Speedy loan online application processes are revolutionizing how we access credit. This streamlined approach offers borrowers a faster, more convenient alternative to traditional lending methods. We’ll explore the key features that contribute to speed, examine security protocols, and delve into the future of this rapidly evolving landscape. Understanding the nuances of online loan applications empowers borrowers to make informed decisions and navigate the process efficiently.

From the user experience and technology driving these speedy applications to the factors influencing processing times and the critical issue of data security, we’ll cover it all. We’ll also compare different platforms, analyze various loan types, and highlight marketing strategies used to attract borrowers seeking fast financial solutions.

Understanding “Speedy Loan Online Application”

The rise of online lending platforms has revolutionized the borrowing experience, offering speed and convenience unavailable through traditional brick-and-mortar institutions. A speedy online loan application promises a quick and efficient process, minimizing paperwork and wait times. This streamlined approach aims to provide borrowers with access to funds rapidly, often within minutes or hours, depending on the lender and the borrower’s financial profile.

The user experience associated with a speedy online loan application is designed for simplicity and ease of use. Borrowers typically interact with a user-friendly interface, completing the application through a series of straightforward steps. Information required usually includes personal details, employment history, and income information. The entire process is often completed digitally, eliminating the need for physical documents or in-person visits. Many platforms incorporate features such as automated credit checks and instant decision-making technologies to accelerate the loan approval process.

Key Features Contributing to Fast Application Processes, Speedy loan online application

Several key features contribute to the speed and efficiency of online loan applications. These features are designed to automate various stages of the application process, reducing manual intervention and processing times. A crucial element is the use of sophisticated algorithms and automated systems for credit scoring and risk assessment. This enables lenders to quickly assess the creditworthiness of applicants and make informed decisions rapidly. Another critical feature is the integration of secure online payment gateways, allowing for swift and secure transfer of funds once the loan is approved. Finally, the use of digital document verification and e-signatures significantly streamlines the paperwork process, eliminating delays associated with traditional paper-based applications.

Comparison of Application Processes Across Online Lending Platforms

Online lending platforms vary significantly in their application processes and the speed at which they operate. Some platforms may emphasize a completely automated process, requiring minimal human interaction, while others may incorporate a degree of manual review, potentially leading to longer processing times. For example, some platforms may offer instant loan decisions based solely on automated credit scoring, while others might require additional verification steps, such as income verification or bank statement review. The speed of disbursement also varies; some platforms may transfer funds within minutes of approval, while others may take several business days. These differences reflect variations in lending criteria, risk tolerance, and technological capabilities across different platforms.

Technology Facilitating Speedy Online Loan Applications

The speed and efficiency of online loan applications are largely driven by advancements in technology. Application Programming Interfaces (APIs) play a crucial role, enabling seamless data exchange between various systems. For instance, APIs can facilitate instant credit checks by connecting the lending platform to credit bureaus. Machine learning algorithms are increasingly used for credit scoring and risk assessment, allowing for faster and more accurate evaluation of loan applications. Furthermore, cloud computing provides the scalability and infrastructure needed to handle large volumes of applications efficiently. The use of biometric authentication and advanced security protocols ensures the safety and security of sensitive data throughout the application process. These technological advancements are continuously evolving, leading to even faster and more efficient online loan applications.

Factors Affecting Application Speed

The speed of your online loan application hinges on several interconnected factors, all impacting your overall experience. Understanding these factors can empower you to streamline the process and potentially secure your loan faster. This section will detail those factors from the borrower’s perspective, highlighting how proactive preparation can significantly influence the outcome.

Required Documentation’s Influence on Application Speed

The completeness and accuracy of your provided documentation are paramount. Lenders require specific documents to verify your identity, income, and creditworthiness. Missing or incomplete documents will inevitably delay the process. For example, submitting a blurry image of your driver’s license or a tax return with missing pages will force the lender to request clarifications, adding days or even weeks to the application timeline. Conversely, providing clear, legible, and complete documents upfront significantly accelerates the process. Pre-organizing all necessary documents—such as proof of income (pay stubs, bank statements), identification (driver’s license, passport), and proof of address—before starting the application is highly recommended.

Lender Verification Procedures and Application Speed

Lender verification procedures are crucial for risk assessment. These procedures vary among lenders but typically involve verifying your identity, employment history, and credit score. The speed of these verifications directly impacts the overall application speed. Lenders utilizing automated verification systems often process applications faster than those relying on manual checks. Furthermore, factors like the time of day or day of the week might affect verification speeds due to differences in staffing levels and system processing capabilities. For instance, applications submitted during peak hours or on weekends might experience slight delays.

Comparative Analysis of Loan Application Speeds

The speed of the loan application process can also differ significantly depending on the type of loan. Below is a comparison table illustrating this:

| Loan Type | Typical Application Time | Factors Affecting Speed | Average Approval Time |

|---|---|---|---|

| Payday Loan | 15-30 minutes | Credit score, income verification speed | 1-2 hours |

| Personal Loan | 1-3 hours | Credit score, income verification, loan amount | 1-3 business days |

| Mortgage Loan | Several weeks | Credit score, income verification, property appraisal, loan amount | 30-60 days |

| Auto Loan | 1-2 days | Credit score, income verification, vehicle appraisal | 1-2 weeks |

Security and Privacy Concerns

Applying for a speedy online loan requires sharing sensitive personal and financial information. Understanding the security measures in place and the potential privacy implications is crucial for borrowers to make informed decisions and protect themselves from fraud. This section details the security practices employed by online lenders and offers guidance on safeguarding personal information during the application process.

Security measures implemented by online lenders vary, but generally include robust encryption protocols to protect data transmitted between the borrower’s device and the lender’s servers. Many platforms utilize Secure Sockets Layer (SSL) or Transport Layer Security (TLS) encryption, which scramble data making it unreadable to unauthorized individuals. Furthermore, reputable lenders employ firewalls and intrusion detection systems to monitor network traffic and prevent unauthorized access to their databases. Multi-factor authentication (MFA) is also becoming increasingly common, requiring borrowers to verify their identity through multiple channels, such as a one-time password sent to their mobile phone, adding an extra layer of security. Data is often stored in encrypted databases, further limiting access even if a breach occurs. Regular security audits and penetration testing are also standard practice for responsible lenders to identify and address vulnerabilities.

Data Encryption and Transmission Security

Online lenders utilize various encryption methods, primarily SSL/TLS, to secure data transmission. This ensures that information exchanged between the borrower and the lender’s website remains confidential and protected from interception. For example, when a borrower submits their application, the data is encrypted before being sent across the internet, preventing eavesdropping by malicious actors. The strength of the encryption is crucial; stronger encryption algorithms offer greater protection against sophisticated attacks. Additionally, the use of HTTPS (Hypertext Transfer Protocol Secure) in the website’s URL indicates that the website is using SSL/TLS encryption.

Privacy Implications of Providing Personal Information

Providing personal information during a speedy online loan application involves inherent privacy risks. Borrowers must trust that the lender will handle their data responsibly and comply with relevant data protection regulations, such as GDPR (General Data Protection Regulation) in Europe or CCPA (California Consumer Privacy Act) in California. This includes the responsible collection, storage, and use of personal information, such as social security numbers, bank account details, and employment history. The lender’s privacy policy should clearly Artikel how they collect, use, share, and protect this information. Borrowers should carefully review this policy before submitting their application. Failure to do so may result in unintended data sharing or misuse. Reputable lenders will have transparent privacy policies and security practices readily available on their websites.

Comparison of Security Protocols Across Lending Platforms

Different online lending platforms employ varying security protocols. While many use SSL/TLS encryption as a standard, the specific implementation and additional security features may differ. Some platforms might offer stronger encryption algorithms or more advanced authentication methods like biometric verification. Others may invest more heavily in security audits and penetration testing. A thorough comparison requires examining each platform’s security and privacy policies, looking for details on encryption methods, data storage practices, and compliance with relevant regulations. It’s advisable to prioritize platforms with transparent security practices and a proven track record of data protection. For instance, a platform with independent security certifications might indicate a higher level of security compared to one without such verification.

Best Practices for Borrowers to Protect Their Information

It’s crucial for borrowers to take proactive steps to protect their information during the online loan application process.

The following best practices are recommended:

- Only apply for loans through reputable and established lenders with clear security and privacy policies.

- Ensure the website uses HTTPS, indicated by a padlock icon in the browser’s address bar.

- Be cautious of phishing scams and avoid clicking on suspicious links or emails requesting personal information.

- Use strong and unique passwords for online accounts and consider using a password manager.

- Regularly monitor your bank accounts and credit reports for any unauthorized activity.

- Read the lender’s privacy policy carefully to understand how your data will be handled.

- Report any suspicious activity or data breaches to the lender and relevant authorities immediately.

Marketing and Advertising Strategies

A successful marketing campaign for a speedy online loan application hinges on effectively communicating the core benefit: rapid access to funds. This requires a multi-faceted approach leveraging various digital and potentially traditional channels, focusing on speed, convenience, and trust. The campaign should target individuals facing urgent financial needs, emphasizing the streamlined application process and quick turnaround time.

The overall marketing strategy should emphasize the speed and convenience of the online loan application, differentiating the service from competitors. This can be achieved through targeted advertising, search engine optimization (), social media marketing, and potentially collaborations with relevant financial websites or blogs. Building trust and addressing security concerns are crucial components of any successful campaign.

Sample Advertising Copy Highlighting Speed

Effective advertising copy needs to be concise, impactful, and easily digestible. It should immediately communicate the key selling point – speed. Here are a few examples:

“Need money fast? Get approved in minutes! Apply for your Speedy Loan now.”

“Urgent cash needed? Our online loan application takes only [Number] minutes. Get funded quickly and easily.”

“Don’t wait for days. Get the cash you need today with our Speedy Loan. Apply online in minutes and get a decision fast.”

Examples of Effective Marketing Materials Used by Online Lenders

Many online lenders use a variety of marketing materials to attract borrowers. These include:

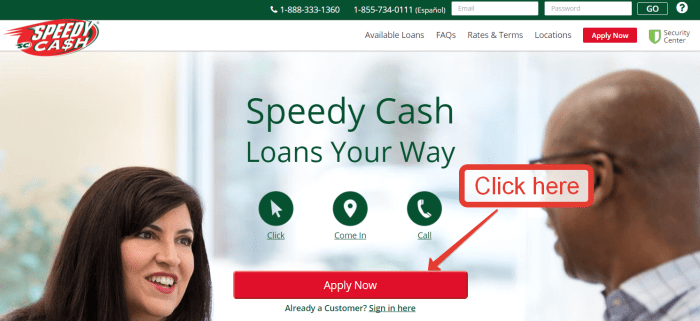

Targeted online advertising: Paid search ads (Google Ads) and social media ads (Facebook, Instagram) are commonly used, focusing on s related to “fast loans,” “emergency cash,” and similar search terms. These ads often include strong calls to action (CTAs) such as “Apply Now” or “Get Your Loan Today.”

Email marketing: Email campaigns can target specific demographics and offer personalized loan options. These emails often include compelling visuals and clear explanations of the loan terms and conditions.

Website design and content marketing: User-friendly websites with clear and concise information about the loan application process, eligibility criteria, and fees are essential. Blog posts and articles addressing common financial concerns can also attract potential borrowers.

Influencer marketing: Collaborating with financial influencers or bloggers can expand reach and build trust among potential borrowers. This can involve sponsored posts, reviews, or giveaways.

Illustrative Image Depicting Ease and Speed of Online Application

Imagine a vibrant, clean, and modern image depicting a user’s perspective on a laptop screen. The screen showcases a simplified online loan application form with large, intuitive buttons and minimal text fields. Progress bars visually represent the stages of the application process, with a prominent bar already nearly complete, suggesting speed and ease. A cheerful, diverse user is subtly shown in the background, possibly smiling and holding a smartphone, reinforcing the accessibility and positive experience. The overall color palette is bright and optimistic, avoiding anything that might appear overwhelming or complex. The background is subtly blurred, keeping the focus on the user-friendly interface and the rapid progress of the application. The overall visual impression is one of speed, simplicity, and trustworthiness. This image visually communicates the core value proposition of the Speedy Loan application – quick and easy access to funds.

Future Trends in Speedy Online Loan Applications

The rapid evolution of technology is dramatically reshaping the landscape of online loan applications, promising faster processing times, enhanced security, and improved user experiences. This shift is driven by advancements in artificial intelligence (AI), automation, and data analytics, leading to a more streamlined and efficient borrowing process. The future of speedy online loan applications points towards a seamless and personalized experience, minimizing friction and maximizing accessibility for borrowers.

The integration of AI and automation is poised to revolutionize the speed and efficiency of online loan applications. These technologies are not merely incremental improvements; they represent a paradigm shift in how lenders assess risk and process applications.

Artificial Intelligence in Loan Application Processing

AI algorithms are increasingly sophisticated in their ability to analyze vast datasets of applicant information, identifying patterns and predicting creditworthiness with greater accuracy than traditional methods. This enhanced predictive capability allows lenders to automate many aspects of the application process, from initial eligibility checks to final approval decisions. For example, AI-powered systems can instantly verify applicant identities, analyze income and employment data, and assess risk profiles, significantly reducing processing times. Furthermore, AI can personalize the application process, tailoring the questions and required documentation to each individual applicant based on their unique circumstances, minimizing unnecessary steps and enhancing user experience. This results in faster approvals and a more positive overall experience for borrowers. The use of machine learning allows for continuous improvement of the AI’s accuracy and efficiency over time, further enhancing the speed and effectiveness of the loan application process.

Automation in Streamlining the Online Loan Application Process

Automation plays a crucial role in accelerating the online loan application process. Robotic Process Automation (RPA) can automate repetitive tasks such as data entry, document verification, and communication with applicants, freeing up human agents to focus on more complex tasks and customer interactions. This not only speeds up processing but also reduces the potential for human error. Optical Character Recognition (OCR) technology can automatically extract data from uploaded documents, eliminating manual data entry and reducing processing time. Integration of various systems, such as credit bureaus and identity verification services, through APIs further streamlines the process by eliminating the need for manual data transfers. For instance, a fully automated system could instantly verify an applicant’s identity, assess their credit score, and approve or deny the loan within minutes, a significant improvement over traditional methods which could take days or even weeks.

In the next five years, we can expect to see a significant reduction in online loan application processing times, with many applications approved within minutes. User experience will be dramatically improved through personalized applications, streamlined processes, and increased transparency. The integration of AI and automation will lead to a more accessible and efficient borrowing experience for all.

Closing Notes: Speedy Loan Online Application

Securing a speedy loan online requires understanding the process, weighing the factors affecting speed, and prioritizing data security. By carefully comparing platforms, understanding required documentation, and following best practices, borrowers can confidently navigate the application process and access the funds they need quickly and securely. The future of online lending points towards even faster, more automated, and AI-powered solutions, promising an even more seamless experience for borrowers in the years to come.

Question Bank

What happens after I submit my online loan application?

After submission, the lender reviews your application and required documents. This may involve credit checks and verification of your information. You’ll typically receive a decision within a timeframe specified by the lender.

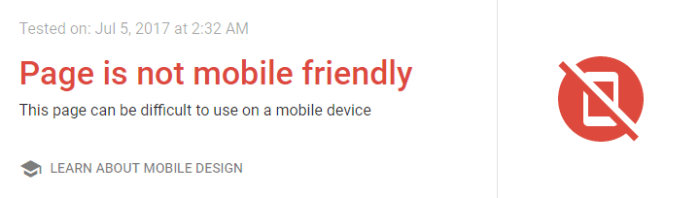

Can I apply for a speedy loan on my mobile phone?

Most reputable online lenders offer mobile-responsive websites and/or dedicated mobile apps, making it easy to apply from your smartphone or tablet.

What if my application is denied?

If your application is denied, the lender will usually provide an explanation. This might be due to credit history, insufficient income, or other factors. You may be able to reapply after addressing the issues raised.

Are speedy online loans more expensive than traditional loans?

Interest rates and fees can vary. It’s crucial to compare offers from multiple lenders to find the best terms, considering factors like APR (Annual Percentage Rate) and any associated fees.