PenFed Pledge Loan offers a compelling solution for borrowers seeking flexible financing options. Understanding its features, eligibility criteria, and the application process is crucial for making an informed decision. This guide dives deep into the intricacies of the PenFed Pledge Loan, comparing it to other loan types and providing insights into managing repayment effectively. We’ll explore interest rates, fees, and real-world scenarios to paint a clear picture of this financial product.

From loan amounts and terms to navigating the repayment process and understanding potential fees, we’ll cover all the essential aspects. We’ll also examine customer experiences to offer a balanced perspective, helping you determine if a PenFed Pledge Loan aligns with your financial goals. This comprehensive overview will equip you with the knowledge to confidently navigate the application and repayment stages.

PenFed Pledge Loan Overview

The PenFed Pledge Loan is a secured loan offered by PenFed Credit Union, using the borrower’s existing vehicle as collateral. This structure allows for potentially lower interest rates and larger loan amounts compared to unsecured personal loans. It’s designed to provide members with flexible financing for various needs, from debt consolidation to home improvements.

PenFed Pledge Loan Key Features and Benefits

The PenFed Pledge Loan offers several key features and benefits that make it an attractive option for eligible borrowers. These include competitive interest rates, potentially lower than those found on unsecured loans; flexible repayment terms tailored to individual financial situations; and the convenience of using existing assets as collateral, simplifying the application process. The loan proceeds can be used for a variety of purposes, providing borrowers with the financial flexibility to address diverse needs. Access to online account management tools allows for easy tracking of payments and loan balances.

PenFed Pledge Loan Eligibility Requirements

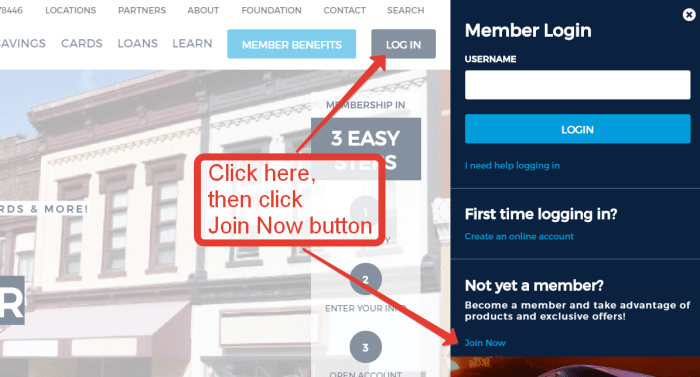

Eligibility for a PenFed Pledge Loan hinges on several factors. Applicants must be a member of PenFed Credit Union, possessing a satisfactory credit history and sufficient income to demonstrate repayment capacity. The vehicle used as collateral must meet PenFed’s valuation criteria, typically meaning it’s in good working condition and of sufficient value to secure the loan amount. Specific requirements regarding vehicle age, mileage, and loan-to-value ratios may apply and are subject to change. Detailed information is available directly from PenFed Credit Union.

PenFed Pledge Loan Application Process

The application process for a PenFed Pledge Loan is generally straightforward. It begins with submitting a loan application either online through PenFed’s website or in person at a branch location. The application requires providing personal and financial information, including details about the vehicle being used as collateral. PenFed will then review the application, assess creditworthiness, and appraise the vehicle. Once approved, the loan proceeds are typically disbursed within a short timeframe. The entire process is designed for efficiency and transparency.

PenFed Pledge Loan Interest Rates Compared to Similar Products

PenFed Pledge Loan interest rates are competitive with similar secured auto loans offered by other financial institutions. The exact rate offered will depend on various factors, including the borrower’s credit score, the loan amount, the loan term, and the vehicle’s value. While a direct comparison requires checking current rates from multiple lenders, it’s generally accepted that secured loans like the PenFed Pledge Loan often carry lower interest rates than unsecured personal loans due to the reduced risk for the lender. Borrowers should compare rates from several lenders to ensure they’re obtaining the most favorable terms. It’s advisable to carefully review all loan terms and conditions before accepting any loan offer.

Loan Amounts and Terms

PenFed Pledge Loans offer a range of loan amounts and repayment terms designed to accommodate various financial needs. Borrowers can access funds to consolidate debt, finance home improvements, or cover unexpected expenses, with flexible repayment options tailored to their individual budgets. Understanding the available loan amounts and terms is crucial for making an informed borrowing decision.

The specific loan amount and repayment terms offered will depend on several factors, including the borrower’s creditworthiness, income, and the purpose of the loan. PenFed typically provides loans ranging from a few thousand dollars to tens of thousands, with repayment periods that can extend for several years. The interest rate applied will also vary depending on these factors.

Loan Amount Examples and Repayment Terms

For example, a borrower seeking to consolidate high-interest credit card debt might qualify for a $10,000 loan with a 36-month repayment term. Alternatively, someone needing funds for home renovations could secure a $25,000 loan with a 60-month repayment term. These are illustrative examples, and the actual loan amount and term offered will be subject to PenFed’s underwriting process.

Loan Amounts, Interest Rates, and Monthly Payments

The following table provides examples of potential loan amounts, corresponding interest rates (APR), monthly payments, and loan term lengths. It’s important to note that these are illustrative examples and actual rates and payments may vary based on individual circumstances.

| Loan Amount | APR | Loan Term (Months) | Estimated Monthly Payment |

|---|---|---|---|

| $5,000 | 8.00% | 36 | $152 |

| $10,000 | 9.00% | 48 | $239 |

| $15,000 | 10.00% | 60 | $308 |

| $20,000 | 11.00% | 72 | $360 |

Note: These are estimated monthly payments and do not include any potential fees. The actual APR and monthly payment will be determined during the loan application process and will be reflected in the loan agreement.

Factors Influencing Loan Approval and Interest Rate Determination

Several factors influence both the approval of a PenFed Pledge Loan and the interest rate offered. These factors are carefully considered during the underwriting process to assess the borrower’s creditworthiness and risk profile.

Key factors include credit score, debt-to-income ratio (DTI), income stability, length of employment, and the purpose of the loan. A higher credit score and a lower DTI generally lead to better interest rates and a higher likelihood of loan approval. Consistent income and a long employment history also demonstrate financial stability, improving the chances of approval. The purpose of the loan may also influence the interest rate, as some purposes might be deemed riskier than others.

Fees and Charges Associated with the Loan: Penfed Pledge Loan

Understanding the fees associated with a PenFed Pledge Loan is crucial for budgeting and ensuring financial preparedness. These fees can impact the overall cost of borrowing, so it’s important to review them carefully before accepting the loan. This section details the potential fees you may encounter.

- Origination Fee: PenFed may charge an origination fee, a percentage of the loan amount, to cover the administrative costs of processing your loan application. The exact percentage will vary depending on several factors, including your creditworthiness and the loan terms. For example, a borrower with excellent credit might receive a lower origination fee compared to a borrower with a lower credit score. This fee is typically deducted from the loan proceeds at closing, meaning you receive less money upfront than the total loan amount.

- Late Payment Fee: Failure to make your monthly payments on time will result in a late payment fee. The specific amount of this fee is Artikeld in your loan agreement and will be added to your outstanding balance. Consistent late payments can negatively impact your credit score and may lead to further collection actions. It’s important to establish a system to ensure timely payments.

- Prepayment Penalty: PenFed’s policy regarding prepayment penalties should be explicitly stated in your loan documents. While some lenders charge a penalty for paying off your loan early, PenFed may or may not have such a fee. Review your loan agreement carefully to determine if early repayment will incur any additional costs. If a penalty does exist, it will likely be a percentage of the remaining principal balance or a fixed dollar amount, designed to compensate the lender for lost interest income.

Other Potential Fees

While the above are the most common fees, additional charges might apply depending on your specific circumstances. These could include fees for things like returned checks, wire transfers, or expedited processing of your loan application. Always carefully review all loan documentation before signing to understand all associated costs. Contacting PenFed directly for clarification on any unclear fees is highly recommended.

PenFed Pledge Loan vs. Other Loan Types

Choosing the right loan depends heavily on your financial situation and the intended use of funds. The PenFed Pledge Loan, with its focus on secured borrowing, offers a distinct profile compared to other common loan types. Understanding these differences is crucial for making an informed borrowing decision. This section compares and contrasts the PenFed Pledge Loan with personal loans, home equity loans, and auto loans.

PenFed Pledge Loan, Personal Loans, Home Equity Loans, and Auto Loans: A Comparison

The following table summarizes key differences between the PenFed Pledge Loan and other loan types. Remember that specific terms and conditions vary based on lender and individual circumstances.

| Feature | PenFed Pledge Loan | Personal Loan | Home Equity Loan | Auto Loan |

|---|---|---|---|---|

| Collateral | Secured; uses a Certificate of Deposit (CD) as collateral | Unsecured or secured (depending on the lender and borrower’s creditworthiness) | Secured; uses home equity as collateral | Secured; uses the vehicle as collateral |

| Interest Rates | Generally lower due to the secured nature | Variable, often higher than secured loans, reflecting higher risk | Generally lower than personal loans, but higher than mortgage rates | Variable, can be competitive depending on credit score and vehicle type |

| Loan Amounts | Varies depending on the value of the CD pledged | Varies widely depending on creditworthiness and lender | Up to a certain percentage of the home’s equity | Based on the vehicle’s value |

| Loan Terms | Typically shorter terms | Ranges from short-term to long-term options | Can be longer terms | Usually shorter to mid-range terms |

| Risk to Borrower | Lower risk of default as the CD acts as collateral, but potential loss of CD if unable to repay. | Higher risk of default, potentially impacting credit score significantly. | High risk of foreclosure if unable to repay, resulting in loss of home. | High risk of repossession if unable to repay, resulting in loss of vehicle. |

Advantages and Disadvantages of Each Loan Type

Each loan type presents a unique set of advantages and disadvantages. Careful consideration of these factors is essential for selecting the most suitable option.

Managing and Repaying the Loan

Responsible loan management is crucial for maintaining a healthy financial standing. Understanding your repayment options and adhering to the payment schedule minimizes financial strain and avoids potential negative consequences. This section details the various methods available for repaying your PenFed Pledge Loan and the implications of missed payments.

PenFed offers several convenient methods for repaying your Pledge Loan, ensuring flexibility to fit your financial routine. Choosing the method that best suits your preferences and lifestyle is essential for timely and efficient repayment.

Repayment Options

PenFed provides borrowers with multiple options for repaying their loans. These options aim to accommodate varying schedules and preferences. Borrowers can select the option that best aligns with their financial management style.

Generally, borrowers can choose between making monthly payments, which is the standard repayment method, or exploring options like accelerated repayment to reduce the overall interest paid. Specific details regarding available repayment plans should be confirmed directly with PenFed.

Making Loan Payments

PenFed offers several convenient ways to make your loan payments, prioritizing ease of access and diverse payment preferences. These methods allow for flexible and efficient management of loan repayments.

PenFed’s online portal provides a secure and user-friendly platform for managing loan payments. This platform typically allows for scheduled automatic payments, offering a convenient method to ensure timely repayment. Alternatively, payments can be submitted via mail using the provided address on your loan statement, or by phone via an automated payment system. Each method requires specific instructions and details, readily available through PenFed’s customer service channels.

Consequences of Missed Payments

Missing loan payments can lead to several negative financial repercussions. Understanding these consequences is crucial for responsible loan management. Failing to make timely payments can significantly impact your credit score and overall financial health.

Late payments result in late fees, increasing the total loan cost. Repeated late payments can damage your credit score, making it more difficult to secure future loans or obtain favorable interest rates. In severe cases, prolonged non-payment may lead to loan default, potentially resulting in legal action and negative impacts on your credit history. Maintaining consistent and timely payments is crucial to avoid these detrimental effects.

Illustrative Example of a PenFed Pledge Loan Scenario

This section presents a hypothetical scenario to illustrate how a PenFed Pledge Loan might work in a real-life situation. We will examine a borrower’s application, outlining the loan details, calculating the total interest paid, and showing how the loan payment integrates into their monthly budget. This example uses assumed interest rates and terms; actual rates and terms will vary based on individual creditworthiness and PenFed’s current offerings.

Let’s consider Sarah, a homeowner seeking to consolidate her high-interest debt. She applies for a PenFed Pledge Loan to refinance several credit cards and a personal loan.

Loan Details and Calculations

Sarah applies for a $20,000 PenFed Pledge Loan with a fixed annual interest rate of 7.5% over a 60-month term (5 years). Using a standard amortization calculator (readily available online), we can determine her monthly payment and total interest paid. The monthly payment would be approximately $398. Over the 60-month loan term, Sarah would pay approximately $7,880 in interest.

Total Interest Paid = (Monthly Payment x Number of Months) – Loan Amount = ($398 x 60) – $20,000 = $7,880

Sarah’s Monthly Budget and Loan Integration

Sarah’s current monthly budget is as follows:

| Expense Category | Amount |

|---|---|

| Mortgage | $1,500 |

| Utilities | $300 |

| Groceries | $500 |

| Transportation | $200 |

| Debt Payments (Pre-Loan) | $700 |

| Other Expenses | $300 |

| Total Expenses (Pre-Loan) | $3,500 |

By incorporating the $398 monthly PenFed Pledge Loan payment, her total monthly expenses increase to $3,898. While this represents an increase in her monthly outgoings, the lower interest rate on the PenFed Pledge Loan compared to her previous high-interest debts could lead to significant savings over the life of the loan. The reduction in overall interest expense may outweigh the increased monthly payment, ultimately improving her financial situation. This example highlights the importance of carefully considering one’s budget and financial goals before taking out any loan.

Customer Reviews and Experiences

Understanding customer feedback is crucial for assessing the overall satisfaction with the PenFed Pledge Loan. Analyzing both positive and negative reviews helps identify areas of strength and areas needing improvement in the loan process and customer service. This section summarizes common themes found in customer reviews, providing insights into the borrower experience.

Positive Customer Reviews, Penfed pledge loan

Many positive reviews highlight the ease and speed of the application process. Borrowers frequently praise the straightforward online application and the quick processing times, often receiving loan funds within a few days of approval. Another recurring theme centers on the excellent customer service provided by PenFed representatives. Customers describe helpful, responsive, and knowledgeable staff who readily address questions and concerns. Finally, the competitive interest rates offered by the PenFed Pledge Loan are frequently cited as a major advantage compared to other loan options. Several reviews specifically mention the loan’s favorable terms and conditions, contributing to overall positive experiences.

Negative Customer Reviews

While overwhelmingly positive, some negative reviews exist. A small number of customers reported difficulties navigating the online application portal, citing confusing instructions or technical glitches. These issues, however, appear to be isolated incidents and not indicative of widespread problems. A few reviews mention longer-than-expected processing times, although these instances seem to be exceptions rather than the norm. Finally, a very small percentage of reviews express dissatisfaction with specific aspects of the repayment process, primarily relating to minor communication issues. These issues, however, were often resolved promptly after contacting PenFed customer service.

Ease of Application

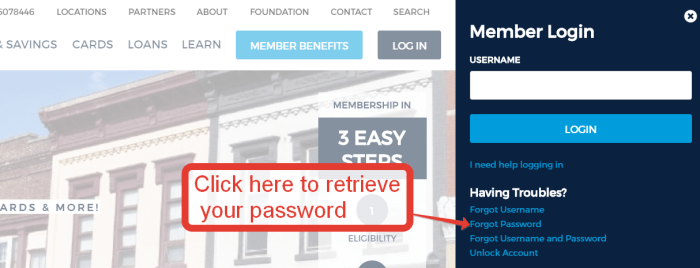

The application process for the PenFed Pledge Loan is generally considered straightforward and user-friendly. Many reviewers praised the intuitive online platform and the clear instructions provided. The streamlined process, coupled with quick processing times, significantly contributes to positive customer experiences. However, some users experienced minor technical difficulties or found certain sections of the application slightly confusing, though these instances are relatively infrequent.

Customer Service

PenFed’s customer service consistently receives high praise in customer reviews. Reviewers frequently cite the helpfulness, responsiveness, and knowledge of PenFed representatives. The ability to easily contact customer service representatives via phone, email, or online chat is often highlighted as a positive aspect. Prompt resolution of issues and the overall positive interactions contribute significantly to the positive perception of the loan.

Repayment Process

The repayment process is generally described as efficient and transparent. Most reviewers reported no significant difficulties with making payments. However, a small number of users experienced minor communication issues, such as delayed confirmation emails or unclear instructions regarding payment methods. These isolated instances did not significantly detract from the overall positive experience reported by the majority of borrowers.

Final Wrap-Up

Ultimately, the PenFed Pledge Loan presents a viable option for individuals needing financial assistance, but thorough research and careful consideration of your financial situation are paramount. By understanding the terms, fees, and repayment options, you can make a well-informed decision. Remember to compare this loan with alternatives to ensure you’re selecting the best fit for your needs. This guide provides a foundation for that process, empowering you to take control of your financial future.

Common Queries

What credit score is needed for a PenFed Pledge Loan?

PenFed doesn’t publicly list a minimum credit score, but a good to excellent credit score significantly improves approval chances.

Can I prepay my PenFed Pledge Loan?

Check your loan agreement for prepayment penalties. While prepayment is usually allowed, there might be associated fees.

What happens if I miss a payment on my PenFed Pledge Loan?

Late payment fees will apply, and your credit score will be negatively impacted. Repeated missed payments could lead to loan default.

How long does it take to get approved for a PenFed Pledge Loan?

Approval times vary, but generally, it’s faster than many traditional bank loans. Expect a response within a few days to a couple of weeks.

Does PenFed offer different repayment plans?

Contact PenFed directly to inquire about potential repayment plan options if you encounter financial hardship. They may offer hardship programs.