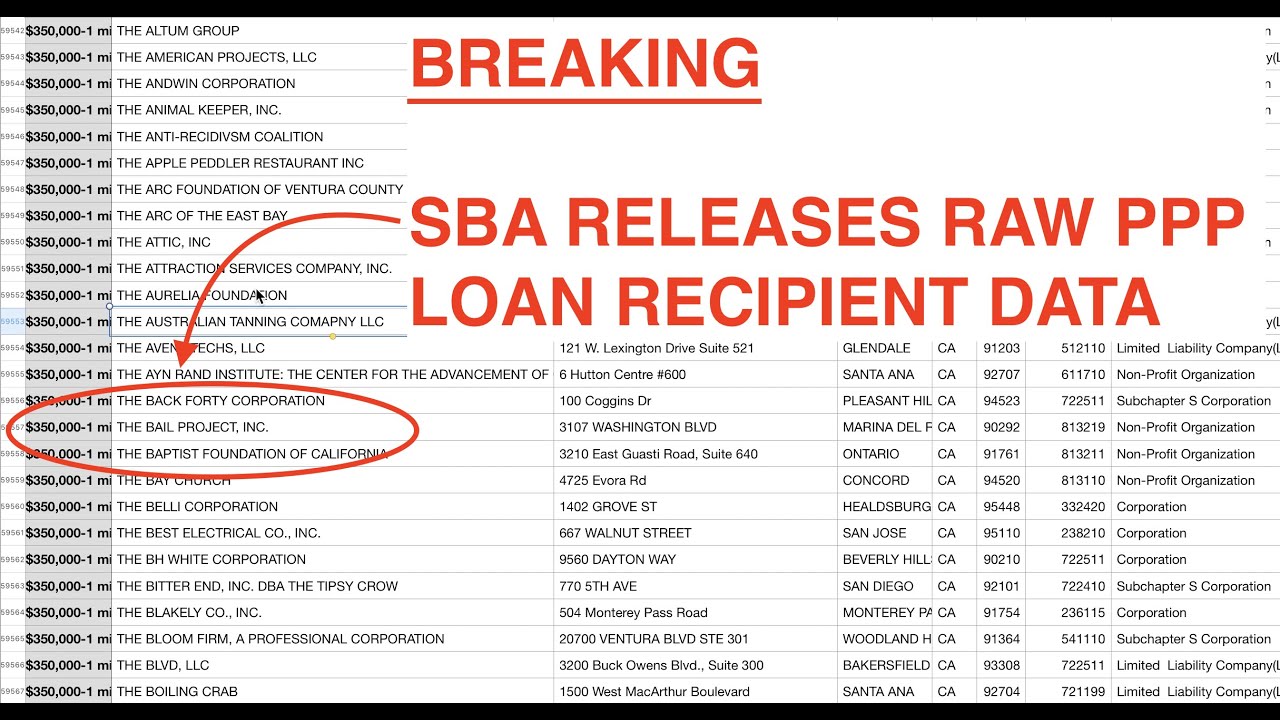

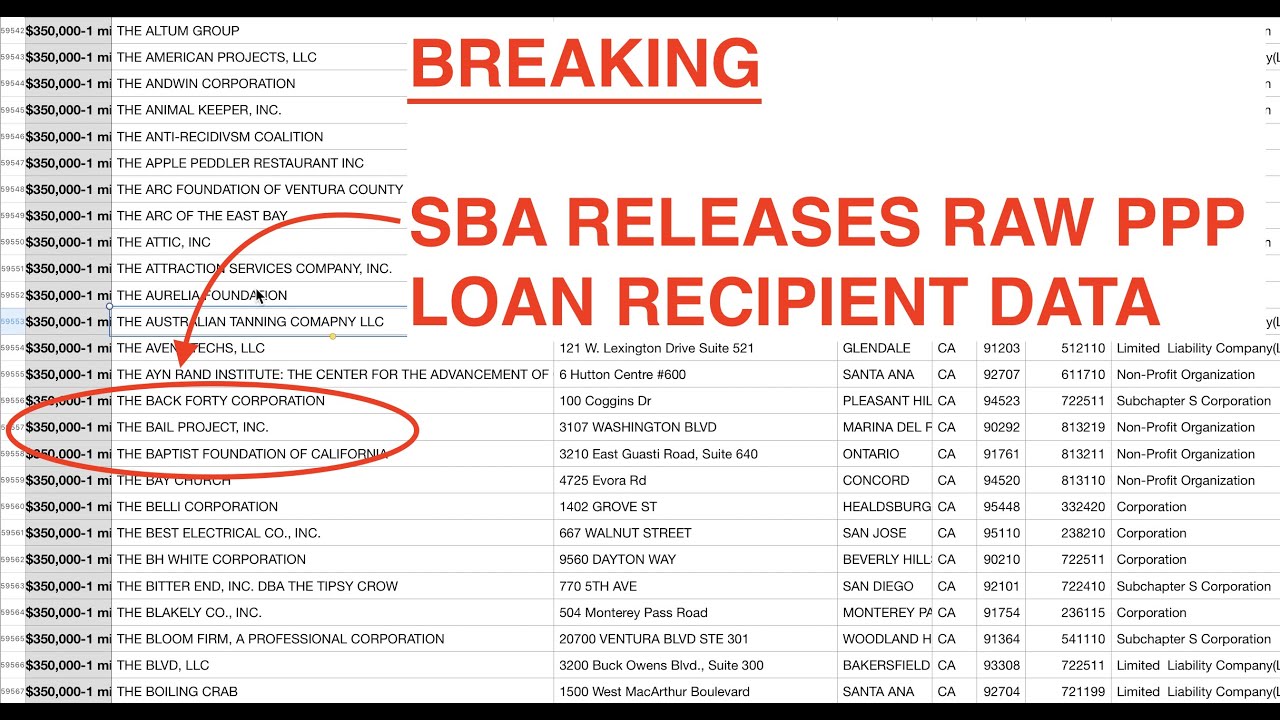

Understanding PPP Loan Eligibility in Georgia

Securing a Paycheck Protection Program (PPP) loan can be a lifeline for Georgia businesses facing financial hardship. Understanding the eligibility criteria is crucial for a successful application. This guide provides a clear overview of the requirements, ensuring you’re well-prepared to navigate the process.

PPP Loan Eligibility Criteria for Georgia Businesses

Georgia businesses, like those in other states, needed to meet specific criteria to be eligible for PPP loans. These requirements focused on factors such as business type, employee count, and operational timeline. For instance, sole proprietorships, independent contractors, self-employed individuals, and small businesses with fewer than 500 employees were generally eligible. Specific industries, such as those severely impacted by the pandemic, might have had additional considerations. It’s crucial to remember that eligibility guidelines evolved throughout the various PPP loan rounds, so referencing the specific rules for the relevant period is essential.

PPP Loan Amounts Based on Employee Count and Payroll

The amount a Georgia business could receive was directly tied to its payroll costs and employee count. Generally, the loan amount was calculated based on 2.5 times the average monthly payroll costs over the prior year. Businesses with fewer employees typically received smaller loans, while larger businesses with higher payroll expenses could qualify for larger amounts. There were also limitations on the maximum loan amount available. For example, a business might have been capped at a certain dollar figure regardless of its payroll costs. The precise calculation varied based on the specific PPP loan program round and its associated guidelines.

Documentation Required for PPP Loan Application in Georgia

A comprehensive application required several key documents. These included tax returns (such as Schedule C for self-employed individuals or Form 1065 for partnerships), payroll records, and bank statements. Providing accurate and complete documentation was crucial for a swift and successful application. Incomplete or inaccurate documentation could lead to delays or even application rejection. Furthermore, the specific documentation requirements might have changed between different rounds of the PPP program.

Comparison of Georgia’s PPP Eligibility with Other States

While the core eligibility requirements for PPP loans were largely consistent across all states, minor variations might have existed. These differences were usually related to state-specific regulations or interpretations of federal guidelines. However, the fundamental criteria regarding business size, employee count, and payroll remained largely uniform nationwide. The application process and required documentation were also largely consistent across states, although minor administrative differences might have been present. The key takeaway is that while Georgia businesses followed the national guidelines, a detailed understanding of the specific requirements for the applicable loan round was critical for a successful application.

Locating Resources for PPP Loan Information in Georgia

Navigating the complexities of the Paycheck Protection Program (PPP) can be challenging, especially when seeking information specific to Georgia. Fortunately, several reputable sources provide comprehensive and up-to-date details on eligibility, application processes, and forgiveness requirements. Understanding where to find this information is crucial for a successful application and loan management. This section will guide you to the most reliable resources.

Ppp loan list georgia – Accessing accurate and timely information is paramount when dealing with government programs like the PPP. Misinformation can lead to delays, denials, or even legal complications. Therefore, relying on official sources is critical. The resources listed below are vetted and offer reliable information directly from government agencies or their authorized partners.

Reputable Resources for PPP Loan Information in Georgia

The following table lists key resources for finding reliable PPP loan information in Georgia. Remember to always verify information against multiple sources to ensure accuracy.

| Resource Name | URL | Description | Contact Information |

|---|---|---|---|

| U.S. Small Business Administration (SBA) | https://www.sba.gov/ | The primary source for all PPP information, including guidelines, application forms, and frequently asked questions. | Contact information varies by program and can be found on their website. |

| Georgia Department of Economic Development (GDEcD) | [Insert GDEcD URL if available; otherwise, state “Information not readily available online. Contact GDEcD directly.”] | The Georgia state agency responsible for economic development, potentially offering resources and support for Georgia-based businesses seeking PPP loans. | [Insert GDEcD contact information if available; otherwise, state “Contact information can be found on their website.”] |

| SCORE | https://www.score.org/ | A non-profit organization offering free mentoring and business advice, including guidance on navigating the PPP loan process. | Contact information varies by location and can be found on their website. |

| Small Business Development Centers (SBDCs) | [Insert general SBDC website URL or state-specific URL if available; otherwise, state “Search ‘Georgia Small Business Development Centers’ online for local contact information.”] | These centers provide business counseling and training, often including assistance with loan applications. Find your local SBDC for personalized help. | Contact information varies by location and can be found online through a search. |

Common Misconceptions Regarding PPP Loans in Georgia

Several misunderstandings surround PPP loans. Clarifying these misconceptions is essential for a smooth application process and successful loan forgiveness.

- Misconception: Only businesses severely impacted by the pandemic are eligible for PPP loans. Correction: While the program aimed to assist businesses affected by the pandemic, eligibility criteria were broader, encompassing businesses experiencing economic injury due to the pandemic’s impact. Many businesses experienced reduced revenue or disruptions, meeting the eligibility thresholds.

- Misconception: The PPP loan forgiveness process is automatic. Correction: Loan forgiveness requires submitting a detailed application demonstrating how the loan funds were used for eligible expenses (payroll, rent, utilities, etc.). Meeting all requirements is crucial for forgiveness.

- Misconception: You need a perfect credit score to qualify for a PPP loan. Correction: While a good credit history is beneficial, it’s not the sole determinant. The SBA considers various factors, including business history, revenue, and the impact of the pandemic on the business.

- Misconception: All PPP loan applications are processed instantly. Correction: Processing times varied depending on the lender and the volume of applications. While some applications were processed quickly, others experienced delays.

PPP Loan Forgiveness in Georgia

Securing PPP loan forgiveness is crucial for Georgia businesses that received funding under the Paycheck Protection Program. Understanding the process, required documentation, and specific requirements is key to a successful application and avoiding potential complications. This section details the steps involved in applying for forgiveness and clarifies any differences between Georgia’s implementation and national standards.

The process of applying for PPP loan forgiveness in Georgia mirrors the national process, but it’s essential to understand the specific nuances and ensure complete compliance. Failure to meet the requirements can result in the loan being considered ineligible for forgiveness, leading to repayment obligations.

PPP Loan Forgiveness Application Process in Georgia

The application process begins by accessing the appropriate forgiveness application form through the SBA’s website or your lender’s portal. Georgia businesses must submit their application through their respective lenders, who will then forward it to the SBA for processing. The application requires detailed financial information, demonstrating how the loan funds were utilized to meet the eligibility criteria. Timely submission is crucial, as there are deadlines for applications. Late submissions may result in penalties or denial of forgiveness.

Documentation Required for PPP Loan Forgiveness in Georgia

Comprehensive documentation is vital for a successful forgiveness application. This includes, but is not limited to, payroll records demonstrating employee compensation, documentation of mortgage interest payments, rent payments, and utility payments. Detailed records of how the funds were spent are critical. Businesses should maintain meticulous records, including bank statements, invoices, and receipts, to support their claims. Failure to provide sufficient documentation can lead to delays or rejection of the application.

Step-by-Step Guide for Georgia Businesses Seeking Loan Forgiveness

- Gather Necessary Documentation: Compile all relevant financial records, including payroll data, rent receipts, utility bills, and mortgage interest statements. Ensure all documentation accurately reflects the use of PPP funds.

- Complete the Forgiveness Application: Download the appropriate application form from the SBA website or your lender’s portal. Carefully and accurately complete all sections, providing detailed information and supporting documentation.

- Submit the Application to Your Lender: Submit the completed application and all supporting documentation to your lender. Confirm the submission and request a confirmation number or tracking information.

- Monitor the Application Status: Track the status of your application through your lender or the SBA portal. Be prepared to respond to any requests for additional information from your lender or the SBA.

- Review the Decision: Once a decision is made, review it carefully. If the application is denied, understand the reasons and consider options for appeal or reconsideration.

Comparison of Georgia Forgiveness Requirements to National Standards

Georgia follows the national standards for PPP loan forgiveness. There are no unique state-specific requirements that deviate from the federal guidelines. However, it’s crucial to ensure that all documentation complies with both state and federal regulations to avoid any complications. The key requirements, such as the permissible uses of funds (payroll, rent, utilities, mortgage interest) and the calculation of loan forgiveness amounts, remain consistent across all states. Businesses should refer to the SBA’s official guidelines for the most up-to-date and accurate information.

Impact of PPP Loans on Georgia Businesses: Ppp Loan List Georgia

The Paycheck Protection Program (PPP) loans had a profound and multifaceted impact on Georgia’s small businesses, acting as a crucial lifeline for many during the economic uncertainty of the COVID-19 pandemic. While the program undeniably provided critical support, its effects were not uniformly positive, and businesses faced various challenges in accessing and utilizing these funds. Understanding both the benefits and drawbacks is crucial to assessing the program’s overall effectiveness in Georgia.

The positive impacts of PPP loans in Georgia were significant. Many businesses were able to avoid layoffs and maintain their operations, preventing widespread unemployment and economic disruption. The loans provided crucial working capital, allowing businesses to cover payroll, rent, utilities, and other essential expenses during periods of severely reduced revenue. This prevented a potential cascade of business failures that could have further destabilized the Georgia economy.

Positive Impacts of PPP Loans on Georgia Businesses

PPP loans enabled many Georgia businesses to retain employees, preventing widespread job losses. For example, a small restaurant in Atlanta used its PPP loan to continue paying its staff throughout the initial lockdown, avoiding the need for layoffs and maintaining a trained workforce ready to serve customers once restrictions were eased. Similarly, a construction company in Savannah used its loan to cover payroll and material costs for ongoing projects, preventing project delays and maintaining its client relationships. The influx of capital also allowed businesses to adapt to the changing market conditions, such as investing in online ordering systems or implementing safety protocols.

Negative Impacts of PPP Loans on Georgia Businesses

Despite the significant benefits, some Georgia businesses faced challenges with the PPP program. The application process was initially complex and confusing, creating hurdles for smaller businesses with limited administrative resources. Some businesses struggled to understand the loan forgiveness requirements, leading to confusion and delays in receiving forgiveness. Furthermore, the initial loan amounts were not always sufficient to cover the extended period of reduced revenue, leaving some businesses still struggling financially even after receiving a PPP loan. For example, a small retail store in Macon received a PPP loan but found it insufficient to cover rent and inventory costs for the entire duration of the pandemic-related restrictions.

Examples of PPP Loan Usage in Georgia Businesses

Georgia businesses utilized PPP loans for a variety of purposes, reflecting the diverse needs of the state’s economy. Many businesses, as previously mentioned, prioritized payroll expenses. Others used the funds to cover rent and mortgage payments, preventing evictions and foreclosures. Some businesses invested in personal protective equipment (PPE) and other safety measures to ensure the health and safety of their employees and customers. Others used the loans to adapt their business models, such as investing in online sales platforms or expanding delivery services. Finally, some businesses used the loans to cover debt payments, helping them to improve their financial stability.

Economic Effects of PPP Loans on Georgia’s Economy

While precise quantification is difficult, it’s reasonable to hypothesize the economic impact using illustrative data. Let’s assume that 50,000 Georgia small businesses received an average PPP loan of $50,000. This represents a total injection of $2.5 billion into the Georgia economy. If we further hypothesize that 75% of this amount was used to maintain payroll, this translates to $1.875 billion directly supporting wages and preventing unemployment. This prevented a potential loss of hundreds of thousands of jobs and maintained consumer spending, preventing a more severe economic downturn. This hypothetical example highlights the significant potential for economic stimulus provided by the PPP program.

Challenges in Accessing and Utilizing PPP Loans in Georgia

Many Georgia businesses faced challenges in accessing and utilizing PPP loans. These challenges included navigating complex application processes, meeting stringent eligibility requirements, and understanding the loan forgiveness provisions. Some businesses lacked the financial expertise or administrative capacity to effectively manage the application process. Furthermore, the initial rollout of the program was plagued by technical glitches and delays, further exacerbating the difficulties faced by many small businesses. Access to reliable information and guidance was also a significant challenge for some businesses.

Georgia-Specific PPP Loan Scams and Fraud Prevention

The Paycheck Protection Program (PPP) offered a lifeline to many Georgia businesses during the pandemic, but unfortunately, it also attracted a wave of fraudulent activity. Understanding the common scams and implementing robust preventative measures is crucial for protecting your business and its financial well-being. This section Artikels common scams targeting Georgia businesses and provides practical strategies to avoid becoming a victim.

The sheer volume of PPP applications created an environment ripe for exploitation by fraudsters. These individuals and organizations preyed on the urgency and confusion surrounding the program, employing various deceptive tactics to steal sensitive information and funds. Knowing how to identify these schemes is the first step in safeguarding your business.

Common PPP Loan Scams Targeting Georgia Businesses

Several types of scams specifically targeted Georgia businesses during the PPP loan application process. These included phishing emails mimicking official government agencies, fraudulent websites designed to collect personal and financial information, and individuals posing as loan consultants promising guaranteed approvals for a fee. These scams often involved requests for upfront payments, promises of expedited processing, and deceptive marketing materials. One example involved emails appearing to be from the Small Business Administration (SBA) requesting immediate login credentials to access a supposed PPP portal. Another involved fake loan consultants advertising their services on social media platforms, promising faster approval than official channels.

Identifying and Avoiding PPP Loan Scams

Identifying and avoiding these scams requires vigilance and a healthy dose of skepticism. Never respond to unsolicited emails or calls requesting sensitive information. Always verify the legitimacy of any communication by contacting the SBA directly through official channels. Be wary of any offer that seems too good to be true, particularly those that promise guaranteed approval or require upfront payments. Remember, the SBA does not charge fees for processing PPP loan applications. Official SBA communication will always be professional and avoid any sense of urgency or pressure. Legitimate loan processors will never ask for your bank account login details or passwords.

Protecting Sensitive Business Information During the PPP Loan Application Process

Protecting your business information is paramount throughout the application process. Use strong, unique passwords for all online accounts related to your application. Avoid using public Wi-Fi when accessing sensitive information. Ensure that your computer and software are up-to-date with the latest security patches. Only share your information with trusted sources and verify their identity before providing any sensitive details. Review your bank statements regularly for any unauthorized transactions. If you suspect fraudulent activity, report it immediately to the appropriate authorities, including the SBA and the Federal Bureau of Investigation (FBI).

Preventative Measures for Avoiding PPP Loan Fraud

To effectively safeguard your business, consider the following preventative measures:

- Verify the identity of anyone contacting you regarding PPP loans by contacting the SBA directly.

- Never share your banking details or passwords with anyone over the phone or email.

- Be wary of unsolicited emails or phone calls promising guaranteed loan approval.

- Use strong, unique passwords for all online accounts.

- Report any suspicious activity to the appropriate authorities immediately.

- Only use official SBA websites and resources for information.

- Review your bank statements regularly for any unauthorized transactions.

- Consult with a trusted financial advisor or accountant before making any decisions related to PPP loans.

Illustrative Example of a Successful PPP Loan Application in Georgia

Savannah Sweets, a small bakery in Savannah, Georgia, faced significant challenges during the initial months of the COVID-19 pandemic. With foot traffic plummeting and event cancellations piling up, their revenue dropped by over 60%. Recognizing the need for urgent financial assistance, the owners, Sarah and Tom Miller, decided to apply for a PPP loan. Their proactive approach and meticulous preparation ultimately led to a successful application.

Savannah Sweets’ PPP Loan Application Process

Sarah and Tom began by thoroughly researching the PPP loan program requirements and eligibility criteria. They meticulously gathered all the necessary documentation well in advance of the application deadline. This included their business tax returns for the past two years, payroll records demonstrating employee compensation, and bank statements showing their average monthly payroll. Understanding the importance of a clean and organized application, they prepared a detailed business plan highlighting their pre-pandemic revenue, projected losses, and plans for utilizing the loan funds to retain their employees and maintain operations.

Visual Elements of the Successful Application, Ppp loan list georgia

The application itself was submitted electronically through their bank’s online portal. The online forms were completed with utmost precision, ensuring accuracy in every field. Supporting documents were uploaded as clear, high-resolution PDF files. Each document was clearly labeled and organized in a logical order, making it easy for the lender to review. For example, the payroll records were presented in a tabular format with clear column headers (employee name, pay period, gross pay, etc.), while the bank statements were formatted to easily highlight the average monthly payroll figures. The business plan was a concise, well-written document, free of grammatical errors and presented with professional formatting, including headings, subheadings, charts, and graphs to visually represent key financial data. The overall presentation of the application was professional, demonstrating a high level of organization and attention to detail. This meticulous preparation clearly communicated their commitment to responsible business practices and significantly contributed to their successful loan application.

Challenges Faced and Solutions Implemented

One significant challenge Savannah Sweets faced was accurately calculating their average monthly payroll. They had experienced some fluctuations in their payroll expenses over the previous year due to seasonal changes in demand. To address this, they carefully reviewed their payroll records, consulting with their accountant to determine the most accurate and compliant method for calculating their average monthly payroll based on the SBA guidelines. They also proactively prepared responses to potential questions regarding any inconsistencies or fluctuations in their payroll data. Another challenge was ensuring they met all the eligibility requirements, specifically the requirement of maintaining employee headcount and compensation levels. They developed a detailed plan to ensure compliance with these conditions, including projecting their payroll expenses for the loan forgiveness period.