Personal loan to start a business Reddit: Navigating the complex world of small business funding often involves exploring various financing options. This exploration frequently leads entrepreneurs to online communities like Reddit, where they share experiences, advice, and cautionary tales about using personal loans to launch their ventures. This deep dive examines the Reddit discussions surrounding this crucial decision, analyzing the perspectives, challenges, and alternative funding strategies revealed in countless user posts.

We’ll dissect the types of personal loans discussed—from unsecured to peer-to-peer—weighing their pros and cons based on real-world Reddit examples. We’ll also delve into the inherent risks, common pitfalls, and valuable lessons learned by those who have successfully (and unsuccessfully) used personal loans to fuel their entrepreneurial dreams. Finally, we’ll explore alternative funding options frequently mentioned alongside personal loans, offering a comprehensive overview to help you make informed decisions about your business funding strategy.

Reddit Discussions on Personal Loans for Business Startups

Reddit serves as a significant platform for entrepreneurs to share their experiences, both positive and negative, regarding securing funding for their ventures. Discussions surrounding personal loans for business startups are common, revealing a complex landscape of financial risk and reward. Analyzing these threads provides valuable insights into the challenges and opportunities associated with this financing method.

Common Themes and Sentiments in Reddit Threads

Reddit discussions on using personal loans for business startups frequently revolve around several key themes. Users often express concerns about the personal financial risk involved, highlighting the potential for significant debt if the business fails. Conversely, many also emphasize the accessibility of personal loans compared to traditional business loans, particularly for individuals with limited credit history or those operating in high-risk industries. A recurring sentiment is the importance of meticulous planning and a realistic business plan before taking on such debt. Users frequently warn against impulsive decisions and advocate for thorough due diligence. There’s a significant amount of advice centered around diversifying funding sources, rather than relying solely on personal loans.

Examples of Successful and Unsuccessful Stories

Reddit threads are filled with anecdotal evidence of both successful and unsuccessful ventures funded by personal loans. Successful stories often feature individuals who meticulously planned their business, demonstrated strong financial discipline, and managed their debt effectively. These users frequently emphasize the importance of bootstrapping, reinvesting profits, and maintaining a healthy cash flow. Unsuccessful stories, on the other hand, typically highlight a lack of planning, poor financial management, and an inability to adapt to market changes. These narratives often serve as cautionary tales, emphasizing the importance of realistic expectations and risk mitigation. For example, one user recounted how their meticulously planned bakery, launched with a personal loan, thrived due to consistent marketing and high-quality products, while another described the failure of their online retail venture, attributing the downfall to poor inventory management and insufficient market research.

Categorization of User Comments

Reddit user comments can be broadly categorized into three perspectives: positive, negative, and cautious. Positive comments generally focus on the accessibility and flexibility of personal loans, emphasizing their role in enabling entrepreneurship. Negative comments often highlight the high-risk nature of this financing method and the potential for severe financial consequences. Cautious comments represent a balanced perspective, acknowledging both the benefits and risks, and often emphasize the need for thorough planning, realistic expectations, and a clear exit strategy.

Comparison of Pros and Cons of Using Personal Loans for Business Startups

| Pro | Con | Reddit User Example | Overall Sentiment |

|---|---|---|---|

| Accessibility: Easier to obtain than traditional business loans. | High Personal Risk: Potential for significant debt if the business fails. | “Got my personal loan approved within a week, couldn’t believe it! Now just need to make it work.” | Positive (but with inherent risk) |

| Flexibility: Funds can be used for various business needs. | Interest Rates: Can be higher than traditional business loans. | “The interest is killing me, but I’m hoping the business takes off soon.” | Negative (high financial burden) |

| Faster Funding: Typically quicker approval process than other loan types. | Impact on Personal Credit: Defaulting can severely damage credit score. | “I almost lost everything when my business failed. My credit is shot.” | Negative (severe consequences) |

| Control: Entrepreneurs maintain full control over their business. | Limited Funding: Personal loans may not provide sufficient capital for larger ventures. | “The loan was enough to get started, but I’m already looking for more funding.” | Cautious (needs further funding) |

Types of Personal Loans Mentioned on Reddit: Personal Loan To Start A Business Reddit

Reddit discussions regarding personal loans for business startups frequently mention several loan types, each with its own set of advantages and disadvantages. Understanding these nuances is crucial for entrepreneurs seeking funding. This section analyzes the most commonly discussed loan types, drawing on real examples from Reddit user experiences to illustrate their practical implications.

Unsecured Personal Loans

Unsecured personal loans are offered based solely on the borrower’s creditworthiness. They typically involve higher interest rates compared to secured loans due to the increased risk for the lender. Reddit users often discuss the convenience of unsecured loans, as they don’t require collateral. However, the higher interest rates and stricter eligibility criteria are frequently cited as drawbacks. Many users report obtaining unsecured loans from traditional banks or online lenders like LendingClub or Upstart, although experiences vary significantly based on individual credit scores and financial history. One Reddit user, for example, reported securing a $10,000 unsecured loan with a 12% APR from a local credit union, while another detailed their struggles to obtain an unsecured loan due to a less-than-perfect credit score.

Secured Personal Loans

Secured personal loans require collateral, such as a car or property, to mitigate the lender’s risk. This often translates to lower interest rates and potentially more favorable loan terms compared to unsecured loans. Reddit discussions highlight the security offered by secured loans, as borrowers risk losing their collateral if they default. However, the risk of losing valuable assets is a significant deterrent for some users. Examples from Reddit include users securing loans against their homes or vehicles to fund business ventures. The interest rates and loan terms varied widely depending on the collateral’s value and the lender’s assessment of the risk. One user mentioned securing a lower interest rate (8%) on a $25,000 loan using their home equity as collateral.

Peer-to-Peer (P2P) Lending, Personal loan to start a business reddit

Peer-to-peer lending platforms connect borrowers directly with individual investors. Reddit users often discuss the potential for more flexible loan terms and potentially lower interest rates compared to traditional banks. However, the approval process can be more stringent, and the lack of regulatory oversight in some platforms is a concern frequently raised. Many users mention using platforms like LendingClub or Prosper, citing both positive and negative experiences. Some reported successful funding with favorable terms, while others highlighted difficulties in securing loans or dealing with platform-related issues.

Table Summarizing Reddit User Experiences with Personal Loans

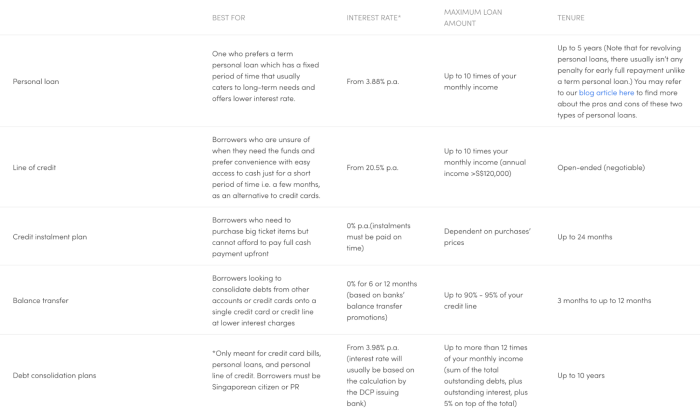

| Loan Type | Interest Rate Range | Loan Term (Months) | Eligibility Requirements |

|---|---|---|---|

| Unsecured Personal Loan | 8% – 20% | 12 – 60 | Good to excellent credit score, stable income, low debt-to-income ratio |

| Secured Personal Loan | 6% – 15% | 24 – 72 | Good credit score, sufficient collateral value, stable income |

| Peer-to-Peer Lending | 7% – 25% | 12 – 48 | Varying credit score requirements, income verification, detailed business plan often required |

Risks and Challenges Highlighted on Reddit

Reddit discussions regarding personal loans for business startups reveal a recurring theme: significant financial risk and numerous challenges. While the potential for entrepreneurial success is alluring, the reality for many Reddit users who’ve pursued this path is often fraught with difficulties, underscoring the need for careful planning and realistic expectations. This section explores the common pitfalls and challenges highlighted in these online conversations.

Financial Risks Associated with Using Personal Loans for Business Startups

Reddit users frequently express concern about the personal financial implications of using personal loans to fund business ventures. The most significant risk is the potential for personal bankruptcy if the business fails. Unlike business loans, personal loans hold the individual borrower personally liable for repayment, regardless of the business’s performance. This means that personal assets, such as homes and cars, could be at risk if the business is unable to generate sufficient revenue to cover loan repayments. Many Reddit threads detail the emotional and financial distress experienced by individuals facing this situation. Furthermore, high-interest rates on personal loans can quickly accumulate, significantly increasing the debt burden and further jeopardizing personal finances. The potential loss of savings, investments, and other personal assets to cover loan defaults is a consistently voiced concern.

Challenges Faced by Reddit Users Who Took Out Personal Loans for Their Businesses

Reddit users describe numerous operational and financial challenges. Many struggle with cash flow management, often underestimating the initial capital required and the ongoing expenses of running a business. Unexpected costs, such as repairs, marketing, or legal fees, frequently strain already tight budgets. Competition in the marketplace also poses a significant challenge, with many startups finding it difficult to attract customers and generate sufficient revenue to meet loan repayments. Furthermore, some Reddit users report difficulties in managing their time effectively, juggling the demands of running a business with the responsibilities of their personal lives. The pressure to succeed, coupled with the financial burden of a personal loan, can lead to significant stress and burnout.

Common Mistakes Made by Reddit Users in Securing and Managing Personal Loans for Business Purposes

A recurring theme on Reddit is the failure to adequately research and understand the terms of the loan agreement. Many users report accepting loans with unfavorable interest rates or hidden fees, leading to unforeseen financial difficulties. Insufficient planning and budgeting are also common mistakes. Without a well-defined business plan and realistic financial projections, it becomes difficult to accurately assess the loan amount needed and manage cash flow effectively. Furthermore, some Reddit users neglect to explore alternative funding options, such as small business loans or grants, which may offer more favorable terms. Finally, a lack of proper financial management and record-keeping practices contributes to difficulties in tracking expenses, monitoring progress, and making informed decisions about the business’s financial health.

Advice Reddit Users Offer to Others Considering This Path

Before taking out a personal loan for a business, Reddit users consistently advise thorough research and planning. This includes:

- Developing a comprehensive business plan with realistic financial projections.

- Exploring all available funding options, including small business loans and grants.

- Carefully comparing loan terms from multiple lenders to secure the most favorable interest rates and fees.

- Creating a detailed budget that accounts for all potential expenses.

- Maintaining accurate financial records and regularly monitoring cash flow.

- Seeking advice from experienced entrepreneurs or financial advisors.

- Understanding the personal liability associated with personal loans.

- Having a clear exit strategy in case the business fails.

Alternative Funding Options Discussed on Reddit

Reddit discussions surrounding business startups frequently delve into alternative funding options beyond personal loans. Understanding these alternatives and how Reddit users weigh their pros and cons is crucial for aspiring entrepreneurs. This section examines several popular alternatives, comparing them to personal loans and highlighting user experiences.

Redditors often explore a range of financing avenues, each with its own set of advantages and disadvantages. The choice often depends on factors like the business’s stage, the entrepreneur’s risk tolerance, and the availability of resources. Analyzing Reddit conversations reveals common themes in how users evaluate these options and the outcomes they experience.

Comparison of Funding Options

The following table compares personal loans with other commonly discussed business funding options on Reddit: crowdfunding, small business loans (SBA loans and others), and bootstrapping. Each option presents a unique set of trade-offs that Reddit users actively consider.

| Funding Option | Advantages | Disadvantages | Reddit User Experience |

|---|---|---|---|

| Personal Loan | Relatively easy to obtain (depending on credit score), predictable repayment terms, no equity dilution. | High interest rates, personal liability for debt, limited funding amounts. | Many Redditors report success with personal loans for smaller startups, but also express concerns about the potential burden of high interest and personal financial risk. Examples include users mentioning using loans from credit unions or banks for initial inventory or marketing expenses. Some report difficulties securing sufficient funds. |

| Crowdfunding | Potential for significant funding, increased brand awareness, validation of the business idea. | Requires significant marketing effort, success is not guaranteed, platform fees can be substantial, potential for negative reviews. | Reddit users often discuss the challenges of successful crowdfunding campaigns. Some share stories of achieving funding goals, while others highlight the difficulty of generating enough traction and the time commitment involved. Examples include users sharing experiences on Kickstarter or Indiegogo, detailing both successes and failures. |

| Small Business Loans (SBA Loans & Others) | Larger funding amounts available, potentially lower interest rates than personal loans, government backing (for SBA loans). | Strict eligibility requirements, lengthy application process, extensive documentation needed, collateral may be required. | Reddit users often express frustration with the complexity and length of the application process for small business loans. Successful applicants frequently mention having a strong business plan and excellent credit history. Others share stories of being denied due to insufficient collateral or weak financials. |

| Bootstrapping | No debt, full control over the business, builds financial discipline. | Slow growth, limited funding, requires significant personal sacrifice, may hinder scalability. | Reddit users who bootstrapped their businesses often praise the independence and financial control it provides, but also acknowledge the slower growth and significant personal investment required. They often share strategies for maximizing resources and minimizing expenses. Examples include users who reinvested profits or utilized personal savings extensively. |

Examples of Reddit User Experiences

While specific usernames and details are omitted to protect user privacy, numerous Reddit threads illustrate the diverse experiences users have with these funding options. One recurring theme is the importance of careful planning and realistic expectations. Users who thoroughly researched their options and developed comprehensive business plans were more likely to secure funding and achieve their goals. Conversely, those who underestimated the challenges or lacked a clear plan often faced difficulties. For example, one user described how securing an SBA loan took months and involved extensive paperwork, but ultimately allowed them to scale their business significantly. Another shared their experience of a failed crowdfunding campaign, highlighting the importance of a strong marketing strategy.

Legal and Financial Considerations from Reddit Discussions

Reddit discussions surrounding personal loans for business startups frequently highlight the crucial intersection of legal and financial responsibilities. Users consistently emphasize the need for thorough planning and understanding of the potential consequences before taking on such significant debt. Ignoring these aspects can lead to severe financial hardship and legal complications.

Legal Implications of Using Personal Loans for Business Ventures

Using a personal loan for business purposes doesn’t automatically transform the loan into a business debt. Reddit users often discuss the importance of maintaining a clear separation between personal and business finances, even when using personal funds to start a business. This separation is crucial for liability protection. Mixing personal and business funds can blur the lines of responsibility, potentially exposing personal assets to business-related lawsuits or debts. Redditors frequently advise maintaining separate bank accounts and meticulously tracking all income and expenses for both personal and business activities. Failure to do so could lead to difficulties in separating business and personal liabilities in case of legal disputes or bankruptcy. The specific legal implications can vary based on location and business structure, underscoring the need for legal counsel before proceeding.

Understanding Credit Scores and Financial Responsibilities

Redditors consistently stress the importance of understanding one’s credit score before applying for a personal loan. A strong credit score significantly impacts the interest rate and terms offered by lenders. Users share experiences of securing favorable loan terms due to excellent credit, while others describe the challenges faced with poor credit, including higher interest rates and stricter lending criteria. Understanding one’s financial capabilities is equally crucial. Reddit users often warn against borrowing more than they can comfortably repay, emphasizing the importance of creating a realistic business plan with projected income and expenses to assess loan repayment feasibility. Failing to account for unexpected expenses or revenue shortfalls can quickly lead to default and severe financial repercussions.

Examples of Reddit User Approaches to Legal and Financial Aspects

Many Reddit users describe meticulously researching different loan options, comparing interest rates and terms before making a decision. Some users highlight the importance of seeking professional financial advice from accountants or financial advisors to develop a comprehensive financial plan that includes loan repayment strategies. Others discuss the benefits of consulting with a lawyer to understand the legal implications of using personal loans for business ventures and to ensure they are structuring their business legally and appropriately. Several users detail their strategies for maintaining separate business and personal accounts, carefully tracking all income and expenses to ensure accurate financial reporting.

Warnings and Precautions Shared by Reddit Users Regarding Legal and Financial Aspects

Reddit users frequently share cautionary tales and offer vital warnings. These cautions underscore the seriousness of this financial decision and highlight the need for thorough preparation.

- Thoroughly research lenders and loan terms: Avoid predatory lenders offering unfavorable interest rates or hidden fees.

- Understand the implications of loan default: Defaulting on a loan can severely damage credit scores and lead to legal action.

- Maintain meticulous financial records: Accurate accounting is crucial for tax purposes and demonstrating financial responsibility.

- Consult with legal and financial professionals: Seek advice from lawyers and financial advisors to navigate legal and financial complexities.

- Develop a realistic business plan: A well-defined business plan is crucial for assessing loan repayment feasibility.

- Never borrow more than you can comfortably repay: Overborrowing can lead to overwhelming debt and financial ruin.

- Keep personal and business finances separate: Maintaining separate accounts protects personal assets from business liabilities.

Epilogue

Ultimately, the Reddit discussions surrounding personal loans for business startups paint a nuanced picture. While the potential rewards are undeniable—the chance to pursue your entrepreneurial vision—the risks are equally significant. Careful planning, a realistic assessment of your financial situation, and a thorough understanding of the loan terms are crucial. By leveraging the collective wisdom and cautionary tales shared on Reddit, aspiring entrepreneurs can better navigate this critical financial decision, increasing their chances of success while mitigating potential pitfalls. Remember to explore all available options and seek professional financial advice before committing to any funding path.

Questions and Answers

What is the average interest rate for personal loans used to start a business, according to Reddit?

Reddit discussions show a wide range, depending on credit score and loan type. Expect higher rates than traditional business loans.

How can I improve my chances of approval for a personal loan for my business?

A strong credit score, a well-developed business plan, and demonstrating sufficient collateral (if seeking a secured loan) are key.

Are there any legal implications I should be aware of when using a personal loan for business purposes?

Yes, it’s crucial to understand the tax implications and potential liability issues. Consult with a legal and financial professional.

What are some red flags to watch out for when considering a personal loan for business?

Predatory lending practices, extremely high interest rates, and unclear terms are all significant red flags.