PPP Loans Nevada: Navigating the complexities of securing a Paycheck Protection Program loan in Nevada can feel overwhelming. This guide provides a comprehensive overview of eligibility requirements, the application process, loan forgiveness, and the economic impact of these crucial funds on Nevada businesses. We’ll break down the steps, highlight common pitfalls, and offer valuable resources to help you successfully navigate this process.

From understanding the specific documentation needed to demonstrate eligibility to mastering the loan forgiveness application, we’ll equip you with the knowledge and tools to maximize your chances of securing and utilizing a PPP loan. We will also explore the broader economic implications of these loans on Nevada’s diverse industries and the vital role they play in supporting job retention and small business survival.

PPP Loan Eligibility in Nevada

The Paycheck Protection Program (PPP) offered forgivable loans to eligible businesses to help them retain employees and cover other expenses during the COVID-19 pandemic. Understanding the eligibility criteria was crucial for Nevada businesses seeking this financial assistance. While the program has concluded, examining its requirements provides valuable insight into future potential government aid programs.

Nevada businesses, like those in other states, had to meet specific criteria to qualify for PPP loans. These criteria encompassed size limitations, industry restrictions, and documentation requirements. Failure to meet these requirements could result in loan denial or, in some cases, legal repercussions.

PPP Loan Eligibility Criteria in Nevada

The eligibility requirements for PPP loans in Nevada mirrored those nationwide. Key factors included the business’s size (typically measured by employee count or revenue), its operational status prior to the pandemic, and the intended use of loan funds. Specific industries were not excluded, but certain types of businesses (e.g., those primarily involved in illegal activities) were ineligible.

Required Documentation for Nevada PPP Loan Applicants

Demonstrating eligibility required providing comprehensive documentation. This included tax returns, payroll records, and bank statements. The specific documents needed varied depending on the applicant’s business structure and size. Accurate and complete documentation was essential for a smooth application process.

Comparison of PPP Loan Eligibility Requirements Across States

The eligibility requirements for PPP loans were largely consistent across all states. There were no significant variations in the core criteria between Nevada and other states. However, the interpretation and application of these criteria might have differed slightly depending on the specific lender.

Summary of PPP Loan Eligibility Requirements in Nevada

The following table summarizes the key eligibility requirements, necessary documentation, and potential penalties for non-compliance. It is important to note that this information is for illustrative purposes and should not be considered legal advice. Always consult with a qualified professional for specific guidance.

| Requirement | Description | Supporting Documentation | Penalties for Non-Compliance |

|---|---|---|---|

| Business Size | Generally, small businesses with fewer than 500 employees. Specific size standards may vary by industry. | Payroll records, tax returns (e.g., Form 1040, Schedule C; Form 1120-S) | Loan denial; potential audit and repayment of funds; legal action. |

| Operational Status | Must have been operating on February 15, 2020. | Business licenses, bank statements | Loan denial. |

| Use of Funds | Funds must be used for payroll, rent, utilities, and other eligible expenses. | Bank statements, invoices, receipts | Loan forgiveness reduction or denial; potential audit and repayment of funds. |

| Applicant’s Citizenship/Residency | Applicant must be a U.S. citizen, U.S. resident, or legal resident alien. | Passport, Green Card, Birth Certificate | Loan denial. |

| Good Standing | The business must be in good standing with the state. | State business registration documents | Loan denial. |

Application Process for Nevada Businesses

Securing a PPP loan in Nevada involves a multi-step process that requires careful preparation and attention to detail. Understanding the requirements and navigating the application procedure effectively can significantly increase your chances of approval. This section provides a step-by-step guide, highlights common pitfalls, and explains the lender’s role in the process.

Step-by-Step Guide to Applying for a PPP Loan in Nevada

The application process for PPP loans in Nevada generally follows these steps. While specific requirements may vary slightly depending on the lender, this provides a general overview.

- Gather Necessary Documentation: Before beginning the application, assemble all required documents. This typically includes tax returns, payroll records, bank statements, and business identification information. Having these readily available streamlines the process.

- Choose a Lender: Select a lender participating in the SBA’s PPP program. Many banks, credit unions, and online lenders offer PPP loans. Research lenders to find one that best suits your business needs and offers competitive terms.

- Complete the Application: Carefully fill out the PPP loan application form provided by your chosen lender. Accuracy is crucial; errors can lead to delays or rejection.

- Submit the Application: Submit your completed application and supporting documentation to your lender. Follow the lender’s instructions carefully for submission methods.

- Review and Approval: Your lender will review your application. This may involve additional requests for information. Once approved, you’ll receive notification and loan disbursement details.

- Loan Disbursement: Upon approval, the loan funds will be deposited into your designated bank account.

Common Mistakes During the Application Process and How to Avoid Them

Several common errors can hinder the PPP loan application process in Nevada. Understanding these pitfalls and taking preventative measures can improve your chances of a successful application.

- Inaccurate Information: Providing false or misleading information is a serious offense and will result in loan rejection. Double-check all information for accuracy before submission.

- Incomplete Documentation: Missing or incomplete documentation is a frequent cause of delays. Ensure you have all required documents readily available before applying.

- Failure to Meet Eligibility Requirements: Carefully review the eligibility criteria before applying. Applying when ineligible wastes time and resources.

- Late Submission: Submitting the application after the deadline will result in rejection. Plan ahead and submit your application well in advance of the deadline.

- Choosing the Wrong Lender: Selecting a lender unfamiliar with the PPP program can lead to delays and complications. Research lenders carefully.

The Role of Lenders in Processing PPP Loan Applications in Nevada

Nevada lenders play a vital role in the PPP loan application process. They act as intermediaries between the SBA and businesses seeking funding. Their responsibilities include reviewing applications, verifying information, and disbursing funds. Choosing a reputable lender with experience in PPP loans is crucial for a smooth and efficient process. Lenders also provide guidance and support throughout the application process.

Flowchart Illustrating the Application Process

[Imagine a flowchart here. The flowchart would begin with “Start,” branching to “Gather Documentation,” then “Choose Lender,” followed by “Complete Application.” This would lead to “Submit Application,” which branches to “Application Approved” (leading to “Loan Disbursement” and “End”) or “Application Denied” (leading to “Review Denial Reasons” and potentially back to “Gather Documentation” or “Choose Lender” depending on the reason for denial). Potential delays could be indicated at various points, such as a delay in documentation review or lender processing.] The flowchart visually represents the sequential steps, highlighting key decision points like application approval or denial, and potential bottlenecks that could cause delays. The visual representation aids in understanding the process’s complexity and potential challenges.

Loan Forgiveness in Nevada

Securing loan forgiveness for your Paycheck Protection Program (PPP) loan in Nevada involves a meticulous process requiring careful documentation and adherence to specific guidelines. Understanding these requirements is crucial for a successful application and avoiding potential delays or denials. The process centers around demonstrating that the loan funds were used for eligible expenses and that you maintained sufficient employment levels.

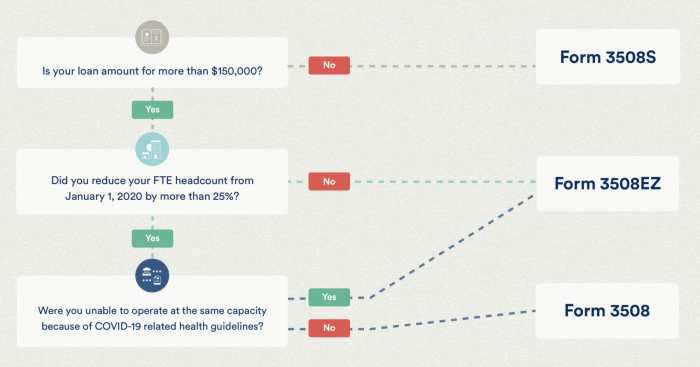

PPP Loan Forgiveness Application Process

The application for loan forgiveness is submitted to the lender that originally provided the PPP loan. The process begins with completing the appropriate forgiveness application form, which may vary slightly depending on the loan amount and lender. This form requires detailed information on how the loan proceeds were used, including payroll costs, rent, utilities, and other eligible expenses. Supporting documentation is then compiled to substantiate these claims. After submitting the application and supporting documentation, the lender reviews the application and makes a determination on the forgiveness amount. This review process can take several weeks, and lenders may request additional information if necessary. Finally, the lender will notify the Small Business Administration (SBA) of its decision, and the SBA will ultimately make the final determination on the loan forgiveness.

Required Documentation for Loan Forgiveness

To support your loan forgiveness application, you’ll need comprehensive documentation. This typically includes payroll records (such as payroll tax filings, bank statements, and employee compensation records) demonstrating payments made during the covered period. Rent and mortgage agreements, along with utility bills, are necessary to prove eligible expenses for these categories. Additionally, you’ll need to provide documentation of any eligible operating expenses. Accurate and complete records are paramount. Missing or incomplete documentation is a common reason for delays or denials. For example, if you claim rent expenses, you must provide a copy of your lease agreement and bank statements showing the rent payments. Similarly, for utilities, copies of the utility bills and bank statements demonstrating payment are required.

Reasons for PPP Loan Forgiveness Denials and Mitigation Strategies

Several factors can lead to PPP loan forgiveness denials. Common issues include insufficient documentation, ineligible expenses, and failure to maintain employment levels. Submitting an incomplete application or failing to provide adequate supporting documentation is a major cause for denial. Using loan funds for ineligible expenses, such as prohibited owner compensation or non-essential purchases, will also lead to denial. Finally, not meeting the employment retention requirements set by the SBA can result in a reduction or denial of forgiveness. To mitigate these risks, meticulously track all expenses and ensure they align with SBA guidelines. Maintain organized financial records, including bank statements, payroll records, and invoices. Seek professional assistance from an accountant or financial advisor to ensure compliance with all regulations and to help prepare a thorough and accurate application.

Steps in the Loan Forgiveness Process

The loan forgiveness process involves several key steps with potential timelines and challenges.

- Step 1: Complete the Forgiveness Application: This involves filling out the necessary forms accurately and completely. Challenge: Understanding the complexities of the application and gathering all required information.

- Step 2: Gather Supporting Documentation: Compile all necessary financial records to support your expenses. Challenge: Ensuring all documentation is complete, accurate, and organized.

- Step 3: Submit the Application and Documentation: Submit the completed application and supporting documentation to your lender. Challenge: Meeting the lender’s deadlines and addressing any potential requests for additional information.

- Step 4: Lender Review: Your lender reviews your application and supporting documents. Challenge: Addressing any questions or concerns raised by the lender in a timely manner.

- Step 5: SBA Review (if necessary): The SBA may review the application. Challenge: Potential delays in the SBA’s review process.

- Step 6: Forgiveness Decision: The lender notifies you of the forgiveness decision. Challenge: Potential for partial forgiveness or denial if requirements are not met.

Impact of PPP Loans on Nevada’s Economy

The Paycheck Protection Program (PPP) loans, a crucial element of the federal government’s COVID-19 economic relief package, significantly impacted Nevada’s economy. The program aimed to provide forgivable loans to small businesses to help them retain employees and stay afloat during the pandemic’s economic downturn. Analyzing the program’s effects reveals a complex interplay of benefits and limitations on Nevada’s diverse economic landscape.

PPP Loan Impact on Job Retention in Nevada’s Economy

The PPP’s impact on job retention in Nevada varied across sectors. While precise figures attributing job retention solely to PPP loans are difficult to isolate, available data suggests a positive correlation. Industries heavily reliant on tourism and hospitality, sectors significantly impacted by COVID-19 restrictions, likely benefited most from the program in terms of preserving employment. Conversely, sectors less affected by the pandemic might have seen a smaller impact on job retention from PPP loans. Further research using econometric models controlling for other factors affecting employment would provide a more precise quantification of the PPP’s role in job preservation across various Nevada industries.

PPP Loans and Small Business Survival Rates in Nevada

The survival rate of small businesses in Nevada during the pandemic was undoubtedly influenced by PPP loans. Access to these funds allowed many businesses to cover operating costs, maintain payroll, and ultimately weather the economic storm. However, the impact varied depending on factors such as business size, industry, pre-existing financial health, and the efficiency of loan disbursement and forgiveness processes. Studies comparing the survival rates of businesses that received PPP loans to those that did not would provide a clearer picture of the program’s effectiveness in ensuring business continuity. Anecdotal evidence suggests that businesses that received timely and sufficient funding demonstrated significantly higher survival rates.

Comparison of PPP Loan Economic Impact in Nevada and Other States, Ppp loans nevada

Comparing Nevada’s experience with PPP loans to other states requires considering several factors, including the state’s economic structure, reliance on specific industries, and the demographics of its small business sector. Nevada’s heavy reliance on tourism and hospitality, sectors particularly hard-hit by the pandemic, likely led to a higher demand for PPP loans compared to states with more diversified economies. Furthermore, the speed and efficiency of loan disbursement in Nevada, compared to other states, may have influenced the overall economic impact. A comparative analysis of PPP loan distribution, usage, and subsequent economic outcomes across multiple states would provide a valuable context for understanding Nevada’s unique experience.

Distribution of PPP Loans Across Industries in Nevada

The following table illustrates the approximate distribution of PPP loans across various industries in Nevada. Note that precise figures are challenging to obtain due to data limitations and variations in reporting methodologies. The data represents an estimated distribution based on available public information and should be considered an approximation.

| Industry | Estimated Percentage of Total PPP Loans |

|---|---|

| Accommodation and Food Services | 30% |

| Retail Trade | 15% |

| Construction | 10% |

| Health Care and Social Assistance | 10% |

| Other Services | 15% |

| All Other Industries | 20% |

Resources and Support for Nevada Businesses

Navigating the complexities of the Paycheck Protection Program (PPP) can be challenging for Nevada businesses. Fortunately, numerous resources and support systems are available to assist with the application process, loan forgiveness, and general business guidance. These resources range from government agencies offering direct assistance to private organizations providing valuable counseling and financial expertise. Accessing these resources can significantly increase the likelihood of a successful PPP application and a smoother overall experience.

Securing a PPP loan and effectively managing the process requires careful planning and often specialized knowledge. Many businesses find that seeking professional guidance is invaluable, not only in ensuring compliance but also in maximizing the benefits of the program. This section Artikels the resources available to Nevada businesses and highlights the advantages of seeking professional assistance.

Available Resources for Nevada Businesses

Several resources are available to assist Nevada businesses with PPP loans and broader business needs. These resources provide crucial support, ranging from direct financial assistance to guidance on navigating the complexities of loan applications and forgiveness. Effective utilization of these resources can significantly improve a business’s chances of success.

- Nevada Small Business Development Centers (SBDCs): SBDCs offer free, confidential business advising, training, and resources to help Nevada businesses succeed. They provide expertise in areas such as business planning, financial management, and marketing, which are all crucial for navigating the PPP loan process. They can assist with application preparation, understanding loan terms, and navigating the forgiveness process.

- Nevada Department of Employment, Training, and Rehabilitation (DETR): DETR offers a range of services for Nevada businesses, including information on unemployment insurance, workforce development, and business resources. While not directly focused on PPP loans, their resources can be valuable for businesses facing economic challenges.

- U.S. Small Business Administration (SBA): The SBA is the primary federal agency responsible for the PPP program. Their website provides comprehensive information on PPP loan eligibility, application procedures, and loan forgiveness requirements. They offer resources and frequently asked questions (FAQs) to clarify any uncertainties.

- SCORE: SCORE is a non-profit organization that provides free mentoring and workshops to small businesses. Their experienced mentors offer guidance on various business aspects, including financial planning and access to capital, making them a valuable resource for PPP loan applicants.

- Local Banks and Credit Unions: Many financial institutions in Nevada offer PPP loans and can provide guidance throughout the application and forgiveness processes. They possess intimate knowledge of the program’s requirements and can often offer personalized support.

Contact Information for Relevant Agencies and Organizations

Accessing the appropriate support requires knowing where to find it. The following list provides contact information for key organizations offering assistance to Nevada businesses regarding PPP loans.

- Nevada SBDCs: Contact information varies by location. Search “Nevada SBDC” online to find the nearest location and its contact details.

- DETR: Their website (usually a .gov site) will provide contact information and phone numbers for various departments.

- SBA: The SBA’s website provides a comprehensive directory of resources and contact information.

- SCORE: Their website (usually a .org site) offers a search function to locate mentors and workshops in Nevada.

Types of Assistance Offered and Benefits of Professional Guidance

The assistance offered by these resources encompasses a broad spectrum of support designed to empower Nevada businesses. This includes counseling on financial planning, application preparation, and navigating the often-complex forgiveness process. Training programs may cover various business management aspects, enhancing the applicant’s overall understanding and capacity.

Seeking professional guidance, such as from a certified public accountant (CPA) or a business consultant experienced in PPP loans, offers several key advantages. These professionals possess in-depth knowledge of the program’s intricacies, ensuring compliance and maximizing the chances of loan forgiveness. They can help businesses accurately assess their eligibility, prepare comprehensive applications, and meticulously manage the documentation required for loan forgiveness. Their expertise minimizes the risk of errors that could lead to delays or loan denial, ultimately saving businesses valuable time and resources. For example, a CPA can help accurately calculate payroll expenses, a crucial element in the loan forgiveness application, preventing potential discrepancies and ensuring a smoother process. A business consultant familiar with SBA regulations can guide the business through the complexities of the application process, ensuring compliance with all requirements. The cost of professional assistance is often outweighed by the potential benefits of a successful and timely loan forgiveness.

Common Misconceptions about PPP Loans in Nevada

Securing a Paycheck Protection Program (PPP) loan can be a lifeline for Nevada businesses, but navigating the process is often fraught with misunderstandings. Addressing these misconceptions is crucial for ensuring businesses receive the appropriate support and avoid potential pitfalls. This section clarifies three prevalent inaccuracies surrounding PPP loans in Nevada.

PPP Loans are Only for Small Businesses

The eligibility criteria for PPP loans encompass a wider range of businesses than many assume. While the program prioritizes small businesses, businesses with up to 500 employees can often qualify, and there are size standards for certain industries that may allow for larger businesses to apply. Furthermore, self-employed individuals and independent contractors are also eligible.

Acting on this misconception can lead to eligible businesses failing to apply, resulting in lost opportunities for crucial financial assistance. Many businesses mistakenly believe they are too large or don’t fit the typical “small business” model and therefore miss out on available funding.

Loan Forgiveness is Automatic

While PPP loan forgiveness is possible, it’s not guaranteed. Borrowers must meet specific requirements, including using a significant portion of the loan proceeds for eligible expenses like payroll, rent, utilities, and mortgage interest within a specific timeframe. Detailed documentation is required to support the forgiveness application.

Failure to understand this can lead to borrowers being unprepared for the forgiveness process, potentially resulting in delays or denial of forgiveness. Meticulous record-keeping throughout the loan period is paramount for a successful forgiveness application. A lack of proper documentation can severely hinder the forgiveness process.

You Must Repay the Entire Loan if Forgiveness is Denied

While the ultimate goal is loan forgiveness, if the application is denied, the loan isn’t necessarily immediately due in full. Borrowers are given options for repayment, often with extended terms and potentially lower interest rates. However, the repayment terms will be stipulated in the loan agreement, and failure to adhere to them can lead to further complications.

Acting on this misconception can lead to unnecessary panic and potential missed opportunities for negotiating repayment terms. Understanding the repayment options available following a forgiveness denial allows for a more proactive and informed approach to managing the debt. Contacting the lender promptly is crucial to explore available options.

Final Conclusion

Securing a PPP loan in Nevada requires careful planning and attention to detail. By understanding the eligibility criteria, meticulously completing the application, and diligently pursuing loan forgiveness, Nevada businesses can leverage these funds to weather economic challenges and contribute to the state’s continued economic growth. Remember to utilize the resources available and seek professional guidance when needed to maximize your chances of success. This guide serves as a starting point—thorough research and proactive planning are key to navigating this critical process effectively.

FAQ Summary: Ppp Loans Nevada

What happens if I don’t meet all the eligibility requirements for a PPP loan?

You may be ineligible for a loan, or you may be eligible for a smaller loan amount depending on the specific requirements you don’t meet. It’s crucial to carefully review all requirements and ensure accurate documentation.

Can I use PPP loan funds for any business expense?

No, PPP loan funds are restricted to specific eligible expenses such as payroll, rent, utilities, and certain other operational costs. Consult the SBA guidelines for a comprehensive list.

What if my loan forgiveness application is denied?

You will have an opportunity to appeal the decision. Carefully review the reasons for denial and provide any additional supporting documentation that may address the concerns raised.

How long does the loan forgiveness process typically take?

The timeframe varies, but it can generally take several weeks or months. Prompt submission of a complete and accurate application is crucial for expediting the process.