PPP Loans Florida: Navigating the complexities of securing a Paycheck Protection Program loan in the Sunshine State can feel overwhelming. This guide cuts through the confusion, offering a comprehensive overview of eligibility requirements, the application process, loan forgiveness, common challenges, and available resources. Whether you’re a sole proprietor, partnership, or corporation, understanding the nuances of PPP loans in Florida is crucial for accessing vital financial support.

From deciphering eligibility criteria based on employee count and revenue to mastering the application process and navigating the forgiveness requirements, we’ll equip you with the knowledge to successfully navigate the PPP loan landscape. We’ll also explore common pitfalls and offer solutions to overcome potential obstacles, ensuring you have the best chance of securing and utilizing this critical funding.

PPP Loan Eligibility in Florida

The Paycheck Protection Program (PPP) offered forgivable loans to eligible businesses to help them retain employees and cover operating expenses during the COVID-19 pandemic. While the program has largely concluded, understanding its eligibility criteria remains relevant for future economic assistance programs and historical context. This section details the specific eligibility requirements for businesses in Florida seeking PPP loans.

Florida Business Eligibility Criteria

To be eligible for a PPP loan in Florida, businesses had to meet several criteria, consistent with national guidelines. These included being a for-profit, non-profit, or self-employed individual operating in Florida, demonstrating economic injury due to the pandemic, and agreeing to use the funds for specific allowable expenses such as payroll, rent, utilities, and mortgage interest. The specific requirements varied somewhat based on the business structure.

Eligibility Requirements by Business Type

The fundamental eligibility criteria remained consistent across different business structures in Florida. However, the documentation required to prove eligibility varied. Sole proprietorships, partnerships, corporations, and limited liability companies (LLCs) all generally qualified, provided they met the core requirements. The key difference lay in the methods of demonstrating revenue and employee count. Sole proprietors used their personal tax returns, partnerships used partnership returns, and corporations and LLCs used their respective business tax filings.

Impact of Employee Count and Revenue

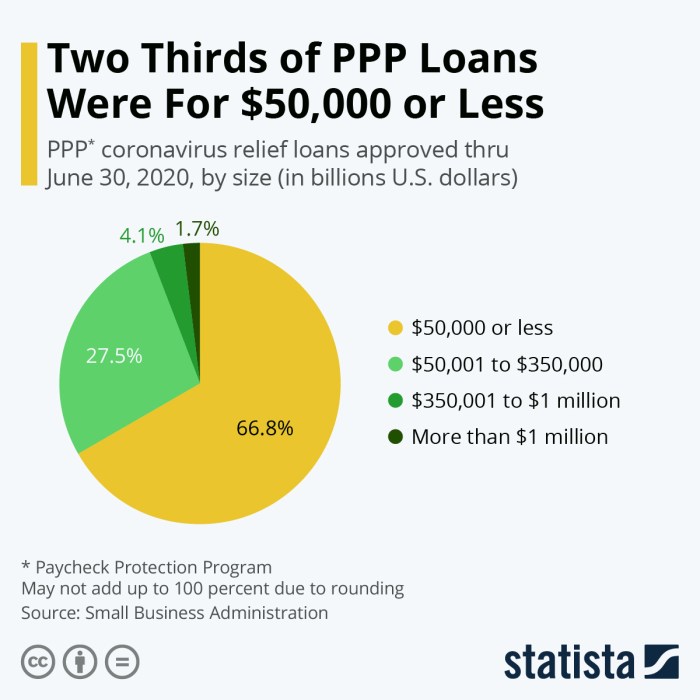

Employee count and revenue were crucial factors in determining loan amounts. The maximum loan amount was based on a calculation involving the average number of employees and average monthly payroll costs. While there weren’t strict revenue caps, businesses with higher revenue generally received larger loans, reflecting their greater payroll expenses and potential economic impact. There were also loan size limitations based on the number of employees.

Examples of Qualifying and Non-Qualifying Businesses

A small restaurant in Miami employing 10 people and demonstrating a significant revenue drop due to pandemic restrictions would likely qualify. Conversely, a large national corporation with thousands of employees and substantial revenue would likely not qualify as it did not fit the program’s focus on small businesses. A freelance graphic designer operating as a sole proprietorship in Orlando, showing reduced income due to the pandemic, would also likely be eligible. A large publicly traded company, however, would not have met the small business size standards.

PPP Loan Eligibility Summary Table

| Business Type | Eligibility Criteria | Revenue Limits | Employee Limits |

|---|---|---|---|

| Sole Proprietorship | Self-employed, demonstrated economic injury, operating in Florida | No strict limit, but loan amount based on income | One |

| Partnership | Partnership operating in Florida, demonstrated economic injury | No strict limit, but loan amount based on payroll | No strict limit, but loan size impacted |

| Corporation | Corporation operating in Florida, demonstrated economic injury | No strict limit, but loan amount based on payroll | No strict limit, but loan size impacted |

| LLC | LLC operating in Florida, demonstrated economic injury | No strict limit, but loan amount based on payroll | No strict limit, but loan size impacted |

Application Process for Florida PPP Loans

Securing a Paycheck Protection Program (PPP) loan in Florida involves a multi-step process that requires careful preparation and adherence to specific guidelines. Understanding the application procedure, necessary documentation, and the role of lenders is crucial for a successful application. This section details the steps involved, highlighting key differences between first-time and second-draw applications.

Required Documentation for PPP Loan Applications

Applicants must gather comprehensive documentation to support their loan application. This documentation verifies eligibility and the requested loan amount. Incomplete applications will likely be delayed or rejected. Key documents typically include:

- Completed PPP loan application form.

- Tax returns (Form 1040, Schedule C or equivalent) for the prior year(s).

- Payroll documentation (pay stubs, payroll tax forms, etc.) demonstrating employee compensation.

- Bank statements showing average monthly expenses.

- Proof of business ownership (articles of incorporation, EIN, etc.).

- A detailed description of how the loan funds will be used to support business operations.

The Role of Florida-Based Lenders in the PPP Loan Process

Florida-based lenders, including banks, credit unions, and online lenders, play a pivotal role in facilitating the PPP loan process. They act as intermediaries between the Small Business Administration (SBA) and borrowers. Lenders assess applicant eligibility, process applications, and disburse approved loan funds. Choosing a lender with experience in PPP loans is highly recommended to ensure a smooth and efficient application process. The lender will also guide the borrower through the loan forgiveness process after the loan term.

Step-by-Step Application Process for Florida PPP Loans

The application process, while seemingly straightforward, requires meticulous attention to detail. Each step is crucial for a successful outcome.

- Choose a Lender: Select a lender familiar with PPP loans and comfortable with your business type and size.

- Gather Required Documentation: Compile all necessary documentation as Artikeld previously.

- Complete the Application: Accurately and completely fill out the SBA’s PPP loan application form. This requires careful attention to detail, ensuring all information is correct and consistent with supporting documentation.

- Submit the Application: Submit the completed application and all supporting documents to your chosen lender.

- Review and Approval: The lender reviews the application and supporting documentation. This process may take several business days to several weeks, depending on the lender and the complexity of the application.

- Loan Disbursement: Upon approval, the lender disburses the loan funds to your designated bank account.

First-Time vs. Second-Draw PPP Loan Applications

The application process for second-draw PPP loans differs slightly from that of first-time applications. Key differences include eligibility requirements (demonstrating a 25% reduction in gross receipts) and the maximum loan amount. While the documentation requirements remain largely the same, the application form itself will specifically indicate that it is for a second draw. The overall process steps remain similar, but the eligibility criteria and the supporting documentation required to demonstrate eligibility changes significantly.

Flowchart Illustrating the Application Process

A simplified flowchart would depict the process as follows:

[Imagine a flowchart here. The flowchart would begin with “Start,” then branch to “Choose Lender,” followed by “Gather Documentation.” The next step would be “Complete Application,” leading to “Submit Application.” This would then branch into two possibilities: “Application Approved” (leading to “Loan Disbursement” and then “End”) and “Application Denied” (leading to “Review and Resubmit” or “End”).]

Forgiveness of PPP Loans in Florida: Ppp Loans Florida

Securing forgiveness for your Paycheck Protection Program (PPP) loan in Florida involves meeting specific criteria established by the Small Business Administration (SBA). Understanding these requirements is crucial for successful loan forgiveness application and avoiding potential complications. This section details the process and requirements for PPP loan forgiveness in Florida, which are largely consistent with nationwide guidelines.

PPP Loan Forgiveness Requirements in Florida

To qualify for PPP loan forgiveness in Florida, borrowers must meet several key requirements. These include using at least 60% of the loan proceeds for payroll costs within the covered period (typically eight to 24 weeks), maintaining employee headcount, and avoiding significant salary reductions. Specific documentation substantiating these expenditures is necessary to support the forgiveness application. The SBA offers detailed guidance on their website outlining these criteria, including specific calculations for determining payroll costs and allowable non-payroll expenses. Failure to meet these criteria will reduce the amount of loan forgiveness.

Documentation Needed for PPP Loan Forgiveness

Applying for PPP loan forgiveness requires meticulous record-keeping. Borrowers must submit a forgiveness application form along with supporting documentation proving eligible expenses. This documentation typically includes payroll records (e.g., pay stubs, bank statements showing payroll deposits), documentation of mortgage interest payments, rent payments, and utility payments. Detailed financial records, such as bank statements showing payments to vendors, are also typically required. The SBA’s online resources provide comprehensive checklists of required documentation. It is advisable to maintain thorough records throughout the loan period to simplify the forgiveness application process.

Examples of Eligible and Ineligible Expenses for Forgiveness

Eligible expenses for PPP loan forgiveness include payroll costs (salaries, wages, benefits), mortgage interest, rent, and utilities. Payroll costs encompass employee salaries, wages, commissions, and certain employee benefits such as health insurance and retirement contributions. Rent payments cover lease payments for business premises, while utility payments include electricity, gas, water, and internet services. Ineligible expenses include non-payroll costs exceeding 40% of the loan amount, owner compensation exceeding pre-pandemic levels, and expenses incurred prior to the covered period. Moreover, expenses that violate federal law or are used for illegal activities are ineligible.

Impact of Changes in Employment Levels on Forgiveness

Maintaining employment levels significantly impacts loan forgiveness. While there are exceptions for certain situations, a reduction in employee headcount or a decrease in employee salaries can reduce the amount of forgiveness received. The SBA provides specific calculations and guidelines for determining the impact of employment changes on forgiveness. For instance, if a business reduces its workforce, the forgiveness amount might be reduced proportionally. Borrowers should carefully review the SBA’s guidance on this matter to understand how changes in employment could affect their loan forgiveness eligibility.

Key Steps in the PPP Loan Forgiveness Process in Florida

The forgiveness process generally follows these steps:

- Complete the forgiveness application: This involves accurately reporting eligible expenses and providing supporting documentation.

- Gather supporting documentation: Compile all necessary financial records to support your expenses.

- Submit the application and documentation: Submit the completed application and all supporting documents to your lender.

- Lender review and decision: Your lender will review your application and supporting documents and make a decision on your forgiveness request.

- SBA review (if necessary): In some cases, the SBA may conduct a secondary review of the application.

Common Issues and Challenges with Florida PPP Loans

Securing and utilizing Paycheck Protection Program (PPP) loans presented numerous hurdles for Florida businesses. The program, while designed to provide crucial relief, was plagued by complexities and inconsistencies that disproportionately affected certain sectors. Understanding these challenges is vital for both future preparedness and for analyzing the effectiveness of such economic stimulus measures.

Application Process Difficulties

The initial application process for PPP loans proved challenging for many Florida businesses. Navigating the online portal, gathering the necessary documentation (tax returns, payroll records, etc.), and understanding the eligibility criteria often proved overwhelming, particularly for smaller businesses with limited administrative resources. Many experienced delays due to technical issues with the application system, leading to missed deadlines and increased stress. Some businesses also struggled to accurately calculate their loan amount, resulting in either under- or over-application. The rapid rollout of the program contributed to this initial confusion and lack of clear, concise guidance.

Challenges Faced by Specific Business Types

Florida’s diverse economy means different business types encountered unique obstacles. Restaurants, for example, faced difficulties demonstrating a significant revenue reduction due to the fluctuating nature of their sales and the impact of varying pandemic restrictions. Small retailers struggled to provide accurate payroll data due to inconsistencies in employee classification and fluctuating staffing levels. Seasonal businesses faced challenges demonstrating their usual revenue levels, as their typical operational period often didn’t align with the loan application timeframe. These challenges highlighted the limitations of a one-size-fits-all approach to economic relief.

The SBA’s Role in Addressing Challenges

The Small Business Administration (SBA) played a critical role in processing applications and addressing concerns. However, the sheer volume of applications and the rapid rollout of the program strained the SBA’s resources. This led to processing delays, inconsistent application reviews, and difficulties accessing support for businesses facing specific challenges. While the SBA provided guidance and resources, the information wasn’t always readily accessible or easy to understand, particularly for businesses without dedicated accounting or legal support. Improved communication and clearer guidelines from the SBA could have mitigated some of these issues.

Solutions and Strategies for Overcoming Issues, Ppp loans florida

Several strategies could have improved the PPP loan process. Pre-application consultations with SBA-approved lenders could have helped businesses prepare accurate applications and understand eligibility criteria. Simplifying the application process, providing clearer instructions, and utilizing more user-friendly technology could have reduced delays and errors. Targeted outreach programs to assist specific business types (e.g., workshops for restaurants, online resources for retailers) would have ensured equitable access to the program. Finally, increased SBA staffing and resources would have enabled more timely processing and better support for businesses navigating the complex application and forgiveness processes.

Problem and Solution Table

| Problem | Solution |

|---|---|

| Complex application process and unclear instructions. | Simplified application forms, clearer guidelines, and pre-application consultations with lenders. |

| Technical issues with the online portal. | Improved website infrastructure and better technical support. |

| Difficulties demonstrating revenue reduction for specific business types (e.g., restaurants, seasonal businesses). | More flexible eligibility criteria and alternative methods of demonstrating economic hardship. |

| Delays in processing applications and forgiveness requests. | Increased SBA staffing and resources, streamlined processing procedures. |

| Inconsistent application reviews and lack of clear communication from the SBA. | Improved training for SBA staff, clearer communication channels, and more accessible resources for businesses. |

Resources and Support for Florida Businesses Seeking PPP Loans

Navigating the complexities of the Paycheck Protection Program (PPP) can be challenging for Florida businesses. Fortunately, several resources and support systems are available to guide applicants through the process, from initial eligibility determination to loan forgiveness. Understanding these resources and how to utilize them effectively can significantly increase the chances of a successful application and subsequent loan forgiveness.

Key Government Agencies and Organizations in Florida

The Florida Department of Economic Opportunity (DEO) played a significant role in disseminating information and providing guidance on PPP loans during the program’s active periods. While the direct application process is now handled through private lenders, the DEO website continues to be a valuable resource for general business support and related information. Other federal agencies, such as the Small Business Administration (SBA), remain critical sources of information and resources. The SBA’s website provides comprehensive information on PPP loan requirements, forgiveness processes, and frequently asked questions.

Support Services Offered by Government Entities

Government agencies offer various support services, including:

- Information and Guidance: Websites and publications provide clear explanations of eligibility criteria, application procedures, and loan forgiveness requirements.

- Resource Databases: Many government sites offer links to lenders participating in the PPP program, enabling businesses to find suitable lenders more easily.

- FAQ and Help Centers: These provide answers to common questions, clarifying ambiguities and addressing concerns about the program.

- Technical Assistance: Some agencies may offer direct assistance in completing applications or navigating the complexities of loan forgiveness.

Contact Information for Relevant Organizations

The primary contact point for SBA-related inquiries is the SBA’s website: www.sba.gov. For general business support and resources in Florida, the Florida Department of Economic Opportunity website is: www.floridadisaster.org/ (Note: This site may contain broader disaster relief information, but contains links to business resources). Specific contact information for individual lenders will vary depending on the chosen lender.

Step-by-Step Guide to Utilizing Resources Effectively

Effectively utilizing these resources requires a systematic approach:

- Assess Eligibility: Begin by thoroughly reviewing the SBA’s PPP loan eligibility requirements on their website to determine if your business qualifies.

- Identify a Lender: Use the resources provided by the DEO or SBA to locate a participating lender that suits your business needs. Consider factors like loan terms, fees, and customer service reputation.

- Gather Necessary Documentation: Prepare all required documentation well in advance of application submission. This includes tax returns, payroll records, and bank statements.

- Complete and Submit the Application: Carefully complete the application form provided by your chosen lender, ensuring accuracy and completeness to avoid delays.

- Maintain Accurate Records: Meticulously maintain all documentation related to your PPP loan, including application materials, loan agreements, and expenses covered by the loan. This is crucial for the loan forgiveness process.

- Monitor Updates: Stay informed about any changes or updates to PPP guidelines and requirements through the SBA and DEO websites.

Impact of PPP Loans on the Florida Economy

The Paycheck Protection Program (PPP) loans significantly impacted the Florida economy, providing a crucial lifeline to businesses struggling during the COVID-19 pandemic. Their effects rippled through various sectors, influencing employment levels and overall economic activity. Analyzing this impact requires considering both the positive and negative consequences, as well as comparing the PPP’s effectiveness to other stimulus measures implemented in the state.

The overall economic impact of PPP loans in Florida was substantial, preventing widespread business closures and job losses. The program injected billions of dollars into the state’s economy, bolstering cash flow for businesses that otherwise might have faced insolvency. This injection of capital helped businesses retain employees, pay rent and utilities, and purchase necessary supplies, thereby mitigating the economic downturn caused by the pandemic. However, the long-term effects are still being assessed, and the program’s effectiveness varied across different sectors and business sizes.

Employment Levels Across Sectors

PPP loans demonstrably affected employment levels in various Florida sectors. Industries heavily reliant on in-person interactions, such as hospitality and tourism, benefited significantly from the program, preventing widespread layoffs and furloughs. Conversely, sectors less reliant on direct customer interaction, such as technology or certain manufacturing segments, might have experienced less dramatic employment changes due to PPP funds. Data from the Florida Department of Economic Opportunity (DEO) and the U.S. Bureau of Labor Statistics could be used to illustrate specific employment trends across different sectors before, during, and after the PPP loan disbursement period. A comparative analysis would reveal which sectors experienced the most significant employment gains or losses as a result of the program.

Comparison with Other Economic Stimulus Measures

The impact of PPP loans can be compared to other economic stimulus measures implemented in Florida during the pandemic, such as unemployment benefits extensions and state-level grants. While unemployment benefits provided direct income support to laid-off workers, PPP loans aimed to support businesses directly, enabling them to retain employees and avoid closures. State-level grants, often targeted toward specific industries or regions, provided additional support. A comprehensive analysis comparing the effectiveness of these different measures in terms of job preservation, business survival rates, and overall economic recovery would require a detailed econometric study. This study would involve examining data from multiple sources and controlling for various factors to isolate the impact of each stimulus program.

Examples of Positive and Negative Effects

Positive effects included the survival of many small businesses that would have otherwise closed, preventing widespread job losses in communities across the state. For example, a local restaurant in Miami that received a PPP loan was able to retain its staff and remain operational, contributing to the local economy and community. Negative effects included concerns about equity and access, as some businesses, particularly those with limited access to capital or complex financial structures, faced challenges in securing and utilizing the loans. Moreover, some argue that the program disproportionately benefited larger businesses, while smaller businesses struggled with navigating the application process and meeting the requirements.

Visual Representation of Economic Impact

A bar graph could visually represent the economic impact. The x-axis would represent different economic indicators (e.g., employment levels in different sectors, business survival rates, GDP growth). The y-axis would represent the change in these indicators before, during, and after the PPP loan disbursement. Different colored bars could represent the impact of PPP loans versus other stimulus measures. The graph would visually demonstrate the relative contributions of PPP loans to the overall economic recovery in Florida, highlighting areas where the program was most and least effective.

Summary

Securing a PPP loan in Florida requires careful planning and a thorough understanding of the program’s intricacies. This guide has provided a roadmap to help Florida businesses navigate the process, from initial eligibility assessment to loan forgiveness. By understanding the requirements, preparing necessary documentation, and proactively addressing potential challenges, businesses can significantly increase their chances of successfully obtaining and utilizing these vital funds to support their operations and employees. Remember to utilize the available resources and seek assistance when needed. The path to securing a PPP loan may seem daunting, but with the right information and preparation, success is within reach.

FAQ Summary

What happens if I don’t meet all the eligibility requirements for a PPP loan?

You may still be eligible for other SBA loan programs or state-level assistance. Contact the SBA or your local Small Business Development Center for more information.

Can I use PPP loan funds for any business expense?

No, only certain expenses are eligible for forgiveness. These generally include payroll, rent, utilities, and mortgage interest. Consult the SBA guidelines for a complete list.

What if my business experienced a significant decrease in revenue during the pandemic?

This could impact your loan forgiveness amount. Document your revenue decrease and follow the SBA’s guidance for calculating forgiveness based on reduced revenue.

How long does the PPP loan forgiveness process take?

The processing time varies, but it can take several weeks or months. Submit your application completely and accurately to expedite the process.