Schools First Auto Loan Calculator: Planning a car purchase? Navigating the world of auto loans can feel overwhelming, but it doesn’t have to be. This powerful tool simplifies the process, letting you quickly estimate monthly payments and explore different loan scenarios. Understanding your financial options is key to making informed decisions, and our calculator provides the clarity you need to confidently take the next step.

Whether you’re a seasoned car buyer or a first-timer, the Schools First Auto Loan Calculator offers a user-friendly interface designed for ease of use. Input your desired loan amount, interest rate, and loan term, and instantly see your estimated monthly payment. Explore additional features like amortization schedules to understand how your payments are allocated over time, and explore the impact of prepayment options. By empowering you with this financial insight, the calculator helps you budget effectively and make a smart car-buying decision.

Understanding the Target Audience for “Schools First Auto Loan Calculator”

The success of the Schools First auto loan calculator hinges on accurately identifying and addressing the needs of its target audience. Understanding their demographics, financial literacy, and technological proficiency is crucial for designing a user-friendly and effective tool. This analysis will define the primary users and map their journey through the calculator.

The primary users of the Schools First auto loan calculator are likely to be employees of the school district or their immediate family members. This encompasses a broad range of individuals with varying levels of financial knowledge and technological expertise. However, certain commonalities will help refine our understanding of the target audience.

Demographics of the Target Audience

The primary demographic includes individuals aged 25-55, reflecting the typical age range of working professionals and established families. A significant portion will likely have some level of higher education, given their association with the school district. Income levels will vary considerably, but generally fall within the middle to upper-middle class range. Geographic location will be dictated by the school district’s service area. The calculator should be accessible and understandable across this diverse group.

Financial Literacy and Technological Proficiency of the Target Audience

Financial literacy will vary significantly within the target audience. Some users will possess strong financial knowledge and be comfortable with complex calculations, while others may require simpler, more straightforward information. Therefore, the calculator should offer varying levels of detail and explanation, catering to diverse comfort levels. Similarly, technological proficiency will range from highly adept users to those less familiar with online tools. The calculator’s interface should be intuitive and easy to navigate, regardless of the user’s technological skills. Clear instructions and minimal jargon are essential.

User Persona: Sarah Miller

To illustrate the target audience, consider Sarah Miller, a 38-year-old elementary school teacher with a family. Sarah is tech-savvy enough to use online banking and shopping platforms but isn’t an expert. She’s looking for a simple and transparent way to estimate her monthly auto loan payments before committing to a loan. She values clarity and ease of use above all else. Sarah represents a typical user who appreciates a straightforward, user-friendly interface. Her needs and preferences will shape the design and functionality of the calculator.

User Journey Map

The user journey for the Schools First auto loan calculator begins with Sarah (or any user) identifying a need to estimate auto loan payments. This could stem from browsing dealerships, seeing an advertisement, or simply planning for a future car purchase. The user then navigates to the calculator page, likely through a link on the Schools First website or an internal communication.

The next step involves inputting the necessary information: loan amount, interest rate, loan term, and down payment. The calculator should provide clear prompts and instructions for each field. Upon inputting the data, the calculator instantly generates an estimated monthly payment. Ideally, the calculator should also offer additional information such as the total interest paid over the loan term, or a loan amortization schedule (as an optional advanced feature). Finally, the user can use this information to inform their decision-making process regarding a potential auto loan. A clear call to action, such as a link to further information or contact details, should be included at the end.

Features and Functionality of the Schools First Auto Loan Calculator

The Schools First auto loan calculator aims to provide a user-friendly and comprehensive tool for educators and school staff to estimate their potential auto loan payments. Its functionality is designed to be both informative and efficient, allowing users to quickly explore various loan scenarios and make informed financial decisions. The calculator’s features are carefully selected to address the specific needs and financial situations of this target audience.

The core functionality revolves around providing accurate and transparent calculations based on key loan parameters. This allows users to understand the financial implications of their borrowing choices before committing to a loan. The inclusion of supplementary features enhances the user experience and provides a more complete financial picture.

Essential Features

The Schools First auto loan calculator includes several essential features to provide users with a complete understanding of their potential loan payments. These features are designed to be easily accessible and intuitive to use, even for those with limited financial experience. The calculator’s design prioritizes clarity and simplicity to ensure a positive user experience.

| Feature | Description | Benefits | User Interaction |

|---|---|---|---|

| Loan Amount | The total amount of money the borrower wishes to borrow. | Allows users to explore different loan amounts and see how it impacts monthly payments. | Users input the desired loan amount using a slider or input field. |

| Interest Rate | The annual percentage rate (APR) charged on the loan. This reflects the cost of borrowing. | Shows users the impact of interest rates on the total cost of the loan and monthly payments. | Users can input a specific rate or select from a range of pre-populated rates based on current market conditions. |

| Loan Term | The length of time (in months or years) the borrower has to repay the loan. | Allows users to compare the effects of shorter versus longer loan terms on monthly payments and total interest paid. | Users select the loan term from a dropdown menu or use a slider to choose the desired length. |

| Monthly Payment | The calculated amount the borrower will pay each month to repay the loan. | Provides a clear and concise representation of the borrower’s financial commitment. | The calculator automatically computes the monthly payment based on the inputted loan amount, interest rate, and loan term. |

Additional Features: Loan Amortization Schedule and Prepayment Options

Beyond the core features, the Schools First auto loan calculator offers additional functionality to enhance the user experience and provide a more comprehensive financial overview. These features aim to empower users to make well-informed decisions about their auto loan.

Including a loan amortization schedule allows users to visualize the breakdown of their monthly payments, showing how much of each payment goes towards principal and interest over the life of the loan. This detailed view helps users understand the repayment process and the long-term cost of borrowing. Prepayment options allow users to explore scenarios where they might pay off their loan earlier than the scheduled term. This feature demonstrates the potential savings in interest payments associated with early repayment. For example, a user could input a scenario where they make an additional payment each year and see how that reduces the total interest paid and the overall loan term.

Competitive Analysis

Compared to competitors’ auto loan calculators, the Schools First calculator distinguishes itself through its user-friendly interface and focus on the specific needs of educators. While many competitors offer similar basic features (loan amount, interest rate, loan term, and monthly payment), the inclusion of a detailed amortization schedule and prepayment option analysis sets it apart. Competitors often lack the detailed visual representation of the loan repayment process provided by the amortization schedule, limiting the user’s understanding of the loan’s financial implications. Furthermore, few competitors offer the level of customization and flexibility in exploring prepayment scenarios. This added functionality provides a more complete and insightful experience for Schools First users.

Accuracy and Reliability of Calculations

The Schools First Auto Loan Calculator prioritizes accuracy and reliability in its computations. This is achieved through a combination of robust mathematical formulas, rigorous error handling, and comprehensive testing. The calculator aims to provide users with dependable estimations of their potential loan payments and overall costs.

The core of the calculator’s functionality rests on established financial formulas. These formulas are designed to accurately reflect the principles of loan amortization and interest calculation.

Mathematical Formulas Used

The calculator employs standard amortization formulas to determine monthly payments, total interest paid, and the remaining loan balance at any given point. The most crucial formula is the following:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly Payment

* P = Principal Loan Amount

* i = Monthly Interest Rate (Annual Interest Rate / 12)

* n = Total Number of Payments (Loan Term in Years * 12)

This formula calculates the monthly payment amount based on the principal loan amount, interest rate, and loan term. The calculator then uses this monthly payment to determine the total interest paid over the loan’s lifetime and the remaining balance after each payment period. Additional calculations are performed to present the total cost of the loan, including any applicable fees.

Input Value Handling and Scenarios, Schools first auto loan calculator

The calculator is designed to handle a wide range of input values. It accepts various loan amounts, interest rates, and loan terms. For instance, it can process loan amounts ranging from a few thousand dollars to hundreds of thousands, interest rates from near zero to upwards of 20%, and loan terms from 12 months to 84 months. The calculator also incorporates logic to handle edge cases, such as zero interest rates (resulting in equal monthly payments of the principal amount divided by the loan term) and extremely short loan terms.

Error Handling and Data Validation

Several mechanisms are in place to ensure data integrity and prevent errors. The calculator validates user input to ensure it falls within acceptable ranges. For example, it checks that the loan amount is positive, the interest rate is non-negative, and the loan term is a positive integer. If invalid input is detected, the calculator displays an appropriate error message, guiding the user to correct the input. Furthermore, the calculator performs range checks to ensure that the entered values are realistic and prevent unexpected results from extreme values. For example, exceptionally high interest rates or loan amounts might trigger a warning to the user.

Test Cases for Validation

A comprehensive suite of test cases is employed to rigorously validate the calculator’s accuracy and reliability. These test cases cover a broad spectrum of scenarios:

- Nominal Cases: These involve typical loan amounts, interest rates, and loan terms within the expected range.

- Edge Cases: These test scenarios with boundary values, such as minimum and maximum loan amounts, interest rates of 0%, and loan terms of 12 months and the maximum allowed term.

- Error Cases: These test cases involve invalid input, such as negative loan amounts, non-numeric inputs, or excessively large values that might exceed the calculator’s computational limits.

- Stress Tests: These test cases involve a large volume of calculations and varied inputs to check for performance issues and unexpected behavior under high load.

Each test case includes expected outputs that are compared against the calculator’s actual results. Discrepancies are thoroughly investigated and corrected, ensuring the calculator’s continued accuracy. These tests are regularly updated to account for changes and improvements to the calculator’s functionality.

User Experience and Accessibility

The Schools First Auto Loan Calculator prioritizes a seamless and inclusive user experience. Its design emphasizes intuitive navigation, clear information architecture, and robust accessibility features to cater to a diverse range of users, including those with disabilities. The goal is to provide a straightforward and efficient tool for anyone seeking to estimate their auto loan payments.

The calculator’s design adheres to established usability principles, including minimizing cognitive load, promoting efficient workflows, and ensuring visual consistency. Accessibility is not an afterthought but an integral part of the design process, ensuring compliance with WCAG (Web Content Accessibility Guidelines) standards. This commitment to accessibility broadens the calculator’s reach and ensures equitable access to financial information.

Interface Design and Navigation

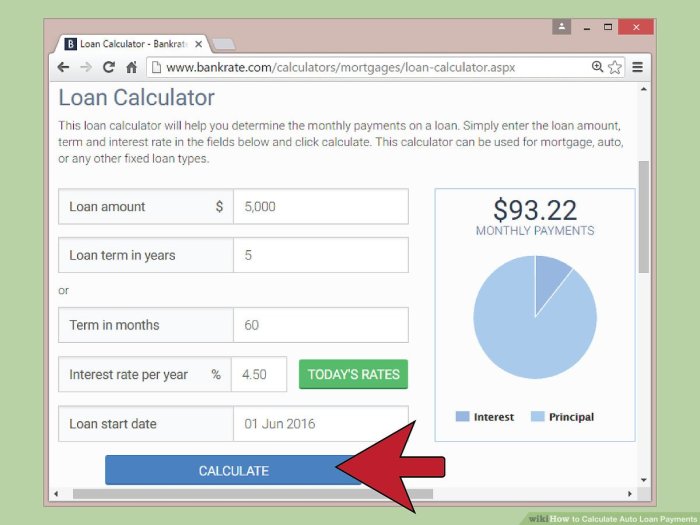

The calculator’s interface is designed for simplicity and ease of use. A clean, uncluttered layout presents information clearly and avoids overwhelming the user with unnecessary details. The primary elements – loan amount, interest rate, loan term, and down payment – are prominently displayed and easily accessible. A clear visual hierarchy, using size and contrast to distinguish between headings, labels, and input fields, guides users through the process. The “Calculate” button is strategically positioned for immediate access, and the results are presented in a concise and understandable format. Navigation is straightforward, with minimal clicks required to complete a calculation. A clean color palette is employed, ensuring good contrast and readability for all users. The entire process is designed to be intuitive, requiring minimal prior experience with financial calculators.

Accessibility Features

The Schools First Auto Loan Calculator incorporates several accessibility features to ensure usability for individuals with disabilities. These features include:

- Keyboard Navigation: All interactive elements can be accessed and manipulated using only a keyboard, eliminating the need for a mouse for users with motor impairments.

- Screen Reader Compatibility: The calculator is designed to be fully compatible with screen readers, providing accurate and descriptive labels for all interactive elements and calculated results. This allows users who are blind or have low vision to independently use the calculator.

- Sufficient Color Contrast: The color scheme adheres to WCAG guidelines for sufficient color contrast between text and background, ensuring readability for users with visual impairments.

- Alternative Text for Images (if applicable): While no images are planned for this specific calculator, should any be added in future versions, all images will include descriptive alternative text, enabling screen readers to convey the image’s content to visually impaired users.

- Semantic HTML: The calculator’s code uses semantic HTML5 elements to ensure proper structure and accessibility for assistive technologies.

Input and Output Labeling

Clear and concise labeling of all inputs and outputs is crucial for usability. Each input field (loan amount, interest rate, loan term, down payment) has a descriptive label clearly indicating the required information. Units are explicitly stated (e.g., “Loan Amount ($)”, “Interest Rate (%)”, “Loan Term (months)”). The calculated results (monthly payment, total interest paid, total amount paid) are also clearly labeled and presented in a user-friendly format, with units included. For example, the monthly payment might be displayed as “Monthly Payment: $XXX.XX”. This clear labeling minimizes ambiguity and ensures that users understand the information presented. The use of plain language avoids technical jargon, making the calculator accessible to a wider audience.

Mock-up of Calculator Interface

Imagine a clean, rectangular interface. At the top, a clear heading: “Schools First Auto Loan Calculator.” Below, four input fields are arranged vertically, each with a descriptive label to the left: “Loan Amount ($)”, “Interest Rate (%)”, “Loan Term (months)”, and “Down Payment ($)”. Each input field has a clear box for numerical entry. Below the input fields is a large, easily identifiable button: “Calculate”. After clicking “Calculate”, the results appear below the button in a neatly formatted section: “Monthly Payment: $XXX.XX”, “Total Interest Paid: $YYY.YY”, “Total Amount Paid: $ZZZ.ZZ”. The numbers “XXX.XX”, “YYY.YY”, and “ZZZ.ZZ” represent the calculated values. The entire layout uses a simple, consistent font and a clean color palette to maximize readability and visual appeal. The design is uncluttered and focuses on ease of use and clear presentation of information.

Marketing and Promotion of the Schools First Auto Loan Calculator

Effective marketing is crucial for maximizing the reach and impact of the Schools First Auto Loan Calculator. A multi-channel approach, targeting specific audience segments with tailored messaging, will be essential for achieving optimal results. This strategy focuses on leveraging digital channels for their cost-effectiveness and precise targeting capabilities, complemented by strategic partnerships to expand reach within the education community.

Successful promotion requires a well-defined strategy encompassing digital marketing, strategic partnerships, and targeted advertising. This plan details the channels, messaging, and timeline for a comprehensive marketing campaign.

Marketing Channels and Strategies

The most effective channels for promoting the Schools First Auto Loan Calculator will leverage the digital landscape and existing relationships within the education sector. These channels allow for precise targeting and measurable results.

- Social Media Marketing: Targeted advertising campaigns on platforms like Facebook, Instagram, and LinkedIn, focusing on students, recent graduates, and faculty at schools served by Schools First. Content will include engaging visuals and short videos showcasing the calculator’s ease of use and benefits. Examples include short explainer videos demonstrating how to use the calculator to compare loan options and infographics highlighting the potential savings.

- Search Engine Optimization (): Optimizing the calculator’s website and related content for relevant s (e.g., “auto loan calculator for teachers,” “best auto loan rates for educators”) to improve organic search engine rankings. This will ensure the calculator appears prominently in search results when potential users search for related terms.

- Email Marketing: Leveraging Schools First’s existing email database to send targeted email campaigns announcing the launch of the calculator and highlighting its key features. This will include personalized messaging based on user demographics and loan needs. Example email subject lines could be: “Get Pre-Approved for Your Dream Car,” or “Simplify Your Auto Loan Search with Our New Calculator.”

- Partnerships with Educational Institutions: Collaborating with schools and universities to promote the calculator through their websites, newsletters, and student services departments. This will involve offering presentations and workshops demonstrating the calculator’s utility to students and staff.

- Paid Advertising: Utilizing pay-per-click (PPC) advertising on search engines and social media platforms to reach a wider audience. This will involve carefully targeting ads to specific demographics and interests within the Schools First member base. This ensures the budget is used efficiently to reach the most relevant prospects.

Marketing Materials

Marketing materials will be designed to be visually appealing, informative, and easy to understand. The key message will emphasize the calculator’s ability to simplify the auto loan process and help users find the best financing options.

- Website Banners: Banners featuring a clean design with clear calls to action (e.g., “Calculate Your Auto Loan Now,” “Find the Perfect Rate”). These banners will include compelling visuals and highlight key features like the ability to compare loan options and estimate monthly payments. An example banner might show a happy person driving a car with text overlay “Find Your Dream Car – Calculate Your Loan Today!”

- Social Media Posts: Short, engaging posts with compelling visuals (images or videos) showcasing the calculator’s benefits. These posts will use concise language and include clear calls to action, linking directly to the calculator. An example post might say: “Confused about auto loans? Our new calculator makes it easy! Calculate your payments in seconds: [link to calculator].”

- Email Templates: Professional-looking email templates with clear subject lines and concise body text. These templates will include a prominent call to action, linking directly to the calculator and providing a brief explanation of its benefits. Example subject lines include: “Schools First Auto Loan Calculator – Get Started Now!”

Promotional Plan

The promotional plan will be executed in phases, starting with a pre-launch campaign to build anticipation, followed by a launch campaign to drive initial usage, and a sustained campaign to maintain engagement and awareness.

| Phase | Timeline | Activities | Budget |

|---|---|---|---|

| Pre-Launch | 1 month before launch | Social media teaser campaign, email announcement to select groups | $500 |

| Launch | 1 month after launch | Full-scale social media and email campaign, website banner ads, partnership outreach | $2,000 |

| Sustained | Ongoing | Ongoing social media and email marketing, optimization, paid advertising | $1,000/month |

Potential Improvements and Future Development

The Schools First Auto Loan Calculator, while currently providing a valuable service, possesses significant potential for improvement and expansion. Future development should focus on enhancing user experience, expanding functionality, and ensuring the calculator remains a leading tool for prospective borrowers. This involves iterative development based on user feedback and incorporating advanced features to meet evolving needs.

The calculator’s accuracy and reliability are paramount, and continuous monitoring and refinement are crucial. Future development should also prioritize accessibility for users with disabilities and incorporate features that cater to a wider range of financial situations.

Enhancements to Calculation Accuracy and Features

Improving the calculator’s accuracy involves incorporating more nuanced calculations. For example, the current model might not account for all potential fees associated with auto loans, such as dealer fees or document preparation charges. Adding these variables would provide a more comprehensive and realistic estimate of the total loan cost. Furthermore, incorporating different interest rate calculation methods (e.g., simple interest versus compound interest) would offer users a more detailed understanding of their financing options. Adding a feature to compare loan offers from different lenders, using a standardized format, would greatly benefit users in making informed decisions. This could include visual representations such as charts comparing monthly payments and total interest paid.

Improving User Experience and Accessibility

The current user interface could be streamlined for improved usability. Clearer labeling of input fields, concise explanations of terms, and a more intuitive layout would enhance the user experience. Incorporating visual aids, such as progress bars during calculations or interactive graphs illustrating loan amortization, could further enhance understanding. Furthermore, ensuring the calculator is accessible to users with disabilities, complying with WCAG guidelines (Web Content Accessibility Guidelines), is crucial. This involves implementing features such as keyboard navigation, screen reader compatibility, and alternative text for images. Examples of WCAG compliance would include providing sufficient color contrast between text and background, and ensuring all interactive elements have clear labels.

Incorporating User Feedback

A robust feedback mechanism is essential for continuous improvement. Implementing a system for users to easily submit suggestions, report bugs, or provide ratings will allow for the identification of areas needing attention. Regular analysis of this feedback will inform future development priorities. For example, if users frequently report difficulty understanding a particular aspect of the calculation, the interface can be redesigned to clarify this point. Similarly, if a specific feature is consistently requested, it can be prioritized for future development. This iterative approach, driven by user feedback, will ensure the calculator remains relevant and useful.

Roadmap for Future Development

The roadmap for future development will be iterative, prioritizing user feedback and market trends. Phase 1 will focus on improving calculation accuracy by adding more fee variables and interest calculation methods, as well as implementing accessibility features. Phase 2 will concentrate on enhancing the user experience through UI/UX improvements and the addition of visual aids. Phase 3 will introduce features like loan offer comparison and integration with external financial data sources. Continuous monitoring and analysis of user feedback will inform the prioritization of features in each phase. This phased approach ensures a manageable and efficient development process, leading to a more robust and user-friendly auto loan calculator.

End of Discussion

The Schools First Auto Loan Calculator is more than just a tool; it’s your partner in making informed financial choices. By providing a clear and concise overview of your auto loan options, it eliminates the guesswork and empowers you to confidently navigate the car-buying process. Take control of your finances, explore various scenarios, and find the loan that best suits your needs. With the Schools First Auto Loan Calculator, you’re equipped with the knowledge to make a smart and financially responsible decision.

Clarifying Questions: Schools First Auto Loan Calculator

What interest rates does the calculator use?

The calculator uses current market interest rates for auto loans. These rates are updated regularly to reflect the most accurate information. However, it’s important to remember that your actual interest rate may vary based on your credit score and other factors.

Can I use the calculator if I don’t have a Schools First account?

Yes, the calculator is available to everyone, regardless of whether you have a Schools First account. It’s a free tool designed to help anyone estimate their auto loan payments.

What happens if I enter incorrect information?

The calculator includes data validation to prevent errors. If you enter incorrect information, such as a non-numeric value, the calculator will display an error message and guide you to correct the input.

Is my data secure when using the calculator?

Your data is handled securely and is not stored permanently. The calculations are performed on your device, ensuring your privacy.