directly to confirm current services and eligibility requirements, as programs and availability can change.

- Catholic Charities of Northeast Kansas

Contact Information: (To be filled in with accurate contact information from their website. Include phone number, address, and website URL.)

Services Offered: Catholic Charities offers a range of services, including emergency financial assistance for rent, utilities, and food. They may also provide case management and referrals to other resources. Their programs are often based on need and eligibility criteria. - Salvation Army Olathe

Contact Information: (To be filled in with accurate contact information from their website. Include phone number, address, and website URL.)

Services Offered: The Salvation Army provides various forms of assistance, including emergency financial aid, food pantries, and utility assistance. They also offer programs focused on long-term financial stability and often work with individuals to create a budget and develop financial management skills. - United Way of Greater Kansas City

Contact Information: (To be filled in with accurate contact information from their website. Include phone number, address, and website URL.)

Services Offered: While not solely focused on Olathe, the United Way serves the wider Kansas City area and offers a 211 helpline that connects individuals to a wide range of community resources, including financial assistance programs. They can provide referrals to relevant organizations and assist in navigating the application process for various aid programs.

How Community Organizations Assist in Financial Management

These organizations play a vital role in helping individuals avoid payday loans by providing alternative solutions to immediate financial needs. They often offer:

- Budgeting and Financial Counseling: Expert guidance on creating and sticking to a budget, understanding credit scores, and managing debt.

- Emergency Financial Assistance: Short-term aid for rent, utilities, or other essential expenses, preventing reliance on high-interest loans.

- Debt Management Strategies: Help in developing plans to manage existing debt and avoid accumulating more.

- Referral Services: Connections to other resources, such as job training programs or food banks, addressing multiple aspects of financial insecurity.

Effective Use of Community Resources During Financial Emergencies

To effectively utilize these resources, individuals should:

- Contact organizations promptly: Seek help as soon as a financial emergency arises.

- Gather necessary documentation: Prepare proof of income, bills, and other relevant financial information to support applications.

- Be honest and transparent: Provide accurate information to ensure eligibility for assistance.

- Follow up regularly: Maintain communication with the organization to track the progress of applications and receive updates.

- Actively participate in offered programs: Engage fully in budgeting workshops, financial literacy courses, or other programs to build long-term financial stability.

Ultimate Conclusion

Securing a payday loan in Olathe, KS, requires careful consideration. While these loans offer quick access to funds, understanding the associated fees, interest rates, and potential long-term financial burdens is paramount. Exploring alternative financial solutions and utilizing available community resources can often provide more sustainable and responsible ways to manage short-term financial difficulties. Remember, informed decision-making is key to navigating your financial situation effectively.

Detailed FAQs

What happens if I can’t repay my payday loan?

Failure to repay can lead to additional fees, damage to your credit score, and potential legal action. Contact your lender immediately if you anticipate difficulty repaying.

Are there any hidden fees associated with payday loans in Olathe?

Always review the loan agreement carefully for all fees and charges. Some lenders may have additional fees beyond the stated interest rate.

How long does it take to get approved for a payday loan?

Approval times vary by lender but are typically fast, often within the same day. However, processing times may be longer depending on the lender and your application.

Can I get a payday loan with bad credit?

Many payday lenders focus less on credit scores and more on your ability to repay. However, approval isn’t guaranteed, and interest rates may be higher.