Recovery loan scheme bad credit: Navigating the complexities of securing a loan with less-than-perfect credit can feel daunting. This guide unravels the intricacies of recovery loan schemes, offering practical strategies and insights for individuals facing credit challenges. We’ll explore eligibility criteria, explore ways to strengthen your application, and compare various lenders’ offerings. Learn how to leverage government support and manage debt effectively to achieve financial recovery.

From understanding interest rates and loan terms to developing a robust repayment plan, we provide a comprehensive roadmap to help you secure the financial assistance you need. We’ll also cover the crucial role of seeking professional financial advice and highlight the potential benefits and drawbacks of different loan options. This guide empowers you to make informed decisions and take control of your financial future.

Eligibility Criteria for Recovery Loan Schemes with Imperfect Credit Histories

Securing a recovery loan, especially with a less-than-perfect credit history, requires a thorough understanding of the eligibility criteria set by lending institutions. These criteria vary, but several common factors significantly influence approval chances. Understanding these factors empowers applicants to improve their prospects and navigate the application process effectively.

Eligibility for recovery loan schemes typically involves a multifaceted assessment beyond just a credit score. Lenders consider various factors to determine an applicant’s creditworthiness and repayment capacity. While a strong credit score is advantageous, it’s not always the sole determinant.

Credit Score’s Impact on Eligibility

A credit score serves as a crucial indicator of an applicant’s financial responsibility and repayment history. Lower credit scores often reflect past financial difficulties, such as missed payments or defaults. Lenders use these scores to assess the risk associated with lending money. Generally, higher credit scores correlate with a greater likelihood of loan approval and potentially more favorable interest rates. However, a low credit score doesn’t automatically disqualify an applicant. Lenders often consider other factors to make a comprehensive assessment.

Situations Where Individuals with Bad Credit Might Still Qualify

Several circumstances can allow individuals with less-than-perfect credit histories to qualify for recovery loans. For instance, demonstrating a recent improvement in financial stability, providing collateral to secure the loan, or having a co-signer with a strong credit history can significantly enhance approval chances. Furthermore, some lenders specialize in working with borrowers who have experienced financial setbacks, offering tailored loan programs designed to support their recovery. The availability of government-backed recovery loan schemes also expands access to credit for individuals with less-than-ideal credit scores. These schemes often have more lenient eligibility requirements compared to traditional commercial loans.

Comparison of Lenders’ Criteria for Bad Credit Applicants

The following table compares the eligibility criteria of different hypothetical lenders for applicants with bad credit. Note that these are examples and actual lender requirements may vary. It is crucial to check directly with each lender for the most up-to-date information.

| Lender | Minimum Credit Score | Collateral Requirements | Other Eligibility Criteria |

|---|---|---|---|

| Lender A | 550 | May require collateral depending on loan amount | Stable income, demonstrable repayment capacity |

| Lender B | 600 | Collateral usually required | Strong debt-to-income ratio, positive banking history |

| Lender C (Government-backed) | 500 | May not require collateral for smaller loan amounts | Demonstrable need for the loan, business plan (if business loan) |

| Lender D | No minimum credit score specified | Collateral strongly preferred | Extensive financial documentation, co-signer may be required |

Securing a Recovery Loan Despite a Poor Credit Rating

Securing a recovery loan with a less-than-perfect credit history presents challenges, but it’s not impossible. Many lenders understand that circumstances change, and a past credit issue doesn’t always reflect current financial stability. By strategically addressing credit concerns and presenting a compelling application, individuals can significantly improve their chances of loan approval. This section Artikels practical steps and alternative options for those seeking financial recovery despite a poor credit rating.

Improving Creditworthiness Before Applying

Before applying for a recovery loan, proactive steps to improve your credit score can significantly increase your approval odds. This involves demonstrating responsible financial behavior and addressing any negative marks on your credit report. Lenders view consistent positive actions as evidence of improved financial management.

The Importance of a Strong Loan Application

A meticulously prepared loan application is crucial for securing a recovery loan, especially with a poor credit history. A strong application showcases your understanding of your financial situation, your commitment to repayment, and your realistic plan for using the loan funds. This minimizes lender risk and increases the likelihood of approval. A complete and accurate application avoids delays and potential rejections.

Alternative Lending Options for Individuals with Bad Credit

If securing a traditional recovery loan proves difficult, alternative lending options exist. These options often come with higher interest rates but offer access to capital for those with impaired credit. Careful consideration of the terms and conditions is essential to avoid accumulating further debt. Examples include peer-to-peer lending platforms or credit unions that specialize in working with borrowers who have experienced credit challenges. Researching and comparing these options is crucial to find the most suitable and affordable solution.

A Step-by-Step Guide for Applicants with Bad Credit

A structured approach maximizes the chances of loan approval. This step-by-step guide provides a framework for navigating the application process effectively.

- Assess your credit report: Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify areas needing improvement. Dispute any inaccuracies immediately.

- Improve your credit score: Pay down existing debts, avoid new credit applications, and maintain consistent on-time payments. These actions demonstrate financial responsibility and contribute to a higher credit score over time. For example, consistently paying off a credit card balance in full each month can significantly boost your credit score within a few months.

- Develop a comprehensive repayment plan: Create a detailed budget showing how you will manage your existing debts and the new loan repayment. This demonstrates financial responsibility and reduces lender risk.

- Research lenders: Explore various lenders, including those specializing in loans for individuals with imperfect credit histories. Compare interest rates, fees, and repayment terms to find the most suitable option. For instance, some credit unions may offer more favorable terms than traditional banks.

- Prepare a thorough application: Complete the loan application meticulously, providing accurate and comprehensive information. Supporting documentation, such as tax returns or bank statements, should be readily available.

- Negotiate terms: If possible, negotiate the loan terms, such as interest rate or repayment schedule, to make the loan more manageable.

Understanding Interest Rates and Loan Terms

Securing a recovery loan with a less-than-perfect credit history often involves navigating complex interest rates and loan terms. Understanding these factors is crucial for making informed decisions and avoiding financial pitfalls. This section details the typical interest rates and repayment structures associated with recovery loans for borrowers with bad credit. It’s important to remember that these are general guidelines, and individual rates and terms will vary depending on several factors discussed below.

Interest rates on recovery loans for borrowers with poor credit are generally higher than those offered to individuals with excellent credit scores. This is because lenders perceive a higher risk of default. The higher the perceived risk, the higher the interest rate they charge to compensate for potential losses. Several factors influence the precise interest rate offered, creating a range of possibilities.

Factors Influencing Interest Rates

Several key factors influence the interest rate a lender will offer on a recovery loan to a borrower with a poor credit history. These include the applicant’s credit score, the loan amount, the loan term, the type of collateral offered (if any), and the lender’s own risk assessment models. A lower credit score will typically result in a higher interest rate, as will a larger loan amount or a longer repayment period. Conversely, offering collateral, such as property or equipment, can potentially lower the interest rate, as it mitigates the lender’s risk. Finally, each lender has its own internal risk assessment model, which may weight these factors differently, leading to variations in interest rates between lenders.

Comparison of Lenders and Loan Terms

The following provides a comparison of hypothetical interest rates and loan terms from three different lenders. It is crucial to remember that these are examples and actual rates and terms will vary depending on individual circumstances and the specific lender. Always check directly with the lender for the most up-to-date information.

Note: The following data is illustrative and should not be considered a definitive representation of any specific lender’s offerings. Always verify rates and terms directly with the lender.

| Lender | Interest Rate (APR) | Typical Loan Term | Typical Fees |

|---|---|---|---|

| Lender A | 15-20% | 1-3 years | Origination fee (around 2-5% of the loan amount), potential late payment fees |

| Lender B | 18-25% | 6 months – 2 years | Origination fee (around 3-7% of the loan amount), monthly service fees, potential early repayment penalties |

| Lender C | 12-18% | 2-5 years | Origination fee (around 1-3% of the loan amount), potential late payment fees, possible prepayment penalties |

The Impact of Government Support on Recovery Loan Accessibility: Recovery Loan Scheme Bad Credit

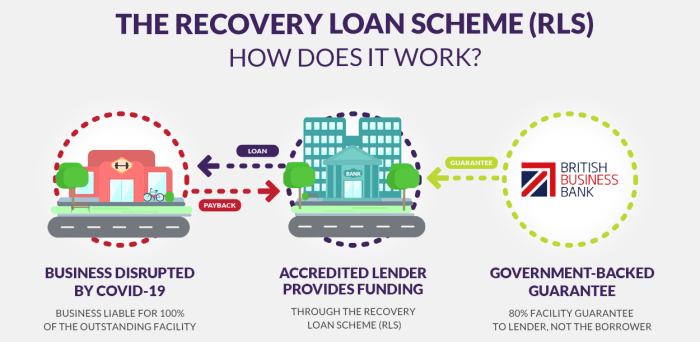

Government-backed recovery loan schemes play a crucial role in bolstering economic resilience, particularly for small and medium-sized enterprises (SMEs) facing financial hardship. These schemes are designed to bridge the gap in lending for businesses that may struggle to secure traditional financing due to imperfect credit histories or other financial challenges. By providing a safety net for lenders, these initiatives encourage greater access to capital for businesses that might otherwise be excluded from the private lending market.

Government-backed recovery loan schemes differ significantly from private lending options in several key aspects. Private lenders typically assess risk based on a stringent credit scoring system, focusing heavily on a business’s past financial performance and credit history. A poor credit rating often results in higher interest rates, stricter loan terms, or outright loan rejection. In contrast, government-backed schemes often incorporate more flexible eligibility criteria, considering factors beyond credit scores. This can include the viability of the business plan, the potential for job creation, and the overall economic benefit to the community. The government’s involvement mitigates some of the risk for lenders, enabling them to provide loans to businesses that might otherwise be deemed too risky.

Examples of Government Initiatives Supporting Businesses with Poor Credit

Several countries have implemented specific initiatives to assist businesses with poor credit access loans. For instance, the UK’s Coronavirus Business Interruption Loan Scheme (CBILS) provided government-backed loans to SMEs affected by the COVID-19 pandemic, even if they had less-than-perfect credit histories. Similarly, the Paycheck Protection Program (PPP) in the United States offered forgivable loans to businesses facing economic hardship, with eligibility criteria that were relatively less stringent than those of traditional lenders. These programs demonstrate a clear government commitment to supporting businesses during times of economic uncertainty, recognizing that a strong business sector is essential for overall economic health. Furthermore, many regional and local governments have also introduced their own initiatives, tailored to the specific needs of their communities. These initiatives often include grants, loan guarantees, and mentoring programs to help businesses navigate financial challenges and improve their creditworthiness over time.

Benefits and Drawbacks of Utilizing Government-Backed Loans

Government-backed loans offer several potential benefits for businesses with poor credit. These include access to capital that might otherwise be unavailable, potentially more favorable interest rates compared to private lenders specializing in high-risk loans, and longer repayment periods. This can provide businesses with the breathing room needed to recover from financial setbacks and invest in growth. However, it is important to acknowledge potential drawbacks. Government-backed loans often come with more stringent reporting requirements and compliance obligations compared to private loans. Additionally, while interest rates may be more favorable than some private options, they may still be higher than rates available to businesses with excellent credit. Businesses should carefully weigh the benefits and drawbacks before applying for a government-backed loan, ensuring a thorough understanding of the terms and conditions to avoid potential future financial difficulties.

Managing Debt and Avoiding Default

Securing a recovery loan can provide a vital lifeline for businesses struggling after a challenging period. However, responsible debt management is crucial to avoid the serious consequences of default. This section Artikels practical strategies for effective debt management and highlights the potential repercussions of failing to meet repayment obligations.

Successfully navigating repayment requires a proactive and organized approach. Understanding your loan terms, creating a realistic budget, and consistently monitoring your financial situation are key elements in preventing default. Failure to adhere to the repayment schedule can have severe implications, impacting your business’s creditworthiness and potentially leading to legal action.

Practical Tips for Responsible Debt Management

Effective debt management begins with a clear understanding of your financial obligations. This involves meticulously tracking all income and expenses, identifying areas where spending can be reduced, and prioritizing debt repayments. Consider consolidating high-interest debts into a single, lower-interest loan to simplify repayment and potentially reduce overall interest costs. Regularly review your budget and make adjustments as needed to ensure you remain on track. Seeking professional financial advice can provide valuable guidance and support in developing a personalized debt management plan. Finally, maintain open communication with your lender; early notification of any potential difficulties can often lead to workable solutions.

Consequences of Defaulting on a Recovery Loan, Recovery loan scheme bad credit

Defaulting on a recovery loan carries significant consequences. Your business’s credit rating will suffer, making it difficult to secure future loans or credit. This can severely hinder growth and expansion opportunities. Furthermore, lenders may pursue legal action to recover the outstanding debt, potentially leading to asset seizure or bankruptcy. The negative impact on your personal credit score can also extend beyond your business, affecting your ability to obtain personal loans, mortgages, or even rent an apartment. In short, defaulting can have far-reaching and long-lasting negative consequences.

Creating a Realistic Repayment Budget

Developing a realistic repayment budget involves a step-by-step process. First, meticulously list all monthly income sources. Next, detail all essential and non-essential expenses. This includes loan repayments, rent or mortgage payments, utilities, supplies, salaries, and personal expenses. Then, subtract total expenses from total income to determine your available funds. Allocate a sufficient portion of this amount to your recovery loan repayment. Finally, regularly review and adjust your budget as needed to account for unexpected expenses or changes in income. A realistic budget ensures you can meet your repayment obligations while maintaining sufficient funds for ongoing business operations.

Illustrative Infographic: The Impact of Missed Payments

The infographic would visually represent the escalating consequences of missed loan payments. It would use a timeline format, starting with a single missed payment. Each subsequent missed payment would illustrate the increasing severity of the consequences. For example, the first missed payment could show a slight dip in credit score and a potential late payment fee. The second missed payment could depict a more significant credit score drop, increased late fees, and potential contact from the lender. The third missed payment could illustrate a substantial credit score decline, mounting late fees, and the potential for legal action or debt collection efforts. The final stage would show the most severe consequences, such as business closure, bankruptcy, and significant damage to personal and business credit. The visual would use a clear color-coded system, perhaps red to represent negative consequences, and incorporate relevant data and statistics on the impact of missed payments on credit scores and business viability. It would be designed to be easily understood and impactful, highlighting the importance of consistent and timely payments.

Seeking Professional Financial Advice

Navigating the complexities of a recovery loan application, especially with a less-than-perfect credit history, can be daunting. Seeking professional financial advice is a crucial step that can significantly increase your chances of securing the loan and managing your finances effectively afterward. A qualified advisor offers unbiased guidance, helping you make informed decisions and avoid potential pitfalls.

A financial advisor provides more than just assistance with loan applications; they act as a strategic partner in your financial well-being. Their expertise can help you understand your financial situation comprehensively, identify areas for improvement, and create a plan to achieve your financial goals. This holistic approach ensures you’re not just addressing the immediate need for a recovery loan but also building a stronger financial foundation for the future.

Benefits of Consulting a Financial Advisor Before Applying for a Recovery Loan

Engaging a financial advisor before applying for a recovery loan offers several key advantages. They can analyze your financial situation, including income, expenses, assets, and liabilities, to determine your loan eligibility and affordability. They can help you explore different loan options, compare interest rates and terms, and identify the best fit for your circumstances. Furthermore, they can assist in improving your creditworthiness, increasing your chances of loan approval and potentially securing better loan terms. Their guidance can help you avoid costly mistakes and ensure a smoother application process.

Improving Creditworthiness with a Financial Advisor’s Help

A financial advisor can play a significant role in improving your creditworthiness. They can help you understand your credit report, identify any errors or negative marks, and develop a strategy to address them. This might involve creating a debt management plan, negotiating with creditors to improve payment terms, or disputing inaccurate information on your credit report. By working with a financial advisor, you can proactively address the factors impacting your credit score and demonstrate to lenders your commitment to responsible financial management. For example, they might help you create a budget to reduce debt-to-income ratio, a crucial factor in loan approvals. They could also advise on strategies for increasing your credit score, such as paying bills on time and maintaining low credit utilization.

Questions to Ask a Financial Advisor Regarding Recovery Loan Options

Before engaging a financial advisor, it’s helpful to have a list of specific questions prepared. This ensures you receive tailored advice relevant to your situation. Inquiries should cover aspects like the eligibility criteria for various recovery loan schemes, the potential interest rates and repayment terms, the impact of the loan on your existing debt, and the overall cost of borrowing. It’s also crucial to discuss strategies for managing your debt after receiving the loan to avoid default. For instance, you should ask about the potential impact of the loan on your credit score, strategies for long-term debt management, and available resources for financial education.

Resources for Finding Qualified Financial Advisors

Several resources can help you find qualified and reputable financial advisors. Professional organizations, such as the Financial Planning Association (FPA) and the Certified Financial Planner Board of Standards (CFP Board), maintain directories of certified professionals. Online platforms, like those offered by financial comparison websites, can provide profiles of advisors along with client reviews. Your bank or credit union might also offer referrals to financial advisors who are familiar with recovery loan programs and government support schemes. Remember to verify the advisor’s credentials and experience before engaging their services. Checking online reviews and seeking referrals from trusted sources are important steps in this process.

Last Word

Securing a recovery loan with bad credit requires careful planning and strategic action. By understanding eligibility requirements, improving your creditworthiness, and comparing lender options, you can significantly increase your chances of approval. Remember to leverage government support where available and prioritize responsible debt management. This guide provides a strong foundation for your journey towards financial recovery, but seeking professional financial advice remains a crucial step in ensuring your long-term success.

Question Bank

What is a recovery loan scheme?

A recovery loan scheme is a government-backed program designed to help businesses and individuals recover from financial hardship, often providing access to loans even with poor credit history.

Can I get a recovery loan with a bankruptcy on my record?

It depends on the specific scheme and lender. Some schemes may consider applications from individuals with bankruptcies, but it will likely impact your eligibility and interest rate.

How long does it take to get approved for a recovery loan?

Processing times vary depending on the lender and the complexity of your application. Expect a timeframe ranging from a few weeks to several months.

What happens if I default on a recovery loan?

Defaulting on a recovery loan can severely damage your credit score, lead to legal action, and result in further financial hardship. It’s crucial to adhere to the repayment plan.

Are there any fees associated with recovery loans?

Yes, most recovery loans involve fees, including application fees, arrangement fees, and potentially early repayment charges. Review the loan agreement carefully.