SchoolsFirst Personal Loan Calculator simplifies the process of estimating your monthly payments and total loan costs. Understanding personal loan options is crucial for responsible borrowing, and this calculator empowers you to compare different loan scenarios before committing to a financial agreement. This guide delves into the features of the SchoolsFirst calculator, explaining how it works, the factors influencing loan costs, and offers comparisons with alternative lenders. We’ll also explore effective strategies for managing loan repayments and provide answers to frequently asked questions.

We’ll cover everything from inputting loan details like amount, interest rate, and term to interpreting the output, which includes monthly payments, total interest, and total repayment amount. By the end, you’ll be confident in using the SchoolsFirst Personal Loan Calculator to make informed decisions about your personal finances.

Understanding SchoolsFirst Federal Credit Union Personal Loans: Schoolsfirst Personal Loan Calculator

SchoolsFirst Federal Credit Union offers personal loans designed to help its members meet various financial needs. These loans provide a flexible and potentially cost-effective borrowing solution compared to other financial products, but understanding the specifics is crucial before applying. This section details the key features, eligibility requirements, and application process for SchoolsFirst personal loans, enabling a thorough comparison with alternative loan options.

SchoolsFirst Personal Loan Features

SchoolsFirst personal loans offer a range of features catering to diverse financial situations. Loan amounts, interest rates, and repayment terms are all variable, depending on factors such as the borrower’s creditworthiness and the loan’s purpose. While specific details aren’t publicly listed on a single page, contacting SchoolsFirst directly or using their online loan calculator provides the most accurate and up-to-date information on available loan options. Generally, expect competitive interest rates compared to other financial institutions, particularly for members with strong credit histories. Repayment terms are flexible, allowing borrowers to choose a schedule that fits their budget, potentially ranging from several months to several years.

SchoolsFirst Personal Loan Eligibility

Eligibility for a SchoolsFirst personal loan hinges primarily on membership within the credit union. This typically requires affiliation with a qualifying school district or educational institution. Beyond membership, SchoolsFirst assesses applicants’ creditworthiness using standard credit scoring methods. A higher credit score generally translates to more favorable loan terms, such as lower interest rates. Income verification is also a standard requirement, demonstrating the applicant’s ability to repay the loan. Additional factors, such as existing debt and employment history, may also influence the approval process. Applicants should be prepared to provide documentation supporting their income, employment, and credit history.

SchoolsFirst Personal Loan Application Process

The application process for a SchoolsFirst personal loan typically begins online or through a visit to a branch location. Applicants will need to provide personal information, including identification, employment details, and financial information. Supporting documentation, such as pay stubs, tax returns, and bank statements, may be required to verify income and credit history. Once the application is submitted, SchoolsFirst will review the information and assess the applicant’s creditworthiness. Approval decisions and loan terms are typically communicated within a short timeframe. The final step involves signing loan documents and receiving the loan proceeds, usually electronically deposited into the borrower’s account.

Comparison with Other Personal Loan Options

Comparing SchoolsFirst personal loans to other options requires considering several factors. Interest rates, fees, and repayment terms vary significantly among lenders. Banks, online lenders, and credit unions all offer personal loans, each with its own set of advantages and disadvantages. SchoolsFirst’s membership requirement may limit its accessibility but often translates to more competitive rates and potentially more personalized service for eligible members. Online lenders may offer a faster and more convenient application process, while banks might provide a broader range of loan products. A thorough comparison of available options, focusing on individual financial needs and circumstances, is essential before selecting a lender.

Functionality of the SchoolsFirst Personal Loan Calculator

The SchoolsFirst Federal Credit Union personal loan calculator is a user-friendly online tool designed to provide quick estimates of monthly payments, total interest paid, and total repayment amount for potential personal loans. It simplifies the loan application process by allowing prospective borrowers to explore different loan scenarios before formally applying. This allows for informed decision-making based on individual financial circumstances.

The calculator streamlines the process of understanding the financial implications of a SchoolsFirst personal loan. By inputting key variables, users receive a clear and concise summary of their potential loan costs, empowering them to make a well-informed choice.

Input Parameters

The SchoolsFirst personal loan calculator requires three primary inputs to generate an accurate estimate:

- Loan Amount: This is the total amount of money you wish to borrow. For example, if you need $10,000 for home improvements, you would enter this figure.

- Interest Rate: This is the annual percentage rate (APR) charged on the loan. The APR reflects the cost of borrowing and will vary based on your creditworthiness and the terms of the loan. The calculator may offer a range of rates or require you to input a specific rate provided by SchoolsFirst.

- Loan Term: This represents the length of time you have to repay the loan, typically expressed in months. Common loan terms might include 12, 24, 36, 48, or 60 months. A longer loan term results in lower monthly payments but higher total interest paid over the life of the loan.

Output Provided

Upon entering the required information, the SchoolsFirst personal loan calculator provides the following outputs:

- Monthly Payment: This is the fixed amount you’ll pay each month towards the loan principal and interest. This figure is crucial for budgeting and ensuring affordability.

- Total Interest Paid: This represents the total amount of interest you’ll pay over the life of the loan. Understanding this figure is vital for comparing different loan options and minimizing overall borrowing costs.

- Total Repayment Amount: This is the sum of the loan amount and the total interest paid, representing the total cost of the loan. This provides a comprehensive view of the loan’s financial impact.

Using the SchoolsFirst Personal Loan Calculator: A Step-by-Step Guide

To effectively use the SchoolsFirst personal loan calculator, follow these steps:

- Navigate to the Calculator: Locate the personal loan calculator on the SchoolsFirst Federal Credit Union website. This is usually found within the personal loan section.

- Input Loan Amount: Enter the desired loan amount in the designated field. Ensure accuracy as this directly impacts the calculations.

- Input Interest Rate: Enter the applicable interest rate. If a range is provided, experiment with different rates to see how they affect the outcome.

- Input Loan Term: Select the desired loan term in months from the options provided.

- Review Results: Once the inputs are entered, the calculator will instantly display the estimated monthly payment, total interest paid, and total repayment amount.

- Compare Scenarios: Adjust the input parameters (loan amount, interest rate, loan term) to compare different loan scenarios and determine the most suitable option based on your financial situation.

For example, let’s say you need $5,000 for a new appliance, and SchoolsFirst offers a personal loan with a 7% APR. Using a 24-month loan term, the calculator might estimate a monthly payment of approximately $220, total interest paid of around $300, and a total repayment amount of about $5300. By changing the loan term to 36 months, you’ll likely see a lower monthly payment but a higher total interest paid. This allows you to weigh the trade-offs between shorter loan terms with higher monthly payments and longer terms with lower monthly payments but greater total interest costs.

Factors Influencing Personal Loan Costs

Several key factors determine the overall cost of a SchoolsFirst personal loan. Understanding these factors allows borrowers to make informed decisions and potentially secure more favorable loan terms. The primary influences are your creditworthiness, the loan’s duration, and the loan amount itself.

Credit Score’s Impact on Interest Rates, Schoolsfirst personal loan calculator

Your credit score significantly impacts the interest rate you’ll receive on a personal loan. Lenders use credit scores to assess risk. A higher credit score indicates a lower risk of default, leading to a lower interest rate. Conversely, a lower credit score suggests a higher risk, resulting in a higher interest rate. For example, a borrower with an excellent credit score (750 or above) might qualify for an interest rate of 7%, while a borrower with a fair credit score (650-699) might receive an interest rate of 12% or higher on the same loan amount. This difference can substantially affect the total cost of the loan over its lifespan. Improving your credit score before applying for a loan can lead to significant savings.

Loan Term and Total Interest Paid

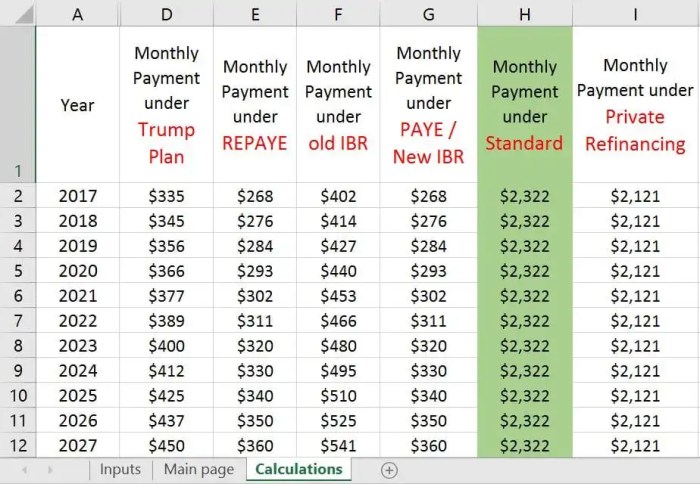

The length of your loan term (the time you have to repay the loan) directly impacts the total interest paid. Longer loan terms generally result in lower monthly payments, but you’ll pay significantly more interest over the life of the loan. Shorter loan terms mean higher monthly payments, but you’ll pay less interest overall. Consider the following hypothetical scenario: a $10,000 loan at 8% interest. A 3-year loan might have monthly payments around $313, with total interest paid approximately $1,670. A 5-year loan might have monthly payments of $203, but total interest paid would increase to approximately $2,150.

Comparison of Loan Costs Across Different Scenarios

The following table illustrates how loan amount and interest rate influence the estimated monthly payment. These are hypothetical examples and actual rates may vary depending on individual creditworthiness and SchoolsFirst’s current lending policies.

| Loan Amount | Interest Rate | Loan Term (years) | Estimated Monthly Payment |

|---|---|---|---|

| $5,000 | 8% | 3 | $161 |

| $10,000 | 10% | 5 | $212 |

| $15,000 | 12% | 7 | $279 |

| $20,000 | 8% | 3 | $626 |

Alternative Loan Options

Choosing a personal loan involves careful consideration of various lenders and their offerings. While SchoolsFirst Federal Credit Union provides a valuable option for its members, exploring alternative loan providers allows for a comprehensive comparison and the selection of the most suitable loan based on individual financial circumstances and needs. This section compares SchoolsFirst personal loans with those from other institutions, highlighting their features, costs, and respective advantages and disadvantages.

Comparison of SchoolsFirst and Competing Personal Loan Providers

The following table compares SchoolsFirst personal loans with loans from other prominent lenders. Note that interest rates and loan amounts are subject to change based on creditworthiness and market conditions. Always check the lender’s website for the most up-to-date information.

| Lender | Interest Rate Range (APR) | Loan Amount Range | Repayment Terms (Months) |

|---|---|---|---|

| SchoolsFirst FCU | Variable, depending on credit score and loan terms. Check their website for current rates. | Varies; typically ranges from a few thousand to tens of thousands of dollars. Check their website for specifics. | Varies, typically ranging from 12 to 60 months. Check their website for specifics. |

| Bank of America | Variable, typically 7.99% – 24.99% APR. This range is illustrative and can vary greatly. | $2,000 – $100,000 (Example range; actual amounts may differ). | 12 – 60 months (Example range; actual terms may differ). |

| Chase | Variable, typically 8.99% – 24.99% APR. This range is illustrative and can vary greatly. | $2,000 – $50,000 (Example range; actual amounts may differ). | 12 – 60 months (Example range; actual terms may differ). |

| Discover | Variable, typically 7.99% – 24.99% APR. This range is illustrative and can vary greatly. | $2,500 – $40,000 (Example range; actual amounts may differ). | 12 – 60 months (Example range; actual terms may differ). |

| Online Lender (e.g., LendingClub) | Variable, depending on credit score. Rates can be competitive but may be higher for borrowers with lower credit scores. | Varies widely depending on lender and borrower profile. | Varies widely depending on lender and borrower profile. |

Advantages and Disadvantages of Different Loan Options

Each lender offers unique advantages and disadvantages. For example, credit unions like SchoolsFirst often offer lower interest rates and more personalized service than large banks, but may have stricter membership requirements. Banks typically offer a wider range of loan products and more convenient branch access, but may have higher interest rates and fees. Online lenders can offer competitive rates but may lack the personal touch of a local credit union or bank. The best choice depends on individual needs and circumstances. Borrowers should carefully compare fees, interest rates, and repayment terms before making a decision.

Managing Personal Loan Repayment

Successfully managing personal loan repayments requires proactive planning and consistent effort. Failing to do so can lead to serious financial consequences, impacting your credit score and overall financial well-being. This section Artikels strategies for effective repayment and addresses potential challenges.

Effective repayment strategies hinge on careful budgeting and proactive financial planning. Understanding your income and expenses is crucial for determining a realistic repayment plan. This involves tracking your income, identifying essential and non-essential expenses, and creating a budget that allocates sufficient funds for loan payments. A well-structured budget leaves room for unexpected expenses while ensuring timely loan repayments.

Budgeting and Financial Planning

Creating a comprehensive budget is the cornerstone of successful loan repayment. This involves meticulously tracking all income sources and expenses. Categorize expenses into needs (housing, food, transportation) and wants (entertainment, dining out). Compare your total expenses to your income to determine your disposable income – the amount available for loan payments and savings. Several budgeting methods exist, such as the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), or zero-based budgeting (allocating every dollar to a specific category). Regularly reviewing and adjusting your budget is essential to adapt to changing circumstances. Consider using budgeting apps or spreadsheets to streamline the process.

Consequences of Loan Default

Loan default, the failure to make timely payments, carries significant repercussions. Your credit score will suffer, making it harder to obtain future loans, credit cards, or even rent an apartment. Late payment fees and penalties will accrue, increasing your overall debt. In severe cases, creditors may pursue legal action, potentially leading to wage garnishment or the seizure of assets. The negative impact on your credit history can persist for seven years or more, making it challenging to rebuild your financial standing. For example, a default on a $10,000 loan could result in thousands of dollars in additional fees and significantly impact your ability to secure a mortgage or auto loan in the future.

Resources for Borrowers Experiencing Financial Difficulties

Facing financial hardship doesn’t necessitate loan default. Several resources can assist borrowers in managing their debt. Credit counseling agencies provide guidance on budgeting, debt management, and negotiating with creditors. They can help create a debt management plan to consolidate debts and reduce monthly payments. Non-profit organizations often offer financial literacy programs and workshops, equipping individuals with the knowledge and skills to manage their finances effectively. Borrowers should contact their lender directly to explore options like forbearance (temporary suspension of payments) or loan modification (altering loan terms). Government programs, such as those offered by the Consumer Financial Protection Bureau (CFPB), may also provide assistance and resources for individuals struggling with debt. Early communication with your lender is crucial; they may be willing to work with you to avoid default.

Illustrative Examples of Loan Scenarios

Understanding the implications of different loan parameters is crucial for making informed financial decisions. The following scenarios demonstrate how varying loan amounts, interest rates, and terms impact monthly payments and total interest paid. These examples are illustrative and assume a fixed interest rate throughout the loan term. Actual SchoolsFirst loan terms and rates may vary.

Scenario 1: Consolidating High-Interest Debt

This scenario focuses on a borrower consolidating several high-interest credit card debts into a single personal loan with SchoolsFirst. The goal is to lower the overall interest rate and simplify repayment.

Let’s assume a borrower has $10,000 in credit card debt with an average interest rate of 18%. They obtain a SchoolsFirst personal loan for $10,000 at a fixed interest rate of 9% over a 60-month term. Using a personal loan calculator (either SchoolsFirst’s or an equivalent), we find the estimated monthly payment and total interest paid.

Scenario 2: Home Improvement Project

This scenario models a home improvement project financed through a SchoolsFirst personal loan. Home improvements can significantly increase property value, but careful financial planning is necessary.

Assume a homeowner needs $20,000 for a kitchen renovation. They secure a SchoolsFirst personal loan at a 7% interest rate for 36 months. The calculator would then be used to determine the estimated monthly payment and total interest paid. This demonstrates the cost of financing a significant home improvement project.

Scenario 3: Unexpected Medical Expenses

Unexpected medical expenses can create significant financial strain. This scenario illustrates how a SchoolsFirst personal loan can help manage these costs.

Suppose a borrower faces $5,000 in unexpected medical bills. They obtain a SchoolsFirst personal loan for $5,000 at an interest rate of 11% over a 24-month term. The estimated monthly payment and total interest paid can then be calculated using the SchoolsFirst personal loan calculator or a similar tool. This example highlights the use of a personal loan for managing emergency expenses.

Loan Scenario Comparison

The following table summarizes the results of the three scenarios:

| Scenario | Loan Amount | Interest Rate | Monthly Payment (Estimated) | Total Interest Paid (Estimated) |

|---|---|---|---|---|

| Consolidating High-Interest Debt | $10,000 | 9% | $210 (Example – Actual amount will depend on the calculator used) | $1,600 (Example – Actual amount will depend on the calculator used) |

| Home Improvement Project | $20,000 | 7% | $625 (Example – Actual amount will depend on the calculator used) | $1,500 (Example – Actual amount will depend on the calculator used) |

| Unexpected Medical Expenses | $5,000 | 11% | $230 (Example – Actual amount will depend on the calculator used) | $550 (Example – Actual amount will depend on the calculator used) |

Ultimate Conclusion

Successfully navigating the world of personal loans requires careful planning and understanding. The SchoolsFirst Personal Loan Calculator is a valuable tool in this process, allowing you to quickly assess the potential costs and repayment implications of different loan options. Remember to consider factors like your credit score and loan term when making your decision, and always explore alternative lenders to find the best fit for your financial needs. By utilizing the resources and strategies Artikeld in this guide, you can confidently borrow responsibly and achieve your financial goals.

Quick FAQs

What happens if I miss a payment on my SchoolsFirst personal loan?

Missing payments can lead to late fees, a damaged credit score, and potential loan default. Contact SchoolsFirst immediately if you anticipate difficulty making a payment to explore options like repayment plans.

Can I prepay my SchoolsFirst personal loan?

Yes, SchoolsFirst typically allows prepayment without penalty. Check your loan agreement for specific details.

What types of personal loans does SchoolsFirst offer besides the standard unsecured loan?

SchoolsFirst may offer various personal loan products; check their website for details on secured loans, debt consolidation loans, or other specialized options.

Where can I find the SchoolsFirst Personal Loan Calculator?

The calculator is usually accessible on the SchoolsFirst Federal Credit Union website. Look for a section dedicated to personal loans or online banking tools.