SchoolsFirst car loan calculator simplifies the process of securing auto financing. Understanding your borrowing power before you even step onto a dealership lot is key, and this tool empowers you to do just that. This guide explores how to use the SchoolsFirst calculator, compares its offerings to competitors, and delves into the factors influencing loan approval and rates, ultimately helping you navigate the car buying journey with confidence.

We’ll break down the features of SchoolsFirst’s car loan products, guiding you through the calculator’s functionalities and interpreting the results. By comparing SchoolsFirst to other lenders, you can make an informed decision that best suits your financial situation. We’ll also examine the critical factors affecting your loan approval and interest rate, ensuring you’re prepared for a smooth and successful car loan application.

Understanding SchoolsFirst Federal Credit Union Car Loan Products

SchoolsFirst Federal Credit Union offers a range of car loan products designed to meet the diverse financial needs of its members. These loans provide competitive interest rates and flexible terms, making it easier to purchase or refinance a vehicle. Understanding the specifics of these offerings is crucial for making an informed financial decision.

SchoolsFirst Car Loan Offerings, Schoolsfirst car loan calculator

SchoolsFirst provides car loans for both new and used vehicles, as well as refinancing options for existing auto loans. New car loans typically offer lower interest rates due to the lower risk associated with newer vehicles. Used car loans, while potentially having higher interest rates, provide access to financing for pre-owned vehicles. Refinancing options allow members to potentially lower their monthly payments or shorten their loan term by securing a better interest rate with SchoolsFirst. The specific interest rates offered will vary depending on several factors, including the borrower’s credit score, the loan amount, the loan term, and the type of vehicle being financed. It’s important to contact SchoolsFirst directly for the most up-to-date interest rate information.

Loan Examples

The following table illustrates potential loan scenarios with varying loan amounts, interest rates, and loan terms. These are examples only and actual rates and payments may vary. Always consult with SchoolsFirst for a personalized quote.

| Loan Amount | Interest Rate | Loan Term (Months) | Monthly Payment (Estimate) |

|---|---|---|---|

| $20,000 | 5.0% | 60 | $377 |

| $30,000 | 6.0% | 72 | $500 |

| $15,000 | 4.5% | 48 | $345 |

| $25,000 | 5.5% | 60 | $470 |

Special Features and Benefits

While specific details on discounts or rewards programs may change, SchoolsFirst often offers competitive rates and flexible terms as key benefits. These benefits aim to make the car buying process more accessible and affordable for its members. Contacting SchoolsFirst directly is the best way to determine current special offers and promotions. Members should inquire about any potential discounts or incentives available at the time of application. The credit union’s focus on member service provides an advantage over some larger financial institutions.

Using the SchoolsFirst Car Loan Calculator

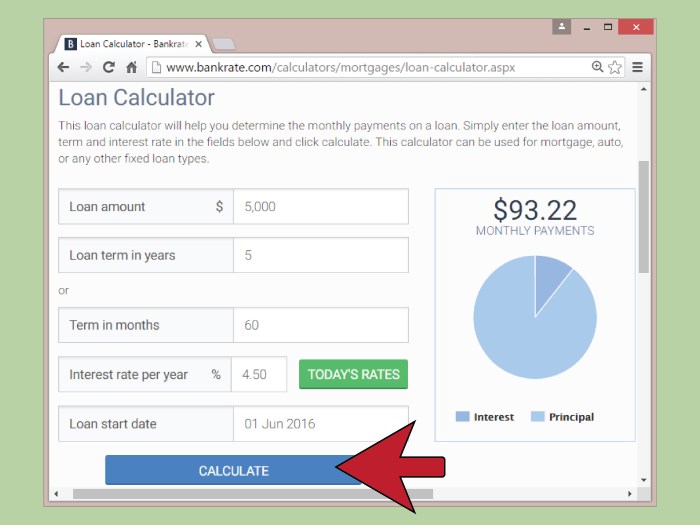

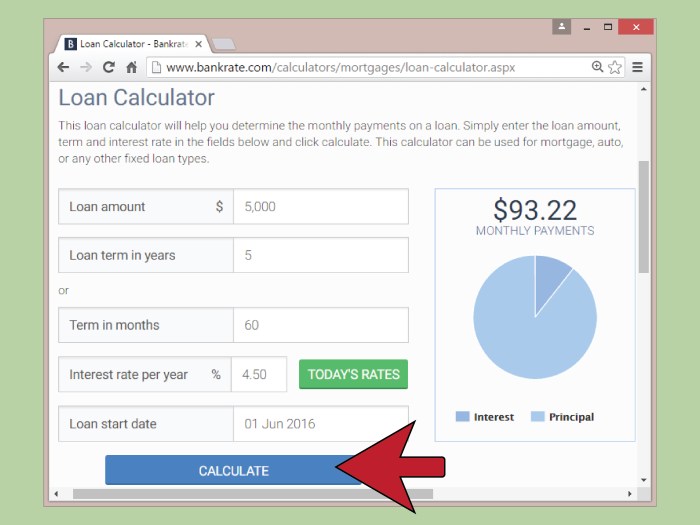

The SchoolsFirst Federal Credit Union car loan calculator is a valuable tool for prospective borrowers to estimate their monthly payments and understand the overall cost of financing a vehicle. This user-friendly calculator simplifies the loan process by providing quick, preliminary estimates based on user-supplied information. Understanding how to use it effectively can significantly aid in financial planning and budgeting for a new or used car purchase.

The SchoolsFirst car loan calculator streamlines the process of estimating car loan costs. By inputting specific financial details, users receive immediate feedback on potential monthly payments, total interest paid over the loan term, and a detailed loan amortization schedule. This allows for informed decision-making before applying for a formal loan.

Required User Inputs and Their Significance

The calculator requires several key pieces of information to generate accurate estimates. Providing accurate data is crucial for receiving a reliable projection of your loan terms. Inaccurate input will lead to inaccurate results.

- Loan Amount: This represents the total amount of money you intend to borrow to purchase the vehicle. This figure is typically the vehicle’s price minus any down payment or trade-in value. For example, if a car costs $25,000 and you have a $5,000 down payment, the loan amount would be $20,000.

- Interest Rate: This is the annual percentage rate (APR) charged by the lender on the loan. SchoolsFirst will provide you with your specific APR upon loan application; however, the calculator allows you to input a range of rates to explore different scenarios. For instance, you might test the calculations with rates ranging from 5% to 7% to understand the impact of different interest rates on your monthly payment.

- Loan Term: This specifies the length of the loan in months. Common loan terms range from 36 months to 72 months (3 to 6 years). Choosing a shorter loan term will result in higher monthly payments but less interest paid overall, while a longer term will result in lower monthly payments but higher total interest paid. For example, a 60-month loan will typically have lower monthly payments than a 36-month loan for the same loan amount and interest rate.

Information Provided by the Calculator

Once you’ve entered the required information, the SchoolsFirst car loan calculator provides a comprehensive overview of your potential loan terms. This information is essential for comparison shopping and budget planning.

- Estimated Monthly Payment: This is the amount you would be required to pay each month to repay the loan over the chosen term. This is a crucial figure for determining your affordability.

- Total Interest Paid: This represents the total amount of interest you’ll pay over the life of the loan. Understanding this figure helps you assess the overall cost of financing.

- Loan Amortization Schedule: This detailed schedule breaks down each monthly payment, showing the portion allocated to principal (the loan amount) and the portion allocated to interest. It illustrates how the loan balance decreases over time. For example, in the early stages of a loan, a larger portion of the payment goes towards interest, while in later stages, a larger portion goes towards the principal.

Comparing SchoolsFirst Car Loans to Competitors

Choosing the right car loan can significantly impact your overall cost. This section compares SchoolsFirst Federal Credit Union’s car loan offerings to those of other major financial institutions, helping you make an informed decision. We’ll examine interest rates, loan terms, eligibility requirements, and application processes to highlight the advantages and disadvantages of each. Note that interest rates and terms are subject to change and are based on current market conditions.

Direct comparison of loan products across different institutions requires considering several factors beyond just interest rates. Loan terms, eligibility criteria, and the overall application process play crucial roles in determining the best fit for individual borrowers.

SchoolsFirst Car Loan Rates and Terms Compared to Competitors

The following table compares SchoolsFirst’s car loan offerings with those from three other major financial institutions – Bank of America, Chase, and Capital One. Remember that these are examples and actual rates and terms can vary based on credit score, loan amount, and other factors. Always check the lender’s website for the most up-to-date information.

| Institution Name | Interest Rate (Example APR) | Loan Term (Example) |

|---|---|---|

| SchoolsFirst FCU | 4.5% – 10% | 24-72 months |

| Bank of America | 5.0% – 12% | 36-84 months |

| Chase | 5.5% – 11% | 48-72 months |

| Capital One | 6.0% – 13% | 36-60 months |

Key Differences in Loan Eligibility and Application Processes

Eligibility requirements and application processes differ significantly among lenders. SchoolsFirst, as a credit union, often has more lenient eligibility requirements than traditional banks, potentially catering to borrowers with slightly lower credit scores. However, membership requirements may apply. Banks like Bank of America, Chase, and Capital One typically have stricter credit score requirements and more extensive application processes.

For example, SchoolsFirst might prioritize its members and offer preferential rates, while Bank of America may emphasize a wider range of loan products but require a higher credit score for the best rates. Capital One might offer pre-qualification tools to simplify the application process, while Chase may focus on online application convenience.

Advantages and Disadvantages of Choosing SchoolsFirst

Choosing SchoolsFirst over its competitors presents both advantages and disadvantages. A key advantage is potentially lower interest rates and more flexible terms for qualifying members. The application process may also be less stringent than at some banks. However, membership requirements might exclude some borrowers, and the range of loan products might be less diverse than at larger institutions. Borrowers should carefully weigh the pros and cons based on their individual circumstances and financial profiles.

For instance, a borrower with a good credit score and a need for a longer loan term might find better options with Bank of America or Chase. However, a borrower with a slightly lower credit score and a preference for a credit union’s member-centric approach might find SchoolsFirst a more suitable choice.

Factors Influencing Car Loan Approval and Rates

Securing a car loan hinges on several key factors, primarily your creditworthiness and financial stability. Lenders assess these elements to determine your eligibility and the interest rate they’ll offer. Understanding these factors empowers you to improve your chances of approval and potentially secure a more favorable loan.

Your credit score is the most significant factor influencing both your approval chances and the interest rate you’ll receive. A higher credit score demonstrates a history of responsible borrowing and repayment, making you a lower-risk borrower in the eyes of lenders. This translates to better loan terms, including lower interest rates and potentially more favorable repayment periods.

Credit Score’s Impact on Car Loan Interest Rates and Approval

Credit scores are typically categorized into ranges, with higher scores indicating better credit health. The impact of your credit score on your loan is substantial. Lenders use these scores to assess your risk, and a higher score often translates to significantly lower interest rates and a higher likelihood of approval.

- Excellent Credit (750+): Borrowers with excellent credit scores typically qualify for the lowest interest rates available, often receiving preferential treatment and the best loan terms. They may also be eligible for loan amounts and longer repayment terms than those with lower scores.

- Good Credit (700-749): Individuals in this range generally receive favorable interest rates, though not as low as those with excellent credit. Loan approval is highly likely.

- Fair Credit (650-699): Borrowers with fair credit may still qualify for a loan, but they will likely face higher interest rates and potentially stricter loan terms. Approval is possible but less certain.

- Poor Credit (Below 650): Securing a loan with poor credit can be challenging. Interest rates will be significantly higher, loan amounts may be lower, and approval is far from guaranteed. Borrowers may need a larger down payment or a co-signer to increase their chances of approval.

Other Factors Affecting Car Loan Approval

Beyond your credit score, several other factors influence a lender’s decision to approve your loan application and the interest rate they offer. These factors are often considered in conjunction with your credit score to create a comprehensive risk assessment.

Your income plays a crucial role. Lenders want to ensure you have the financial capacity to repay the loan. A stable and sufficient income demonstrates your ability to meet your monthly payments. Similarly, your debt-to-income ratio (DTI) – the percentage of your monthly income dedicated to debt repayment – is a key indicator of your financial health. A lower DTI generally improves your chances of approval and may lead to better loan terms. A substantial down payment also significantly strengthens your application. A larger down payment reduces the lender’s risk, potentially leading to lower interest rates and a greater likelihood of approval.

Illustrating Loan Amortization

Understanding how your loan payments are allocated between principal and interest is crucial for effective financial planning. An amortization schedule provides a clear breakdown of this distribution over the life of your loan. This allows borrowers to track their progress towards paying off the loan and understand the changing proportions of principal and interest payments over time.

An amortization schedule details each payment’s impact on the loan balance. It shows how much of each payment goes towards reducing the principal (the original loan amount) and how much goes towards paying the interest accrued on the outstanding balance. The schedule visually demonstrates the decreasing principal balance and the gradual reduction in interest paid with each subsequent payment.

Sample Loan Amortization Schedule

Let’s illustrate with a hypothetical example: a $20,000 car loan at a 5% annual interest rate, amortized over 60 months (5 years). The following table shows a simplified version of the amortization schedule. Note that actual schedules may vary slightly due to differences in calculation methods used by lenders.

| Payment Number | Beginning Balance | Payment Amount | Ending Balance |

|---|---|---|---|

| 1 | $20,000.00 | $377.42 | $19,622.58 |

| 2 | $19,622.58 | $377.42 | $19,243.16 |

| 3 | $19,243.16 | $377.42 | $18,862.74 |

| 4 | $18,862.74 | $377.42 | $18,481.32 |

| 5 | $18,481.32 | $377.42 | $18,100.00 |

| … | … | … | … |

| 60 | $8.75 | $377.42 | $0.00 |

The payment amount remains constant throughout the loan term, but the proportion allocated to principal and interest changes. In the early stages of the loan, a larger portion of the payment goes towards interest, while a smaller portion reduces the principal. As the loan progresses, the proportion shifts, with a larger portion going towards principal repayment and a smaller portion towards interest.

Principal and Interest Distribution

The amortization schedule clearly illustrates this distribution. For example, in the first payment, a significant portion covers the interest accrued on the $20,000 balance. Only a small amount reduces the principal. However, as the loan progresses and the principal balance decreases, the interest calculation base shrinks, leading to a lower interest component in each subsequent payment. Consequently, a larger proportion of each payment is applied to reduce the principal balance, accelerating the repayment process.

Concluding Remarks

Securing a car loan can feel overwhelming, but with the right tools and knowledge, the process becomes significantly easier. The SchoolsFirst car loan calculator provides a valuable starting point, allowing you to estimate monthly payments and explore different loan scenarios. By understanding the factors that influence loan approval and comparing offers from various lenders, you can confidently choose the financing option that best aligns with your needs and budget. Remember to carefully review the terms and conditions before committing to any loan.

FAQ Corner

What credit score is needed for a SchoolsFirst car loan?

While SchoolsFirst doesn’t publicly state a minimum credit score, a higher score generally results in better interest rates and loan terms. It’s best to check your credit report and score before applying.

Can I refinance my existing car loan with SchoolsFirst?

Yes, SchoolsFirst offers car loan refinancing options. The calculator can help you estimate potential savings by inputting your current loan details and comparing them to SchoolsFirst’s rates.

What documents do I need to apply for a SchoolsFirst car loan?

You’ll likely need proof of income, identification, and information about the vehicle you’re financing. Check the SchoolsFirst website for a complete list of required documents.

How long does it take to get approved for a SchoolsFirst car loan?

Approval times vary, but generally, you can expect a decision within a few days to a week. The speed depends on factors like the completeness of your application and your credit history.